Sovereign bond purchases and risk sharing arrangements: Implications for euro-area monetary policy

The ECB´s asset purchase program has been successful from a macroeconomic standpoint for the euro area as a whole, and in particular for Spain. Under most scenarios, the program is expected to generate positive profits, while potential losses should be limited due to adequate loss absorption capabilities and risk sharing agreements.

Abstract: The ECB’s asset purchases program has been an unambiguous success, quickly improving the euro area’s macroeconomic outlook. It has been particularly positive for Spain, leading to a sharp decline in interest rates across the yield curve, lower bank lending rates, a weaker currency, and protecting Spanish assets from contagion during the recent Greek crisis. This has sparked an acceleration of growth, facilitating the easing of the fiscal stance, and leading to an upward revision in growth forecasts. The program’s design has raised some doubts about the potential scarcity of bonds eligible for purchase and the likelihood of losses derived from purchases executed at very low yields. This paper argues that the program is well designed and calibrated for the characteristics of the euro zone bond market, and the ECB could easily relax some of the eligibility restrictions if needed. The program is likely to generate profits and the risk sharing and accounting arrangements, as well as the ECB loss absorption capabilities, look adequate for the potential risks of the program. Should losses materialize, a prompt recapitalization would be desirable to maintain the credibility of monetary policy and the independence of the European Central Bank. [1]

Introduction

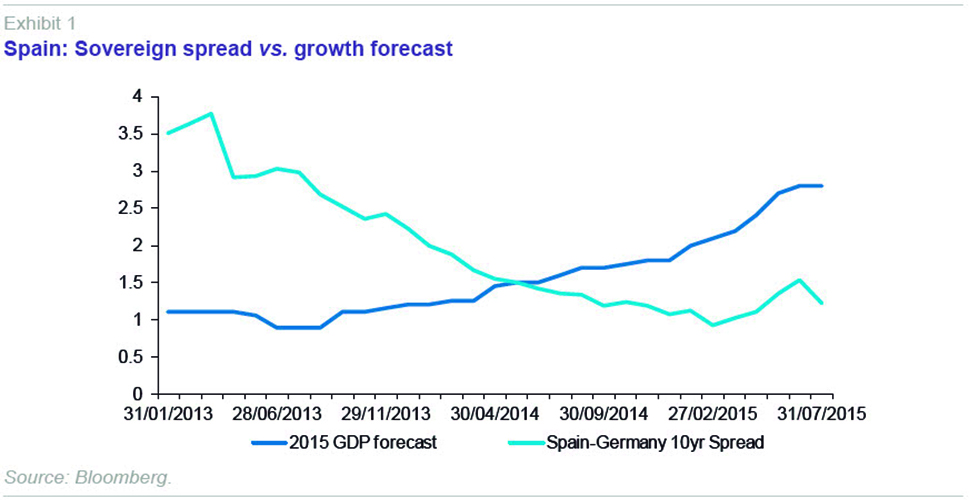

At its meeting on January 22nd, 2015, the ECB announced the EAPP (Expanded Asset Purchase Program), a program of secondary market purchases of euro-denominated investment-grade securities issued by euro area governments and agencies and European institutions, to complement the monetary policy measures adopted in the second half of 2014, which included the TLTRO and the programs of purchases of private assets (the Covered Bond Purchase Program (CBPP3) and the Asset Backed Securities Purchase Program (ABSPP). The intent was to address the heightened risks of too prolonged a period of too low inflation. The purchases started in March, and the combined purchases of public and private sector securities will amount to 60 billion euros per month. The ECB intends to purchase private and public securities until end-September 2016 and, in any case, until it sees a sustained adjustment in the path of inflation which is consistent with its aim of achieving inflation rates below, but close to, 2% over the medium term. There is clear evidence that the policy measures are effective, as financial market conditions and the cost of external finance for the private sector have eased considerably over the past months and borrowing conditions for firms and households have improved notably, with a pick-up in the demand for credit. As a result, consensus forecasts for growth and inflation in the euro area have been revised upwards. It has been particularly positive for Spain, leading to a sharp decline in interest rates across the yield curve, lower bank lending rates, and a weaker currency. This has sparked an acceleration of growth and of growth expectations (Exhibit 1), facilitating the easing of the fiscal stance, and leading to an upward revision in growth forecasts. In addition, the program has been very effective in containing contagion and spillovers from the Greek crisis into periphery spreads.

