Spain’s budget for 2022: An assessment

Spain’s state budget for 2022 includes forecasts that appear markedly optimistic in comparison to other institutions’ estimates. Despite this, an increase in structural spending is likely, which casts doubt on the government’s ability to meet its deficit reduction targets.

Abstract: There are three key aspects of Spain’s state budget for 2022: the underlying macroeconomic forecasts; the public revenue and expenditure projections; and, the resulting deficit. The macroeconomic forecasts assume a 6.9% growth in private consumption, a 12.2% increase in investment, and export growth of 10.3%. However, other institutions have estimated GDP growth that is between 0.4 and 1.5 percentage points lower. In regards the second aspect, an unusually strong growth in revenue will be essential to delivering the forecasted deficit in 2021. The budget contemplates growth in non-financial income of 10.8% in 2022 to 279.32 billion euros. However, in the absence of the Next Generation-EU funds, that growth would narrow to 6.8%. Furthermore, various new taxes have yet to be approved and some of the temporary measures, such as the VAT cut on electricity, could be extended. Rising inflation is anticipated to increase structural spending by at least 8 billion euros in 2022. As for the level of public debt, the government is forecasting a reduction from 120% in 2020 to 119.5% in 2021 and 115.1% in 2022. In the absence of a credible fiscal consolidation plan, there are doubts about the feasibility of the deficit reduction path between 2021 and 2024.

