COVID-19: A tsunami for public finances

COVID-19 has placed considerable pressure on Spain’s public finances, further complicating the outlook for the country’s fiscal consolidation. Though much of the deficit reflects the impact of the recession and the costs of one-off fiscal measures, there remains an important structural component.

Abstract: Economic figures published in April by Eurostat suggest that Spain’s fiscal consolidation experienced a setback in 2019. Unfortunately, this setback will become substantially greater given the economic paralysis caused by COVID-19. The uncertainty surrounding the COVID-19 crisis makes forecasting both growth and the deficit extremely difficult and has contributed to a wide range of forecasts published by the Bank of Spain, the European Commission, the AIReF, the IMF, BBVA and Funcas, among others. These institutions have forecasted a GDP contraction of between 6.8% and 12.4% with the public deficit ranging from 7.2% to 11.0%. Though much of the deficit reflects the impact of the recession and the costs of one-off fiscal measures, there remains an important structural component. Indeed, structural deficit is among the highest in the European Union, with the EU Commission calculating a cyclically-adjusted budget deficit for Spain at slightly over 3% in 2020.

[1]

Background: 2019 figures and the draft budget for 2020

The public deficit numbers published on April 22nd by Eurostat (2020) were worse than expected. With a deficit equivalent to 2.83% of Spanish GDP, nearly 0.2 percentage points above the preliminary figure of 2.64% announced by the Spanish government on March 31st (Ministry of Finance, 2020a), the fiscal consolidation effort has clearly suffered a setback. The figure took most analysts by surprise, judging by Funcas’ consensus forecasts, which called for a deficit of 2.4% in 2019 (Funcas, 2020a). The difference of over 0.6 percentage points between the final figure and the baseline 2.2% deficit forecast by Spain’s independent fiscal institution, the AIReF, stands out (AIReF, 2019) as that institution is usually more accurate in aligning its dynamic forecasts with delivery of the deficit targets. Funcas, the Bank of Spain and Fedea were closer to the mark, forecasting a deficit of 2.5% (Lago-Peñas, 2020).

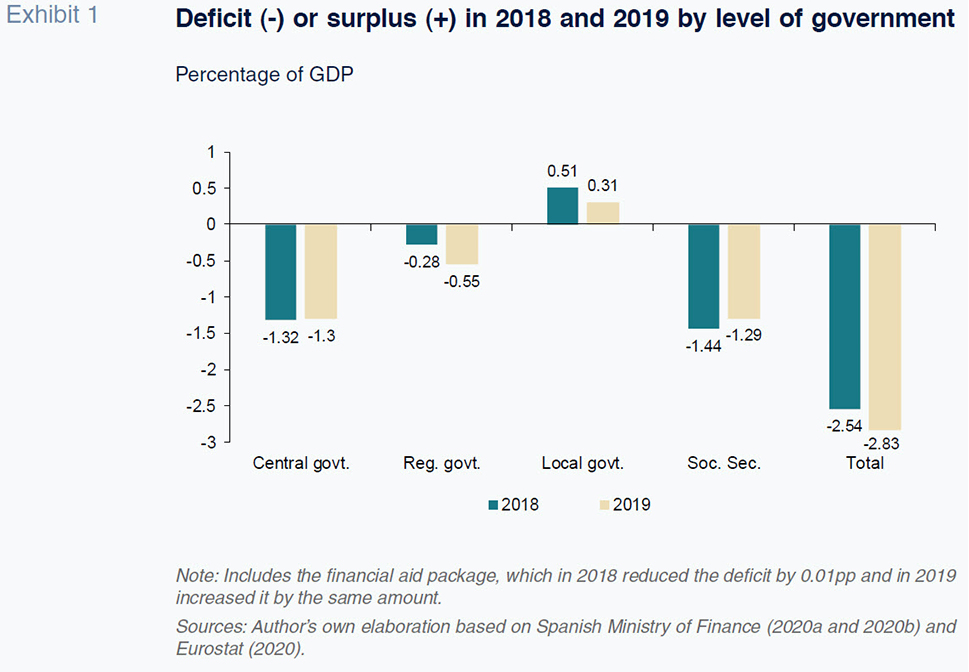

Exhibit 1 compares the deficits in 2018 and 2019 at the various levels of government and overall. The year-on-year deterioration of 0.29 percentage points is attributable, above all, to a narrower surplus at the local government level as well as a poorer performance at the regional government level (an increase in the deficit of 0.27 percentage points). The main reason for the regional governments’ underperformance lies with the 2.5 billion euros (0.2% of GDP) which the central government decided not to transfer to the regional governments. The 2017 change in the management of the VAT regime meant that those funds were not collected.

