New forms of investor activism and the shift in market outlook

The emergence of ‘populist activism’ best exemplified by the volatility in GameStop shares is distinct from previous forms of shareholder activism and entails risks for both institutional investment funds and retail investors. While Spanish regulators believe existing laws would render such activity illegal in Spain, other potential sources of volatility this year could still pose risks for financial markets participants.

Abstract: In the wake of the financial crisis, new financial market trends have emerged such as the disconnect between financial signals and the real economy, the accumulation of bargaining power in certain investment arenas, and the impact of shareholder activism on corporate governance and valuations. Although shareholder activism has traditionally been more prolific in the US, the percentage of campaigns launched in Europe has been on the rise, prompting responses by both governments and corporations. More recently, a novel form of shareholder activism has developed, coined ‘populist activism’, which differs from traditional shareholder activism in terms of liquidity and suitability for retail investors. Perhaps the best example of this new investment activity is the purchase of GameStop shares by retail investors coordinating over Reddit. These actions had unforeseen consequences for both the retail investors who may have lacked the knowledge to properly assess their risk-taking as well as for institutional investment funds. While Spanish regulators believe that existing laws would make such collaboration illegal in Spain, there are other areas of potential risk for financial market participants such as an uptick in inflation and pressure on the bond market, which will warrant close attention throughout the second half of this year.

Introduction: Markets, real economy and activism

The pandemic has been a watershed moment for the securities markets. Before the onset of COVID-19 there were already signs of change in the structure of the fixed-income and equity markets and their related trading patterns. Following several months of uncertainty due to lockdowns, rising infection rates, and the vaccination effort, four of those transformational changes are re-appearing. Firstly, it is relatively hard to connect financial signals with the real economy, as several factors point to a certain divergence between the two. Secondly, bargaining power is accumulating in certain investment arenas and algorithmic automated trading is gaining ground. Thirdly, there are growing signs that shareholder activism is altering corporate governance and company valuations, not only in the US but also, increasingly, in Europe. Fourthly, new forms of investing are emerging, such as that coined “populist activism”, which has implications that are difficult to calibrate.

Regarding the distinction between the equity markets and the real economy, academic theory holds that the markets predict economic performance. This means that there are phases during which financial markets’ performance does not coincide with that of the the macroeconomic aggregates they purport to anticipate. Although markets currently predict that the economy will recover once COVID-19 vaccinations become widespread, we are seeing swings and valuation differences across sectors that often appear decoupled from fundamentals. One of the explanations for this phenomenon is the abundance of liquidity, which is driving investors to switch between high risk investing to excessive caution in very short time spans, fuelled by rumours and fleeting opportunities. These trading patterns have affected the valuations of pharmaceutical companies as well as cryptocurrencies, such as bitcoin. It is worth noting, however, that the proliferation of so-called fat tail risks (pandemics, global cyberattacks, violent protests) of late makes it difficult to identify those fundamentals. Another plausible explanation is that we have yet to identify major composition changes in financial markets. There is a significant performance gap between tech stocks and other equities. That fragmentation is echoed in the real economy, which is at a crossroads in its transformation from analogue to digital. That transformation is unleashing a productivity crisis in which ageing populations, typically lagging behind, in advanced economies are generating intergenerational conflicts. A third explanation is the existence of a major monetary trap. With rates ultra-low or even negative in real terms and a proliferation of financing options, aggressive speculative plays are rife. If inflation returns, the tides of monetary policy will turn and we will have to live with the consequences. There is no institutional precedent for economic and price buoyancy, coupled with protracted quantitative easing.

Despite increasing market complexity, a growing number of platforms have expanded the capacity and reach of retail investing. However, it is possible that these unsophisticated retail investors lack the knowledge needed for the kinds of investments they are making. Importantly, a lot of trading today is channelled through automated systems programmed using algorithms to calibrate portfolios with hardly any human intervention. The speed at which those systems operate and the criteria they are articulated around increase the complexity and the cognitive distance between the retail investor and the functioning of the market.

