Spain’s budget debate and fiscal outlook: Elements of uncertainty

As a result of the new Socialist party (PSOE) government passing an inherited 2018 budget this summer, the country has been forced to revise its 2018 deficit target upward, slowing its path towards fiscal consolidation. Looking forward, domestic political dynamics mean the PSOE will need to engage in complex negotiations with political parties, at both the national and regional level, who hold a variety of diverse fiscal and budgetary positions.

Abstract: Uncertainties over Spain’s fiscal outlook became apparent earlier this year when the previous administration under the Popular Party (PP) struggled for several months to pass its 2018 general state budget (GSB). After coming to power as a result of emerging victorious in a no-confidence vote against the former PP president Rajoy, the new minority government reversed its previous opposition to the budget and oversaw its passage through parliament in June. Since then, a consensus has formed amongst the AIReF, Bank of Spain, and European Commission that Spain is expected to miss its initial 2018 deficit target of 2.2% by half a percentage point. This is despite the fact that Spain’s local governments are likely to post a considerable fiscal surplus again. The fiscal situation is especially worrying as Spain’s deficit has remained the highest in the EU, even with a rapid improvement in the country’s output gap. Looking forward, the government faces an uphill battle in its attempt to get the 2019 general state budget approved by the Lower House. With just 85 of the 350 seats in the Chamber of Deputies, the government will need to engage in complicated negotiations with several national and regional parties that hold widely different positions on budgetary and fiscal policies.

A brief overview of current fiscal dynamics

As early as spring 2018, the fiscal situation in Spain became increasingly complicated.

[1] Having extended the previous year’s budget, it appeared that Spain would struggle to remain on the path towards fiscal consolidation. In contrast to the government’s projected fiscal deficit of 2.2% of gross domestic product (GDP), the Funcas estimate stood a 2.5% in May 2018. Similarly, data compiled by Spain’s independent fiscal institution (AIReF) resulted in a confidence interval mid-point of 2.5%. The Popular Party’s minority government faced significant challenges pushing through the general state budget for 2018 (2018 GSB), which had already been delayed by several months. Given the rollover of the 2017 GSB, there was widespread doubt over the prospect of the 2018 GSB’s approval. Concessions were subsequently struck in order to guarantee a majority vote in the Lower House, which pushed the projected deficit up to 2.7%. As the 2018 GSB made its way through parliament, an unexpected no-confidence vote was held, ushering in a new government on June 2

nd.

Upon forming a new government, Spain’s Socialist party (PSOE), led by Pedro Sánchez, faced a difficult prospect. Although it inherited a draft 2018 GSB that had broad support in the Lower House, the PSOE had refused to support the budget prior to assuming office. In order to stave off a possible deadlock in the Senate and pre-empt the Popular Party from reversing its position in the Lower House (”Chamber of Deputies”), the new government decided to back the draft budget.

[2] This has resulted in an unprecedented situation, prompting an attempt to renegotiate the 2018 deficit target with the European Commission. The key premise of the government’s argument is that meeting the 2.2% deficit target would force it to make significant cuts that could undermine the recovery of the Spanish economy. On July 13

