The impact of ageing on the Spanish economy

Increased longevity in Spain will have important implications for society and the economy, specifically in the realm of labour markets, healthcare and pensions. These effects will only be problematic if accompanied by a failure to adapt economic, social and savings systems to the new reality.

Abstract: There is often times a distorted perception of population ageing in Spain and many other countries, which limits the scope for action to assess and address its real implications. Nevertheless, the considerable rise in life expectancy, coupled with the sustained drop in birth rates in many advanced economies, implies formidable challenges for many welfare state programmes, the job market and social dynamics in general. In Spain, these dynamics could result in a shortfall in labour supply in the medium term, especially in the under 44 age categories. In contrast, life expectancy increases alone, accompanied by a notable decline in the size of the overall population, should not necessarily put upward pressure on healthcare spending in Spain; expenditure is more exposed to other factors, such as expansion in the portfolio of services offered to the public, intensification of the use of technology and the cost of provision. Lastly, pensions in Spain, whether public or private, pay-as-you-go or funded, do face a sustainability and sufficiency challenge in the context of growing life expectancies, which will call for further reform efforts in addition to the meaningful measures already undertaken.

[1]

Introduction

There is a distorted perception about population ageing in Spain and many other countries. The anxiety over low birth rates leads many to believe that the lack of working-age people will render numerous social and economic systems unsustainable as the older generations of workers reaching retirement age are not replaced at a sufficient pace.

It is possible that this perception is not only wrong but also gravely damaging to the dynamism necessary in advanced societies in which life-style considerations and other ‘cost-benefit’ trade-offs are fuelling low birth rates. The source of such dynamism lies precisely in intelligent adaptation to the biodemographic phenomenon that complements birth rates: longevity.

Intense adaptation at the productive, social and savings-planning levels is necessary. Indeed, the failure to adapt will spell fulfilment of the fears of those who see growing life expectancy as a threat.

This short article addresses the general implications of increased life expectancy both in the absence of and in the event of such active adaptation. The article emphasises the vision that the phenomenon of growing longevity does not necessarily have to lead to some of the problematic consequences typically attributed to it. Focusing on Spain, the article addresses the huge life expectancy gains achieved over the last century and analyses the foreseeable implications on the labour, healthcare and pension fronts.

Ageing in the twenty-first century

Population ‘ageing’ is of concern in Spain and in the advanced economies as a whole. It is seen as a ‘problem’. In fact, the economic decline affecting key economies such as Japan is already being attributed to the ageing phenomenon (Adachi and Oki, 2015). There is broad consensus that pension systems, starting with ‘pay-as-you-go’ public pensions, will be the biggest victims, but that the healthcare systems, the job market and other social services will similarly be affected. From a sociological standpoint, it is also widely agreed that ageing is problematic for society dynamics in general. Only in the marketing field will you find a widespread belief that the ‘new consumers’ (read, the elderly) constitute a potential opportunity for companies offering goods and services to this segment of the population.

How would all these perspectives change if someone were to come out and say that ageing doesn’t exist? Is it possible to take such a stance in light of the apparently overwhelming evidence that our societies are ageing, and at an increasingly faster pace?

Yes, it is perfectly feasible. There is no denying that life expectancies have been increasing linearly for decades now with no apparent limit. However, what can be openly questioned is whether individual ageing should be measured exclusively by means of this indicator and with this interpretation.

The first section of this article argues that it is possible to interpret available data in such a way as to conclude that we, or society, are not necessarily ageing. Certainly, the individual perspective does not paint the same picture as the aggregate perspective (individuals as a whole), just as the longitudinal perspective (one individual, society as a whole over time) does not paint the same picture as a momentary snapshot (the whole at a given point of time). There are many ways, therefore, to use population science to approach the ageing phenomenon.

A common source of confusion in this line of debate relates to the biodemographic factors that result in population ageing: birth and mortality rates. Birth rates are very low in most advanced societies and no longer ensure generational replacement. Moreover, individuals are living longer and longer. Longevity is, in fact, the concept that tends to be confused with ageing.

It is generally accepted that a society in which longevity is not rising but the birth rate is falling is doomed to experience far more pronounced population ageing than a society in which longevity is also increasing. This is because increasing longevity is the result of an improvement in individuals’ health and living conditions over the course of their life cycles.

