Foregone revenues in respect of Spain’s key taxes

As a result of tax breaks for personal income tax, value-added tax, and corporate income tax, the Spanish government foregoes 77.18 billion euros worth of revenue each year. However, closer analysis shows there is room to rationalise existing tax benefits in order to increase the efficiency and simplicity of the Spanish tax system.

Abstract: Governments provide tax breaks to both individuals and companies in the form of allowances, exemptions, rate relief, credits and deferrals. By focusing on tax breaks for personal income tax (PIT), value-added tax (VAT) and corporate income tax (CIT), which together account for 85% of Spain’s total tax revenue in recent years, it is possible to determine the costs of these tax policies. The analysis conducted reveals that all of the foregone tax revenues, or tax expenditures, associated with these three taxes amount to 77.18 billion euros per annum, of which 61% is absorbed by VAT, 36% by PIT and the remaining 3% by CIT allowances and credit. In addition, the personal and household allowances in respect of personal income tax imply an additional annual collection cost of 24.53 billion euros. Those figures clearly indicate that there is adequate room for manoeuvre in the Spanish tax system to reduce the marginal tax burden without foregoing revenue. In other words, rationalisation of the existing tax benefits would be sufficient to finance a tax reform package that would deliver a more efficient and simpler tax system with greater revenue collection.

Introduction

In order to achieve their economic and social objectives, governments provide tax breaks to both individuals and companies. This tax relief can take many forms including allowances (deductions from the base), exemptions (exclusions from the base), rate relief (lower rates), credits (reductions in liability) and tax deferrals (postponing payments). In each instance the legislator assigns a socio-economic objective to the cost of a reduction in revenue. That loss of tax revenue is equivalent to a sui generis form of public spending which is channelled via the tax system, hence the term “tax expenditures”. Importantly, foregone tax revenue can imply a significant cost. For example, Spain’s independent fiscal institute, AIReF (2020), recently assessed 13 tax benefits, assigning a total cost in terms of revenue of 34.25 billion euros, which it estimates account for 60% of total tax relief awarded under the Spanish tax system. That means that the annual tax relief granted in Spain is, according to AIReF, equivalent to 57.08 billion euros, or 5% of GDP. As we shall see, this figure actually underestimates the true cost.

For tax policy transparency purposes, it is important to calculate the revenue foregone as a result of tax relief. In this case, knowledge of tax expenditures is a vital input for assessing the suitability of the underlying relief. However, it is not easy to quantify the revenue foregone as a result of tax relief for several reasons. Firstly, there is a lack of consensus as to how to define tax benefits. Secondly, tax expenditures are defined as a deviation from a “baseline” taxation scenario. Nevertheless, that counterfactual is neither easy to identify nor is it necessarily the only alternative outcome. In other words, there is no consensus about the “baseline” or benchmark scenario against which comparison is possible. Lastly, the way in which a given form of tax relief is articulated impacts the complexity of calculating the lost tax revenue.

In this paper, we quantify the foregone tax revenue, or tax expenditure, associated with the main Spanish taxes: personal income tax (PIT), value-added tax (VAT) and corporate income tax (CIT). Those three concepts account for the bulk of the Spanish system’s tax collection. According to the tax revenue series compiled by the Spanish tax authority, those three taxes alone have accounted for approximately 85% of total tax revenue in recent years. Given their significance, this paper will concentrate exclusively on evaluating those three taxes. Note, however, that while the estimates in respect of PIT and VAT reflect nearly all available tax relief, the CIT analysis is not as exhaustive due to a lack of data. In the case of CIT, it was only possible to quantify the foregone tax revenue associated with allowances and credits, i.e. only a limited portion of existing CIT tax relief.

