Recent trends in Spanish consumer credit: A comparison with the European experience

In recent years, Spain has experienced a sharp uptick in consumer credit thanks to both demand and supply side factors. However, close analysis reveals this does not, at present, appear to be a significant source of concern, given that this loan segment has a relatively low non-performance rate, makes up a small proportion of Spain’s overall household borrowings and is likely to decrease as GDP growth rates slow and the savings rate increases.

Abstract: Since emerging from recession, Spain has experienced significant growth in consumer lending to households. This expansion of credit can be attributed to demand side factors such as the consolidation of the economic recovery (

e.g., the decline in the unemployment rate), improvement in

consumer confidence and a decline in interest rates. Supply-side factors have also contributed to consumer credit growth, including the easing of approval standards and the corresponding terms and conditions associated with these loans. While it is true that the growth in Spanish consumer credit has outpaced the eurozone average and should continue to be monitored, close analysis suggests this does not, at present, appear to be a significant source of concern. Higher interest rates on Spanish consumer loans are in line with the risks posed by lending to Spanish households, which are more highly leveraged than their Eurozone peers. Additionally, these loans represent just 11.8% of total household borrowings and 7.1% of total credit extended to the non-financial sector by monetary financial institutions, are largely undertaken to finance house purchases and have low rates of non-performance. Furthermore, it is likely that the demand for consumer credit will decrease as pent-up household expenditure is exhausted, GDP growth rates slow and savings rates normalise.

[1]

Introduction

The sharp pace of consumer credit growth in Spain, which contrasts with the downward trend in the outstanding stock of private sector loans, has sparked concern amongst supervisors. The Bank of Spain’s May 2018 Financial Stability Report concluded that “how consumer credit and its NPL rates perform should be monitored closely in coming quarters”. In November 2017, the ECB also published an article in which it flagged the momentum in consumer credit across the eurozone, noting that in Spain, “consumer credit is growing at double-digit rates”.

This paper analyses the growth in consumer finance in Spain against prevailing trends in other eurozone countries. To that end, the paper assesses the following: a) the growth in consumer credit; b) its weight in terms of total household borrowings; c) the associated non-performance ratios; d) the rate of interest applied to consumer loans; e) the changes in banks’ credit criteria and the associated terms and conditions applied to these loans; and, f) the demand-side factors driving the growth in consumer credit.

Trends in consumer credit

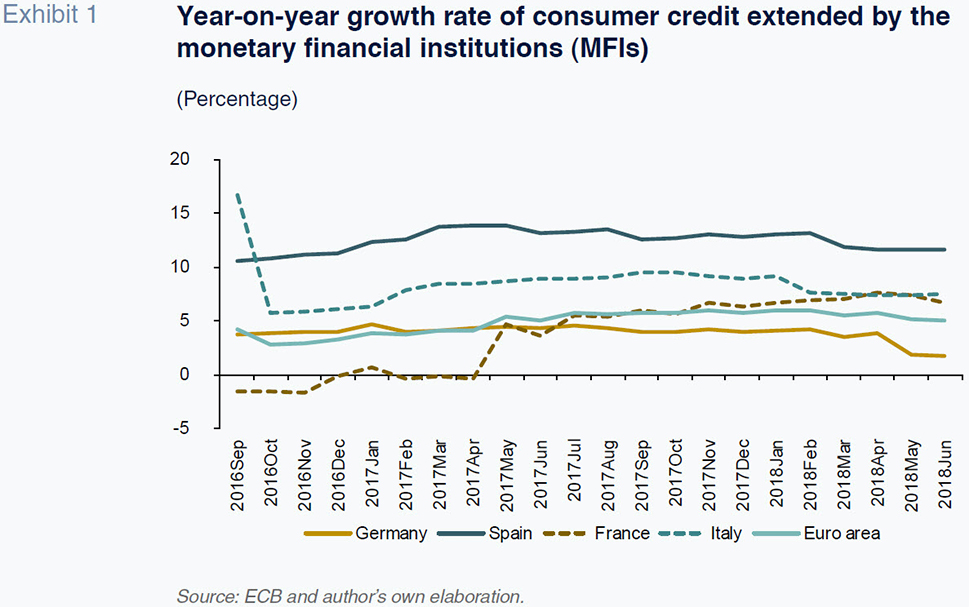

ECB data on monetary financial institutions (MFIs) allow us to analyse the trend in household consumer credit across the eurozone, including the weight of this loan segment in overall household borrowings. As shown in Exhibit 1, consumer credit has registered double-digit growth in Spain since September 2016. Most recently, it has posted average growth rates of 13% in 2017 and of over 10% in 2018, during which time the Spanish economy has also consistently outgrown the eurozone and its main economies. In addition to supply-side factors such as bank-dictated criteria and conditions,

