Fiscal imbalances in Spain: Progress and risks

Spain’s 2020 deficit came in better than expected, with analysts’ projections for 2021 more favourable than current government estimates. That said, risks relating to an ageing society, an entrenched structural deficit, and a permanent increase in spending mean Spain requires a credible fiscal consolidation plan.

Abstract: Spain’s 2020 deficit came in at 10.1% of GDP, better than estimated but still topping the EU-27 ranking. Looking forward, there are reasons for optimism such as the Next Generation-EU funds, the recovery in tax collection, and extension of the Stability and Growth Pact escape clause, though these do come with notable downsides. While current forecasts for 2021’s deficit are below the government’s budgetary plan, the structural deficit could prove a weak spot in the coming years, as it is forecast to reach 4.5% in 2022. Regarding the Stability and Growth Pact, the most likely outcome is a reformist approach, with greater flexibility built around a medium-term debt anchor, a simple expenditure benchmark and a general escape clause. However, Spain cannot wait for the official rewriting of the EU’s fiscal rules. As it stands, the country lacks a credible and ambitious medium-term budget strategy. Over the next five years, Spain’s public deficit will not fall below 4.2% of GDP, while public debt will still be stuck at close to current levels. Curtailing spending will become even more difficult due to Spain’s ageing society, with spending on dependency care, employment, education, health, science and innovation, government, and a fair transition likely to increase.

Introduction [1]

Despite the massive impact of the pandemic on Spain’s economy and public finances, the public deficit is performing better than expected. The 2020 deficit came in lower than most analysts and the government itself were forecasting. Leaving aside financial assistance, the 2020 deficit was equivalent to 10.1% of GDP, helped by a narrower contraction in tax revenue than was expected given prior recessionary experience. Nevertheless, Spain’s deficit still topped the EU-27 ranking.

In 2021, the fiscal imbalance will be reduced, again by more than was predicted a few short months ago. Despite inflationary dynamics, high energy prices and global supply chain friction, the Spanish economy is staging a significant recovery. Spain’s hugely successful COVID-19 vaccination drive has shored up the normalisation of social and economic activity, which is having a positive impact on multiple economic indicators, including the deficit.

In addition to the economic risks affecting the supply side of the economy, the risk of new variants of the virus lingers. On the whole, however, things are looking moderately optimistic, a mood that extends to the public accounts. That optimism is underpinned by a combination of factors, including the disbursement of the Next Generation-EU funds, the recovery in tax collection, the decision to leave the Stability and Growth Pact escape clause activated for some time (paving the way for public deficits well in excess of the reference values) and the European Central Bank’s extraordinary asset purchase programme.

That said, there is the risk of being lured into a false sense of comfort. The current situation is artificial and will come to an end. Every item on the list of grounds for optimism has its downside: the receipt of the NGEU funds is not guaranteed, but rather depends on Spain honouring the agreed-upon reform commitments; the growth in GDP and tax revenue will wane as business volumes return to pre-pandemic levels; the fiscal discipline rules will come back into play in 2023 and, even if they are reformulated in the interim, will once again constrain Spain; and, lastly, the ECB is set to gradually roll back its asset purchases over the coming months. Recall, moreover, that Spain’s structural deficit and debt levels in 2019, before the onset of the pandemic, were among the worst in the EU-27 and there are latent risks of permanent increases in pandemic-induced expenditure that could complicate the budget consolidation strategy.

There are, as always, solutions. Tax reform and a broad assessment of the effectiveness of public spending to identify inefficiencies and potential savings are two high-potential tools for balancing Spain’s accounts. It is imperative, however, to map out and negotiate a roadmap for budget accommodation and structural deficit elimination so that Spain is ready when the European fiscal and monetary authorities decide to withdraw their no-strings-attached protection.

The objectives of this paper are threefold. Firstly, to analyse Spanish public deficit dynamics and forecasts for 2021 and 2022. Secondly, to look at the likelihood of changes to the European fiscal rules and how they could shape budget consolidation in Spain. Finally, we list the risks that some of the public spending associated with the pandemic could become permanent, alongside an analysis of the impact of the gradual ageing of Spain’s population.

