The Spanish economy in recovery mode: Opportunities and challenges

Recent indicators point to a vigorous economic recovery for Spain, with GDP set to grow by 6.3% this year despite rising infection rates, supply chain bottlenecks and a slower than anticipated return of tourists. The challenge is to maintain the expansionary phase, which involves implementing the reforms foreseen in Next Generation EU and tackling the legacy of unemployment and public debt.

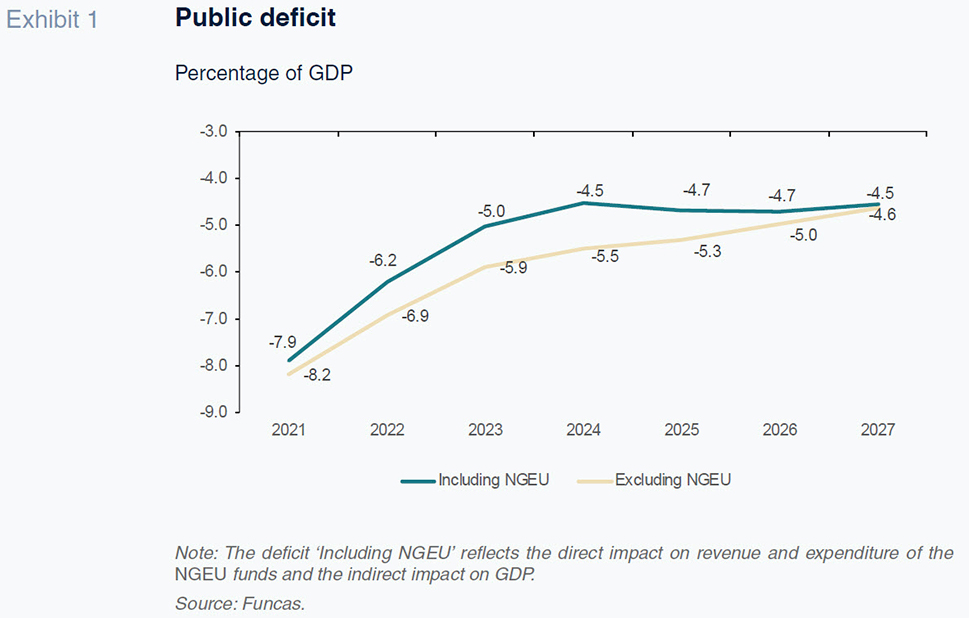

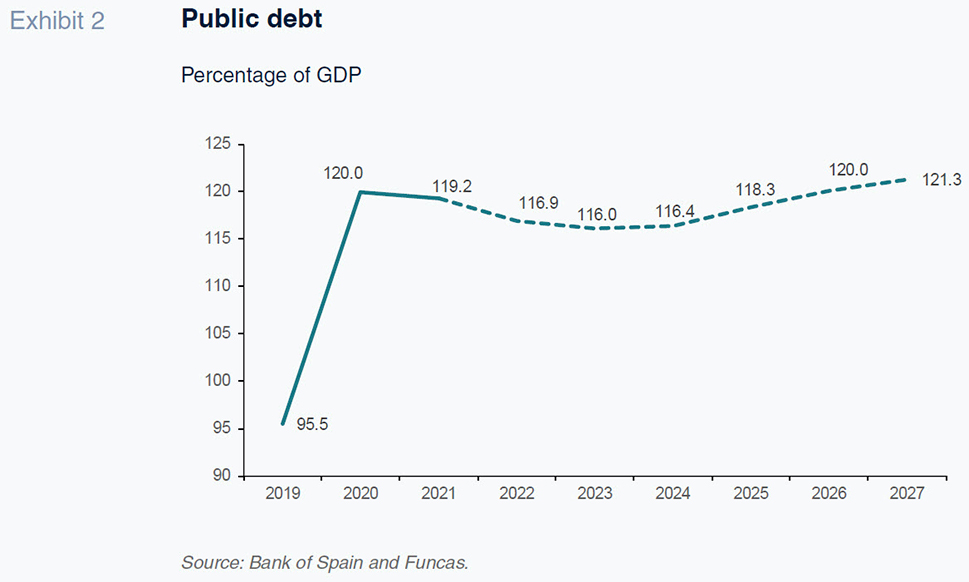

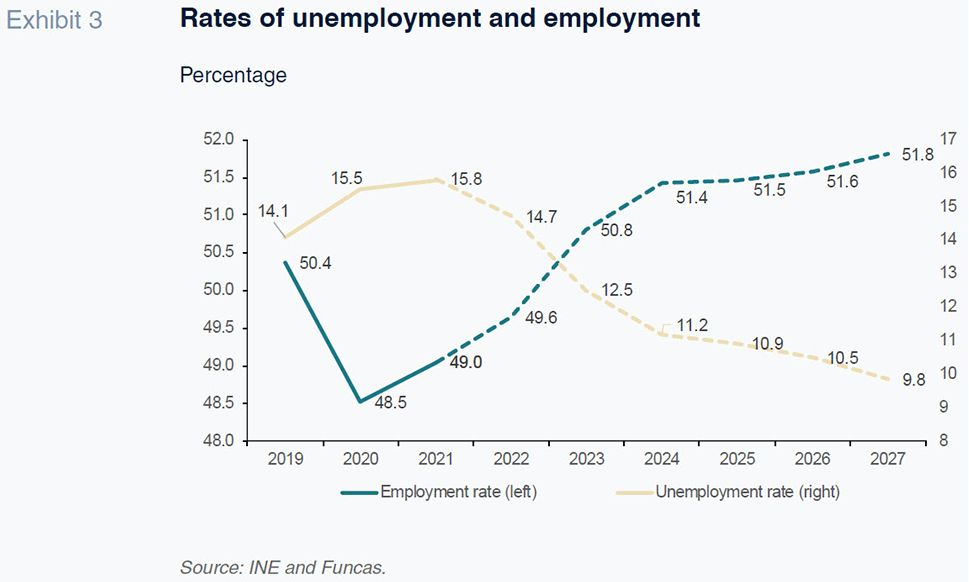

Abstract: Spain’s economy contracted by 0.4% in 1Q21, with all components of demand except investment in capital goods affected. However, second-quarter indicators released to date point to a sharp turnaround. Jobs registered strong growth in May and June, while the manufacturing and services PMI readings rose to near-record levels. Although tourism seemed to be headed towards recovery in May, rising infection rates appear to have weighed on tourist numbers in June. Also, inflation rose from negative rates at the end of last year to 2.7% in June and is expected to rise above 3% by the end of 2021. The forecast for GDP growth in 2021 stands at 6.3% and at 5.8% for 2022. This growth pattern reflects the fact that consumers are spending their precautionary savings faster than anticipated, which should benefit growth this year at the expense of 2022 (the pent-up demand effect). Conversely, the protracted negotiations over the NGEU mean that those funds will have a bigger impact next year (without fully offsetting the pent-up demand effect). Meanwhile, the budget deficit will reach 6.2% in 2022. And, in the absence of measures, debt is expected to increase to nearly 117% of GDP by 2022.

Recent performance of the Spanish economy

After a stagnation in the fourth quarter of 2020, Spanish GDP contracted by 0.4% in 1Q21. This was due to the imposition of new restrictions to curb the third wave of the pandemic, and also the effects of the January snowstorm. The contraction affected all components of demand except for investment in capital goods, which has been recovering steadily since the third quarter of last year.

By sector, only services –both public and private– reported growth in gross value added in the first quarter. However, the various sub-sectors performed very unevenly. For example, according to the services sector turnover index, the retail, hospitality and air travel sectors contracted sharply.

As for jobs, although the number of hours worked declined by 2%, the number of job holders, as per the labour force survey, registered growth of 0.5%, pushing unemployment down to 16%.

