Bank profitability ten years

after the crisis: The digital opportunity

The latest quantitative indicators for the European banking sector largely show improvement in the ten years following the financial crisis. Despite recovery, key profitability challenges remain for most of Europe’s, including Spain’s, banks, with the digital channel offering opportunities to increase financial results, but not without risks.

Abstract: In the ten years from the advent of the financial crisis, various quantitative indicators suggest that although the European banking sector is today considerably more solvent, it has not managed to fully dispel concerns about the quality of its assets. Moreover, the sector faces important challenges in terms of profitability, with margins still significantly below pre-crisis levels. The five major Spanish banks posted a combined net profit of 13.44 billion euros in 2017, up 53.5% from 2016 and nearing the levels reported in 2008 – at the start of the crisis. Compared to the main European markets, Spanish banks rank in the mid to upper quadrant in terms of profitability and efficiency, albeit still faring below average on capital adequacy. The restructuring forced by the crisis is ongoing, particularly as regards digitalisation, as banks strive to bring about more radical transformation in the ways customers are serviced in the years to come. In this context, a more qualitative analysis of the situation reveals digitalisation as the best opportunity for lifting profitability, framed by the choice of a range of competitive alternatives. Spanish banks are relatively well positioned compared to their European counterparts for tackling the digital challenge, although we do not rule out that relevant changes in the competitive landscape and service channels may still materialise.

Business environment at the start of 2018

The banking sector is experiencing a period of transformation all over the world, one that is uniquely characterised by intense technological transition – probably the most intense of the last four decades. In parallel, the gradual normalisation of monetary conditions could, however, result in destabilisation to the extent this process leads to greater volatility in the markets. This paper analyses these challenges in the case of European banks – paying particular attention to the Spanish banking system – in 2018, a year that is shaping up to mark a ‘crossroads’. It has been ten years since the moment that best pinpoints the start of the crisis: October 2008. The time is right for considering how the European banking industry has changed in the past decade.

The crisis in the eurozone was marked by diff circumstances to that of the United States, diff which aff the banking sector in particular. The sovereign debt crisis of 2012 and 2013 marked a first significant difference with respect to the crisis experienced on the other side of the Atlantic. Many of the eurozone economies suffered a second wave of recession, protracting the crisis and triggering fresh episodes of financial instability. Although conditions started to improve considerably from 2014 – particularly with the articulation for more ambitious quantitative easing strategies – European banks have continued to see their market values swing considerably in recent years. SEFO has been noting that the unfinished business on the recapitalisation front –coupled with the uneven pace of progress being made by the various member states in this respect – has eroded investor confidence. Elsewhere, regulatory pressure, coupled with negative real rates, has had an adverse impact on profitability and equity market valuations.

The outlook is still for higher rates but it is unlikely that we will see the beginning of rate hikes in 2018. As a result, pressure on margins lingers. Europe’s banks have begun to react by cutting costs – also at an uneven pace, as we will show later on – and M&A activity has been intense. Elsewhere, the sole supervisor policy attempts to address concerns regarding the sector’s financial health. This response is, at best, one of wavering intensity. In 2018, the key benchmark on the transparency front will be the new European Banking Authority (EBA) stress tests, the results of which are due to be published this November. On January 31st, 2017, the EBA published the basic guidance defining how these tests will be performed. The adverse scenario to be modelled contemplates a deviation with respect to currently-estimated baseline EU GDP of an accumulated 8.3% between 2018 and 2020, a scenario the EBA itself describes as “the most severe scenario to date”. Another new development in the tests is the fact that the information will be submitted in keeping with IFRS for the first time. And, in response to widespread demand stemming from prior experiences, for the first time, it incorporates IFRS 9 accounting standards. No pass-fail threshold has been included as the results of the exercise are designed to serve as an input to the Supervisory Review and Evaluation Process (SREP). The Spanish banking sector heads into this transparency exercise from a position of relative strength thanks to the recapitalisation efforts already undertaken.