Spain’s public deficit in 2021 and 2022

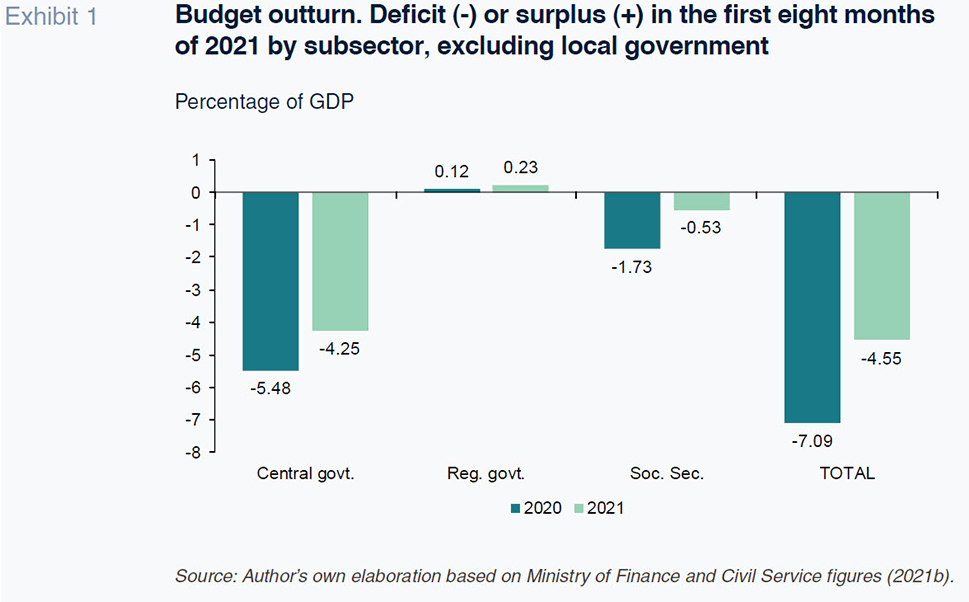

The budget outturn figures to August 2021 are provided in Exhibit 1. To put this year’s figures into context, we also provide the numbers for 2020. The figures are expressed as a percentage of Spanish GDP. The deficit dynamics are healthier than in 2020. Leaving aside the local authorities, the deficit is down by 2.54% of GDP and the last few months of the year are also expected to be positive, as the cyclical component will improve, while the magnitude of the discretionary measures, particularly furlough scheme benefits, will be substantially lower. The trend at the regional government level for the first eight months of the year mirrors that of last year because the central government has rolled out a similar financial umbrella in 2021, with a slightly smaller extraordinary fund offset by the allocation of a significant portion of the NGEU funds received by Spain (Lago-Peñas, 2021).