[2] Lastly, the Social Security deficit narrowed slightly, from 1.44% to 1.29% (+0.15).

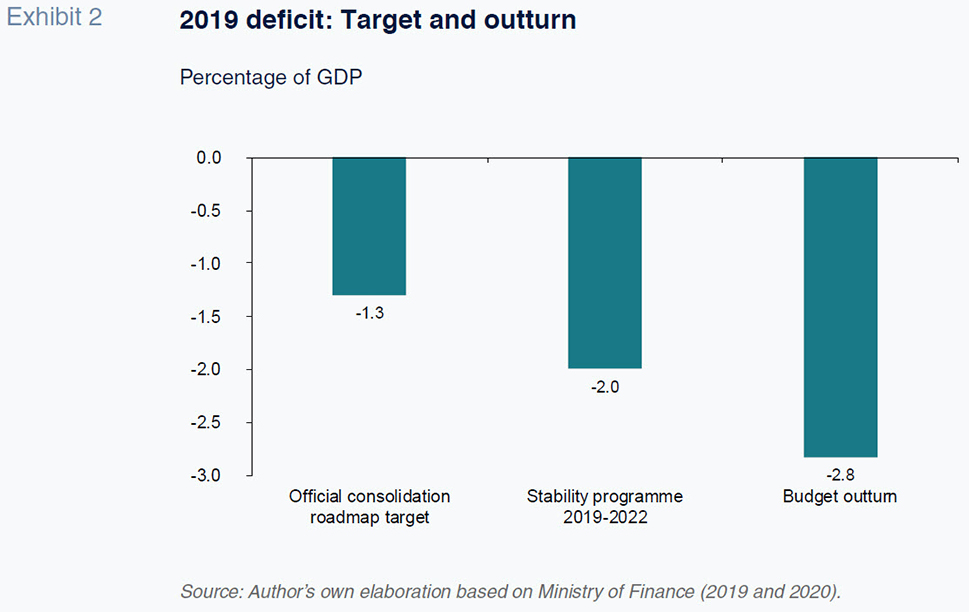

To round out that analysis, Exhibit 2 compares three deficit figures for the overall deficit: the targeted deficit outlined in the fiscal consolidation roadmap that is still in force (approved by the Spanish Cabinet on July 7

th, 2017, and ratified by the Parliament for 2018-2020); the deficit featured in the Stability Programme Update 2019-2022; and the budget outturn numbers. It shows how the targets have been missed by a wide margin, despite the fact that the economy registered growth of 2% and the deficit target was raised by 0.7 percentage points (1.3% to 2.0%) from the legally stipulated target.

2020 did not get off to a more auspicious start. No meaningful progress was made on drawing up a General State Budget for 2020 (2020-GSB) in January and February, before COVID-19 thoroughly disrupted the economic and political environment. The reference document was still the Draft Budgetary Plan for 2020 (2020 Plan), which was published and submitted to the European Commission on October 15th, 2019 (Ministry of Finance, 2019). This Plan does not reflect new discretionary spending measures other than the public sector pay increases contemplated under the scope of the multi-year plan backed by the previous Partido Popular government and pension increases. The European Commission did not respond favourably to the 2020 Plan. In its opinion, the Plan meant that the deficit would barely change in 2020 and that the structural deficit would deteriorate by 0.1 percentage point. Conversely, the recommendation contained in the Stability and Growth Pact is a deficit reduction of 0.65% of GDP. The difficulty in reconciling the European Commission’s demands, the measures contemplated in the coalition agreement and the pacts made with a number of parties with more regional interests whose support for the investiture of Pedro Sánchez placed pressure on government expenditure, undermined the preparation of the 2020-GSB. The COVID-2019 crisis has since buried that process altogether. On March 18th, the Spanish President announced to the Congress of Deputies that it was abandoning the negotiation of a budget for 2020 to concentrate on preparing an “Economic and Social Reconstruction Budget” for 2021, after the public health crisis has been addressed.