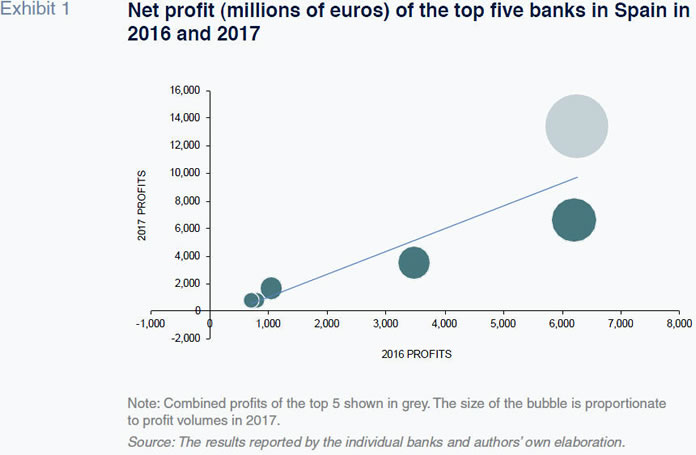

Elsewhere, on the profitability front, Spanish banks have been reporting their 2017 results in recent weeks. As shown in Exhibit 1, the year-on-year improvement in net profits was sustained across the board. The five largest Spanish banks (Santander, BBVA, CaixaBank, Bankia and Sabadell) posted aggregate net profits of €13.44 billion in 2017, marking growth of 53.5% from 2016. The results do not include the cost for the Bankia group of acquiring BMN in order to make the year-on- year comparison more meaningful.

The banks’ 2017 profits are beginning to get close to the 17.46 billion euros earned by the top 5 banks in Spain in 2008, the year in which the crisis was sparked internationally, although it would not be felt in Spain until somewhat later. What has changed at the European banks in the last 10 years? What sets the Spanish sector apart?

Ten years after the crisis: What has changed?

The data provided by the European Central Bank’s Statistical Warehouse allow us to track a series of key banking business and profitability indicators over time, in this case from 2008 until 2017. Our analysis looks at three classes of indicators: i) profitability and efficiency indicators; ii) income structure indicators; and, iii) leverage and capital adequacy indicators. We take the Spanish banks as our reference and compare their situation with those of the other four major European banking systems, namely those of Germany, France, Italy and the Netherlands.

