Spain’s recent performance implementing the recovery funds and outlook for 2022

Spain is set to received 140 billion euros as part of the Next Generation EU funds to facilitate the country’s recovery from the COVID-19 crisis, with a focus on the green and digital transitions. So far, progress on executing plans to use these funds has been uneven, with investments and reforms expected to ramp up in 2022.

Abstract: Spain’s Recovery, Transformation and Resilience Plan (the Plan), approved by the European Commission in June, will mobilise up to 140 billion euros of funds. Spain is currently in the process of implementing the first tranche, in the amount of 69.53 billion euros – transfers from the Recovery and Resilience Facility (RRF). Although execution of the investments contemplated under the Plan will last until 2026, 70% of the RRF funds have to be committed in 2021–2023. That means there is little more than two years left for highly ambitious commitments to materialise. Based on the budget breakdown contemplated in the Plan for 2021 and the information gleaned from the tenders published up until October (inclusive), a significant volume of funds still needs to be executed before the end of the year. Furthermore, execution levels across the various Plan drivers and components are proving uneven. Nevertheless, any RRF funds that are not executed in 2021 will be rolled into next year’s budget. The general state budget for 2022 contemplates 26.9 billion euros of investments under the Plan. That sum implies stepping up the pace of investments and reforms by over 10% by comparison with 2021.

Introduction

Implementation of the Next Generation EU (NGEU) funds to counteract the impact of the COVID-19 crisis is underway. Up to 672.5 billion euros (out of a total of up to 750 billion euros) contemplated for 2021–2026, will be disbursed and distributed among the 27 member states via the Recovery and Resilience Facility (RRF). Each country has submitted its recovery plan to the European Commission for subsequent approval by the Council.

In this paper, we analyse the plan presented by Spain and the RRF funds that have been allocated to it, [1] along with the scheduled disbursement timeline. For the disbursement of recovery funds to take place, Spain must meet a series of milestones and objectives outlined in its Plan. To that end, we also analyse in greater detail the progress Spain has made on executing the Plan. Lastly, we identify key aspects of the actions for next year, now that Spain has presented its general budget for 2022, which is still pending approval.

Spain’s Recovery Plan and its funding

The European Commission approved the Recovery, Transformation and Resilience Plan presented by the Spanish government on June 16th, 2021. The goal is to boost the social and economic recovery following the impact of the health crisis and amplify the Spanish economy’s longer-term growth capacity.

The Plan contemplates the mobilisation of up to 140 billion euros, in keeping with the assignation approved by the European Council for Spain, to finance over 200 structural investments and reforms across the four axes around which the Plan is articulated: green transition; digital transformation; gender equality; and, social and territorial cohesion. The twin green and digital transitions account for 39.7% and 28.2% of the total fund, respectively.

Within the four cross-cutting axes, the Plan is structured into 10 so-called policy levers. Those drivers in turn encompass 30 specific initiatives or components. Each of those initiatives is targeted at a specific objective, addressing the investments and reforms needed to deliver that objective. In order to oversee execution of the Plan as intended, a series of goals and milestones have been set that will trigger disbursements by the European Union. Those milestones will serve to assess the progress and cost of the initiatives for each component and the scale of their impact in terms of the number of potential beneficiaries.

Spain is currently in the process of implementing the first tranche of the 140 billion euros, specifically a sum of 69.53 billion, in the form of non-reimbursable grants (transfers from the RRF). Spain can mobilise another 71.7 billion euros until 2026 which would take the form of loans. The country has not yet applied for those loans (it can do so from next year).

Fund execution will be aligned with the existing distribution of competencies among the various levels of government and in keeping with the spending formalities stipulated in applicable public administration legislation.

Note that even though execution of the investments contemplated under the Plan will be spread out between now and 2026, 70% of the RRF funds must be committed between 2021 and 2023. That means there is little more than two years left for highly ambitious commitments to materialise. [2] Additionally, Spain stands to receive 44 billion euros of structural funds during the new European Union budget period 2021-2027, bringing the total to almost 200 billion euros.

A number of milestones and targets condition the disbursement of the recovery funds

Disbursement of the RRF funds depends on delivery of a series of milestones and objectives [3] set for each time interval under the umbrella of the financing agreement struck with the European Commission.

During execution of the Recovery, Transformation and Resilience Plan, Spain will have to attain multiple, interrelated milestones and targets in order to ensure it makes full use of the funds allocated and maximises their impact in terms of supporting the recovery, growth and modernisation of the Spanish economy. Starting from the second half of this year, Spain is due to receive six-monthly disbursements until the end of 2023, subject to delivery of the above-mentioned milestones and targets.

