Bank financing for micro and small

enterprises: Spain in the European context

In, Spain, the weight of micro and small enterprises is the most relevant to the productive landscape. Like their EU counterparts, Spanish micro and small firms face harsher terms and conditions in accessing finance, but improvement observed in recent years has also benefitted these firms the most.

Abstract: One of the distinguishing traits of Spain’s productive landscape is the significant weight of its micro and small enterprises, which generate 60% and 44% of all jobs and GDP in Spain, respectively, well above the EU averages. But the small size of Spanish companies serves as a barrier in terms of the ability to invest in the factors that drive productivity (R&D, human capital, international expansion,

etc.) as well as in terms of their access to finance. The findings of the latest ECB survey addressing firms’ access to finance show that micro and small enterprises face harsher financing conditions, particularly in the case of micro enterprises. Although these terms and conditions have improved substantially in recent years, firms with fewer than 50 employees are perceiving the improvement to a lesser degree. The good news is that the differences in spreads on bank loans by loan size have narrowed and that access to finance is now the key problem for only a very small percentage of Spanish companies (around 7%), irrespective of size. In addition, financing conditions have improved in terms of interest rates, but have gotten tighter in terms of commissions and collateral, more so for micro and small enterprises[

*].

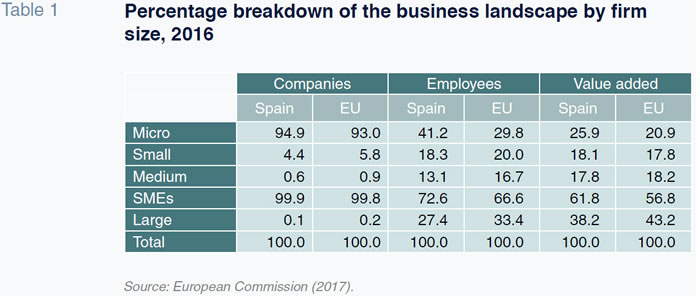

IntroductionThe important role played by SMEs in Spain’s productive landscape is well documented and has accordingly been the subject of research and focus of public policy. To recap, 99.9% of Spain’s companies are SMEs; they account for 72.6% of employment and 61.8% of the economy’s value added. On these last two variables, the importance of companies of this size is evident in the fact that they contribute six and five percentage points (pp) more to employment and GDP than the EU averages, respectively.

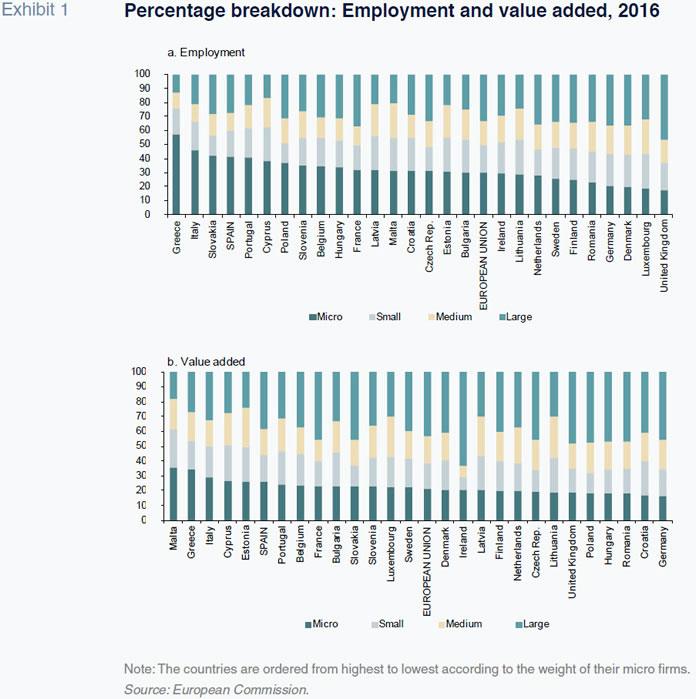

However, the characteristic that sets Spain’s productive landscape most strikingly apart from that of other countries is not the weight of its SMEs but specifically that of its micro and small enterprises

[1]. Micro firms, those with fewer than 10 employees, are responsible for 41.2% of all employment in Spain, 11.4 pp more than the EU average, with Spain ranking fourth in the EU-28 on this measure (Exhibit 1). As for value added, the weight is lower (25.9%, a sign of their reduced productivity), but still 5 pp above the EU average, with Spain once again ranking as one of the member states in which this size of company is most significant on this count. In the case of small enterprises (those with between 10 and 49 employees), the differences with Europe are narrower, and their weight is still above average in Spain in terms of value added but not in terms of employment.