Budget scenario in 2022: Deficit and debt

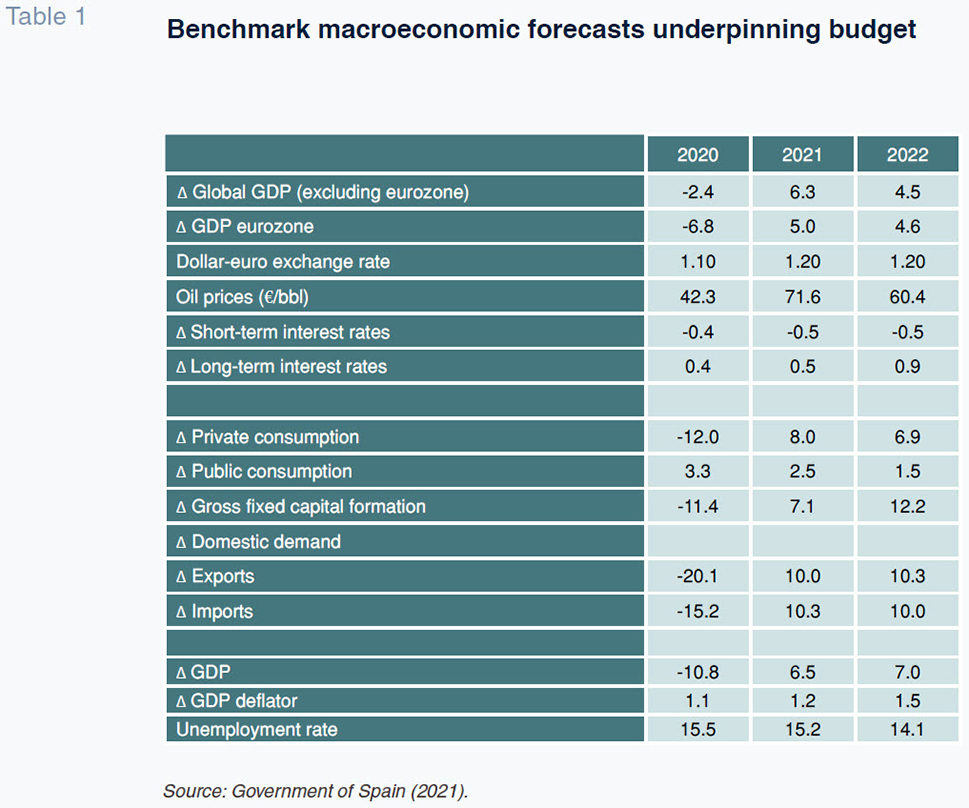

Table 1 presents the macroeconomic forecasts used to calculate the 2022 budget. The government assumes that the global economy will shake off a contraction of 2.4% in 2020 to register growth of 4.5% in 2022. As for the eurozone, Spain’s primary export market, growth is expected to reach 5.0% in 2021 and ease slightly to 4.6% in 2022. Against the backdrop of global economic recovery, Spain has drawn up its budget on the assumption that its GDP will register real growth of 6.5% in 2021 and 7.0% in 2022. That sharp growth in the Spanish economy is estimated using a dollar-euro exchange rate of 1.20, oil prices of around 60 euros per barrel and short- and long-term interest rates of -0.5% and +0.9%, respectively. However, those oil price assumptions could undershoot considering the steady growth sustained throughout 2021, with prices topping $80 per barrel in October. The macroeconomic forecasts assume three key growth drivers for the Spanish economy in 2022: (i) sharp expected growth in private consumption (6.9%); (ii) a strong rebound in investment (12.2%); and, (iii) positive trade dynamics, namely growth in exports of 10.3% in 2022. Framed by those assumptions, the government is forecasting unemployment at 14.1% in 2022.

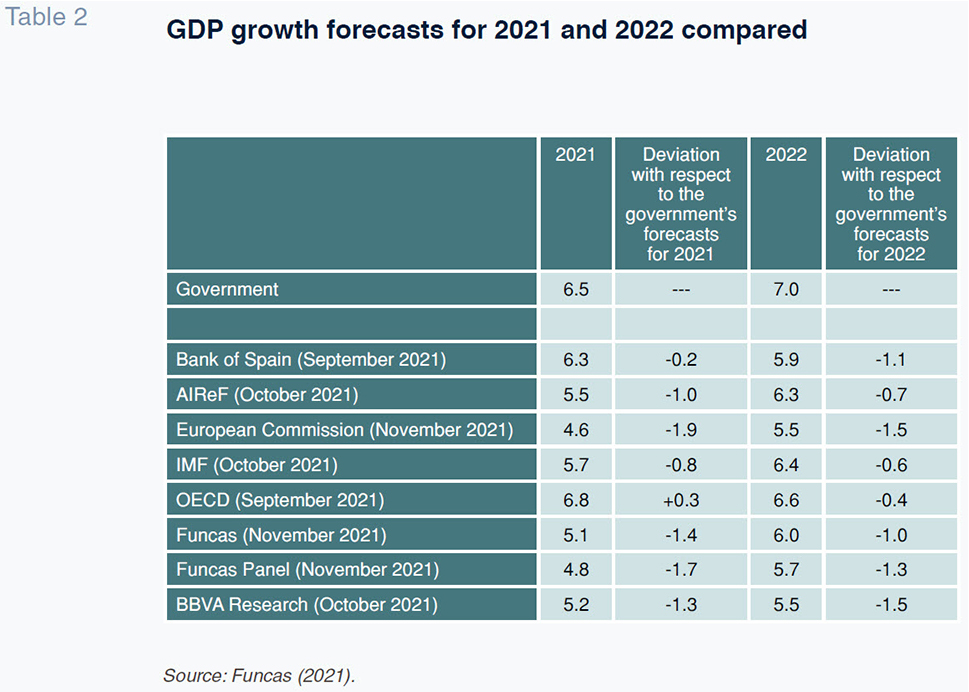

Forecasts published by leading economic institutions and think tanks are considerably less optimistic. As shown in Table 2, the latest forecasts for 2021 are lower than those modelled by the government by between 0.2 points (Bank of Spain) and 1.9 points (European Commission). For 2022, the differences, with respect to the government’s official update range from 0.4 points (OECD) to 1.5 points (most recent report from BBVA-Research and European Commission). October and November were marked by widespread forecast downgrades by the analyst community. For example, in just one month, the Funcas forecast for 2021 was cut from 6.3% to 5.1%.

The spate of downgrades was prompted by the downward revision to the second-quarter 2021 growth figure by Spain’s

Official Statistics Office, INE, from a preliminary estimate of 2.8% to 1.1%. The Spanish economy did not rebound as intensely as expected during the first half of the year on account of the restrictions induced by the third wave of COVID-19. Additionally, global supply chain friction has intensified, generating bottlenecks and driving intermediate goods prices higher, undermining the global economic recovery. Lastly, the downward revision to the forecasts also has to do with sluggish execution of the investments associated with the Next Generation-EU funds. According to BBVA-Research, Spain will be pressed to execute more than 10 billion euros of the 27 billion euros of NGEU funds budgeted by the government.

