Redesigning the European stress tests: Considerations from COVID-19 and the US experience

The EBA’s postponement of the 2020 stress tests due to COVID-19 comes at a time of growing debate about the effectiveness of their methodology. Unlike the EBA, the Fed went ahead with its stress tests this year, offering potential insight into how the EBA could possibly reform its tests for 2021.

Abstract: The COVID-19 crisis has emerged as a critical event that affects all aspects of bank management and supervision, including the design and execution of the stress tests — a key oversight tool with a forward-looking approach. In March, the EBA postponed the biennial stress tests originally scheduled for 2020 due to the banks’ operational challenges brought on by the pandemic. Notably, this decision took place in the context of a growing debate regarding the EBA’s stress testing methodology, especially in light of the failure of two banks in Italy and one in Spain. Unlike the EBA, the Fed went ahead with its stress tests, layering in sensitivity analyses designed to model the various economic scenarios the pandemic could leave in its wake, providing potential insight into how the EBA could improve its 2021 stress tests. The EBA could also adopt a `top down´ approach like the Fed, instead of its ‘bottom up’ method, which makes it harder to discriminate between healthy and weak entities. Whatever the outcome, the stress tests’ impact on the alignment of capital with the risk assumed by the banks has been critical and the continuity of the tests must be assured in the medium- and long-term.

The banking business in the wake of the COVID-19 crisis

The onset of the coronavirus pandemic and the

health, social distancing, and lockdown measures taken to curb its spread have ushered in the worst international economic crisis since World War II. The European and Spanish banking sectors entered this recession from a moderately strong position. Although they have made considerable progress on addressing those weaknesses that emerged during the Great Recession (asset provisioning, capital reinforcement and capacity downsizing), the inability to generate sufficient margins or shareholder returns has become a more salient issue.

[1]

Against this backdrop, the banks face multiple hurdles in mitigating the adverse impact of the pandemic, with the additional challenge of uncertainty around asset impairment, earnings and solvency. The supervisory authorities have been very permissive, adopting flexible accounting approaches in order to avoid the automatic impairment of exposures due to ad hoc increases in the probability of default, and approving prudential measures aimed at easing the requirements for complying with the capital adequacy metrics. The purpose of that regulatory and supervisory fine-tuning is not to avoid reality but to factor in the uncertainty surrounding the intensity and duration of the COVID-19 crisis, which could generate excessive volatility for the banks if not analysed from a medium- and long-term perspective.

The ability to generate business will also be shaped by the efforts made by the monetary and fiscal authorities. Monetary policies have been reinforced in the wake of the pandemic and designed to ensure the system’s liquidity. Additionally, there are support measures introduced for those sectors hardest hit by the crisis through the provision of state-backed guarantees and moratoria on mortgage and consumer debt payments.

At the same time goverments declared the health crisis a pandemic, triggering lockdowns with highly uncertain effects, the European Banking Authority (EBA) decided to postpone this year’s edition of its biennial stress tests that it had been conducting uninterruptedly since 2014.

[2] This was an unprecidented decision, which the EBA attributed to the increased operational challenges facing the banks in light of COVID-19.