In short, within the universe of SMEs, the most important sub-segment is by far the smallest-sized enterprises, to the extent that they account for more jobs than their larger-sized counterparts, in contrast to the EU average. In Spain, enterprises with fewer than 50 employees account for 59.5% of all jobs (10pp above the EU average) and 44% of GDP (+5.3pp).

Size confers businesses an advantage in terms of access to financing and financing conditions. To start with, it is very hard to access capital markets unless an enterprise has a minimum size to absorb the costs of issuing debt. In fact, in Spain, despite the creation of an alternative fixed-income market, the MARF, designed to facilitate SME access to the corporate bond market, just 11 companies have managed to do so. Elsewhere, the so-called alternative financing route remains very insignificant in Spain. As a result, this type of company (to a greater extent micro and small enterprises) is highly dependent on bank credit, which is why it is important to analyse the terms on which they can access bank financing.

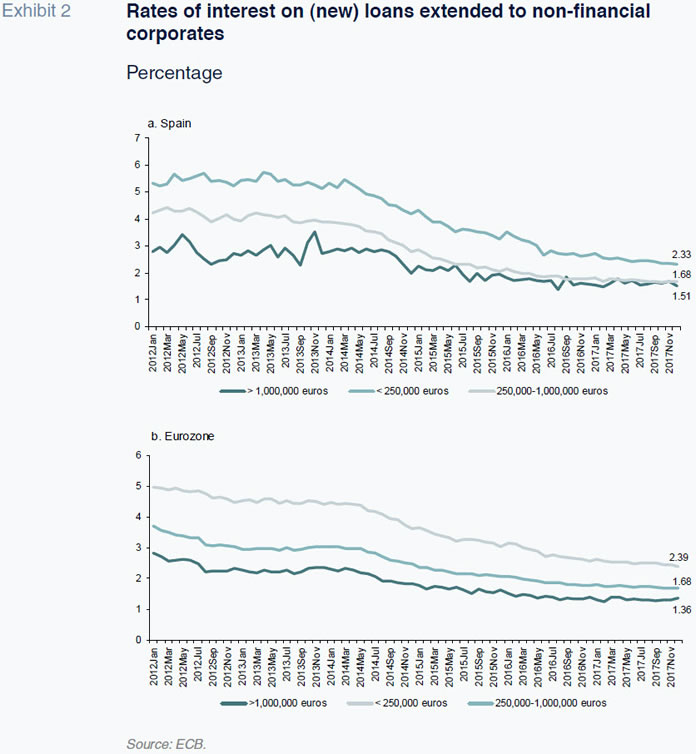

There are reasons justifying the advantages size affords in terms of access to bank financing. In particular, banks have less and poorer quality information about smaller companies, for one thing because many of them are not audited. The issues posed by asymmetric information in the banking relationship justify the higher risk premium demanded by banks, as is evident in the interest rates charged on loans as a function of their size. As shown in Exhibit 2, interest rates come down with the size of the transaction in Spain and the eurozone alike, so that micro enterprises bear the highest borrowing costs. As of December 2017, a loan of under 250,000 euros was priced at a premium of 65 bp with respect to one sized between 250,000 and 1,000,000 euros (2.33% vs. 1.68%), with this spread rising to 82 bp in the case of larger loans (2.33% vs. 1.51%). A similar pattern is observed in the eurozone, namely premiums of 71 bp (2.39% vs 1.68%) and 103 bp (2.39% vs. 1.36%), respectively. The good news is that the interest rate gap by the size of the loans extended to enterprises has been narrowing. Moreover, the difference between the rates charged in Spain versus the eurozone is very small across all size intervals, with micro firms actually borrowing at a lower cost in Spain.

Against this backdrop, the purpose of this paper is to analyse the recent trend in the terms on which micro and small enterprises can access bank financing in Spain compared to larger companies and also compared to their counterparts in the eurozone, based on the data provided by the ECB survey. This survey contains information broken down by country and company size, which is helpful to achieving the paper’s objectives. The time horizon analysed runs from 2012 until today, as 2012 marked a turning point in financing access terms as a result of the expansionary monetary policies adopted by the ECB. The most recent available wave of the survey on the access to finance of enterprises (SAFE) corresponds to the period between April and September 2017.

