Financial digitalisation in Spain: Projections for 2017-2020

Spain has made significant progress on its digital agenda over recent years, specifically in financial digitalisation. Although lagging behind the European average overall, Spain outperforms the EU on some digital indicators, with Funcas’ projections pointing to an improved performance in this area over the medium-term horizon.

Abstract: According to the most recent assessment by the European Commission, Spain ranks as a “medium performer” in the European context in terms of its performance on the so-called digital agenda (primarily in the area of financial digitalisation). However, European indicators reveal considerable progress in the last three years, which is necessarily shaping the increasingly financial dimension of the digitalisation process. Specifically, Europe’s Digital Economy and Society Index (DESI) suggests that the penetration of online banking stood at 53.6% in Spain in 2016, somewhat below the European average of 59.2%. Funcas Observatory of Financial Digitalisation’s projections indicate that Spain will continue to make progress on the financial digitalisation front in the coming years. Our indicators, constructed on the basis of proprietary survey data, predict that Spain’s financial digitalisation will increase across a broad range of areas, whereas by 2020: 79.4% of Spaniards will use their computers to check their bank balances or conduct banking business, with 54% settling invoices online and 64.8% using their online bank accounts to transfer money. Frequency of online banking will also increase, with the percentage of Spaniards expected to check their balances or transfer money online at least once a week estimated to reach 59% over the same timeframe.

The path towards financial digitalisation: Digitalisation as a European endeavour

It’s easy enough to list the benefits digitalisation affords society: cost savings; communication speed; universal access to information and data exchange; broad opportunities for progress on research in numerous scientific fields, etc. However, understanding how a society becomes digital is not so obvious and poses economic policy, corporate strategy and staff planning tests which, combined, constitute one of the biggest social challenges for the years to come.

Retail financial services are no exception. What’s more, they are an essential part of the change for at least three reasons. Firstly, personal finances represent one of the most important dimensions of citizens’ everyday lives, personal and household planning and expectations. Secondly, the financial institutions and non-banking suppliers are aware of these changes and are backing strategies designed to transform their distribution channels and, by extension, their customers’ habits. Thirdly, the very use of financial services and digital payment platforms in turn fuels the broader digitalisation process which encompasses issues such as access to the Internet, smartphones and the broad spectrum of associated technologies, as well as the intensity with which they are used.

In terms of financial digitalisation, there are multiple avenues through which citizens access these services and the way they take decisions can vary depending on a broad range of factors which include socio-demographic factors (age, urban vs. rural living, population size), factors related to income levels and job status and perceptions regarding the characteristics of digital services relative to conventional financial services (safety, efficiency, cost, etc.).

The Funcas Observatory of Financial Digitalisation (OFD) tracks all these financial digitalisation drivers, paying particular attention to developments in Spain but also watching the key global trends. Indeed, one of the OFD’s core features is the monitoring of progress on financial digitalisation and evaluation of how the shift from traditional to digital financial services is unfolding. Along this lines of research, the OFD is in the process of conducting a study (to be released soon) about how Spaniards take decisions regarding the various dimensions of financial digitalisation, including the range of uses given to these online opportunities (enquiries, transfers, payment methods) and the decision tree for each. This paper, however, is more closely related with the monitoring objective and projected trends and shows the progress being made on the so-called digital agenda in Spain and how this is being reflected in the ambit of retail financial services.

The so-called Digital Agenda for Europe was set up in May 2010 and, as indicated by the European Commission itself, was created with the aim of “boosting Europe’s economy by delivering sustainable economic and social benefits from a digital single market.” At the time it was noted that although 250 million Europeans were using the Internet daily, there were still millions that had never used the Internet at all. The timeframe set at the time for the creation of 16 million jobs that require information and communications technology (ICT) skills was 2020. The 2010 digital agenda also provided other illustrative facts and figures. For example, that for every two “offline” jobs lost, the Internet economy would create five. Or that half of productivity growth in the European economy derives from investment in ICT.

