Spanish economic forecasts panel: May 2018*

Funcas Economc Trends and Statistics Department

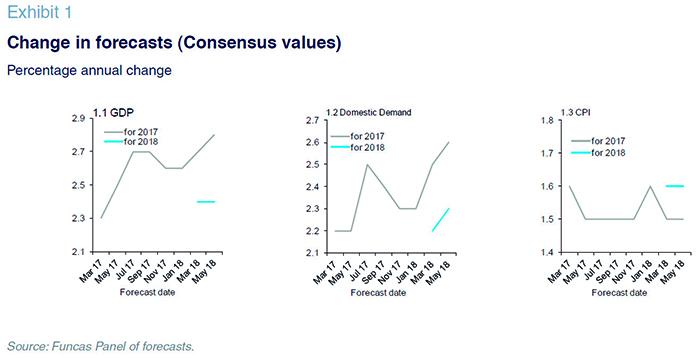

GDP growth in 2018 has been revised upwards by 0.1 percentage points to 2.8%

In the first quarter of 2018, GDP grew by 0.7%, according to advanced data, in line with what was expected by the consensus forecast. The indicators available for the start of the second quarter point to a slight slowdown. Consumer and sector confidence indices for April have deteriorated with respect to the average for the first quarter, except for industry. Meanwhile, the manufacturing and services PMIs have moderated, and the increase in Social Security contributor numbers has slowed.

The consensus forecast for GDP growth for 2018 is 2.8%, up 0.1 percentage points on the last Panel. Rates of 0.7% in the second quarter and 0.6% in the remaining quarters of the year are expected.

Domestic demand is set to contribute 2.5 percentage points to this growth, up 0.1 percentage points on the last consensus forecast. The forecast for growth in investment has risen again, especially investment in construction. As for the foreign sector, its expected contribution remains at 0.3 percentage points.

The forecast for 2019 remains unchanged at 2.4%

The consensus forecast for GDP growth in 2019 remains at 2.4% due to the slight slowdown that will begin in the third quarter of 2018. This expected rate is in line with the forecasts of the Spanish Government and the European Commission. The slowdown is attributable mainly to a weakening of private consumption and investment, which explains a reduction of 0.3 percentage points in the contribution of domestic demand to growth. As for the foreign sector, its contribution is down by 0.1 percentage points, as a result of a slight acceleration in the growth of imports.

Inflation on the rise in 2019

Inflation up to April was contained despite the rise in oil prices, thanks to a drop in electricity prices. In recent weeks, the price of crude oil has risen to around 75 dollars, the highest level since the end of 2014, while the euro depreciated against the dollar.

Nevertheless, there have been no changes in the inflation forecast. It is expected to continue increasing until the third quarter, and then decrease to end the year with a year-on-year rate of 1.5% in December, the same as the average annual rate. As for 2019, a slight acceleration is expected up to an average rate of 1.6%, with a year-on-year rate of 1.5% in December. Core inflation, on the other hand, will be 1.2% and 1.4%, respectively, in 2018 and 2019.

The unemployment rate continues to decline

According to the Labour Force Survey, seasonally adjusted employment increased by 0.5% in the first quarter of the year. The unemployment rate stood at 16.7%, down 2.1 percentage points on one year ago.

Social Security contributor numbers, however, grew in that period at a noticeably more intense rate than indicated by the Labour Force Survey figures, which had already occurred in the previous quarter. However, in March and April progress slowed, as did the rate of decline in registered unemployment, which points to a more moderate job growth in the second quarter.

According to consensus forecasts, job creation will grow 2.4% in 2018 and 2% in 2019, unchanged from the last Panel. Using the forecasts for growth in GDP, job creation and wage remuneration yields implied forecasts for growth in labour productivity and ULCs: the former is to grow by 0.4% in 2018 (up 0.1 percentage points with respect to the last Panel) and 0.4% in 2019, while ULCs will increase by 0.7% in 2018 (down 0.1 percentage points on the last Panel) and 1.1% in 2019 (up 0.1 percentage points on the last Panel).

The average annual unemployment rate will continue to fall to 15.3% in 2018, and to 13.6% in 2019 (the latter being down 0.1 percentage points on the previous consensus forecast).

In 2018, the current account will remain in comfortable surplus

According to revised figures, the current account balance recorded a surplus of 22.1 billion euros in 2018, somewhat higher than the 2017 balance. In the first two months of 2018, the trade surplus increased slightly compared to the surplus for the year-ago period, while the income deficit narrowed, so that the current account balance improved.

