Spanish economic forecasts panel: September 2015 [1]

FUNCAS Economic Trends and Statistics Department

The growth forecast for 2015 has been raised one tenth of a percent to 3.2%

Driven by domestic demand, GDP grew by 1% in the second quarter compared with the previous quarter. Private consumption was highly dynamic, as was investment in both construction and capital goods. Exports progressed rapidly, although they were outpaced by imports, such that the net contribution of the external sector to GDP growth was negative, thus resuming the habitual pattern seen since the start of the recovery, after two consecutive quarters in which it made a positive contribution.

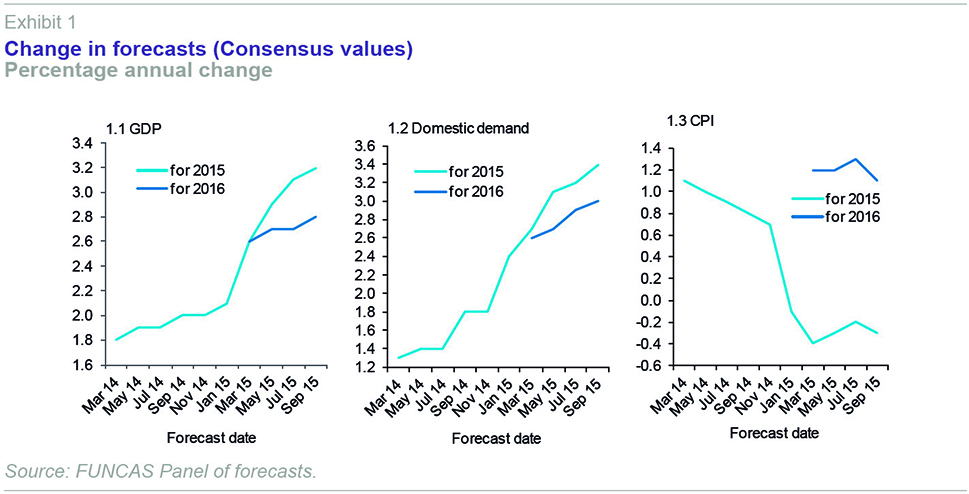

The consensus forecast for 2015 has been raised one tenth of a percent to 3.2%. This revision derives from an increase in the expected contribution of domestic demand, which will be 3.4 percentage points, while the contribution of the external sector will be -0.2 pp.

Growth in the third and fourth quarters will slow to 0.8% and 0.7%, respectively (Table 2).

The forecast for 2016 has been revised upwards a tenth of a point to 2.8%

The consensus forecast for GDP growth in 2016 is 2.8%, one tenth of percentage point higher than in the previous Panel. In this case too, the upward revision has been the outcome of greater than expected growth in domestic demand. As in 2015, the external sector is expected to make a negative contribution.

The quarterly profile is for a stable growth rate of 0.6% throughout the year.

The outlook for the industrial sector is very positive

The rise in the industrial production index accelerated in the second quarter of the year. The positive trend in industrial activity has also been reflected in GVA, which is higher than in other sectors –excluding agriculture– and the positive trend in employment.

The consensus forecast for IPI growth in 2015 has been raised considerably to 3.1%, five tenths of a percent higher than in the previous Panel. That for 2016 has also been revised upwards, to 3.3%.

Falling oil prices have again pushed inflation into negative territory

The inflation rate, which in June and July turned positive after almost a year in negative territory, dropped again to -0.4% in August, due to falling oil prices. The consensus forecast for the 2015 average rate has dropped by a tenth of a point to -0.3%, and that for 2016 has also been revised downwards to 1.1%. The year-on-year rate expected for December this year is 0.9% and that for December 2016 is 1.2%.

The employment forecast has improved

Employment, in full-time job equivalent terms, increased by 0.9% in the second quarter. In line with better growth forecasts for the economy, the forecast for job creation in 2015 has been revised upwards to 3% and that for 2016 to 2.7%. The average annual unemployment rate forecast for this year is 22.3%, while that for 2016 is 20.5%.

The consensus estimates for GDP, employment and wage growth can be used to deduce the implicit productivity and unit labour cost growth estimates. On this basis, productivity per worker is expected to grow by 0.2% in 2015 and 0.1% in 2016, while ULCs, are expected to change by 0.4% this year and 0.9% next year.

Cheaper oil has improved the current account balance

The balance of payments on the current account in the first half of 2015 registered a slight surplus, compared with a deficit of 3.5 billion euros in the year-earlier period. This improvement was partly due to lower oil prices, as, according to Customs data, the goods trade balance excluding energy products worsened in the period. An additional factor was the reduction in the deficit on the income and transfers balance.

The consensus forecast for the current account balance is for a surplus of 1% of GDP in 2015 and 0.9% in 2016.

The government deficit will overshoot the target by a few tenths of a percent

The overall balance of the central government, social security and autonomous regions to May was 2.2% of GDP, just one tenth of a percentage point less than in the same period in 2014. The autonomous regions’ deficit up to May was 0.5%, one tenth of a percentage point less than in the year-earlier period, and only two tenths of a percent short of its objective for the year as a whole.

The consensus forecasts for the general government deficits for 2015 and 2016 are 4.5% and 3.2% of GDP, respectively. These figures are three and four tenths of a percent, respectively, over the government’s targets.

The state of the global economy is perceived to have worsened

Growth expectations for the global economy deteriorated over the summer as a result of the doubts about the state of the Chinese economy, particularly after the devaluation of its currency in mid-August. By contrast, the outlook for the United States has improved with the surprising upward revision of GDP growth in the second quarter to 3.7% and the drop in the unemployment rate to 5.1%. Growth in the euro area remains weak, despite the slight upward revision in the results of the first and second quarters.

Panellists’ view of the current situation in the EU has worsened somewhat since the last panel, although the majority continue to think it will improve in the months ahead.

As regards the situation outside the EU, the worsening perception has been more pronounced, with a significant shift in opinions from favourable and neutral to unfavourable.

The consensus view is that long-term interest rates are too low

Short-term interest rates (three-month EURIBOR) have been negative since mid-April. As in previous Forecast Panels, this rate is still felt to be too low, but is expected to remain unchanged over the months ahead.

In the case of the long-term rate (10 years), yields have risen to over 2% in recent weeks, and Spain’s risk premium has also risen, now exceeding Italy’s. This is likely to be due to concerns over domestic political uncertainties.

In any event, the view remains that interest rates on Spanish debt are very low, and they are expected to remain stable over the next few months.

The euro continues to depreciate

The euro has traded at around 1.11 dollars in recent months. Most panellists consider this exchange rate to be neither over nor undervalued, but expect the euro to lose value over the next few months.

Fiscal policy is too expansionary

After the recent measures announced by the government, most panellists consider fiscal policy to be expansionary relative to the state of the Spanish economy, although opinions differ as to the appropriate stance. All the panellists classed current monetary policy as expansionary, and the unanimous view was that this was the appropriate stance.

The Spanish Economic Forecasts Panel is a survey run by FUNCAS which consults the 16 analysis departments listed in Table 1. The survey, which has taken place since 1999, is published bi-monthly in the first half of January, March, May, July, September and November. The responses to the survey are used to produce a “consensus” forecast, which is calculated as the arithmetic mean of the 16 individual contributions. The forecasts of the Spanish Government, the Bank of Spain, and the main international organisations are also included for comparison, but do not form part of the consensus forecast.