Official financing aid in response to COVID-19: Timeliness and sufficiency

In contrast with the US, the state support measures adopted in Spain and the EU have mainly taken the form of credit guarantees and liquidity support rather than direct aid. While there is still scope to expand these support mechanisms, there is a growing sense that the EU’s uneven response will result in an asymmetric recovery across member states.

Abstract: Financing policies are essential in the context of a public health pandemic that results in the paralysis of economic activity. However, the effectiveness of these policies will hinge on the duration of lockdown measures as well as the timely and effective disbursement of funds to the real economy. At present, the forcefulness and direct nature of US policy contrasts with the uneven and issue-ridden nature of the European response to the COVID-19 crisis, which could lead to greater divergence within Europe. EU member states have issued aid primarily in the form of state guarantees for loans provided by banks to companies facing difficulties. In Spain, 200 billion euros has been earmarked for public-private financing schemes, but the roll out has been gradual. While state guarantees are expected to cushion the effect of a rise in NPLs, there will be a time lag. In the EU, aid has also been mostly directed at stimulating bank lending, with the ECB having stepped up its buyback programme. Having rejected the idea of ‘coronabonds’, the EU is expected to announce a new reconstruction fund later this year. However, looking forward, it is possible that the bloc’s uneven response will result in an asymmetric recovery across the EU.

Introduction: Tackling a ‘COVID-crunch’

Although it is hard to compare the COVID-19 crisis with the financial crisis of just over a decade ago, the transmission effect is common to both. In a globalised market, the transmission of risks is swift; a short circuit in one place can have highly adverse ripple effects in others. Nevertheless, the COVID-19 crisis is a new phenomenon, without precedent in terms of its scale and the constraints it imposes on the broader economy. The measures required to deal with the health problems imply major economic restrictions such as lockdowns and social distancing. The international experience to date shows that the extent of those constraints depends on how quickly a country responds and its technological readiness. COVID-19 infection and mortality rates have been far more limited in those countries where higher volumes of resources were put to work to detect and control outbreaks. However, most governments still adopted varying degrees of lockdown measures. The effects of these measures will largely depend on those financial policies introduced to mitigate and overcome the effects of this crisis, with specific focus on actions that prevent a credit crunch, or in this instance, a ‘COVID-crunch’.

Lockdown is equivalent to a heart attack or induced coma for the economy. If it lasts too long, the aftereffects could be significant. In a country like Spain, there are numerous businesses and households unable to carry out their normal activities remotely or online. As a result, many have lost their jobs or been placed on furlough. It is vital that the economy receives the financing it needs to transition from the pre-COVID-19 situation to the post-COVID-19 paradigm. The effectiveness of any such financing is conditional upon two factors:

- The duration of the lockdown measures; and,

- The timely and effective disbursement of financing to the real economy.

In the US, the reaction has been somewhat comparable to the policy response during the last financial crisis. Although the effectiveness of US measures to contain the virus has been and remains a matter of debate, the economic policy reaction was swift. The initial injection of $2.2 trillion in March, a programme which the federal government subsequently increased to $3 trillion at the end of April, is equivalent to 13.6% of US GDP. The money has been earmarked to help companies, provide funds to overwhelmed medical service providers and aid for families in need. Specific measures include the provision of $350 billion in loans for small companies and $250 billion to supplement unemployment insurance. Every household with an annual income of under $75,000 has received $1,200 directly, plus $500 for every minor under the age of 17 in their care. Those measures were supported by a new expansionary shift in the Federal Reserve’s monetary policy, which included benchmark rate cuts to between 0%-0.25% and the roll out a $700 billion asset buyback plan.