Stress tests and tail risks: The Fed’s solution

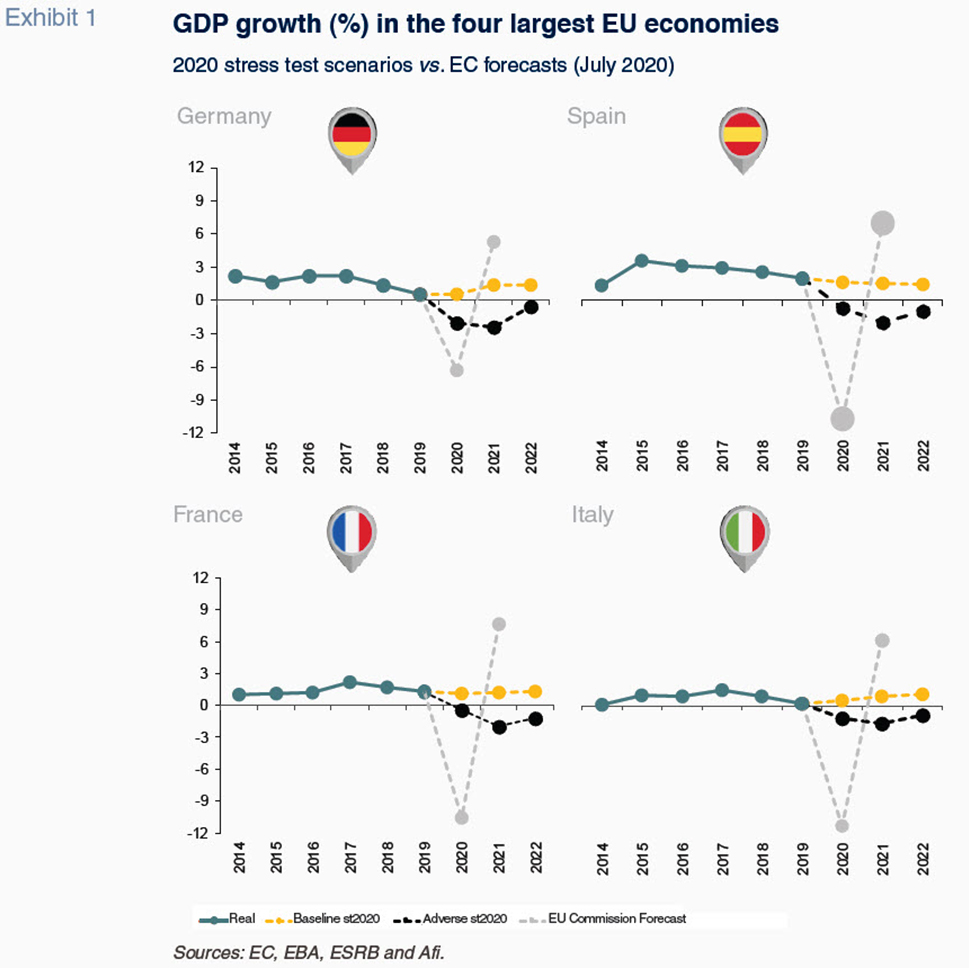

The EBA’s decision to postpone the stress tests has raised serious questions given that the European Commission’s current macroeconomic forecasts are far worse than those contemplated in the most severe scenario that was to be modelled in the cancelled tests.

The above developments have prompted us to ponder the nature and purpose of the stress tests and their implications for the banks. The stress tests are designed to assess the banks’ ability to withstand statistically and financially plausible hypothetical, low-probability scenarios, particularly with respect to solvency, liquidity and profitability.

Obviously, that premise, a test of survival, cannot address events that were absent from prior observed episodes and therefore fall outside of the expected loss distributions used to define an adverse scenario.

The complexity of designing scenarios in response to the COVID-19 pandemic comes on the heels of a debate unfolding within the EBA in recent years

[3] about whether the stress testing methodology reflects the banks’ reality, covers all risks and constitutes an effective predictor of resolution events. Over the next few sections, we reflect on the challenges facing stress testing, from which we attempt to draw a few lessons from the stress tests conducted recently by the US Federal Reserve.

Athough the EBA decided to suspend its stress tests, the ECB did conduct a COVID-19 vulnerability analysis, the results of which were published in July. Given that the EBA’s methodology and the information disclosed were very limited in comparison with the biennial tests, the ECB’s effort does not constitute stress tests per se; nor will it translate into any requirements for the banks. That being said, the ECB warned of the greater impact on capital compared to the last edition of the stress tests and the highly varied impact across the banking sector, trends which will undoubtedly also emerge from the EBA’s stress tests using scenarios designed to reflect the economic impact of the pandemic.

The Fed, meanwhile, took a different course of action, opting to conduct stress tests and publish the results, albeit adapting its methodology in light of COVID-19 to layer in the so-called “tail risks”, which while improbable, would have an extroadinary impact if they materialised. In order to incorpate those risks, the US central bank performed sensitivity analyses, without assigning probabilities of occurrence, to provide the supervisors and banks with an idea of the direction and magnitude of the possible outcomes.

