Tax decentralisation in Spain: Significant progress and remaining challenges

While decentralization in Spain prioritised devolving spending rather than revenue power to its regions, it scores comparatively better than other federal OECD countries for tax decentralisation at present. For this reason, reform should focus on redesigning the context in which tax autonomy is exercised rather than increasing tax decentralisation itself.

Abstract: Like many other countries, the decentralisation process in Spain has made more progress in terms of granting its regions spending responsibility rather than revenue powers. However, ensuring fiscal autonomy at the sub-central level is important as it supports a regional government’s political autonomy, strengthens political accountability among voters, and disincentivizes large public deficits. Nevertheless, Spain’s current decentralised tax system compares favourably with other countries. According to the OECD, on the expense and revenue side, Spain ranks 5th and 6th, respectively. Furthermore, the OECD’s effective measurement of tax autonomy places Spain first within the EU. This suggests that the focus should not be on increasing the extent of tax decentralisation in Spain but redesigning the context in which tax autonomy is exercised. To accomplish this, it is vital to tighten the so-called ‘soft budget constraint’ in the regional sphere and fine-tune most of the taxes transferred. Such action would involve reforming tax management and the partial alignment of environmental taxes collected by the regions with a nationwide green tax strategy.

Introduction [1]

Spain’s transition to democracy ushered in a period of intense and swift decentralisation. [2] However, the process occurred faster in terms of spending responsibility than in revenue powers. This is often the case, as it is usually easier for central governments to relinquish spending powers than their tax collection authority. In parallel, sub-central governments are more likely to request new spending responsibilities than tax collection powers since a financing regime based on transfers entails a lower political cost than one articulated around taxes, whether collected directly or indirectly.

Ensuring fiscal autonomy at the sub-central level is important for three reasons. The first is that in the absence of tax autonomy, political autonomy remains incomplete. Under such circumstances, a regional government cannot calculate their budget. Moreover, the system’s financial sufficiency remains conceptually undefined, as it can only be identified endogenously, via interaction between governments and voters. It is the democratic process of choosing both the level of spending and the corresponding tax burden in each jurisdiction that should determine the fiscal menu. In this respect, the debates around autonomy and sufficiency converge. Regional governments should have their own tax instruments and strong tax collection powers, coupled with hard budget constraints imposed by the central government. It is vital to articulate that there will be no bailouts, explicit or implicit, or cost-free handouts from the central government.

The second reason is that without fiscal autonomy, political responsibility and accountability to the voter become diluted. It is essential that voters are aware of the cost of the public goods and services they demand so their choice of government and by extension regional expenditure is informed and rational.

Lastly, we know that significant vertical imbalances between decentralised expenses and revenue sources undermine fiscal stability and generate higher public deficits (Lago-Peñas, Martínez-Vázquez and Sacchi, 2019).

The objectives of this paper are threefold. Firstly, to analyse the current status of tax decentralisation at the regional level in Spain; secondly, to compare that level within the international context; and thirdly, to identify potential challenges and possible solutions ahead of the imminent review of the regional financing regime.

Regional taxation at present

Two models of fiscal federalism co-exist in Spain, with one system for two specific regions -the Basque region and Navarra (which encompass around 6% of the Spanish population)- and the system for Spain’s other 15 autonomous regions. The former takes its inspiration from the fiscal confederation approach. This means the central government’s tax authority has been minimised, with subcentral governments exercising most of that power. The lack of fiscal autonomy has never been an issue with this arrangement. In the rest of Spain, the regime is based on a more orthodox model of fiscal federalism. These regions finance themselves partly via taxes and grants from the central government. The debate around fiscal responsibility has centred on the second model, which is also the focus of this article.