In 2021, Spain received a first payment by way of ‘pre-financing’ of close to 9.04 billion euros (equivalent to 13% of the 69.53 billion euros of RRF transfers due in total). Before the end of the year it is due to receive its first six-monthly disbursement, in the amount of 10 billion euros, following delivery of the milestones and targets established for the period between February 2020 and June 2021 (with around 100 milestones associated with structural reforms). [4]

Effectiveness of Law 7/2021, of May 20th, 2021, on climate change and energy transition, adoption of the Circular Economy Strategy and of the hydrogen roadmap, approval of the Energy Storage Strategy and of the State Inspection Plan for Cross-Border Waste Transfers, 2021-2026 are a few of the headline milestones reached on the green transition front. In terms of digital transformation, it is worth mentioning the adoption of the Digital Spain 2025 Agenda and within it, approval of: the National Strategy for Artificial Intelligence; the Plan for Connectivity and Digital Infrastructures of Society, the economy and the territories; the Strategy to Promote 5G Technology; the SME Digitalisation Plan 2021-2025; the Plan for the Digitalisation of Spain’s Public Administration: 2021-2025; the National Plan for Digital Skills; and, the Spain Audio-visual Hub. Also, Spain has delivered a number of milestones and targets related with education, social protection, labour market modernisation, business climate improvement and tax reform, among others.

In January 2022, Spain will request a disbursement of 12 billion euros on the basis of the milestones and targets delivered during the second half of 2021. And in the second half of 2022, it should be due another 6 billion euros. In 2023, it may qualify for another two disbursements, the first of 10 billion euros in the first half and the second of 7 billion euros in the second half. After 2023, it would be due one annual disbursement: 8 billion euros at the end of the first half of 2024, another 3.48 billion euros at the same juncture of 2025, and a final payment of 4 billion euros in December 2026, marking the end of the RRF.

Execution performance as of October 2021

The rollout of the investments contemplated in the Plan is not, however, subject to effective disbursement of the RRF funds by the European Commission and receipt thereof by Spain. To the contrary, the Spanish government is anticipating receipt of the funds, layering them into its general budgets, in order to be ready to put them to use quickly. It will then repay the debt taken on to front-load the investments as it receives the funds from the European Commission.

The Plan sets down the funds needed to implement the measures comprising each component (maximum budget) and the types of tenders that the administration will call (grants, refundable financing [soft loans], tenders, etc.). The first tenders were published in April 2021 and since then the authorities have run a series of tenders associated with implementation of the various components of the Plan.