The progress made in terms of longevity and survival rates in the various age categories between the end of the nineteenth and beginning of the twentieth century was spectacular, all the more so considering that these gains evidence the human system’s superb ability to ‘compress’ morbidity at old ages for all individuals while shortening senescence, the phase of life during which the accumulation of functional and cognitive impairments leads to death (Vaupel, 2010).

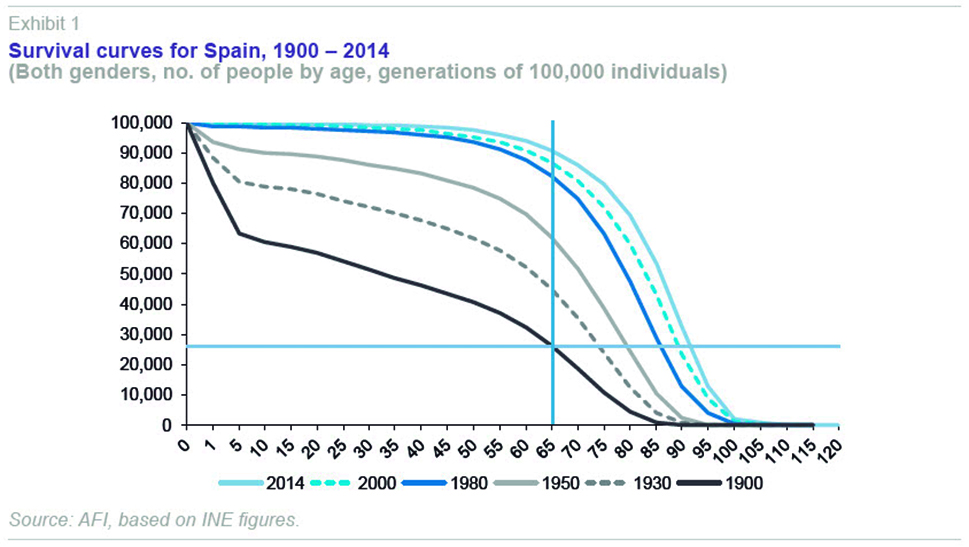

Exhibit 1 illustrates Spain’s survival curves between 1900 and 2014, as taken from the mortality tables compiled by the national statistics bureau, the INE.

[2] Each curve displays the number of people surviving from a generation of 100,000 individuals at each age until the age of 120.

This perspective is of the utmost interest. Infant mortality, which took the life of almost 40% of a generation in Spain in 1900 before the age of 5, is insignificant today. However, the trend in survival at all ages has been similarly spectacular. The exhibit has been used to zoom in on the historical barrier represented by the age of 65, used for over a century to mark the passage into ‘old age’, retirement, etc. At that age a horizontal line has been drawn that cuts the 1900 survival curve along with another vertical line cutting all the survival curves precisely at the age of 65.

By tracing these two simple lines, the reading of the above exhibit becomes very revealing in terms of how disorientating the ‘65 convention’ – given so much weight in all social and labour systems in all countries – is nowadays. Indeed, in 1900, less than 30% of a generation reached the age of 65. However, moving up the vertical line, we note that this percentage has risen to 90% today. Moving out along the horizontal line, meanwhile, we observe that almost 30% of today’s generations – the percentage of people reaching the age of 65 in 1900, is living until over the age of 90.

Turning to the mortality tables on which the above exhibit is based firmly corroborates these findings, while additionally yielding very valuable information about the ‘ageing’ process in Spanish society.

The pertinent question prompted by the information contained in the table below is: what is the ‘equivalent age’ today to 65 in 1900? The equivalent age concept requires additional nuances as it can be interpreted in several ways. Without having to get into greater complexity, however, the takeaways from the information in the table are quite clear.

Firstly, the age until which the same percentage of a generation that survived until 65 in 1900 survives today (26.18% for both genders) is 91. Moreover, the age at which one has the same life expectancy today as at 65 in 1900 (9.1 years for both genders) is 81. It is hard to imagine that the age equivalent to 65 in 1900 falls somewhere between 81 and 91 today; however, it is similarly hard to deny that an individual aged 65 today is substantially ‘younger’ than a person of that same age 50 years, let alone a century, ago. This notion is surprising given that the psychological barrier of 65, established over a century ago as the retirement age for the purposes of the then-incipient pension systems, continues to be used today to refer to old age and as the average benchmark for retirement and numerous other matters (discounts on public transport and other public and private services).