The use of stress tests in parallel with sensitivity analyses was justified in the US by the fact that the two exercises serve different purposes:

- The stress tests underpin the required capital buffer in anticipation of possible ‘stress’ events. The size of each bank’s capital buffer depends on the results of the stress test.

- The purpose of the COVID-19 sensitivity tests was to determine the scale of the ongoing recession and to inform the U.S. supervisor’s decisions in regard to the limiting of capital distributions via dividends or share buybacks as well as establishing periodic capital adequacy assessments.

This combination of initiatives led by the Fed

[4] addresses the issue of unknown tail risks such as an intensification of the crisis, which could lead to negative consequences for both the economy and banking sector that are difficult to quantify.

Against that backdrop, the stress tests dovetail better with the sensitivity analyses. The latter are designed to measure the potential impact of certain high risk situations on capital, liquidity and profitability. Importantly, the probability that such events occur and the severity of their consequences are unknown.

Sensitivity modelling also differs from stress test modelling insofar as it explores different assumptions regarding the impact which the unknown risk event could have, assigning weights to those assumptions that can be fine-tuned over time as the uncertainty regarding the duration and intensity of the crisis diminishes.

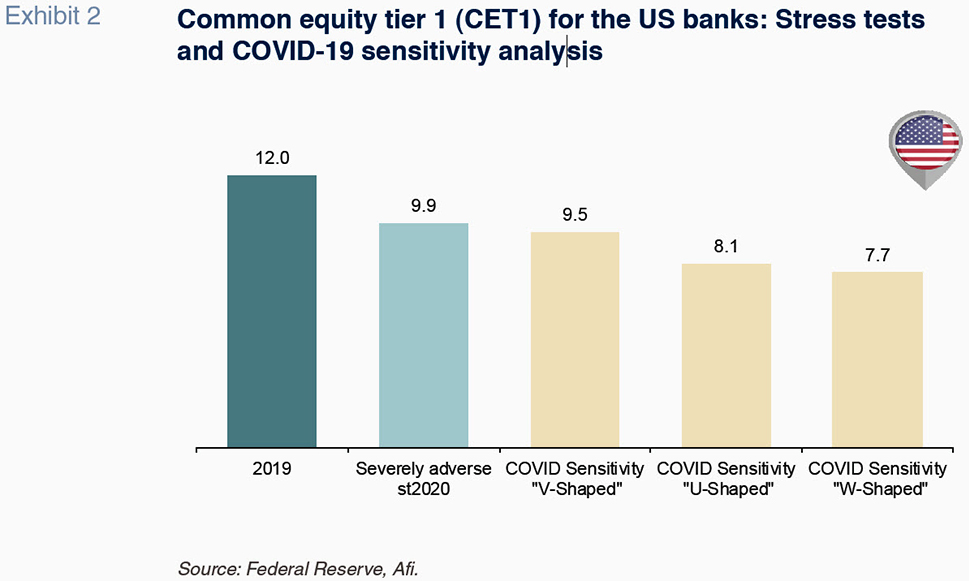

The Fed ran COVID-19 sensitivity tests for three alternative downside scenarios for the same sample of banks:

- A V-shaped recession, implying a swift recovery in GDP and employment levels;

- A U-shaped recession, involving a slower recovery in output and employment with respect to pre-pandemic levels; and,

- A W-shaped recession, resulting in a short recovery followed by a deeper contraction due to a second wave of infections and economic paralysis.

The Fed concluded that in the most adverse stress test scenario, all of the banks under its supervision would have enough capital to handle a V-shaped recession and only some would be at the required capital threshold in a U-shaped and W-shaped recession. Note that the downside scenarios are conservative to the extent that they do not factor in the extraordinary economic and monetary policies implemented to mitigate the effects of the pandemic.

