Digitalisation and intangible assets: Unlocking bank lending

Spain’s lacklustre investment in intangible assets needs to be addressed if the country is to reap the productivity gains of the digital transformation. Initiatives such as the extension of government guarantees for loans used to invest in intangibles as well as the introduction of a supporting factor for banks’ RWA calculations could help increase bank lending to this category, which has lagged far behind other funding sources.

Abstract: Digitalisation has become a key focus of the EU, as evidenced by the allocation of Next Generation EU funds to support the digital transformation of the EU economy. This is because of its potential to boost growth, and by extension, social welfare. However, the digitalisation of Europe’s economy will be dependent on investments in intangible assets, which in some cases are considered ‘expenses’ rather than investments according to national accounting systems. Examples of intangible assets include design, market research, specific human capital training and organisational capital. Unfortunately, Spain lags behind when it comes to investing in intangible assets, standing second to last in the EU and significantly behind the EU average. Importantly, investment in intangible assets is rarely financed through bank loans, with firms instead relying on own funds or private equity. However, policy shifts could help channel more bank credit to investments in intangibles. For example, governments could issue guarantees for these loans so as to reduce the potential risks faced by banks. As well, the introduction of a supporting factor for banks’ risk weighted asset (RWA) calculations along the lines of what is used for loans to SMEs and infrastructure investments could also help increase bank lending.

Introduction [1]

One of the aims of the European Reconstruction Fund is to finance the push towards greater digitalisation, in tandem with other important objectives such as the green transition, social inclusion and gender equality. This is good news for Europe, which has lagged behind other regions’ embrace of digitalisation. Advancing on the digital transformation of the European economy is vital to making it more competitive and thereby increasing the wellbeing (income) of its citizens.

It is well established that boosting competitiveness requires productivity gains, the latter being one of the most important sources of economic growth. Importantly, digitalisation has the potential to generate these sought after productivity gains.

Digitalisation refers to technologies such as the internet of things, artificial intelligence, big data, blockchain, cloud computing and e-commerce, to name just a few. For all those technologies it is important to invest in intangible assets such as R&D, databases, software, design, digital skillsets, etc. To support the digital transition it is necessary to step up investment in those assets, which, in turn requires an increase in funding. The lockdown measures necessitated by COVID-19 have shown that those companies that were already digitalised to a degree were better able to mitigate the effects of the crisis, thanks to remote working and e-commerce capabilities. Going forward, it will be essential to invest further in those technologies and digital skillsets.

The extensive empirical evidence in the area of intangible assets provides several key conclusions (Mas, 2020): a) Intangible assets are a very important source of productivity gains. Indeed, the countries with the highest productivity levels are those that invest the most in intangible assets; b) Intangible assets need to complement tangible assets in order to maximise the productivity gains. They are, therefore, complementary and not ‘either or’ investments; c) Although intangible assets have been increasing in all countries, there are significant differences between countries and those differences partially explain the productivity gaps; d) The EU lags the US in terms of investment in intangibles and Spain lags the EU; and, e) Investment in intangible assets in Spain is mainly financed via own funds or private equity; the bank financing that predominates in other countries is very scant in Spain.

Against that backdrop, the purpose of this paper is to emphasise the importance of shifting how investments in intangible assets are financed. We present certain proposals for increasing the weight of bank financing, which is currently very low. To do so, we first analyse intangible asset investment intensity in Spain by means of a comparative analysis at the international level. We also analyse the breakdown of those investments to demonstrate the correlation with income standards. A simple comparison between GDP per capita and intangibles investment in the US and EU already evidences the positive correlation between the two variables, a correlation that holds with other countries. This analysis shows that Spain presents GDP per capita and productivity levels below the European average (10% below the EU-27 average and 19.3% below the eurozone average in the case of GDP per capita), which is partially attributable to its lower relative investment in intangible assets (33% lower in terms of its weight in GDP). Given the importance of intangible assets in furthering the economy’s digital transformation, attractive financing conditions for the investments in intangible assets are needed. This in turn requires the articulation of measures to encourage banks to provide that financing, including a change in the banks’ capital requirements.

