Spain’s healthcare spending: Projections pre and post COVID-19

Analysis of healthcare spending patterns per capita by age and gender categories alongside demographic projections shows Spain’s healthcare spending will grow by over 10.83 billion euros between 2018 and 2030. While this increase in spending is necessary to bring Spain closer to international benchmarks, it will require an independent assessment to ensure the efficient allocation of funds.

Abstract: With EU fiscal rules frozen due to the COVID-19 crisis, the Spanish government has some scope to increase spending on health services, which has been low compared to peer countries. However, upward pressure on healthcare expenditure will likely extend beyond the pandemic. Analysis of healthcare spending patterns per capita by age and gender categories alongside demographic projections shows Spain’s healthcare spending will grow by over 10.83 billion euros between 2018 and 2030. However, this spending will not be evenly dispersed across Spain’s regions. One source of increased spending will be investment in healthcare technology, which will translate into constant average annual spending growth of 2.2%. Despite its already high ranking for health digitalisation initiatives, Spain is expected to allocate additional spending to enhance system interconnectivity, improve patient empowerment and prevent and monitor chronic conditions. Such e-Health initiatives imply a 1.5% increase in estimated health expenditure. Other areas requiring additional spending include recruiting and retaining healthcare workers as well as the expansion and upgrading of healthcare technology. The likely consolidation of those higher spending levels in the future needs to be framed by criteria related to efficiency, value creation and programme assessments (spending reviews). An independent assessment is the only way to ensure that the additional funds injected help to build a more favourable position for responding to potential future health emergencies.

Introduction

The analysis presented in this paper began before the onset of the pandemic and was aimed at assessing the impact of demographic projections on healthcare spending between now and 2030, leaving all other factors constant, at the national and regional levels. Relying solely on a demographic scenario, the variability of other key factors, such as technology and its impact on expected spending, was incorporated at the end of the projection horizon (complementary scenario). Although the activation of the Stability and Growth Pact escape clause has put the previously established budget consolidation roadmap temporarily on hold, a gradual return to the stability targets for deficit, debt and public spending is expected.

The conclusions reached in the demographic analysis combine the current population projections by age and gender categories with the patterns in healthcare spending per capita in each bracket. The findings confirm that demographics are not the main source of pressure on healthcare spending in terms of GDP. This source of pressure will, however, be relatively higher in regions with an estimated differential increase in the older segments of their populations.

That said, the pandemic has altered these projections radically for 2020 and possibly for all of 2021, too. One aim of the sizeable amounts of non-reimbursable state funds earmarked for the regional governments is to cover emerging healthcare and education spending needs during these two years. However, it is unclear how long this additional spending will last and what scope it will take. The impact on spending in the medium-term will depend on the sources of upward pressure on the key expenditure headings in response to the COVID-19 crisis. These include the review of public health system staffing and remuneration, system digitalisation and the reinforcement of the public health function. It will also depend on the opportunity the regional authorities have to attract additional funds via the Recovery and Resilience Facility (RRF) and REACT-EU schemes. It is likely we will see an increase in the level of healthcare spending as a percentage of GDP that warrants the recalibration of the Spanish stability rules and regulations.

Healthcare spending scenarios and expected impact of the pandemic in the medium-term

The COVID-19 pandemic has highlighted the scale of the resources needed to handle exceptional demand for essential services, particularly healthcare services. One of the first decisions taken by the Spanish federal government during the first half of 2020 was the authorisation of an extraordinary 16 billion euro fund for the regional governments (the COVID-19 Fund) to support regional governments in their response to the crisis. Of the total, 9 billion euros covered healthcare needs and 2 billion facilitated the adaptation of education services. As the crisis has yet to abate, the general state budget for 2021 contemplates similar measures. Specifically, the budget envisages additional extraordinary regional funding of 13.47 billion euros. Moreover, the regional governments are given greater room for fiscal manoeuvring by easing their deficit targets to 1.1% of GDP, framed by the temporary suspension of the fiscal rules. However, the sources of regional funding do not stop there. Regional governments will have access over the coming years to the European funds channelled via the Recovery and Resilience Facility (RRF) and REACT-EU initiative.

[1]

The new world order being forged by coronavirus necessitates reflection on the sufficiency of healthcare spending. Until relatively recently, the OECD was focused on the risks to fiscal sustainability associated with a return to pre-crisis health spending growth rates. According to projections drawn up in 2019, the OECD

[2] forecast average annual growth in total health spending per capita across all OECD countries of 2.7%, compared to average estimated GDP growth of 2.1%.

Given the demographic challenge facing the Spanish economy, the initial interest focused on calibrating the scope of that impact on the outlook for social spending and, above all, determining whether that outlook, which has been dubbed the “pure demographic” scenario, could jeopardise delivery of the fiscal rules and to what extent the outlook varies from one region to the next. In the specific case of health spending, the technology factor is incorporated to arrive at a more realistic proxy. With the onset of the pandemic, it is necessary to go one step further and factor in the expectations for the consolidation of public health spending at structurally higher levels.