The program will encompass investment grade euro-denominated bonds from euro area central governments, agencies, and supranational or international institutions located in the euro area. The ECB intends to allocate 88% of the total purchases to government bonds and agencies, and 12% to bonds of supranational and international institutions. The purchases of the supranational and international institutions will be performed by a few selected NCBs. The residual maturity range will be 2-30 years at the time of purchase and purchases will be allocated along this maturity spectrum in a market neutral way via weights on nominal outstanding amounts. The purchases will be allocated across issuers of the various countries on the basis of the ECB’s capital key.

In order to limit the market interference of the purchases and to better manage the risk across national central banks, the ECB introduced a series of restrictions to the program. The ECB decided to apply a limit of 25% per issue (including pre-existing holdings from the SMP program and other portfolios of eurosystem central banks) to avoid obstructing the application of collective action clauses in an eventual case of debt restructuring, as this could be construed as monetary financing of governments. It also decided to apply a 33% limit per issuer to preserve market functioning and avoid becoming a dominant creditor to any country. [2] These percent limits apply to nominal, not market values. It also decided to exclude from the universe of eligible securities those with a yield below the current deposit rate (-0.2%) in order to avoid ex-ante losses (see below).

The ECB had bought about 300 billion euros worth of assets by June 30th, with an average maturity of about 8 years. As regards Spanish debt, the ECB has bought about 5.5 billion euros/month of Spanish bonds, in line with its capital key share, with an average maturity of about 10 years.

Accounting and risk sharing arrangements

The ECB follows a prudent accounting approach. This applies particularly to the differing treatment of unrealised gains and losses for the purpose of recognising income, and to the prohibition on netting unrealised losses on one asset against unrealised gains on another. Unrealised gains are transferred directly to revaluation accounts. Unrealised losses exceeding the related revaluation account balances are treated as expenses at the end of the year. Impairment losses are taken to the profit and loss account in their entirety.

The distribution of profits and losses of the ECB follows the following rule: (1) at the discretion of the Governing Council, up to 20% of the net profit may be transferred to the general reserve fund, subject to a limit equal to 100% of the capital; (b) the remaining net profit may be distributed to the shareholders of the ECB in proportion to their paid-up shares. In the event of a loss incurred by the ECB, the shortfall may be offset against the general reserve fund of the ECB and, if necessary, following a decision by the Governing Council, against the monetary income of the relevant financial year in proportion and up to the amounts allocated to the national central banks.

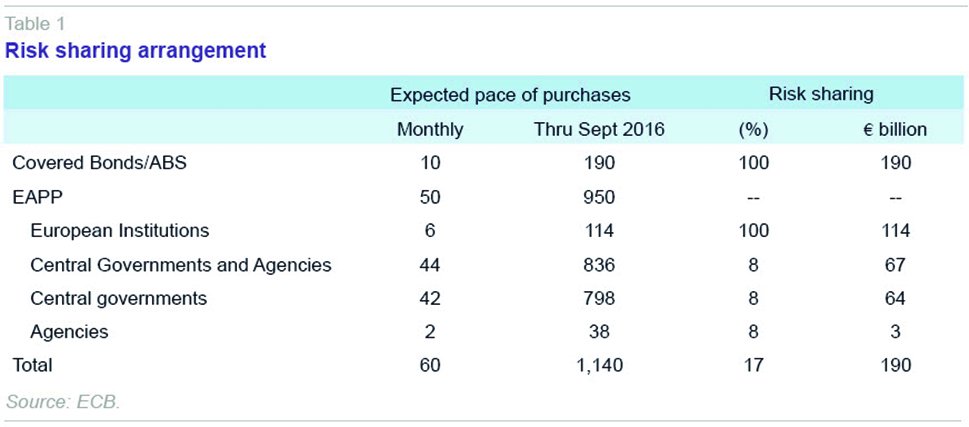

Because the size of the EAPP program is expected to be large, reaching around 1.1 trillion euros by September 2016, and in view of potential quasi fiscal implications of the program in the event of a debt restructuring, the ECB decided to adopt a specific risk sharing agreement for the EAPP program. Based on this agreement, 92% of the net profit from the purchases of central government bonds and agencies will be kept at the NCB level, while the remaining 8% will be shared according to the capital key. On the other hand, the net profits of the purchases of bonds of supranational and international institutions, and of the private sector assets programs (CBPP3 and ABSPP), will be fully shared according to the capital key.

