The pandemic and its impact on the insurance business in Spain

The impact of the pandemic on the insurance industry was significant, if uneven, across both geographies and business lines. While the industry is showing signs of recovery, forecasts are predicated on the normalisation of claims and the continuation of financial market stability.

Abstract: In 2020, the insurance sector sustained a real contraction in premium volumes of 1.3% compared to the pre-pandemic trendline growth of close to 3%, with much of this contraction concentrated in advanced economies. The decline in premium volumes in real terms was uneven across the various lines of business, with the life insurance segment falling by close to 4.5% in 2020. However, the non-life insurance business segment managed growth of 1.5%. As a result of this subsector divergence, the non-life insurance business now outweighs the life insurance business. So far this year, momentum in non-life insurance remains strong, with particularly robust growth in the health and multi-risk lines, while the contraction in motor insurance is slowing. Turning to the Spanish insurance sector, signs suggest it is riding out the pandemic’s impact with relative ease, with the volumes for non-life recovering faster than initially expected. In this context, the trend in margins will be shaped by what happens to claims, which are expected to normalise. This is, however, based on the assumption that financial market stability continues.

Introduction

The pandemic brought the global economy to its heels, resulting in sharp contractions in GDP and employment. The unprecedented negative shock had a major impact on aggregate supply and demand. Although the intensity of the adverse shock has easily surpassed that of the Global Financial Crisis of 2008, the nature of the pandemic-induced crisis and the response to it by governments and institutions could not be more different, enabling, barring surprises, a much quicker return to pre-pandemic growth momentum.

The impact of the crisis has, however, differed greatly across sectors. The insurance industry, which is connected to every sector, was inevitably hit by the direct effects of the crisis and the transformations it initiated. Specifically, the insurance sector faced threats via three channels – the potential adverse impact on: (i) revenue (premiums); (ii) claims; and, (iii) the value of the asset portfolios held by insurers to support the technical provisions recorded for the various contingencies the sector covers. The latter risk materialised rapidly when the markets (bonds and equities) collapsed as soon as the pandemic was declared. However, with the passage of time, asset valuations have recovered, very remarkably in some cases, thanks to unprecedented and forceful governmental and institutional responses.

Given the insurance industry’s relevance for economic and financial stability, this paper

[1] synthesises the impact of the pandemic now that: (i) we have comparable, international sector data for 2020; and, (ii) the Spanish insurance companies have released earnings updates for the first half of 2021.