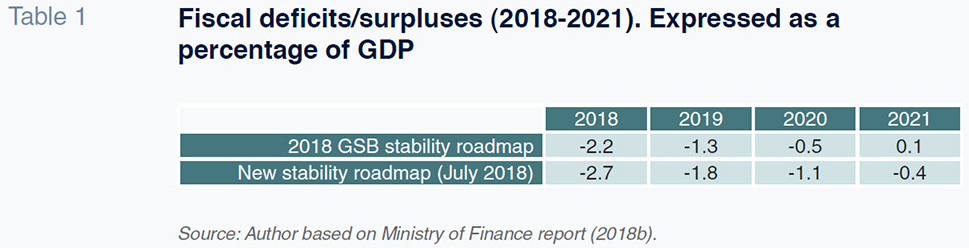

th, Spain’s finance minister announced that the European Commission was open to the idea of raising the 2018 deficit target to 2.7%, albeit with two important caveats. The first is that it will be up to the Council of the European Union and not the Commission to issue the final decision on the matter. The second is that the decision will depend on an assessment of the 2019 GSB, which will be presented to the European Union this autumn and must resume the path towards a significant reduction in the structural deficit. The half-point increase in the 2018 deficit inevitably means that subsequent targets will be impacted. The 2019 deficit target will increase to 1.8%, implying a margin of 0.5 percentage points within the Stability Programme threshold established by the previous administration. For 2020, the target increases to 1.1%, 0.6 percentage points above the original target. Lastly, the 2021 deficit target has been set at 0.4% (Table 1).

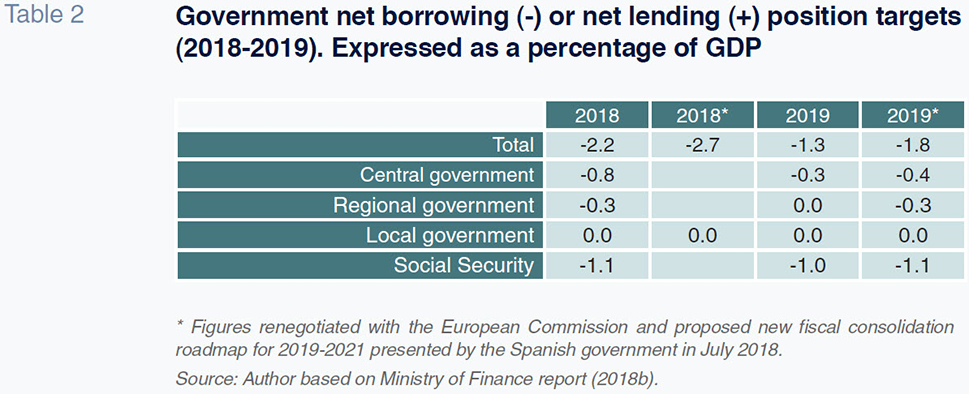

The debate over the 2019 GSB started when the government presented the ceiling on public expenditure, and the 2019-2021 deficit targets, which include a breakdown at all levels of government (Table 2). However, the government’s motion was voted down in the Lower House by 174 deputies (86 abstentions and 88 votes in favour) on July 27

th. Nevertheless, the incumbent government has continued to negotiate with those four political parties that abstained from the vote.

[3]

At present, it seems probable that a second vote in the Lower House will result in the approval of the new fiscal roadmap; however, it is likely to be contested in the Senate by the Popular Party, which holds a majority in that chamber, resulting in yet another deadlock. As a result, on August 24th, the PSOE, Unidos Podemos, Compromis and Esquerra Republicana de Catalunya (ERC) presented a motion for the urgent amendment of Article 15 of Organic Law 2/2012 on budget stability and financial sustainability. The amendment proposes the elimination of the Senate’s veto right. Expedited processing could take between two and three months, during which time the administration is expected to postpone its presentation of the 2019 GSB. The government has suggest that if the amendment fails to be enacted in a timely manner or ultimately proves unfeasible, it may stick with the former deficit reduction timeline, although this would require expenditure and tax measures that would undermine support from left-leaning parties.

In short, we are looking at an extraordinarily complex budget environment, with the government constrained by its minority in the Chamber of Deputies (85 out of 350 seats). Achieving a majority of votes would require an agreement with two of the four major parties (Popular Party with 137 seats and Ciudadanos with 32), however, such a deal looks highly unlikely. Podemos, the third biggest party by seats, has forced the PSOE to shift further left. Two pro-independence Catalan parties could be convinced to support the PSOE, but this would require the government meeting their institutional demands. Lastly, there are a number of parties with a small number of seats which may prove key in light of the prevailing parliamentary fragmentation. These parties express a wide range of ideologies and, in general, strong local interests, which tend to condition their support on measures that favour a given region. The left-right axis that historically dominates the debate on budgetary and fiscal affairs is therefore layered with regional disputes, in addition to the already fraught situation resulting from Catalonia’s independence movement.