Access to bank financing: A top concern

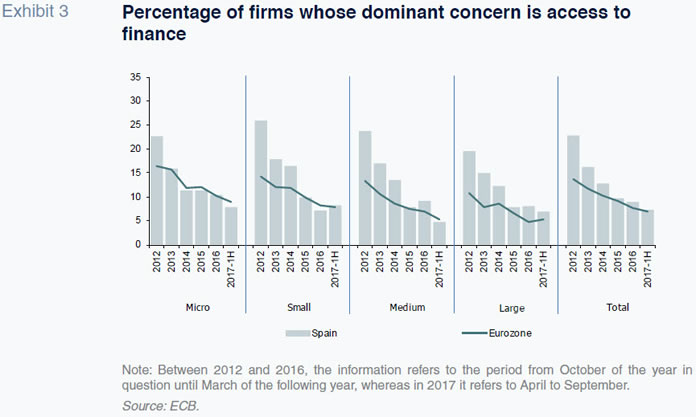

The first indicator of the importance of size when it comes to getting finance is the quantification of the percentage of enterprises in each size category that report that their biggest problem is access to finance, ahead of other issues such as ‘finding customers’, ‘competition’, the ‘availability of skilled labour’, ‘regulation’ or ‘costs of production’.

Just 7.2% of Spanish enterprises reported ‘access to finance’ as their dominant concern, a figure that is very similar to the average for all eurozone enterprises (7%). This percentage has been falling steadily since 2012, closing the gap versus the eurozone in the process. In 2012, the percentage of enterprises in Spain reporting access to finance as their major concern stood at 22.7%, at which point of time this percentage was 9 pp lower in the eurozone. Since the ECB has been tracking this information, this percentage was at its lowest in Spain and the eurozone alike in the April-September survey, the percentage in Spain being lower than in Italy (7.4%) and France (8.3%), albeit higher than in Germany (4.8%).

The breakdown by company size (Exhibit 3) reveals that a higher percentage of micro and small enterprises cite access to finance as their main problem in Spain and in the broader eurozone. In Spain, 7.9% and 8.1% of micro and small-sized companies currently report access to finance as their major problem, respectively, compared to 4.7% and 7% in the case of medium and large enterprises, respectively. These percentages are similarly higher for micro and small enterprises in the broader eurozone.

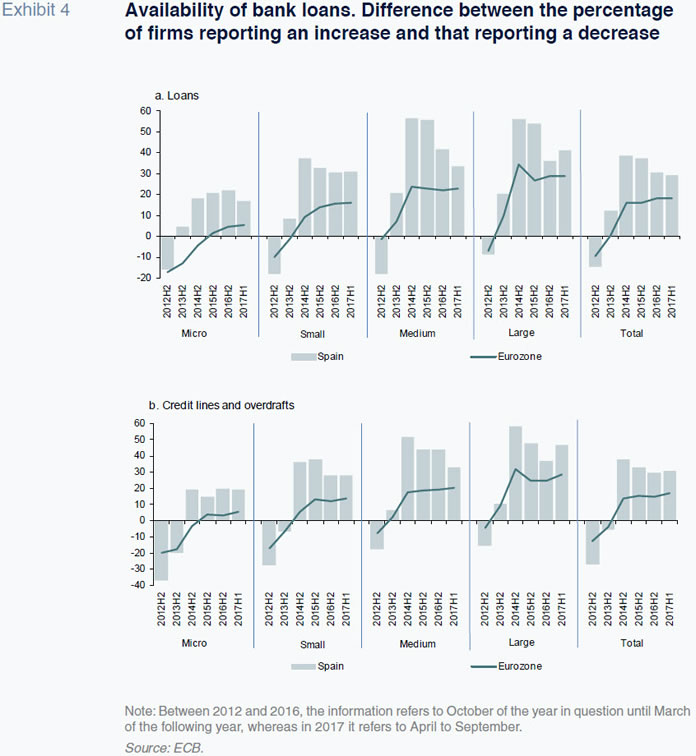

Availability of bank financing

Another aspect of the financing equation on which enterprise size has an impact is availability, i.e., the amount of bank loans or credit lines/overdrafts available. In the first instance, the difference between the percentage of Spanish companies reporting that availability had improved and those reporting that it had decreased currently stands at 29 pp, which is significantly higher than the difference of 18.3 pp reported by the eurozone enterprises as a whole. Gone therefore are the years of credit rationing: the percentage of enterprises reporting a perceived improvement in credit availability is well above those perceiving a deterioration.