Impact of the pandemic on the insurance industry

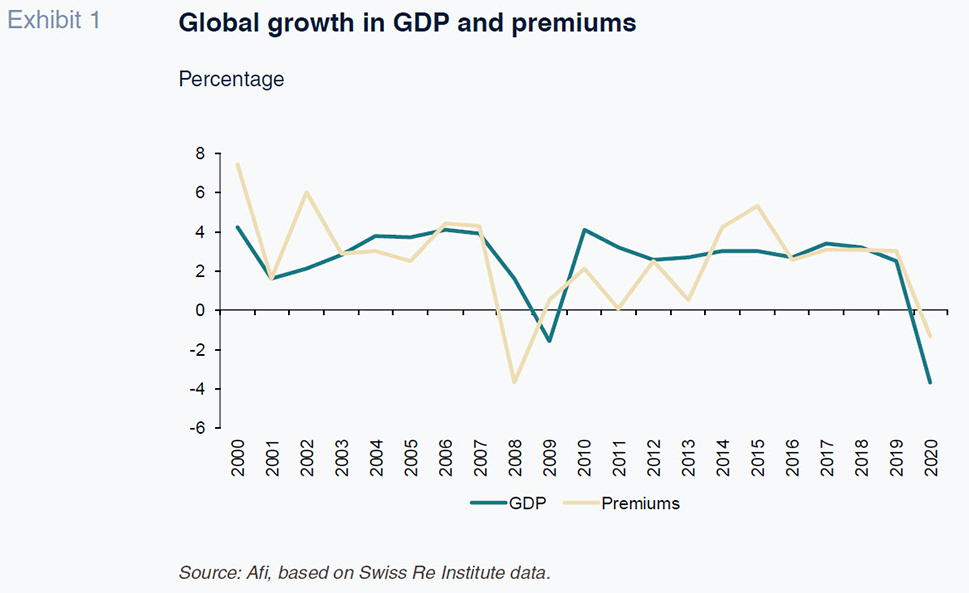

The forward-looking report published annually by the Swiss Re Institute (2020) provides insight into the disruption wrought by the pandemic on the insurance industry. In the advanced economies, non-life insurance premiums have trended upwards in line with GDP over the previous three decades. Growth in life insurance premiums, however, has trailed GDP since the financial crisis of 2008, having grown at a factor significantly higher than GDP growth up until then.

Meanwhile, in emerging markets, both life and non-life had been growing significant faster than GDP, fuelled by low penetration (premiums/GDP) of insurance coverage in those countries, as well as the elasticity-to-income of over one that tends to define its purchase. As a result, those markets have witnessed a continuous and rapid reduction in the insurance gap relative to the advanced markets (albeit remaining very high), led by China, which accounts for half of the universe of emerging markets and in size is already second in the world, behind the US.

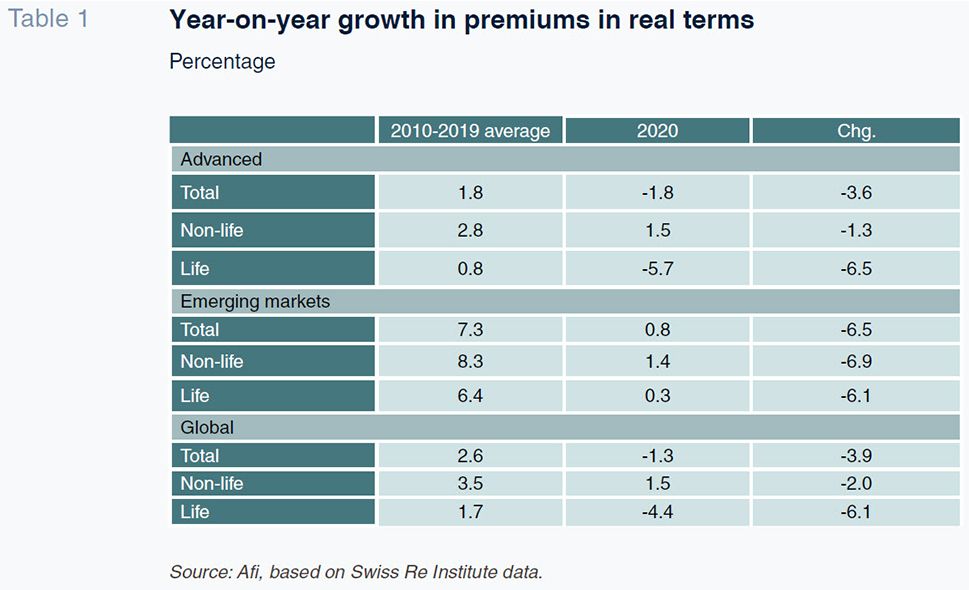

In advanced economies, real growth (net of inflation) in the non-life insurance business had been running at around 2% in recent years, while in life, growth was more subdued, at just under 1%. However, in emerging economies, that growth had been running at much higher thresholds, of 6%-8% in both instances. Globally, given the still relatively low weight of the emerging markets in the insurance business in terms of total premiums (less than 20% compared to a contribution to global GDP of close to 40%), the sector had been registering overall growth in recent years of close to 3%.

That momentum in the insurance market led to an abrupt halt as a result of the direct and indirect effects of the pandemic, albeit sustaining uneven impacts by line of business and market:

- In 2020, the sector sustained a real contraction in premium volumes of 1.3% compared to the pre-pandemic trendline growth of close to 3%. Although that performance clearly marks a sudden downturn in revenue, it was significantly less than the contraction observed in global economic growth.