The forcefulness and direct nature of the US intervention contrasts with the uneven and issue-ridden nature of the European response to the crisis. The European limitations have constrained the intervention of member state governments and, to a lesser degree, the ECB’s response. In this article, we provide an overview of the financial aid measures rolled out in Spain and in the EU and analyse their effectiveness. Note, however, that the unprecedented nature of this crisis means there is no established framework for this form of analytical assessment. The IMF has compared the economic policies in response to COVID-19 with those of a war economy (see Dell’Ariccia et al., 2020). The IMF flags two dimensions for framing the financing issue:

- The distinction between liquidity and solvency. Economic policy should not be limited to liquidity measures that enable companies to service their payment obligations. Instead, it should also aim to reinforce, via public-private schemes, the solvency of businesses, regardless of their size. That is the only way to ensure businesses retain their ability to invest and fund themselves going forward. In short, economic policy should encourage a virtuous circle that cannot be broken.

- Identifying the role of financing, liquidity and solvency for households, businesses of differing sizes and financial institutions. For households, the most commonly deployed liquidity measures are the deferral of taxes and suspension of rent payments, while solvency measures include the expansion of unemployment insurance and benefits. For businesses, liquidity measures may include the deferral of loan or tax payments. They can also take the form of debt repurchases by central banks or the securitisation of their debt under public-private schemes. Policymakers can boost businesses’ solvency through subsidies that support employment or offset the loss of sales. That being said, the most effective and direct measure is to inject equity, often in the form of profit-participating loans. As for the financial sector, liquidity initiatives tend to be restricted to central bank intervention, while on the solvency front, the supervisory authorities can consider easing capital requirements.

Importantly, the banks have an active role to play in this crisis by extending financing to alleviate the pressure COVID-19 places on businesses and households. The banks are far more solvent than they were at the onset of the 2008 crisis. The Spanish banks have decided that the best course of action is to recognise upfront the losses they expect to accrue as a result of COVID-19. Spain’s six largest banks have already recognized loan-loss provisions related to COVID-19 of around 6 billion euros, resulting in an aggregate first-quarter loss of 1.05 billion euros. That strategy should allow them to move through this crisis in a realistic manner and with sufficient loss-absorbing buffers.