In short, the longevity considerations above illustrate the fact that mortality has been substantially compressed over the last century, a trend set to continue in the decades to come, triggering two phenomena loaded with repercussions: (i) most individuals will reach the age of 100 this century and most will suffer considerably shorter periods of senescence compared to today.

This has huge implications which our societies and their political representatives are rarely conscious of. Many of these implications are quite simply positive. Others are indeed problematic, although some less than might seem at first glance. In reality, the negative implications of so-called population ageing are problematic insofar as we refuse to adapt our economic, social and savings systems to increasing longevity which, at the end of the day, is very good news.

Implications for the labour market

Population ageing is particularly evident in the increase in the average age of the population, in turn driven by two factors: a longer lifespan coupled with a drop in birth rates to below mortality rates (or negative net migration rates). In the job market, however, the demographic trend is shaped by the inflow of people of a minimum age (the minimum legal working age) and their exit at an age which is generally well below the legal retirement age.

Against this backdrop, the impact of the birth rate is of particular importance many years after changes therein become evident, as is the corresponding rise in the average age of the labour force, since the drop in mortality and increase in life expectancy have not had any impact on any part of the working age spectrum for decades now.

The trend in the working-age population is, therefore, in the absence of changes in the legal retirement age, dictated exclusively by the net balance between those retiring and those embarking on their working lives, as well as by labour force participation at pre-retirement ages.

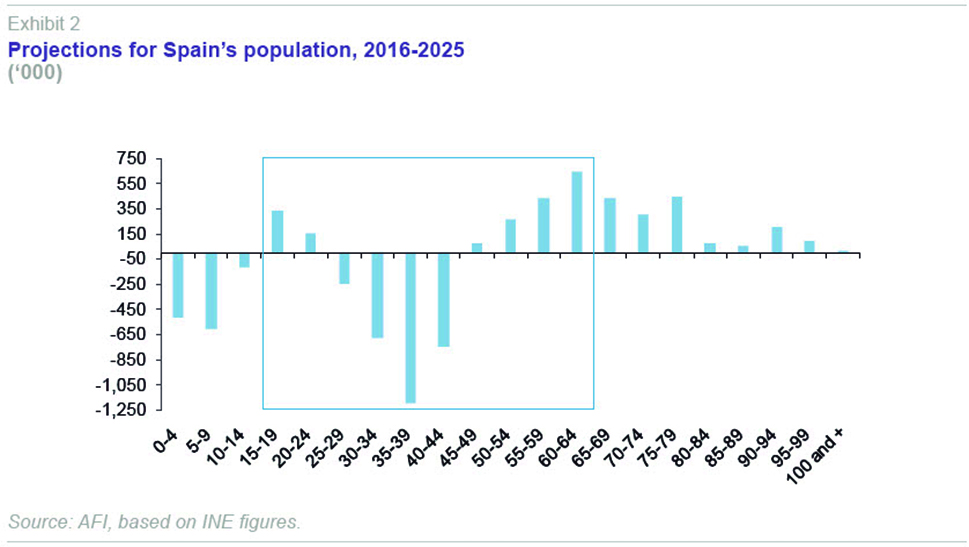

Exhibit 2 depicts the foreseeable trend in the working-age population in Spain over the next 50 years according to the most recent projections released by the INE. It shows that the working-age categories (within the box) are set to undergo substantial change: the number of people aged between 16 and 44 is expected to decline by almost 2.5 million, while the number of people aged between 45 and 66 is expected to increase by nearly 1.8 million, yielding a net reduction in the working-age population of 890,000 people.

The increase in the active participation rate (at ages 55 and over) will only partially mitigate the substantial decline in the number of people aged under 45. Today, the percentage of the population aged between 55 and 64 that is active in the job market stands at 57.64%. However, the active population in Spain is set to experience considerable ageing as well as severe contraction. This will not facilitate generational renovation across company workforces, nor their necessary adaptation to the digitalisation of the economy. On the other hand, it may bring much-needed relief to the calamitous unemployment situation, in all likelihood before the end of this decade. In any case, there continues to be huge potential for intelligent adaptation of the work force to the prevailing improvement in physical and other conditions of those, workers or not, aged above 50.

