COVID-19 and its asymmetric impact in Spain by province: Recent trends and projections

The COVID-19 crisis in Spain has been marked by a triple asymmetrical impact in terms of timing, sector and region. While those sectors and regions hardest hit by the crisis should post strong growth, the recovery will likely be characterised by disparity across sectors and regions in Spain.

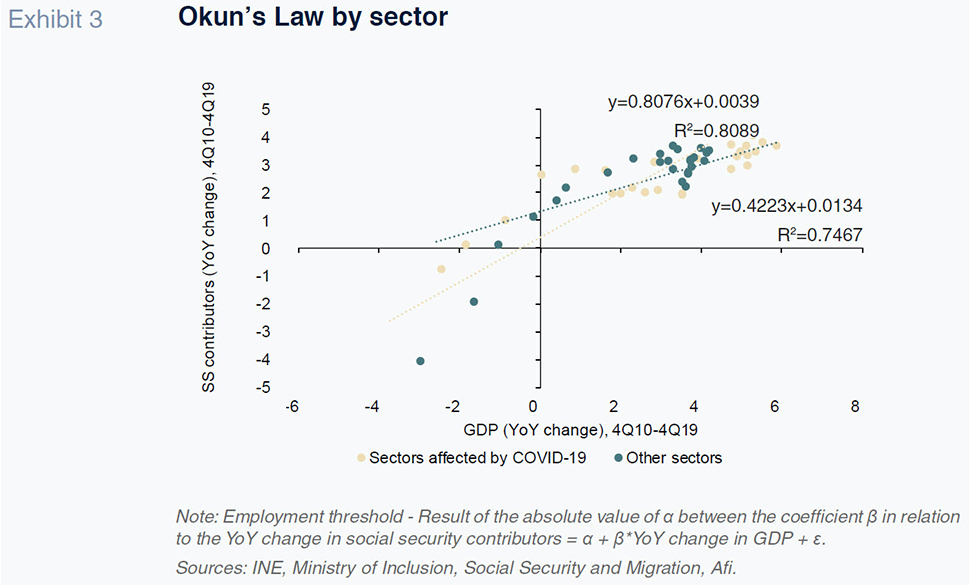

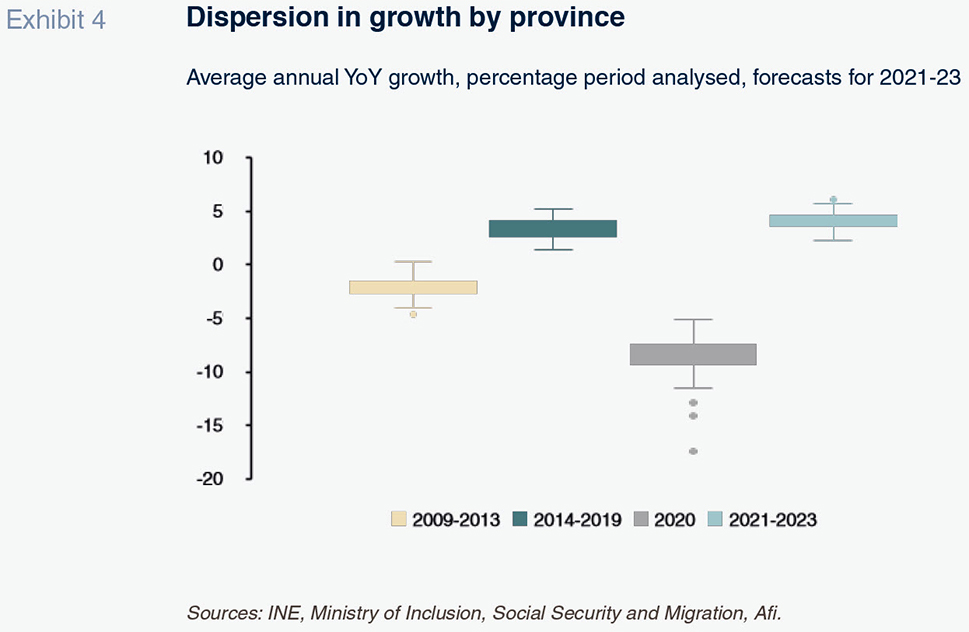

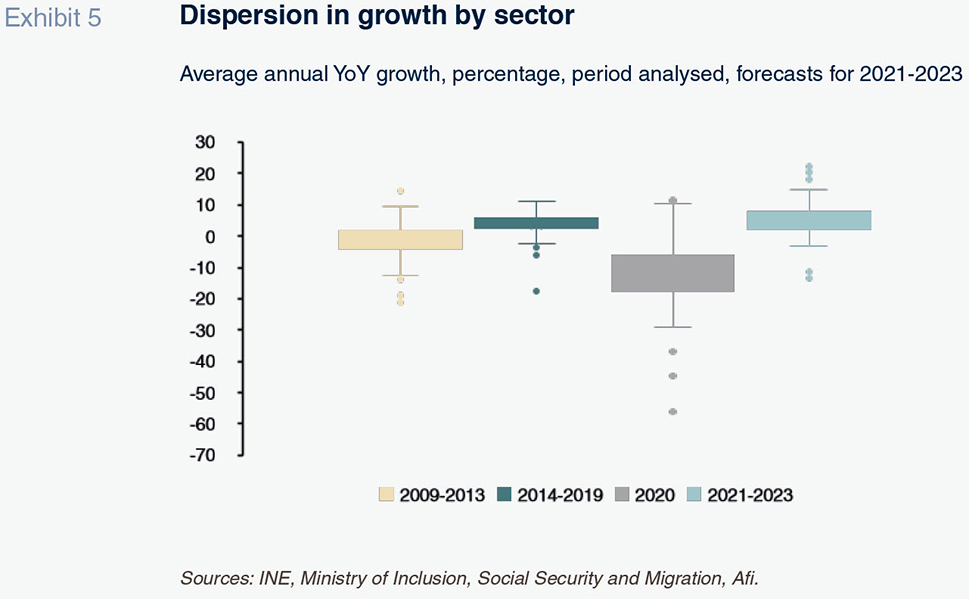

Abstract: The economic crisis in Spain has been characterised by a triple asymmetric impact in terms of timing, sector and region. That asymmetry explains the differing impacts on the economic front and will also shape the varying speeds of recovery over the coming months. Regarding timing, the crisis began in 2Q20, resulting in a quarterly contraction of 17.8%, with a 17.1% recovery in the following quarter. Customer-facing sectors most affected by the restrictions saw GVA contract at a quarterly rate of 41.4% in 2Q20. Due to their reliance on tourism, the Balearic and Canary Islands, along with certain provinces along the Mediterranean coast, were the regions hit hardest. Our nowcasting model [1] points to quarterly growth of over 3% in 2Q21. Importantly, those sectors most exposed to the restrictions are very labour intensive. As a result, they require less growth than other sectors to increase employment. Specifically, those sectors need activity to grow by 0.24% year-on-year to create jobs, while all other sectors require growth of at least 0.33% year-on-year to increase employment. [2] Nevertheless, the economic and job recovery will continue to be characterised by disparity across sectors and regions.

Introduction

The COVID-19 pandemic has been like a tidal wave for the economy, with knock-on effects on a scale not seen in the post-war period. The extent to which productive activity ground to a halt was unprecedented, with the crisis engulfing practically the whole world.

The disruption to economic activity resulted in persistent supply side shocks that are very likely to give way to a demand shock. Services and durable goods consumption are the economic areas most sensitive to economic shocks and the hardest to reconstitute in an uncertain environment.

The economic crisis in Spain has been characterised by a triple asymmetric impact: timing, sectoral and regional. That asymmetry explains the differing impacts on the economic front and will also shape the varying speeds of recovery over the coming months. This paper attempts to quantify that socio-economic impact by focusing on the recent trend and outlook at the individual provincial level in Spain.

Triple asymmetry

The asymmetry of the economic crisis caused by COVID-19 has so far manifested in three key ways:

-

Timing. The onset of the COVID-19 pandemic during the second half of March 2020 drove a particularly severe economic contraction in 2Q20. Since then, the economy has been trying to catch up on the volume of activity lost in just a few weeks. According to Spain’s National Statistics Office, the INE, GDP contracted by a quarterly rate of 17.8% in 2Q20, going on to rebound 17.1% the following quarter.

