Net interest income in the context of COVID-19

COVID-19 has contributed to both a significant uptick in business lending and a slowdown in household lending. While the overall stock of credit issued has increased, net interest income during 1H2020 contracted thanks to the negative contribution of average loan book rates.

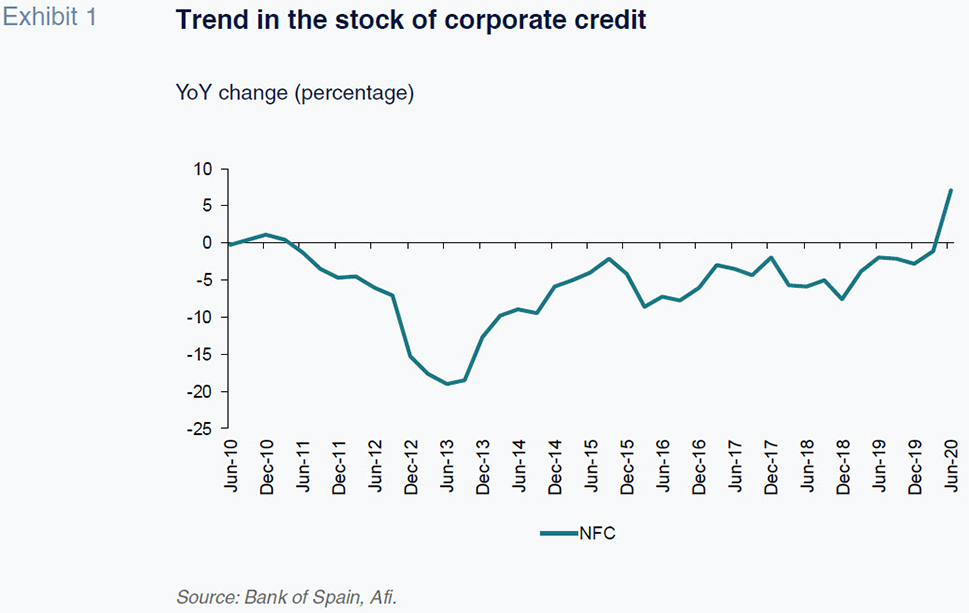

Abstract: Banks have taken a leading role in implementing the measures introduced to halt the economic effects of COVID-19. As a result, lending momentum has been altered significantly, marked by sharp growth in business lending and a slowdown in household lending compared to prior years. In the household segment, it is worth highlighting the moratoria extended on both mortgages and consumer loans, which impacted this trend. During the second quarter of 2020, the stock of outstanding business debt registered strong year-on-year growth, increasing almost 50 billion euros in one quarter. This comes after a decade long contraction in business lending and can be explained by the banks’ participation in channelling 90% of the loans guaranteed by the government to businesses. Despite the increase in the stock of credit issued, banks experienced a contraction in net interest margin during the first half of 2020 (-3%). This paradox is due to the negative contribution of average loan book rates (driven by the downtrend in EURIBOR as well as narrower credit spreads), which more than offset the positive effect of the growth in the stock of outstanding credit.

Background

Despite not having had time to fully digest the effects of the last crisis, the banking system has had a fresh crisis thrust upon it. The origins of this crisis are neither financial nor economic, however, it will have significant ramifications for the banks. Specifically, there is the potential impairment of their assets through lockdowns, and social distancing measures as well as their prominent role in channelling credit and relief toward the companies and households most affected by the crisis.

To analyse the effects of the pandemic on the banks’ net interest income it is necessary to factor in the regulatory and accounting measures introduced relating to capital adequacy, liquidity and provisions, as detailed in a previous paper (Alberni, Rodríguez and Rojas, 2020).

Even more important, however, are the measures passed to facilitate corporate financing at a time when businesses are seeing their revenue collapse and a moratoria on mortgages and consumer loans has been extended to groups hit particularly hard by the pandemic. Both have affected the flow and stock of credit to enterprises and households, with the resulting inflection points in business volumes being one of the key factors shaping the trend in the banks’ net interest income. In addition to those measures, these loans have become less profitable due to the acceleration in the downtrend in interest rates, the tightening of spreads on new loans (largely implicit in the terms on which the guarantees are awarded) and also the non-accrual of interest on certain transactions affected by loan moratoria.

Given the confluence of those opposing forces, it is necessary to analyse the impact of each on the trend in net interest income at a time when the banks –and their share prices (Aires, Alberni and Berges, 2020)– are extraordinarily sensitive to their ability to generate net interest income.