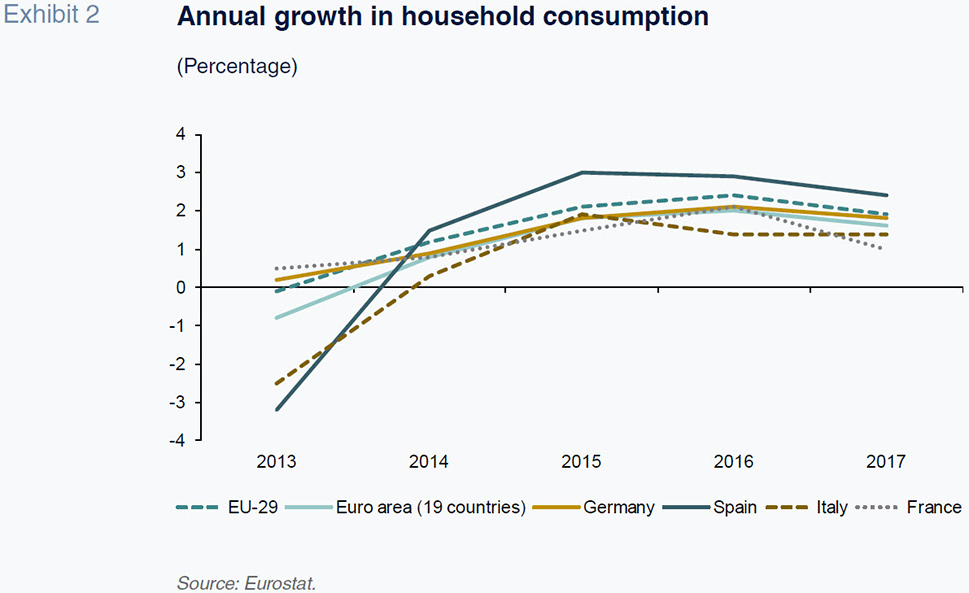

[2] the momentum in Spanish consumer credit can be attributed to the uptick in GDP growth as well as related variables such as the decline in the rate of unemployment and a rise in consumer confidence. All of these variables explain why, after emerging from a recession in the latter part of 2013, Spain’s consumption rate has outpaced the rest of the eurozone (Exhibit 2) since 2014. In 2017, household consumption registered growth of 2.4%, exceeding the EU-29 (1.9%), the eurozone (1.6%) and the main EMU economies (1.8% in Germany; 1.4% in Italy and 1.0% in France). The most recent preliminary data available for the second quarter of 2018 suggest that this expansion has eased with year-on-year growth of 2.2% in the first half (0.2% quarter-over-quarter, compared to 0.7% in the first quarter of 2018), trending below the 2017 rate of 2.4%.

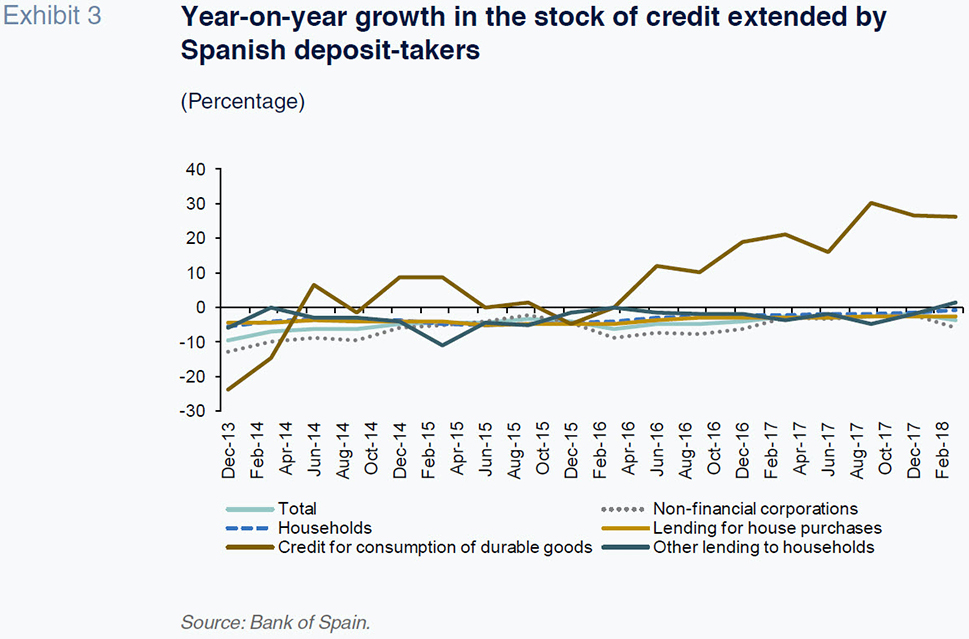

The high growth rate of Spanish consumer credit contrasts with the ongoing decline in the overall stock of outstanding household credit in Spain. Data published by the Bank of Spain on deposit-takers (Exhibit 3) show that the stock of credit extended to the resident private sector in Spain has continued to decrease, with a 3.5% year-on-year contraction in the first quarter of 2018. The stock of loans to enterprises experienced the sharpest fall (-5.7%), with household credit registering a far more modest decline (-0.8%). Lastly, outstanding mortgages decreased by 2.4% year-on-year in the first quarter. Conversely, the trend in loans to finance the purchase of durable consumer goods jumped by 26.4% between the first quarters of 2017 and 2018. Growth in this segment has accelerated since the end of 2015 and remains dynamic despite having eased slightly in 2018 (it previously peaked at 30.4% in the third quarter of 2017). ‘Other loans to households’

[3] registered growth of 1.3% in 2018.