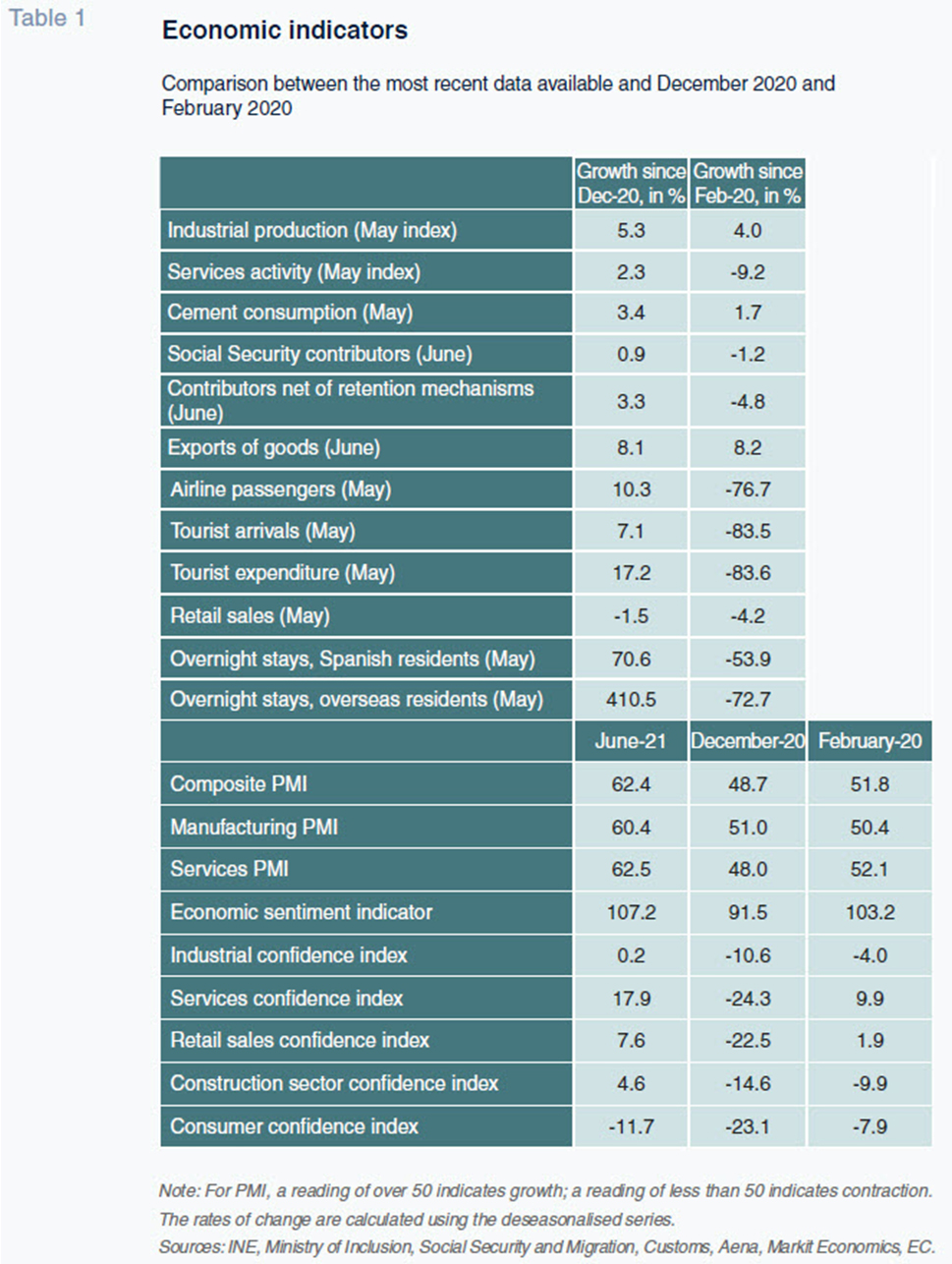

In contrast with the stalled economic recovery in the fourth quarter of 2020 and the first quarter of 2021, second-quarter indicators released to date point to a sharp turnaround, particularly in May and June, fuelled by the easing of restrictions, the end of the state of emergency, and accelerating vaccination levels. Jobs registered strong growth in both months, while the number of people brought back to work from furlough accelerated.

The manufacturing and services PMI readings rose to near-record levels, while the confidence readings, albeit with ups and downs, are back above pre-pandemic levels in all sectors, including construction and retail (Table 1). This suggests that the impact of supply shortages of certain commodities and microchips, has, so far, been moderate.

Other indicators, such as the number of overnight stays, passenger air travel and tourist arrivals, registered strong growth in May (the last month for which those readings are available), coinciding with the relaxation of mobility restrictions in most European countries.

As for consumption, retail sales (similarly based on data to May) growth remains negative. Spending remains below fourth- quarter 2020 figures. That may be because the growth in spending was largely channelled into services as restrictions on activities and movement were eased. The sharp rebound in hotel stays by Spanish residents, which in May topped 4Q20 levels, corroborates that thesis. In addition, domestic credit card spending during the first week of July was up 7% year- on-year, underpinned by very significant growth in restaurant and tourism spending, while spending on foreign cards increased 70%,

[1] confirming that both domestic and foreign tourism consumption started to recover strongly towards the end of the quarter.