- The decline in premium volumes in real terms was not even across the various lines of business. In 2020, revenue in the life insurance segment fell by close to 4.5% (vs. average annual growth of 1.7% during the previous decade), evidencing far greater sensitivity to the pandemic. That adverse trend was fuelled by collateral damage related to the pandemic, beyond the mere impact of the collapse in economic activity. Note, moreover, that the bulk of the revenue generated in the life insurance business (nearly 80%) is generated in developed economies.

- In the non-life insurance business, despite the sharp contraction in the GDP, the segment managed growth of 1.5% (albeit below the 3.5% average of the previous decade). In other words, this segment proved far less sensitive to the pandemic shock than the life insurance business. Its sensitivity was also lower than its own long-run rate, although an accurate assessment requires factoring in 2021 premiums, given the usual time lag in responsiveness. All signs suggest, however, that the rollout of the vaccination drive and the massive stimulus packages articulated by the various governments, which facilitated an unusually quick V-shaped exit from the current crisis, should pave the way for overcoming, in just a few short quarters, the slowdown observed during the pandemic.

- From a geographical perspective, the trend has also been highly uneven from one region to the next. Specifically, the above-mentioned contraction of 1.3% in global insurance premiums, in real terms, was concentrated in the advanced economies (-1.8% vs. +1.8% on average during the previous decade), as growth in the emerging economies (spearheaded by China, which accounts for half of this group) simply eased, albeit sharply (+0.8% vs. +7.3% on average during the previous decade).

- The contrast with the Global Financial Crisis of 2008 is stark. The most noteworthy difference is the relatively smaller impact on the insurance business of this crisis in relation to the change in GDP. The contraction and recovery in GDP are both proving much sharper on this occasion. In line with the last crisis, however, the life insurance business is proving more sensitive than the non-life insurance segment. The ‘transient’ nature of the prevailing crisis is substantially responsible for these differing trends.

The relatively limited impact in terms of overall demand for insurance, coupled with evident signs of a more vigorous recovery than after the financial crisis, has also been accompanied by reasonably healthy trends in margins and profitability, with the drop in claims in certain lines (

e.g., motor insurance) as a result of the mobility restrictions offsetting the growth in claims in those lines more exposed to the adverse effects of the recession.

Elsewhere, as signalled in the Swiss Re Institute report, the pandemic has triggered the emergence of two important factors that are set to stimulate development of the insurance market in the long-run. A heightened aversion to risk has emerged, which in all probability will increase society’s propensity to insure, even in countries in which penetration was already high. The most obvious case would be health insurance alongside coverage against global supply chain disruption or protection against cyber risks.