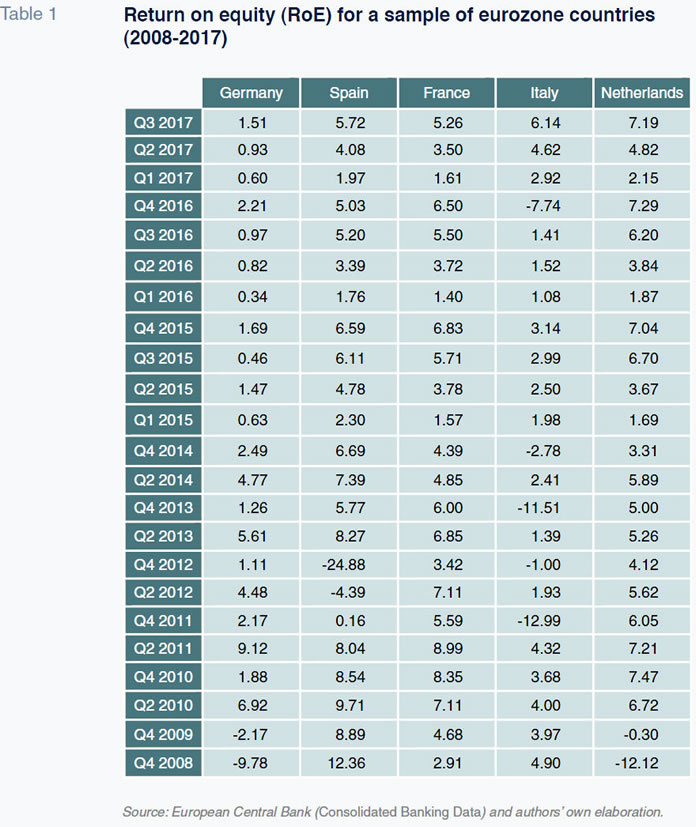

Table 1 provides the banks’ return on equity (RoE) figures. In all instances, the trend is one of widespread reduction. Pre-crisis RoEs were typically in the double digits and made the banking sector a benchmark in terms of market value growth. However, there is widespread consensus that those levels can no longer be the norm, due to prevailing regulatory pressure, interest rate levels and a competitive landscape marked by new players, new technology and falling prices. The Spanish banks rank somewhere in the middle on this count, presenting an average RoE of 5.72% in the third quarter of 2017 (latest data available), behind the Netherlands (7.19%) and Italy (6.14%) but above France (5.26%) and Germany (1.51%). The table also depicts how the impact of the crisis was not homogeneous timing-wise and highlights that the years of the sovereign debt crisis were particularly adverse for banks’ earnings.

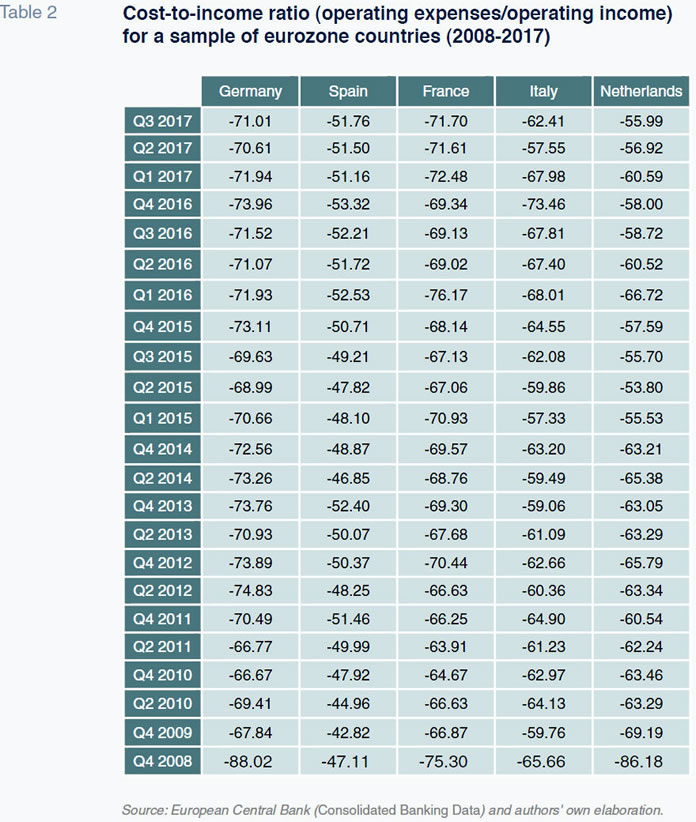

Probably the most commonplace response to the difficulties in boosting returns has been to cut costs. As shown in Table 2, most of the major European banking sectors presented higher efficiency levels (lower cost-to-income ratios) than at the start of the crisis. Although a more detailed empirical analysis is needed to draw more definitive conclusions, the data would appear to suggest that the years in which the crisis (in its two waves) required the greatest restructuring efforts were also the years in which the banks improved their cost- to-income ratios the most. In 2008, Spain presented the lowest cost-to-income ratio of the countries analysed and continued to do so as of the third quarter of 2017: at 51.76%, Spain’s banks were more efficient than even the Dutch banks (55.99%) and significantly more so than the French (71.70%), German (71.01%) and Italian (62.41%) banks. Given that branch network and staff downsizing has already been intense in many of these countries, it would appear that the digitalisation phenomenon may require harder work on this front, requiring the banks to maintain even lower cost-to-income ratios.