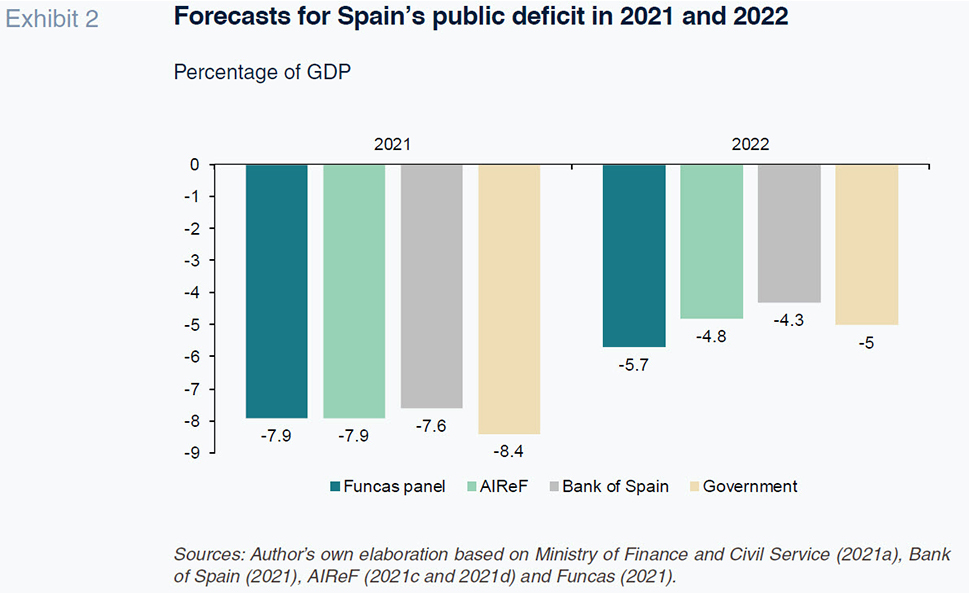

As a result, the forecasts for 2021 have been

improving, with most analysts’ forecasts currently lower than those of the government (Exhibit 2). Whereas the government is forecasting a deficit of 8.4%, the Funcas consensus (2021) forecast is for a deficit of 7.9%, with the independent fiscal institute, AIReF, also expecting a deficit of 7.9% and the Bank of Spain (baseline scenario) estimating it at a slightly lower 7.6%. However, no matter which forecaster proves nearer the mark, the scale of the improvement with respect to the 2020 deficit of 10.1% is below the automatic correction of the cyclical deficit expected. That means that the structural deficit, which ended 2019 at around 3%, has been increasing during the pandemic.

The 2022 forecasts endorse that hypothesis. The government’s forecast (deficit of 5%) is worse than that of AIReF and the Bank of Spain, albeit better than the Funcas consensus forecast. If real GDP growth comes in above 6%, the output gap will be virtually zero in 2022 and the cyclical deficit should disappear (Ministry of Finance and Civil Service, 2021a). The structural deficit is forecast at 4.5%, with the half-point difference to make up the 5% forecast by the government corresponding to one-offs and other temporary measures. The risks enumerated in the last section contribute to that increase in the structural deficit. However, significant increases in certain expenditure headings, including pensions (expected to increase by around 9 billion euros in 2022) and the minimum income scheme, will also play a part.

Outlook for changes in EU fiscal rules

In February 2020, the European Union embarked on a discussion about reforming its fiscal rules (European Commission, 2020). However, the pandemic disrupted these discussions. The need to act swiftly and forcefully pushed the authorities to activate the Stability and Growth Pact (SGP) escape clause and delay the debate until the health and economic situation provided some breathing room. On October 19th, 2021, the European Commission launched a period that will run until the end of the year for gathering all stakeholder contributions and opinions (European Commission, 2021) with the aim of coming up with a specific proposal, debating it and reaching an agreement by 2023.

It will be a complex and thorny debate, with several possible outcomes. That being said, the likeliest outcome is that the reformist approach, which would continue to pivot around quantitative rules, will prevail. The manifesto signed by the ministers of finance of Austria, Denmark, Latvia, Czech Republic, Finland, Netherlands, and Sweden in September 2021 drew a red line with respect to sticking with a rules-based system (Blümel, 2021). Taking a similar approach, albeit with greater flexibility, the European Fiscal Board (2019) suggests replacing the current framework with three complementary elements: a medium-term debt anchor; a simple expenditure benchmark with a built-in debt brake; and, a general escape clause. In practice, those suggestions would translate into the transparent setting of different speeds for countries to bring their debt ratios back down to 60%. The current state of Spain’s public finances makes that asymmetric approach particularly interesting and obliges its government to seek alliances around proposals that fit with that approach.

Blanchard, Leandro and Zettelmeyer (2020) defend a more ground-breaking approach which would materialise in a break from the quantitative rules to embrace what they dub fiscal “norms”, such as article 126 of the European Union Treaty: “Member States shall avoid excessive government deficits”. “Excessiveness” would be identified using sophisticated stochastic tools analysing debt sustainability, with an independent organisation tasked with resolving disputes between member states and the European Commission. That approach fits with that proposed by AIReF (2021a), which calls for giving a bigger role to the national independent fiscal authorities and their singular fiscal policy design tools: medium-term scenario generation, sustainability analysis and impact assessments. The main weakness of that approach lies with the political aspect. It is a less defined approach and potentially laxer than the use of quantitative rules. It also depends more on ad-hoc technical analysis, something that would be hard to swallow for the above mentioned so-called frugal countries, among others.

At any rate, Spain cannot afford to wait until all the questions about the future of the EU’s fiscal rules are answered to articulate its strategy. Such a delay would risk leaving issues aside until it is too late to ensure Spain’s continued smooth access to the debt markets and scrutiny of the EC authorities. [2] The reality is that today Spain still lacks a credible and ambitious medium-term budget strategy, which is apparent in the International Monetary Fund’s mediocre projections (IMF, 2021). According to the IMF, over the next five years, Spain’s public deficit will not fall below 4.2% of GDP, while public debt will still be stuck at close to current levels in 2026 (117.5%).