-

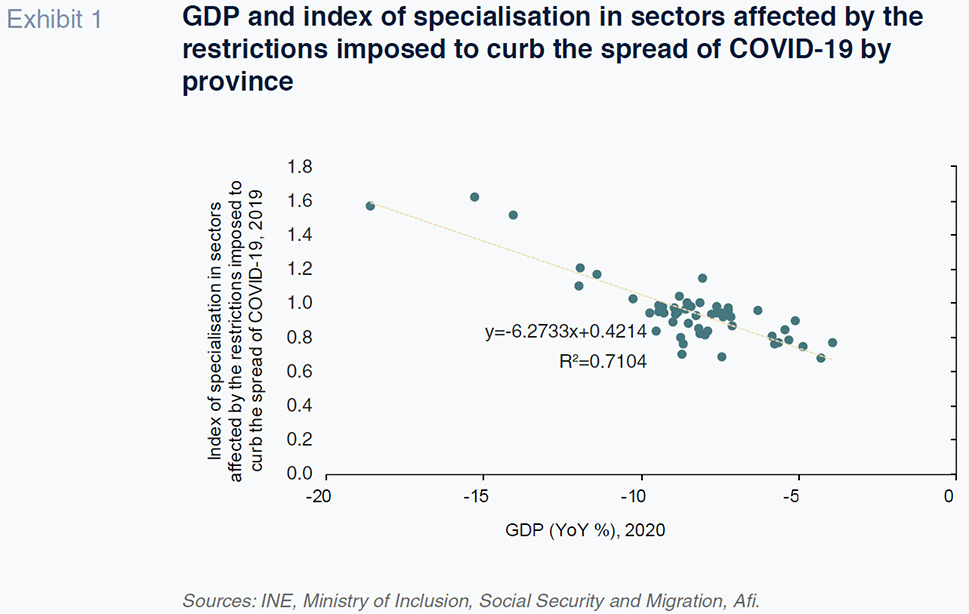

Sectoral. The sectors most sensitive to the business restrictions are those requiring social contact, which has translated into particularly severe contractions in revenue and employment (albeit contained by the furlough scheme) compared to other sectors of the economy. These sectors include retail, hospitality, transport (particularly air travel) and leisure and cultural activities. Those sectors were deemed ‘non-essential’ when Spain initiated the state of emergency on March 14th, 2020. Our estimates suggest that on aggregate those sectors’ GVA contracted at a quarterly rate of 41.4% in 2Q20, going on to rebound by 50.9% in 3Q20 (leaving it 12% below pre-pandemic levels). The other sectors experienced a much smaller rebound (12% QoQ in 3Q20), having contracted by relatively less the previous quarter.