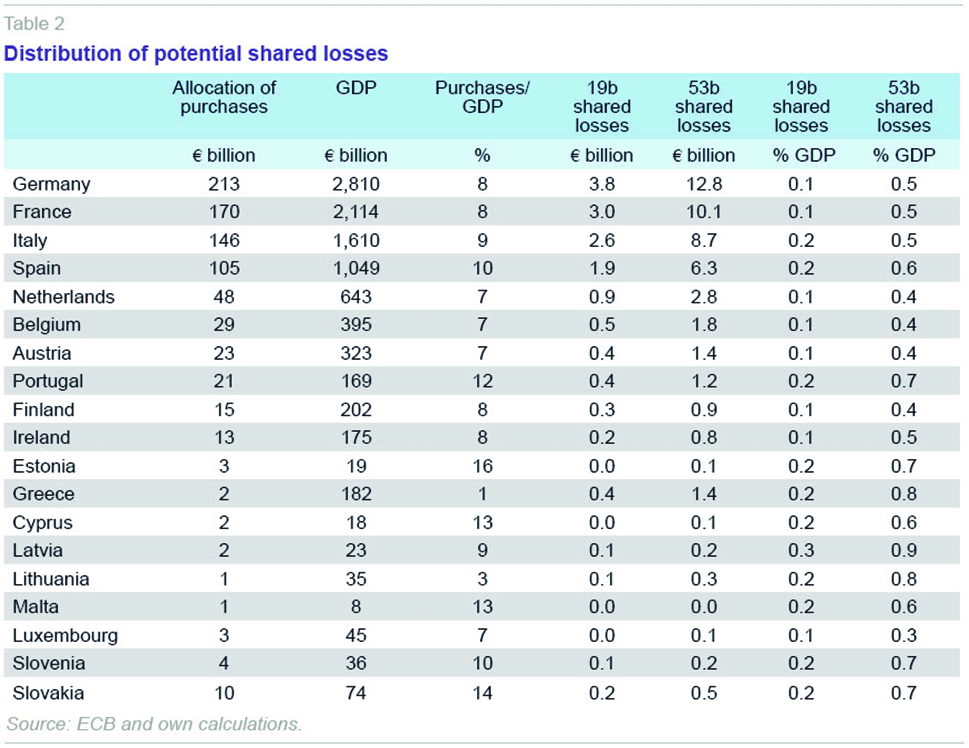

Table 1 shows the details of the risk sharing agreement. Based on these calculations, on average about 17% of the net profit of the comprehensive asset purchases program will be shared. Table 2 shows the expected distribution of purchases, in billions of EUR and as share of GDP per country. [3] This allows the calculation of the potential losses from an eventual debt restructuring. Imagine, in an extreme case, that the debt of the 4 countries that were under pressure during the crisis (Italy, Spain, Portugal and Ireland), suffers a haircut of 50%. (The haircut in the Greek restructuring was 53.5%.) That would imply losses of about 140 billion euros. Assuming no losses on the purchases of European institutions’ assets and on the CP/ABS programs, the risk sharing agreement would imply shared losses of about 15 billion euros. Of course, in that case, one would need to assume some default ratio for the ABS/CP program, although this need not be high. The historical default rate in European ABS is very low, a mere 2% over the last 10 years (see Financial Times 2014), which would imply losses of about 4 billion euros. For the sake of argument, one could assume the historical default rate of ABS in the U.S., which is about 20%. In that pessimistic case, a 20% haircut applied to the CP/ABS program would then yield total shared losses of about 38 billion euros. Therefore, potential losses from the three programs could be in the range of 19-53 billion euros, or between 0.2 and 0.9% of GDP, depending on the country.

In theory, in addition to a potential debt restructuring, losses could arise from valuation changes. By its nature, the portfolio of government bonds purchased under a successful quantitative easing program should have an expected negative value on a mark to market basis, because the intention of the central bank is to improve the growth and inflation outlook and restore inflation expectations back up to the desired level. This should lead to an appreciation of risky assets and, eventually, to an increase in long term yields to reflect the better nominal growth outlook. Because bond prices move inversely to yields, a successful bond buying program implies buying government bonds when they are expensive (their yield is lowest) hoping they will become cheap (their yield will increase, or at a minimum stabilize and stop declining). Note that this would not be the case if the assets purchased were risky assets, as the central bank would be buying them when they are cheap and would appreciate if the program is successful.

The probability of incurring mark to market losses increases the closer bond yields are to zero. Bond pricing is a function of maturity and the coupon yield and, because all the bonds that can be purchased have been issued with positive coupon yields, bonds purchased at negative yields will deliver with certainty a capital loss at expiry. However, because the purchase of the bond also generates an increase in reserves, and those reserves are “remunerated” at -0.2% (the ECB charges -0.2% on deposits), the ECB ensures that there is no ex-ante loss if bonds are purchased at -0.2% or higher.