Outlook for the rest of 2018

Budgetary figures calculated up until May 31

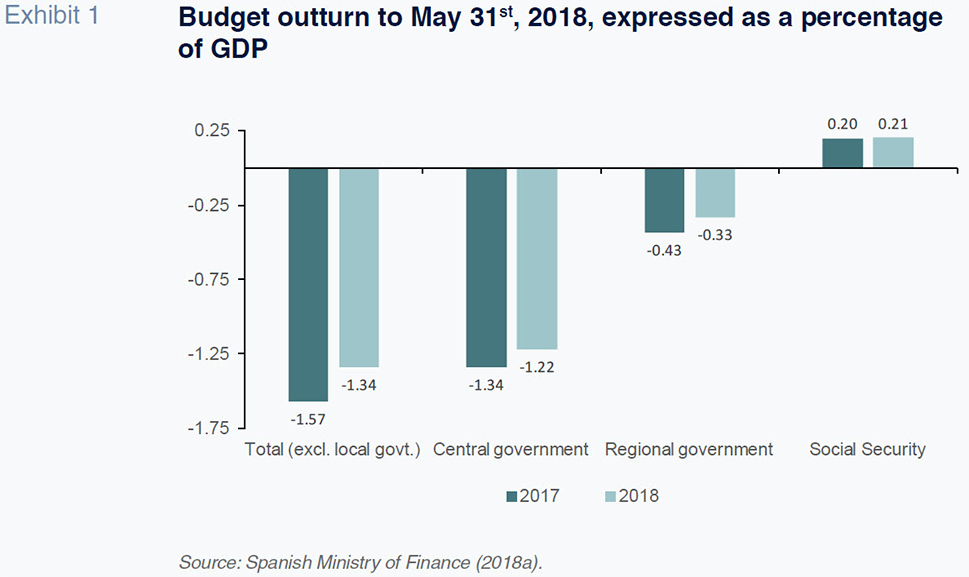

st reveal a small reduction in Spain’s fiscal deficit. Excluding local government expenditure, the deficit stood at 1.34% of GDP in May, compared to 1.57% during the first five months of 2017. However, this 15% reduction is far from the 29% required to achieve the initial 2018 fiscal deficit target. Based on deficit figures, and assuming that the local governments end 2018 with a surplus similar to that of 2017, the overall 2018 public deficit will be approximately 2.6%. Note that these figures reflect the fiscal situation that preceded the passage of the 2018 GSB, which included measures that will likely increase spending relative to taxation. (BBVA Research, 2018).

The 2018 projections published by various public and private institutions point in a similar direction. The deficit forecast published by Funcas in September (Funcas, 2018) was 2.7%. This figure is in line with the forecasts of both the Bank of Spain (2018a) and the European Commissions (European Commission, 2018a), which stand at 2.7% and 2.6%, respectively.

The most recent AIReF report (2018b) published in July estimates that Spain’s deficit, which includes all levels of government, will also be 2.7% in 2018. This calculation is based on the hypothesis of no-policy changes. Furthermore, AIReF figures suggest that the probability of achieving the initial 2.2% deficit target is just 24%. This projected deviation of half a percentage point is attributed mainly to spending dynamics, as the probability of achieving the initial revenue forecast – around 50% – has not changed since the beginning of the year. The reduction of expenditure on unemployment benefits and debt service is expected to only partially offset the growth in public sector salaries, pensions and infrastructure investment contained in the 2018 GSB.