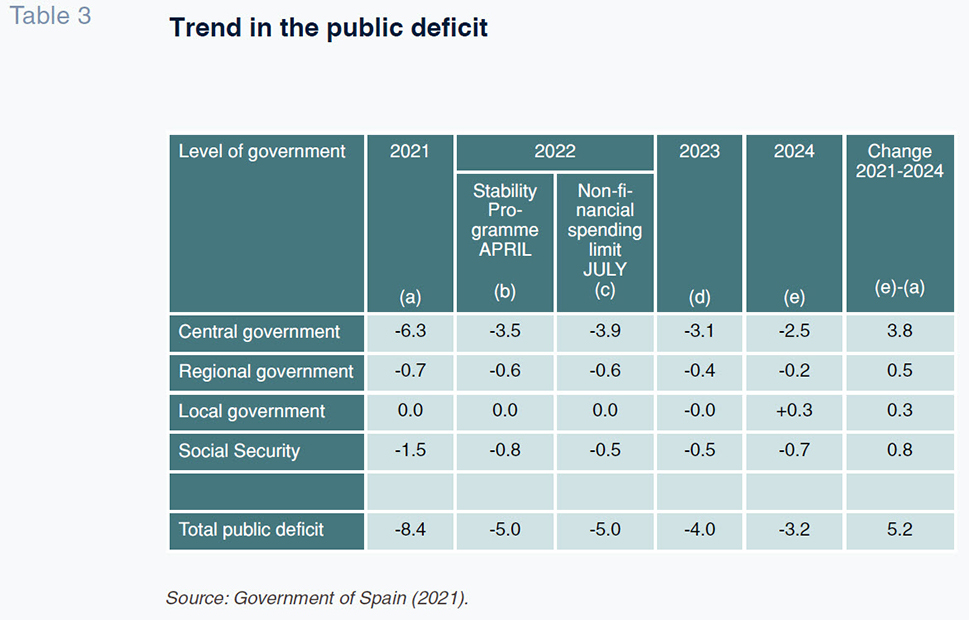

[1] The revision of the 2021 forecasts evidences the significant degree of uncertainty surrounding the deficit and debt consolidation paths contemplated by the Spanish government between now and 2024, as shown in Table 3.

According to the government’s roadmap, Spain will bring its public deficit down from 8.4% in 2021 to 3.2% in 2024. In just four years, the deficit will be cut by 5.2 percentage points of GDP to very close to the 3% threshold set by the European authorities. Of the expected 5.2 percentage point reduction, 3.8 percentage points would be covered by the central government, 0.8 percentage points by the Social Security and 0.5 percentage points by the regional governments (as the local authorities are expected to pass from deficit to surplus).