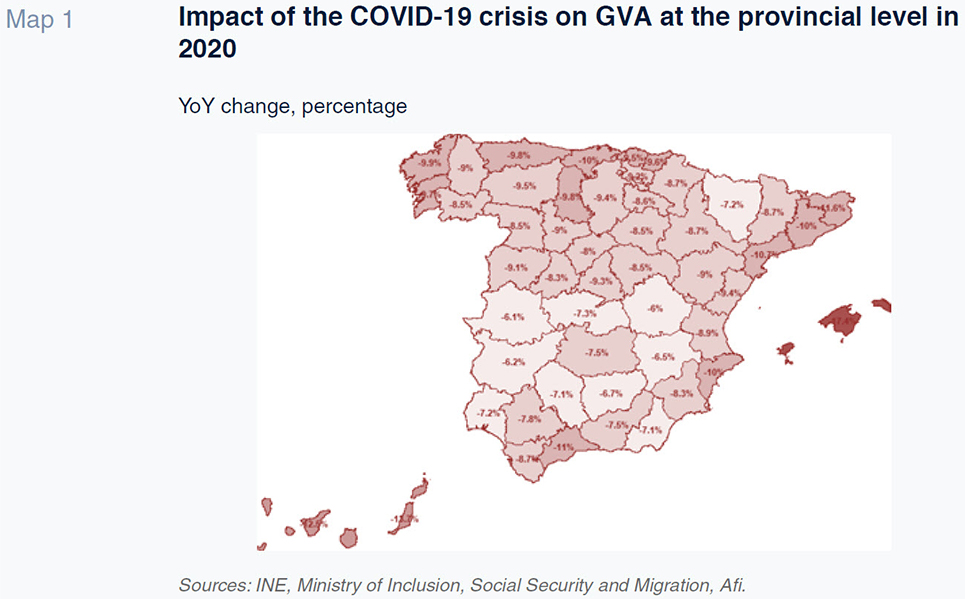

- Regional. Because of their exposure to the hardest-hit sectors and the seasonality of some of the above sectors, the provincial economies most affected have been the Balearic and Canary Islands, along with certain provinces along the Mediterranean coast (Map 1). The Balearic Islands was particularly affected (its economy contracted by 17.4% on average in 2020), evidencing its reliance on the tourism sector and related activities. According to Exceltur (2014), the tourism sector is responsible for 44.8% of the regional economy between direct, indirect and induced effects, which is significantly above the national average (12.4% in 2019) and even other regions heavily exposed to the sector (the equivalent percentage in the Canary Islands was 35% in 2018).

The intensity and uniformity of the economic recovery across Spain’s regions will determine the territorial cohesion resulting from this crisis and the economic policies best suited to addressing a potential increase in inequalities.

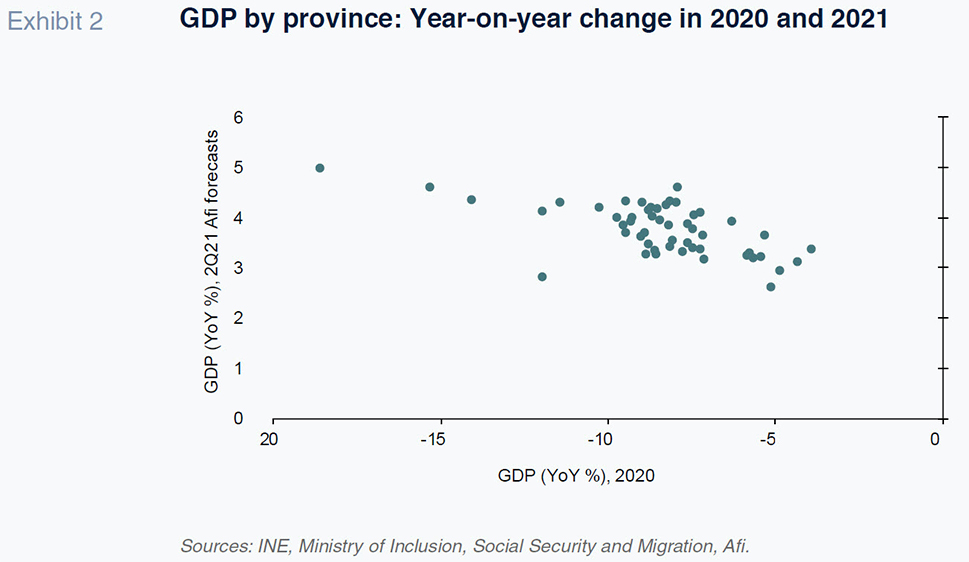

The trend in social security contributors in 2Q21, coupled with other leading indicators (new car registrations, manufacturing and service PMIs, exports and imports of goods, etc.), suggests that the Spanish economy is set to rebound sharply, offsetting the weak start to the year (1Q21 GDP: -0.4%). More specifically, our model points to quarterly growth of over 3% in 2Q21. Judging by the differences at the sector level and in infection rates in each region, that growth is likely to be heterogeneous at the provincial level.

According to our sector-provincial model, the provincial economies set to perform the best in 2Q21 will be those that saw their GDP and employment suffer the most (discounting employees affected by furloughs) in 1Q21 and all of 2020 (Exhibit 2). The Balearic and Canary Islands are expected to report significant economic growth in 2Q21, underpinned by the bright outlook for their tourism sectors during the summer season. Although tourism will remain well below pre-pandemic levels, the sector will make a positive contribution to growth in those regions.

