Spanish economic forecasts panel: January 2020*

Funcas Economic Trends and Statistics Department

Spanish GDP grew by 1.9% in 2019

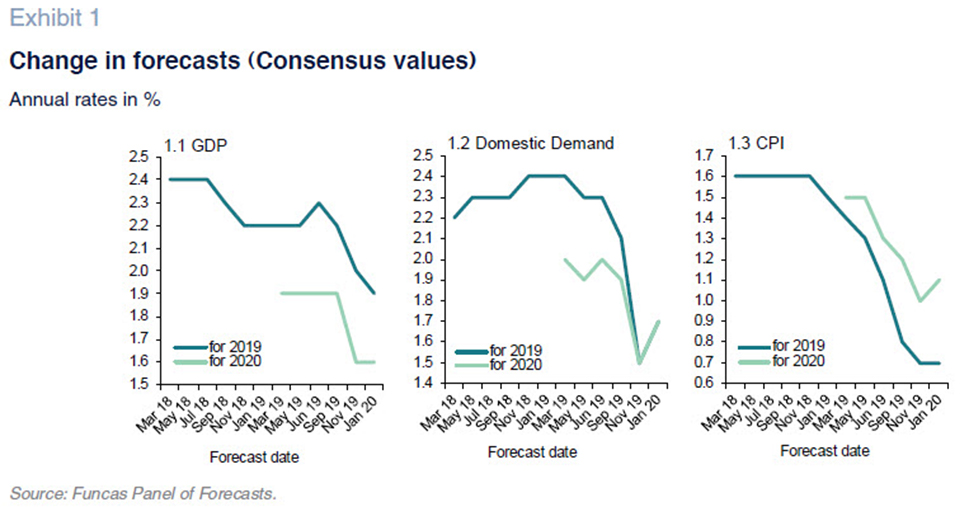

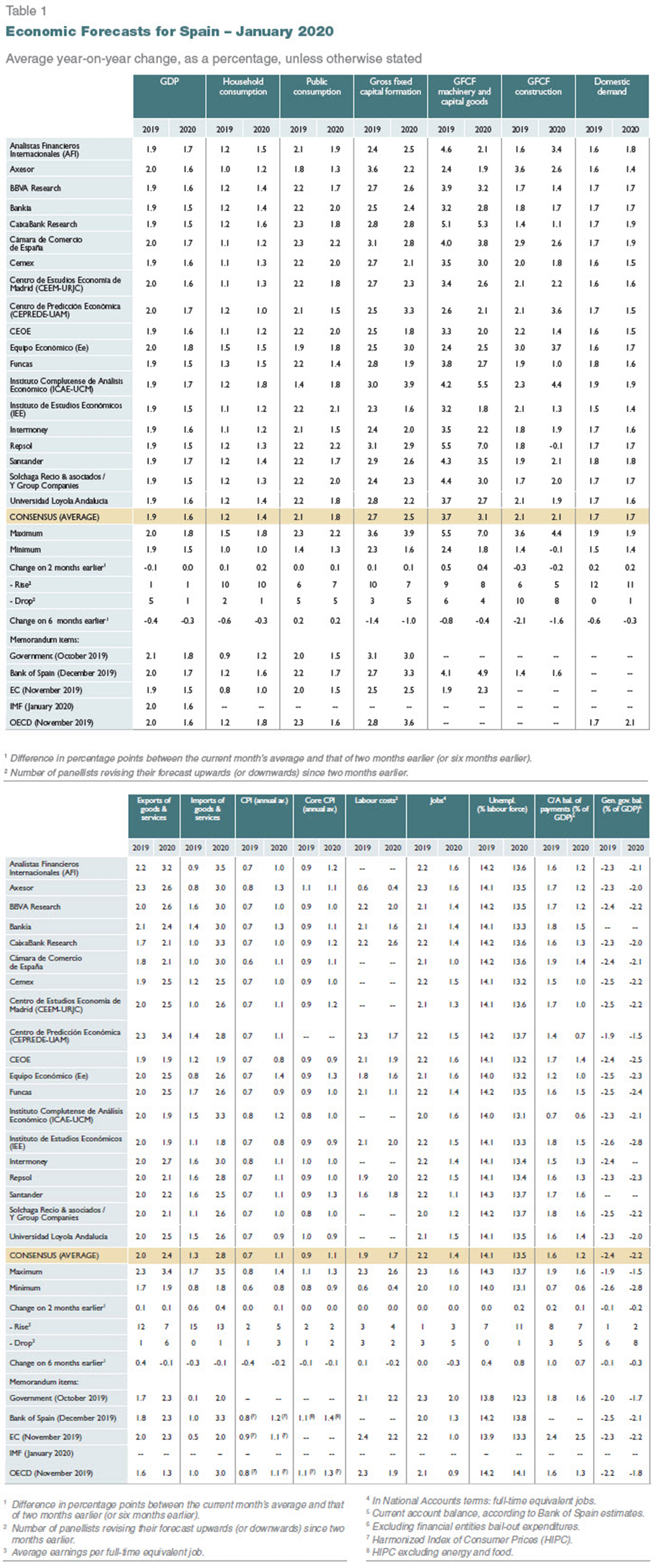

The consensus is that Spanish GDP grew by 1.9% in 2019, down 0.1pp from the last survey, even though the forecast for fourth-quarter growth is unchanged at 0.4%. The reason for the trimmed forecast is the National Statistics Office’s downward revision of the growth figures for the first three quarters. Domestic demand is expected to contribute 1.7 percentage points (up 0.2pp from the last forecast) and foreign demand the remaining 0.2 percentage points (down 0.3pp). The upward revision of estimated import growth –to 1.3%– stands out. The estimate for growth in investment has been raised by 0.1pp, due to a significant increase in the estimate for investment in capital goods, partially offset by the reduction in estimated investment in construction.

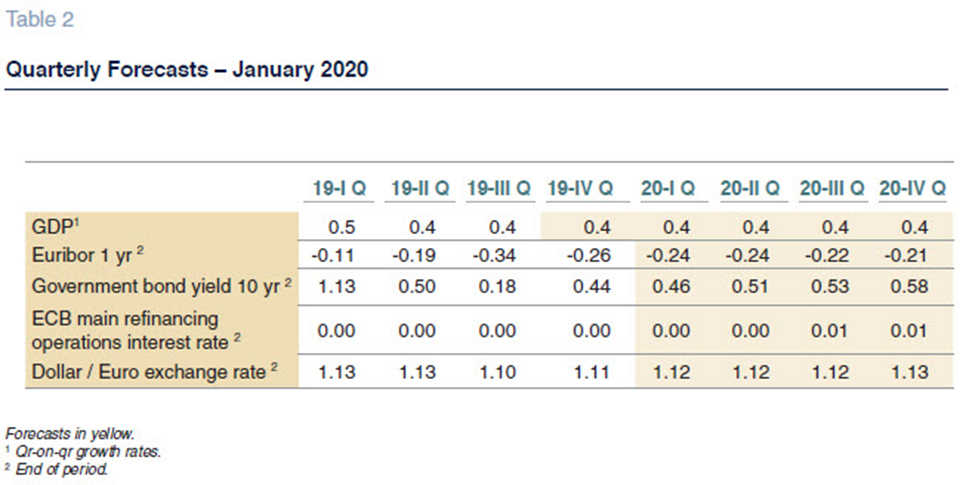

Growth forecast for 2020: Unchanged at 1.6%

The consensus forecast for GDP growth in 2020 is unchanged at 1.6%, with barely any analysts having changed their forecasts. Flat quarterly growth of around 0.4% is still expected (Table 2). However, the composition of that growth has shifted a little since the last survey, with domestic demand lifted up by 0.2pp to 1.7%, while the contribution by trade has been cut by 0.2pp to -0.1%.

Slightly higher estimate for 2020 inflation