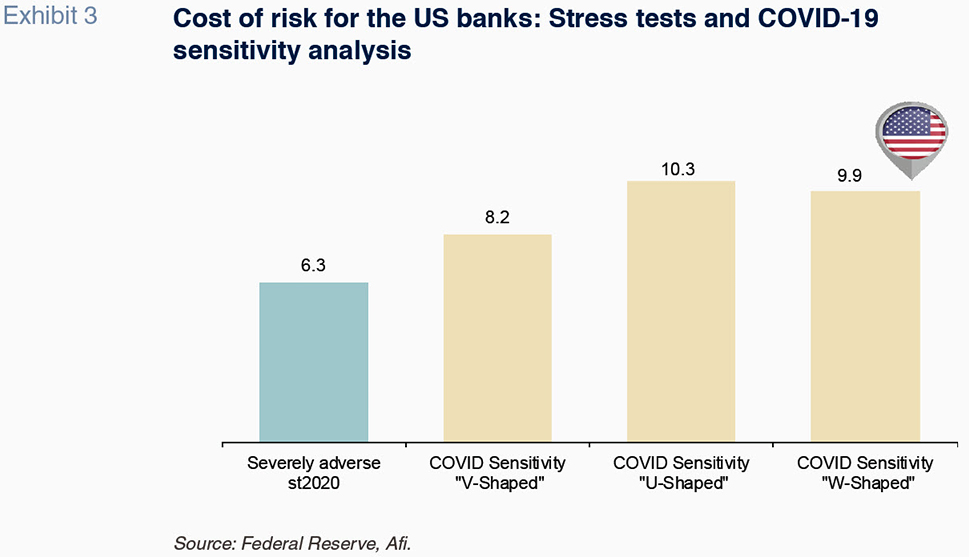

The decrease in capital is due primarily to the significant impact of loan-loss provisions. Loan-loss provisions have risen signifacntly as a result of the impairment of loan portfolios in scenarios characterised by an intense contraction in output and employment. In the stress tests’ adverse scenario, the cost of risk amounts to a cumulative 6.3% between the end of 2019 and the first quarter of 2022. That cost increases to 8.2% in the V-shaped recession scenario, to 10.3% in the U-shaped recession scenario and to 9.9% in the W-shaped recession scenario. Interestingly, the W-shaped recession scenario results in the largest erosion of capital despite the lower level of provisions compared to the U-shaped scenario. This is due to the use of forward-looking models that more heavily penalise the ability to generate income and, by extension, capital in longer-lasting crises.

The Fed’s stress tests have garnered cririticsm, especially for the manner in which the Fed communicated the results. The ultimate goal of the Fed’s stress tests is to determine the size of an anti-cyclical buffer that will be required in the current recession. Normally, this determination would be followed by the publication of the results in exhaustive detail in order to provide the market with highly valuable information. However, the results of the COVID-19 sensitivity analysis were not published on a bank-by-bank basis.

Stress tests and tail risks: The ability to anticipate resolution events

One of the best ways of evaluating whether the stress tests have met their purpose is to assess their ability to anticipate the resolution events that have subsequently materialised.

The stress test methodology and scope were standardised in the EU with the creation of the Single Supervisory Mechanism (SSM) in 2014. The resolution processes underwent similar standardisation under the second pillar of the Banking Union initiative —the Single Resolution Mechanism— which came into effect in January 2016.

Since the creation of the Single Resolution Board (SRB), there have been five notified cases of bank resolution: one Spanish bank (Banco Popular), two Italian banks (Banca Popolare di Vicenza and Veneto Banca) and two Latvian banks (PNB Banka and ABLV, together with its subsidiary in Luxembourg).

Of those five groups, only the Spanish and two Italian banks had undergone the EBA stress tests in 2014 and 2016. These stress tests were based on three-year projections, a time horizon which would ultimately encompass the dates of their resolution (all three were notified in June 2017). The Latvian banks were excluded as the country joined the eurozone and Banking Union at a later date.

It is worth highlighting the differences in the test methodologies used in 2014 and 2016. The 2014 tests were designed to evaluate the banks’ asset and capital quality, which were subject to the supervision of the ECB. They took a ‘pass or fail’ approach, requiring entities that failed to present CET1 ratios of more than 5.5% under the adverse scenario to raise capital. However, in 2016, there was no capital threshold for banks to pass. Instead, the tests were intended as a tool for guiding the supervisor’s capital adequacy assessments. For the purposes of the matter at hand —assessing the tests’ ability to predict resolution events— the under-capitalisation of the banks that presented ratios below the prior capital threshold serves as a reasonable proxy.