Spain’s growing consumer credit: A source of concern?

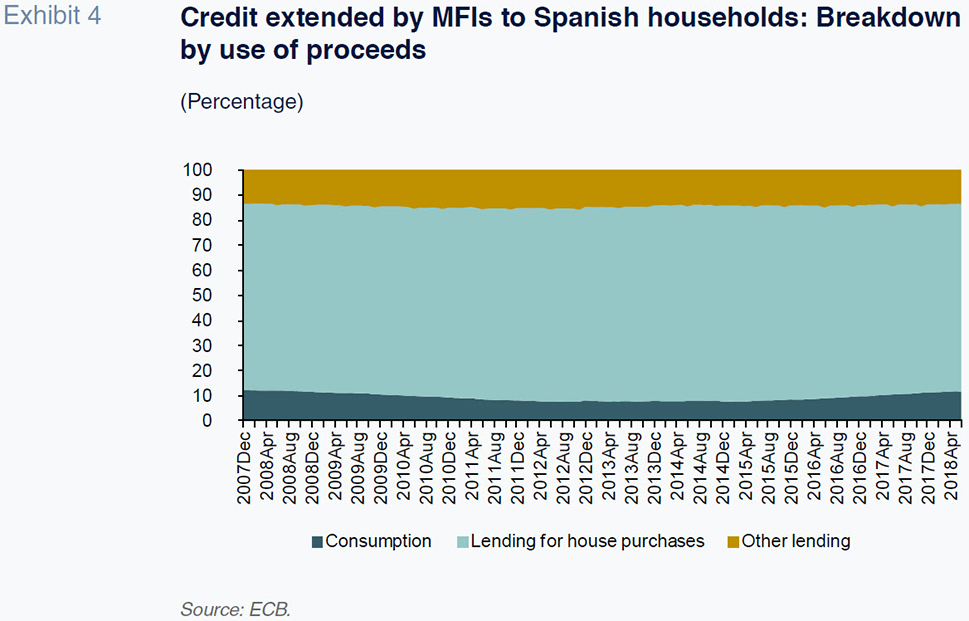

It is worth noting that the current stock of consumer credit extended by MFIs to Spanish households represents just 11.8% of total household borrowings. Despite having increased by four percentage points since its low in 2012,

[4] this rate is exactly the same as the eurozone average and below both France (13.4%) and Italy (15.6%). As shown in Exhibit 4, consumer credit is primarily used by Spanish households to finance the purchase of homes. Specifically, mortgages currently account for 74.8% of outstanding household credit.

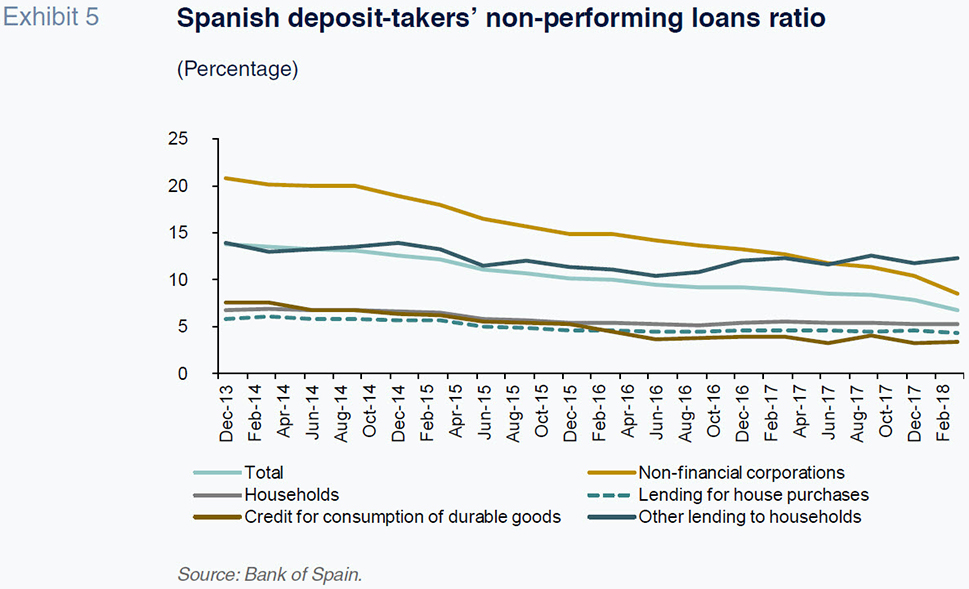

It would be worrying if the high rate of growth in consumer credit was accompanied by a spike in the rate of non-performing loans (NPLs). However, as demonstrated in Exhibit 5, this is not in fact the case. Looking specifically at Spanish deposit-takers, the non-performance ratio of loans for the purchase of durable goods has declined from a high of 7.6% in December 2013 to 3.4% as in March 2018. In absolute terms, the volume of non-performing loans for the purchase of durable goods has contracted by 61% since early 2009 to 1.1 billion euros. Although the Bank of Spain doesn’t provide data on the purchase of non-durable goods (this is lumped in with other uses for household credit), non-performing loans in this segment must be higher since the NPL ratio on ‘other loans to households’ (