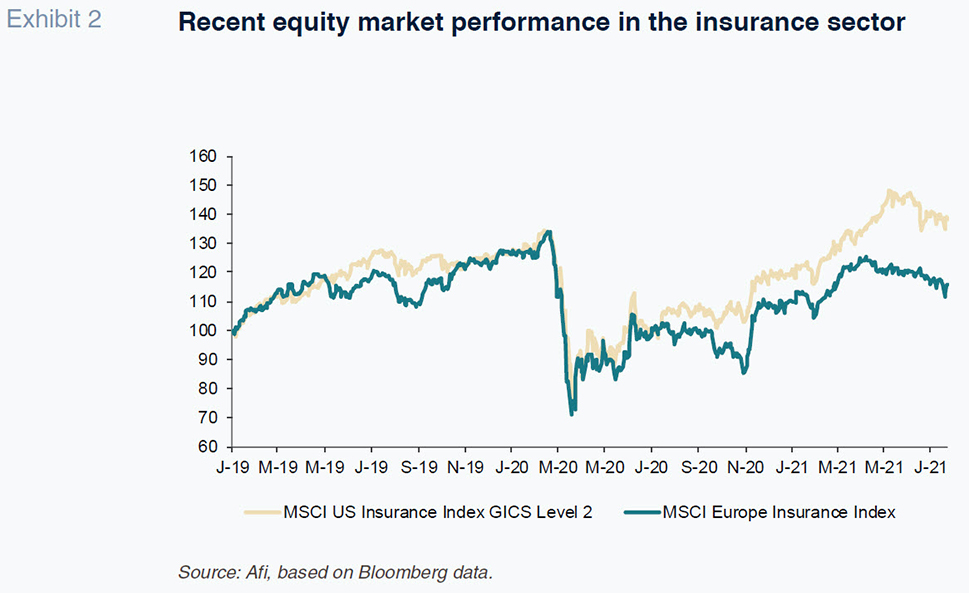

Elsewhere, the arsenal of measures rolled out by governments and central banks around the world has also managed to stabilise the markets, whose rout initially threatened to have a serious impact on the value of insurance companies’ portfolios. Although the risks have not fully dissipated, portfolio valuations have, in some cases, surpassed pre-pandemic thresholds. Credit spreads are relatively tranquil, and the stock markets have digested the initial shock.

More than a year after the onset of the pandemic, the insurance sector’s equity market valuation is a good indicator of the investment community’s current positive outlook for the business. As shown in the accompanying exhibit, the main international insurance sector indices have been closing in on pre-pandemic valuations (in Europe) and in some cases (US) have clearly overshot those levels.

Spanish insurance sector: Replica of global dynamics

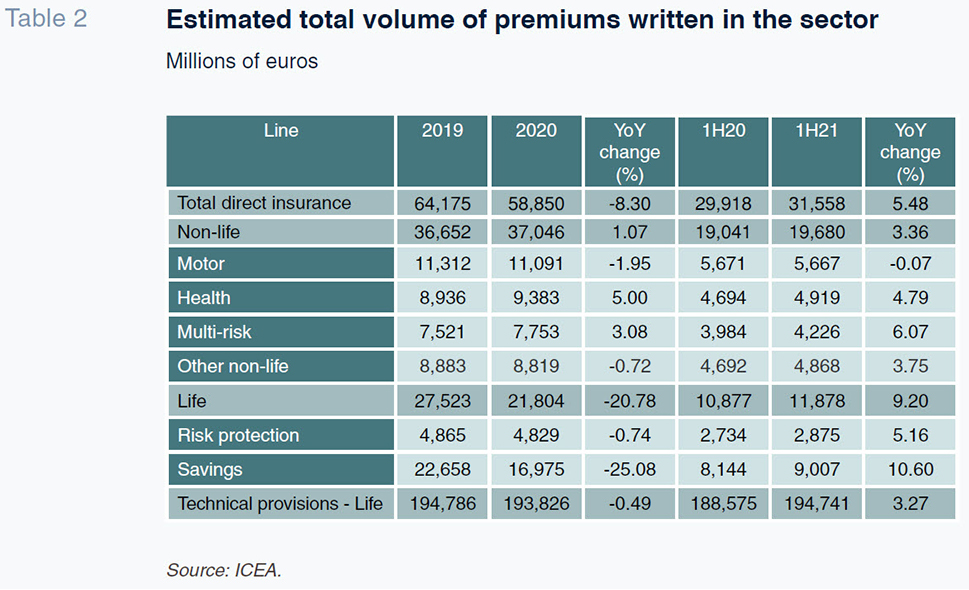

In Spain, albeit marked by similar differences across business lines, the sector is also performing relatively well, based on our analysis of the key metrics for 2020, complemented by the latest figures available for this year. As shown in the accompanying table, the sector activity figures, measured by the volume of direct insurance premiums written, reveal a considerable overall contraction in 2020 (-8.30%). Note, however, that the contraction was shaped by an exceptional collapse (-20.78%) in life premiums.