Beyond those measures, it is worth flagging those that have distorted the stock of private sector credit: (i) the two public guarantee schemes passed by the government to guarantee that credit continues to flow to Spain’s businesses; and, (ii) in the household sector, the introduction of temporary relief from mortgage and consumer loan debt servicing.

These distortions have negatively impacted banks’ net interest income generation. Consequently, it is necessary to first consider their timing, analysing those that are affecting business lending separately from those that are reshaping household lending.

Credit during the pandemic: Opposite trends in business and household lending

The most noteworthy development in lending volumes during the months hardest hit by the pandemic has been the inflection point in the trends observed in recent years, marked by sharp growth in business lending and a considerable slowdown (even contraction) in household credit (mortgage and consumer credit).

During the second quarter of 2020, the stock of outstanding business debt registered strong year-on-year growth, increasing by almost 50 billion euros in one quarter. This comes after a decade long contraction in business lending.

This reversal of the trend in corporate credit can only be explained by the high volume of new credit triggered by the first guarantee scheme approved by the government. That programme, which amounted to 100 billion euros, was designed to alleviate the liquidity pressures facing businesses and the self-employed, whose income was collapsing due to the ban of all non-essential activities.

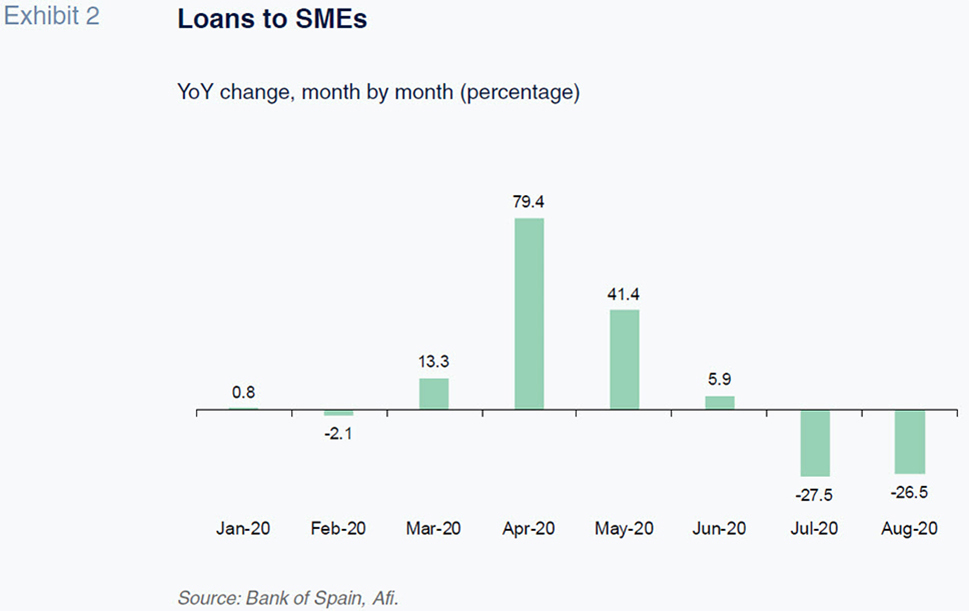

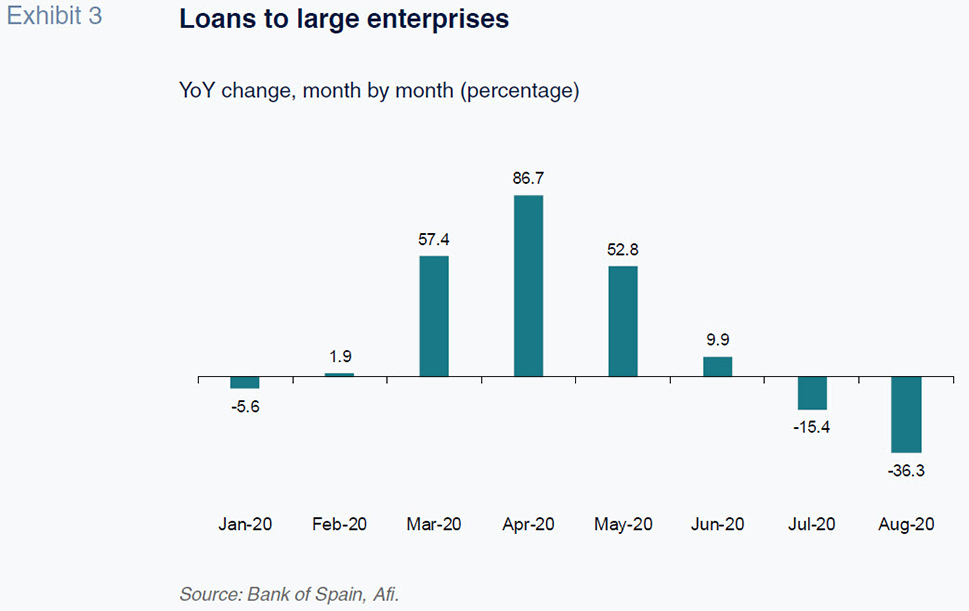

Over 90% of that scheme was channelled via the banks, evidencing its impact on the trend in bank loans to enterprises. The profiles of the loans awarded (Exhibits 2 and 3) perfectly mirror the activation pattern of the various tranches of the scheme, much of which was concentrated in April and May.

The slowdown, and even change in trend, observed in the ensuing months, particularly during the summer, may be the result of a dual effect: (i) a degree of ‘saturation’ of the businesses and/or of the self-employed qualifying for financing without assuming excessive credit risk; and, (ii) a certain ‘holding pattern’ before the launch of the new credit scheme that began in September.

The new 40 billion euro guarantee scheme departs from the ‘fire-stopping’ tactics taken by the first programme. It takes a far more proactive approach to the issuance of credit, with a major focus on digitalisation and sustainability investments. These more restrictive characteristics suggest that demand for the second guarantee programme is likely to be considerably lower than for its predecessor. This in turn will likely lead to a substantial slowdown in business lending growth in comparison with the first half of the year.