Investment intensity in intangible assets: Spain in the EU context

Analysis of the importance of intangible assets has sparked growing academic interest, as evidenced by the number of papers published on this subject. Focusing on those published in the last decade, authors such as Timmer et al. (2011), Corrado et al. (2013 and 2016), Melachroinos and Spence (2013), Muntean (2014), Archaya (2016), and Corrado, Haskel and Jona-Lasinio (2017), among others, have demonstrated how higher investment in intangible assets is responsible for a significant portion of economic growth. The work done by Fox et al. (2017) and McGrattan (2017) also demonstrates the importance of intangible asset investment intensity as it relates to productivity differences across sectors. There is also evidence of the importance of intangible assets in explaining growth differentials at the regional level (Marrocu, Paci and Pontis (2012); Dettori, Marrocu and Paci (2012) and Mas and Quesada (2019), with the latter focusing on the Spanish regions).

Traditionally, intangible assets were generated by means of investment in software, databases, R&D, entertainment, mineral exploration and artistic originals. That list has since grown to include other types of assets, although in many cases these are considered expenses rather than investments by the national accounting system (and therefore not part of GDP). That said, several authors (such as Corrado et al., 2015) consider certain expenses as capital and, therefore, an investment. These include design, advertising, marketing research, specific human capital training and organisational capital.

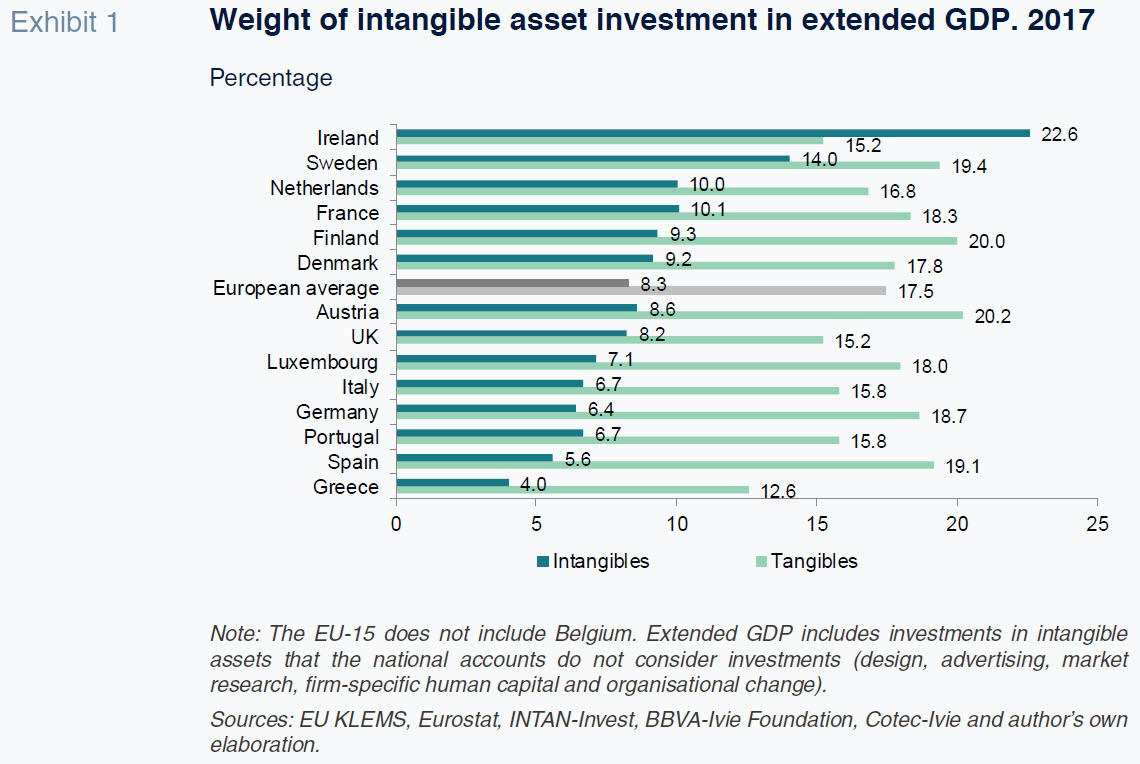

Using the extended definition of intangible assets, Exhibit 1 provides a snapshot of the investment intensity