Measures approved in Spain and neighbouring European economies

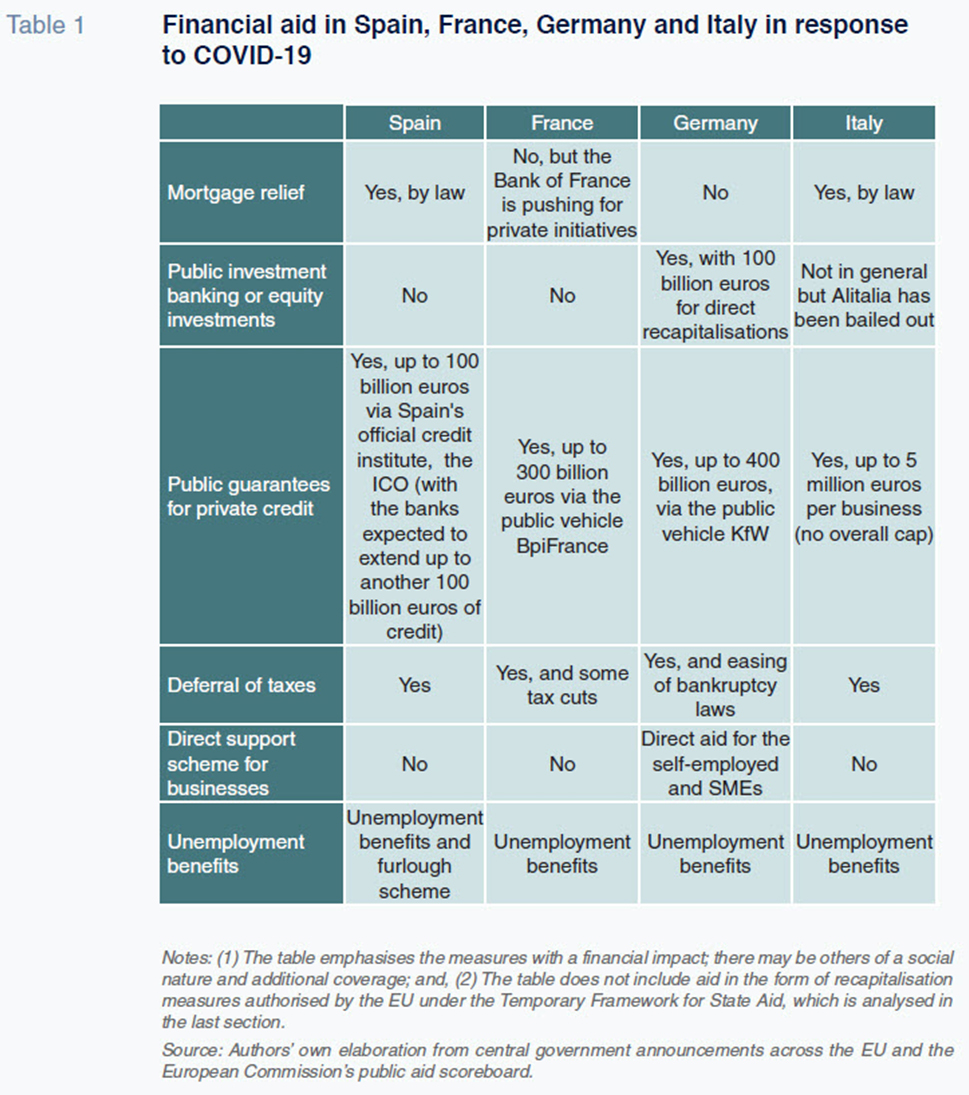

Table 1 summarises the key actions taken by the governments of Spain, France, Germany and Italy to mitigate the financial effects of COVID-19. In most instances, the bulk of the aid consists of the provision of state guarantees for loans provided by banks to companies facing difficulties. In those countries hit the hardest –Spain and Italy– the governments have also approved the suspension of mortgage payments for the most vulnerable households. In Germany, however, the government has opted to provide businesses with direct aid of as much as 100 billion euros to reinforce their solvency. Germany has also made bankruptcy laws more flexible and provided direct transfers to the self-employed and SMEs.

Spain’s financing policies are primarily framed by Royal Decree-Law 8/2020 (March 17th, 2020) on urgent and extraordinary measures for combating the economic and social fallout from COVID-19. In its preamble, the legislation itemises a series of decisions designed to maintain financing flows as well as working capital and liquidity at normal levels “so that businesses and the self-employed can continue to pay their employees and suppliers”. The legislation contemplates a guarantee scheme of up to 100 billion euros as collateral for loans by banks to businesses and self-employed individuals. The idea is that the banks, on the basis of those guarantees, will extend up to 100 billion euros of additional financing. The measures also include 17 billion euros of “direct aid for the most vulnerable groups”. Most of that direct aid has to be articulated as a function of the needs of each line of action. Much of this aid will cover direct support for businesses to be borne by the Social Security Administration, Treasury and the State Employment Service. More specifically, it will cover a large part of the costs of the new furlough scheme, known as ERTE for its acronym in Spanish, and the expansion of unemployment benefits.

With respect to public-private support for financing, the legislation states that the “state credit scheme will cover the renewal of loans and new financing extended by credit institutions, specialised lending institutions, electronic money institutions and payment institutions to service [the recipients’] needs deriving, among other things, from invoice management, working capital requirements or other liquidity needs, including financial and tax payments that fall due, to facilitate the maintenance of jobs and mitigate the economic effects of COVID-19”.

Other measures that complement the business liquidity and solvency measures include the deferral for six months of Social Security payments, an extraordinary benefit for self-employed individuals unable to continue to work and ‘compulsory paid furlough’ for sectors whose activities were frozen or interrupted. Spain has also extended the deadlines for filing and paying quarterly tax returns (VAT, personal income tax and corporate tax instalments) for the self-employed and SMEs. As for households, utilities have been banned from cutting off water, electricity or gas supplies and social utility vouchers have been extended. In addition, employees who lose their jobs or a substantial portion of their income (at least 40%) and business owners whose sales collapse (falling more than 40%) are entitled to defer mortgage payments. Lastly, the legislation contemplates providing assistance with rent and evictions have been suspended for six months.