Those investment trends are coinciding with sophisticated movements to alter management decisions at large enterprises via shareholder activism. Specifically, hedge funds and other sophisticated large investors build up shareholdings in companies that, without taking majority positions, give them sufficient influence to sway strategic decision-making at those firms. To maximize their influence, they take aggressive positions and make them public, achieving significant about-faces in decisions related to investment/division sales, executive appointments, M&A strategy, etc. As analysed later on in this paper, movements of that nature have been proliferating in the post-financial crisis economy and there are arguments both for and against them.

Recently, retail investors have joined forces to channel sizeable funds through commission-free, mobile-based platforms in order to bring about valuation changes through large, aggregated positions. The most notorious example of this phenomenon was spearheaded on the Robinhood platform with investors coordinating via Reddit.

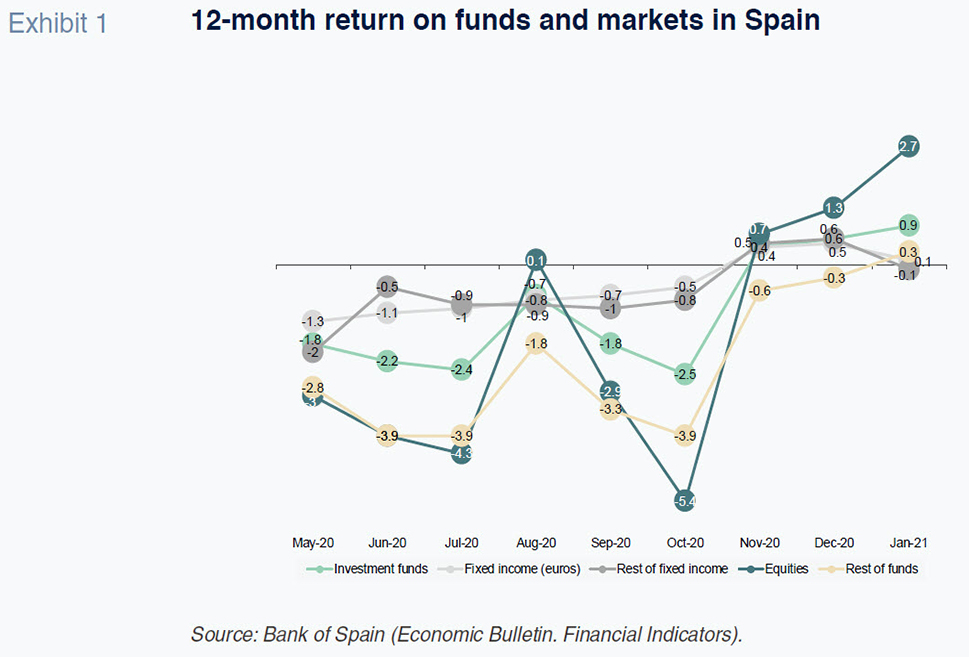

This combination of changes in investor attitudes comes at a key juncture for the markets with potential implications for Spain. As shown in Exhibit 1, although the fixed-income and equities markets appear to have recovered from the first major lockdown in 2020, volatility remains considerable and uncertainties continue to abound in 2021.

In the following sections, we analyse the implications that these new forms of shareholder and ‘street’ activism could have on the markets and the scope for them to flourish in Spain. We also analyse the key challenges facing the Spanish securities markets, with an eye on the second half of 2021, when we could see important changes in the economic situation and outlook.

Shareholder activism, populist activism and retail investor positioning

The financial crisis triggered major bank restructuring on both sides of the Atlantic but also significant corporate restructuring, mainly due to the debt assumed by a sizeable number of corporations. Against this backdrop, there is increasing talk about the role of the so-called activist funds in financial markets. These activist investors have targeted a range of different types of investment funds that take equity positions in companies and use their direct influence to bring about changes in companies’ management or strategic decisions, e.g., asset sales, dividend distributions or M&A deals. Detractors view these shareholder activists as opportunists that build positions in vulnerable companies, take decisions with a short-term horizon and unwind their positions as soon as the companies’ share prices recover. Others believe these investors are injecting efficiency into the market by addressing productivity or viability problems.