Pandemic-induced spending could become permanent

A new risk associated with the pandemic looms large over Spain’s fiscal trajectory: the possibility that some of the public expenditure needed to tackle the crisis could become structural. Although it is hard to assign a probability to its materialisation, a few economists have attempted to do so. Díaz and Marín (2021) provide an estimate for each region of Spain of the percentage of regional spending (essentially healthcare and education) due to COVID-19 that could become structural. [3] In their opinion, of the 13.69 billion euros of incremental spending, 60% (8.21 billion euros) could become permanent, within a spectrum that runs from 47% in the Canaries to 68% in the Balearics. That figure is equivalent to 0.7% of Spanish GDP. The increase in permanent spending is estimated to have caused a deterioration in the regional governments’ structural deficit in 2020, which went from a shortfall of 0.5% of GDP to 1%, despite the fact that the overall deficit actually narrowed, from 0.6% to 0.2%.

Although much of that spending has already been executed and most of the regions are already in the process of debating and approving their budgets for 2022, it would be advisable for those that have yet to do so to review the corresponding parts of their spending programmes to pinpoint the portion of expenditure that stems from their responses to COVID-19. That is the only way to avoid the inertia that so often characterises public spending and stop the budgeting process from limiting attention to other collective needs or driving indebtedness higher. Most importantly, the demographics forecasts point to pressure on regional spending, with a particularly strong upward trend in health spending.

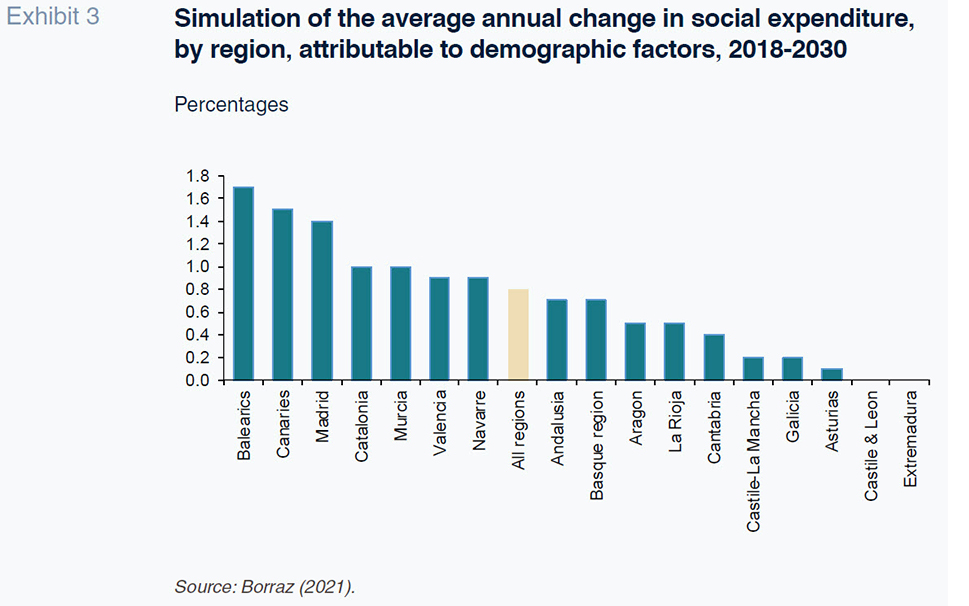

The calculations run by Borraz (2021) shed light on this issue. Using a time horizon of 2030 and leaving aside other factors that exert upward pressure on spending (such as technological progress or the rollout of effective coverage of the dependency aid services), the change in the age structure of the population coupled with longer life expectancies will translate into significant growth in regional social spending (including education), which accounts for roughly three quarters of all regional expenditure. Moreover, the projected increase will be highly asymmetric: ageing will be more pronounced in the regions with younger populations today. Exhibit 3 depicts the real average annual change in social spending that is attributable exclusively to the demographic factor. Adjusted for inflation, that figure ranges from 1.7% in the Balearic Islands to 0% in Castile & Leon and Extremadura, with an average of 0.8% for all regions.

