Shift in retail money from funds to deposits

The past year has seen a reversal of capital flows from previously dominant mutual funds to demand deposits, despite the continued decline in interest rates. This dynamic indicates a growing sense of caution and sensitivity among households, which could contribute to greater volatility in households’ financial asset allocation decisions and financial markets in general.

Abstract: The growth in the volume of retail customer funds managed by Spain’s financial institutions has accelerated in the last year from the scant 1% observed in prior years to nearly 4%. This development has occurred in tandem with a two-percentage point increase in the savings rate. Of particular note is the shift from mutual funds to demand deposits. While the former attracted increased capital after 2012 thanks to the strong performance of equity markets and ultra-lax monetary policy, this trend has lost steam over the past year in both Spain and other main EU markets. Specifically, assets under management contracted by around 4 billion euros in Spain with bank deposits growing by 37 billion euros. Such a reversal is curious given the continued decline in demand deposit interest rates, indicating growing caution among households due to global uncertainty as well as increasing sensitivity to swings in the value of holdings. Importantly, these changes in risk appetite could lead to greater volatility in households’ financial asset allocation decisions, with potential implications for financial stability.

Introduction

The volume of retail customer funds has grown close to 4%, from a scant 1% in previous years. This is consistent with a similarly significant recovery in the household savings rate, which topped 7% of gross disposable income in mid-2019, up from less than 5% a year earlier. Importantly, the rise in the savings rate is reason for caution amidst growing economic uncertainty.

More significant, however, than the overall trend in customer funds is the noteable shift in the composition between their two major components –bank deposits and mutual funds– from the latter to the former. This shift has interrupted the non-stop upward trend observed in mutual funds since the peak of the crisis in the summer of 2012. Factors that triggered the trend include: (i) the ECB’s decisive message (the now-famous “whatever it takes”); (ii) a political commitment to completing Banking Union; and, (iii) the rapid execution of Spain’s financial assistance programme in summer 2012, which marked the start of an extraordinary period of growth in mutual funds, which would receive the bulk of household savings throughout the ensuing years.

2012-2018: The growth of mutual funds

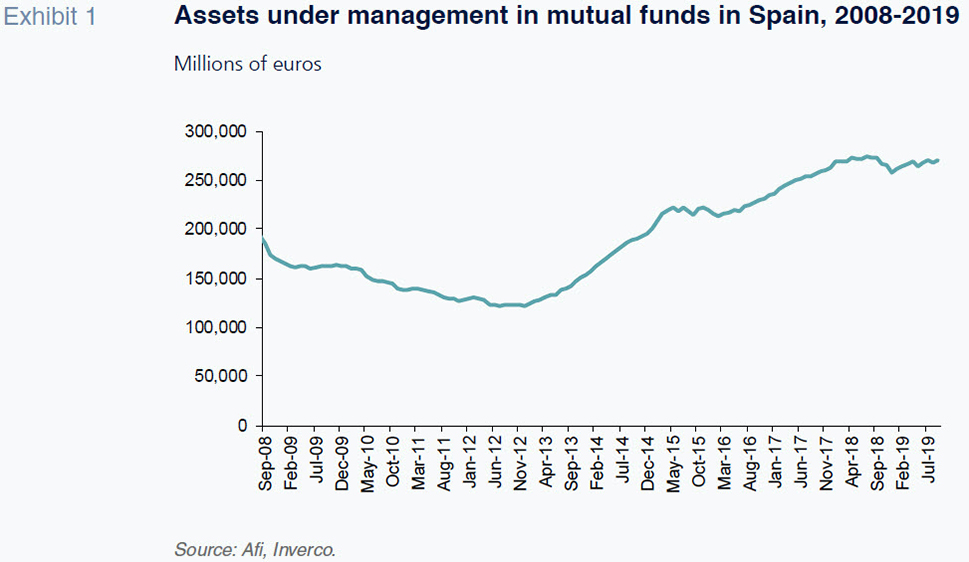

Exhibit 1 illustrates the trend in assets under management in Spanish mutual funds over the past decade. Those assets contracted during the early years of the crisis, as the securities markets corrected sharply. Assets under management reached a bottom at 122 billion euros in the summer of 2012, recovering thereafter to reach 273 billion euros by the summer of 2018.