Drawing up health spending projections based on per capita spending curves by age and gender

In the health arena, the main studies used in the preparation of these health spending projections rely on a combination of: (i) health spending patterns by age and gender categories that are constant over time; and, (ii) demographic forecasts based on various scenarios.

[3] [4]

That was the basic approach used for these spending projections in a “pure” scenario, in which spending is driven exclusively by forecast demographic trends. To compile those projections, per-capita spending curves are estimated for each of the three key components of health spending: specialist and hospital care; primary care; and pharmaceutical spending (prescriptions).

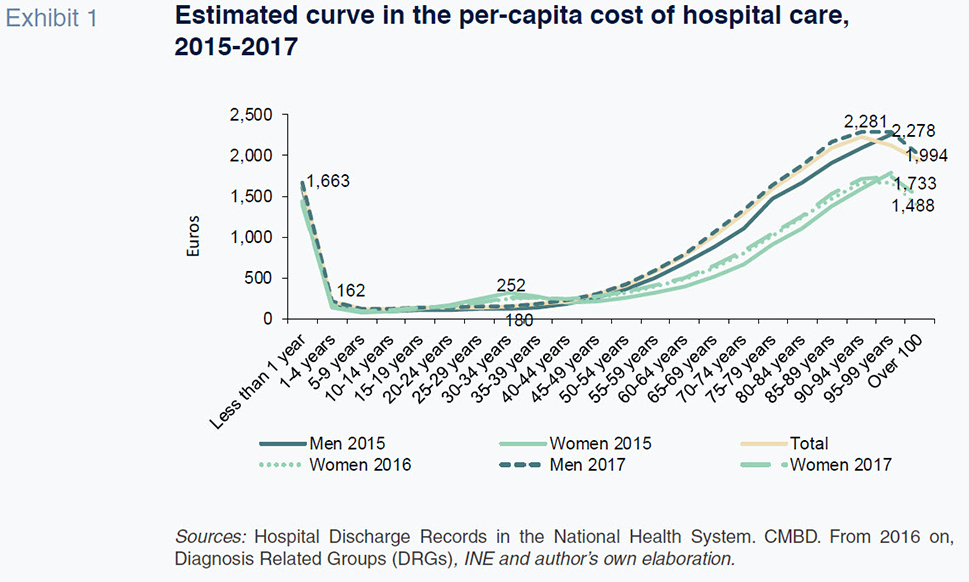

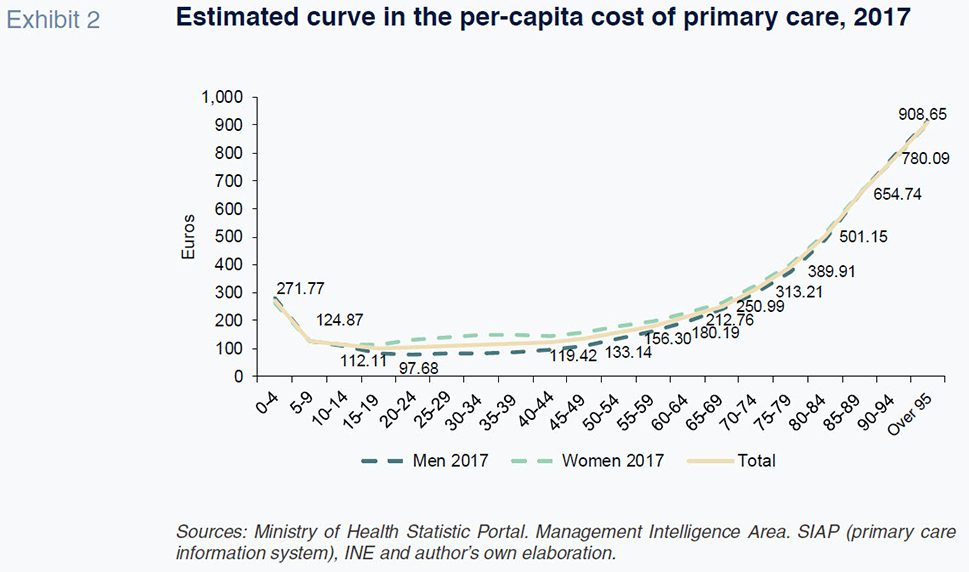

The per-capita spending curves obtained for each component in Spain take the form

[5] of J-curves, in which spending is high during the first year of life, after which it falls sharply. From the age of 49, spending starts to gradually rise, with the growth in hospital care expense far more pronounced among men.

[6]

Having estimated the patterns in spending per capita by age category and gender, it was then possible to layer in the demographic projections of the Spanish National Statistics Institute (INE) by region until 2030 to obtain results for the expected growth in total health spending due exclusively to demographic trends.