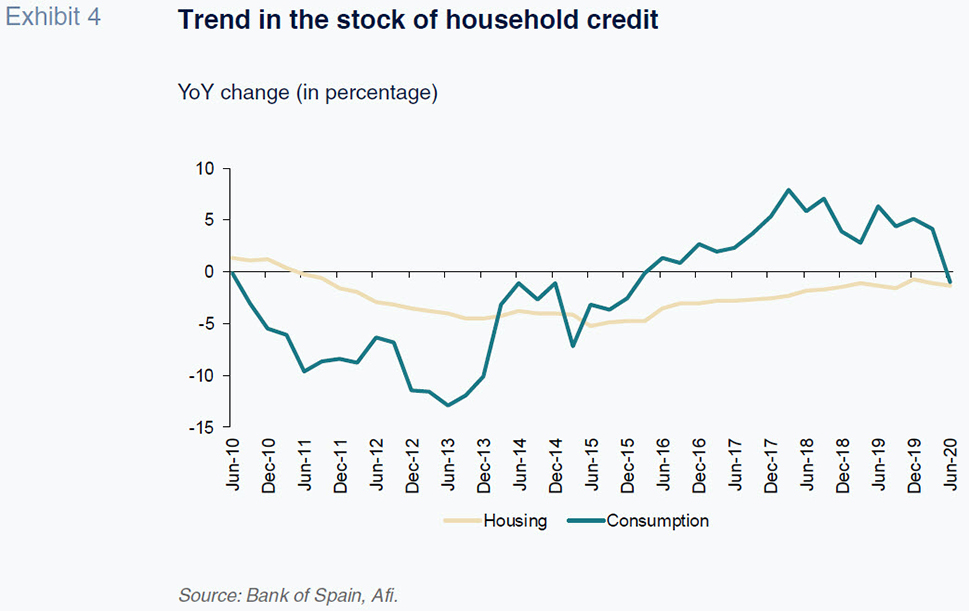

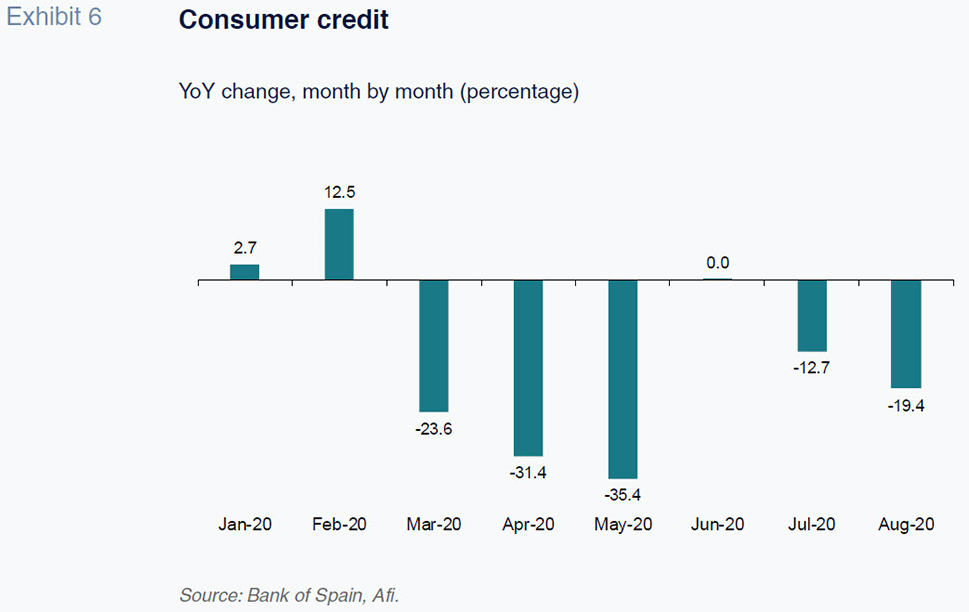

In the case of household credit, the dynamic during the pandemic was radically different to that observed in business lending. Mortgage lending, which had already been easing, and consumer lending both contracted, breaking with a period of sharp growth in recent years.

This shift, particularly in consumer credit, is due to the collapse in private consumption, attributable to both a more conservative attitude towards spending and the fact that it was much harder to consume during lockdown. That contraction in consumption, which was particularly intense during the three months of ‘hard’ lockdown and only partially made up for afterwards, is echoed in the sharp drop in new consumer credit, as is illustrated in Exhibit 6.

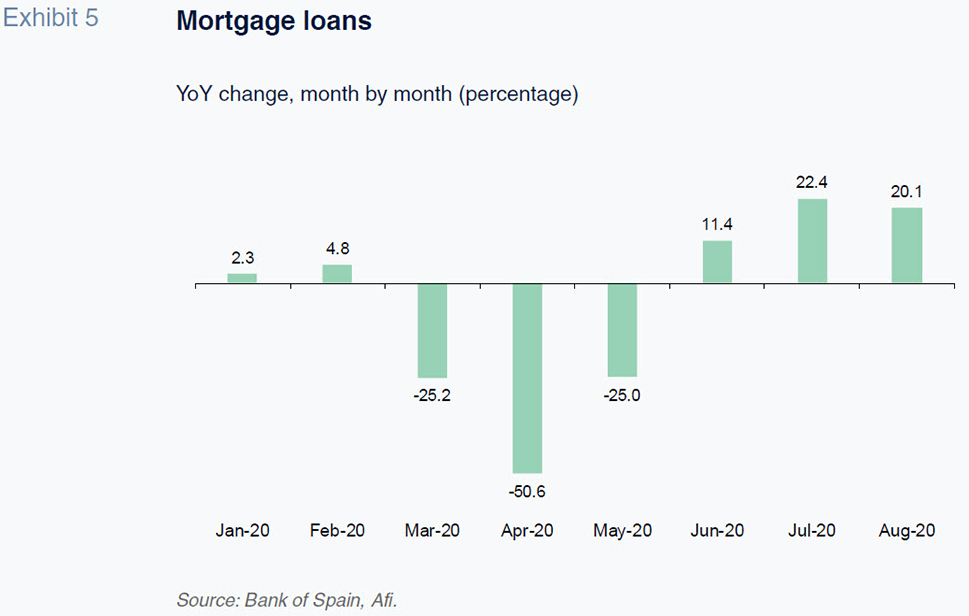

In the case of mortgage lending, the trend illustrated by the issuance of new credit (Exhibit 5) also reveals a sharp contraction during the months of lockdown (March, April and May), mirroring the trend in home purchases. However, in contrast to the trend in consumer credit, mortgage lending recovered strongly during the summer, with growth of over 20% in new credit.

That recovery in the issuance of mortgages is closely correlated with the uptick in housing transaction volumes. By July, housing transaction volumes were at very similar levels to those observed before the lockdown, having experienced a deep slump that saw volumes fall by almost 70% at one point. Notwithstanding the improvement in transaction volumes and correction in prices, the year-on-year series may be subject to upward distortion on account of a ‘base effect’. That base effect originates from the introduction in 2019 of the Real Estate Credit Agreements Act, which during the first few months after it took effect, had the effect of slowing new lending due to technicalities associated with the rollout of the new customer information platforms stipulated in the new legislation.