In addition, the accounting convention of the ECB distinguishes securities held for monetary policy purposes from other securities. Those held for monetary policy purposes are valued at amortized cost subject to impairment. The rest of securities are valued at amortized cost if they are expected to be held to maturity or marked to market otherwise. Thus, assets purchased under the EAPP, CBPP3 and ABSPP programs are valued at amortized cost and will not be at risk of mark to market losses unless they are sold. The ECB has not disclosed whether it plans to sell these assets at some point or keep them to maturity. The Federal Reserve has announced that it plans to hold to maturity the assets purchased in the context of its quantitative easing programs, and it should be expected that the ECB do the same as the size of the balance sheet is not an impediment for the effective conduct of monetary policy.

This accounting convention plus the likely hold to maturity of the purchased assets implies that losses arising from the ECB’s quantitative easing program would only arise from default. [4] The restriction not to buy securities below -0.2% ensures that no valuation driven losses are incurred; moreover, because the weighted yield of the purchases is materially above the ECB’s funding cost of -0.2%, the ECB ensures that it makes a profit with the QE program. For illustrative purposes, the weighted yield of the bonds purchased under the EAPP program during March-May has been about 0.6%. If this were to become the average yield of the full program, 1 trillion euros worth of asset purchases would generate a minimum profit of about 7.5 billion euros.