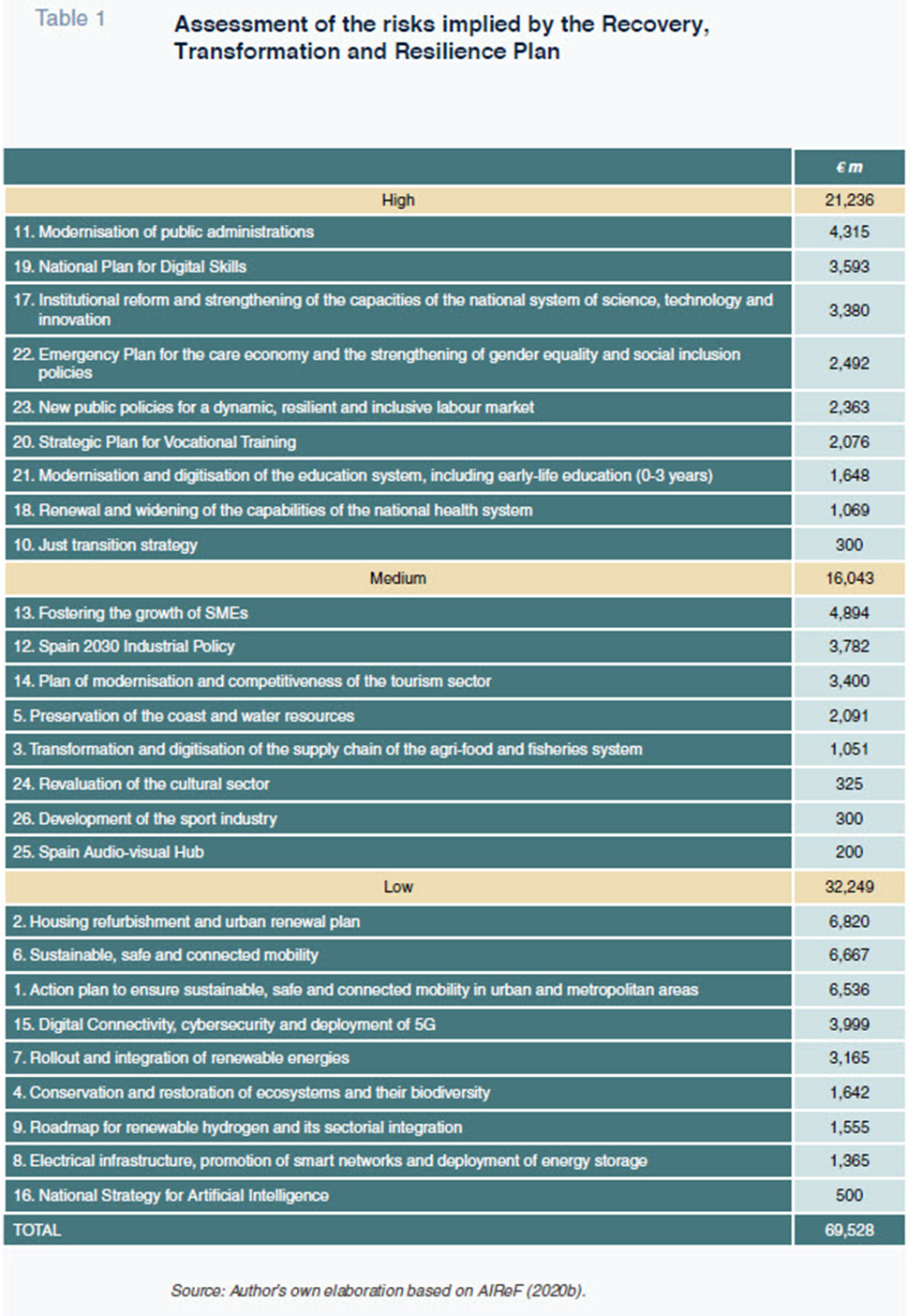

Lastly, AIReF (2021b) focuses its analysis on the risk that the one-off spending under the umbrella of Spain’s Recovery, Transformation and Resilience Plan will become permanent. The Plan will mobilise a total of 69.53 billion euros over the next few years, starting in 2021 and most significantly in 2022 and 2023. AIReF classifies the programmes comprising the Plan into three levels in accordance with the potential risk that their endowment could end up increasing structural spending without lining up the corresponding permanent financing (Table 1). The biggest risks are concentrated in the parts of the Plan related with dependency care, employment, education, health, science and innovation, government, and a fair transition.

Based on that classification of the programmes, a simple simulation is possible. Thirty-one per cent of expenditure will be channelled into projects categorised as high-risk and another 23% to projects classified as medium-risk. Even assuming that the low-risk programmes do not end up generating structural expenditure, that only 25% of the outlay for medium-risk programmes becomes structural, and that 50% of high-risk project spending becomes chronic, the impact would be 14.6 billion euros, which is equivalent to over one percentage point of GDP.