The growth in assets under management over the course of the six-year period (150 billion euros) was shaped by two dynamics. The first related to valuation growth (~25 billion euros), which was driven by well-performing markets. The second, and most important driver, is the significant contributions by unitholders. Those mutual funds subscriptions, which reached around 125 billion euros over the course of six years, accounted for a very important chunk of household savings. Moreover, they outpaced the growth in deposits over the period, which amounted to a much lower 80 billion euros.

Shift to deposits

As already analysed in an earlier paper by Berges, Rojas and Troiano (2018), The structure of customer deposits in the Spanish banking system, the growth in mutual fund assets at the expense of deposits was strongly driven by the rollout of an ultra-lax monetary policy. This in turn led to a sharp reduction in the interest rates relevant to the banking business. This trend was supported by the absence of liquidity problems, which was influenced by the drop in credit activity, derived from a demand problem by the private sector that did not go to the banking channel for financing, as well as the virtually unlimited capacity of resorting to the European Central Bank (ECB) to obtain liquidity.

However, that systematic growth in mutual fund assets lost steam over the past year (Exhibit 1). Indeed, assets under management have contracted by around 4 billion euros in the last year. That contraction has coincided with noteworthy growth in bank deposits, which have increased by 37 billion euros, albeit heavily skewed towards demand deposits (+69 billion euros), at the expense of term deposits (-23 billion).

While the switch from deposits to funds between 2012 and 2018 was mainly attributable to the drop in the deposit interest rates, the reversed dynamic does not explain the subsequent recalibration, as rates have continued to trend lower. There has even been talk of penalising certain deposits with negative rates (deposits placed by corporates and high net worth individuals) in order to offset the negative rate (-0.5%) applied to the liquidity placed with the ECB’s deposit facility.

Understanding the drivers of the trend

It is therefore necessary to identify the factors behind retail investors’ paradoxical retreat from mutual funds just as their savings are registering strong growth. Why are they earmarking all of their financial investments to a single product, namely demand deposits, which are not offering remuneration and are clouded by the spectre of negative rates?