i.e., excluding loans for home and durable goods purchases) stood at 12.3% as of March 2018, barely budging from its high of 13.9% of December 2014. According to the Bank of Spain’s 2018 Financial Stability Report, excluding consumer credit and mortgages, this presents the highest NPL ratio (15.4% in 2017), whereas non-performing loans for consumer credit is lower (5.2%). Likewise, durable consumer goods and non-durable consumer goods loans have NPLs of 3.3% and 7.3%, respectively.

Interest rates on consumer credit

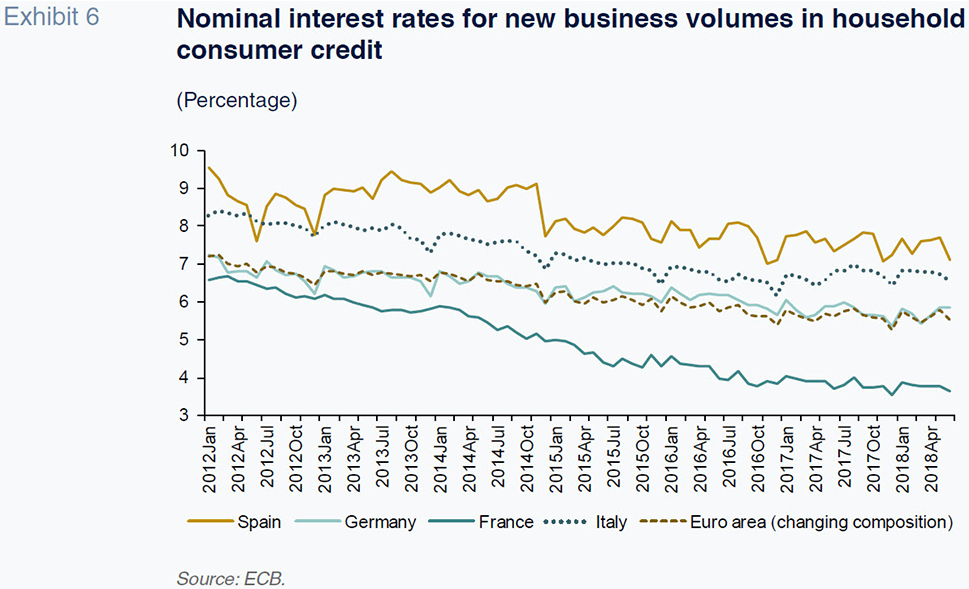

One of the reasons consumer credit has expanded so significantly in Spain is the fall in borrowing costs. Between November 2014 and June 2018, interest rates charged on new transactions decreased by 202 basis points (Exhibit 6), which significantly exceeds the 98 basis points contraction observed in the eurozone. The decline in Spanish borrowing costs is also steeper than in the main eurozone economies. For example, rates decreased by 43 basis points in Germany and 69 basis points in Italy over the same period. However, it is worth noting that consumer credit has always been more expensive in Spain relative to the eurozone and its main economies (with the odd exception such as Italy). Nevertheless, the gap between Spanish and eurozone borrowing costs has narrowed by 104 basis points since November of 2014.