As shown in Exhibit 4, there are significant differences in the net percentages of enterprises perceiving an improvement in the availability of bank loans by enterprise size, with these percentages increasing with size. Specifically, while the percentage of large enterprises perceiving an improvement in credit availability is 41 pp higher than those perceiving a deterioration, in micro, small and medium sized enterprises, these net percentages fall to 16.8, 30.8 and 33.5 pp, respectively. It is worth highlighting that the difference between medium and small enterprises is small, suggesting that it is above 10 employees (the threshold separating micro from small sized enterprises) that the availability of bank financing improves most significantly. The micro enterprises present by far the smallest net percentage regardless of the year analysed. This aspect is common to all of the eurozone enterprises and across all time intervals.

As for the availability of bank financing in the form of overdrafts, the pattern is similar: a) availability increases with firm size; b) perceived availability varies only scantly above the threshold of 10 employees; c) the net percentage of micro firms reporting improved perceived availability is currently 28 pp below that reported by large enterprises; and, d) whereas the perceived improvement in bank overdraft availability began in 2013 in the case of medium and large enterprises, in the case of small and micro firms it took until 2014 for this to take place. On the plus side it is worth highlighting the fact that the improvement in the amount of financing available has been higher in Spain than in the eurozone as a whole across all firm size categories since 2014.

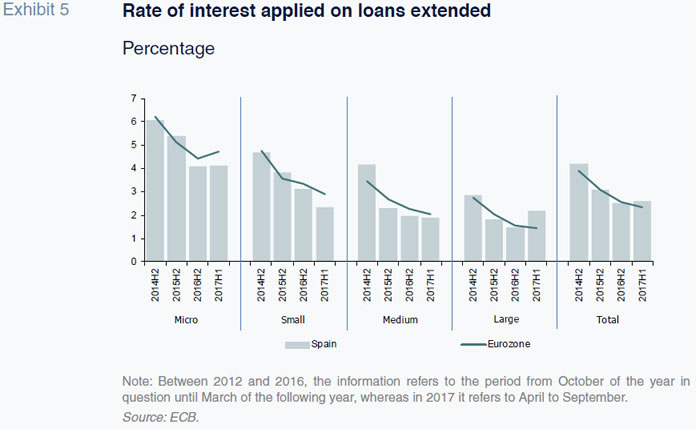

Costs of corporate financing

In 2014, the ECB added a question to its survey which is of significant interest in terms of analysing the terms on which enterprises can access finance: the interest rate applied to their financing transactions. As is logical, this cost has been diminishing in parallel with the downtrend in the ECB benchmark rate and money market rates. Specifically, Spanish companies – all sizes – report that the interest rates they are charged have fallen by 1.6 pp, from 4.2% to 2.6%, between 2014 and 2017. In the eurozone as a whole, the trend has been similar, with average interest rates currently standing 25 bp below those of Spain.

Zooming in on the differences encountered by companies of different sizes, the cost borne by micro firms is in all instances significantly higher, at 4.12% according to the latest survey, compared to a cost of 2.2% borne by large enterprises, 1.91% by medium firms and 2.35% by small companies. Here the good news is that except for the large enterprises, the Spanish firms in the other size categories currently enjoy lower borrowing costs than their European counterparts, with the micro and small enterprises enjoying the greatest comparative advantage in this respect. Note that in terms of interest rate levels, it is the threshold of 10 employees that makes the biggest difference: the biggest change in borrowing costs is observed between micro and small companies, with the former paying a spread premium of 177 bp, compared to a difference of just 15 bp between small and large firms. In contrast, in the broader eurozone, the cost gap between micro and small firms (183 bp) and small and large firms (147 bp) is similar. In Spain, therefore, relief in terms of bank financing costs comes above all when companies achieve the scale of a small enterprise.