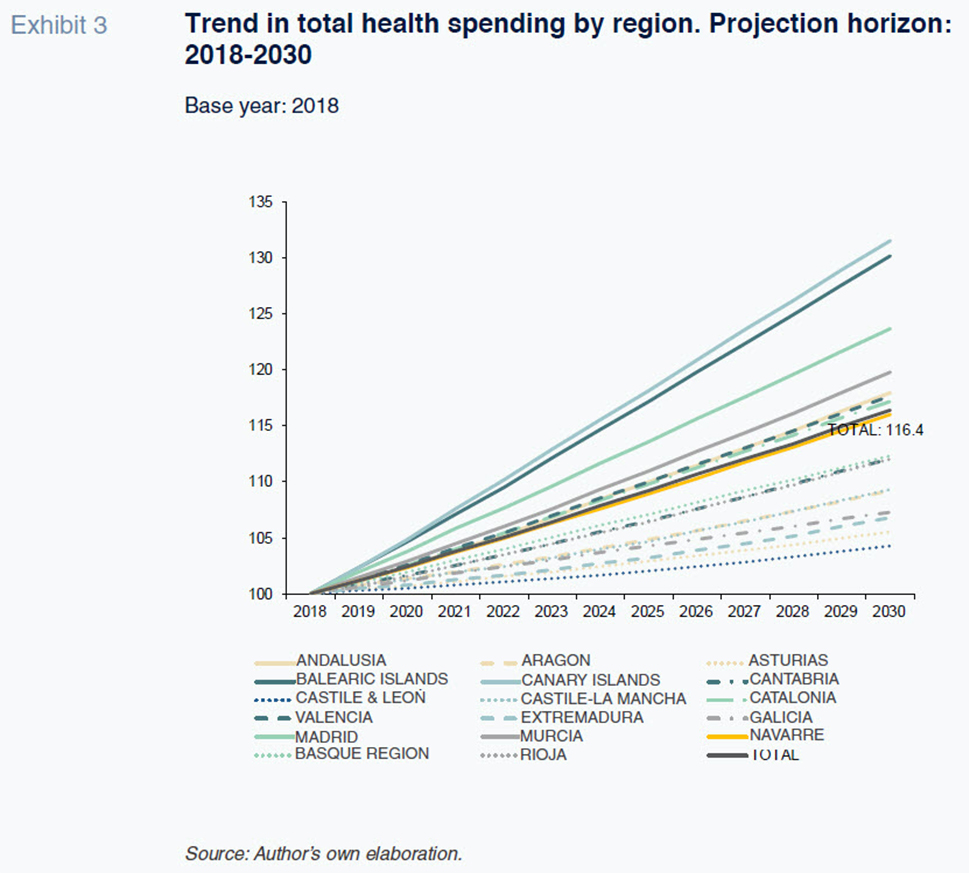

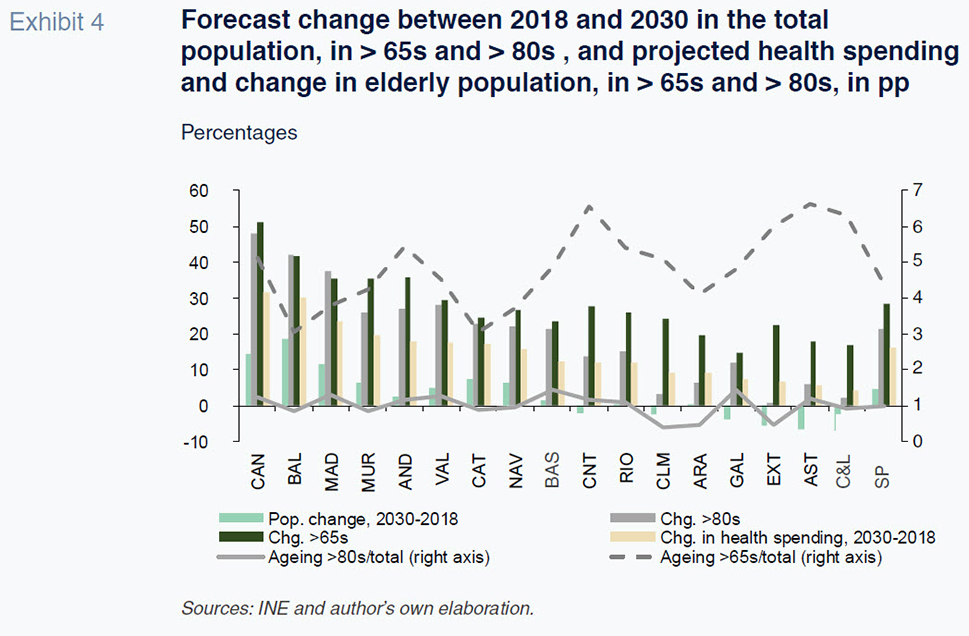

The resulting overall healthcare spending projections point to growth, driven exclusively by demographic trends, of over 10.83 billion euros between 2018 and 2030. On average, cumulative growth amounts to 17% by the end of the period, translating into annual growth of 1.27%. If we assume growth in real GDP that is minimally higher in the coming years, population ageing will not on its own drive growth in spending as a percentage of GDP.