As for the purpose of this paper, there are aspects of the digital agenda and its indicators that are essential to determining the level of progress being made on one of its manifestations: Financial digitalisation. On February 24th, 2015, the European Commission published a new composite indicator designed to measure progress on telecommunications and on development of the information society in the member states: the Digital Economy and Society Index (DESI). The DESI composite indicator evaluates five areas or dimensions: Connectivity, Human Capital, Use of Internet, Integration of Digital Technology and Digital Public Services. Each of these dimensions is in turn associated with several specific sub-indicators. It is important to point out that most of these indicators are relative scores used to build the overall indicator so that their usefulness lies primarily with the ability to compare across countries and to measure progress over time. In this paper we review each of these five dimensions on aggregate as core elements of the “general” digitalisation process which in turn condition the financial digitalisation process. We then analyse three sub-indicators: Online retail, business digitalisation and online banking. Lastly, we analyse certain dimensions of the financial digitalisation process in Spain using the survey of 3,005 residents compiled for Funcas by IMOP (refer to https://www.funcas.es/_obsdigi_/) and provide the latest projections for 2017-2020.

European comparative: Progress during the last three years

The five dimensions covered by the DESI Overall Index are defined as follows:

- Connectivity: Fixed broadband, mobile broadband, speed and prices.

- Human Capital: Internet use, basic and advanced digital skills.

- Use of Internet: Citizens’ use of content, communication and online transactions.

- Integration of digital technology: Business digitalisation and eCommerce.

- Digital public services: eGovernment.

The DESI Overall Index is the sum of the scores obtained on each of the above five dimensions. According to the 2017 edition of the DESI, Spain ranks 14th among the 28 member states with an overall score of 0.54. The DESI country report suggests that “Overall, Spain has improved its score on all of the dimensions measured with the exception of Human Capital, where it scored lower than last year, in spite of its solid growth in science, technology, engineering and maths (STEM) graduates. Its performance is especially remarkable in Digital Public Services, although Spain made most progress in the Integration of Digital Technology dimension. Although Spanish public and private sectors are quickly progressing in the integration of digital technologies, in general, some indicators seem to point to a weak demand

on the user side, with lower levels of growth on digital skills that hamper development in the Human Capital dimension.”

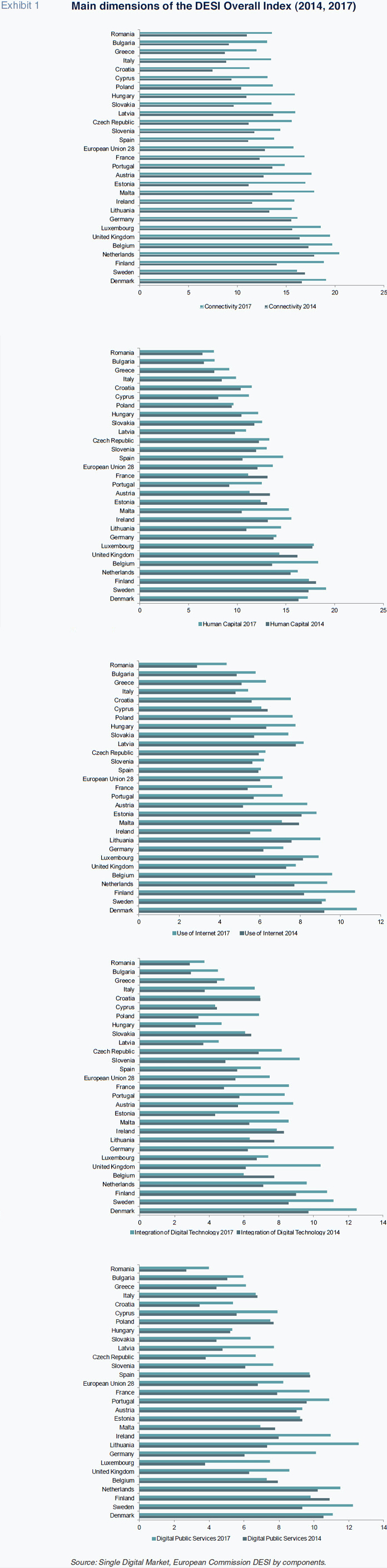

As indicated by the European Commission, “Spain belongs to the medium performance cluster of countries.” The progress made along the key indicators between 2014 and 2017 is shown in Exhibit 1. On connectivity, Spain obtained a score of 13.8 in 2017, marking considerable progress from the 11.1 recorded in 2014. Nevertheless, it continues to lag the EU-28 average (15.7). Netherlands is the best-performing member state in this regard.