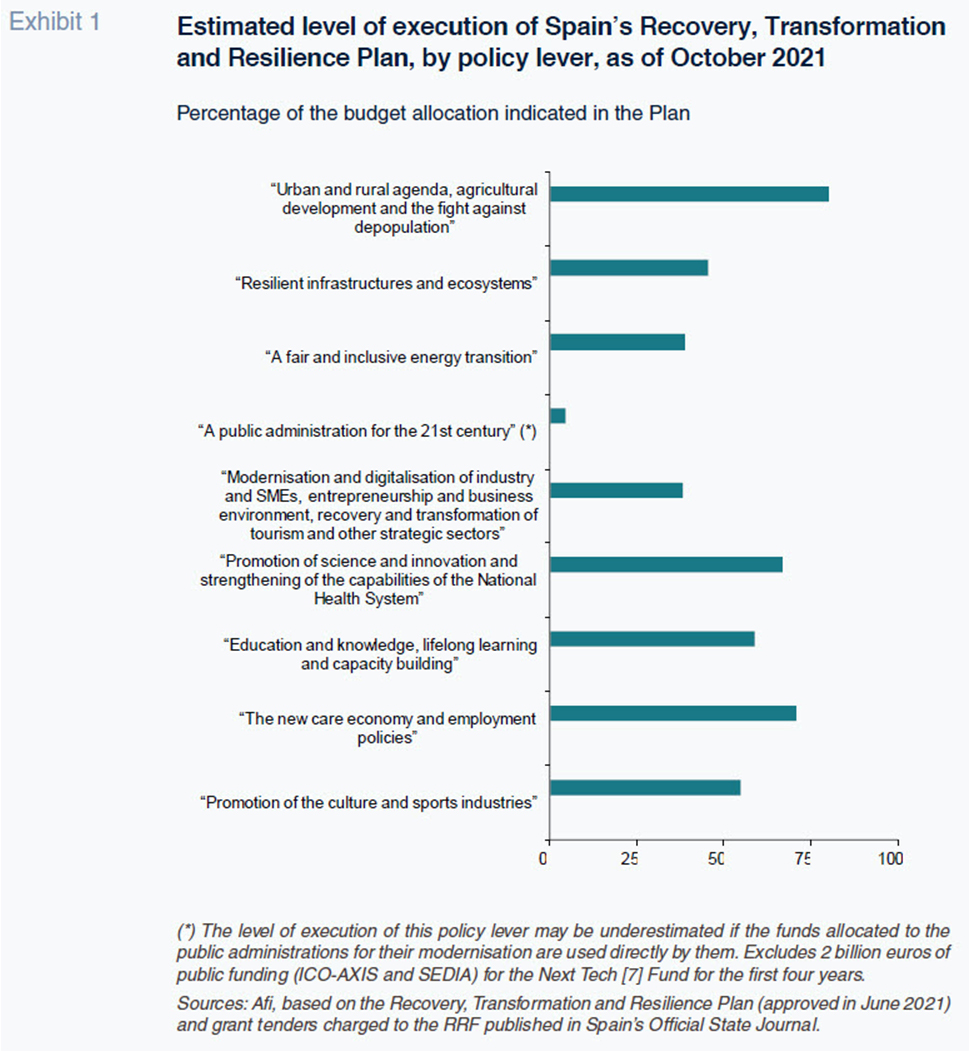

However, judging by the budget breakdown contemplated in the Plan for 2021 and the information gleaned from the tenders published up until October (inclusive), [5] a significant volume of funds still needs to be executed before the end of the year. Note additionally that the pace of execution across the various drivers and components of the Plan is proving uneven. Next, we analyse the state of progress of [6] each of the policy levers and their components.

Policy lever #1 is “Urban and rural agenda, agricultural development and the fight against depopulation”, with a budget for this year of close to 4.5 billion euros. It is the most advanced in terms of the funds mobilised as of October 2021, with an execution or outturn rate of around 80%. That high percentage is attributable to the progress made on two of its core components. The first of those two components is “Housing rehabilitation and urban renewal plan” and the favourable progress report is thanks to the launch of the so-called “Building Energy Rehabilitation Programme”, along with another two programmes for municipalities facing demographic challenges and the Residential Rehabilitation Programme. The other top-performing component (albeit one with a much smaller budget allocation) is “Green and digital transformation of agri-food and fisheries industries”; an area in which grants have already been channelled into projects addressing sustainable irrigation and fishing fleet modernisation and digitalisation, in addition to other aid via the regional governments for the development of precision agriculture, energy efficiency in fish farms and energy recovery from subproducts and biomass.

Under policy lever #2 “Resilient infrastructures and ecosystems” less than half of the 1.35 billion euros budgeted for this year has been allocated. Nevertheless, within the “Ecosystems and biodiversity conservation and restoration” component, over 80% of the budget has already been distributed among the regional governments to pursue initiatives in this area. Albeit to a lesser extent, funds have already been distributed regionally for the “Coastal area and water resources preservation” component.

As regards policy lever #3 “A fair and inclusive energy transition”, the execution rate stands at 40% of the current budget of 2.75 billion euros. The strongest progress has been made in the “Fair transition strategy”. That said, this component has a budget of just 90 million euros in 2021. The “Renewable energies implementation and integration” component, on the other hand, boasts the biggest budget: 1.9 billion euros. The grants launched to subsidise the installation of renewable energy self-consumption and storage infrastructure stand out; they will be channelled by the regional authorities and charged against the above component as well as “Electrical infrastructures, promotion of smart networks and deployment of flexibility and storage”.

Policy lever #4, “A public administration for the 21st century”, has been allocated a budget of a little over 1.9 billion euros for this year, earmarked to a single component: “Modernisation of public administration”. Here, the percentage of funds to be allocated for the remainder of the year is higher but we think the award process could be more agile as it does not depend on tenders involving private agents.

“Modernisation and digitalisation of industry and SMEs, entrepreneurship and business environment, recovery and transformation of tourism and other strategic sectors” (policy lever #5) presents an execution rate of around 40% of the 3.8 billion euros allocated for 2021. However, the level of progress differs significantly across its four components. The component with the biggest budget allocation for this year (around 1.06 billion euros), which is “Digital connectivity, cybersecurity, 5G deployment”, has launched a few banner tenders, including the “Single Broadband” project for the rollout of ultra-high speed broadband networks. The “Industrial Policy Spain 2030” component, despite having a somewhat smaller budget, will channel close to 840 million euros, including a range of grants in the form of reimbursable financing (such as the Active Financing Facility and innovation and sustainability plans in the manufacturing sector) and we estimate execution levels at over 70%. This component also encompasses the sector-specific plans, the so-called Strategic Economic Recovery and Transformation Plans, although only the plan for electric and connected cars has been approved so far. The tender for aid for “End-to-end initiatives in the electric and connected vehicle industrial chain” is set to be published before the end of the year. Elsewhere, the “Modernisation and competitiveness of the tourism sector” (over 1 billion euros in 2021) and “Fostering SME growth” components (over 900 million euros) are far less advanced, with estimated execution rates of under 13%. Some of the lines of initiative falling under this category include destination market sustainability plans and aid for local authorities for the purpose of modernising business districts.