In terms of the breakdown by region, the results point to an uneven trend in healthcare spending, with a gap between the fastest and slowest growth regions of over 22 percentage points during the 12 year projection period. The regions expected to experience the greatest pressure on spending for demographic reasons are the Canary and Balearic Islands, with cumulative growth of over 30% with respect to the base year, followed by Madrid at 24%. Those regions are expected to experience sharp population growth relative to other regions, particularly in the older age brackets (> 65s and > 80s). At the other end of the spectrum, regions such as Castile & Leon, Asturias, Extremadura and Galicia are expected to see far lower growth rates that are significantly below the regions’ projected rise in GDP.

Adding the technology factor into the purely demographic mix

As we have seen, demographic trends on their own are not expected to prove a source of upward pressure on health spending as a percentage of GDP in aggregate terms. Instead, other factors affect that growth more significantly.

Among these factors, health technology deserves special attention. Some authors have shown that it does not have a simple and unidirectional effect on health spending. In fact, although there are technologies that can save costs, such as telemedicine, there is a broad consensus in the health economics literature that health technology leads to, on aggregate, an increase in spending. The OECD has recently compiled different estimates of this impact on health spending and concludes that technological change could explain an annual increase of 0.9%. Given its significance, the technological factor, together with the demographic structure and prevalence, are the main determinants of this growth in spending.

[7]

Adding in the technology factor boosts the forecast growth in health spending to almost 30% over the starting level of 2018, which translates into constant average annual growth of 2.2%. Using those growth estimates, in a scenario of pre-pandemic fiscal rules, the spending rule

[8] would be breached in nearly every region. Had the pandemic not occurred, it is likely that health spending would have increased on account of both factors by just under 0.3 percentage points of GDP. That increase is, however, highly variable from one region to the next. In the Balearic and the Canary Islands, the projected increase would exceed one percentage point, whereas in others, such as Galicia and Castile & Leon, spending would not increase in terms of GDP.

[9] However, COVID-19 has altered those initial estimates due to the shock inflicted during the most critical years of the pandemic (2020 and 2021) and the likelihood that post-pandemic dynamics will result in structurally higher spending levels in the medium- and longer-term.

An estimation of the possible impact of the pandemic on health care spending

Although it initially looked as if the extra health spending needs might prove temporary, the duration of the health emergency, small budget allocations, and the urgency of speeding up the digitalisation of health services are raising expectations for spending in the years beyond the pandemic.

While the health emergency has highlighted the vulnerability of the system in times of crises, the health centers have also demonstrated their notable strengths during the crisis. These include a compelling capacity for organisational adaptation; flexibility and versatility in managing available resources; and, the ability to modify routines and protocols and to adopt new solutions, innovations and ways of cooperating in a short period of time.

[10] However, that organisational success has not stopped certain structural cracks from appearing. According to the European Commission (EC), the Spanish health system had offered good health outcomes until now despite a relatively low level of investment.

[11] In signalling the system’s weakness, the EC pointed to investment in physical infrastructure and shortcomings in the recruitment and working conditions of healthcare workers.

The strain placed on the system has revealed that hospitals were not prepared for a shock of this calibre given their capacity, available infrastructure or their production capabilities. As for staffing, the pressure was concentrated initially in the hospitals but later spread to the primary care system, which already entered 2020 in a fragile state and with diminished appeal for new professionals.

[12] The pandemic also highlighted the need for improvement in areas of lesser significance, such as coordination of medical and social care and, above all, the need to reinforce the functioning of public healthcare (preventive medicine) in order to better prepare for possible future shocks.

The prevailing situation points to demand for new resources to address pandemic-driven healthcare needs and to pave the way for a convergence towards international benchmarks. However, increased spending alone does not necessarily generate the desired impacts in terms of value. It is also important to make further progress on operational efficiency and management, an area in which some of Spain’s neighbours have already embarked,

[13] alongside enhanced evaluation of interventions, programmes and public policies. In a context of freely flowing European funds and expansionary budgets, it is important to ward off the risk of introducing ineffective programmes.

[14]

Framed by those forces, the likely scenario is a “policy of reinforcing” health care spending that will increase the end projections

[15] via anticipated upward pressure on certain headline spending categories.

E-Health development

E-Health has been a cornerstone of the digital transformation for several years. Its associated benefits include: electronic health records; data analytics and big data as a foundation for the integration of artificial intelligence and machine learning; telemedicine; telecare; mobile devices for monitoring and controlling physiological parameters; and e-commerce for pharmaceutical and health products (m-Health). The pandemic has shined an even brighter light on the potential implied by these applications. Indeed, healthcare digitalisation is part of the universe of objectives enshrined in the Digital Spain 2025 Agenda.

Spain boasts a long track record in health digitalisation. It ranks favourably internationally, thanks especially to its electronic health record development and the provision of certain services online.