Measures approved by the EU and the ECB

The financial measures adopted in Spain reveal the budget restrictions imposed by the fiscal deficit and government debt. These restrictions make united action by the EU key. However, similar to last crisis, EU intervention has been haphazard. EU action can be divided into three categories: ECB measures; EU aid and financing for the present problems generated by COVID-19; and, the European post-pandemic reconstruction programme (and its financing), which includes economic revitalisation and structural reforms.

With very little room for additional rate cuts at the ECB, early March saw stock market valuations and sentiment collapse. The ECB’s initial reactions were somewhat contradictory and tentative. The central bank expanded its liquidity-injecting asset repurchasing programme by just 120 billion euros. However, on March 19th, it boosted those repurchases to 750 billion euros and introduced the necessary flexibility for their extension (as needed) until at least the end of 2020. The ECB dubbed its plan the Pandemic Emergency Purchase Programme, or PEPP. Adding in the previously contemplated repurchases, the ECB will buy back 1.1 trillion euros of assets by the end of this year and has said if warranted, it could further expand the programme.

It is also worth highlighting the decisions taken by the supervisory authorities to ease certain bank solvency standards. The Bank of Spain published new criteria for loans backed by public support measures on March 20th, increasing flexibility with respect to the classification of certain exposures as non-performing. The European Banking Authority (EBA) and the European Securities and Markets Authority (ESMA) made announcements in March and April easing certain accounting and provisioning criteria in relation to late payments. Significantly, regulators have provided banks with greater flexibility in terms of capital usage. Banks will be permitted to use existing reserves of 120 billion euros to absorb losses or to finance as much as 1.8 trillion euros. The authorities are giving full flexibility for loans backed by state guarantees. The Basel Committee on Banking Supervision issued recommendations for the temporary easing of the expected credit loss accounting criteria on April 2nd, while on April 6th the ECB temporarily relaxed the capital requirement for market risk. Spain’s securities market regulator, the CNMV, had banned short selling until May 18th to prevent speculative trades that could further destabilise volatile stock markets.

Other more procedural measures have been taken to facilitate trading during lockdown, particularly in relation to payments. With the aim of reducing friction on payments of limited amounts, the EBA has given permission to ease identification standards for such transactions, temporarily eliminating the need for two-factor authentication (double ID check) on such payments.

Regarding EU measures to cushion the impact of COVID-19, the Eurogroup approved a 500 billion euro rescue package on April 10th. Firstly, governments can apply for a credit line of up to 240 billion euros under the European Stability Mechanism (ESM) mainly to support domestic financing of healthcare costs. Under the ‘safety net for companies’, SMEs stand to benefit from a 200 billion euro loan guarantee scheme with the support of the European Investment Bank (EIB). Lastly, the EU is setting up a 100 million euro fund for workers and the self-employed, which will deploy loans to those governments hardest hit by the COVID-19 crisis to help fund short-term work schemes.

The third leg –financial support for the reconstruction effort– is the current focus of European debate following the rejection of the so-called ‘coronabonds’, mutualised eurobonds to fund the actions taken by member states to fight COVID-19. Since then, the debate has shifted to the establishment of a post-coronavirus reconstruction fund. However, this fund is under ongoing assessment by the Eurogroup, which has yet to reach a consensus on its form. The size of the fund is not final, although there is talk of a sum of 1.5 trillion euros. Division is greatest with respect to how the aid should be dispersed and structured. Some call for direct subsidies (without repayment obligations) to be charged against the European budget. However, most countries have put their weight behind structuring the bulk of the money as loans. This leaves one remaining matter: what type of debt to issue? Although some countries including Spain had proposed the issuance of perpetual debt, it is more likely that the so-called core nations’ view will ultimately prevail. This would result in long-dated paper with a set repayment date. The EU does not expect to reach a decision until later this year.

An overview of the various financial measures in Spain and Europe is summarised in the appendix of this article.