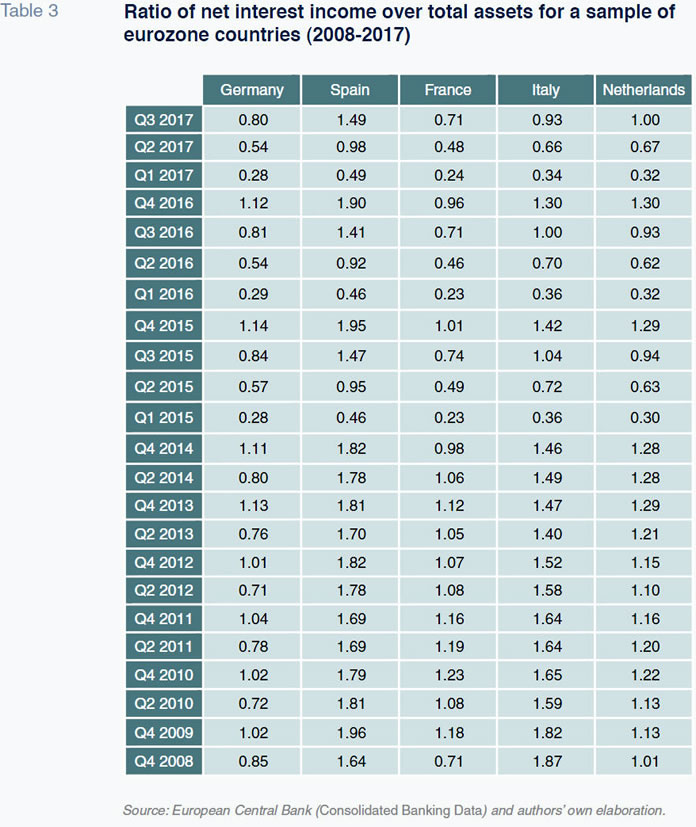

Although inflation has trended upwards, European banks continue to face negative real interest rates. This is making it hard for them to generate income from their most basic intermediation activity,

i.e., the spread between the return on funds loaned and the cost of funding. As shown in Table 3, the net interest margin (as a percentage of total assets) has been trending lower, albeit unevenly, between 2008 and 2014 and, although it has recovered slightly in recent years, it remains below pre-crisis levels. Note that in terms of the annual trend, there is considerable variation quarter over quarter. In the third quarter of 2017, the Spanish sector presented the highest spread (1.49%), outperforming the Netherlands (1%), Italy (0.93%), Germany (0.80%) and France (0.71%).