The consensus forecast for the current account balance remains at 1.6% of GDP in 2018, and 1.5% in 2019. Therefore, the external strength of the Spanish economy will continue.

The public deficit will narrow, but without meeting the targets

The Public Administrations recorded a deficit of 3.1% of GDP in 2017, compared to 4.3% in the previous year. The improvement was the result of an increase in revenue higher than that of expenditures, and came basically from the Autonomous Regions, whose deficit was below

the target, while the State failed to meet its target. In the first months of 2018, both the State and the Autonomous Regions have improved their balance compared with the year-ago period, while the Social Security System deteriorated slightly.

The Panel foresees a reduction of the deficit of the Public Administrations in the next two years to 2.5% of GDP in 2018 and 1.9% of GDP in 2019, up 0.1 percentage points on the March forecast in both cases. Failure to hit the deficit target in both years is therefore expected – even bearing in mind that some analysts could not fully reflect in their forecasts the latest measures to increase expenditure and reduce taxes announced in the General State Budget.

External tail winds are subsiding

The Spring round of forecasts of the main international organizations points to continued vigorous growth for the world economy. The IMF forecasted that world GDP will increase by 3.9% in both 2018 and 2019, unchanged from January forecasts. In addition, the expansion does not appear to create excessive pressure on prices, even in countries that are approaching full employment, such as Germany, the US and Japan.

However, there have been recent signs of a weakening external boost for the Spanish economy. Oil has become more expensive, exceeding 77 dollars per barrel, i.e., around 10 dollars more than at the beginning of the year. On the other hand, the eurozone has seen slower growth during the first quarter. The slowdown is especially pronounced in Italy, one of the main export markets. Finally, the withdrawal of monetary stimuli by the Federal Reserve has triggered a return of capital to the United States, attracted by the prospect of an increase in yields. The impact on the most vulnerable economies, such as Argentina (an important trading partner for Spanish companies) and Turkey, followed shortly.

All in all, most panellists believe that the international context is favourable, both in the EU and beyond. However, a number of analysts believe that the current environment is neutral. Moreover, while most analysts believe that the favourable environment will continue, a growing number of them believe that the climate will deteriorate in the coming months.

Interest rates will rise

The normalization of the Federal Reserve’s monetary policy has begun to put pressure on interest rates in Europe. Thus, German bond yields have picked up and the trend is expected to continue as the ECB follows in the footsteps of its American counterpart.

The majority opinion among the panellists is that ECB benchmark rates will rise from the third quarter of 2019. Several panellists anticipate that this shift will occur even earlier, during the first part of next year. An anticipated benchmark rate rise would impact on markets. Thus, according to the majority of the panellists, 12-month Euribor, which has remained negative in recent months, would begin an upward path from the second half of this year to end 2019 in clearly positive figures.

Also, the Panel anticipates a change in trend of 10-year government bond yields, reflecting expectations of short-term interest rates. By the end of 2019, the majority of analysts foresee a yield of 2%, 65 basis points above the average values recorded during the first quarter of 2018. However, this is a level that most panellists consider relatively low and appropriate for the current situation.

The euro could appreciate slightly against the dollar

Since mid-April, the dollar has appreciated against the euro, reflecting the adjustment to expectations with respect to US monetary policy. Currently, the euro is trading at around 1.20 dollars, slightly less than in the last Panel. However, the majority of the panellists anticipate that the euro will recover the ground lost during the coming months and that it will appreciate to above 1.25 dollars in 2019.

Change in assessment with respect to fiscal policy

The panellists maintain their opinion on monetary policy. All continue to believe that it is expansionary and none of them foresee a restrictive monetary policy for the coming months, as was the case in the last Panel.

However, there is a change in assessment with respect to fiscal policy. More panellists consider that this policy is expansionary, while it should be neutral or even restrictive, taking into account the cycle and the persistence of high public debt.

The Spanish economic forecasts panel is a survey run by Funcas which consults the 17 research departments listed in Table 1. The survey, which dates back to 1999, is published bi-monthly in the first fortnights of January, March, May, July, September and November. The responses to the survey are used to produce a “consensus” forecast, which is calculated as the arithmetic mean of the 17 individual contributions. The forecasts of the Spanish Government, the Bank of Spain, and the main international organisations are also included for comparison, but do not form part of the consensus forecast.