Regional tax collection can be divided into two main categories: regional taxes collected directly and centrally-collected taxes transferred to the regions. In 2018, the number of own regional tax instruments stood at 82; however, their combined contribution was less than 2% of revenue across the 15 regions who participate in this second model. Moreover, those instruments are concentrated around taxes associated with the environment and natural resources. Around 80% of overall tax revenue stems from the taxation of water including levies on sanitation, discharges, reservoirs, etc. (REAF, 2018). The fact that regional governments cannot levy taxes on items that are taxed by the other two levels of government limits the value of a region’s own taxation. In some cases, regional governments’ tax collection has encroached upon the central government’s territory, forcing the regional administrations to withdraw their tax instruments to prevent double taxation issues.

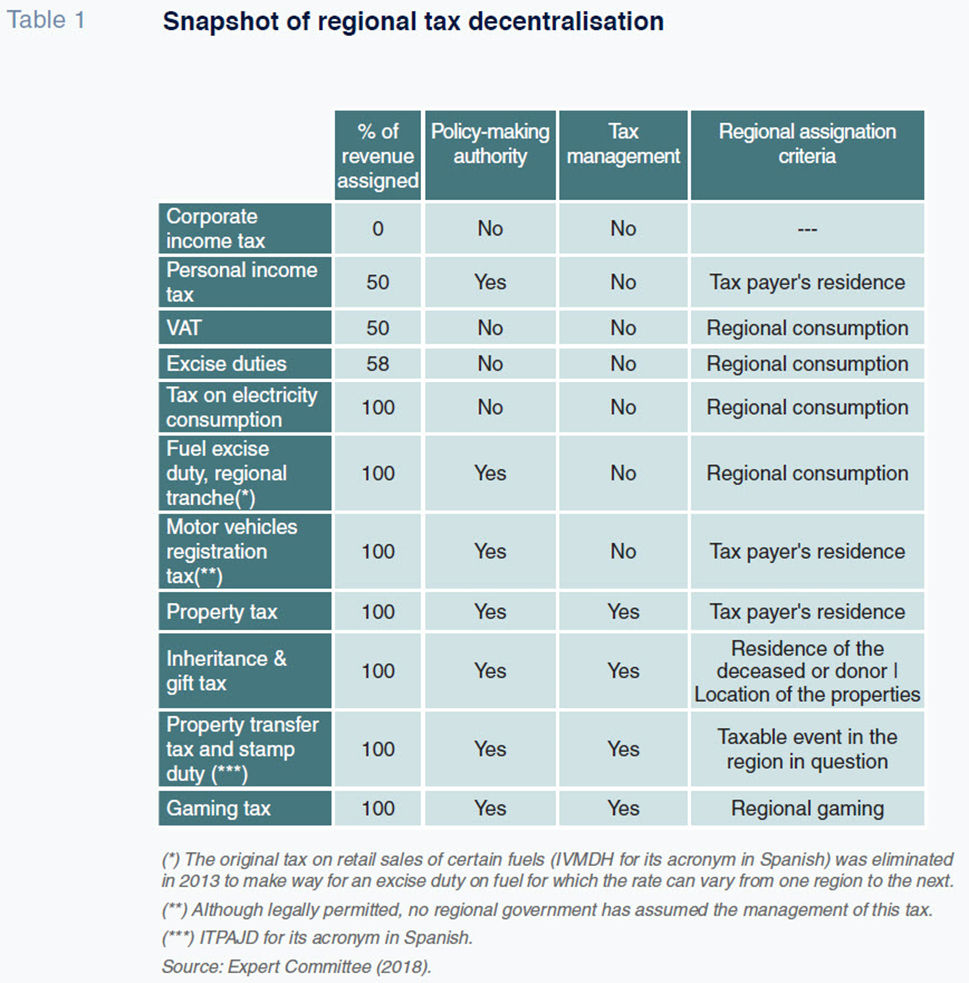

Therefore, the regional governments really obtain their fiscal autonomy through those taxes transferred from the central government. Tax decentralisation in Spain got underway with the reforms implemented in 1997. Since then, additional steps have expanded the regional governments’ array of tax instruments (see Table 1). The three key takeaways are: (i) the assignment percentages are high; (ii) the main taxes continue to be managed by the state tax agency (AEAT for its acronym in Spanish); and, (iii) the taxation of consumption (VAT and excise duties) is subject to tax harmonisation rules at the European Union level, which prevents the differentiation of rates between the various regions and, by extension, the existence of regional autonomy. The only area where progress has proved possible (but not without difficulties) is the fuel tax. It is also worth highlighting the non-transfer of corporate income tax, which aligns with the recommendations from fiscal federalism theory. It advises against decentralisation of corporate income tax for reasons such as: distortion of the efficient location of various corporate activities; sensitivity to the economic cycle; the existence of significant imbalances in the distribution of the taxable income; surplus costs associated with decentralised administration and the possibility of tax exporting (Martínez-Vázquez, 2013). The experiences in the Basque region and Navarra, where corporate income tax is decentralised, provides empirical evidence that the above recommendation is warranted.