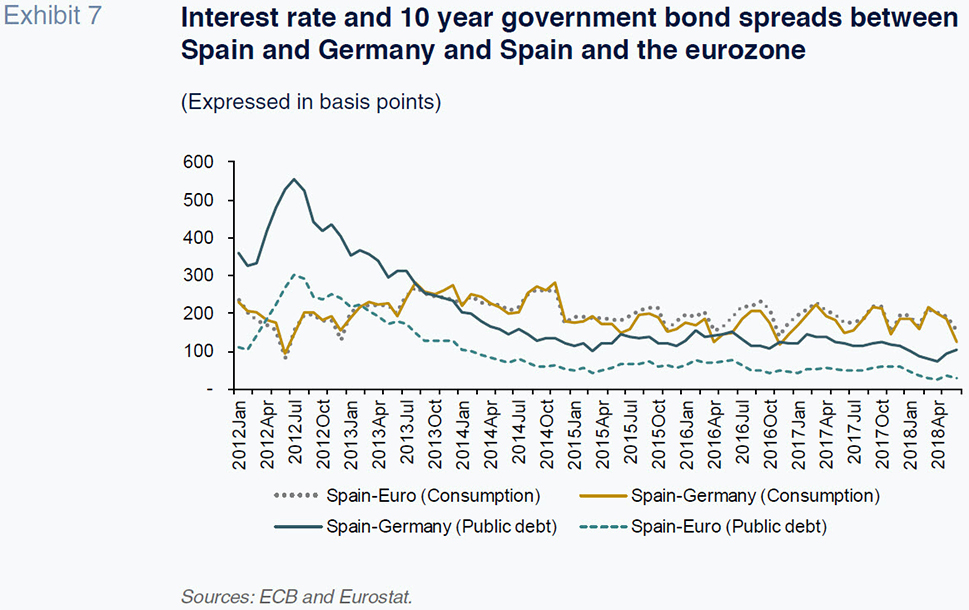

As of June 2018, a consumer loan in Spain cost 158 basis points more than the eurozone average and 124 basis points more than in Germany. One way of determining whether this premium is excessive is to compare it with the spread on long-term sovereign bonds, which is used as the benchmark for the return on risk-free assets. In Germany, that spread is used as an indicator of the economy’s risk premium. Logic dictates that if the spread between the two countries is higher on consumer credit than on sovereign debt, then the risk implicit in extending consumer credit to households is higher in Spain than in Germany or the eurozone. That risk in turn is determined by differences in the levels of household indebtedness and financial vulnerability. Consequently, if Spain’s households are more indebted and more financially vulnerable than those of Germany (or the eurozone), it would make sense that the risk premium applied to Spanish consumer loans exceeds that of Germany (or the eurozone).

In June 2018 (Exhibit 7), the spread between the cost of a consumer loan in Spain and Germany stood at 124 basis points, compared to a spread of 104 basis points between the yields of the two countries’ sovereign bonds. This amounts to a gap of just 20 basis points, which given the higher leverage rates of Spanish households, doesn’t appear excessive. Specifically, Spain has a debt to gross disposable income ratio of 102.9%. In comparison, Germany’s ratio is 84.7%. Similarly, the spread between the cost of a consumer loan in Spain and the eurozone average stood at 158 basis points in June, with Spain’s debt to gross disposable income ratio 8.6 percentage points above the eurozone average. Considering the greater risk associated with extending consumer loans in Spain, it makes sense that these loans would entail a higher interest rate.

Supply-side factors: Consumer credit approval standards and terms and conditions

The quarterly bank lending survey conducted by the ECB offers insight into the changing standards used to approve loans, including factors on both the demand and supply side of the equation. Specifically, the survey provides information with respect to the tightening or easing of: a) credit standards applied to the approval of credit (and contributing factors); b) terms and conditions for credit; c) the rejection rate for credit applications; and, d) changes in net demand for credit and contributing factors. Our analysis focuses on the trend since 2016, the year in which growth of Spanish consumer credit began to accelerate.