As for Human Capital related with digital technology, Spain scored 14.7 in 2017 (up from 10.5 in 2014), which is above the EU average of 13.6. The best performer in this category is Sweden (19.1).

In Use of Internet, Spain made more modest progress (scoring 6 in 2017 vs. 5.9 in 2014), ranking below the European average (7.1). The highest score was recorded by Denmark (10.8).

As for the Integration of Digital Technology (business digitalisation and eCommerce), although Spain made considerable progress (from 5.6 in 2014 to 6.9 in 2017) it remains below the average (7.4) and far from front-runners such as Denmark (12.5).

Lastly, Spain scores a noteworthy 9.7 on eGovernment with respect to the EU average (8.2), albeit barely improving since 2014. This category is led by Lithuania (12.6). Note that certain Eastern European countries have made considerable progress across the board.

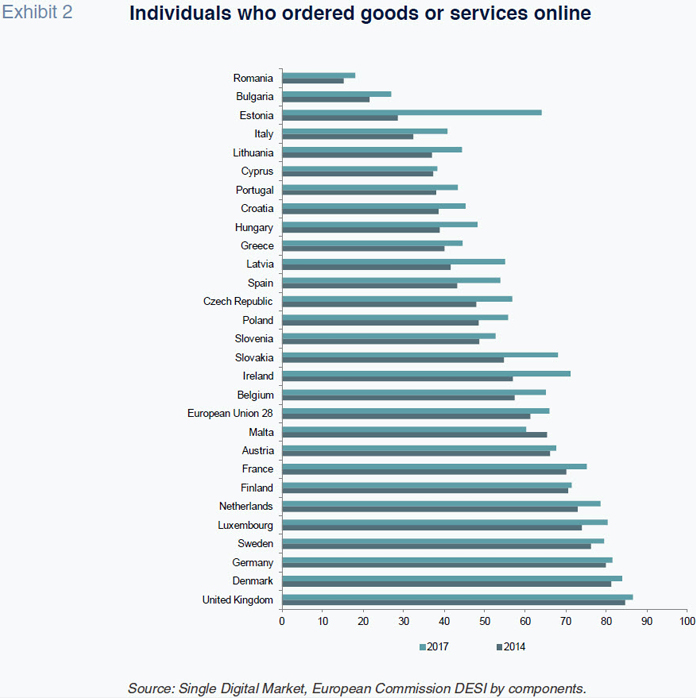

One of the DESI sub-indicators of interest from the financial digitalisation perspective is the use of the Internet for online retail (Exhibit 2). It is of interest primarily because it determines the use of electronic payment methods and, by extension, digital electronic transfers or at least an initiation in online transacting (even if, ultimately, payment is not always electronic). This indicator is measured as a percentage. Spain progressed from 41.5% in 2014 to 55% in 2017. However, it remains below the EU average of 66%.