[16] Bertelsmann Stiftung’s Digital Health Index awards Spain a score of 71.4 out of 100, which places it near to the top of the table, not far behind leaders like Estonia, Canada and Denmark. In overall terms, though, the digitalisation effort remains far from complete, with enhancing system interconnectivity a particular concern.

Spain could also improve patient empowerment, with a particular focus on the prevention and monitoring of chronic conditions, many of which are associated with ageing. The aim is to facilitate more active patient participation by means of easy access to the contents of their electronic health records and to encourage them to provide information. This would have the added benefit of also detecting their healthcare needs sooner. There is also a need to continue to make progress on the availability of enhanced remote functionality in respect of medical care, along with other advances enabled by mobile devices and apps (m-Health).

[17]

Nevertheless, the available international comparisons do not factor in some of the major advances made in recent years, such as the 2019 implementation of the Interoperable e-Prescription scheme

[18] or the creation at the end of 2020 of a General Secretariat for Digital Health, Information and Innovation within the National Health Service, to which the latter’s departments of digital health and IT systems will report.

Having analysed the situation and the objectives still to be achieved, the next step is to attempt to quantify the amount of public funds that will be earmarked to health digitalisation and the potential convergence timeline for attaining the targets that have been set. A report issued by the COTEC Foundation for innovation whose title translates as

Digitalisation in Health. Digital medical records as the driver of healthcare system transformation [19] reveals that in 2017, Spain earmarked 696 million euros to health information and communication technology (0.06% of GDP). That figure is a mere 1.2% of the overall healthcare budget, which is significantly behind the investment levels observed in the countries at the forefront of digital transformation, which invest roughly 2-3% of their public health budgets in technology.

[20] [21] [22]

Targeting investment in e-Health of 2.5% of the public health spend (the average for the subset of benchmark countries) would imply an increase of almost 1.5% in estimated healthcare expenditure. An effort of that scale would have increased spending by 1.07 billion euros

[23] in 2018.

Recruitment and remuneration of health workers

The need to take immediate steps in this arena was set down in the Ruling by the Committee for Social and Economic Restructuring, which included the reinforcement of human resource policies as a priority issue. Among the various lines of action, it underscored the need to introduce professional planning and development policies at the National Health Service level and to roll out a specific human resource plan for improving remuneration. Against that backdrop, a scenario of reinforcement along two dimensions emerges: (i) expanding the density of health professionals; and, (ii) enhancing remuneration policies.

Again, taking international benchmarks as our reference,

[24] the most noteworthy difference arises in the density of nursing personnel, which stands at 5.9 in Spain, in contrast with over 10 in Denmark, France, the Netherlands, Ireland and Germany. In contrast, in terms of medical doctors per 1,000 inhabitants, Spain is much closer in line with the EU frontrunners.

To estimate the need for practitioners in the years to come, the conclusions reached in the paper whose title translates as

Estimation of supply and demand for specialist doctors. Spain: 2018-2030 [25] is of particular interest. In its baseline scenario, the authors forecast growth in demand for specialist practitioners of 8.9% between 2018 and 2030.

[26] Using their growth estimate through to 2030, and assuming that all vacancies are covered in full, the Spanish healthcare system will need 13,291 additional practitioners

[27] during that time horizon, which would translate into average annual growth of 0.71% from the base year.