Decentralisation in Spain, a comparative analysis

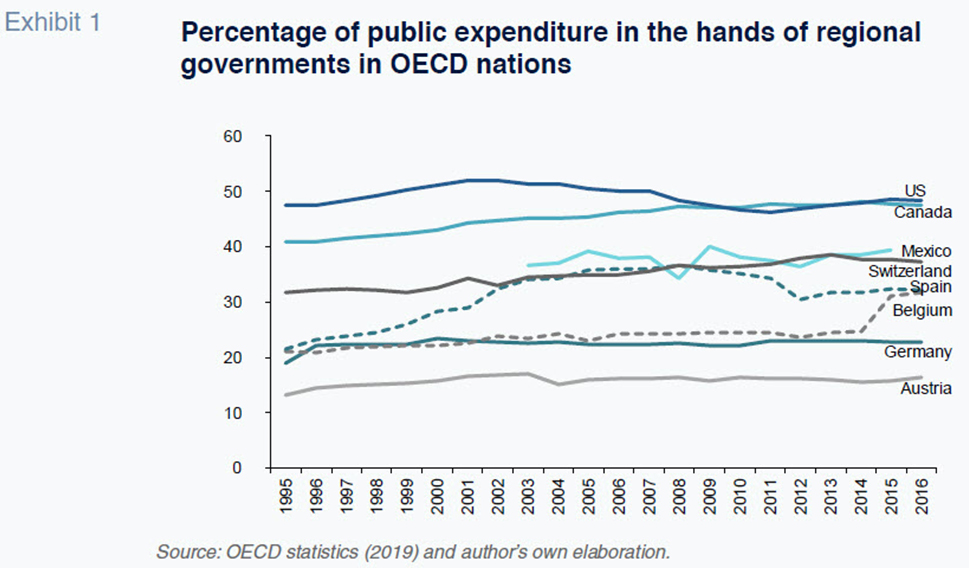

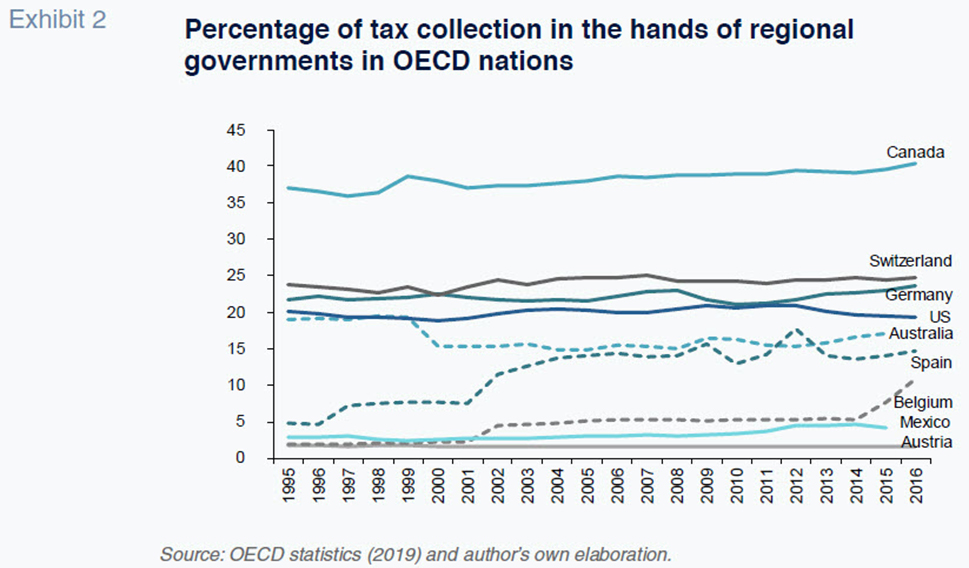

Exhibits 1 and 2 illustrate the public spending and tax decentralisation dynamics for the members of the OECD with intermediate governments in between their central and local governments. The data include percentage of public spending and tax collection controlled by the members’ regional governments. [3] On the expense side, only Canada, Switzerland, the US and Mexico are more decentralised than Spain. On the revenue side, Spain ranks sixth, just behind Australia and further behind Canada, Switzerland, Germany and the US.

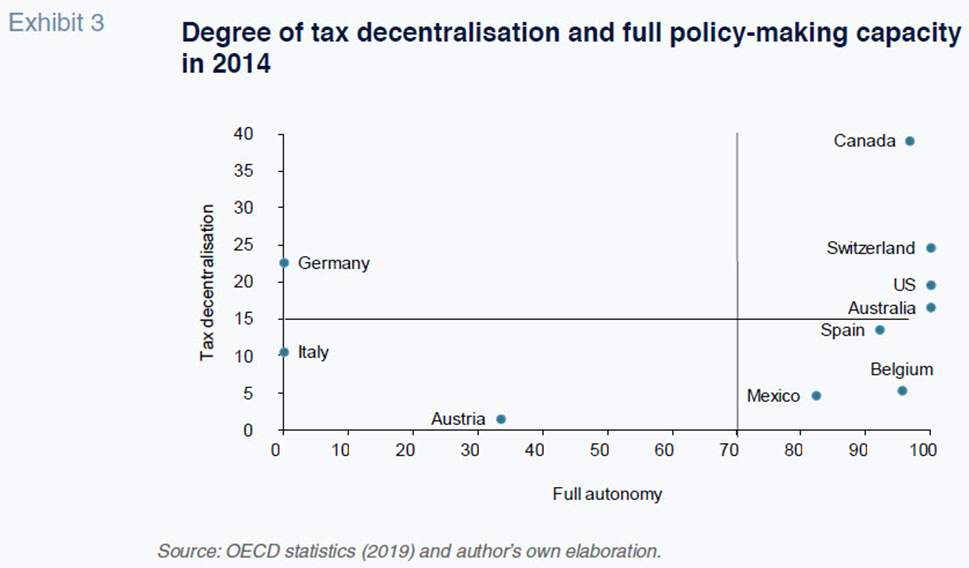

However, it is insufficient to focus on the share of decentralised tax collection. In some cases, tax revenues are not accompanied by decision-making power and therefore do not depict real autonomy. Germany is the classic example. The Länder finance themselves mainly through a regime of regional participation in a broad array of taxes.

To overcome this limitation, the OECD has estimated the effective level of autonomy. For the purpose of this article, we have selected the last year for which data is available (2014) and the information on the percentage of regional revenue that stems from taxes for which the sub-central governments have the power to modify the rates without having to consult the central government. The results are shown in Exhibit 3. The vertical axis depicts the percentage of taxes in regional hands provided in Exhibit 2. In the European Union (EU), Spain is currently the leader in effective tax decentralisation. The regions in Italy and Germany do not enjoy true autonomy, while in Austria and Belgium, the taxes under regional control are scant. Spain also ranks in the top 5 worldwide, behind Canada, Switzerland, the US and Australia (Lago Peñas and Vaquero, 2016).