Outlook for the public deficit in 2020

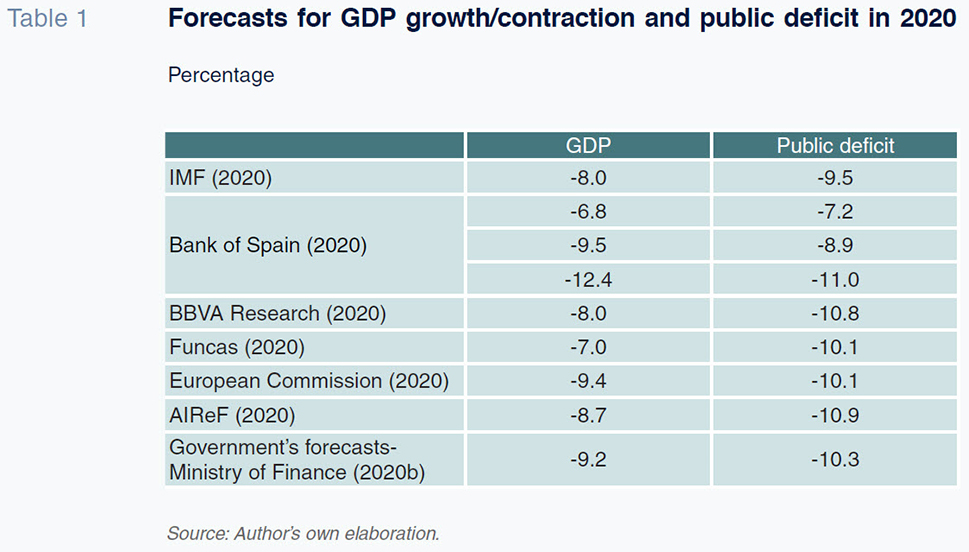

It is particularly hard to forecast the deficit in 2020 due to the uncertainty surrounding the nature of the virus and the evolution of the pandemic. These exogenous and unexpected factors will determine the speed of the economic recovery and the possibility of new stoppages during the second half of the year as a result of a potential second wave of infections. That means economic forecasts are being recalibrated faster than ever before, with the potential for further revisions over the coming months. It has also prompted analysts and institutions to work with multiple scenarios in which the figures vary as a function of different assumptions. The Bank of Spain is one such institution (2020). Table 1 provides the latest figures for GDP and the public deficit published by six benchmark economic forecasters, four of which are associated with public institutions (the Bank of Spain, the AIReF, the European Commission and the International Monetary Fund (IMF)), while the other two have been published by private organizations (Funcas and BBVA Research).