Implications for the healthcare system

As for the implications of ageing for healthcare systems, the predominance of the National Health System (public) in relation to total healthcare provision in Spain means that the debate regarding its sustainability is particularly intense and, frequently, focused on the outlook for healthcare spending in the face of population ageing. This perspective is based on the idea that ageing entails growing health and long-term care related requirements and that society must prepare for inevitably higher healthcare spending.

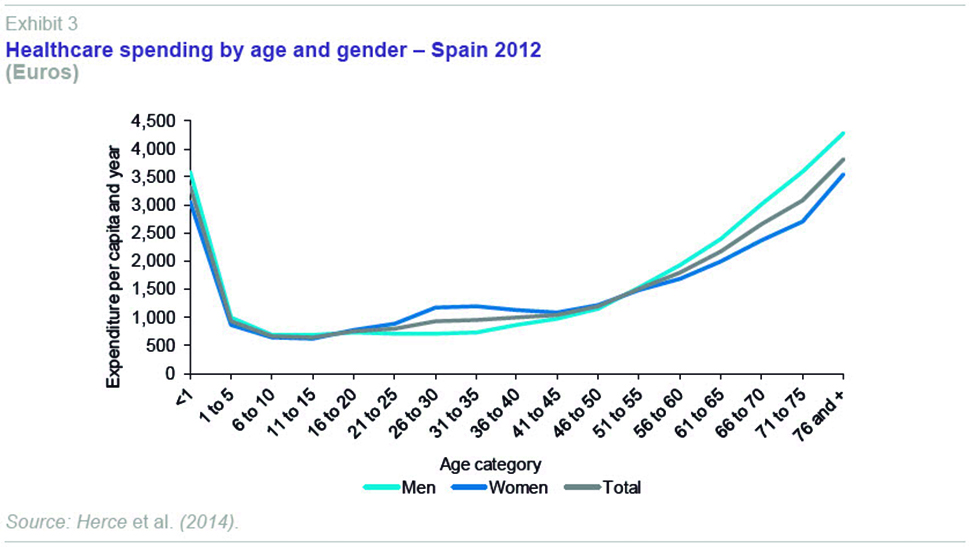

It is true that healthcare spending by age and gender presents a ‘J curve’ profile, as shown in the following exhibit, but this does not mean that a higher number of elderly people will necessarily send healthcare spending soaring or that any such growth will be linear.

Both the overall population (which tends to diminish as the average age increases) and the ‘package’ of services (healthcare, hospital services and long-term care) received by every healthcare system user are very important in determining total healthcare expenditure and tend to be neglected in spending sustainability analyses.

This trend, in itself, does not determine the bulk of healthcare spending, although it is certainly true that, all other things being equal, an increase in the number of people aged, for the sake of argument, 55 and over will drive an increase in aggregate health expenditure.

However, it is important to note that a longer life-span does not imply, as already noted (Vaupel, 2010), an increase in the senescence phase in which health problems intensify and long-term care needs increase. Indeed, the period of senescence is also expected to become shorter for all individuals, potentially at an accelerating pace.

Similarly, longer lifespans tend to be accompanied (albeit not a by-product necessarily of growing longevity) by contracting overall populations, implying reduced aggregate expenditure at younger ages when spending per person also tends to be higher.

Moreover, unlike in other welfare state programmes, such as pensions and all regimes under which monetary benefits are handed out, the healthcare system provides in-kind benefits (even when granted to patients in the form of vouchers) and growth in the use of these ‘bundles’ of services by users and the costs of their provision can be controlled in a variety of ways. To this end, it is vital for system managers to be on the same page as the healthcare professionals whose job it is to prescribe and provide the services in question to the population in order to control spending and keep the system working optimally.

Lastly, demand for healthcare services by each individual can be reduced considerably if the latter reduce their reliance on the system to the strict minimum and pursue healthy lifestyles, thereby preventing excessive use, or abuse, of the system.

These and other considerations make the healthcare system considerably less sensitive to population ageing than is commonly believed; in this context its sustainability should not prove an insurmountable problem. The projections for growth in healthcare spending in the context of growing longevity suggest that, indeed, this factor is not highly determinant and, moreover, is substantially mitigated by the decline in the number of inhabitants, particularly in relation to GDP, which is the metric which warrants tracking when analysing the sustainability of healthcare spending (Herce et al., 2014). Recent studies carried out by OECD economists similarly conclude that demographic factors (growing longevity and trend in population size) are in fact not the key drivers of overall healthcare spending (Maisonneuve and Oliveira-Martins, 2013).