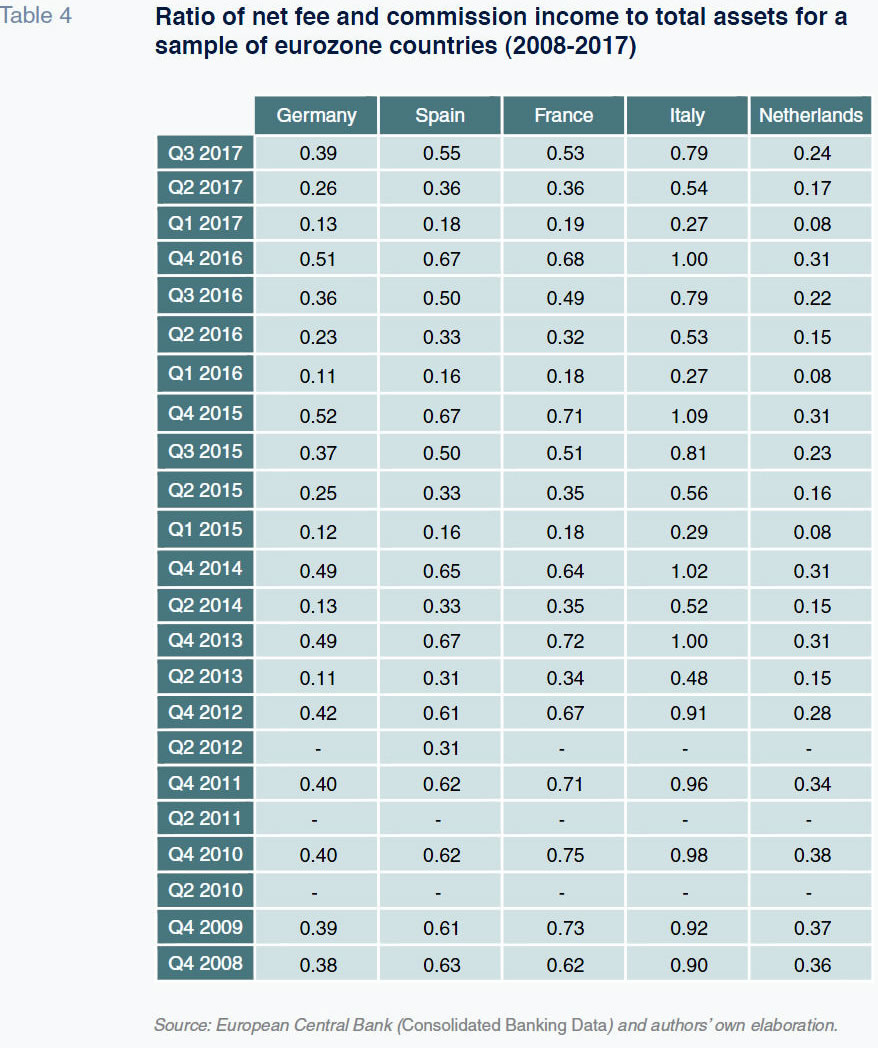

It is hard to say whether fee and commission income has largely offset the downtrend in net interest income. Table 4 shows how the ratio of net fee and commission income to total assets does not follow a clearly-defined pattern (even though in most cases this source of income increased during the initial years of the crisis, going on to decline and since recovering slightly). As of the third quarter of 2017, this ratio stood at 0.55% in Spain, below Italy (0.79%) but above France (0.53%), Germany (0.39%) and the Netherlands (0.24%).

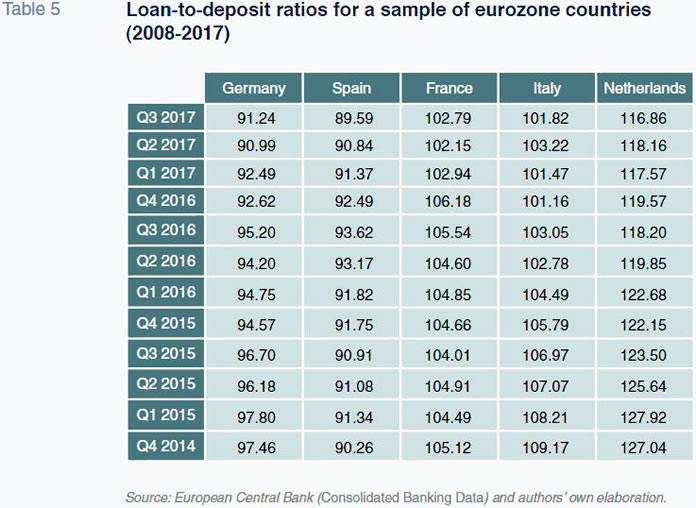

The financial crisis has also shifted the banking sectors’ relative ranking in terms of leverage, defined as the ratio between borrowed funds and sources of financing. The most basic, yet perhaps most intuitive, expression of this relationship is the loan-to-deposit ratio. Table 5 indicates that this ratio has come down across all sectors (comparable information is not available prior to 2014), which is probably attributable to a combination of factors. These include more prudent lending policies and regulatory pressure which, in addition to shaping capital adequacy, is increasingly having a bearing on liquidity and leverage. At any rate, as of 2017, Germany and Spain continued to present a ratio of around 90%, whereas Italy, France and the Netherlands presented ratios of above 100%.