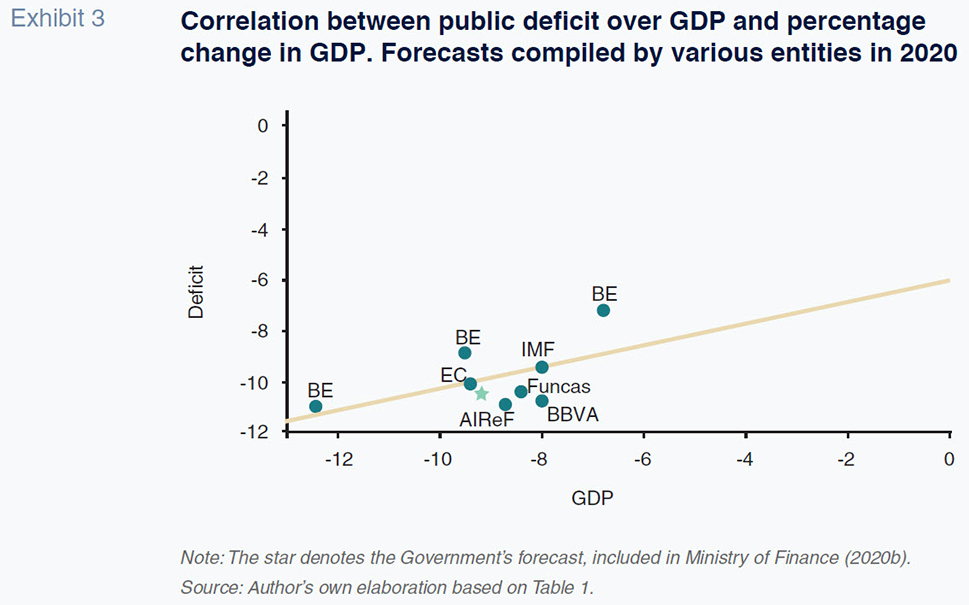

The forecasted GDP contraction ranges from 6.8% to 12.4%, corresponding to the best-case (almost full normalcy following an 8-week lockdown) and adverse scenarios (normalcy yet to be reached at year-end following a 12-week lockdown) drawn up by the Bank of Spain. The forecasted public deficit falls into a slightly narrower range: from 7.2% to 11.0%. Exhibit 3 shows how the two variables are positively correlated. The regression line has a positive slope (+0.42), albeit marked by substantial dispersion around that line. Notably, the differences in GDP estimates only explain 29% of the differences in the deficit forecasts. There is a nearly one and a half point difference between the forecasts of the IMF and those of BBVA Research in the scenarios that consider an economic contraction of 8%. Also, BBVA and the Bank of Spain (this time in its pessimistic scenario) are forecasting virtually the same public deficit for economic contractions that are over four points apart. The Spanish government, meanwhile, in its Stability Programme Update, published on May 1

st (Ministry of Finance, 2020b), is forecasting a GDP contraction of 9.2% and a deficit of 10.34%. A combination that is slightly below the regression line and towards the left (the point marked with a star on the exhibit). The Government’s figures would appear to rule out the more optimistic GDP and deficit scenarios. The two most recent estimates by the AIReF and the European Commission, subsequent to those of the Government, reinforce this outlook. The European Commission estimates a drop in GDP of 9.4% and a deficit of 10.1%. For its part, the AIReF considers revenue figures excessive, but nevertheless estimates a deficit figure not too far from the Government’s forecast (10.9%), and a slightly lower fall in GDP (8.7%).

Given this wide divergence, we break the forecast deficit down into its three essential components for analytical purposes: the structural deficit pre-crisis (the part not related to the state of the economy); the cyclical component of the deficit associated with the loss of GDP, which automatically erodes tax revenue and increases spending on benefits such as unemployment; and the discretionary measures taken by the government to combat the crisis.