That marked the fourth year in a row of contractions in life premiums against the backdrop of ultra-low interest rates, making life insurance coverage a harder sell. Logically, those headwinds blew much stronger in 2020 due to the effects of the pandemic: reduced sales capacity at the insurers; intensification of the central banks’ zero-rate scenario; and, a greater propensity by households, faced by heightened pandemic-induced uncertainty, to channel their savings into cash (deposits) rather than the savings products traditionally marketed by the insurance sector.

Compared to the sharp contraction in premium volumes in the life insurance business, non-life insurance products reported volume growth (+1.07%), despite the fact that the Spanish economy contracted by a resounding 10.8%. Non-life insurance volumes continued to be spearheaded by health and multi-risk products, which even in recessionary times continued to display solid growth dynamics (+5.0% and +3.08%, respectively). The insurance products with a more cyclical component (motor and other lines) saw their volumes contract, however (-1.95% and -0.72%).

The combination of the two trends means that the non-life insurance business now outweighs the life insurance business. The former currently accounts for over 60% of annual premiums, whereas as recently as in 2016 the business was evenly split between the two lines.

During the first half of this year, even though the comparison is partially distorted by the effects of the lockdown during the second quarter of 2020, the life insurance business has recovered sharply (+9.20%), in both the personal protection and savings and retirement segments, with an intensity that is proving a pleasant surprise. It would be prudent, however, to wait for the data for the second half of the year to confirm the consistency of this recovery trend with a more like-for-like comparison. Certainly, the prevailing economic and financial conditions do not bode well for a significant recovery in the life-savings business, although the outlook for unit-linked policies, where investment risk is borne by the policyholder, and life-protection is good.

In non-life insurance, the momentum remains strong (+3.36%), with particularly robust growth in the health and multi-risk lines (+4.79% and +6.07%). Meanwhile, the contraction in motor insurance is slowing (-0.07%), virtually replicating the 1H20 performance, with ‘other’ lines taking off (+3.75%). As a result, the sector is close to revising its pre-pandemic cruising speed without having sustained the delayed adverse impact that an economic shock typically has on the insurance business. In short, the non-life insurance business has registered uninterrupted growth, even when the pandemic was at its worst (2020). Forecasters expect that in 2022 the numbers will converge around the growth path that had been estimated for next year before the pandemic came to light.

[2] In fact, premiums written in health and mixed insurance were nearly 10% higher year-on-year in 1H21.

[3] Against that backdrop, it is reasonable to expect the health insurance line to lead the non-life insurance business in the not too distant future, relegating the segment’s long-standing leader, motor coverage, to second place.