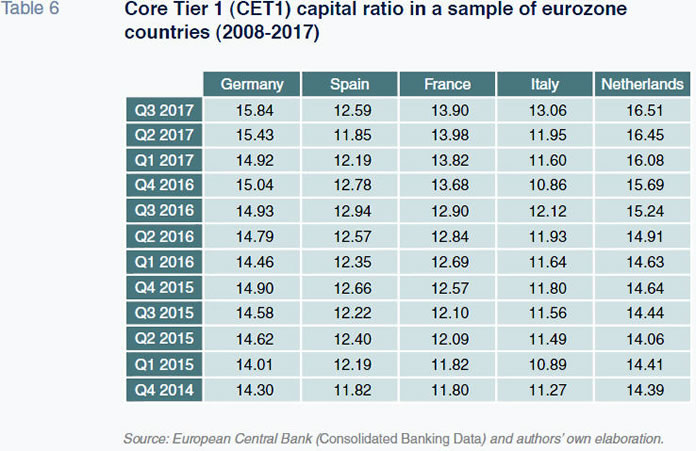

There is little doubt that if there is one requirement that has become more stringent since the crisis – due to pressure from the regulators and the market alike – it is capital adequacy. Table 6 shows the trend in the ratio of tier 1 capital to risk weighted assets (comparative information prior to 2014 is not available). Although Spain appears to be in a comfortable position in this respect (12.59%), there is nevertheless a gap with respect to the other major European banking sectors, especially Germany (15.84%) and the Netherlands (16.51%). It is worth noting that this across-the-board requirement to hold ample capital buffers implies an opportunity cost in terms of investment, further eroding the scope for higher returns.

The profitability horizon: The new bank transformation function and the digital opportunity

Our analysis of the prospects for profitability is constrained by the quasi-inevitable restriction of not having hard data regarding how the shift in technology and channels will affect banks’ profits. In this section, however, we attempt to analyse in qualitative terms how the banking industry in general, and the Spanish sector in particular, can leverage the opportunity afforded by the digital dimension in order to boost its efficiency and profitability, framed by the restriction of having to face competition from newcomers to the market.