The revenue foregone as a result of the tax relief reported in this paper is calculated by comparing the status quo revenue situation, as each tax is currently applied, with an alternative – counterfactual – scenario in which the tax relief has not been provided. However, it is worth singling out certain disadvantages with this approach. Firstly, the alternative scenario does not contemplate potential behavioural changes of taxpayers in response to the elimination of the tax relief, which could affect tax revenue. Also, the procedure of sequentially eliminating tax relief could jeopardise the viability of the resulting tax by rendering it excessive. In sum, the resulting tax may turn out to be economically non-viable. Under such circumstances, the results obtained from this line of analysis may not be meaningful. For example, the elimination of the main relief from PIT analysed here would mean that the current existing marginal PIT tax rates would apply directly to taxpayers’ pre-tax income, which is implausible.

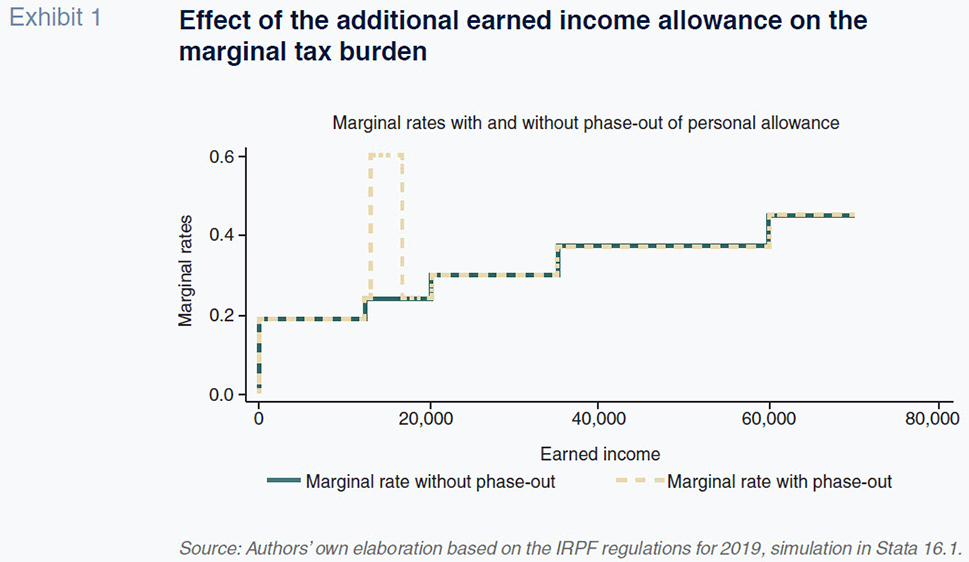

The analysis conducted reveals that all of the foregone tax revenues associated with these three taxes amount to 77.18 billion euros per annum, of which 61% is absorbed by VAT, 36% by PIT and the remaining 3% by CIT allowances and credit. These figures suggest that by reducing this tax relief, Spain could finance a tax reform agenda that is more efficient, simpler, and boosts revenue. In addition to the above figures, the analysis performed shows that the existing tapering or phase-out of the earned income allowance is hugely distortionary, as its existence lifts the marginal rate for people earning salaries of between 13,115 and 16,825 euros by 250%, from 24% to 60%. Moreover, the revenue cost typically ascribed to pension plans is significantly overstated due to the failure to factor in the tax borne on the benefits when they are actually received. Lastly, the VAT analysis suggests that Spain could keep collection at close to current levels with a single rate of close to 10% if the various exemptions and rate relief were eliminated.

PIT tax expenditures

The foregone revenue from the PIT tax was calculated using the tax microdata published by IEF, the tax studies institute, and AEAT, Spain’s tax authority, for the most recent year available. The information contained in Table A1 of the appendix shows that foregone PIT tax revenues totalled 27.7 billion euros in 2017, of which 19.68 billion euros were applied as deductions from the tax base, 3.23 billion euros as deductions from taxable income and the remaining 5.45 billion euros from reductions in liability (credit). What that means is that the bulk of foregone tax revenues are applied to the tax base (gross income) (71.05%). Below is a more detailed description of foregone PIT tax revenue, referenced to the concepts itemised in Table A.1 of the appendix. The table provides the revenue cost, the number of beneficiaries and the per-capita saving for each type of tax expenditure.