The situation is better with policy lever #6, “Promotion of science and innovation and strengthening of the capabilities of the National Health System”, which has a budget allocation of around 1.86 billion euros and presents an execution rate of nearly 70% as of October 2021. The best-performing component is “Renewal and expansion of the capabilities of the National Health System”, where execution stands at over 90%, thanks to the rollout of a specific plan, via the regional authorities, for the acquisition of medical technology. However, the component with the biggest budget for 2021 (over 1.1 billion euros) is “Institutional reform and capacity building in the national science, technology and innovation system”. The launch of several grant tenders by CDTI (acronym in Spanish for the Centre for the Development of Industrial Technology) and other entities (such as the Science and Innovation Missions Programme) and the aid for the acquisition of scientific-technical equipment, managed by the State Research Agency) has enabled the execution of over two-thirds of the planned funding. The “National Strategy for Artificial Intelligence” component is at a similar level of progress, thanks to the completion in early October of a tender for grants for R&D projects in the field of artificial intelligence and other digital technologies.

Policy lever #7, “Education and knowledge, lifelong learning and capacity building” presents an execution rate of around 60% as of October, out of the total 2021 budget of almost 3.3 billion euros. The level of execution varies between this policy’s three components, although most of the budget, over 2.2 billion euros, has been assigned to the “National Plan for Digital Skills”. Within the funds allocated to date, it is worth highlighting the distribution among the regional governments of over 1.6 billion euros of funds for classroom digitalisation, vocational training, the implementation of education orientation programmes for vulnerable groups and training and skills provision for teaching and research staff.

“The new care economy and employment policies” (policy lever #8), with a budget of over 2 billion euros in 2021, presents an execution level of just over 70%. This lever’s two components boast broadly similar budgets. That being said, fund allocation is further along in the “Emergency plan for the care economy and reinforcement of inclusion policies” component relative to “New public policies for a dynamic, resilient and inclusive labour market”. In both instances, the funds are being mobilised via the regional governments and are being earmarked to initiatives to promote jobs for youths, labour activation policies, territorial rebalancing and equality projects and initiatives related with social inclusion and the minimum income scheme.

Lastly, policy lever #9, “Promotion of the culture and sports industries”, is smaller in scale, with a budget of 307 million in 2021, and presents a modest execution rate, of an estimated 55%. Nevertheless, the budget assignation devoted to the “Unlocking of value in the cultural industry” has been awarded in full and progress has been made on the odd initiative within the “Spain AVS Hub” component in order to foster the international expansion of the Spanish audiovisual sector.

At any rate, just two months shy of year-end, it looks unlikely that all of the budget allocated for year one of the Recovery Plan will be executed. However, unlike other funds awarded by the European Union, the RRF funds that are not executed this year will not be lost but will rather get rolled over to next year’s budget.