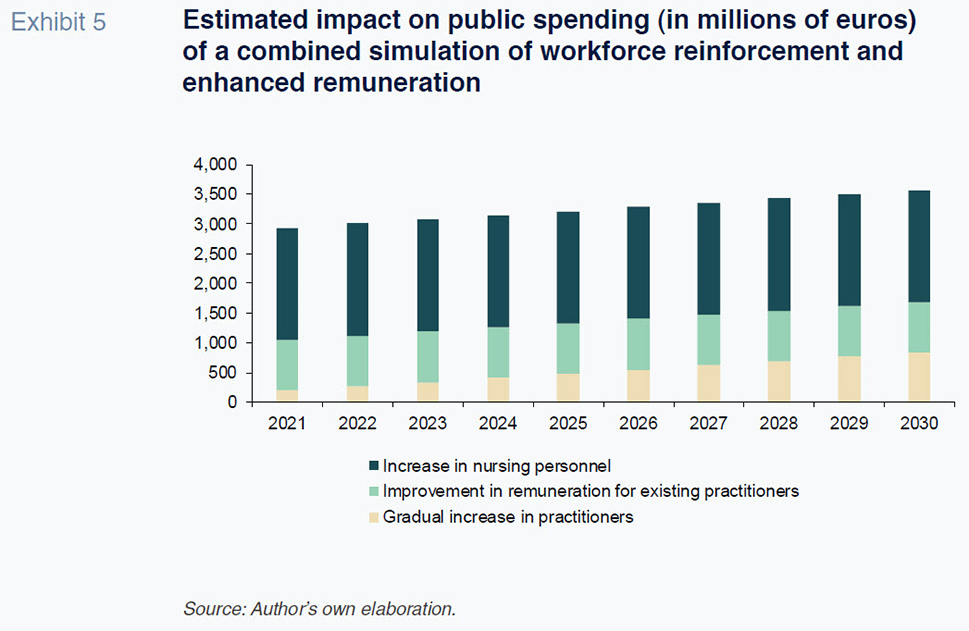

To quantify the expansion of the healthcare workforce it is necessary to address the remuneration question in order to create the incentives needed to reduce emigration rates of healthcare professionals. The OECD publishes data about the relationship between the remuneration earned by medical practitioners and the average wage in each country. Spain ranks below the international benchmarks, such as Portugal and Denmark, where the ratio of medical professional salaried income to the country’s average wage averages 2.7/2.6. That dual effort–healthcare workforce and remuneration– could imply an additional budget allocation ranging from 1 billion euros in 2021 to almost 1.7 billion euros at the end of 2030.

Lastly, the staffing shortfall issue is most notable in the case of nursing personnel from a comparative standpoint. Spain presents a density of just 5.9 jobs for every 1,000 inhabitants, in marked contrast with the readings for Norway, Finland, Ireland, Denmark and the UK. Looking to 2030, assuming a target density of 7 nursing jobs for every 1,000 inhabitants, the workforce will increase by 1.1 for every 1,000 inhabitants. The impact on public spending of that measure would be 1.88 billion euros, assuming the average earnings estimated for 2020. In sum, the potential upward revision of public health spending in the medium- and longer- term in the wake of the pandemic suggests an overall increase in healthcare expenditure of 3.5 billion euros in 2030, equivalent to 0.27% of real GDP.

Reinforcement of the functioning of public health (preventive medicine)

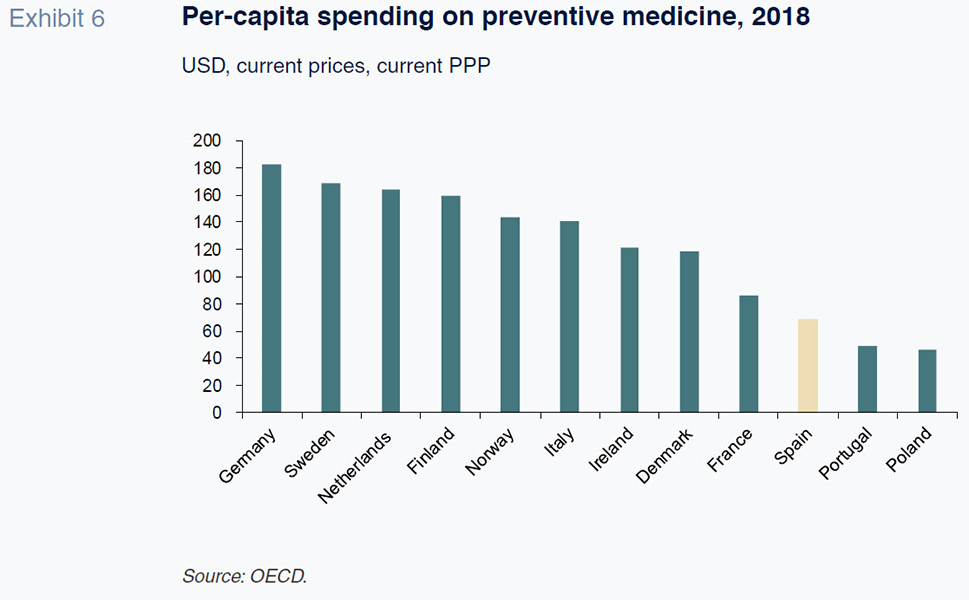

Another weakness of the National Health Service highlighted by the pandemic is the insufficient development of the public health, or preventive medicine, function in relation to other European countries. In Spain, expenditure on preventive medicine is virtually negligible, accounting for just 1.1% of the total health spend. [28] Notably, the WHO and OECD have for some time been urging nations to reinforce areas such as preventive medicine, the promotion of healthy habits and the monitoring and prevention of chronic diseases, which are especially important in the context of an ageing population and longer life expectancies.

By comparison with other countries, Spanish spending on preventive medicine

[29] ranks towards the bottom in per-capita terms at constant prices and purchasing power parity. Countries such as Germany, the UK, Sweden and Italy spent more than twice as much as Spain on preventive medicine per person

in 2018.

Given the distance between Spain and the top-ranked countries, a minimum target could be to at least double allocated public funds. The public cost incurred at the regional government level

[30] (as recorded in the satellite public health spending account for 2018) amounted to 668.5 million euros. Doubling the regional government allocation would increase the budget by 0.056% of nominal GDP (base year: 2018).