Banking sector: Situation and outlook

In evaluating the state of the banking sector in Spain, it is important to note that the last financial crisis is not comparable in many respects. The COVID-19 crisis does not involve some of the constraints that undermined long-term growth and employment during the previous crisis such as the bursting of the real estate bubble, the rapid build-up of debt in the run-up to the crisis and impaired asset quality. With respect to asset quality, the last crisis demonstrated the need for quick intervention. As far as the banking sector is concerned, the creation of financing mechanisms with state guarantees could counteract the credit shock and cushion the rise in non-performance at both the banks and businesses, to the extent the latter can continue to finance their working capital or secure temporary financing to ‘bridge the gap’. As noted earlier, the Spanish banks have opted to take a ‘realistic’ stance upfront, already provisioning sizeable amounts of expected losses in their first-quarter results.

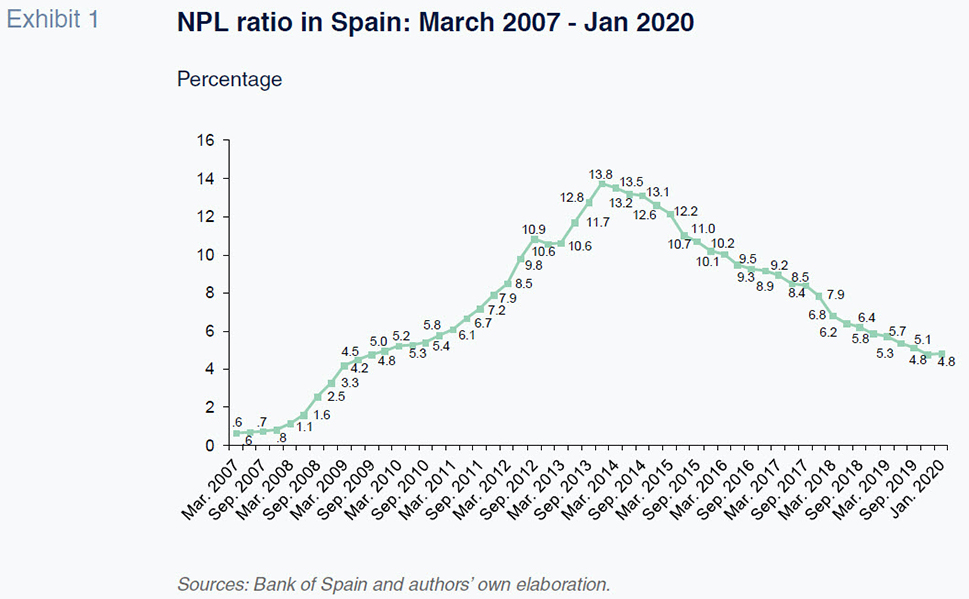

Before the last financial crisis, the non-performing loan ratio in Spain was under 1%. However, it quickly surged to 8% during the first wave of the crisis, topping 13% as a result of the medium-term effects of the second wave, when country risk premiums soared (Exhibit 1). Since then, non-performance has come down significantly, ending 2019 at 4.78% (edging slightly higher to 4.82% in January 2020). The trend in non-performance has varied significantly by sector in recent years. The crisis revealed a credit quality problem that was primarily concentrated in the real estate sector, particularly with developer loans. The weight of the construction industry drove the ratio of non-performance in loans to productive activities to reach over 20% in 2013 (a figure which has returned to 5.53% as of December 2019). Although mortgage non-performance increased, it peaked at barely above 6% in 2013 and had fallen back to 3.27% by year-end 2019. Non-performance in consumer credit, albeit less significant in absolute terms, peaked at close to 10% in early 2014. Although that ratio had decreased to 4.59% by December 2019, this is likely to be the category with the most precarious credit quality over the near term.

In light of the current circumstances, it is expected that the non-performance ratio will increase significantly from the second quarter of the year. It is conceivable, at least initially, that non-performance in consumer credit will rise, but the more significant effects will be felt in corporate lending. Although the extraordinary injection of credit secured by state guarantees will increase the numerator (total volume of credit), the volume of ordinary new transactions is likely to fall. Additionally, the guarantees will cover any increase in non-performance from new credit extended as the state will absorb up to 80% of such exposure. That will help cushion the impact on non-performance, albeit with a time lag, particularly at the end of 2020 and in 2021 (although by the second half of next year, the NPL ratio should start to trend lower as the Spanish economy begins to grow again).