Once that base effect is accounted for, it is forecast that growth in mortgage lending will ease from the highs of the summer months to around 10% to 12%, depending on the direction the pandemic takes and the measures introduced to counteract its spread.

Net interest income and margin: Falling despite growth in lending volumes

The aforementioned dynamics in lending during the pandemic –sharp growth in business lending more than offset by the slump in household lending– should be evident in the trend in net interest income and margin, with the growth in the stock of outstanding credit, unseen in a decade, making a positive contribution.

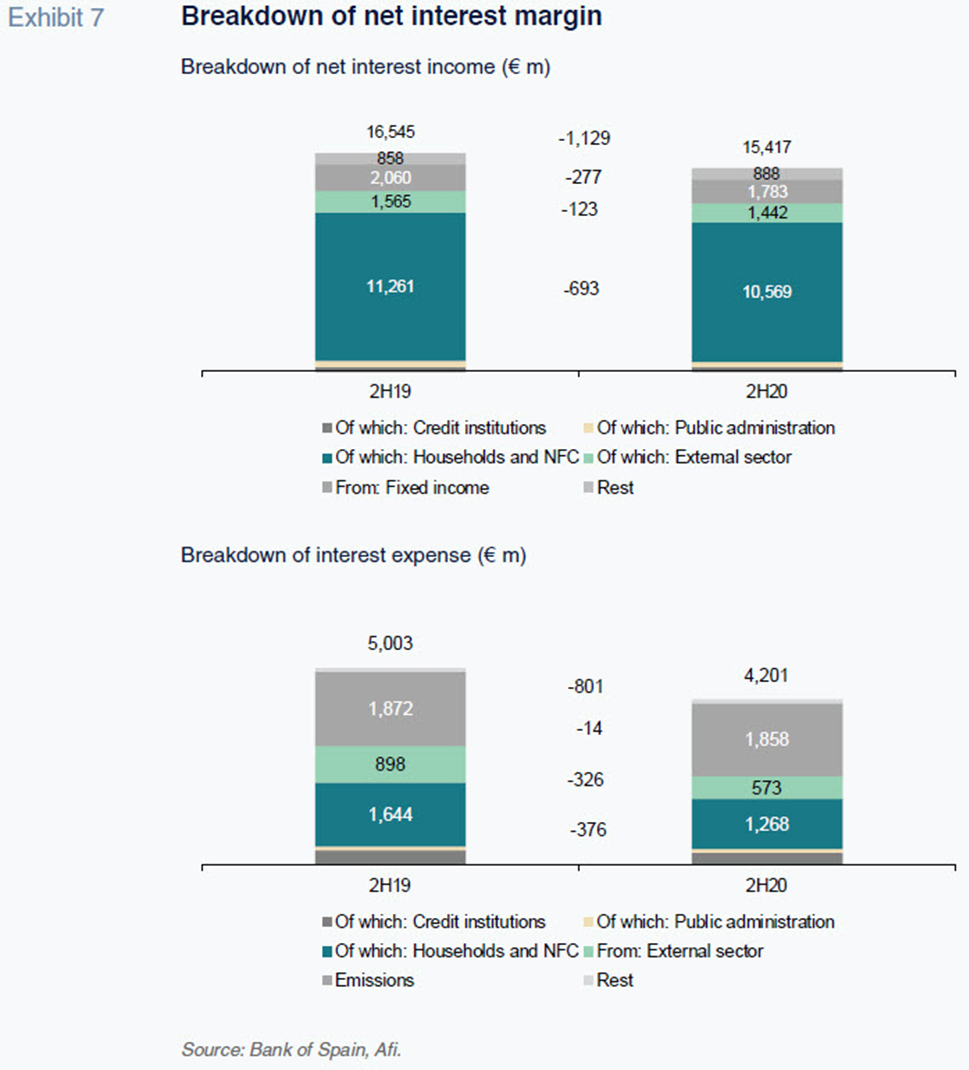

Nevertheless, net interest margin declined by 3% year-on-year across the Spanish banking system in the first half of 2020. As shown in Exhibit 7, the decline in net interest margin, which in fact accelerated with respect to the downtrend of recent years, is the result of a much narrower drop in interest expense (around 800 million euros) compared to net interest income (over 1.1 billion euros).

The significant decline in net interest income, particularly that generated by loans to enterprises and households, is somewhat paradoxical considering the fact that the overall stock of credit increased for the first time in ten years during the period.

To explain that paradox we need to take a look at the three main components of net interest income, namely:

- The average outstanding balance of interest-earning credit (volume effect).