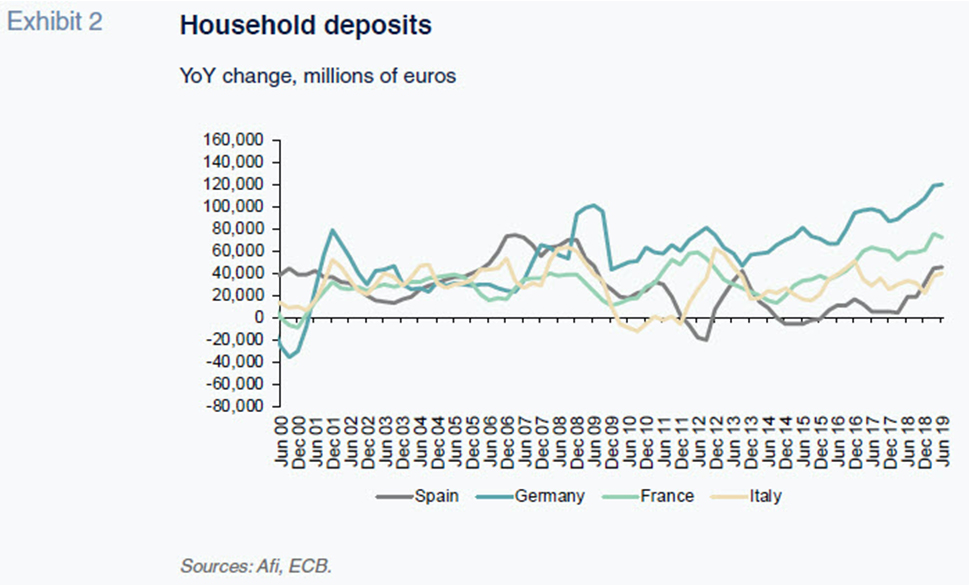

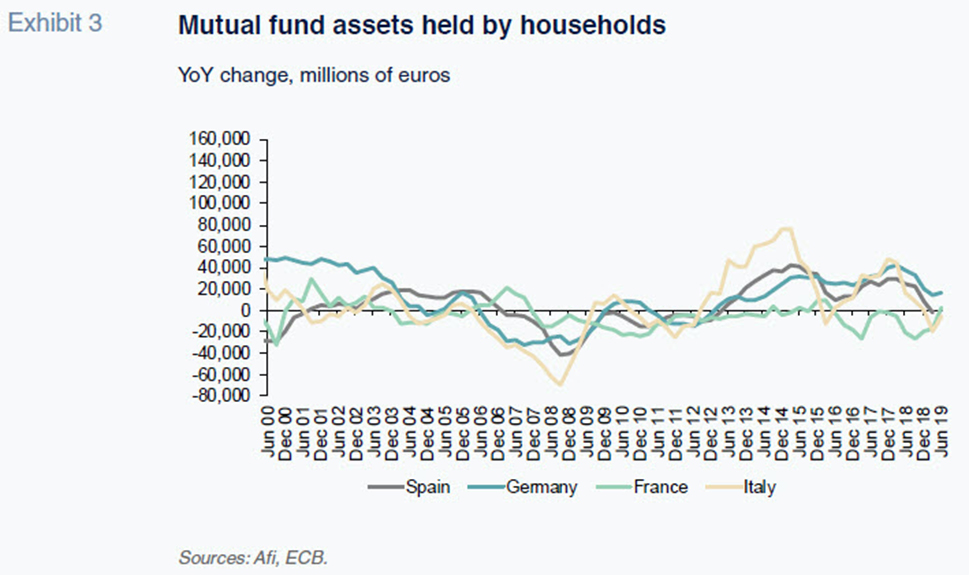

Before considering the factors driving this paradoxical trend, it is worth highlighting that the growth in deposits at the expense of mutual funds when deposits interest rates are low is not exclusive to Spain. This dynamic has been observed across the main European economies (Germany, France and Italy), as illustrated in Exhibits 2 and 3, which depict the year-on-year changes in deposit and mutual fund holdings in each of those countries. In every case, the trend is similar to that observed in Spain: significant growth in household bank deposits, with growth in mutual fund assets clearly slowing and even contracting in Spain and France.

Focusing on the situation in Spain, we have broken down the contraction in mutual fund assets into its two key components: the net change in subscriptions and revaluation by unitholders as well as the portfolio valuation effect. This analysis reveals that since the peak of September 2018, assets under management have decreased by 5 billion euros. Specifically, 4 billion euros of the contraction is attributable to the valuation effect and 1 billion to a net outflow of holdings.

The change in the attitude of Spanish and European households away from mutual funds at a time when there is no opportunity cost to eschewing deposits can only be attributed to a higher degree of caution. That renewed investor caution –or risk aversion– is also displayed in the trend of movements between the various classes of funds. Significantly, the overall net outflow of 1 billion euros during the past year masks two starkly different trends between pure fixed-income funds (net subscriptions of close to 8 billion euros) and those with higher exposure to equities (pure equity, mixed, global and absolute return funds), in which redemptions have outstripped subscriptions by a little over 8 billion euros.

The heightened risk aversion is likely attributable to both a global economic environment rife with uncertainty and a ‘self-fulfilling prophecy’ whereby a number of fund holders exhibit sensitivity to the swings in the value of their holdings. Indeed, the net outflow of capital from mutual funds with greater exposure to equities intensified in the final months of 2018 and the early months of 2019, following a period of adverse performance by the equity markets with very negative implications for portfolio valuations.

The negative feedback loop and implications

The correlation between fund performance and the subsequent trend in subscriptions and redemptions indicates a negative feedback loop. This is a situation that supervisors strive to avoid in the securities market by requiring managers to include in their prospectuses the classic disclaimer that “prior returns are no guarantee of future performance”.