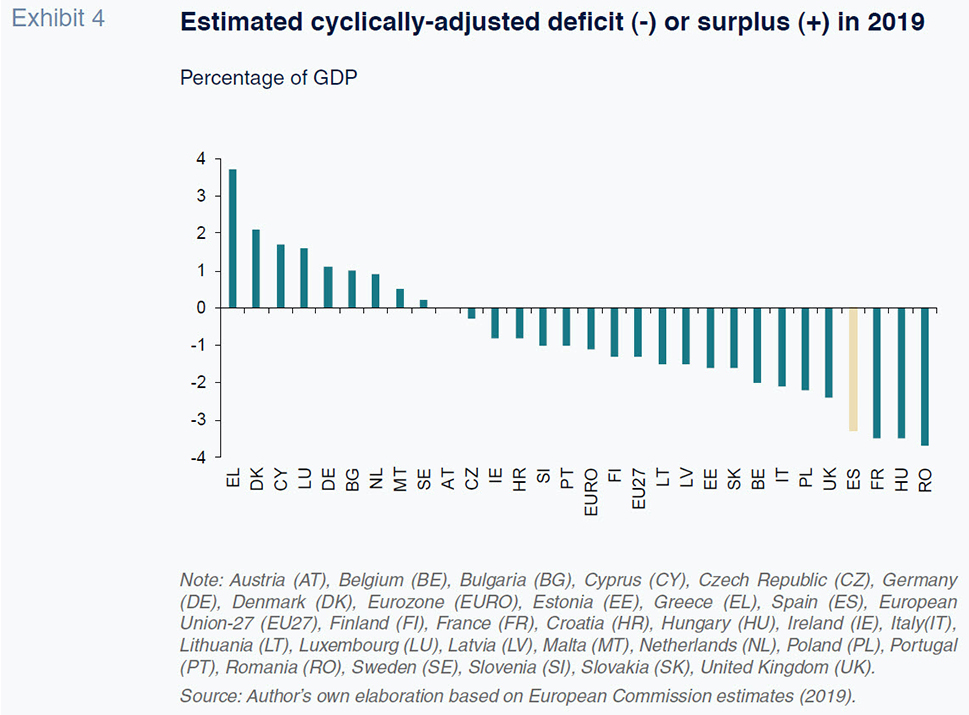

Spain’s structural deficit is among the highest in the European Union, as shown in Exhibit 4. Acknowledging that this variable is not directly observable but rather estimated, the European Commission calculates Spain’s cyclically-adjusted budget deficit at slightly over 3% in 2020 (European Commission, 2019).

[3]

Next comes the cyclical component of the deficit, which is set to be very significant in 2020. Before the COVID-19 crisis, the European Commission was forecasting GDP growth of 1.5% in Spain in 2020 and an output gap of 1.7% (European Commission, 2019). The average GDP contraction forecast in Table 1 of around 8% implies a widening in the output gap of close to 10 percentage points.

The most recent estimates of the impact of the business cycle, measured by the output gap, on the budget rank Spain as one of the countries with the highest elasticities in the European Union, at around -0.6 (Mourre et al., 2019). If GDP contracts by 9.2% as the Spanish government is forecasting, the output gap would widen to 11% and the cyclical component of the deficit would be around 6.5%.

Lastly, the measures rolled out in Spain to date are among the least significant in the developed world in terms of their impact on the government budget. According to the IMF’s estimates (IMF, 2020), the countries that have been most aggressive in terms of discretionary fiscal policy (expenditure and revenue) are Japan, Australia and the US. A second-tier group includes Germany, Canada, the UK and China. Spain falls within the group of countries with less aggressive fiscal policy measures, in line with France and Italy.

[4] The Stability Programme Update (Ministry of Finance, 2020b) provides a little more information. According to the Spanish government, the state’s discretionary spending measures amount to 28.4 billion euros. However, a gross estimate of the spending measures, which takes into consideration tax deferrals, will reduce revenue by 6.1 billion euros in 2020. Additionally, there are several regional and local government measures estimated at 900 million euros. In total, these measures amount to 35.4 billion euros, equivalent to 3% of GDP.

However, there are three caveats with respect to the figure above. Firstly, the discretionary spending measures include 17.8 billion euros associated with furlough schemes (ERTEs for their acronym in Spanish), the solution adopted by the Spanish government to prevent business interruptions from translating into massive job losses. Without that scheme, job losses would have been significantly higher. Therefore, the funds transferred on account of that furlough scheme reduce unemployment benefits, which are already captured in the cyclical component of the deficit. If we were to add in the impact of the furlough scheme on the deficit, we would be double counting.

In contrast, the government-backed credit line of up to 100 billion euros generates a partial exposure to non-performing loans. Nor should we rule out the possibility that the government could pass additional discretionary measures in the coming weeks and months. For example, the universal basic income scheme, at an advanced stage of debate, due to come into force in May, could imply additional expenditure equivalent to between 0.3 and 0.4 percentage points of GDP.

[5]

In short, the sum of the cyclical and structural components of the deficit would put the overall fiscal deficit at close to 9.5% of GDP, assuming the government’s macroeconomic scenario materialises as modelled. Uncertainty regarding the discretionary component is greater as that figure is susceptible to new decisions by the government. However, as seen in the previous paragraph, that component is bound to represent at least 2% of GDP, even if we leave aside the potential impact of the government-backed guarantee scheme and assume that the cost of the furlough initiative is fully reflected in the cyclical deficit.

Adding in those discretionary fiscal measures means that the total public deficit is highly likely to rise above 11.5% of GDP in 2020.