Foregone tax revenues in respect of earned income

The foregone revenue associated with earned income totals 12.86 billion euros. Some 99% (12.74 billion euros) is derived from the following two concepts.

- The standard personal allowance of 2,000 euros applied to all wage-earning taxpayers (9.32 billion euros).

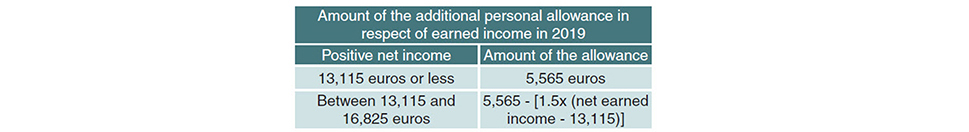

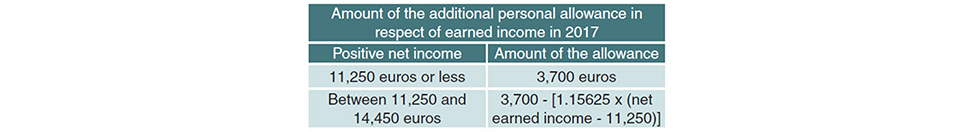

- An additional personal allowance whereby the wage-earners that meet certain requirements can reduce their taxable income further [1] (3.42 billion euros):

Those two components of foregone revenue alone account for 46% of total PIT-related tax relief. From an economic standpoint, the reduction in net earned income has two negative effects. First, the reduction constitutes a violation of the principle of generality of a tax insofar as it affects the fairness of the tax and limits the redistributive power of PIT by removing wealthier taxpayers from the scope of the tax. [2] Secondly, the phase-out of the allowance for earnings between 13,115 euros and 16,825 euros – above this bracket the allowance goes from its maximum amount to total elimination, has a perverse effect on the magnitude of the marginal rates. As illustrated in Exhibit 1, those earners bear an effective marginal rate of 60%, compared to the 24% they would bear if that allowance did not exist. as currently designed. [3] The explanation lies with the fact that for every additional 100 euros earned by those taxpayers, they lose 150 euros of personal allowance, in addition to incurring the marginal income tax rate of 24% on incremental earnings. These effects suggest the additional personal allowance should be reassessed.

Foregone tax revenues associated with the treatment of savings and home equity

Spanish PIT is articulated around two components. Since 2007, savings income has been taxed at lower marginal rates than other earned income. The distancing from an all-encompassing taxable base in which all income is taxed at the same rates has an annual cost of 5.59 billion euros. In addition to the different treatment of savings income, PIT also allows for a deduction equivalent to 60% of the net income derived from house rentals in a quest to boost the supply of residential properties. The goal of that incentive is to foster a downtrend in rental prices. The annual cost of that relief amounts to 1.23 billion euros. In sum, the two incentives combined imply a revenue cost of 6.82 billion euros.

Foregone tax revenues generated by the allowance for joint tax returns

Ever since the Constitutional Court declared the articles of the PIT implementing regulations that obliged the accumulation of all income obtained by the members of a given household void in 1989, there have been measures for reducing the tax burden in respect of joint PIT returns. As currently designed, the households entitled to this allowance are those in which just one household member earns an income or where one of the spouses earns significantly less than the main wage-earner. Two-parent tax-paying household units are currently entitled to an allowance of 3,400 euros (2,150 euros for single-parent households). As shown in Table A.1 of the appendix, the revenue cost of this tax expenditure is 2.98 billion euros.