[2] in 2017 in Spain and the universe of countries for which comparable information was available. The numbers show that the effort in Spain is among the lowest, at 5.6% of expanded GDP (including the intangible assets “beyond GDP”). The only other country with a lower level of investment intensity is Greece, which is 4.3 percentage points below the EU average (8.3%) and far behind economies such as France and the UK.

Spain’s positioning in the European context changes radically if we look at its investment intensity in tangible assets (capital goods, machinery, infrastructure, etc.). From this perspective, Spain ranks above the European average (19.1% vs. 17.5%) and also ahead of major economies such as the UK, France and Italy.

Thus, in analysing the breakdown of total investment, distinguishing between tangible and intangible assets, the weight of tangibles in the total mix is much higher in Spain, at 77%, which is 9 percentage points above the EU average. In fact, that is the highest weighting of any of the countries analysed. The corollary is that Spain is the country with the lowest weight of investment in intangibles (23% or 9 points below the EU average).

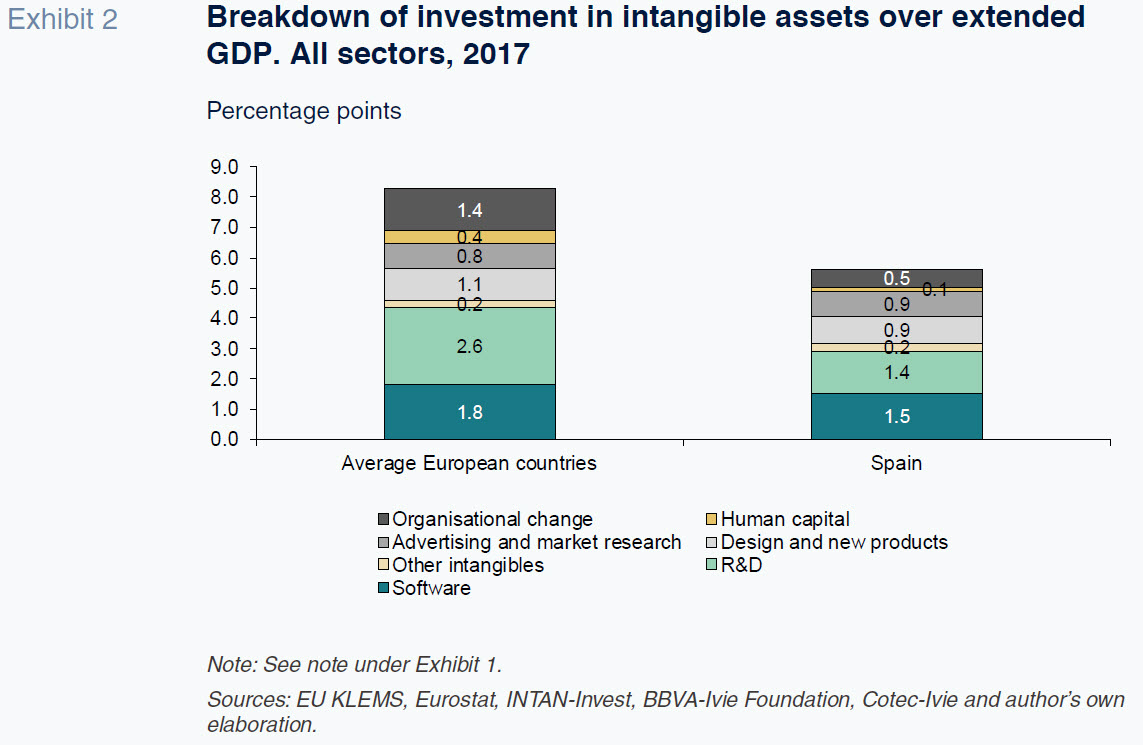

Breaking the information down by asset class, as is done in Exhibit 2, which compares Spain with the EU average, evidences the fact that Spain faces a problem of low investment intensity across all types of intangible assets other than investment in brand image (advertising and market research). The biggest gaps with respect to the EU are observed in investments in R&D (1.2 percentage points below the average) and organisational change (0.9 percentage points below).