If the above risk materialisation percentages of 0%, 25% and 50% were raised to 25%, 50% and 75%, respectively, the impact would jump to 32 billion euros, which is over 2.5 percentage points of GDP. Given the magnitude of the potential risk, it is easy to understand AIReF’s (2021b) warning that “The time dimension of this plan requires mechanisms to be in place to ensure the financing over time of the reforms and investments initiated with the financing from NGEU funds”.

Notes

The author would like to thank Diego Martínez López (UPO) for his valuable input and Alejandro Domínguez (GEN-UVigo) for his assistance.

Lago Peñas (2021) outlines the need for and difficulties and opportunities implicit in articulating such a strategy in greater detail.

References

AIReF (2021a). The Independent Fiscal Institutions in the European Union. Retrievable from:

www.airef.esAIReF (2021b). Report on the 2021-. May 11

th, 2021. Retrievable from:

www.airef.es. 2024 Stability Programme Update.

AIReF (2021c).

Monthly stability target monitoring, 2021. September 16

th, 2021. Retrievable from:

www.airef.esAIReF (2021d).

Report on the main lines of the 2022 budgets of the public administrations. October 25

th, 2021. Retrievable from:

www.airef.esBANK OF SPAIN (2021).

Macroeconomic projections for the Spanish economy (2021-2023), September 9

th, 2021. Retrievable from:

www.bde.esBLANCHARD, O., LEANDRO, A. and

ZETTELMEYER, J. (2020). Redesigning the EU fiscal rules: From rules to standards.

72nd Economic Policy Panel Meeting. Germany: Federal Ministry of Finance.

BLÜMEL, G., WAMEN, N., REIRS, J., MATOVIC, I., SCHILLEROVÁ, A., SAARIKKO, A., HOEKSTRA, W. and

ANDERSSON, M. (2021).

Common views on the future of the Stability and growth Pact. September 9

th, 2021. Retrievable from:

https://www.bmf.gv.atBORRAZ, S. (Coord.) (2021).

La sostenibilidad del gasto social en las haciendas autonómicas [Sustainability of regional government social spending] Funcas. Retrievable from:

https://www.funcas.es/libro/la-sostenibilidad-del-gasto-social-en-las-haciendas-autonomicas-perspectivas-2018-2030/DÍAZ, M. and

MARÍN, C. (2021). El saldo estructural de las CC.AA. 2018-2020 [Regional public finances in Spain. 2018-2020]. Estudios sobre la Economía Española, 2021/17.Fedea. Retrievable from:

www.fedea.esEUROPEAN

COMMISSION (2020).

Economic governance review. COM(2020) 55 final, February 2

nd, 2020. Retrievable from:

https://ec.europa.eu/EUROPEAN

COMMISSION (2021).

The EU economy after COVID-19: Implications for economic governance. COM(2021) 662 final, October 19

th, 2021. Retrievable from:

https://ec.europa.eu/EUROPEAN FISCAL BOARD (2019).

Assessment of EU Fiscal Rules with a Focus on the Six and Two-Pack Legislation. Retrievable from:

https://ec.europa.eu/European-fiscal-boardFUNCAS (2021).

Spanish Economic Forecasts Panel. November 2021. Retrievable from:

www.funcas.esIMF (2021).

Fiscal Monitor. Strengthening the credibility of public finances. Retrievable from:

www.imf.orgLAGO PEÑAS, S. (2021).

Déficit y consolidación fiscal en España: perspectivas y propuestas [Deficit and fiscal consolidation in Spain: outlook and proposals]. Funcas. Retrievable from:

https://www.funcas.es/documentos_trabajo/deficit-y-consolidacion-fiscal-en-espana-perspectivas-y-propuestas/SPANISH MINISTRY OF FINANCE AND CIVIL SERVICE (2021a).

Draft Budgetary Plan for 2022. October 15

th, 2021. Retrievable from:

www.hacienda.gob.esSPANISH MINISTRY OF FINANCE AND

CIVIL SERVICE (2021b).

Ejecución presupuestaria de las Administraciones Públicas. Agosto 2021 [Budget outturn figures. August 2021]. October 29

th, 2021. Retrievable from

www.hacienda.gob.es

Santiago Lago Peñas. Professor of Applied Economics and Director of the Governance and Economics Research Network (GEN) Vigo University