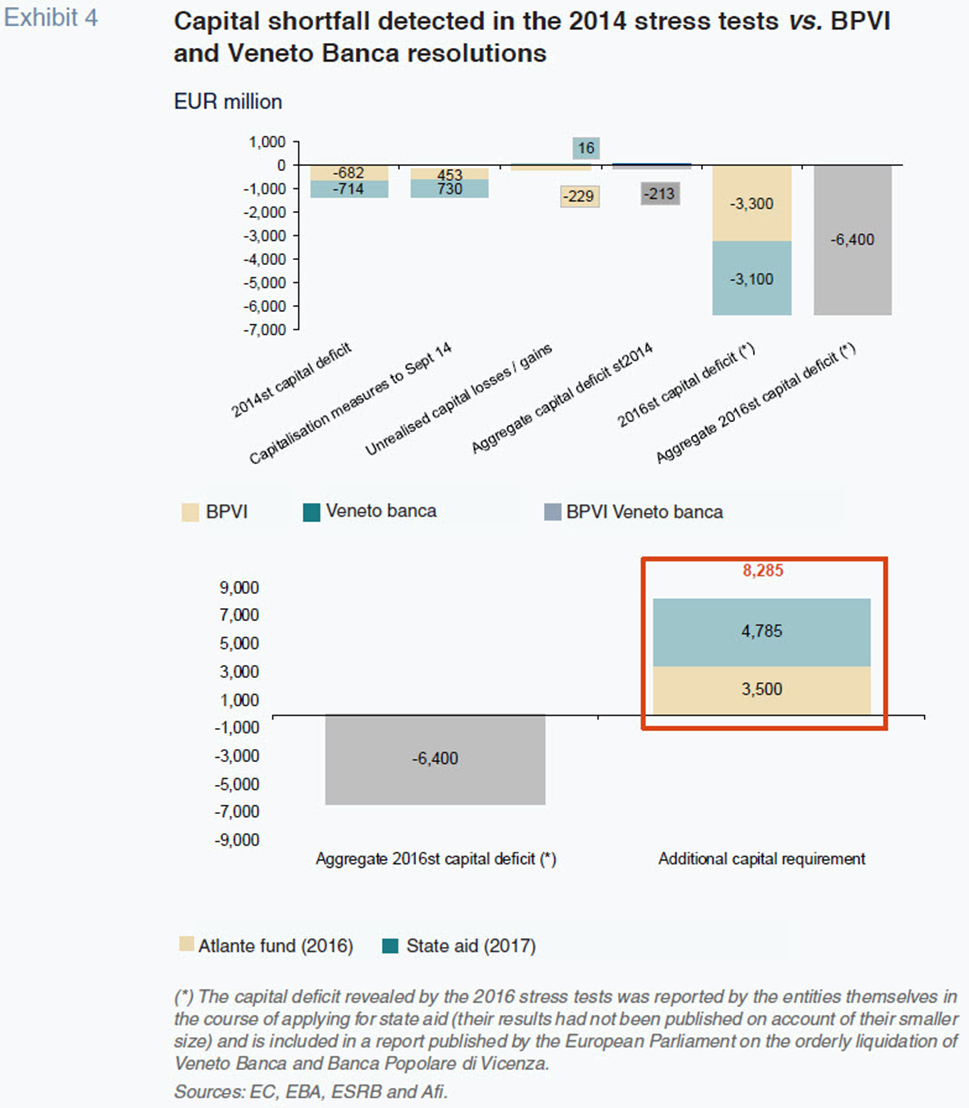

Notably, Banco Popolare di Vicenza (BPVI) and Veneto Banca presented an aggregate capital deficit of 213 million euros in the 2014 tests, factoring in the adjustments made by both banks up until the results were published. That capital shortfall increased exponentially, to 6.4 billion euros, under the adverse scenario modelled in the 2016 tests, implying a solvency ratio of under 0% (technical bankruptcy). This prompted the ECB to declare the banks as ‘failing or likely to fail’, thereby activating the resolution mechanisms and a request for state aid, which was endorsed by the European Commission.