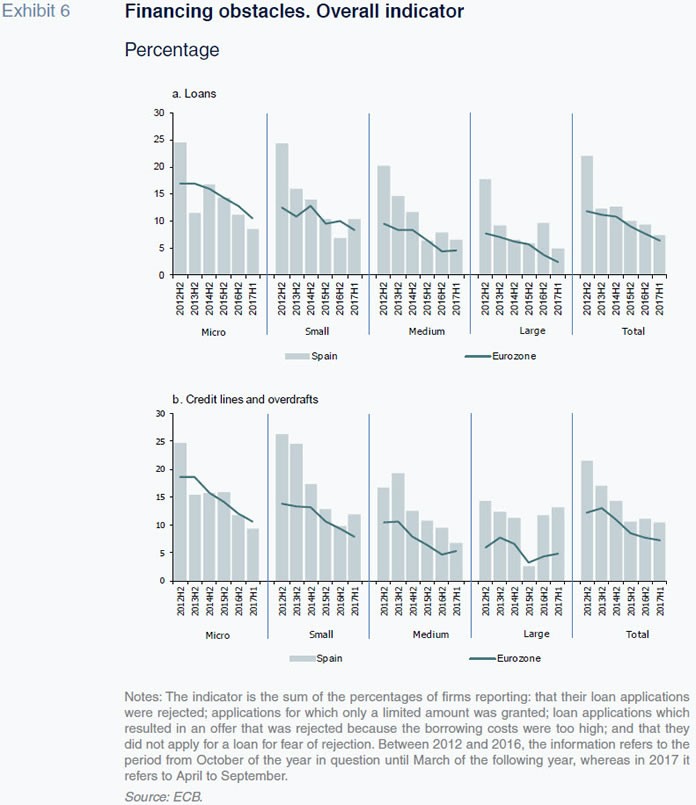

Obstacles to receiving a bank loan

One of the questions on the ECB survey of greatest value in evaluating the terms and conditions on which enterprises can access finance is that related to the obstacles they have encountered. The overall indicator in this respect is measured as the sum of the percentages of firms reporting: a) that their loan applications were rejected; b) applications for which only a limited amount was granted; c) loan applications which resulted in an offer that was rejected because the borrowing costs were too high; and, d) that they did not apply for a loan for fear of rejection.

In the specific case of bank loans (Exhibit 6a), financing obstacles have been trending lower in Spain: the cited obstacles have gone from affecting 22.1% of companies in 2012 to 7.5% in 2017, just one point above the eurozone average. Yet again, the relationship between company size and terms of access to finance is clear, with micro and small firms reporting greater obstacles. In particular, the last survey indicates that these obstacles affect 8.5% and 10.3% of micro and small firms, respectively, compared to 6.6% and 4.9% in the case of medium and large enterprises. On the other hand, it is the micro enterprises that have reported the biggest drop in financing obstacles: 16 pp between 2012 and 2017.

The percentage of firms reporting obstacles when applying for an overdraft is higher, 3 pp more in 2017 (10.5% vs. 7.5% for bank loans) and 3.2 pp above the Eurozone average. What is eye-catching on this occasion is the fact that it is the large enterprises that report the highest percentages in Spain (13.2%), in marked contrast with the trend in the broader eurozone (4.9%).

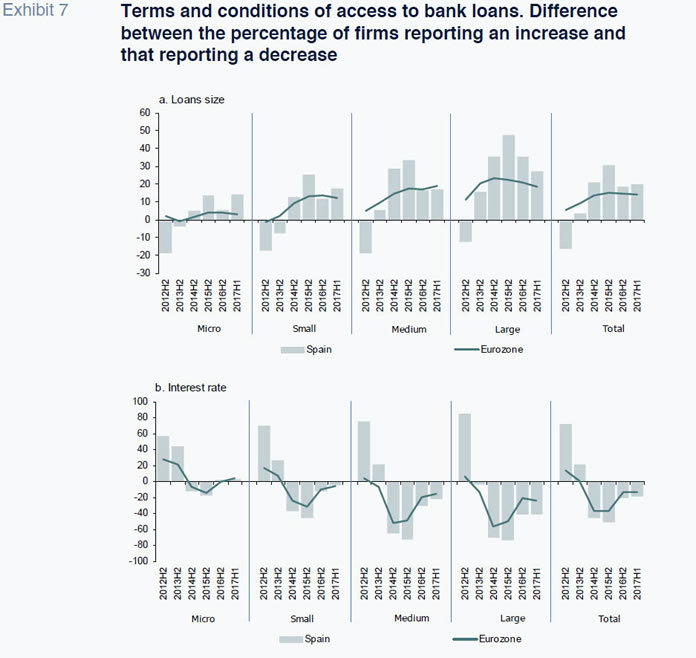

Terms and conditions of access to finance

What terms and conditions do banks apply to the financing they extend to companies? Has the amount of financing improved? And the rate of interest? What about their non-interest charges, fees and commissions? Are banks looking for more collateral in order to extend a loan? These are the variables (amount, interest rate, fees and commissions and collateral) that define financing terms and conditions.