[4] The various levels of government are, however, expected to perform unevenly. According to the AIReF’s calculations, Spain’s local governments are expected to record a considerable surplus (+0.6%). Moreover, at 67%, the probability that the regional governments will deliver their deficit target of 0.4% is high. However, this won’t be enough to offset the upward revisions to the estimated central government deficit of around 1.4%, which is twice the level forecasted at the start of the year. Nor will this surplus make up for the 1.5% Social Security deficit, which exceeds Spain’s 1.1% target.

In short, the consensus is that Spain will miss its 2.2% deficit target. The AIReF, Bank of Spain and the European Commission have each shifted their forecasts towards the 2.7% mark, which is exactly the figure the new government has proposed to the European authorities. Having inherited a budget for 2018 that forces the upward adjustment of Spain’s deficit target and finding themselves with very little political room to manoeuvre, the PSOE has opted to take ownership for this shortfall and has asked for the appropriate approval by Brussels. In the next section, we examine the plausibility that Spain will end 2018 with a deficit closer to 3%.

The Spanish public deficit: A comparative analysis

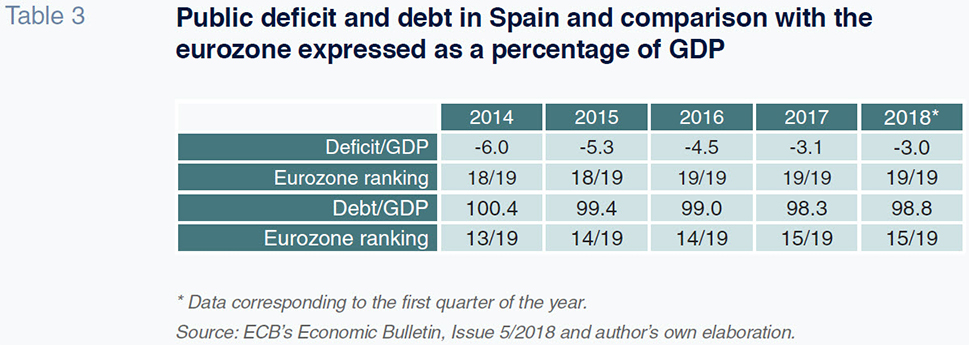

Upon examining Spain’s public deficit trend over the last decade, it becomes clear that the country has struggled to achieve a balanced budget. The financial crisis resulted in an unprecedented contraction in Spanish GDP, thereby placing considerable strain on Spain’s public finances. However, this is an insufficient explanation for the fiscal dynamics of the last five years. Table 3 compares the deficits between Spain and the Eurozone from 2014 up to the first quarter of 2018. In 2014, the year in which Spain emerged from recession, the Spanish deficit amounted to 6.0%. Only Greece recorded a higher deficit. Since then, Spain’s fiscal deficit has only gradually improved, with the country having registered the highest deficit in the eurozone since 2016. Spain has also failed to significantly reduce its public debt. Specifically, its public debt stood at 100.4% of GDP in 2014 and fell to just 98.8% in the first quarter of 2018. Today, only four eurozone countries have a higher debt-to-GDP ratio than Spain, compared to six in 2013.