Implications for pensions

Pensions are, without a doubt, the cornerstone of the Spanish welfare state and seen by analysts, experts, academics, the media and the general public as the most affected by population ageing. The age of 65, the psychological barrier alluded to at the beginning of this article, has for decades been the standing threshold marking the passage into retirement – that age at which one ceases to accumulate retirement rights or money and starts to reap their rewards.

Regardless of whether we are talking about a public or private pension scheme, a pay-as-you-go or funded regime, a defined benefit or defined contribution plan, they may all be seriously affected by growing longevity in the absence of significant changes to the retirement age, the contributory or savings effort during working years, the watering down of pension expectations or a combination of all of the above.

That being said. There are several caveats. First of all, it would be careless not to state that any delay in the start of working life and an increase in life expectancy against the backdrop of an insufficient increase in the retirement age is the worst of all worlds. This is so, on the one hand, because the period during which people pay into pensions or save is reduced. An increase in the number of years in education is fully recommended as life-spans lengthen; however, the age at which people are finding their first jobs is also increasing with respect to the already delayed age at which studies are terminated. On the other hand, the lengthening of life beyond the age of 65 implies more years receiving pension benefits.

The argument is that delaying the retirement age to 67 (effective in Spain from 2027 but not for all employees) will have the effect of increasing working lives and reducing the number of years in retirement. This is so, but only in part in light of the formidable rise in life expectancy in recent years and the telling ‘equivalent age’ calculations made above.

Obviously, nobody is suggesting adjusting the retirement age fully in line with these calculations. However, the Swedish parliament began to debate the possibility of pushing the retirement age back to 75 in early 2013. Meanwhile, it is common to see or hear debates about what age equates with the age of 60 or 65 a century ago. Most of these debates reference an age of 80 or even higher.

[3]

As is well known, in 2011 and 2013, the Spanish government ambitiously tackled pension reform in an attempt to address the consequences of growing longevity on the public system. The main measures contemplated in the first round of reforms included a phased-in increase in the legal retirement age from 65 to 67 to be completed in 2027 and a gradual lengthening in the pension contribution calculation period from 15 years today to 25 in 2023. The main purpose of the second round of measures was to introduce a new (annual) pension revaluation index in 2014 and the so-called sustainability factor, from 2019. Both have been amply debated and assessed (Conde Ruiz and González, 2013 and Conde Ruiz, 2013).

By and large, estimates suggest that the growing financial insufficiency of the public pension system will be mitigated by at least one-third with respect to the shortfall estimated before the two rounds of reform, thanks to the introduction of the revaluation index (with an annual reset floor of 0.25%); mitigation will be considerably higher if inflation settles at around 2% per annum in the medium and long term. Prior to the reforms, it was estimated that by the middle of this century, the public system deficit could exceed 6 percentage points of GDP, giving rise to accumulated Social Security debt roughly equivalent to GDP at that time. Today, the structural pension deficit stands at around 1.5% of GDP and it is believed likely that the Social Security Reserve Fund will be depleted by around 2020.

In the case of public pensions, which in Spain are financed using the pay-as-you-go formula and are structured as defined benefits, population ageing has a dual effect. Present and future pension spending is increasing as a result of growing life expectancy while income is falling due to the drop-off in the number of new system contributors in light of the decline in births and the negative net migration rate, as detailed in earlier sections of this report. These impacts will translate into less sustainable and/or insufficient pensions unless additional drastic solutions of the calibre already taken in Spain and elsewhere are implemented.

Growing longevity also affects, as could only be expected, private pension schemes, which are usually structured as funded regimes. In this instance, sustainability is not the issue insofar as most of these schemes are defined contribution plans and are 100% funded as required under prevailing law.

The issue then becomes one of sufficiency as the capital accumulated prior to retirement is exposed to financial risks (which can be mitigated) and, above all, longer lifespans, given that the capital saved and the returns thereon translate into smaller “annuities” that have to cover a longer period. This problem is no small one and is not easy to resolve as, beyond the realm of return variability and the fees levied on capital management and retirement income, the main risk lies with the fact that it is very hard to insure against longevity, at least at an affordable cost (Barr, 1989).

Nobody is prepared today for a scenario in which all individuals live until 120, the age which is currently, according to leading demographers, the limit to human life (Vaupel, 2010). However, if we are to believe certain claims, albeit headline-grabbing, the first person in documented history who will live until 150 has already been born, or so says Dr. De Grey, the scientist responsible for California’s Foundation Strategies for Engineered Negligible Senescence (SENS), which he co-founded in 2009.