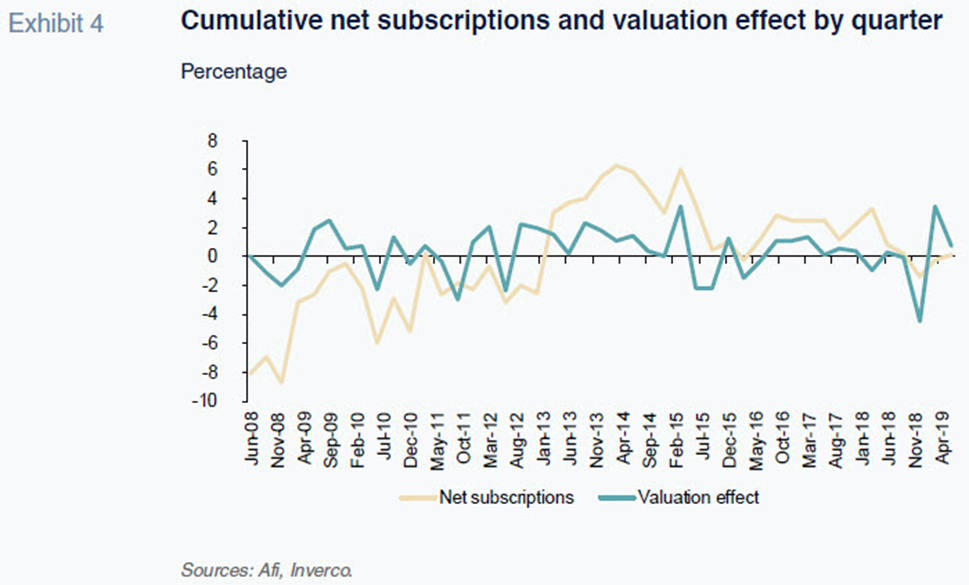

In order to analyse whether such a feedback loop is affecting mutual funds in Spain today, we have broken the change in assets under management down into its two components: (i) the valuation effect; and (ii) net subscriptions/redemptions. We then measured the two components by quarter, expressing the changes as a percentage of net asset value (NAV) at the start of each quarter.

Exhibit 4 reveals how closely correlated the two components are, verifying the existence of the above-mentioned feedback loop, or ‘herd behaviour’ as it is known in financial circles.

The trend in net subscriptions (subscriptions less redemptions) is also very closely correlated to the trend in portfolio valuations with a one-quarter time lag. This suggests investors adjust their investment behaviour to the performance observed in their funds with a bit of a lag, likely between the market trend in question and the fund statements received by investors. If that is indeed the driving force, we can posit that fund subscriptions will recover towards the end of 2019 and in the early part of 2020, as the markets’ strong performance in 2019 trickles down to portfolio valuations and statements.

Conclusion

Regardless of these developments, it is worth emphasising that while the weight of mutual funds in household savings in Spain still trails that of neighbouring economies, it reflects an assumption of risk in this segment of the economy. This in turn could lead to greater volatility in households’ financial asset allocation decisions. That heightened volatility, and its potential implications for financial stability, explain the growing interest of organisations such as the International Monetary Fund (2019) and the International Organisation of Securities Commissions (2018) who are concerned about the ability of the funds, and institutional investment community as a whole, to absorb the liquidity shocks associated with sudden shifts in investor preferences, which are closely correlated with sharp increases in market volatilities.

Paradoxically, these potential liquidity shocks can be more intense in fixed-income funds than in equities funds for two reasons. Firstly, households are less prone to absorb losses on their fixed-income holdings than on their equity investments. Secondly, liquidity in the fixed-income markets has decreased considerably following the massive bond purchases by the central banks (essentially the ECB), eroding those markets’ ability to absorb sudden sale orders by funds in the event of potential interest rate hikes.

References

BERGES, A., ROJAS, F. and TROIANO, F. (2018). The shifting structure of customer deposits in the Spanish banking system. SEFO, November, 2018.

IMF. (2019). Institutional Investors: Falling rates, rising risks, Chapter 3. In Global Financial Stability. November, 2019.

IOSCO. (2018). Recommendations for Liquidity Risk Management for Collective Investment Schemes. Final Report.

Ángel Berges, Federica Troiano and Fernando Rojas. A.F.I. - Analistas Financieros Internacionales, S.A.