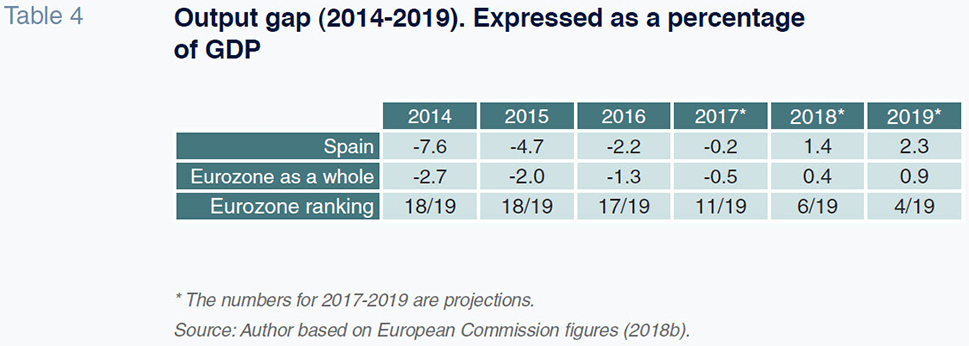

These fiscal dynamics contrast with the trend in Spain’s output gap, which measures the economy’s cyclical position. The output gap is zero when an economy is in a neutral position, positive when the economy is expanding above its neutral rate, and negative when the economy is producing below its potential output. Although estimating the output gap is a complex process and the figures should always be taken with a degree of caution,

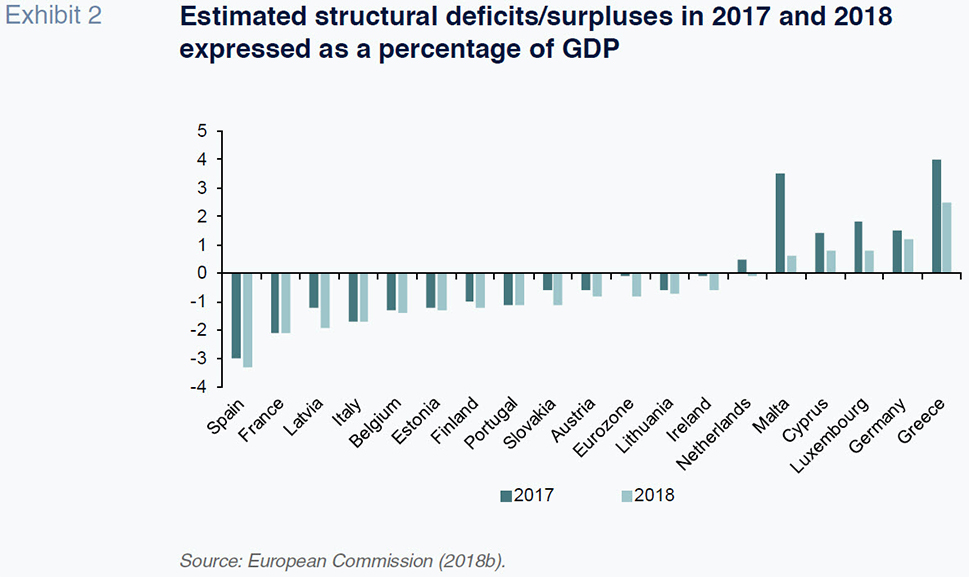

[5] the results shown in Table 4 are still noteworthy. In 2014, Spain’s negative output gap ranked second last in the eurozone. Compared to a eurozone average negative gap of -2.7%, Spain’s output gap stood at -7.6%. This meant that its actual GDP was -7.6% below its potential output. That year, the cyclical component of the deficit weighed heavily on the observed deficit. However, since then, Spain has experienced a rapid change in its output gap. In fact, the Spanish economy has grown so quickly that the European Commission estimates that Spain’s positive output gap will be the sixth highest in the eurozone this year, with projections suggesting it will rise to fourth place in 2019. Furthermore, the proportion of the 2017 deficit attributed to adverse economic circumstances decreased dramatically (less than 0.1 percentage points), with economic conditions expected to have a positive impact on the 2018 deficit. Exhibit 2 extends this idea further. The European Commission puts Spain’s structural deficit at the top of the table for both 2017 and 2018. GDP growth and monetary stimulus measures, which continue to reduce the debt service bill, have nudged Spain from a cyclical budget deficit to a cyclical surplus. However, the structural deficit is expected to widen by 0.3 percentage points in 2018.