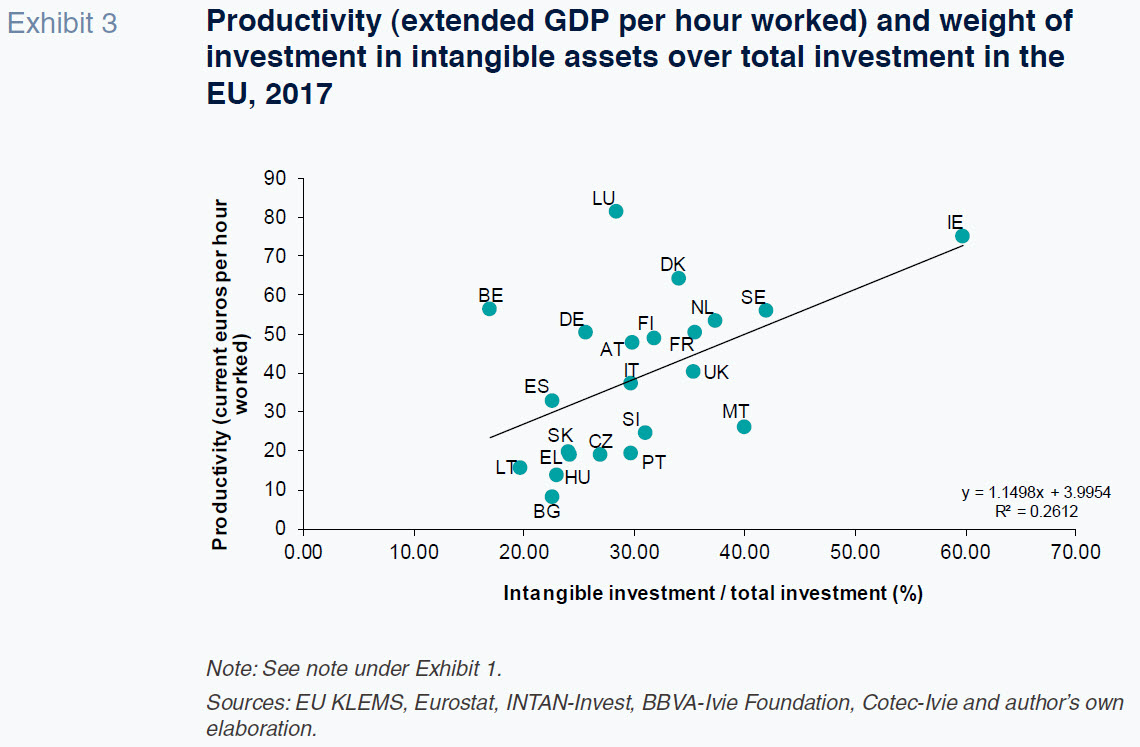

The positive influence investment in intangible assets has on productivity jumps out from Exhibit 3, which depicts the relationship between productivity per hour worked and the weight of investment in intangible assets in total investment. The same positive correlation holds when comparing the weight of investment in intangible assets (whether in terms of total investment or extended GDP) and GDP per capita. Namely, the richest countries are those with the highest intangible asset investment intensities.

Proposals for increasing investment in intangible assets

Investment in intangible assets does not materialise in a stock of tangible capital (unlike investments in properties or machinery, capital goods, infrastructure, etc.). However, this does not mean that intangible assets lack residual value. Because the assets are intangible and imply higher risk for lenders (returns on such investments, such as R&D, are more uncertain), using them as collateral for a loan is difficult. As a result, firms usually rely on funds or private equity rather than debt when investing in intangible assets.