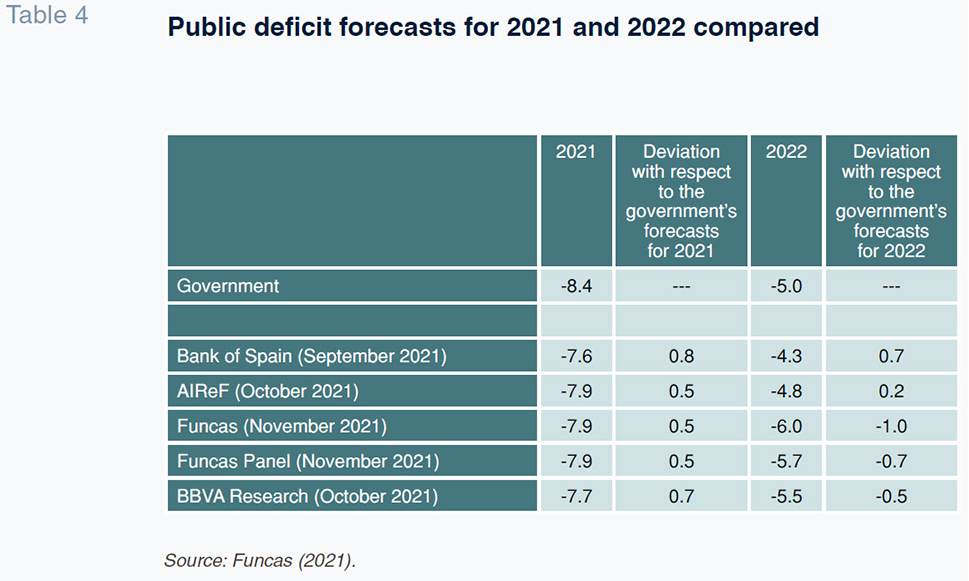

The deficit forecast gleaned from the 2022 budget, a draft of which was approved by the Spanish Cabinet on October 7th, coincides with that sent to Brussels in March as part of the updated version of its Stability Programme. However, a comparison with the deficit estimates provided in Table 4 shows that the most recent forecasts by the Bank of Spain, AIReF, Funcas and BBVA-Research point to a deficit this year of between 0.5 and 0.8 percentage points less than the government’s estimate of 8.4%. That highly unusual and somewhat unexpected situation is attributable to a stronger recovery in tax revenue than would be expected on the basis of the growth elasticities used for previous budgets. For illustrative purposes, accumulated tax revenues during the first six months of 2021 (90,475 million euros) were 3.45% higher than those obtained during those same months in 2019 (87,456 million euros) (Tax Agency, 2021). This occurred despite the fact that the average per capita income level in the first two quarters of 2021 was 8.70% lower than in the same period in 2019 (OECD, 2021). AIReF (2021) has pinpointed three possible factors for the recovery in tax collection: (i) recovery in employment and income support policies; (ii) shift back into spending on goods that carry standard VAT rates in 2021 following the spike in expenditure on goods taxed at discounted rates in 2020; and, (iii) reporting of previously undeclared income.

The analysts and organizations are more divided when it comes to the 2022 deficit. Specifically, the Bank of Spain and AIReF are estimating a deficit of between 0.2 and 0.7 percentage points below the 5% estimated by the government (note, however, that the Bank of Spain’s forecasts date to September). By contrast, BBVA-Research is estimating a deficit of 5.5% and the Funcas forecast is higher again, at 6.0%. Unfortunately, the dispersion around the forecasts casts doubt about the feasibility of the 5% deficit contemplated by the government for 2022, particularly as there is still no fiscal consolidation plan underpinning the deficit-cutting roadmap presented in Table 3. In other words, the downtrend in the deficit relies entirely on the cyclical impact on revenue and the gradual withdrawal of the COVID-19 mitigation measures. Note, however, that the challenges looming in terms of fiscal consolidation are only growing in light of the sharp increase of structural government spending, such as pensions. By way of illustration, every point of inflation implies an increase in public pension spending of approximately 1.6 billion euros. Pensioners will have to be compensated in 2021 by a payment equivalent to approximately 1.6 percentage points.

[2] That will imply an increase in pension spending this year of around 2.6 billion euros. Elsewhere, Funcas is forecasting inflation of 2.5% in 2022, which would lift pension spending a further 4.0 billion euros. In short, structural spending will increase by at least 6.6 billion euros in 2022 merely as a result of the impact of inflationary pressures. As for the level of public debt, the government is forecasting a reduction from 120% in 2020 to 119.5% in 2021 and 115.1% in 2022. The 2021 and 2022 figures are higher than those estimated by the Bank of Spain, which is forecasting 117.9% and 114.3%, respectively. Either way, those levels of debt are 20 percentage points above 2019 levels of 95.5%. Correcting the significant prevailing deficit and debt imbalances is an unavoidable task that needs to be tackled head on by the Spanish government in the years to come.