Those capital (and sometimes debt) position tend to be built in listed entities of substantial size. Sometimes they trigger negotiations that lead to the resolution of certain viability or management issues. Other times they lead to conflicts that delay essential decision-making at the companies. Activism of that kind has intensified in the post-crisis environment. The need to find new investors, new methods of placing debt, or ways of making debt more sustainable has become more pressing, prompting issuers to also look overseas.

According to Lazard (Table 1), shareholder activism has been growing in recent years and only fell slightly in 2020 as a result of the pandemic. Although shareholder activism has traditionally been more prolific in the US, the percentage of campaigns launched in Europe has been on the rise. Significantly. these developments have set off a chain reaction. First, given that many of these companies are strategic in their home markets, governments are quick to respond to initiatives launched by activist investors. Corporations have also responded by developing new defensive strategies. Of particular note are the so-called poison pills strategy, whereby existing shareholders are allowed to acquire new shares at significant discounts, thus thwarting hostile takeovers by activist investors. However, in a competitive environment with low levels of liquidity and an insufficient number of investment opportunities, shareholder activism is destined to play an increasingly prominent role in the years to come.

In recent months, a new form of activism has emerged among primarily unsophisticated retail investors. The most noteworthy example of this is seen in the case of GameStop, which was targeted by retail investors between the end of January and beginning of February 2021. This phenomenon, also known as “populist activism”, consists of gathering thousands of small investors together to drive the price of a specific stock higher. Advocates view their actions as merely a response to short positions (bets that a stock price will move lower) taken by some of the large investment funds that hope to reap the rewards of a price correction as a company’s fortunes crumble. GameStop sells physical video games at a time when the sector is becoming increasingly virtual. As with many other “analogue” companies, a number of investment funds had built up considerable short positions in it. The online forum WallStreetBets (where participants talk about market and share price trends) published a series of posts on Reddit, the social news aggregation and discussion website, calling for investors to collaborate in building up long positions in GameStop. The call met with success and the resulting investment positions were channelled through the Robinhood app, a retail investor stock trading platform in the US. The investments placed through Robinhood not only drove GameStop’s share price higher, they forced the funds that had bet in the other direction to also buy shares of GameStop to minimise their losses.