As foreshadowed in November, the December 2019 year-on-year rate of inflation stood at 0.8%, putting the annual average at 0.7%, compared to 1.7% in 2018. The drop in inflation is attributable primarily to the reduction in energy prices and, to a lesser degree, slower growth in the cost of non-processed food.

The forecast is for average annual inflation of 1.1% in 2020, which is up 0.1pp from November and would mark growth of 0.4pp with respect to the 2019 rate. The forecasts imply a year-on-year inflation rate in December 2020 of 1.2% (Table 3). The forecast for core inflation is unchanged at 1.1%, which is 0.2pp above the 2019 rate.

Slowing job creation

According to the Social Security contributor numbers, job creation was a little stronger in the fourth quarter of 2019 than in the third quarter, albeit continuing to slow. For the year as a whole, contributor numbers climbed 2.6%, which is equivalent to 489,000 new contributors.

In terms of full-time equivalent jobs, the analysts put employment growth at 2.2% in 2019 and are forecasting a slowdown to 1.4% in 2020. Both figures are unchanged from the November consensus forecasts.

The forecasts for growth in GDP, job creation and wage compensation yield implied forecasts for growth in productivity and unit labour costs (ULC). The former eased by 0.3% in 2019 and is expected to increase by 0.2% in 2020, while ULCs increased by 2.2% in 2019 and are expected to increase a further 1.5% in 2020.