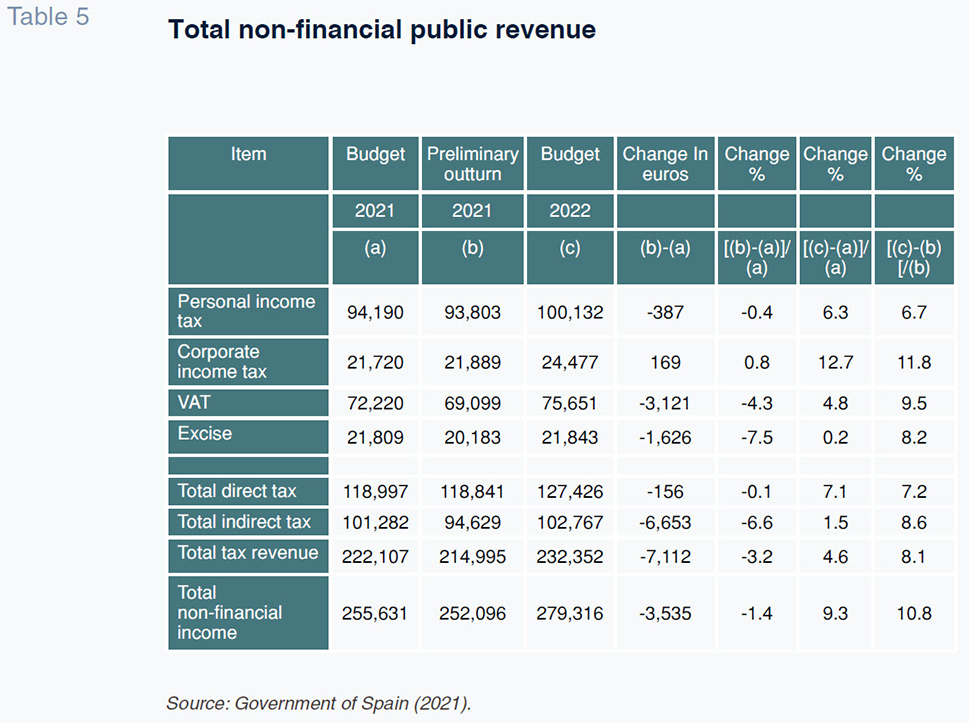

Revenue forecasts

Table 5 provides the revenue forecasts for 2022 and the preliminary budget execution figures for 2021 for the key taxes. Those forecasts assume nominal GDP growth of 7.8% in 2021 and of 8.6% in 2022, with domestic demand increasing by over 8% both years. Against that backdrop, the budget contemplates growth in non-financial income of 10.8% in 2022 to 279.32 billion euros. However, in the absence of the Next Generation-EU funds, that growth would narrow to 6.8%. The sharp estimated growth in non-financial income in 2022 is underpinned by the following three drivers:

- Growth of 6% in taxable income.

- The injection of 20 billion euros of European funds into the economy.

- The impact of changes in tax regulations, some of which rolled out in 2020 and 2021 but with effect in 2022.

With regard to the latter, the rate of personal income tax has been increased from 45% to 47% for incomes of over 300,000 euros. Also, the marginal rate on saving income was increased from 23% to 26% for incomes in excess of 200,000 euros. In addition, following recommendations made by AIReF, in 2022 the tax deduction for contributions to pension plans will be cut from 2,000 to 1,500 euros. That reform will deprive workers of one of their main avenues for channelling their long-term savings as the regulations governing the employer plans that will replace them have yet to be implemented. At any rate, this financial product has been erroneously discredited using not entirely valid arguments about the high cost in tax collection and the adverse impact on tax equity (Sanz and Romero, 2020). Framed by the economic crisis generated by COVID-19, the limits on the application of the objective estimation regime have been rolled over to 2022 for all activities other than farming, breeding and forestry activities, which have their own quantitative limit.

Turning to corporate income tax, the 2021 budget curtailed the scope of the exemption on dividends and income from share sales to companies with revenue of over 40 million euros (the exemption percentage was changed to 95%). The scope of the exemption for double international taxation was likewise limited. In 2022, framed by the international agreements reached by the OECD on taxation of multinational enterprises, the minimum rate on the taxable income of enterprises with revenue of over 20 million euros or those that pay tax under the tax consolidation regime, regardless of their revenue, will be set at 15%. The minimum rate for start-ups will be 10% (their statutory rate is 15%) and the minimum rate for banks and oil and gas exploration firms will be 18% (their statutory rate is 30%).

Regarding VAT, Spain has increased the rate applicable to all sugary and sweetened drinks from 10% to 21%. As with personal income tax, the limits on the application of the simplified regime and the farming, breeding and fishing regime have been rolled over to 2022. Meanwhile, two new taxes came into effect in 2021. The first is the tax on financial transactions, coined the Tobin tax, which is levied on the acquisition of shares in Spanish companies. The second is the digital services tax, popularly known as the Google tax, which is levied on online sales, online brokerage, the supply of digital content and the sale of data, among other services. Unrelated to the budget for 2021, in May, the Spanish Cabinet enacted two new environmental taxes as part of its goal of cutting waste generation by 30% in 2030 compared to 2010 levels. The first is a tax on single-use plastic containers (0.45 euros per kilogram). The second is a state tax on waste sent to landfills or for incineration, which some regional governments were already applying (40 euros per metric tonne in the case of municipal landfills). Both taxes are pending approval and entry into effect. Note, additionally, the possibility that some of the temporary measures in place could be rolled back in 2022, notable among which the reduction in VAT on electricity to 10%.