One development that could have accelerated the recovery in the Balearic Islands was the recent decision by the UK to include the islands on its green list for travel (the UK accounts for over 20% of overseas visitors to Spain). However, due to rising infection rates, the British government has moved the Balearic Islands to the amber list. The Canary Islands too will have to wait until further reviews.

The provincial economies’ productive specialisation has had economic consequences. Many establishments have remained closed as they continue to wait for the recovery to consolidate and for more tourists to arrive, particularly from abroad, before reopening.

As economic activity begins to take off, employment should grow. The first milestone is likely to be the re-engagement of those currently on furlough, before going on the create jobs with greater intensity, assuming the recovery pans out. Notably, the sectors most affected by the restrictions continue to account for over half of the total on furlough but were also the sectors to bring the greatest number people out of furlough in May.

Those sectors most exposed to the restrictions are very labour intensive. As a result, they require less growth than other sectors to increase employment. This means the pace of the recovery in jobs lost or furloughed could be faster than initially anticipated. Analysing the year-on-year growth in GDP and social security contributors in 2010-2019 yields an estimate of the rate of GDP growth required to generate jobs,

i.e., the employment threshold. This is what is known as Okun’s Law (Exhibit 3). The sectors that are more sensitive to the COVID-19 restrictions need activity to grow by 0.24% year-on-year to create jobs, while all other sectors require growth of at least 0.33% year- on-year to increase employment. Note that this exercise was conducted using social security contributor numbers, where the year-on-year movements are more pronounced than in full- time equivalents (FTEs), which is the metric that should be used in theory to calculate the employment threshold. If the FTEs metric were used, the employment threshold would be higher at an estimated 0.8%. However, that data is not broken down at the sector level to two digits (NACE codes).

Nevertheless, the growth forecast for the coming years will continue to be marked by disparity at both the sector and regional levels, potentially exacerbating existing inequalities. However, that heterogeneity is not likely to be equivalent to that observed in the wake of the financial crisis (Exhibits 4 and 5). Moreover, the NGEU funds should help mitigate the adverse effects of differing rates of economic recovery, as one of the drivers of the recovery plan is, precisely, regional cohesion and responsiveness to demographic challenges.

Conclusions

The initial fallout from the crisis was marked by an asymmetric impact in terms of timing, sectors and regions affected. The two island chains –Balearic and Canary Islands– will top the growth rankings in 2Q21, after having sustained the biggest contractions in GDP and jobs (discounting the effect of the furlough scheme) in 2020 and even in 1Q21. The sectors most sensitive to the restrictions (retail, tourism, transport and leisure) can create jobs faster than other sections, heralding a potentially faster recovery in employment than initially expected. Nevertheless, the economic and job recovery will continue to be characterised by disparity across sectors and regions.

Notes

A.F.I. has developed an econometric model to analyse the impact of the COVID-19 crisis and the outlook for recovery at the sector and regional levels in Spain. That model, dubbed MSA II, predicts how the Spanish economy will perform in terms of GVA (a measure similar to GDP) and jobs. The model draws on the national accounts published by the INE (for sector GVA at the national and provincial levels) and data published by the Ministry of Inclusion, Social Security and Migration (for the social security contributor and furlough numbers by sector and province). The forecasts encompass 88 sectors, at the two-digit NACE code level, and all 52 Spanish provinces. It is therefore capable of generating forecasts for over 4,500 pairings. Not only does it estimate recent performance, but it can make forecasts over a specific time horizon.

If the full-time equivalents (FTEs) metric were used, the employment threshold would be higher at an estimated 0.8%.

References

EXCELTUR (2015).

Impactur 2014 – Islas Baleares: Estudio del impacto económico del Turismo sobre la economía y el empleo [Impactur 2018 - Balearic Islands: Study of the impact of tourism on the economy and employment] Exceltur. Retrievable online at:

https://www.exceltur.

org/impactur-2/#EXCELTUR (2019).

Impactur 2018 – Islas Canarias: Estudio del impacto económico del Turismo sobre la economía y el empleo [Impactur 2018

– Canary Islands: Study of the impact of tourism on the economy and employment] Exceltur. Retrievable online at:

https://www. exceltur.org/impactur-2/#

María Romero, Juan Sosa and Javier Serrano. A.F.I. - Analistas Financieros Internacionales, S.A.