Intangible asset investments constitute a niche business opportunity for the banks for two reasons. First, investment in intangible assets has significantly outgrown investment in tangible assets in recent years. Second, the digital transformation should drive continued higher intensity in the investment of intangible assets. However, capitalising on these opportunities depends on whether measures are taken to reduce the risks assumed by the banks in this kind of financing. Those measures could take the form of adjustments to the banks’ capital regulations or public guarantees to protect the banks against potential losses.

On the regulatory front, banks’ capital requirements (in terms of their risk-weighted assets, or RWAs) are designed to ensure they hold sufficient capital buffers to cover unexpected losses. Risk assessments therefore determine the capital weightings assigned to each type of asset. However, those rules must align with the ability to stimulate the provision of credit to certain sectors, assets or companies in a bid to enhance social wellbeing. Notably, there are two precedents for incentives articulated by means of a supporting factor in the RWA calculation: SME lending and certain classes of strategic infrastructure.

In the case of SME lending, the support factor in the capital requirements is designed to make it easier for banks to lend to SMEs, considering these firms’ unique characteristics (due to their size, they are highly dependent on bank financing) and importance in the economy (in the EU-28, SMEs account for two-thirds of employment and 56% of added value). In the context of the COVID-19 crisis, the EU decided to reinforce that supporting factor. In the so-called CRR quick fix package, the date of effectiveness of the revised supporting factor was brought forward by one year (to June 28th, 2020).

Regarding bank exposures to entities that operate or finance physical structures or facilities, systems and networks and provide or support essential public services (the infrastructure supporting factor), the quick fix package also included a reduction in the capital allocation requirements (which also took effect on June 28th, 2020), designed specifically to stimulate investments of that nature.

Additional support to stimulate bank financing for intangible asset investments in Europe should be considered for several reasons: (i) their importance as a source of productivity gains; (ii) their growing importance in the context of the digital transition as outlined by the European recovery packages such as the Next Generation EU funds; (iii) the relative underdevelopment of EU capital markets by comparison with the US markets; and, (iv) banks’ need for new business opportunities, particularly in areas with strong growth prospects.

The provision of public guarantees for intangible asset financing is another potential tool. In the context of the pandemic, governments have issued loan guarantees to ensure credit reaches those companies experiencing difficulties. Loan guarantees that protect banks against losses from loans made for investments in intangibles could also be justified. The extension of loan guarantees would increase investment in intangibles, drive productivity gains, and bolster the banks’ business volumes.

Conclusions

The analysis conducted in this paper, focused on intangible asset investment intensity in Spain compared with that of other European countries, yields the following conclusions:

- Spain suffers from low productivity that is partially attributable to its relatively low investment in intangible assets. Specifically, its investment intensity, expressed as the ratio of investment to GDP is 33%, or 2.7 percentage points, lower than the EU average (5.6% vs. 8.3%). Of the European countries for which that same information is available, Spain is the country that invests the least in intangible assets as a percentage of total investment (9 percentage points below the average).

- The productivity and per-capita GDP gaps between Spain and the rest of Europe could be reduced by means of digital transformation, a transition that requires investing in intangible assets. This is supported by the EU, which has made digitalisation one of the four cornerstones of its economic recovery plan, an area set to receive at least 20% of EU funds.

- Since financing intangible assets is riskier, companies have tended to use their own funds or rely on private equity to fund their investments in place of bank loans. Given the importance of intangible assets to the digitalisation effort and unlocking productivity gains, banks should be encouraged to provide more financing for these types of investments. Two policy approaches are worth exploring: a) a change in banks’ capital requirements by introducing a supporting factor for RWA calculations, emulating those already introduced for loans to SMEs and certain infrastructure investments; and, b) public guarantees securing bank loans that fund investments in intangibles, where the state would assume a percentage of the losses the banks could incur, thus sharing the risk associated with this type of investment in a bid to boost growth, and by extension, social wellbeing.