In addition to strong sales of non-life insurance in 2020,

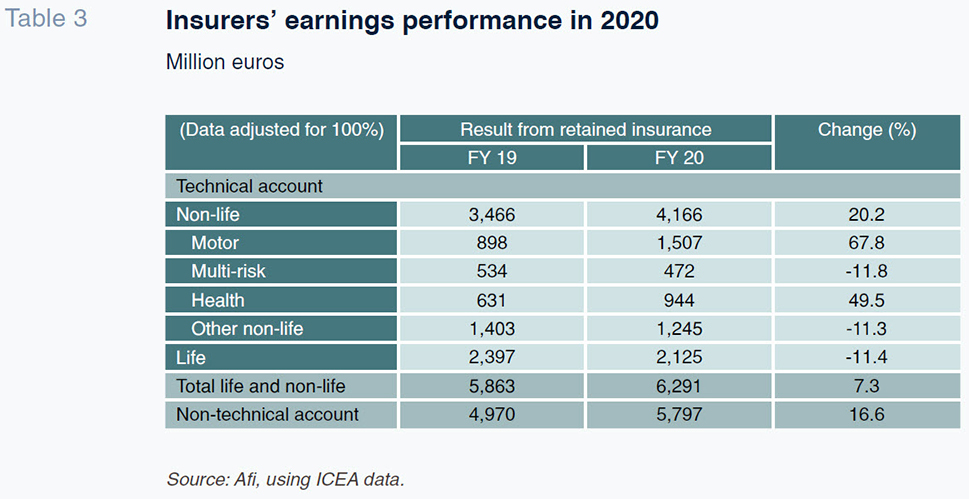

[4] claims were exceptionally low in the top two sub-lines, motor and health, as a result of the effects of the lockdown and mobility restrictions. That had an extraordinary effect on the margins and profitability of the insurers active in those segments. As shown in the accompanying exhibits, claims-to-premiums declined by around 10 percentage points and nearly 4 percentage points in motor and health, respectively. That drove an exceptional increase in the technical result in both classes of insurance, in turn shaping the best technical result in the non-life segment in a decade in both absolute terms and as a percentage of premium volumes (up to 12.14%, compared to an average of 10% during the past decade). This is despite the economic slump and the growth in claims in classes such as civil liability, death and multi-risk.

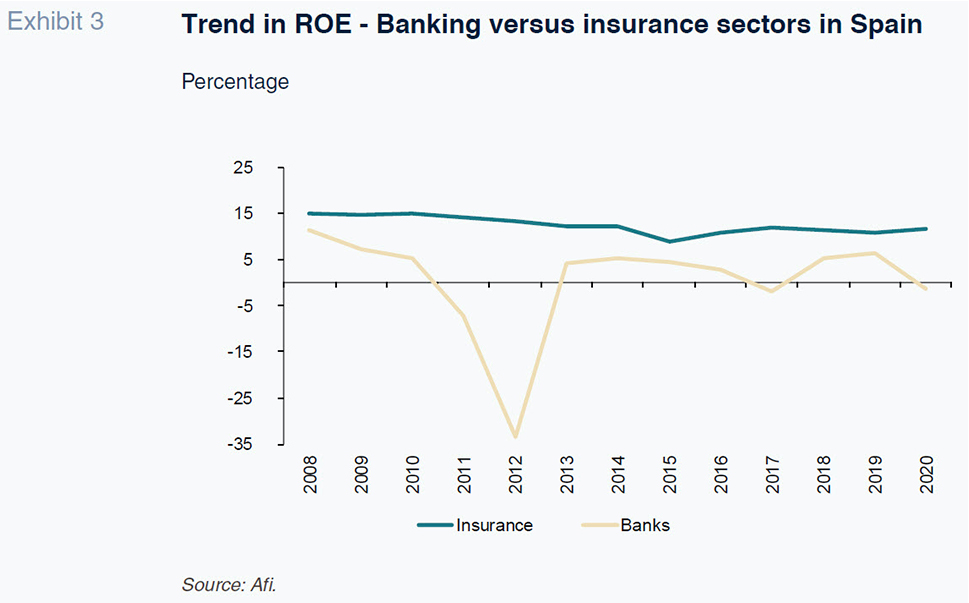

That exceptional trend in non-life insurance offset the adverse trend in life whose technical result, as illustrated by the table, sustained a contraction of over 10% in 2020. So much so that in the year of the pandemic the overall profits of the Spanish insurers increased by 16.6%, the highest level in recent years. In fact, they reported a ROE of over 12%, up two points from 2019, the year before the pandemic, and the highest level since 2014.