Foregone tax revenues associated with contributions to pension/welfare systems

With the aim of increasing the purchasing power of employees and the self-employed after they retire, the pension/welfare systems allow them to receive their income over their life spans. Such assets play a clear social role by encouraging employees and the self-employed to self-transfer their income from their years in the workforce to their retirement. Pension plans are the savings instrument most widely used in Spain. Their tax treatment is similar to state pensions: contributions are deducted from the tax base of the contributor such that no income tax is paid on those sums during the years of saving and when the relevant event occurs – usually retirement – the benefits are taxed at the amount of capital accumulated (contributions ± capital gains/losses) at the then-prevailing income tax rates for wage earners. That means that the only tax benefit awarded in respect of such income is, in the best case scenario, the ability to defer the payment of the corresponding income tax from the time of the contribution until receipt of the benefit. In fairness, savers are penalised in respect to any capital gains insofar as such gains constitute savings income that, rather than being taxed at the lower rates applied to savings income, are taxed at more onerous earned income tax rates.

Surprisingly, errors are made when calculating the revenue cost associated with these assets. The mistakes consist of computing only the deductibility of the contributions as revenue foregone, neglecting the fact that such deductions revert when the associated benefits are received, at which point they are taxed as earned income. For example, around 1.5% of the earned income declared annually in recent years stemmed from pension plan benefits, which is equivalent to around 1.5 billion euros of PIT revenue a year. The recovery of that revenue when the pension plan benefits are received is missed if only the deductibility of the original contributions is taken into account. That is the case with the tax benefits assessment recently published by AIReF (2020), which estimates pension plan-related tax expenditure at 1.64 billion euros per annum.

As shown in the appendix, the real revenue cost of pension plans needs to be measured as the difference between the tax savings generated by the contributor when paying into a pension (1.81 billion euros) and the present value of the tax payable when the benefits are collected (1.56 billion euros). In sum, the effective revenue cost of the contributions made to pension plans in 2017 is 250 million euros (1.81 billion euros minus 1.56 billion euros). [4]

Those figures suggest that the revenue argument for eliminating the current treatment of pension plan contributions is extremely tenuous. All the more so considering that fact that if the deductibility of pension plan contributions were to be eliminated, any subsequent capital gains would no longer be taxable at earned income but rather at savings income rates.

Foregone tax revenues associated with reductions in liability (credit)

Lastly, Table A.1 of the appendix shows the foregone tax revenues associated with reductions in liability. Of the total 5.45 billion euros of foregone tax revenue associated with such credit, 3.28 billion euros corresponds to general credit in respect of the tax liability before deductions (1.63 billion euros of state tax payable and 1.65 billion euros of regional tax payable) and 2.07 billion euros is applied against the tax liability after deductions and withholdings. The credit within the purview of the regional governments is scant, at just 385 million euros.

The revenue cost of minimum personal and household allowances

Qualifying minimum personal and household

[5] allowances as tax relief is debatable. However, Table A.2 of the appendix provides the revenue cost of the minimum personal and household PIT allowances in 2017, which amounted to 24.53 billion euros.

[6]