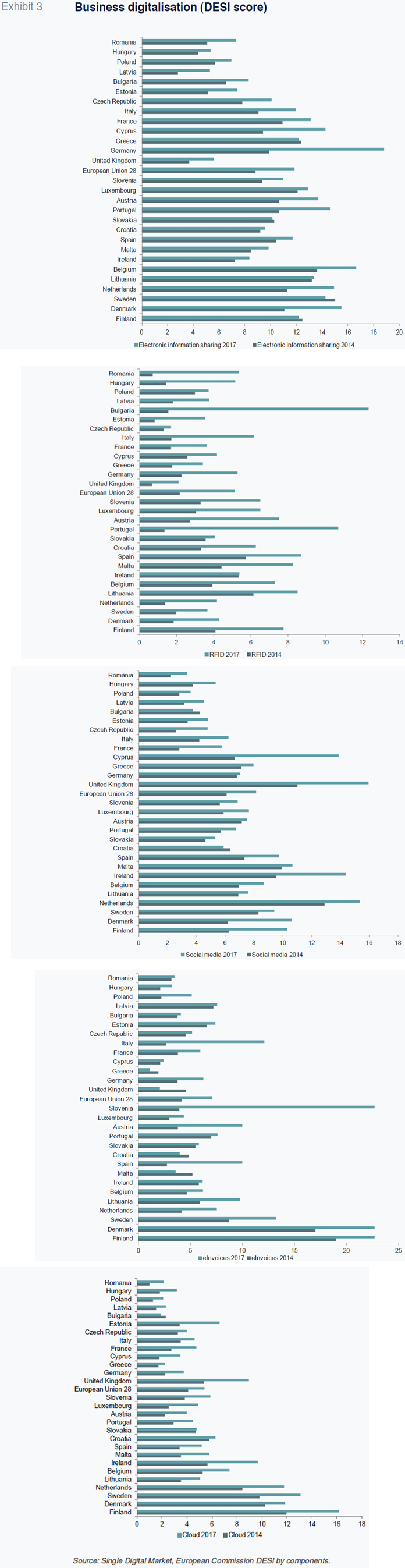

One very illustrative aspect of the DESI sub-indicators in the economic and financial arena relates to the use by businesses of digitalisation-related services. The five aspects measured for the DESI relative score are: Electronic information sharing, radio frequency identification technology (RFID, such as QR codes, etc.), social media, eInvoices and cloud computing (storage and remote security). Exhibit 3 shows Spain’s position on these aspects relative to the EU-28.

On electronic information sharing, Spain scored 11.7 in 2017, up from 10.4 in 2014 and in the vicinity of the European average (11.9). As for the use of RFID systems, Spain is a leader, scoring 8.7 in 2017 (5.7 in 2014), compared to an EU average of 5.1. Spain also stands out for its businesses’ use of the social media, scoring 9.7 (7.3 in 2014), compared to an EU-28 average of 8.1. The UK excels by this yardstick, scoring 16. As for eInvoicing, Spain has made a considerable quantitative leap, jumping from a score of 2.7 in 2014 to 10 in 2017, putting it above the EU average of 7.1. The top performer on this aspect is Finland, with a score of 22.7. The last aspect comprising the business digitalisation indicator relates to cloud computing, where Spain lags somewhat (3.4 in 2014 to 5.2 in 2017). The European average is 5.4 and the top performer is Finland (16.1).

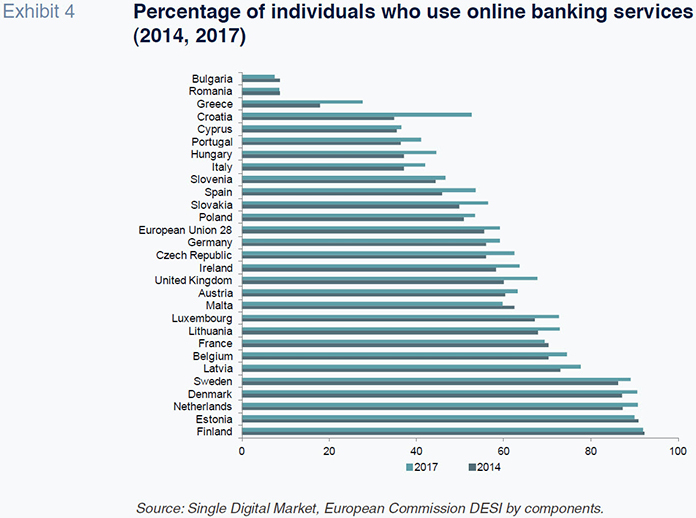

As noted earlier, the DESI provides another sub-indicator of particular relevance to financial digitalisation, namely tracking the percentage of the population using online banking services (Exhibit 4). Spain’s score on this sub-indicator increased from 45.9% in 2014 to 53.6% in 2017. Nevertheless, it continues to lag the European average somewhat (59.2%). Note that some countries really stand out on this benchmark, namely Finland, Estonia, the Netherlands and Denmark; in all of these countries, over 90% of the population uses online banking services.

Financial digitalisation in Spain: Projections for 2017-2020

The previous section details two important aspects of Spain’s performance in terms of the digital agenda relative to the EU-28, specifically its business and financial manifestations. On the one hand, Spain ranks as a “medium performer” on these aspects in the European context. However, the progress made by Spain in the last three years has been among the most noteworthy, suggesting that Spain will gradually climb to a more prominent position.