Factoring in all those regulatory developments, 2022 tax revenue is estimated at 232.35 billion euros, up 8.1% from 2021 (on the basis of the execution figures available year-to-date). The tax bases set to increase the most are those related with consumption, which are forecast to increase by 8.5% in 2022, compared to growth of 4.3% in the bases fuelled by income. The government expects personal income tax receipts to top the 100 billion euros threshold for the first time ever, thanks to growth in gross household income of 3.5%. In addition, the cyclical effect is expected to drive growth in receipts from the main taxes: 11.8% in corporate income tax; 9.5% in VAT and 8.2% in excise duty.

The information gleaned from the preliminary outturn report for 2021 suggests that tax revenue will be 7.11 billion less than initially estimated this year. However, there are considerable differences from one tax to the next. The biggest shortfall is concentrated in the consumption taxes which between them are short by €6.65 billion euros. In contrast, the taxes levied on income are shy by 156 million euros. It is worth highlighting the trend in corporate income tax revenue where the preliminary figures suggest that receipts will actually top the original forecast (169 million euros).

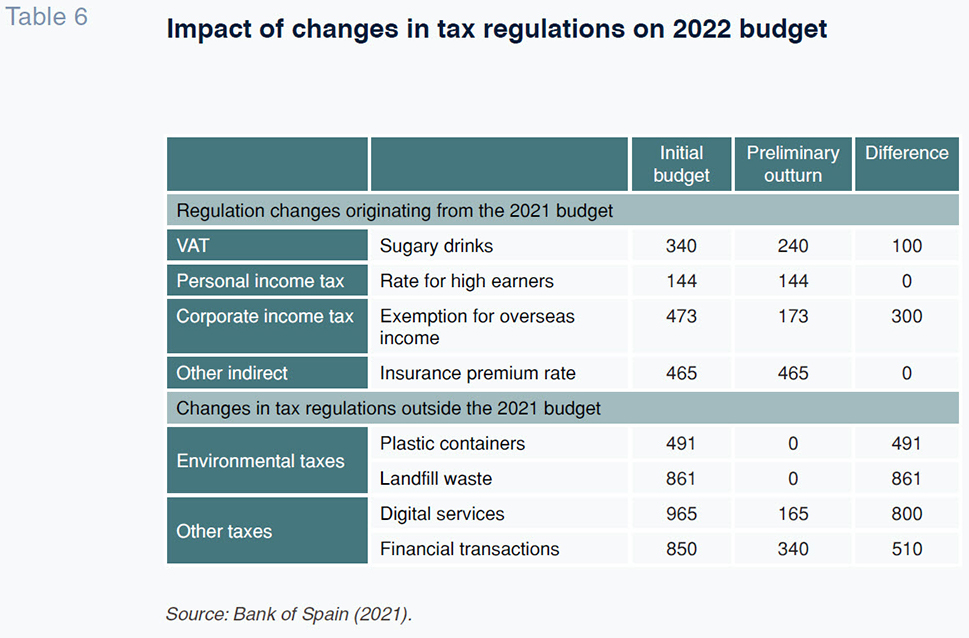

According to calculations made by the Bank of Spain (2021), reproduced in Table 6, around 3 billion euros of the revenue shortfall in 2021 is attributable to a smaller than estimated impact from the tax regulation changes. Specifically, 400 million euros is attributable to lower impact fom: (i) the increase in VAT on sugary and sweetened drinks (100 million euros) and the corporate income tax exemption for overseas earnings (300 million euros). Furthermore, the two new taxes introduced in 2021 – on digital services and financial transactions – are now expected to generate around 1.3 billion euros, less than originally estimated. On top of all that, the 2021 budget was counting on 1.4 billion euros of environmental levies on plastic containers and waste collection that have not arrived as the taxes have not come into effect. Elsewhere, the regulatory changes due to take effect in 2022 are expected to have only a very limited impact on revenue. Specifically, the above-mentioned change in pension plan deductions is expected to generate additional tax revenue of 77 million euros. Meanwhile, the introduction of a minimum corporate income tax rate of 15%, coupled with the reduction in house rent deduction, will generate 421 million euros in 2021.