Outstanding challenges and possible solutions

In light of the above, one could conclude that further tax decentralisation is not a pressing issue in Spain. Between the reforms of 1997, 2002 and 2009, Spain has done an adequate job decentralising its tax system. However, certain issues and challenges remain. As pointed out by the dedicated Expert Committee (2018), and illustrated in Exhibits 2 and 3, the focus should not be on increasing decentralisation as much as redesigning the context in which tax autonomy is exercised.

To accomplish this, it is vital to tighten the so-called ‘soft budget constraint’ at the regional tier (Fernández Llera, Lago Peñas and Martínez-Vázquez, 2013). Following the regional financing reforms undertaken to date, the regional governments have seen their resources increase significantly (particularly in 2009) without having to raise taxes and assume the corresponding political cost, either individually or collectively. This situation has also been buoyed by the central government’s financing instruments, which over the past decade supported regional fiscal deficits (particularly the so-called Regional Liquidity Fund). The regions have been able to finance their deficits, even those that missed the stipulated limits, at zero or almost-zero cost. Although the Great Recession had the effect of raising regional taxes (Solé-Ollé, 2015), its contribution to fiscal adjustment has been marginal compared to expenditure cuts.

Secondly, there is a need to fine-tune most of the taxes transferred, including aspects of their management, and to align environmental taxes collected by the regions with a nationwide green tax strategy. The main changes include:

- The current VAT and excise duties revenues sharing should be replaced by regional tranches. Decision-making regarding those tranches would be taken by the regional governments collectively. Although this solution poses challenges, they are not insurmountable. Spain’s Fiscal and Financial Policy Council could provide the forum for debate among the regions. A qualified majority could also prevent the need for outright consensus. Any regions that were not in agreement with changes to the regional tranche could compensate their citizens with changes in other regional taxes. Given the amount of tax raised via VAT and excise duties, the regional governments would benefit considerably, while the central government could permanently end the regions’ demands for new revenue transfers. Thus, this solution could solve the soft budget constraint problem and the mismatches between public service preferences and the corresponding tax burdens. As noted in the introduction, it is the synchronisation of these two aspects that enables the endogenous determination of financial sufficiency.

- In the case of personal income tax, regions should enjoy the speed and transparency of decisions taken at the central government level. The current asymmetry and time lag are problematic and significantly discourage the use of the regional tranche. For example, if the central government decides to raise rates, that increase is reflected in tax payers’ withholdings within weeks. In contrast, if a regional government takes a decision in December 2019 to increase personal income tax rates in the next fiscal year, withholdings do not change in 2020. The increase is only felt by the tax payer when he or she presents the corresponding annual tax return in the spring of 2021; and transfers of the additional funding to the regions do not occur until July 2022. Furthermore, citizens also need to be informed clearly in their payrolls and other sources of income about which portion of their withholdings is going to finance regional competencies. The assistance programmes and tax returns need to unambiguously illustrate that citizens really pay two taxes. While they coexist under the same legal umbrella and name, they correspond to two different tax authorities.

- On the wealth taxation front, which includes property, inheritance and gift tax, it is necessary to first address whether or not it is advisable to maintain these instruments as part of the Spanish tax system. The arguments and international experience are stronger for inheritance tax than property tax. The report issued by the Expert Committee on the Spanish tax system in 2014 took a similar stance. Regardless, if one or both of these taxes are maintained, consistency is key. Either policy-setting power has to be recentralised or a tax floor needs to be set at the state level to end counterproductive competition among the regions.

- The regional governments can play a meaningful role in the implementation of new or reformulated tax instruments under the umbrella of the country’s ‘green tax reforms’. Although discussion of these reforms dates back nearly two decades, it has since been set aside. The regional and central governments should work together to define a catalogue of appropriate taxes for optional implementation at the regional level. That effort should leverage the experience of regional governments in defining in detail the instruments that would substitute the existing direct taxes in favour of greater simplicity and legal certainty.