Nevertheless, as from the end of June, the tourism sector may have already begun to feel the effects of the surge in transmission due to the spread of the Delta variant. In mid-June, flight bookings to Spain were 5.2% above levels for the same week of 2019 (they had trended around 70% below in the early months of the year). However, by the end of the month, bookings were down 23.4% compared to the same period of 2019.

[2]

As for exports, since the sharp contraction registered in January, the trend has been very positive. In April, the last month for which export figures are available, volumes in constant prices were back above pre-crisis levels.

The balance of payments remained in surplus, a remarkable development considering the collapse in tourism receipts. The first-quarter external accounts presented a deficit of 2 billion euros but the first quarter tends to be seasonally adverse.

One of the most noteworthy traits of Spain’s recent economic performance is the rise in inflation, from negative rates at the end of last year to 2.7% in June. For now, the rise in the headline rate has not affected core inflation, which remains subdued, and is attributable mainly to the reversal of the oil price correction sustained during the early months of the pandemic, as well as more expensive electricity. From August, we will see new base effects, this time in services, so that inflation is expected to exceed 3%. That may be exacerbated by the sharp increases in commodity prices in recent months, as is already apparent in the pronounced increase in the industrial price index.

The first-quarter budget deficit was nearly 5 billion euros higher year-on-year. Note, however, that January and February of 2020 were not yet affected by the pandemic. The April figures already revealed a noteworthy change in trend, thanks mainly to the favourable year-on-year comparison, as much of the economy had come to a halt in April 2020. The resumption of the economic recovery at the start of the second quarter of this year is another factor at work. Tax revenues registered year-on-year growth of 46.8%, while expenditure eased by 9.7%, so that the accumulated deficit for the first four months of the year was smaller than in the same period of 2020.