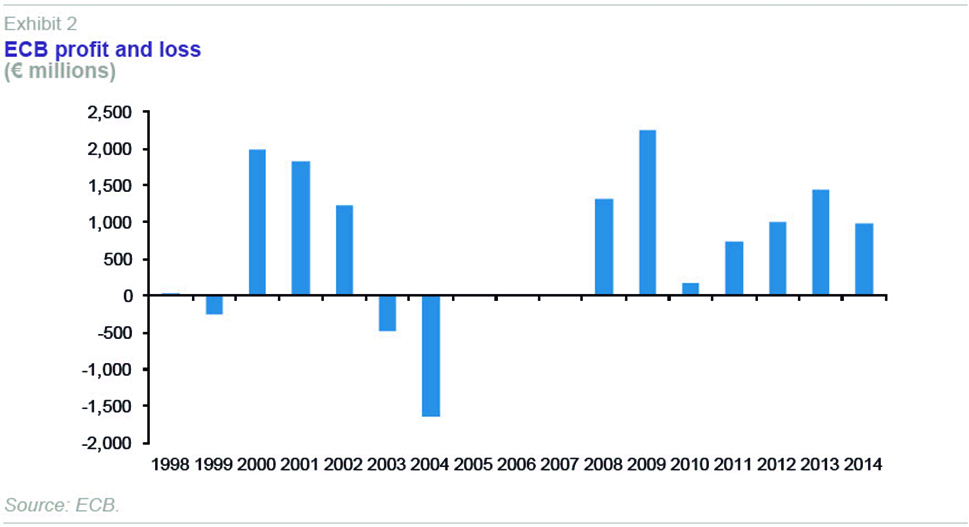

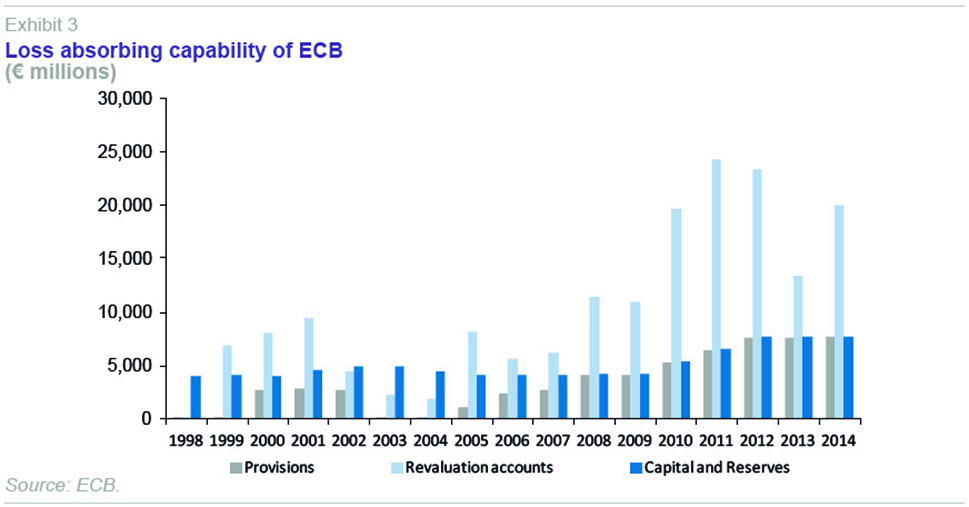

Finally, it is important to clarify that central banks do at times incur losses (see, for example, the discussion in Dalton and Dziobek (2005)), and have built-in buffers to absorb these potential losses. For example, in 2003 and 2004, the ECB incurred significant losses in its holdings of foreign exchange as a result of the steady appreciation of the euro (Exhibit 2). The ECB has a loss absorbing capability that includes capital, provisions, and revaluations accounts (see Exhibit 3). Provisions for foreign exchange, interest rate credit and gold price risk have been accumulated to offset future realized and unrealized losses, in particular valuation losses not covered by the revaluation accounts. The provision was created in 2000 and its size is assessed annually based on an assessment of exposure to risks, and cannot exceed the value of paid up capital. In 2003 and 2004, the provision was depleted as a result of the losses incurred and was replenished in the subsequent years. The revaluation accounts arise from unrealized gains on assets, liabilities and off balance sheet instruments. These accounts have increased in parallel to the increase in the size of the ECB’s balance sheet and show, at the moment, a sizable surplus of 19.9 billion euros.

As of end 2014, the total loss absorption capacity of the ECB amounted to about 35 billion euro. Any future losses from the EAPP program would have to be set against the profits generated by the program (in an accounting sense) and the major macroeconomic improvement that it has generated. [5] The euro area GDP forecasts for 2015 are being revised upwards steadily, in part due to the positive effect of the quantitative easing program, inflation expectations have shifted upwards and closer to the ECB’s definition of price stability, and the reduction in interest expenditure in 2015 due to the reduction in bond yields amounts to about 0.6% of GDP. As a result, the fiscal outlook of the euro area has improved.

In the case of Spain, the impact of the ECB’s quantitative easing program has been particularly positive. The associated sharp reduction in interest rates, the rally in the stock market, and the decline in the euro, at a time when the banking system had been recapitalized and thus no longer presented a headwind to growth, have been a major determinant of the acceleration in growth. Because of the ECB’s QE program, the softening of the fiscal stance since 2014, which has also supported growth, has not had any negative impact on long term interest rates or sovereign ratings.

The euro area bond market

The face value of the outstanding amount of euro area government bonds is over 6.5 trillion euros. Taking into account the ECB self-imposed maturity restrictions, eligible securities in the 2-30 yr range have a face value of about 5 trillion euros. Because many of these bonds are trading at above par, the market value of eligible bonds is closer to 6 trillion euros. In addition, the face value of outstanding debt of eligible agencies and supranational European institutions in the 2-30 yr maturity range is about 825 billion euros.

In addition, the restriction not to buy bonds with yields below -0.2% has the potential to further reduce the universe of eligible bonds, although the recent back up in yields has lowered that risk. At the recent low point in yields during April-May 2015, over 7% of euro area bonds were trading below -0.2%, affecting bonds in Germany, Austria, the Netherlands and Finland.

Two additional factors make the ECB’s quantitative easing program different from those of the Fed, the BoE or the BoJ, both in the direction of pushing long term yields closer to zero. First, the ownership structure of euro area bond holdings is such that there are more constraints to sales by large domestic holders such as insurance companies and pension funds, domestic banks, and foreign central banks. In addition, the combination of QE and negative deposit rates is pushing investors further out the curve. This is making the portfolio rebalancing effect more effective but also raises the probability of hitting the -0.2% constraint.

The bond scarcity problem

Quantitative easing affects long term interest rates via three main channels: (1) the signalling effect of market expectations of short term interest rates; (2) the duration effect, via the general reduction of the term premium across maturities and assets; and (3) the scarcity effect, via the reduction in term premium of the specific assets being purchased, due to reduction of the available local supply (associated with the preferred habitat literature, see Vayanos and Vila (2009)).

The combination of smaller fiscal deficits (and thus smaller net issuance), low yields, and the ECB limits could exacerbate the scarcity of eligible bonds in some countries. This would amplify the positive impact of the QE program, but it has also raised worries that the ECB may not be able to fully execute the program. Because of the combination of lower net issuance and a higher percentage of bonds trading close to or, at times, below -0.2%, the market where the ECB may encounter more difficulties at the time of achieving its objectives is German bunds.