VAT tax expenditures

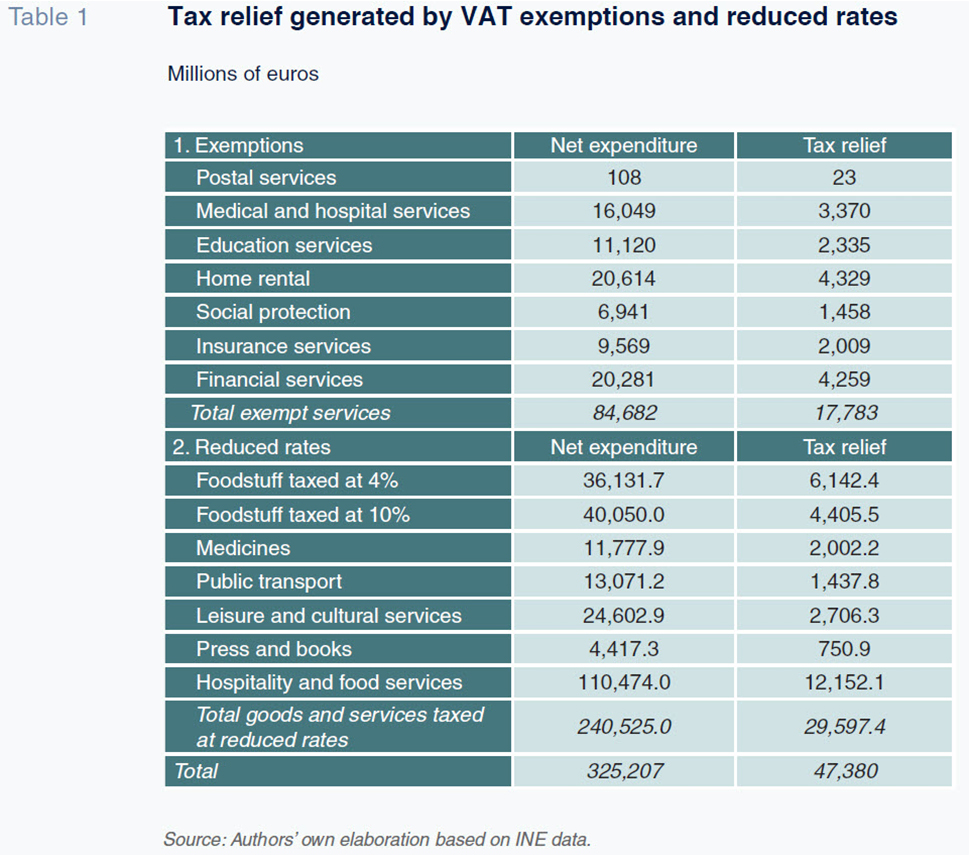

There are two ways in which VAT can be altered to generate tax relief: exemptions and rate relief. Since this tax came into being in 1986, a catalogue of services, which can be grouped into the following seven categories, has been deemed exempt: (i) postal services; (ii) medical, hospital and social welfare services; (iii) education and professional training services; (iv) services provided by non-profits and sports federations; (v) state lotteries and betting games; (vi) financial and insurance services; and (vii) rental of one’s primary abode. For various different socio-economic reasons, these services are exempt from VAT, unlike the vast majority of services which are levied at the standard rate of VAT. Since its reform in 2012, the above-mentioned standard rate has been 21%, while the reduced rates are 4% and 10%. [7]

The calculations provided next refer exclusively to the household sector of the economy. To that end, we use the aggregate household private consumption figures included in Spain’s National Accounts using the COICOP/ECOICOP classification at the 2-digit level. Except for very specific goods and services, that level of disaggregation is sufficiently broad to enable the allocation of the correct rate to each spending category. A more detailed allocation of the rates borne by the goods/services included in each spending category would require the use of the microdata from the Household Budget Survey which uses the COICOP/ECOICOP classification at the 4-digit level. However, household budget surveys present certain issues such as the infrequency of purchase or the concealment of expenditures that undermine their usefulness as a credible proxy for total existing VAT tax relief. In other words, while the household budget survey may be appropriate for analysing the breakdown of household consumption by socioeconomic categories, it is not the right database for estimating the overall tax relief embedded in indirect taxation.

Using the National Accounts consumption data for 2017, Table 1 synthesises the tax relief generated by VAT exemptions and rate relief. It shows that VAT tax relief that year totalled 47.38 billion euros. Of that sum, 62.5% corresponded to exemptions and the remaining 37.5% to reduced rates. Specifically, the tax relief generated by the reduced rates amounted to 29.6 billion euros, of which 30% was generated by goods and services taxed at the super-reduced rate, with the remaining 70% stemming from goods and services taxed at the 10% reduced rate.

The comparison between VAT tax revenue in 2017 – 63.65 billion euros – and the amount of tax relief – 47.38 billion euros – provides a clear picture of the significant revenue cost of the exemptions and reduced rates. By eliminating that tax relief and replacing it with a single flat rate of close to 10%, the government would generate similar revenue levels. That simple back-of-the-envelope calculation evidences the scope for VAT revenue growth at much lower than current rates.