While the tests did serve to trigger the resolution mechanism, they did not predict that outcome. The tests failed for two reasons. Firstly, the capital deficit ended up being significantly higher, as the two banks ultimately received extraordinary capital injections from the Atlante Fund and aid from the Italian state totalling 8.29 billion euros, compared to the 6.4 billion euros shortfall predicted in the worst-case scenario in the stress tests. Secondly, the adverse scenario defined by the European Systemic Risk Board (ESRB) never materialised, such that the funds had to be injected to cover tail risks that did not occur and would have initiated a resolution.

Conclusion: The challenges facing the EBA stress tests

This analysis reveals two major challenges with respect to the direction of the stress tests in Europe:

- As the tests are configured today, it is difficult to predict unknown tail risks. This will become increasingly clear as the fallout from the pandemic and new unknowns are likely to continue to materialise, not least of which are those related to climate change.

- To address tail risks of this nature, the best solution may lie with the inclusion of sensitivity analyses, such as those conducted by the Fed to assess the impact of COVID-19. The Fed modelled a series of alternative downside scenarios and assumptions which the event could trigger, assigning weightings and/or severities to them, a more open and dynamic approach than traditional stress tests.

- The last round of stress tests did not result in a correlation between robust test results and their ability to predict resolution events. This disconnect is easier to understand if we look at the rationale underlying the methodology that guides the tests:

- Firstly, the methodology is based on static balance sheet assumptions that are out of sync with either the second-round effects of banking crises, which can accelerate resolution events, or the mitigating actions the banks may take in the event of such episodes.

- Secondly, the tests do not address all risks which could be covered by means of additional scenarios run for reasons other than the severity of the macroeconomic projections. Specifically, they do not cover the business risk derived from the failure to deliver on business plans.

- Lastly, unlike the testing framework used by the Fed, the EBA takes a ‘bottom-up’ approach in which most of the assumptions used in the projections are made by the banks themselves, albeit in line with the methodological instructions. The bottom-up approach demands far more granular information, therefore requiring a significant workload. That approach ultimately renders the results less comparable from one bank to the next, making it harder to discriminate between healthy versus weak entities.

Following the criticism voiced by the European Court of Auditors regarding the stress tests’ fit for purpose, the rigour of the results and agents’ ability to use the tests to assess system resilience, the EBA has launched a public consultation with the aim of introducing improvements going forward.

The 2021 tests, which will be of extraordinary importance, will unquestionably require greater methodological rigour and more stable and realistic rules. This would enable a more succinct diagnosis of the European banks’ resilience while also providing a potential ‘siren call’ for pan-European banking consolidation to which the banks have turned a deaf ear until now despite the ECB’s insistence on this point.

The fact that it is the EBA itself that has invited debate about the weaknesses of the tests provides grounds for optimism. The tests are a key aspect of banking supervision and should be fundamental to bank management. Their impact on the alignment of capital with the risk assumed by the banks has been critical and the continuity of the tests must be assured in the medium- and long-term.

Notes

Scant profit margins and market capitalisations across much of the European banking sector have led the Single Supervisory Mechanism (SSM) to flag banks’ business models as a supervisory priority year after year.

Previously, the Committee of European Banking Supervisors (the ECB’s predecessor) had conducted stress tests in 2009 and 2011, albeit using far less sophisticated and uniform methodology than the EBA. In 2012, the Bank of Spain conducted stress tests encompassing banks representing 90% of the banking system’s assets against the backdrop of the Memorandum of Understanding entered into with the European Commission, the ECB and the IMF under the scope of the EU’s Financial Assistance programme.

EBA consults on the future of the EU-wide stress test framework. European Bank Authority (EBA), 22 January 2020.

The Fed uses a ‘top down’ approach in its stress tests, which means that the data, scenarios, assumptions and models are defined by the supervisor based on less granular banking information than that required of the European banks by the EBA.

Ángel Berges and Jesús Morales. A.F.I. - Analistas Financieros Internacionales, S.A.