Forecasts for 2021 and 2022

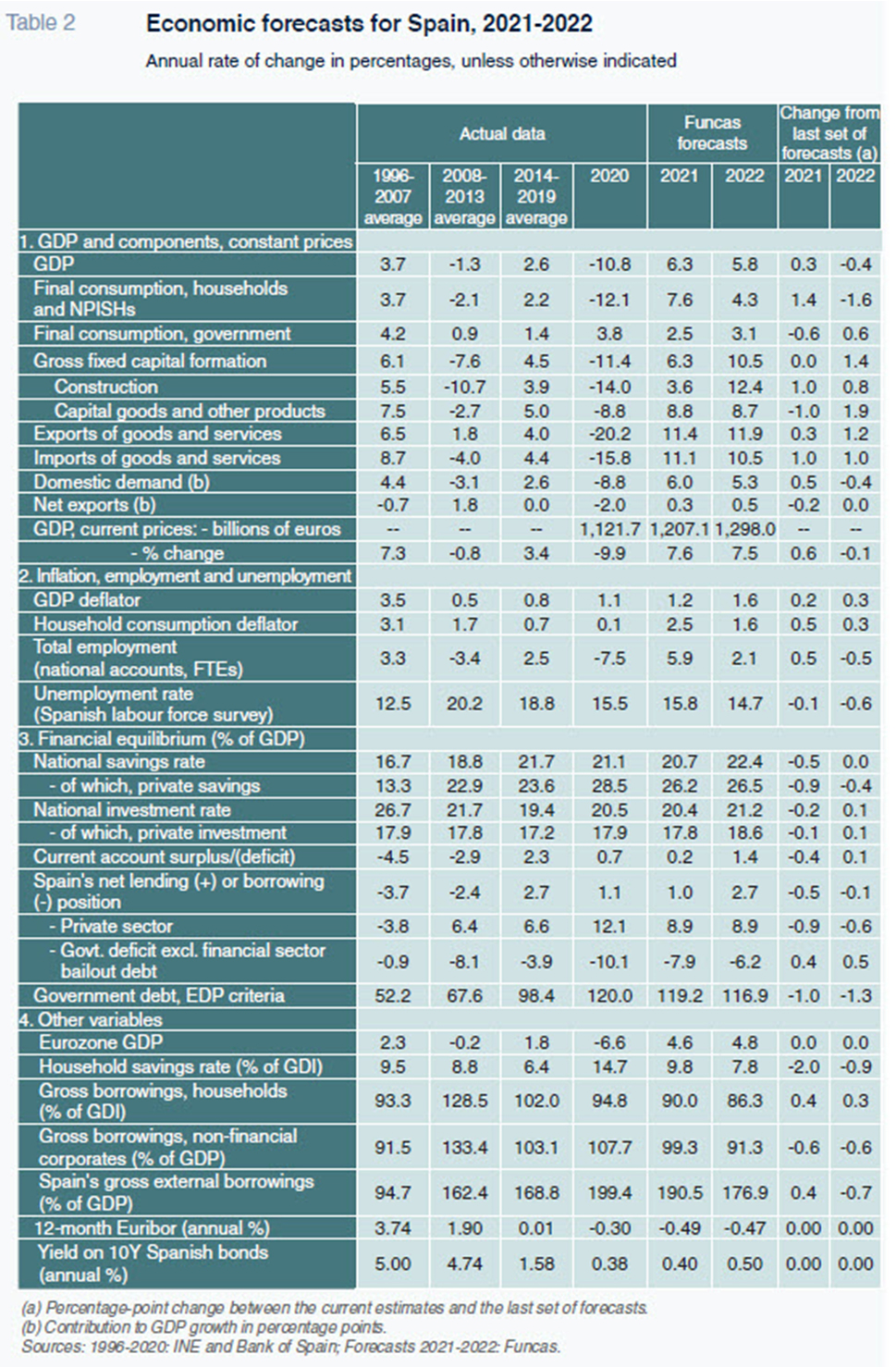

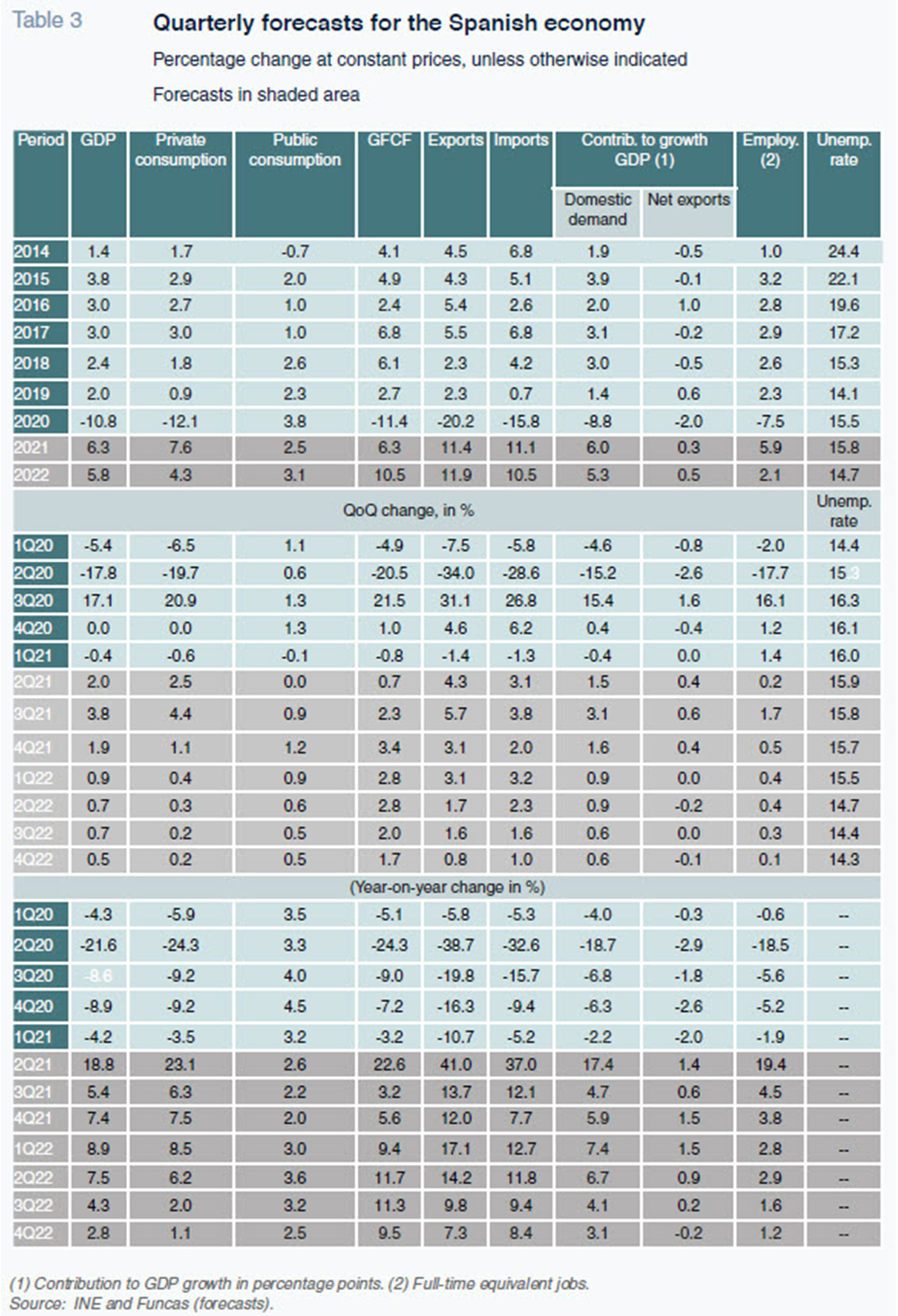

The economic recovery initiated after the weak start to the year gained traction during the second quarter. This occurred alongside a reduction in uncertainty thanks to higher vaccination rates, the release of pent-up demand accumulated during the crisis, and the recovery in the global economy. As a result, the forecast for GDP growth this year stands at 6.3%, up 0.3 percentage points from the May forecasts. The forecast for 2022 is for growth of 5.8%, down 0.4 percentage points from May, due to the loss of momentum in some of the main drivers of the rebound (Tables 2 and 3).

The revised forecasts –upward in 2021 and downward in 2022– reflect the trend in domestic demand, which is expected to contribute 6 percentage points to GDP growth in 2021, up 0.5 percentage points from May, and 5.3 percentage points in 2022, down 1.4 percentage points. The main factor is the ‘pent-up demand’ eff It appears that the precautionary savings accumulated during the pandemic are being wound down faster than expected, a phenomenon also being observed in countries further along the recovery path, such as the US. As a result, the boost from private consumption and construction (the aggregates that benefit the most from the pent-up demand effect) have been revised significantly higher for 2021 and then lower for 2022 in the case of the former (due to the premature depletion of that phenomenon).

On the other hand, some of the growth in public spending and investment that had been anticipated in 2021 has been pushed back to next year, reflecting the protracted negotiations and approval for the

Next Generation EU (NGEU). The current forecasts assume the execution of 10 billion euros of

NGEU funds in 2021 (down 4 billion euros from the May forecasts) and of 26 billion euros in 2022 (unchanged).

[3] Those revisions do not, however, offset the pent-up demand effect.