- The benchmark rate of interest, measured using 12-month Euribor (base or benchmark rate effect).

- The spread applied over the above benchmark rate (spread or credit risk premium effect).

We perform that analysis separately for each of the three key credit segments, which are:

- Business loans

- Mortgages

- Consumer credit

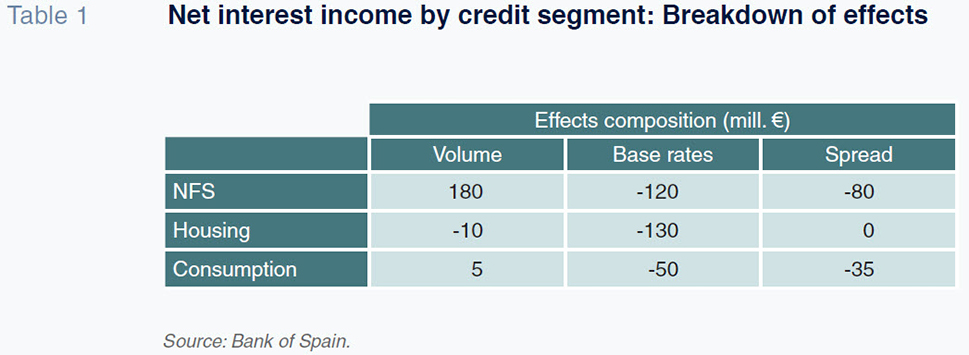

The breakdown of the contribution to the change in net interest income by each of those three effects is shown in Table 1 below and yields some very interesting conclusions.

Firstly, it is worth highlighting the adverse effect on all segments of the base rate effect due to the acceleration in the downtrend in Euribor, which was six basis points lower on average in the first half of 2020 compared to the first half of 2019.

Next, we note that the credit spread (between the average rate charged on the outstanding loan book and average benchmark rates) was constant in the mortgage business but narrowed in the business lending and consumer credit segments.

The spread narrowing in the corporate lending segment is particularly noteworthy and is probably attributable to an increase in competitive pressure in the segment that is most attractive to the banks on account of its growth potential, particularly in the context of state guarantees.

Indeed, the sum of the two adverse rate effects (base rate and spread) exceeds the positive effect of the growth in the average stock of outstanding credit. This is the most resounding conclusion in relation to the business lending segment.

In the other two segments –consumer credit and mortgages– the ‘volume effect’ is nil or slightly negative, such that the combined rate effect (base and spread) materialises in the contraction observed in net interest income in both segments.

Conclusions

Since the first half of the year, the Spanish banking sector has played a leading role in channelling the support measures to the sectors and groups most affected by the pandemic. In the household segment it is worth highlighting the moratoria extended on both mortgages and consumer loans. In the corporate segment, the Spanish banks have been responsible for channelling over 90% of the guarantees provided, reaching more than 500,000 businesses (including the self-employed).

The banks’ role in articulating the public guarantee scheme has boosted their loan books, following a decade long contraction in the stock of outstanding credit.

Paradoxically, however, that increase in the stock of credit was accompanied by a contraction in the banks’ net interest margin during the first half of 2020 (-3%), and has even accelerated with respect to the trend observed during the last three years.

The explanation for that paradox lies with the negative contribution by average loan book rates (driven by the downtrend in Euribor as well as narrower credit spreads), which more than offset the positive effect of the growth in the stock of outstanding credit.

References

AIRES, D., ALBERNI, M. and BERGES, Á. (2020). Banks’ market value in times of COVID-19.

Spanish Economic and Financial Outlook, Volume 9

| number 3, May.

ALBERNI, M., RODRÍGUEZ, M. and ROJAS, F. (2020). Capital and liquidity relief in response to COVID-19: Implications for the Spanish banks.

Spanish Economic and Financial Outlook, Volume 9 | number 3, May.

BERGES, A., ALBERNI, M. and AIRES, D. (2020). Banks’ market value in times of COVID-19.

Spanish Economic and Financial Outlook, Volume 9 | number 4, July.

ECB. (2020). COVID–19 and the increase in the household savings: precautionary or forced?, published as part of the

ECB Economic Bulletin in June 2020. Retrievable from:

https://www.ecb.europa.eu/pub/economic-bulletin/focus/2020/html/ecb.ebbox202006_05~d36f12a192.en.html

Ángel Berges, María Rodríguez and Fernando Rojas. A.F.I. - Analistas Financieros Internacionales, S.A.