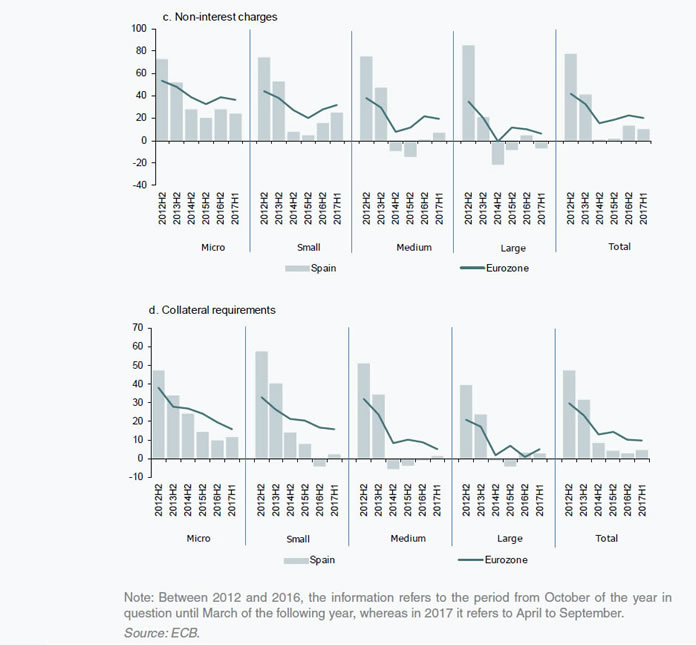

Exhibit 7 shows the difference between the percentage of enterprises that believes that their financing terms and conditions have improved and the percentage that believes they have deteriorated. Note that in the case of interest rates, non-interest charges and collateral, a positive net percentage indicates that conditions have deteriorated, while in the case of the loan size, a positive net difference points to improved conditions.

In terms of the loan size, the net percentages have been in positive territory since 2013, at 19.9 pp in 2017, indicating a predominance of firms that perceive that the amount of available credit is improving. This is 13.9 pp above the eurozone average. The net percentages are lower in the case of micro firms (13.9 pp), broadly similar between small (17.3 pp) and medium enterprises (17.1 pp) and much higher in the case of large enterprises (27.2 pp). In short, the large enterprises are reporting the greatest improvement in the amount of credit available and the micro firms the smallest improvement.

Focusing now on the price of bank loans, Spanish firms have predominantly been perceiving an improvement in this metric since 2014, with a current net percentage of -18.4 pp, better than the eurozone average of -13 pp. What is surprising and of concern here is that the only size segment in which a higher percentage of firms continues to believe that interest rates have increased relative to those that believe they have fallen (net difference: 3 pp) is the micro segment, a trait shared by the Spanish firms of this size with their European counterparts. The situation changes radically for firms with more than 10 employees, with small enterprises reporting a negative net percentage of -4.3 pp in Spain, compared to -5.6 pp across the eurozone. Had the cost of financing analysis been performed at the aggregate SME level, we would have mistakenly concluded that more companies with fewer than 250 employees perceive that their borrowing costs have fallen relative to those that believe they have increased, something we have seen is not true in the case of the micro companies.

Banks’ non-interest charges also affect borrowing costs. In this instance, size counts, as only the large-sized enterprises are currently reporting a negative net percentage, i.e., a higher percentage of respondents who believe these charges have come down. The highest positive net percentages are reported by the micro (24.3 pp) and small enterprises (24.7 pp), with the medium-sized respondents reporting a much smaller gap (7 pp). For the Spanish companies as a whole, although the net percentages are lower than in 2012 and 2013, they remain positive, which means more firms believe that banks are charging more fees and commissions than believe the opposite. Nevertheless, these percentages are currently lower in Spain than in the eurozone (10.2 vs. 19.9 pp) and this phenomenon holds across all size categories.

Lastly, in the case of collateral requirements, although terms have improved, a higher percentage of firms continues to perceive that banks are demanding tighter collateral and guarantees, with Spain reporting a net percentage of 4.8 pp, compared to 9.6 pp in the eurozone. The micro companies reported the highest positive net percentages (11.5 pp in 2017, albeit below the eurozone average of 15.8 pp), followed at a good distance by the small (2.4 pp), medium (1.3 pp) and large enterprises (2.7 pp). In short, the collateral requirements – another important aspect of the access to financing equation – demanded are yet again more stringent for micro firms and have become tighter in recent years.