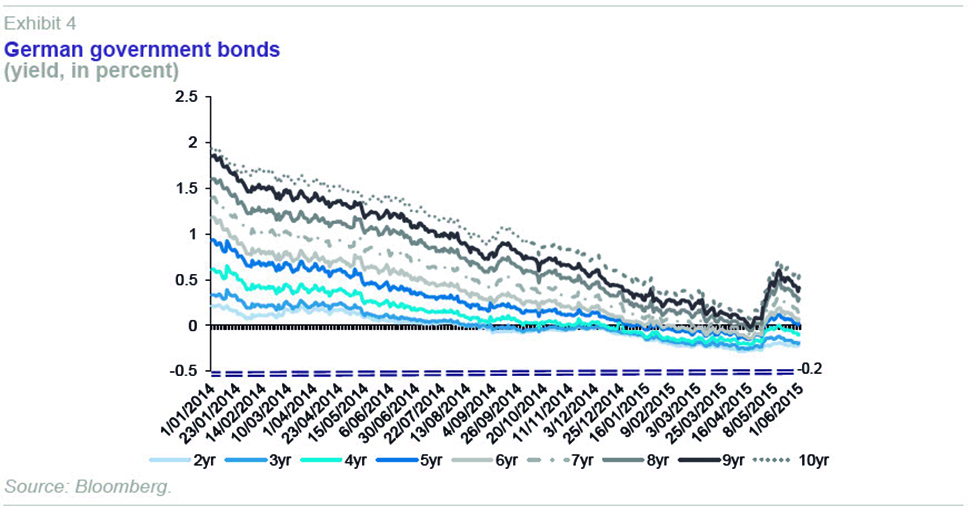

Based on the program size and the capital key, the objective is to buy about 210 billion euros worth of German bonds by September 2016. The market value of eligible securities fluctuates depending on market pricing. Exhibit 4 shows that at the lows in yields in mid-April, bonds up to the 4 year maturity had become ineligible (their yields had fallen below -0.2%). That reduced the pool of available German bonds to about 225 billion, once the ownership limits are taken into account, creating a very small buffer with respect to the target purchases. However, the recent bond sell off has rendered eligible all German bonds across the maturity spectrum, increasing the size of the available pool of bonds to about 260 billion, well above the 210 billion target. In addition, the Bundesbank can use these market fluctuations to opportunistically buy at different points of the curve that could become ineligible again, to alleviate the potential for bond shortages. In fact, in May the Bundesbank took advantage of the increase in yields to dramatically shorten the maturity of its purchases –from an average of 8.1 years in March to an average of 5.8 years in May. Furthermore, the Bundesbank’s securities lending program should also alleviate the potential scarcity problem, as it should reduce the banks’ concern that by selling bunds to the Bundesbank they could run out of collateral needed for repo operations. The securities lending program is currently limited to overnight transactions, but it is expected to be expanded later in the year to weekly and monthly maturities.

The scarcity problem could over time apply to other countries, and become more severe if purchases were to be extended beyond September 2016. In the case of Greece, the ECB already holds more than 33% of its bonds, and thus would be unable to buy Greek bonds (assuming other conditions, such as participation in a program, are met) until August 2015 at the earliest, when some of the holdings of Greek bonds mature. For many of the smaller euro area countries, the 25% issue limit could be reached well before September 2016 and, in the case of Portugal, by December 2016. For the larger euro area countries, the timing of reaching the limit will depend on the level of yields. In the case of Spain, it is unlikely to happen before end 2016. If the -0.2% limit is not binding, the 25% limit would be reached in Germany in late 2017.

To alleviate these scarcity constraints, the ECB could change the rules of the program. For example, the set of eligible issuers could be expanded to include other agencies or even state-level German debt. The ECB has announced that the 25% limit on individual issues will be reviewed after 6 months, and could be increased if needed, for example for issues with very low risk (i.e., rated AA or AAA) or without collective action clauses. And the ECB could decide to change the allocation of purchases from the capital key weighted to the more efficient market weighted, thus transferring some of the allocation of the Bundesbank to other NCBs.

Does capital matter for central banks?

We have shown that the risk sharing arrangements, the ECB’s accounting convention and loss absorption capability, and the structure of the euro area bond market all bode well for a successful quantitative easing program that does not generate any losses (absent an unexpected shock) that could lead to a depletion of the ECB’s capital. But even if that were to be the case, it should not become an impediment for the operations of the ECB. In fact, capital may not be the best concept to assess the strength of a central bank.

Central banks are not commercial banks. Central banks pursue the maximization of national welfare, not profits. Therefore their financial success is a poor, and many times misguided, indication of their overall success. Central banks can always create money to earn seigniorage and pay their bills, and cannot be declared bankrupt by a court. They do not need capital to cover start-up costs or buttress their credibility to borrow in markets (unless they have to borrow in foreign exchange). In abstract, central banks do not need capital to operate.