For bank capital regulation ‘purists’, the RWA calculation should reflect the riskiness of assets and exceptions in the form of supporting factors should be avoided. However, without arguing against that theory, the regulations also need to consider economic well-being in the long-term and the factors on which that depends, one of which is enhanced productivity, which will be fuelled by digitalisation. In a recent Op-Ed piece for the Financial Times, the President of Banco Santander highlighted the need for a regulatory reset conducive to facilitating the twin green and digital transitions. If such a reset were to stimulate bank lending for investments in intangible assets, the digital transformation would accelerate. One strategy highlighted by Ana Botín relates to the calculation of risk weightings on bank assets, with an eye to freeing up capital to back new loans. That is precisely one of the proposals put forward in this paper: a supporting factor in the RWA calculation for intangible asset financing.

Notes

This paper falls under the scope of research projects ECO2017-84828-R (Spanish Ministry of the Economy, Industry and Competitiveness) and AICO2020/217 (Valencian Government).

Defined as the ratio between investments made and expanded GDP, i.e., adding in the assets deemed investments even though the national accounting system does not include them in GDP.

References

ARCHAYA, R. (2016). ICT use and total factor productivity growth: intangible capital or productive externalities? Oxford Economic Paper, 68(1), pp. 16–39.

CORRADO, C., HASKEL, J. and JONA-LASINIO, C. (2017). Knowledge Spillovers, ICT and Productivity Growth. Oxford Bulletin of Economics and Statistics, 79(4), pp. 592–618.

CORRADO, C., HASKEL, J., JONA-LASINIO, C. and IOMMI, M. (2013). Innovation and Intangible Investment in Europe, Japan and the United States. Oxford Review of Economic Policy, 29, pp. 261–286.

— (2016). Growth, Tangible and Intangible Investment in the EU and US Before and Since the Great Recession. In: Investment and Investment Finance in Europe. European Investment Bank Report, pp. 73–102.

DETTORI, B., MARROCU, E. and PACI, R. (2012). Total factor productivity, intangible assets and spatial dependence in the European regions. Regional Studies, 46, pp. 1401-1416.

EUROPEAN COMMISSION (2020). Coronavirus response: Banking Package to facilitate bank lending - Supporting households and businesses in the EU. Brussels, April 28th, 2020.

FOX, K., NIEBEL, T., O’MAHONY M. and SAAM, M. (2017). The Contribution of Intangible Assets to Sectoral Productivity Growth in the EU. Review of Income and Wealth, 63, pp. 49-67.

MARROCU, E., PACI, R. and PONTIS, M. (2012). Intangible capital and firm’s productivity. Industrial and Corporate Change, 21(2), pp. 377-402.

MAS, M. (2020). El crecimiento de la productividad y los activos intangibles [Growth in productivity and intangible assets]. Papeles de Economía Española, No. 164, pp. 41-59.

MAS, M. and QUESADA, J. (2019). La economía intangible en España. Evolución y distribución por territorios y sectores (1995-2016). [The intangible economy in Spain. Trends and breakdown by region and sector (1995-2016)]. Cotec-Ivie Foundation.

McGRATTAN (2017). Intangible capital and measured productivity. NBER Working paper, 23233.

MELACHROINOS, K. and SPENCE, N. (2013). Intangible Investment and Regional Productivity in Great Britain. Regional Studies, 47 (7), pp. 1048-1064.

MUNTEAN, T. (2014). Intangible Assets and Their Contribution to Labor Productivity Growth in Ontario. International Productivity Monitor, 27, pp. 22–40.

TIMMER, M., INKLAAR, R., O’MAHONY, M. and VAN ARK, B. (2011). Productivity and Economic Growth in Europe: A Comparative Industry Perspective. International Productivity Monitor, Centre for the Study of Living Standards 21, pp. 3-23.

Joaquín Maudos. Professor of Economic Analysis at the University of Valencia, Deputy Director of Research at Ivie and collaborator with CUNEF