International trade is expected to perform well both years, in line with our previous sets of forecasts. The momentum in goods exports should continue in 2021, in line with the trend-improvement in Spanish firms’ market share gains abroad, going on to slow in 2022, when the global recovery is expected to ease. Tourism service exports, meanwhile, should recover in tandem with the gradual resumption of mobility. However, there is significant uncertainty regarding the impact of the virus mutations on travel. Flows are extraordinarily volatile, as many travel and hotel bookings include cancellation clauses related with pandemic developments. For now, we have revised our forecasts for the recovery in tourism downwards as a result of the rapid spread of the Delta variant. Tourism is currently forecast to detract 0.3 percentage points from GDP growth in 2021. Overall, net exports are projected to contribute 0.3 points to growth in 2021 (down from an estimated 1.5 points in May) and 0.5 points in 2022 (unchanged).

The intensity of the global recovery is expected to continue to create bottlenecks in certain strategic supplies, including semiconductors, metals and energy products. All of which will weigh on the recovery, particularly in the more exposed sectors such as the automotive industry, while putting upward pressure on production costs and inflation. The personal consumption expenditure deflator is expected to rise to 2.5% in 2021, up half a percentage point from our last forecasts. The theoretical easing of the bottlenecks should facilitate a reduction in inflation in 2022, to an estimated 1.6% (nevertheless up 0.3 percentage points from our last set of forecasts). Assuming that the increase in the cost of supplies proves transitory, internal prices (the GDP deflator) and salaries would remain under control and therefore act as a buffer against the chronification of inflation.

Despite the deterioration in the terms of trade, Spain will continue to present a current account surplus, which should widen as international tourism recovers. Moreover, Spain is expected to receive sizeable sums under the NGEU programme, fuelling a growing net lending position. That outcome reflects the sharp rise in national savings, to record levels in terms of GDP.