In light of these calculations, it is obvious that Spain has a serious problem with its structural deficit. While Spain posted abundant observed surpluses prior to the financial crisis, these numbers were inflated by the property boom and masked an underlying structural deficit. Although public expenditure in Spain is significantly below the EU average, its tax revenue falls shorter, even in times of economic growth. These dynamics pose a threat given the anticipated normalisation of interest rates and could leave the Spanish economy more vulnerable in a future financial crisis. Spain’s structural deficit also constrains the government’s ability to use fiscal policy as a macroeconomic management tool. In the next section, we discuss the outlook for the 2019 GSB from the standpoint of fiscal policy concerns.

Outlook for the 2019 GSB

Aside from the government’s new deficit roadmap, borrowing targets, and spending limits, details about the 2019 GSB are still limited. Based on the AIReF report on the macro-budgetary scenario for 2018-2019 (AIReF, 2018a) and the information gleaned from several statements and notes released by the Ministry of Finance, the plan for the overall 2019 deficit will likely contain the following:

- A 0.9 percentage point reduction in the public deficit (from 2.7% of GDP to 1.8%), of which 0.5 percentage points can be attributed to the positive effects of Spain’s position in the economic cycle, mainly via the public spending side of the equation. This figure is based on the “budget scenario in 2018 assuming policy status quo” used by the AIReF. The remaining 0.4 percentage points would come from new tax measures designed to reduce the structural deficit, the measurement that the European Commission focuses on once a country has exited the so-called “corrective arm” and is subsequently placed under the EU’s “preventative arm”, which will happen to Spain this year. The overarching plan is to achieve a deficit reduction in 2019 by increasing the ratio of revenue to GDP to around 38.8% and reducing expenditure to 40.6%. [6]

- The tax measures, which are expected to collect 5 billion euros, would include a new tax on certain digital services, [7] a new tax in the banking sector, an increase in the effective corporate income tax rate for large businesses (with the aim of lifting the minimum effective rate to 15%), an increase on the duty levied on diesel consumption and a new action plan for combating tax fraud.

This scenario marks a shift in strategy from that of the Popular Party. The previous government’s 2018-2021 Stability Programme emphasised spending cuts relative to GDP in order to achieve the targeted fiscal consolidation. However, the pace of adjustment has not significantly diverged. Having raised the deficit target in 2018, there is considerable overlap between the new roadmap proposed by the PSOE and that of the previous government. Moreover, the European authorities are likely to accept this amended strategy. Therefore, it is in the Lower House, where the government must garner sufficient votes to pass its budget, that the main obstacle lies.

For instance, the Popular Party is unlikely to support this strategy.

[8] The stance taken by Podemos represents a considerable departure from the budgetary strategy of the Popular Party.

[9] Among other measures, Podemos wants to raise the 2019 deficit target above 1.8%, repeal existing budget stability and fiscal sustainability legislation, create a new ‘solidarity’ tax on the super-rich, eliminate the tax deductibility of pension plan contributions, increase the marginal personal income tax rate for pre-tax income brackets of over 60,000 euros, and eliminate the ceiling on national insurance contributions. Current circumstances suggest that it is unlikely that the PSOE will make these concessions but the parties appear to be keen to strike an agreement. However, any such agreement would make acquiring the support of Ciudadanos, the fourth largest party by seats, difficult. As a result, the PSOE will need the backing of several nationalist or regional parties (ERC, PDeCAT, PNV, Compromis, etc.), who differ widely in terms of their positions on budget and fiscal policy. It is therefore inevitable that the government will face an uphill battle over the next few months.

Notes

The press release put out by the Spanish Ministry of Finance in conjunction with the new minister’s appearance before the Senate (on June 9th, 2018) underscored that “the minister is appearing before the Senate of her own volition to demonstrate the government’s willingness to engage in dialogue and be held accountable. She is doing so not to defend the 2018 GSB but rather to assist with its passage through parliament for the good of the country and its stability”.

Three left-wing parties, Unidos Podemos, Compromís and Esquerra Republicana de Catalunya (ERC) and another centre-right party, Partido Demócrata Europeo Catalán (PDeCAT). The last two parties are pro-independence in Catalonia.