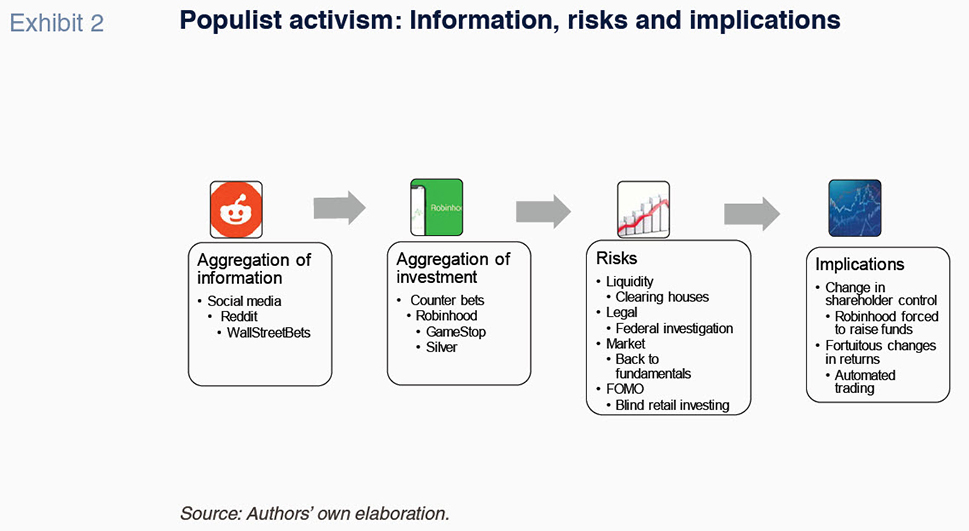

However, the effect of the subsequent correction in GameStop’s share prices brought about several negative consequences. As shown in Exhibit 2, the aggregation of information permitted by the new platforms enabled by social media (such as Reddit) increases, at least initially, retail investors’ market power. However, this investment activity entailed certain risks which many retail investors may have been unaware of. The vast demand for GameStop shares increased clearinghouse deposit requirements. Robinhood, however, did not have enough liquidity to post the money required. Meanwhile the investments in GameStop multiplied and similar strategies were pursued at other companies and even in commodities such as silver. Robinhood was forced to raise investment funds to cover its rising deposit requirements. Specifically, they raised 3.4 billion dollars, with investors now commanding a meaningful shareholding in Robinhood, which could distance it from its retail origins. This form of investment activism was also subject to risk investor bias, or as its more colloquially known, the fear of missing out (FOMO). However, none of the company’s fundamentals justified the rally in GameStop’s shares, which gained as much as 2,400% at the peak, going on to correct sharply as most of the positions were unwound. Lastly, it is hard to make out where the losses fell in the wake of such significant ups and down. It has been reported that the automated trading platforms sustained some of the heaviest losses, while the hedge funds racked up mixed results, with some making a profit and others taking hits, both of which were unexpected.

The investor movements generated by WallStreetBets on Reddit and the risks accumulated by Robinhood have prompted an investigation by the US Congress regarding the potential risks for financial stability and consumer protection. It is worth analysing the likelihood of something similar happening in Europe and specifically in Spain, where retail investors recently pushed shares of Tubacex 8% higher through a coordinated action via Telegram (emulating Reddit). Although the Spanish securities market regulator (CNMV) did not intervene in that instance, it has said that a movement of the scale and implications of that witnessed in the US is impossible in Spain. The regulators argue that such activity would be considered “market manipulation” and therefore illegal in Spain under existing legislation. Nevertheless, it looks as if those types of events, specifically the aggregation of information or sudden concentration of investments, could generate market distortions that will warrant supervisory and regulatory attention in the near future. Moreover, the phenomenon has spread to the arena of cryptocurrencies. The recent concentration of purchases of bitcoin (by Tesla, for example) has similarly fuelled messaging, expectations and retail investments in high-risk assets whose valuations appear disconnected with their underlying fundamentals.

Outlook for the Spanish securities markets

It is conceivable that the different forms of activism and the volatility around traditional assets (stocks and bonds) as well as unconventional assets (cryptocurrencies) are related with protracted misalignments in some markets. The benchmark in recent years has been the US market and the extraordinary performance of the BigTech stocks. Although things are unlikely to change significantly in the first half of 2021, market corrections remain a distinct possibility in the second half of the year if vaccination progress overlaps with both additional fiscal stimulus and highly expansionary monetary policy.

We have already seen some signs of tensions in the bond markets in early 2021. Yields have been rising and markets appear closer to reaching the tipping point (the breakeven rate) that could trigger a possible mass sell-off in bonds (estimated at when the cost of US 10-year Treasuries approaches the 3% mark). That uncertainty in the bond markets could spill over to equities if inflation returns stronger than expected, effectively increasing the market cost of bonds. In the European markets, the effect on both public and private debt could be even more significant, particularly for Spain. It will therefore be important to watch how some of the current sources of uncertainty play out over the course of 2021. Will prices advance gradually, alongside a degree of monetary tightening, facilitating investor repositioning without too much upheaval? If, on the other hand, tension in the debt markets increases, the economic recovery could coincide with considerable corrections and stock price volatility.

It is in this context that debates over the possibility of extreme options, such as debt forgiveness by the European Central Bank or haircuts on loans extended to companies during the pandemic are occurring. However, far from correcting existing imbalances, such actions would only exacerbate them. Moreover, there is the risk of setting a negative precedent in terms of investor and business expectations.

Santiago Carbó Valverde and Francisco Rodríguez Fernández. University of Granada and Funcas