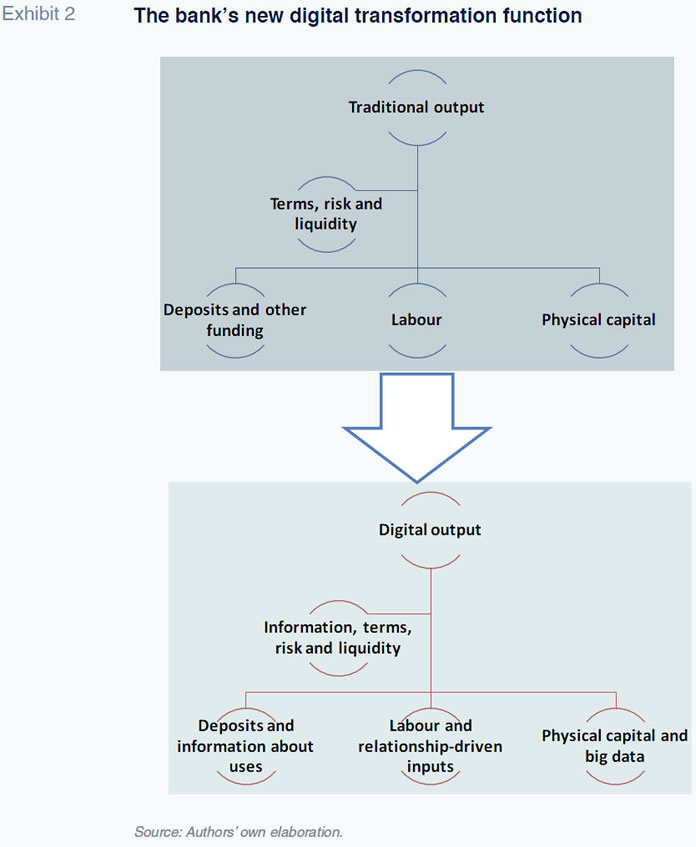

Drawing from the evidence gleaned from the profitability and efficiency indicators analysed above, one might wonder why the banks are not accelerating their restructuring processes and opting for pure play digital strategies. Among the various responses to this question, two are worthy of special attention. Firstly, the digital banking market is not shaped solely by supply but also by demand; in short, customers need to embrace digital uses that work with the channels offered to them by the banks. Secondly, this transformation entails a shift in the banks’ culture, internalisation of a new transformation function, as depicted in Exhibit 2. The traditional conception of the banks’ intermediation function (top section of the exhibit) is that of agents that transform liquidity (raised via deposit-taking and used to extend loans), term management (short- term fund withdrawal vs. long-term loans) and risks (high for loans extended and low for deposits taken). In the classical banking equation, these functions are performed using three inputs: essentially, deposits and other funds, staff and physical capital. However, version 2.0 of the banking business equation (bottom section of the exhibit) introduces information into the transformation function. This implies tremendous scope for interaction with customer data. The regulatory framework in Spain and Europe – starting this year with application of the second – European payments services directive (PSD2) – implies the possibility of having to share part of this information with other competitors. To produce, these new banks can leverage their information to add a new dimension to their customer relationships, creating the opportunity to exploit their big data to provide far more personalised services.

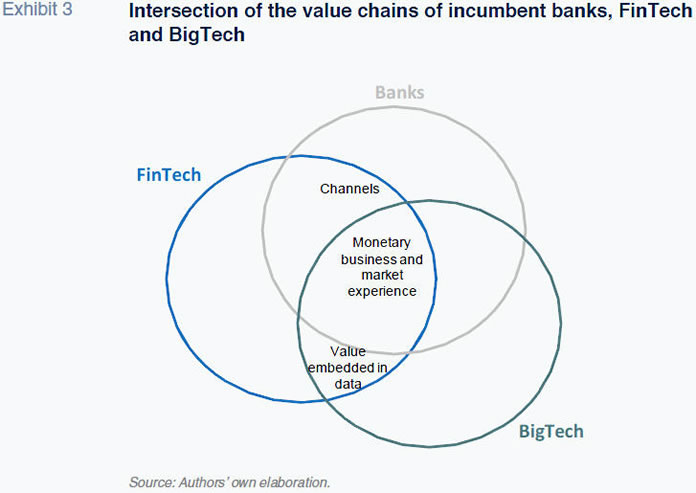

This information is generated, as is shown in Exhibit 3, in an area of intersection between the traditional or incumbent banks, their competitors in the FinTech environment and the major BigTech players (the likes of Apple, Google, Facebook and Amazon). There is overlap among channels, businesses and the value embedded in data that can be approached via a range of competitive formulae that go beyond that of natural rivalry, such as cooperation, integration and process outsourcing.

Within this qualitative assessment, the Spanish banks are of particular interest for a number of reasons:

- In Spain, the sector has been and continues to be radically restructured with new digitalisation initiatives emerging in parallel at the incumbent banks and newcomers alike. From the structural standpoint, this competitive environment means that variables such as branch density are no longer as important as indicators of market power or rivalry. The result – as demonstrated by the case of Spain – is competition along price and non-price variables whose geographic pinpointing is increasingly diffi in light of the declining importance of the physical distance between customer and provider.

- The physical structure (branches) of the Spanish financial sector and its high level of specialisation generated a banking system in the past in which the relationship component was of great significance to the value chain. That relationship component is currently being redefined by the advent of the digital dimension.

- The Spanish banks’ cost competitiveness (refer to the previous section of this paper) is a sound starting point for tapping the opportunities afforded by digitalisation in order to drive their efficiency even higher and remain at the forefront of financial service provision in Europe.