There is, however, ample empirical evidence, mostly for less developed countries (see Stella (1997), Ize (2005), Schobert (2008), Stella and Lonnberg (2008)) showing a negative correlation between inflation performance and financial strength of central banks. This has led to a view that central banks need a certain level of capital in order to achieve their monetary policy objectives. It is an issue worth exploring, as the explanations of the causation and exact nature of the relationship have often remained vague. In its simplest form, a central bank earns a return on its monetary policy operations, on its assets, and on its issuance of base money (banknotes and reserves) and incurs operational costs. Thus, in principle, a central bank will steadily generate profits for as long as people are willing to hold central bank liabilities at no interest and base money grows at least as fast as operating expenses.

Therefore, under most macroeconomic scenarios and central bank balance sheet structures, a temporary shock creating a loss-making situation (as a result of operating expenses exceeding operating income or net valuation losses) that leads to negative capital would always be reversed in the medium run with the central bank returning to profitability and a positive level of capital. There are two possible theoretical exceptions, though: when the economy falls into a persistent deflationary trap and the growth rate of banknotes falls below the growth rate of operating costs; and when the growth rate of the demand for banknotes falls short of nominal interest rates (see Bindseil, Manzanares and Weller, 2004).

But even a negative long term profitability outlook should not necessarily lead to failure to conduct monetary policy in an effective way. [6] For that to happen, a relationship between central bank capital and other institutional factors, such as credibility or independence, is needed. It can be argued that, regardless of the tightness of the legal arrangements, a central bank can never achieve a bullet-proof, guaranteed institutional independence. Changes in the exchange rate regime, such as dollarization, could hamper the central bank’s solvency. But, more importantly, no government can commit future governments not to change the central bank law or abolish its exclusive right to issue legal tender.

From a conceptual standpoint, a better concept than capital to assess the soundness of a central bank would be net worth, or financial strength (Stella (1997)). Net worth takes into account the central bank’s “franchise value” –its monopoly over the issuance of money and the right to impose reserve requirements on commercial banks– and its off balance sheet obligations, such as the potential need to bail out banks during crisis or defend an exchange rate regime. Net worth will depend on the functions for which the central bank has independent responsibility, and will vary over time. Therefore, the optimal size of a central bank’s capital will vary across countries and depend on its risk exposure (including currency, interest rate, and credit risks), profit sharing and accounting arrangements, institutional strength, and crisis management responsibilities. The bigger the risk exposure and crisis management responsibilities, and the weaker the institutional strength and profit sharing arrangements, the bigger the capital buffers the central bank should build during good times.

Central banks can be run with persistently negative capital, but over time this could create perverse incentives. On the central bank side, a loss making central bank may attempt to restore profitability by easing monetary policy in order to accelerate the demand for banknotes – and this could be incompatible with its price stability objective. This is what Stella and Lonnberg (2008) defined as “policy insolvency.” On the government side, the government may be tempted to put conditions on recapitalization that could jeopardize the credibility and independence of monetary policy, leading to fiscal dominance.

Thus, a condition for a credible central bank is to have positive net worth (its future stream of profits), regardless of whether current profits and capital are positive, and recapitalization arrangements must focus on the rapid rebuilding of equity. Most modern central bank laws require that, in case of negative capital, the government issue to the central bank interest bearing securities at market rates to restore capital levels and provide a level of core earnings that covers operating expenses, thus reducing the scope for further operational losses. A fully automated and fully credible rule of recapitalisation by the government of the central bank in case of losses can be regarded as a substitute for positive capital. Since such rules are however difficult to implement in practice, positive capital levels remain a key tool to ensure that independent central bankers always concentrate on achieving their mandate.

This link between net worth and credibility has become even more critical as central banks have reached the zero lower bound (ZLB) and have had to resort to tools that are highly dependent on the ability to do whatever it takes for as long as it takes, such as QE or foreign exchange intervention. If market participants doubt the resolve of the central bank because of its reluctance to incur losses (as it has happened recently in the case of the Swiss National Bank and its exchange rate floor) then the policy may fail. Therefore, there is an argument that central banks should have higher levels of capital (or stronger arrangements for recapitalization) as the risk of hitting the ZLB increases. This creates a trade-off between a lower inflation target (which increases the odds of hitting the ZLB) and the level of capital. On the other hand, this desirability to have higher levels of capital has to be offset by the heightened democratic requirements needed to conduct quasi fiscal activities. There is a strong argument to keep capital levels of central banks at minimum levels, so that any central bank action that increases risks above normal levels is accountable democratically and not the decision of an independent body. This is the basis for the Bank of England (BoE) strategy, where there was a specific authorization by the Chancellor for each stage of the BoE’s asset purchases program.