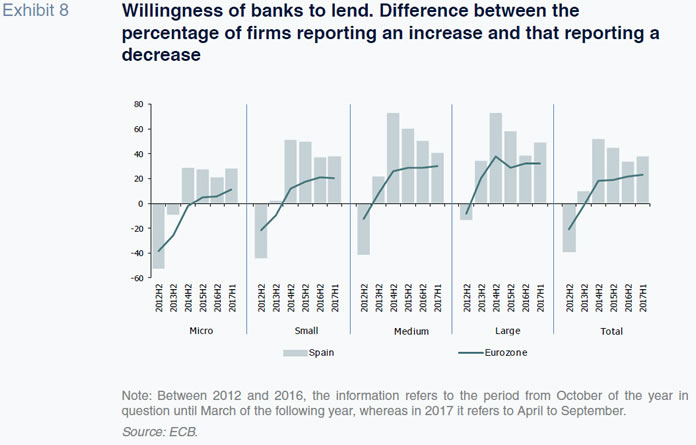

Willingness of banks to lendThe willingness of banks to lend money (Exhibit 8) has improved continuously in Spain since 2013, with the percentage of companies reporting an improvement in willingness consistently higher than the percentage reporting the opposite. The latest survey reveals a net percentage of 38 pp, which is 15 pp above the eurozone average. The differences by company size are noteworthy, with the net percentage reported by micro firms some 20.5 pp lower than that reported by the large enterprises. The difference between a micro and small enterprise is substantial (9.2 pp lower for the former), whereas the difference between small and medium firms is narrower. Thus by merely surpassing the barrier of 10 employees, firms benefit from a significant improvement in financing, evident in banks’ substantially higher propensity to lend money to somewhat larger firms. In terms of the comparison with Europe, it is worth highlighting the fact that the improvement in banks’ willingness to lend is higher in Spain for all company sizes, the biggest difference being observed in the micro category.

Company expectations regarding future availability of bank financing in the coming months

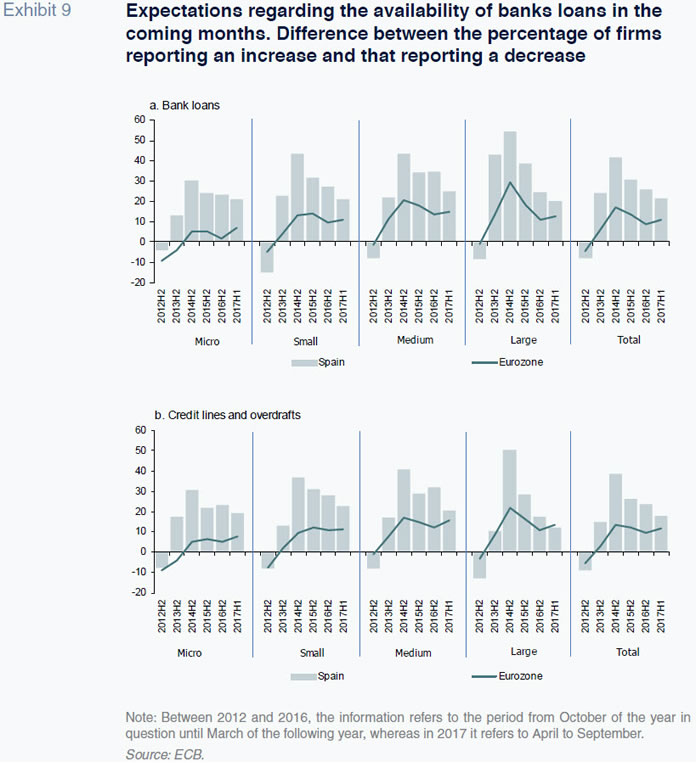

In the case of bank loans, Spanish companies have been optimistic about the availability of credit since 2013. The most recent 2017 figure

indicates a difference between the percentage of firms expecting the availability of financing to improve compared to those expecting the opposite to happen of 21.4 pp, double the eurozone average. In contrast to the rest of the indicators analysed to date, in this instance the differences in net percentages by company size are very small, with medium firms the most optimistic and small firms the least optimistic. In Spain, the micro firms are far more optimistic regarding the outlook for the availability of financing (net percentage: 21.3 pp) than their European counterparts (6.8 pp).

The snapshot is very similar looking at the expectations regarding the availability of credit lines or bank overdrafts in the coming months, albeit somewhat less optimistic. Also on this occasion, as we saw earlier regarding other findings on overdrafts, the large firms present the lowest net percentages (12.2 pp), figures that are considerably below those reported by the other sizes of companies. This trait is not shared with other large corporates in the eurozone, where these firms are more optimistic in this regard than the micro and small firms.