Public expenditure

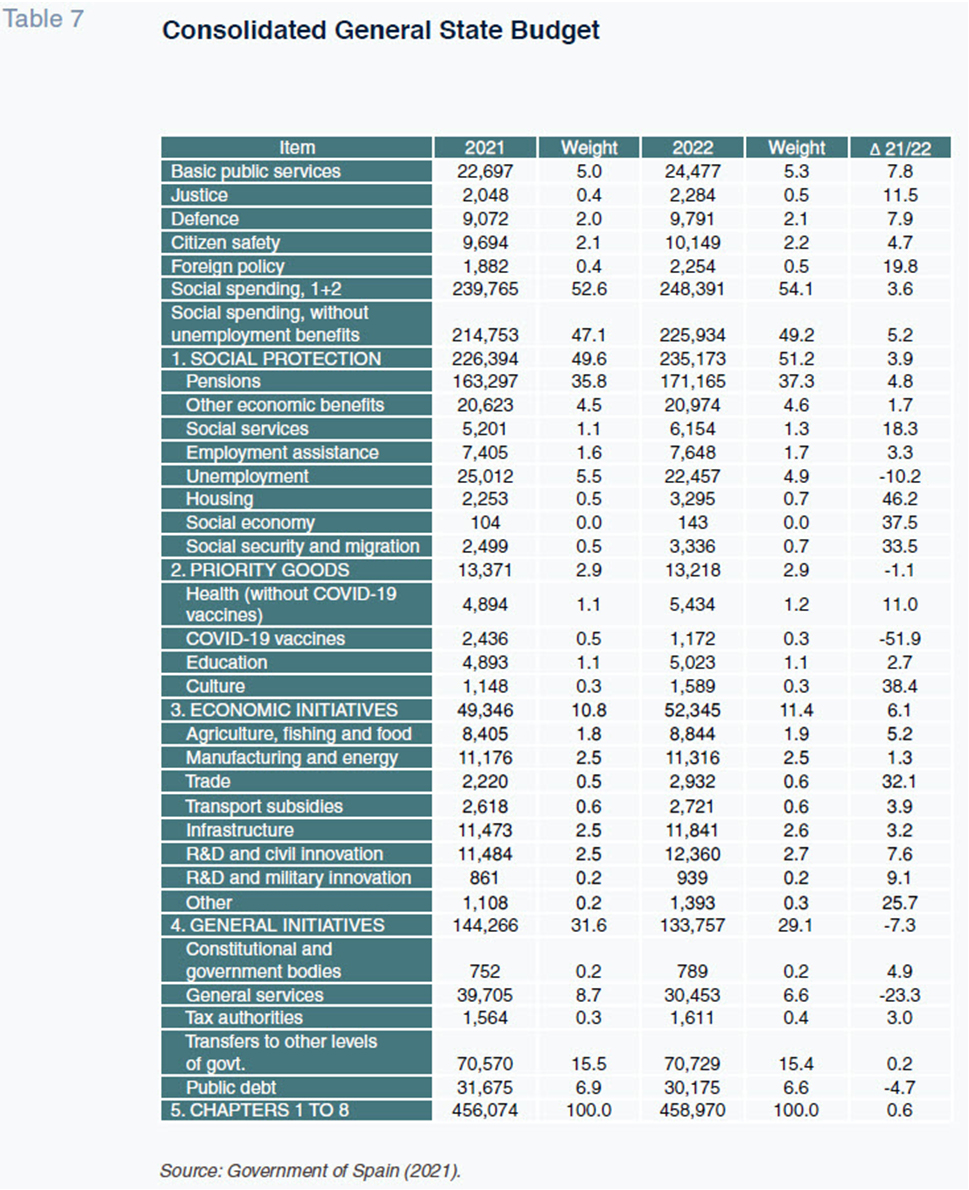

Table 7 shows consolidated state spending by category: basic services; social protection; priority goods; interventions of an economic nature; and, interventions of a general nature. The information presented in that table indicates that consolidated state expenditure across the above categories will reach 458.97 billion euros in 2022, up 0.6% from 2021 and that 52.6% will be managed by the state. Recall that those figures include the funds under the Recovery, Transformation and Resilience Plan (the Recovery Plan) and the Recovery Assistance for Cohesion and the Territories of Europe (REACT-EU). Those programmes imply the advent of 27.63 billion euros in 2022 (26.63 billion euros in 2021).