Expansion and upgrade of high-tech health equipment

The assessment of the need for investment in high-tech health equipment in Spain in the coming years is based on the conclusions reached in the report corresponding to the second phase of the Spending Review by Spain’s independent fiscal institute, AIReF, Hospital spending of the National Health System: drugs and investment in capital goods which discusses the need to expand and upgrade the stock of high-tech hospital equipment. The available data suggest that investment in national health system hospital high-tech equipment amounted to 320 million euros in 2018, 0.5% of the total health spend, divided almost evenly between the purchase and maintenance of equipment. That is a very insignificant percentage of total health spending, particularly considering the importance of technology to health outcomes and cost savings. The report draws three main conclusions:

- Spain ranks relatively poorly in terms of equipment per inhabitant by comparison with the OECD average.

- The stock of medical imaging equipment installed in Spain is more obsolete than the European average. COCIR [31] data suggest that approximately 40% of the equipment installed in Spain is over 10 years old. [32]

- However, the intensity level or use of that technology in Spain is low, particularly in CAT scanners, gamma cameras and mammography devices, with marked differences from one region to the next.

AIReF recommends embarking on a strategy for investing in high-tech equipment so as to facilitate convergence between the Spanish national health system and the European average in terms of funding and modernisation. Assuming the replacement of the equipment that has exceeded its useful life and convergence towards the OECD average in terms of equipment per million inhabitants, estimates of investment in 2018 and 2019

[33] stand at around 608 million euros, with 299.5 million euros going to upgrades and 308.8 million going to new equipment. Nevertheless, the post-pandemic paradigm may imply a significant incentive for generating the related plans and responses against the backdrop of a joint governance framework, such as that proposed in the Social and Economic Restructuring Committee’s findings.

Conclusions

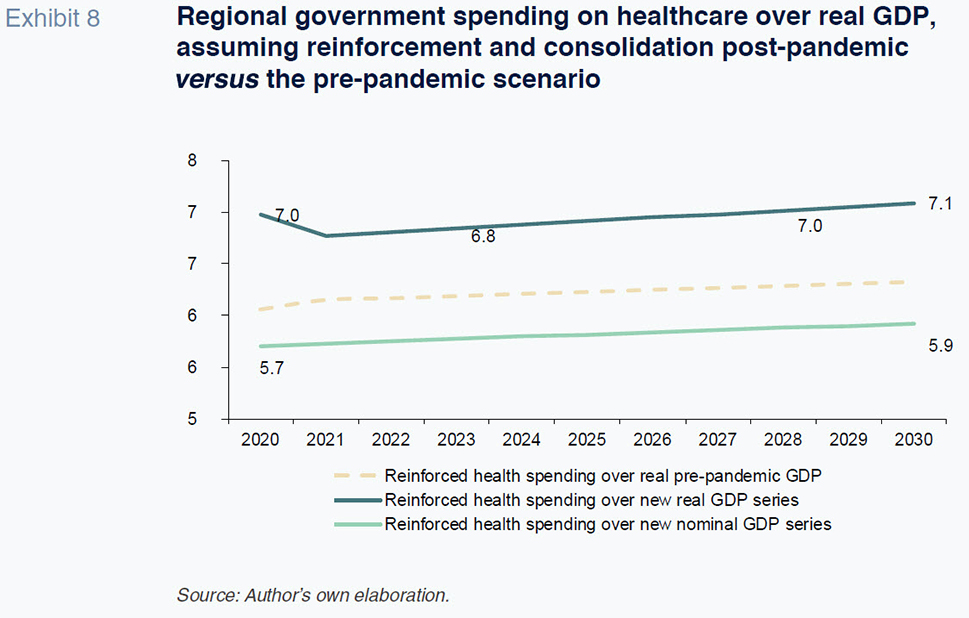

This paper models the potential public health spend in Spain between now and 2030 in light of forecasted demographic trends, an acceleration of the digital transformation and consolidation over time of structurally higher spending in order to reinforce specific functions and policies deemed critical during the pandemic. In sum, the pending targets modelled for each of the aspects itemised above total 5.13 billion euros in real terms, which is approximately 7.4% of estimated real expenditure without considering the pandemic. The new health spending paradigm in terms of real GDP will be conditioned not only by the growth anticipated in non-financial expenditure, but also the base effect derived from the significant GDP contraction triggered by the pandemic. As indicated in Exhibit 8, the level of spending over real GDP is set to increase by a very significant 1.3 percentage points

[34] and will stay at close to 7.1% until 2030,

[35] which is equivalent to 1.2 percentage points more than that estimated in a pre-pandemic model. Such an increase in health spending in terms of GDP would realign Spain with the international context in relative terms,

[36] nudging it potentially slightly above the OECD average.

The pandemic has highlighted the need to bring Spanish health spending per capita in line with the EU average in order to better prepare the country for responding to the economic sustainability challenge. The temporary freezing of fiscal rules in 2020 and 2021 gives the government some scope to increase spending levels without breaching rules, particularly the spending rule, which limits growth in spending to the rate of growth in potential output. The likely consolidation of those higher spending levels in the future needs to be framed by criteria related to efficiency, value creation and programme assessments (spending reviews). A realistic outlook for health spending, which adds the digitalisation factor into the demographic mix, warrants thinking about essential service management and the implications for budget sustainability.