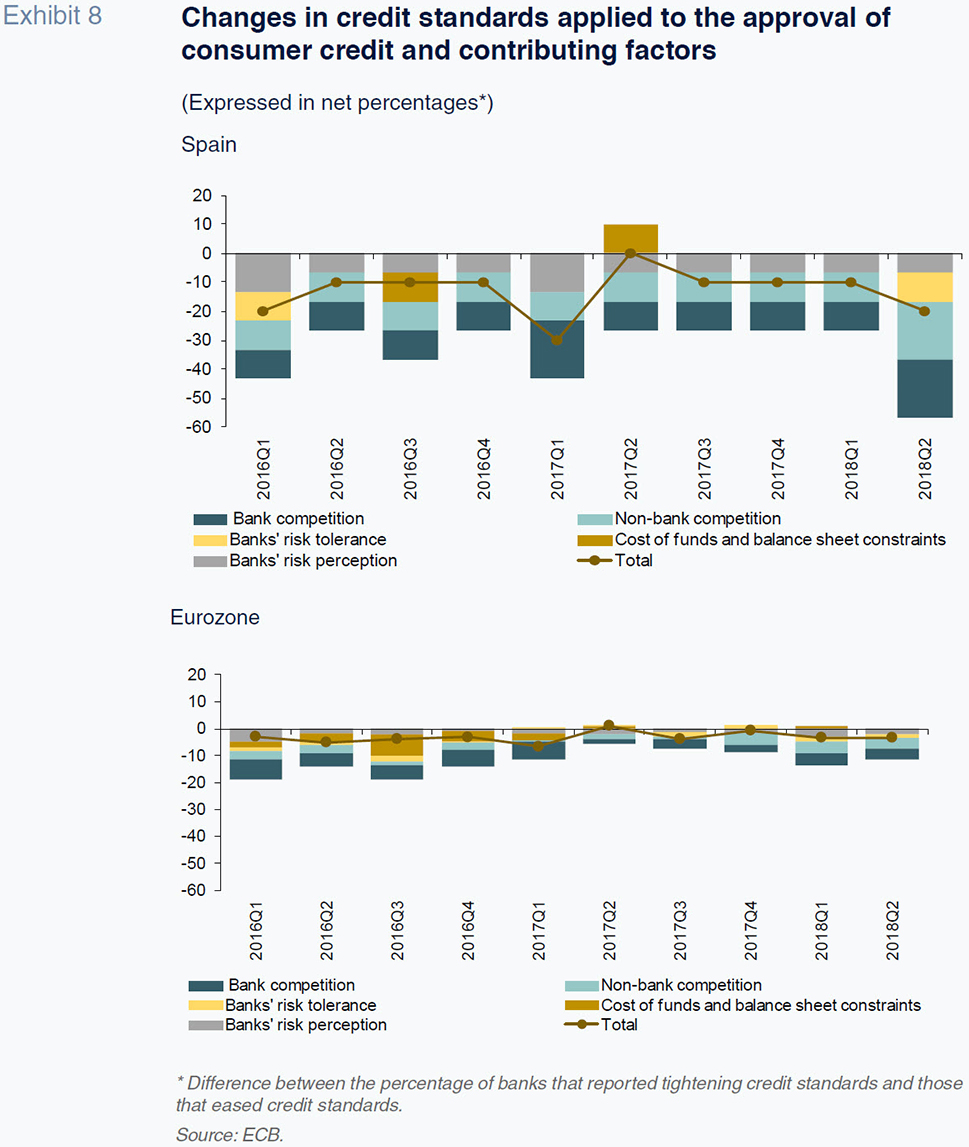

In virtually every quarter since early 2016 (Exhibit 8), Spanish banks have eased their credit standards for consumer loans, thereby contributing to the spike in this particular loan segment. Although eurozone banks have also eased their approval criteria, the net percentages are narrower. Notably, these figures are similarly negative, which suggests that a higher percentage of banks reported having eased rather than tightened their lending standards.

Turning to Spain, net percentages stood at -20 percentage points in the second quarter of 2018. One reason for this is the greater competition between banks. Another contributing factor is that banks’ perception of borrowers’ risk has diminished, which has undoubtedly been influenced by Spain’s economic rebound. More recently, a new underlying factor has been identified, namely the uptick in banks’ risk tolerance. A comparison with the eurozone suggests that the same factors are present but with less intensity than in Spain.