The Bank of Spain’s (2018b) estimates run in a similar direction but include the impact of personal income tax cuts, calculated at close to 0.2 percentage points of GDP between 2018 and 2019.

For example, the AIReF (2018a) believes that the output gap will remain slightly negative in 2018 (-0.7%) and turn positive in 2019 (+0.4%). The Ministry of Finance’s estimates, published in an update of its 2018-2021 Stability Programme in April, fall somewhere in the middle (+0.1% in 2018 and +1.2% in 2019).

This reduction is compatible with growth in spending in nominal terms. Given that the AIReF estimates GDP growth of 4.4% in nominal terms in 2019, there would be room for non-financial spending at all levels of government to increase by roughly 15 billion euros in 2019.

It is line with the Directive presented by the European Commission in March 2018. The “Proposal for a Council Directive laying down rules concerning the corporate taxation of a significant digital presence” had already been contemplated during the debate on the passage of the 2018 GSB in order to partially finance the extraordinary increase in pensions (Lago-Peñas, 2018).

On August 23rd, the Popular Party’s new president criticised the fact that: “The increase in the spending ceiling proposed by Pedro Sánchez’s government and forced by Podemos conceals a ‘tax blow’ for all citizens […]. The PP will not support this deficit roadmap as it is not necessary. The time is right, with Spain registering growth thanks to the reforms enacted by the Popular Party, for cutting taxes.” http://www.pp.es/sites/default/files/documentos/18.08.23_casado_acto_en_mahon.pdf

References

AIReF (2018a),

Escenario macroeconómico y presupuestario de 2018 y 2019 bajo el supuesto de políticas constantes [Macroeconomic and budgetary outlook for 2018 and 2019 assuming policy status quo], July 10

th, 2018.

www.airef.es — (2018b),

Report on expected public administration compliance with the budget stability target, government debt target and expenditure Rule: 2018, July 23rd, 2018.

www.airef.es BANK OF SPAIN (2018a),

Macroeconomic projections for the Spanish economy (2018-2020): The Banco de España’s contribution to the Eurosystem’s June 2018 joint forecasting exercise. www.bde.es — (2018b), “Quarterly report on the Spanish economy”,

Economic Bulletin, 2/2018.

www.bde.es BBVA RESEARCH (2018), “The expansive measures will offset the recovery in the cyclical recovery in the public deficit in 2018”, Fiscal Watch 3Q18, July 30

th, 2018. Retrievable from

www.bbvaresearch.com ESCRIBÁ, J. L. (2018), “Lowering Fiscal Vulnerabilities in Spain,”

Joint Conference Banco de España and International Monetary Fund, April 3

rd, 2018.

www.bde.es EUROPEAN COMISSION (2018a),

Assessment of the 2018 Stability Programme for Spain, May 23

rd, 2018. ttps://ec.europa.eu/info/sites/info/files/economy-finance/09_es_sp_assessment_0.pdf

— (2018b),

European Economic Forecast. Spring 2018. https://ec.europa.eu FUNCAS (2018),

Spanish Economic Forecasts Panel, July 7th, 2018.

www.funcas.es LAGO-PEÑAS, S. (2018), “Progress on fiscal consolidation: Risk of non-compliance and complacency”,

SEFO, 7(3).

www.funcas.es SPANISH MINISTRY OF FINANCE AND CIVIL SERVICE (2018a),

Ejecución presupuestaria hasta el mes de julio de 2017 [Budget outturn through July 2017], July 31

st, 2018.

http://www.hacienda.gob.es/ — (2018b),

Objetivos de estabilidad 2019-2021 y límite del gasto no financiero del Estado para 2019 [Stability targets for 2019-2021 and limit on non-financial state expenditure for 2019], July 20th, 2018. http://www.hacienda.gob.es/

Santiago Lago Peñas. Professor of Applied Economics and Director of the Governance and Economics Research Network (GEN) Vigo University