The recovery will trickle down to the job market. We are forecasting job creation of close to 500,000 in total over the two years (on a seasonal-adjusted basis). That fi includes the employees on furlough that are brought back to work, which we estimate at around 40% of the 450,000 people still on the scheme as of the end of June.

[4] The remaining 60% are expected to become unemployed or economically inactive. As a result, employment would be back at pre-crisis level by the end of 2022 but with a higher number of job-seekers and unemployment rate.

The recovery will also benefit the deficit, thanks to growth in revenue as economic activity rebounds and a reduction in pandemic- related expenditure needs. Meanwhile, the ECB’s debt purchases, coupled with low policy rates, will continue to alleviate the state’s financial burden, although we are forecasting a gradual increase in Treasury bond yields. Nevertheless, the deficit will reach 6.2% in 2022, underpinned by a significant structural deficit, with no information at the time of writing on whether measures to tackle the issue in the medium- and longer-term will be introduced. Public debt will also remain high, at close to 117% of GDP.

Risks

Short-term, the big unknown remains the evolution of the pandemic, particularly the reaction to the rapid spread of new variants among the young, unvaccinated segments of the population. The next few weeks will be telling in this respect. Firstly, there is the forecast volume of tourism receipts. Our projections assume the infl of close to 8.5 billion euros of tourism revenues this summer, which is 40% of the level recorded in the same period of 2019. However, the introduction of new travel restrictions in issuer markets could stymie those expectations, weakening an overly indebted business fabric without room for manoeuvre. All of which is exacerbated by the surprising delay in the deployment of the direct transfers for businesses decreed in March, in contrast with the agility with which other European countries have rolled out similar support schemes. Secondly, a spike in case numbers could affect confidence and undermine consumption and investment.

The rise in production costs is another risk in the short-term. Should costs remain infl for longer than we are forecasting, households and businesses could face a significant erosion of their purchasing power, which would weigh on demand. Moreover, if infl expectations become unanchored, the ECB could feel obliged to tighten monetary conditions, which would translate into higher financial costs for the more indebted governments and sectors. Fortunately, the ECB’s recent move to make its infl targets more fl has pushed back that prospect for now.

[5]

Longer-term, the Spanish economy faces the risk of hysteresis effects in terms of chronic public deficits and unemployment, which have been exacerbated by the pandemic. In a no-policy-change scenario, which assumes continued ultra-low interest rates and full execution of the 70 billion euros of transfers expected under the NGEU programme (an assumption that implies significant improvements in project management and allocation mechanisms), the public deficit would still be around 4.5% of GDP at the end of the European budget period, i.e., 2027 (Exhibit 1). And public debt would stagnate at 120% of GDP, i.e., almost 25 points above pre- pandemic levels (Exhibit 2). Spain is therefore vulnerable to potential monetary policy tightening or the reactivation of the European fiscal rules, which would require drastic cuts over a relatively limited period of time.

As for jobs, although the unemployment rate should come down, the gap relative to Spain’s main EU partners could widen (Exhibit 3). Germany and other central and northern European countries are expected to approach full employment, while others, like Portugal, have embarked on reforms to tackle labour market duality and enhance skills. The reforms contemplated in Spain’s recovery plan are therefore urgent. That is the only way to improve job prospects for those most affected by the crisis, including youth and other groups that have historically faced difficulties in finding decent work.

Notes

Monitor de consumo | CaixaBank Research.

Global Covid-19 Insight Dashboard for Travel Marketers / Sojern.

The execution forecast –of 10 billion euros in 2021– refl the spending programmes committed to this year against the European funds. That fi is less than the total European transfers expected this year –9 billion euros in July and another 10 billion euros in December – which are classifi as non-financial income for public account purposes. Therefore, the lag between the receipt and spending of the NGEU funds could translate into a reduction in the public deficit in 2021 and an increase in subsequent years.

For the purposes of these forecasts, we have assumed that those currently on furlough in the restaurant, hospitality and leisure sectors (approximately 40% of the total) will be re-employed once mobility is fully back to normal. However, we assume that employees in sectors that have fully recovered and remain on furlough (the remaining 60%) will not go back to their jobs, as they may be employed in unviable businesses.

Raymond Torres and María Jesús Fernández. Funcas