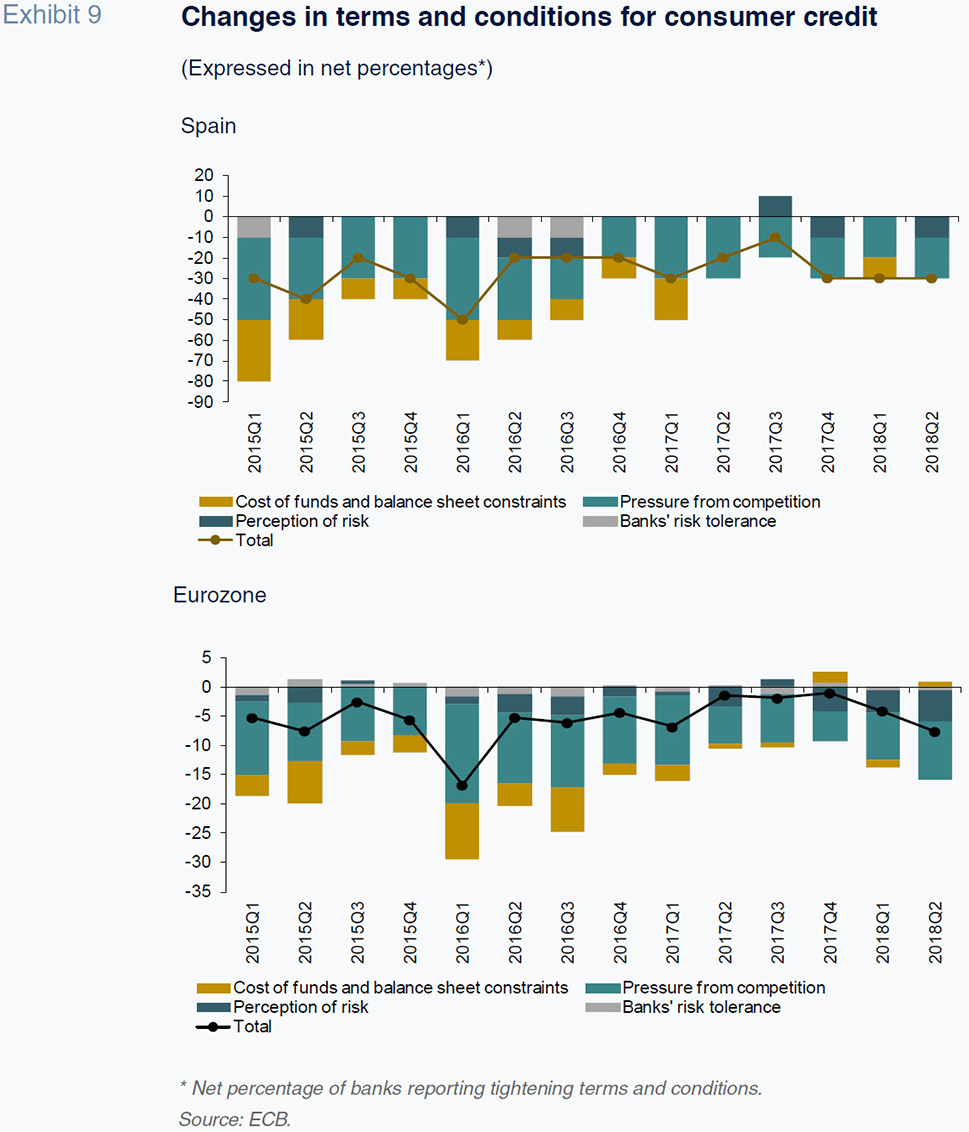

In tandem with the easing of lending criteria for consumer credit, Spanish banks have also been improving the terms and conditions applied to these loans since at least 2015. As shown in Exhibit 9, competitive pressure largely explains this development. Other less influential factors include banks’ reduced perception of risk and the lower cost of funds. The most recent figures, which date to the second quarter of 2018, reveal an overall net percentage of -30, and net percentage points of -20 and -10 for competition and risk perception, respectively. These figures are wider than those of the eurozone banks on average, indicating that in Spain, the terms and conditions applied to consumer credit are improving more vigorously.

One final factor that accounts for improved terms of access to consumer credit in Spain relates to the rate of loan applications rejected. Since 2016, the rejection rate has fallen each quarter in Spain, with differences between the percentage of banks reporting an increase and those that reported a decrease in the rate ranging between -10 and -30 percentage points. These net percentages are significantly higher than those of the eurozone and its main economies.