Conclusion

The ECB’s asset purchase program has been successful from a macroeconomic standpoint, leading to higher inflation expectations, higher asset prices, and better growth prospects. It has been particularly positive for Spain, leading to a sharp decline in yields across the yields curve, lower bank lending rates, a weaker currency, and protecting Spanish assets from contagion during the recent Greek crisis. This has sparked an acceleration of growth, facilitating the easing of the fiscal stance, and leading to an upward revision in growth forecasts.

The program has been calibrated based on the capital key and it is expected to buy a bit over 100 billion euros of Spanish bonds, equivalent to about 10% of Spanish GDP and similar in magnitude to the net issuance of Spanish bonds over the life of the program. The use of the capital key implies that purchases of German government bonds are too large with respect to its market share in the total stock of government bonds. This has created a worry that there may not be enough bonds available for purchase.

One of the channels of transmission of quantitative easing is the reduction in the term premium via the so-called scarcity effect. Therefore, the creation of scarcity is a positive development that will boost the portfolio rebalancing effect and the program’s impact on the economy. The current design should be successful in its implementation, although the restrictions imposed by the ECB on the eligibility of bonds could become binding for Germany if yields were to decline abruptly from current levels or the program had to be extended further beyond September 2016. In that case, the ECB could easily modify the rules to be able to ease monetary policy as much as needed. The restrictions should not become binding for Spanish bonds at least until end 2016.

Under most scenarios, the asset purchase program should generate positive profits. The restriction not to purchase bonds yielding below -0.2% ensures that there will not be ex-ante valuation losses and, if the bonds purchased are held to maturity, the ECB’s accounting standards imply no mark to market losses.

The ECB’s loss absorption capacity and the risk sharing agreement limit the amount of potential losses that could be shared across countries in the case of default. Even under the very extreme assumption of a debt restructuring in several countries similar in size and extent to that of Greece in 2012, the losses and potential ECB recapitalization needs would be small. Although central banks can operate with negative capital, if losses were to materialize, a prompt recapitalization would be desirable to maintain the credibility of monetary policy and the independence of the European Central Bank.

Notes

This paper is a revised and adapted version of a testimony to the European Parliament’s Economic and Monetary Affairs Committee.

The ECB cannot hold more than 25% of an issuer without holding more than 25% of some issues. Thus, the 33% per issuer limit was driven by the fact that the ECB already holds more than 25% of some issues on its balance sheet as a result of the SMP program.

Some of the smaller euro area countries will hit the 25% limit fairly soon and thus the amount of purchases shown is smaller than what the capital key allocation would suggest. For Greece, the 33% limit will be binding and thus its share is also smaller.

A very sharp increase in short term interest rates could also lead to losses, very unlikely over the life of the program.

See Ubide (2014) for a detailed discussion of the need and likely impact of the ECB’s QE program.

For example, the Central Bank of Chile incurred significant losses during the 1990s from sterilization and bank recapitalization activities and recorded negative net worth as late as 1997.

References

BINDSEIL, U.; MANZANARES, A., and B. WELLER (2004), “The Role of Central Bank Capital Revisited,” ECB Working Paper, 392.

DALTON, J., and C. DZIOBEK (2005), “Central Bank Losses and Experiences in Selected Countries,” IMF Working Paper 07/72.

IZE, A. (2005), “Capitalizing Central Banks: a new worth approach,” IMF Working Paper 5/15.

FINANCIAL TIMES (2014), (http://www.ft.com/intl/cms/s/0/7d9d25f0-4729-11e4-ba74-00144feab7de.html#axzz3ZxCxft5W).

SCHOBERT, F. (2008), Why do Central Banks make losses?, Central Banking, February.

STELLA, P. (1997), “Do Central Banks Need Capital?,” IMF Working Paper 97/83.

STELLA, P., and A. LONNBERG (2008), “Issues in Central Bank Finance and Independence,” IMF Working Paper 8/37.

UBIDE, A. (2014), “The ECB must act aggressively to restore price stability in the euro area,” in POSEN, ADAM and UBIDE (eds.), Rebuilding Europe’s Common Future: Combining Growth and Reform in the Euro Area, PIIE Briefing 14-5.

VAYANOS, D., and J.-L. VILA (2009), “A Preferred-Habitat Model of the Term Structure of Interest Rates,” NBER Working Paper No. 15487.

Ángel Ubide. Senior Fellow, Peterson Institute for International Economics