Conclusions

It is true when they say that Spain is a country of SMEs and that this is a shortcoming in terms of attaining higher productivity levels in light of the barrier implied by size in terms of the key drivers of productivity (R&D effort, international expansion, investment in skills, etc.). However, the universe of SMEs comprises firms of very different sizes and it is on the incidence of micro (< 10 employees) and small firms (between 10 and 49) that Spain stands out most starkly compared to its European counterparts. Micro firms are the biggest contributors to job creation in Spain, accounting for 41.2% of the total, ranking fourth in the EU-28 on this measure. Although their weight is smaller than that of the large firms in terms of contribution to GDP, Spain once again ranks sixth in Europe by this count.

The barrier posed by failing to achieve a certain size manifests not only in terms of the key productivity drivers but also the restrictions micro and small firms face in terms of access to finance. However, a higher cost in terms of interest rates should not be interpreted as a penalty, as it is logical for banks to apply a premium to compensate for the greater risk assumed when financing these companies on account of the issue of asymmetric information (banks tend to have less and poorer quality information about these firms).

The information analysed in this paper demonstrates that in effect micro and small firms face harsher terms and conditions in accessing finance, a condition they share with their European counterparts. The good news is that the improvement observed in recent years, which has coincided with the ECB’s rollout of expansionary monetary policies, has also benefitted these firms the most. The key findings are:

- Today, the difference between the level of interest rates borne by the smallest Spanish companies (proxy: a loan of less than 250,000 euros) compared to larger enterprises (loans above this amount) is smaller than in 2012 and stands at a spread of 65 bp in the case of loan of between 250,000 and 1,000,000 euros and 82 bp in the case of a loan of over 1,000,000 euros. In contrast, these differences stood at 160 bp and 320 bp in 2012, respectively.

- The improvement in access to finance is evident in the fact that an increasingly lower percentage of firms cite access to finance as their biggest concern: this percentage currently stands at 7.2% in Spain, which is similar to the eurozone average. At micro and small firms this percentage (~ 8%) is currently very similar to that reported by large enterprises (7%).

- The size barrier is more evident in the availability of bank loans. The latest available survey in this respect reveals that in Spain the difference between the percentage of firms reporting that availability has improved and that reporting the opposite stands at 16.8 pp in the case of micro firms, compared to 33.5 pp and 41 pp for medium and large firms, respectively. The message is the same in the case of credit lines/overdrafts.

- Size is also relevant in explaining obstacles encountered in receiving financing, with the the smallest companies the most affected. That being said, micro firms have reported the biggest reduction in these obstacles.

- The terms and conditions of access to bank financing have improved significantly in recent years for all companies. However, micro firms have perceived this improvement to a lesser degree and their perception of the interest rates they are charged is noteworthy. In 2016 and 2017 a higher percentage of micro firms reported an increase rather than a decrease in the interest rates they were charged, albeit a situation similarly experienced by their European counterparts.

- One area of concern in terms of access to finance is the fact that, except for the large Spanish firms, more companies than not in the other size categories report an increase in fees and commissions, this net percentage being highest for micro and small firms. In a similar vein, the firms report that banks are demanding more stringent collateral and guarantees, with micro firms again bearing the greatest burden in this respect.

- Lastly, the improvement in access to bank financing is evident in the fact that a majority of firms report that banks are more willing to extend finance. However, the net percentage of micro firms reporting this improvement is 20 pp lower in comparison with the large enterprises.

Notes

This article was written as part of research work tendered by the Spanish Ministry of Economy, Industry and Competitiveness (ECO2017-84828-R).

Micro enterprises are those with fewer than 10 employees and less than 2 million euros of revenue or assets. Small enterprises are those with between 10 and 49 employees and between 2 and 10 million euros of revenue/ assets. Medium-sized enterprises are those with between 50 and 249 employees and under 43 million euros of revenue/assets. Large enterprises have 250 employees or more and over 50 million euros of revenue or 43 million euros of assets.

References

ECB (2017), Survey on the Access to Finance of Enterprises in the euro area - April to September 2017.

EUROPEAN COMMISSION (2017), SME Performance Review, 2017.

Joaquín Maudos. Professor of Economic Analysis at the University of Valencia, Deputy Director of Research at Ivie and collaborator with CUNEF