Explanations for demand-driven consumer credit growth

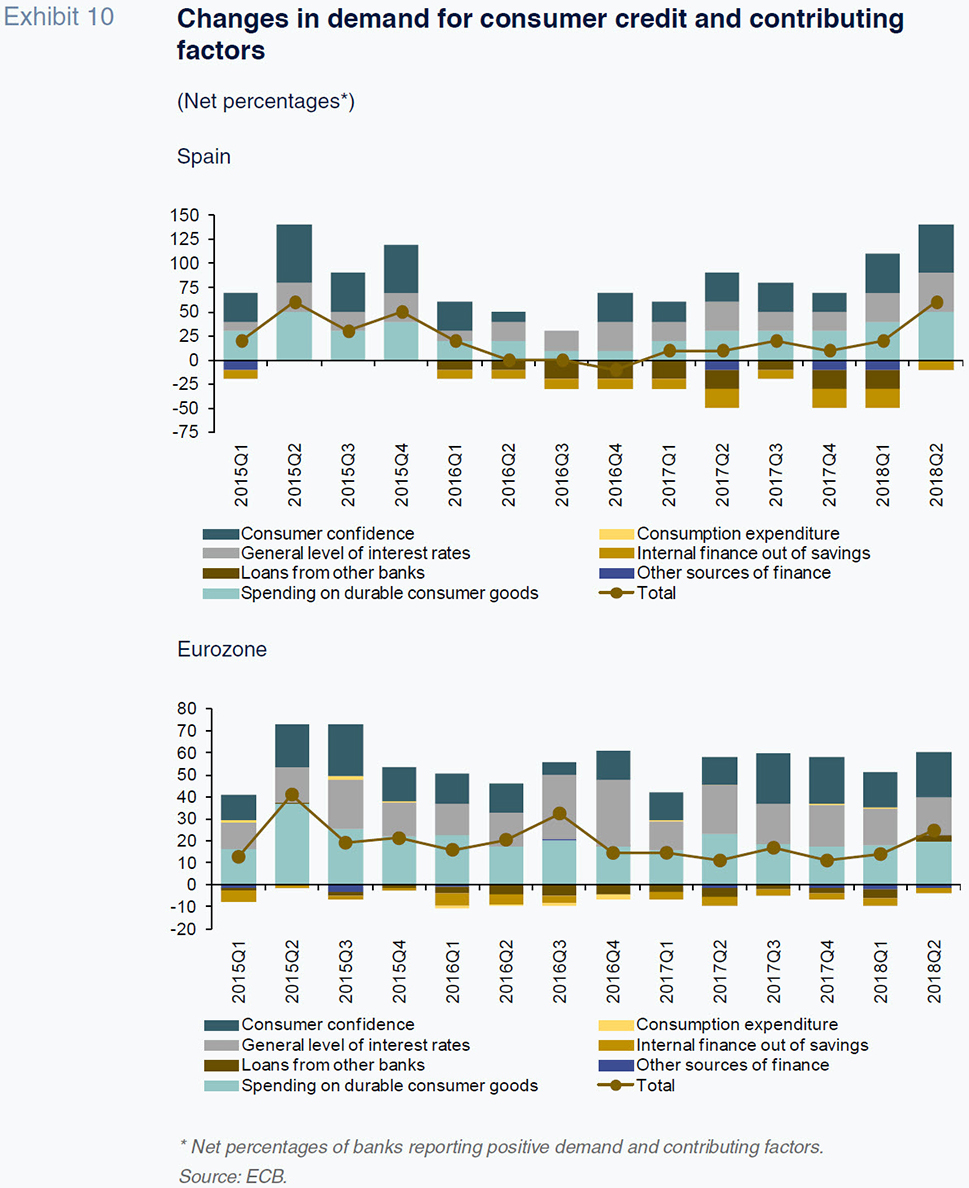

The ECB survey also enables an analysis of those demand-side factors that have contributed to the high rate of growth in Spanish consumer credit. Since the first quarter of 2017 (Exhibit 10), the percentage of banks reporting that demand is growing has been higher than the percentage reporting a slump in demand. The net percentage peaked at 60 percentage points in the second quarter of 2018, which is more than twice the eurozone average.

Looking at the most recently available data, it becomes apparent that two specific factors have driven demand for consumer credit: growth in spending on durable goods and higher consumer confidence. Specifically, these two factors had net percentages of 50 percentage points. The general level of interest rates also made a considerable contribution with net percentages of 40 percentage points. Recall that rates (12m Euribor) have been in negative territory since February 2016 and at close to -0.2% since the end of 2017. Although these contributing factors also underpinned the increase in the demand for consumer credit in the eurozone, their overall effect has been greater in Spain.

Conclusions

The onset of the financial crisis in Spain triggered a collapse in household expenditure, which contracted until 2013. Simultaneously, the savings rate increased as households set money aside. Specifically, it oscillated around 10% until 2013, after having peaked at 13.4% in 2009. Once the Spanish economy emerged from recession in 2013, spending rebounded and the savings rate began to decrease, reaching a low of 5.7% in 2017. As a result, household expenditure that had been put on hold during the crisis was unlocked, thereby spurring the growth in consumer spending observed in recent years.

Against this backdrop, the recent jump in Spanish consumer credit can be attributed to demand-side factors such as the consolidation of the economic recovery (e.g., the decline in the unemployment rate), improvement in consumer confidence and the drop in interest rates. However, supply-side factors have also played an important role with banks easing approval standards for consumer credit as well as the corresponding terms and conditions. Increased competition amongst banks and the general interest rate environment have squeezed banks’ profits, encouraging them to look for higher-margin lending opportunities such as consumer credit.

However, the high growth rates in Spanish consumer credit do not appear to be a source of concern for several reasons: a) the existing stock of consumer credit represents just 11.8% of household credit and 7.1% of the credit extended to the private sector by monetary financial institutions; b) the rate of non-performance is low (5.2% for all consumer credit and 3.3% for credit used to purchase durable consumer goods, the segment registering the fastest growth); c) a significant portion of the increase in spending on durable goods is the result of pent-up demand such that growth rates can be expected to normalise once that demand has been satisfied; d) GDP growth is expected to ease in the coming years, as will consumer spending, taking some of the wind out of the growth in consumer credit (data for the second quarter of 2018 already reveal a slowdown in consumer spending); and, e) the savings rate is currently very low (5% in the first quarter of 2018) and can be expected to trend back to the historic average, thereby reducing households’ propensity to spend.

Lastly, although Spanish banks charge higher interest rates for consumer credit than their European counterparts, this is largely due to the Spanish economy’s relatively higher risk premium and the higher risk assumed by the banks when they lend to Spanish households, which are more indebted than their European peers.

Notes

This article was written as part of a Spanish Ministry of Science and Innovation project (ECO2017-84828-R).

The effect that a drop in interest rates has on consumption levels depends on the impact on household net borrowing costs. As noted by the ECB (2018), the amount of interest paid in Spain fell by more than the amount collected between 2008 and 2017, so that the downward trend in rates has had a positive impact on consumer spending. The greater drop in interest paid is due to high household leverage, as well as the fact that a high percentage of home mortgages carry floating interest rates.

This balance includes loans for the purchase of non-durable consumer goods, loans extended to households to finance the acquisition of land, rural estates and financial securities and loans for other uses not included in any of the other categories. Unfortunately, the Bank of Spain does not track total consumer credit. Instead, it provides a series for durable consumer goods financing and a series for other loans to households, which excludes consumer finance. If, rather than using the data tracking the stock of outstanding loans, we use new business volume flows, the Bank of Spain provides data on consumption expenditure financed via credit cards and credit. Using the new business volume figures, we note that bank loans earmarked for consumption expenditure increased by 17.3% in 2017.

As for total credit extended to the non-financial sector, consumer credit from Spanish MFIs accounted for a 7.1% share as of June 2018.

References

BANK OF SPAIN (2018), Financial Stability Report, May.

EUROPEAN CENTRAL BANK (2017), Recent trends in consumer credit in the euro area, Economic Bulletin, 7: 32-35.

— (2018), Private consumption and its drivers in the current economic expansion, Economic Bulletin, 5: 86-110.

Joaquín Maudos. Professor of Economic Analysis at the University of Valencia, Deputy Director of Research at Ivie and collaborator with CUNEF