CIT tax expenditures

The structure of corporate income tax makes the measurement of the associated foregone tax revenues complex. The potential sources of relief from CIT include the following:

- Non-accounting adjustments with the purpose of recognising measurement differences between accounting and tax rules. Those adjustments affect the size of the tax base and, by extension, the amount of tax borne.

- Tax relief with respect to the tax base such as reserves for investments.

- Reduced CIT rates for certain types of companies, including SMEs, open-ended mutual funds (SICAVs) and real estate investment funds (REITs or SOCIMIs in Spanish).

- Allowances in respect of tax payable legislated for differing socio-economic reasons: income earned in Ceuta and Melilla; the profits of ‘specially-protected cooperatives’, income from home rentals; and, the profits obtained from the provision of local services.

- Deductions for certain kinds of investments (including investments in R&D, technological innovation, film production and the purchase of fixed assets) and job creation.

It is not possible to arrive at an overall estimate of those tax benefits without access to government corporate income tax records. Unfortunately, unlike in the case of PIT, sample microdata from the CIT returns is not publicly available. We only have access to the aggregate information included in the CIT statistics published by the tax authority each year. Moreover, for the purposes of measuring the extent of CIT relief, those statistics only contain the revenue cost of the credits awarded for qualifying investments and job creation. In other words, the aggregate data available can only be used to compute a small part of all existing CIT expenditures, making it impossible to estimate the tax relief applied to the tax base and that deriving from the existence of reduced rates. Based on those statistics, the amount of relief generated by the credit existing in 2017 was 250.5 million euros. 57.4% of that relief corresponds to the credit awarded for profits obtained from the provision of local services. Meanwhile, the relief generated by credit for qualifying investments and employment in 2017 amounted to 1.82 billion euros. 59.7% of that sum derived from activities related with investments in R&D, innovation and job creation. In sum, the tax relief generated by CIT allowances and credit totalled 2.1 billion euros in 2017.

Notes

That allowance is regulated in Article 20 of Spain’s PIT Act. Specifically, in 2019, the amounts awarded in respect of this additional allowance are as follows:

The allowance, despite its high costs in terms of efficiency by increasing the marginal rates borne by moderate earners, has been the subject of systematic increases over time. By way of comparison, in 2017 this allowance was significantly lower:

Exhibit 1 assumes that the regional governments replicate the state rate structure at the regional level. However, because the regional governments have legislative powers that enable them to design their own rates, the range of marginal rates generated by this allowance varies depending on the region in which the taxpayer resides, from 57% to 61%. Refer to Table A.3 of the appendix.

If we assume that the standard pension plan in 2017 is capable of generating an average annual return equal to the cumulative return on Spanish pension plans between 2003 and 2018, which according to the Inverco Watch amounted to 2.11%, then, considering that the annual contributor is aged 50, implying 17 years until retirement, the 5.2 billion euros contributed to pension plans in 2017 will become a little over 7.41 billion euros of earned income down the line. Those earnings will generate deferred tax revenue of around 2.22 billion euros, whose present value discounted back to 2017 is 1.56 billion euros.

It is also debatable whether some of the other forms of tax benefits discussed so far are in fact tax relief. For example, the allowance for joint marital returns could be seen as a tool designed to align the taxpayers’ tax burden with the households’ means. Others such as double taxation deductions are questionable as tax relief as they are articulated to correct a technical issue.

Although these items continue to be referred to as personal and household allowances, the term allowance is actually a misnomer. These amounts have actually been structured as reductions in the PIT liability (credit) since 2017.

Specifically, the super-reduced rate of 4% is levied on many food staples (bread, milk, eggs, fresh produce), medicines, books and prostheses. The reduced rate of 10% applies to all other food products (including meat and fish), public transport, new housing, hospitality and food services, water services and cultural services, among others.

References

José Félix Sanz-Sanz. Madrid’s Complutense University, ICAE and the Funcas Public Finance Observatory (OFEP)

Desiderio Romero-Jordán. King Juan Carlos University and the Funcas Public Finance Observatory (OFEP)