- Lastly, the regions need to be involved to a greater degree in tax management tasks. These are primarily in the hands of the AEAT, which is perceived as a state agency disconnected from the regional authorities. As recommended by the Expert Committee in 2018, the long-term objective should be to create an integrated joint agency with state and regional representation that would service the various levels of government. Bilateral consortia between the AEAT and the regional agencies would be an interim step towards formalising this strategy.

Notes

The author would like to thank Alejandro Domínguez for his assistance.

Lago-Peñas, Fernandez Leiceaga and Vaquero (2017) provide a comprehensive overview of the process.

The OECD data used in this section are taken from its fiscal decentralisation database (OECD, 2019). Specifically, the figures in the database’s Table 1 are used to calculate effective tax autonomy (Exhibit 3), the figures in Table 5 to calculate decentralised public expenditure (Exhibit 1) and the figures in Table 9 to estimate taxation (Exhibit 2).

References

COMISIÓN DE EXPERTOS. (2018). Informe de la comisión de expertos para la revisión del modelo de financiación autonómica [Expert Committee report on reforming the regional financing regime], Madrid: Institute of Fiscal Studies (IEF). https://www.ief.es/docs/destacados/publicaciones/libros/lb/2018_ReformaFinanciacionTerritorial.pdf

FERNÁNDEZ LLERA, R., LAGO PEÑAS, S. and MARTÍNEZ-VÁZQUEZ, J. (2013). La autonomía tributaria de las comunidades autónomas y su (des)uso: Presencia de una restricción presupuestaria blanda [Tax autonomy in regional Spain and its (dis)use. Existence of soft budget constraint], In S. LAGO-PEÑAS, and J. MARTÍNEZ-VÁZQUEZ (Dir.), La consolidación fiscal en España: El papel de las Comunidades Autónomas y los municipios (experiencias, retos y perspectivas) [Fiscal consolidation in Spain: The role of the regional and local governments (experiences, challenges and outlook)]. Madrid: Institute of Fiscal Studies (IEF).

LAGO PEÑAS, S., FERNÁNDEZ LEICEAGA, X. and VAQUERO, A. (2017). Spanish fiscal federalism: A successful (but still unfinished) process. Environment and Planning C: Politics and Space, 35(8).

LAGO PEÑAS, S., MARTÍNEZ-VÁZQUEZ, J. and SACCHI, A. (2019). Fiscal Stability During the Great Recession: Putting Decentralization Design to the Test. Regional Studies. Forthcoming.

LAGO PEÑAS, S. and VAQUERO, A. (2016). Descentralización y sistema tributario: Lecciones de la experiencia comparada, [Decentralisation and the tax system: Lessons from a comparative analysis]. Madrid: Fundación Impuestos y Competitividad. http://www.fundacionic.com/wp-content/uploads/2017/04/descentralizacion-sistema-tributario-lecciones-experiencia-comparada.pdf

MARTÍNEZ-VÁZQUEZ, J. (2013). Tax Assignments at the regional and local levels. In E. Ahmad, and G. Brosio (Dirs.), Handbook of fiscal federalism and multilevel finance. Chentelham: Edward Elgar.

OECD. (2019). OECD Fiscal Decentralization Database. https://www.oecd.org/ctp/federalism/fiscal-decentralisation-database.htm

REAF. (2018). Panorama de la fiscalidad autonómica y local 2018, [Fiscal autonomy at the regional and local levels in 2018], Madrid: Consejo General de Economistas, https://www.economistas.es/Contenido/REAF/Documentos/Panorama2018-WEB-OK.pdf

SOLÉ-OLLÉ, A. (2015). Regional tax autonomy in Spain: ‘words’ or ‘deeds’?. In J. KIM, N. LOTZ, and J. MAU (Eds.): Interaction Between Local Expenditure Responsibilities and Local Tax Policy, Copenhagen: Korea Institute of Public Finance. http://www.svt.ntnu.no/iso/Lars.Borge/interaction_copenhagen_workshop_2013_pdfa.pdf

Santiago Lago Peñas. Professor of Applied Economics and Director of the Governance and Economics Research Network (GEN) Vigo University