In this section, we attempt to project how this progress may manifest in the financial digitalisation sphere. To do this, we use some of the indicators from the IMOP survey compiled for Funcas, which are of particular relevance to the task at hand. Based on these indicators, the projections are built from the correlations identified between the survey’s micro-data, the frequency of Internet usage and certain socio-economic variables.

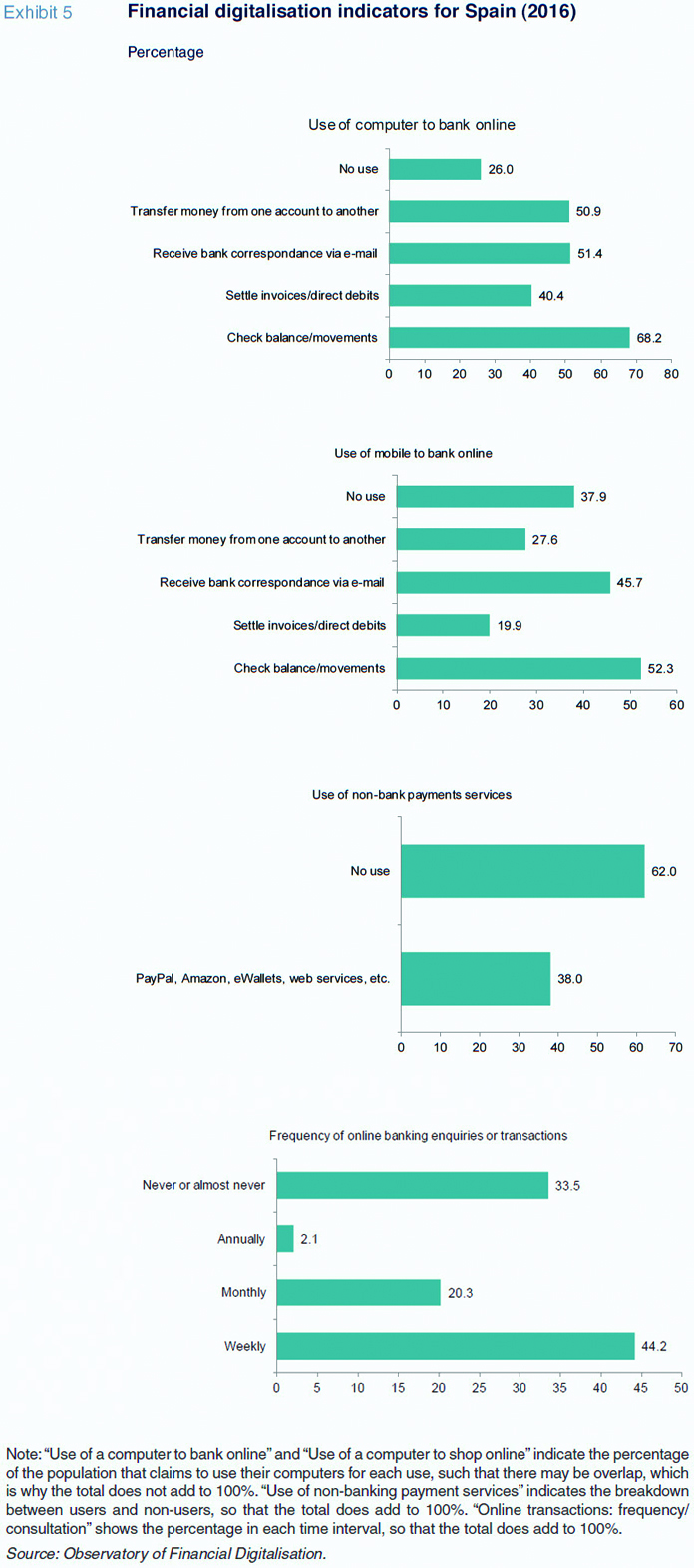

The results for these indicators for 2016 obtained from the above-mentioned survey, as depicted in Exhibit 5, provide the starting point.