Expectations for 2022

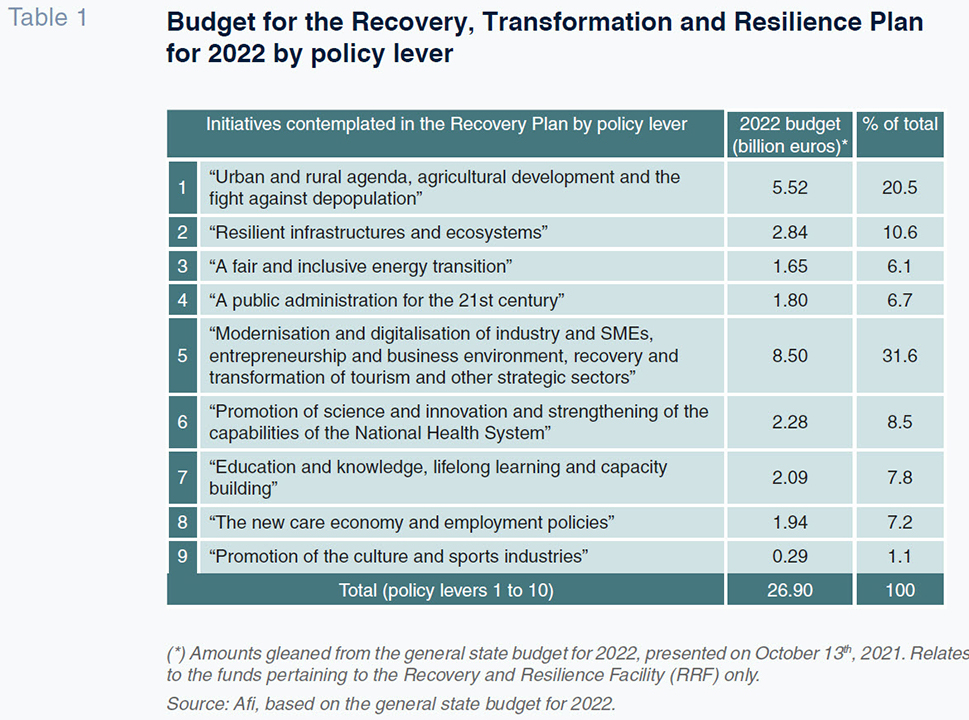

The general state budget for 2020 assigns 26.9 billion euros to the Recovery, Transformation and Resilience Plan, pending adjustments for the funds that ultimately are not executed in 2021 and get rolled over to next year. That sum implies stepping up the pace of investments and reforms by over 10% by comparison with 2021.

That growth will similarly be felt at the regional and local levels as the regional governments are expected to receive 8.71 billion euros, and the local authorities, a further 2.05 billion euros, in order to set the initiatives contemplated in the Plan that fall under their purview in motion. As a result, the regional governments will receive 31% more funds than they have been allocated in 2021, while the local authorities will get an additional 58%, without prejudice to the adjustments stemming from effective fund execution each year.

Elsewhere, the ministries that will be allocated the highest volumes of funds in 2022 for execution of the Plan are the ministry of transport (22% of the total), followed by the ministries of industry (18%), green transition (16%) and economic affairs (15%). Between them, those four ministries will be responsible for over 70% of the RRF budget for next year.

In terms of lines of initiative, the biggest budget allocation in 2022 (close to 32% of the total) goes to policy lever #5, “Modernisation and digitalisation of industry and SMEs, entrepreneurship and business environment, recovery and transformation of tourism and other strategic sectors”. Its materialisation will depend to a significant degree on the implementation of major projects, such as the strategic sector-specific plans, in order to drive the competitiveness and sustainability of Spanish industry. It will also require actions targeted at SME digitalisation and the modernisation of business restructuring mechanisms that help nurture highly innovative enterprises.

A little over 20% of the 2022 budget is earmarked to fostering a range of initiatives under “Urban and rural agenda, agricultural development and the fight against depopulation” (refer to Table 1 for additional details about the budget breakdown).

In short, execution of the recovery funds is set to be more dynamic in 2022, articulated to a greater degree across the various levels of government, in keeping with their respective areas of competence. It will, therefore, be up to the various economic agents to identify opportunities for carrying out new projects with the capacity to drive the competitiveness and modernisation of the Spanish economy, advance on the key challenges associated with the long-sought twin green and digital transition, while forging more solid foundations in the areas of equality and social and territorial cohesion.

Notes

In this paper, we only contemplate the RRF funds, as they constitute the main NGEU instrument.

The deadline for committing the non-reimbursable portion of the funds is December 31st, 2023.

The milestones and objectives are structured into three levels: (i) those allocated to each component of the Plan; (ii) those corresponding to the measures comprising each component; and, (iii) those related with projects or sub-projects associated with those measures.

[5]

Information gathered by tracking the rules published for the various tenders in the Official State Journal and on the public sector contracting platform, along with other public data sources.

We do not analyse policy lever #10 “Modernisation of the tax system for inclusive and sustainable growth”, as it is not tied to the RRF transfers.

References

GOVERNMENT OF SPAIN (2021). Recovery, Transformation and Resilience Plan. (June 16th, 2021).

Regulation (EU) 2021/241 of the European Parliament and of the Council, of February 12th, 2021, establishing the Recovery and Resilience Facility.

SECRETARY OF STATE FOR BUDGETS AND EXPENDITURE (2021). Proyecto de Presupuestos Generales del Estado 2022 [Draft National Budget for 2021]. Yellow Book, 2022.

Ana María Domínguez and César Cantalapiedra. A.F.I. - Analistas Financieros Internacionales, S.A.