Assessment of the rescue effort

The financial measures approved by the Spanish government and the European authorities constitute a sizeable effort to mitigate the loss of liquidity and solvency caused by COVID-19. However, taken as a whole, or in comparison with those rolled out in other jurisdictions, such as the US, certain potential shortcomings emerge. There are also additional aspects that could be addressed without having to expand the scope of the existing legal framework:

- Uneven application. Both Spain and the EU have introduced gradual measures, which could be insufficient to tackle the urgency and depth of the problem. Implementation has also been too gradual and indirect, e.g., the state credit guarantee lines are being rolled out in tranches of 20 billion euros or less. Moreover, the aid extended in Spain and other Southern European countries as a percentage of GDP is low by comparison with other countries, such as Germany, making it highly likely that the exit from this crisis and the ultimate impact on the various banking sectors will be asymmetric.

- Financing or direct injections? Confined by budget constraints and a lack of decisiveness and cohesion at the European level, most of the aid, at least at the corporate level, is being issued in the form of credit. Consequently, there is a risk that the money will fail to flow to where it is needed in the economy, or that it will arrive too late.

- Insufficiently tapped solvency options. The self-employed and SMEs, which make up a significant proportion of the Spanish and European private sector, are perhaps the most financially vulnerable in the current context. Some highly strategic large companies (e.g., hotels, airlines) may require solvency support in addition to liquidity. Mixed financing schemes, currently rare, which imply short-term support in the form of guaranteed credit plus capital injections for a longer-term solution, make increasing sense in this environment. Access to some of the public financing programmes is only possible if applicants can present minimum solvency thresholds in order to hedge risk and avoid bankruptcies. The EU has authorised a Temporary Framework for State Aid to allow national governments to temporarily reinforce the solvency of applicants, possibly without paying enough attention to the potential asymmetry down the line, which could benefit certain countries relative to others. Germany is making intense use of the relaxed rules through its direct business recapitalisation programme structured via KfW, a further example of how asymmetries between European nations could be accentuated post-coronavirus. The countries with stronger Treasuries will do a better job reaching their companies, which could weaken the Single Market and entrench existing competitive imbalances. We already saw this occur in the 2008 financial crisis when some European countries took greater advantage of the previous Temporary Framework for State Aid to recapitalise their banks at the onset of the crisis.

- Greater reliance on securitisation. An innovative way of turning vulnerable businesses’ short-term debt into long-term paper would be to use securitisation techniques so that the ECB can cushion the impact of the liquidity crisis on these companies. One possibility would be for suppliers to obtain liquidity by securitising their current receivables (recognised in the form of bills of exchange, for example) from a financial institution with public backing (the ICO in Spain or the European Investment Bank, for example). These institutions would bundle tens of thousands of similar securities to create asset-backed securities (ABSs), which could then be used as collateral to obtain long-term liquidity from the ECB. Note that countries such as Italy and France have used these liquidity schemes for their companies on different occasions in recent years without any legal impediment or public resistance from supervisors.

All of the measures implemented –and those that may follow– will be evaluated in time not just on their structural form, but on the effectiveness and timeliness of their actual application. Given that the main sources of uncertainty –how long the pandemic will last and whether there will be fresh outbreaks–persist, it would be advisable to set up more flexible contingency plans to pre-empt in the future the improvisation seen during the current COVID-19 crisis.

References

DELL’ARICCIA, G., MAURO, P., SPILIMBERGO, A. and ZETTELMEYER, J. (2020). Economic Policies for the COVID-19 War. Blog: Special series on the response to the coronavirus. April 1st, 2020. IMF.

Santiago Carbó Valverde. CUNEF, Bangor University and Funcas

Francisco Rodríguez Fernández. University of Granada and Funcas