Notes

These funds are designed to facilitate the transformation of the Spanish economy, the goals for public sector digitalisation and primary care reinforcement set down in the REACT-EU scheme, which will undoubtedly have a significant impact.

OECD. Projections of health expenditure. Health at a Glance 2019. Lorenzoni, L. et al. (2019). Health Spending Projections to 2030: New results based on a revised OECD methodology. OECD Health Working Papers, No. 110. OECD.

This study relies on the projections compiled by Spain’s national statistics office, the INE, for each region, to 2030.

A key source was the study published by Ahn, García and Herce (2005).

A common health spending pattern was used for each region.

Different sources of information are used to estimate the spending patterns for each component. In the case of hospital care, there is a database that enables the correlation of incidence (number of cases diagnosed) of each disease or hospital “product” by age category with the average cost. That information is taken from the Diagnosis Related Groups (DRGs).

Specifically, the so-called Hospital Discharge Records in the National Health System. CMBD. From 2016 on. Diagnosis Related Groups. That database provides a statistical proxy for the unit costs associated with each product. Therefore, a single cost pattern is used and the regional trend inferred by layering in the various population projections, then applying those forecasts to spending levels in the base year for each component of health spending region by region.

Other factors for consideration include prices, income and GDP.

Drawn up in real terms with pre-pandemic data and formulated for this exercise in a cumulative manner with respect to the estimates made for each year.

Note that the INE’s projections point to declining populations in those regions.

Antares Consulting. (2020). European health systems in transformation. Ideas to promote a change in Spain. January.

Council Recommendation on the 2020 National Reform Programme of Spain and delivering a Council opinion on the 2020 Stability Programme of Spain. May 5th, 2020.

Conference titled Retos actuales y post-COVID para el Sistema Nacional de Salud [Present and post-COVID challenges for the national health system]. Tribute to Ernest Lluch at Barcelona City Council. November 27th, 2020 Beatriz González López-Valcárcel.

Antares Consulting (2020). European health systems in transformation. Ideas to promote a change in Spain. January.

Beatriz González López-Valcárcel Conference. November 2020.

For this part of the analysis, projections are run for the regions as a whole.

A description of how to implement a nationwide system of patient summaries, e-prescriptions, online appointments and patient portals was included in the so-called Plan Avanza 2 (2009-2015).

Mobile apps for the provision of routine services.

That initiative means that all of the regional governments can generate e-prescriptions that can be filled in other regions.

COTEC Foundation for Innovation. Digitalización en Salud. La Historia Clínica Digital como motor de transformación del sistema sanitario.

SEIS (Spanish Society for Health IT) (2015).

Measured in terms of total real public spending in Spain in 2017, it accounts for 0.96%.

The statistics available about public spending on e-Health by country are very limited. Italy is one of the few countries to have published information in this respect. In 2020, public spending on e-Health amounted to 1.62 billion euros, equivalent to 0.08% of GDP and 1.3% of the public health spend.

Calculated as a percentage of total healthcare expenditure regardless of the level of government at which it is incurred. For the purposes of our impact calculations, we assume that the regional authorities would manage 92% of the additional expenditure, i.e., around 981 million euros.

The international comparisons of healthcare workforces for both general practitioners and nursing should be limited to the national health systems that are financed from general taxes and offer universal coverage (the Beveridge model): the UK, Italy, Scandinavia and Spain (refer to the Funcas blog post by Félix Lobo titled ¿Qué sistemas sanitarios están mejor preparados para responder a la COVID-19?, which translates as Which health systems are best prepared to respond to COVID-19?)

Revised edition (January 2019) of Estimación de la oferta y demanda de médicos especialistas. España 2018-2030. Written by Barber Pérez P. and González López-Valcárcel B. from the Health Economy Team at the University of Las Palmas in Gran Canary Island.

Demand would increase in line with the demographic forecasts modelled by the INE, while supply would be partially conditioned by a concentration of retirements between now and 2024, contracting 1.2%.

Using data published on the Ministry of Health’s Portal — Health in Figures, in 2018, it was reported that 149,342 medical practitioners were working for the National Health Service, of whom 24% were assigned to primary care, with the rest in hospital care, A&E and specialist training.

However, it is a budget allocation that involves the three levels of government in Spain: central, regional and local.

The terms public health and preventive medicine are used interchangeably.

Our approach has been to focus on the impact on regional spending. However, the public health effort should be reinforced at all levels of government.

COCIR is the European Trade Association representing the medical imaging, radiotherapy, health ICT and electromedical industries.

Medical Imaging Equipment. Age profile and density. Ed. 2019.

The two years in which the investment requirement numbers were run by the AIReF.

Which tends to decline sharply due to the forecasts for economic recovery in 2021.

Recall that the numbers are limited to regional health spend and do not factor in the areas managed by the state and local governments, which would push the total higher.

Per inhabitant, the impact would be lower and the repositioning more moderate.

Susana Borraz. A.F.I. - Analistas Financieros Internacionales, S.A.