The average annual unemployment rate is expected to continue to decline to 14.1% in 2019 and 13.5% in 2020 (up 0.2pp from the November survey).

External surplus expected to persist in 2020

The current account surplus stood at 18.4 billion euros to October, compared to 19.3 billion euros in the same period of 2018. That slight reduction is attributable to a wider income deficit, as the trade balance was broadly flat year-on-year.

The consensus forecast is for a surplus equivalent to 1.6% of GDP in 2019 and of 1.2% in 2020, both of which have been revised upwards –by 0.2pp and 0.1pp, respectively– since November.

The government is expected to miss its fiscal deficit targets in both 2019 and 2020

In the first 10 months of the year, the deficit at all levels of government except for the local corporations stood at 17.5 billion euros, compared to 13 billion euros over the same period in 2018, due to slower growth in revenue (3.8%) relative to spending (4.9%). The weaker performance is attributable to the regional governments, which have moved from surplus into deficit territory, more than offsetting the deficit reduction at the state level. The Social Security deficit was more or less similar year-on-year.

Nearly all of the analysts expect the 2019 deficit to come in above the government’s target as set in October. The consensus forecast for 2020 is similarly above the government’s target (by 0.5pp). Some of the analysts caution, moreover, that they have yet to factor in the coalition government’s recently announced spending and revenue measures.

The outlook for the international environment has become slightly less negative

The global economy is trending in line with expectations as of November. The main economic activity indicators, such as the PMI readings, suggest that the manufacturing sector continues to contract due to the sharp slowdown in global trade and adaptation difficulties in certain sectors, such as the car industry. The services sector, meanwhile, continues to expand, driven by growth in consumption and the resilience of the labour market.

In its January outlook, the IMF cut its forecast for global growth in 2019 by 0.2pp to 2.9%, and for 2020 by 0.1pp to 3.3%. The IMF believes that the economy will rebound slightly, within the context of global economic weakness, thanks to the expected rebound in trade as a result of the easing of tensions between the US and China (phase one of the trade deal). The monetary stimuli delivered by the main central banks are also expected to contribute to putting a floor on the slowdown.

Most of the analysts view the external environment as unfavourable, in both the EU and globally. They have become slightly less pessimistic about the outlook for the months to come, however. None of them expects the international environment outside of the EU to deteriorate in the near future (whereas three of them did in November). And just one thinks that the outlook will get worse in the EU (versus three in November).

Monetary policy set to remain expansionary

Monetary policy has been characterised by continuity ever since the Draghi era. The prospects for ECB benchmark rates and asset purchase volumes under the programme (APP) are the same as in November. The ECB continues to expect economic weakness in Europe, making it unlikely that inflation will close in on the target rate of close to 2% in 2020. However, during her last presentation, Christine Lagarde flagged certain signs of improvement. Elsewhere, banks are showing more signs of interest in the new targeted long-term refinancing operations programme (TLTRO–III) as the last series’ operations mature.

12-month EURIBOR remains firmly anchored in negative territory, up slightly since November. The yield on 10-year Spanish bonds also remains low and will continue to do so judging by the success of recent Treasury placements.

The analysts remain unanimous about the expansionary nature of monetary policy. The yield on the 10-year bond is barely expected to move in the next few months and is forecast at 0.58% at the end of 2020, marginally down from the last forecast of 0.60%. 12-month EURIBOR is expected to remain in negative territory for the entire forecast horizon, at similar readings to those forecast in November. The majority of analysts believe that the prevailing accommodative monetary policy is what the Spanish economy needs right now (similar stance to that expressed in the last survey).

Euro stability against the dollar

Since November, the euro has been trading sideways against the dollar, oscillating at around 1.11, despite the fact that the US economy has been outperforming the EU. The analysts are forecasting an exchange rate of EUR/USD1.13 at the end of the projection period, up USD0.01 from the last report.

Fiscal policy should be neutral or contractionary

There is no major change in the analysts’ assessment of fiscal policy. A solid majority believes that it is expansionary. Moreover, their opinion with respect to what line fiscal policy should take has remained consistent. All except one believe it should be neutral or contractionary.

The Spanish Economic Forecasts Panel is a survey run by Funcas which consults the 19 research departments listed in Table 1. The survey, which dates back to 1999, is published bi-monthly in the months of January, March, May, July, September and November. The responses to the survey are used to produce a “consensus” forecast, which is calculated as the arithmetic mean of the 19 individual contributions. The forecasts of the Spanish Government, the Bank of Spain, and the main international organisations are also included for comparison, but do not form part of the consensus forecast.