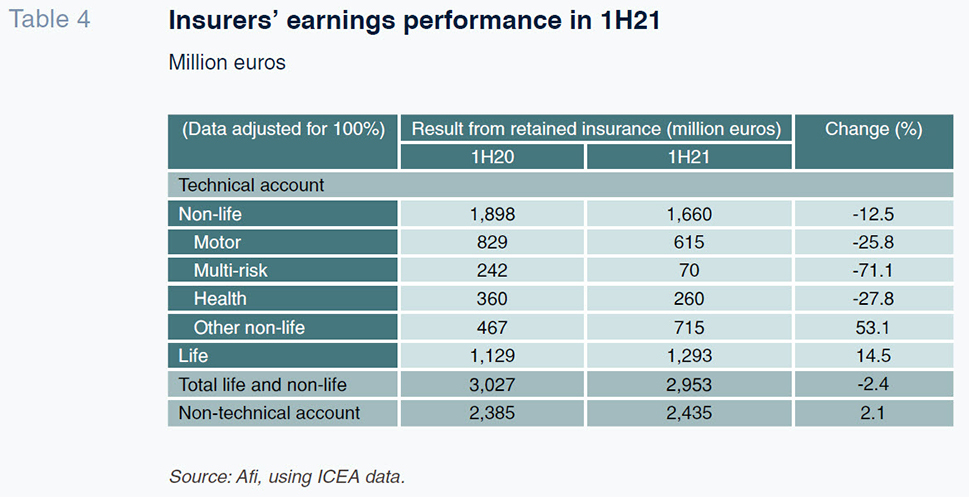

In the first half of 2021, the extraordinarily low claims registered in motor and health have increased. Nevertheless, in motor insurance, they remain low by historical standards (67.31%

vs. an average of 75% in the years prior to the pandemic). Meanwhile, claims in the multi-risk line reached highs for the last decade (72.32%), primarily on account of the unprecedented January snow storm.

[5] As a result, in the first half of 2021, the overall non-life insurance technical result declined by 12.5%, albeit shaped by the extraordinarily strong result recorded during the same period of last year.

In life, the above-mentioned improvement in the first half of the year, coupled with favourable market dynamics, has paved the way for a much better earnings performance in this line, which has practically offset, in terms of both the technical and non-technical accounts, the dip in earnings in the non-life business during the period, so that the Spanish insurance sector ended up recording a similar volume of profits as it did in the first half of 2020. Although it is unlikely that by the end of 2021 the sector’s earnings and profitability will be as strong as in 2020, this year should, nevertheless, prove a relatively good one.

It is worth highlighting the contrast between the earnings and profitability of the insurance sector in Spain relative to the banking industry (Manzano, 2017). Compared to the momentum in the insurance business, in 2020, the banks front-loaded the expected adverse impact of the pandemic on loan performance, such that it returned to loss-making territory, following the ‘clean-up’ of its assets in 2011 and 2012 and the fall and takeover of Banco Popular in 2017. That proactive provisioning strategy is, however, facilitating a significant margin recovery this year. Nevertheless, as shown in the exhibit, the long-run gap between the two sectors’ returns, measured by ROE, is clearly set to continue.

In short, the Spanish insurance sector is riding out the impact of the pandemic with relative ease and all indicators suggest that non-life insurance business volumes are recovering, albeit at considerably different rates from one class to another, faster than initially expected. In this context, the trend in margins will be shaped by what happens to claims, which are expected to normalise. This is, however, based on the assumption that financial market stability continues, which seems relatively assured in the short-term at least given the scenario depicted by the central banks. That scenario, which includes forward rate guidance for the next 12 to 18 months, and the attendant protraction of negative real rates is not, however, the best recipe for a lift-off in savings and retirement cover in the form of traditional insurance products. That is expected to curb growth in the non-life business, which is likely to remain focused on the policyholder risk-bearing products, which are still underdeveloped in the Spanish market.

Notes

It compiles and integrates the analysis conducted in a series of sector reports published by Afi.

It is true that the higher rates of inflation are impacting some areas of insurance premiums and are bound to make a difference.

The increase is partially attributable to collateral effects of the pandemic, driving health risk awareness; and, as a result of the impact of the lockdown, growth in home protection coverage (within multi-risk cover).

Driven by the solidity in health and multi-risk, given the fact that premiums in motor and other non-life covers contracted.

The significant drop in claims in “Other non-life” is noteworthy and is probably largely shaped by the much lower than initially expected rate of claims in the credit insurance areas due to the positive initial impact of the support measures deployed by the Spanish government in response to the pandemic (state guarantees, official loans, etc.).

References

Ignacio Blasco, Daniel Manzano and Aitor Milner. A.F.I. – Analistas Financieros Internacionales, S.A.