The so-called basic services include spending on justice, defence, citizen safety and foreign policy, which between them will account for 5.3% of consolidated expenditure (1.78 billion euros) in 2022. Around 10% of the increase (182 million euros) will go to the 2030 Justice Plan which will facilitate the creation of new judicial units, among other initiatives. The essential component of public spending is that related to social spending, which includes pensions, unemployment benefits, education and housing and represents 54.1% of the total in the 2022 budget. The largest item is pension spending which in 2022 is set to reach a record level of 171.17 billion euros, up 7.87 billion euros from 2021. In the context of rising inflation, the growth in pension spending in 2022 will be driven by: (i) the compensation to be received by pensioners in January 2022 for the difference between forecast and real inflation in 2021; and, (ii) the increase in public-sector pensions in 2022 (2.3% for contributory pensions and 3% for non-contributory and minimum pensions). That increase will trigger a jump in structural public spending. That is a matter of great significance considering that the structural public deficit has been rising since 2015. Elsewhere, unemployment benefits are expected to come down by 10.2%, from 25.01 billion euros in 2021 to 22.46 billion euros in 2022 thanks to the forecast reduction in the unemployment rate, from 15.2% to 14.1%. Also, the budget contemplates earmarking 200 million euros to helping to finance rent for youth. That measure consists of a monthly grant of 250 euros for two years for youths aged between 18 and 35, so long as they earn a salary and their total income is less than three times IPREM (acronym in Spanish for the public income index), [3] which translates into maximum annual income of around 23,700 euros. One of the biggest weaknesses of that measure is that it fails to consider the significant differences in average rents across the various Spanish provinces.

Expenditure on priority goods (health, education and culture) is budgeted at 13.22 billion euros in total, down 1.1%. The weight of those headings in consolidated expenditure is small (2.9%), as health and education are spending functions transferred to the regional governments. Spending on culture includes a 400-euro voucher that will only benefit young people turning 18 in 2022. The high cost of that measure, 210 million euros, has generated controversy, given the scale of the public deficit at present. Health spending specifically includes expenditure on COVID-19 vaccines, estimated at 1.17 billion euros in 2022, which is around half of the 2021 cost. Expenses of an economic nature relate to a wide variety of policies, including industry, tourism, energy and R&D policies, and are budgeted at 52.35 billion euros in 2022, growth of 6.1%. Within this heading it is worth highlighting the cost of the heating vouchers, budgeted at 157 million euros, for vulnerable families at a time of record electricity prices. According to the consumer protection association, OCU (2021), monthly electricity bills have increased by approximately 30% between 2020 and 2021. Spain will earmark 5.48 billion euros to boosting the competitiveness and sustainability of Spanish industry with a charge against the Recovery and Resilience Facility. It is also worth pointing out the sharp increase (32.1%) in the assignations to policies in the areas of trade, tourism and small business with the aim of making Spain’s SMEs more competitive and bolstering the tourism sector in the wake of COVID-19. Lastly, the government is expecting its interest burden to come down from 31.68 billion in 2021 to 30.18 billion in 2022 as a result of the downtrend in interest rates, despite the fact that absolute debt levels have been increasing in 2020 and 2021. Spain’s debt measured using the Excessive Deficit Procedure criteria amounted to 1.35 trillion euros at the end of 2020, rising to 1.42 billion euros by the end of June 2021.

Notes

Spain Economic Outlook. Fourth Quarter 2021. https://www.bbvaresearch.com/publicaciones/situacion-espana-cuarto-trimestre-2021/

Contributory pensions are set to increase by 0.9% in 2021 to adjust for inflation. However, Funcas puts inflation in 2021 at 2.9%.

Used as the indicator for awarding aid, grants and unemployment benefits since 2004.

References

Desiderio Romero-Jordán. Rey Juan Carlos University and Funcas

José Félix Sanz. Complutense University of Madrid and Funcas