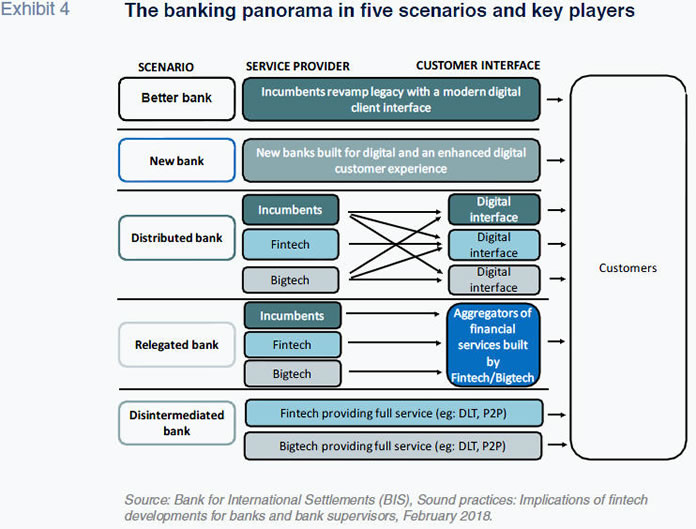

One of the difficulties posed by the banking sector’s emerging structure is that, although the incumbent banks continue to dominate, the possibilities for competing as a financial institution have multiplied. It is worth resorting to an intuitive taxonomy in order to visualise where things are headed. The Bank for International Settlements published a report last February titled Implications of fintech for banks and bank supervisors which provides a highly intuitive classification scheme, reproduced here in Exhibit 4. At the bottom of the schematic, we observe the ‘Disintermediated bank’, that which would theoretically lose its intermediation space as a result of failing to respond to the challenges posed by the FinTech and BigTech players. At the top of the schematic, at the other extreme, we have the ‘Better bank’, incumbent suppliers that fully internalise the change imposed by the digital challenge. These entities compete with the so-called ‘New banks’, created as pure-play digital entities, without the trajectory of a traditional bank but also without the need to transform legacy models. In the middle of the exhibit is where a significant number of entities in the midst of the transformation process find themselves. If they fail to embrace change and interact with digital channels and suppliers, they risk becoming ‘Relegated banks’. However, cooperation and the development of digital interfaces gives them the chance to become ‘Distributed banks’, with a mix of in-house processes and processes outsourced to new suppliers.

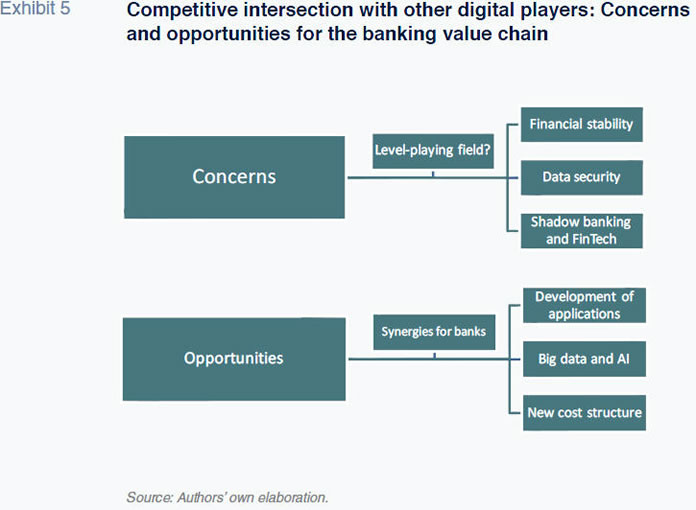

Lastly, it is worth highlighting the fact that this new playing field implies risks and opportunities, as depicted in Exhibit 5. The regulations themselves are introducing significant constraints. Regulations such as PSD2 are creating a benchmark legal framework but do not guarantee a level playing field. Although most of the new suppliers introduce a level of competition that should ultimately boost service standards in the sector as a whole, the difficulty in determining the legal origin or true nature of some of the suppliers’ activities also raises potential concerns about financial stability and security aspects and the development of ‘shadow’ Fintech players. Nevertheless, the digital arena is replete with opportunities for the world of banking by presenting the scope for extracting cost synergies and developing more tailored products and services.

Santiago Carbó Valverde. CUNEF and Funcas Francisco Rodríguez Fernández. University of Granada and Funcas