[4]

Whatever the outlook for future longevity, financial markets and the pension industry will not remain idle, although it might be said that, as with the Social Security systems, they tend to be a bit off the mark.

Summary and conclusions

Just as we must acknowledge that ageing is a phenomenon often times erroneously perceived by society, analysts and policy-makers, which limits the scope for action to tackle real issues, we must also admit that the considerable rise in life expectancy, coupled with the sustained drop in birth rates in many advanced economies, implies formidable challenges for many welfare state programmes, the job market and social dynamics in general.

In the case of Spain, these dynamics could even drive a manpower shortfall in the medium term, demographically speaking (horizon: 2025), especially in the under 44 age categories. In contrast, if it were only for the increase in life expectancy, which will be accompanied by a notable decline in the size of the overall population, healthcare spending should not be especially affected in Spain; expenditure is more exposed to other factors such as expansion in the portfolio of services offered to the public, intensification of the use of technology and the cost of provision. Lastly, pensions, whether public or private, pay-as-you-go

or funded, do face a sustainability and sufficiency challenge in growing life expectancies which will oblige policy-makers to go beyond the already-meaningful reforms undertaken in recent years.

Notes

This article is partially based on a paper published by Fernández and Herce in 2009.

The survival curves relate to a fictional and synthetic generation of 100,000 individuals whose biodemographic characteristics represent those of real generations and are estimated based on observations regarding the breakdown of inhabitants and deaths at specific ages each year. This method is used to generate annual mortality tables without the need to gather survival observations from a real generation from when the first member of that generation is born until its last member dies. See

http://www.ine.es/metodologia/t20/t2020319a.pdf for more information about the methodology used by the INE to compile its mortality tables.

References

ADACHI, M., and G. OKA (2015), “Japan: Lessons from a hyperaging society,” McKinsey Quarterly, March, Downloadable at: www.mckinsey.com/insights/asia-pacific/japan_lessons_from_a_hyperaging_society?cid=mckgrowth-eml-alt-mkq-mck-oth-1503BARR, N. (1989), “Social Insurance as an efficiency device,”

Journal of Public Policy, Volume 9, Issue 01, January, pp 59-82.

CONDE RUIZ, J. I. (2013), “Los Retos del Factor de Sostenibilidad de las Pensiones: Presente y Futuro,” [The Challenges Posed by the Pension Sustainability Factor: Present and Future] FEDEA, December. Downloadable at:

www.fedea.net/wp-content/uploads/2013/conde-ruiz.pdf CONDE RUIZ, J. I., and C. I. GONZÁLEZ (2013), “Reforma de pensiones 2011 en España,” [The 2011 pension reforms in Spain]

Hacienda Pública Española / Review of Public Economics, 204-(1/2013): 9-44, Downloadable at:

www.ief.es/documentos/recursos/publicaciones/revistas/hac_pub/204_Art01.pdfDE LA MAISONNEUVE, C., and J. OLIVEIRA-MARTINS (2013), “Public spending on health and long-term care: a new set of projections,” OECD

Economic Policy Papers, Nº. 6, June. Downloadable at:

http://www.oecd.org/eco/growth/Health%20FINAL.pdfFERNÁNDEZ, J. L., and J. A. HERCE (Dirs) (2009), “Los retos socio-económicos del envejecimiento en España,” [The socio-economic challenges posed by population ageing in Spain], UNESPA, July, Downloadable at:

www.unespa.es/adjuntos/fichero_3009_20100125.pdf HERCE, J. A.; AZPEITIA, F.; MARTÍN, E., and A. RAMOS (2014),

The role of private insurance providers in the sustainability of the public healthcare system, Fundación Edad & Vida y Segurcaixa-ADESLAS, July, Downloadable at:

http://www.edad-vida.org/fitxers/premio/621Rol%20de%20las%20Aseguradoras_FINAL.pdfVAUPEL, J. (2010), “Biodemography of human ageing,” Nature,

Insight Review, Volume 464/25, March, Downloadable at:

www.nature.com/nature/journal/v464/n7288/pdf/nature08984.pdf

José A. Herce. Madrid’s Complutense University and A.F.I. - Analistas Financieros Internacionales, S.A.