Notes

I would like to thank Diego Martínez (UPO) for his valuable input and Fernanda Martínez and Alejandro Domínguez for their assistance.

This issue is discussed in detail by Lago-Peñas (2020).

The European Commission defines the structural deficit as the cyclically-adjusted budget balance net of one-off and temporary measures.

According to estimates compiled by Mapfre Economics (2020), the impact of the direct fiscal measures adopted in response to the COVID-19 crisis are equivalent to 11.9% of GDP in Germany, 9.3% in the US, 4% in China, 2.6% in Japan, 1.9% in France, 1.5% in the UK, 1.4% in Italy and 1.2% in Spain. Although these numbers imply a different ranking compared to those of the IMF, Spain’s relative position is similar. The network of EU independent financial institutions has published a detailed analysis of the impact of the pandemic on public budgets but in the case of Spain it only quantifies the number of measures but not their impact (EUIFIS, 2020).

On May 2nd, the President of Spain announced the federal government had approved an additional 16 billion euro fund (1.4% of GDP) for transfers to the regional governments. According to subsequent explanations provided by the Ministry of Finance, that figure is already included in the Stability Programme Update submitted to the European Commission.

Referencias

AIReF. (2019).

Monthly stability target monitoring. A. General Government. November 2019. Retrievable from:

www.airef.es, December 26

th, 2019.

—. (2020).

Report on the Stability Programme Update 2020-2021. Retrievable from:

www.airef.es, May 5

th, 2020.

BANK OF SPAIN. (2020). Reference macroeconomic scenarios for the Spanish economy after COVID-19.

Analytical Articles. Economic Bulletin, 2/2020. Retrievable from:

www.bde.esBBVA RESEARCH. (2020). Expected evolution of the Spanish economy in light of the COVID-19 crisis.

Spain Economic Outlook 2Q20. Retrievable from:

www.bbvaresearch.comEUIFIS. (2020).

European Fiscal Monitor Special Update. EU Independent Fiscal Institutions. Retrievable from:

https://www.euifis.eu/EUROPEAN COMMISSION. (2019).

Cyclical Adjustment of Budget Balances. Autumn 2019. Retrievable from:

https://ec.europa.eu—. (2020).

Spring 2020 Economic Forecast: A deep and uneven recession, an uncertain recovery. Retrievable from:

https://ec.europa.euEUROSTAT. (2020).

Euroindicators 65/2020. Retrievable from:

https://ec.europa.eu/eurostat, April 22

nd, 2020.

FUNCAS. (2020a).

Spanish Economic Forecasts Panel. January 2019. Retrievable from:

http://www.Funcas.es—. (2020b).

Spanish economy forecast panel: Impact of COVID-19, Retrievable from:

www.Funcas.es, April 23

rd, 2020.

IMF (2020).

Fiscal Monitor. Chapter 1: Policies to Support People during the COVID-19 Pandemic. Retrievable from:

http://www.imf.orgLAGO-PEÑAS, S. (2020). Deficit Reduction: Insufficient Progress and Low Probability of Improvement.

SEFO 9(1). Retrievable from:

http://www.Funcas.esMAPFRE ECONOMICS. (2020).

Economic and Industry Outlook 2020: Second Quarter Perspectives. Retrievable from:

https://www.mapfre.com/MINISTRY OF FINANCE. (2019).

Draft Budgetary Plan for 2020. Kingdom of Spain. Retrievable from:

www.hacienda.gob.es. October 15

th, 2019.

—. (2020a).

Ejecución presupuestaria de las Administraciones Públicas en 2019 [Government budget outturn report for 2019]. Retrievable from:

www.hacienda.gob.es. March 31

st, 2020.

—. (2020b).

2020 Stability Programme Update. Retrievable from:

www.hacienda.gob.es. May 1

st, 2020.

MOURRE, G., POISSINIER, A. and LAUSEGGER, M. (2019): The Semi-Elasticities Underlying the Cyclically-Adjusted Budget Balance: An Update and Further Analysis.

Discussion Paper, 098. Retrievable from:

www.ec.europa.eu

Santiago Lago Peñas. Professor of Applied Economics and Director of the Governance and Economics Research Network (GEN) Vigo University