Regarding the use of a computer to bank online, the percentages measuring usage for information purposes (communication with the bank, at 51.4%, or balance/transaction checking, at 68.2%) stand out. 50.9% of those surveyed claimed to make transfers from one account to another, and 40.4% said they settled invoices online. In mobile banking, the percentages are significantly lower for transfers (27.6%) or direct debits/invoice settlement (19.9%), mobile devices being used most commonly for communication or consultation purposes. 62% of the population does not use any non-banking payment service whatsoever, leaving 38% as users of Paypal, Amazon, eWallets and other online payment services of this kind. It is important to analyse not only the usage given to these technologies but also the intensity of usage. The last indicator in Exhibit 5 attempts to approximate this notion by measuring the percentage of users who consult their accounts or transfer money online weekly, monthly, annually or “never or almost never”. Some 44.2% of users perform these transactions at least weekly and another 20.3% monthly, which looks compatible with the 53.6% of online banking users estimated for Spain by the DESI methodology.

The methodology used to draw up the projections is divided into four stages:

- Stage one: Spain’s statistics bureau, the INE, provides an indicator for the frequency of Internet usage from 2003 to 2016. The INE data stem from the so-called Survey on ICT Equipment and Usage in Households. This INE survey distinguishes between three age brackets. For our purposes, specifically stage one, a non-linear trendline was fitted for the 2003-2016 series in order to estimate the trajectory from 2017 to 2020.

- Stage two: Using the micro-data obtained from the Funcas survey, we analysed the correlation between Internet usage (frequency of usage) and three socio-economic variables: age, population size and monthly household income. This was done using a logit model. This provided weightings for each individual regarding how his/her socio-economic status affects his/her use of the Internet. These weights were then applied to the INE-based frequency of Internet usage projections derived in stage one to yield a weighted projection for each individual in the sample regarding his/her usage of the Internet between 2017 and 2020.

- Stage three: Using the survey’s micro-data, we then estimated the correlation between the four financial digitalisation indicators we were looking to project (use of computers to bank online, use of mobiles to bank online, use of non-banking payment platforms and the frequency of online banking transactions/enquiries) and Internet usage (usage frequency of each individual). These correlations were similarly estimated using a logit model.

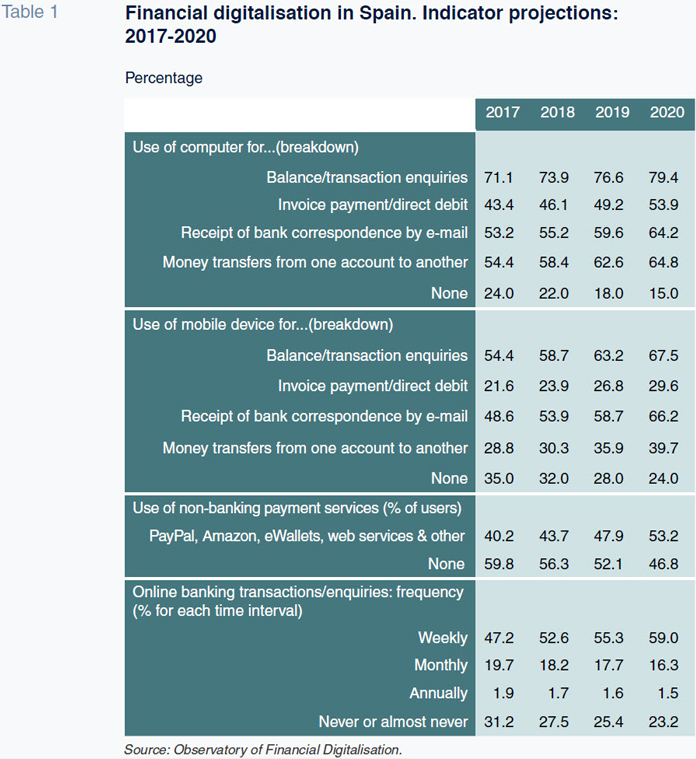

- Stage four: Using the estimates regarding individual usage of the Internet from stage 2 and the correlations between that usage and the socio-economic variables derived in stage 3, we then projected the trend in the four financial digitalisation indicators over the 2017-2020 time horizon. Those projections are shown in Table 1.

The results allow us to draw certain interesting conclusions:

Firstly, according to our estimates, 79.4% of Spaniards will use their computers to check their bank balances or conduct banking business by 2020, with 54% settling invoices online and 64.8% using their online accounts to transfer money. This estimate has at least two implications of interest for the banking industry and for understanding how things are unfolding on the supply side of the industry. One the one hand, online financial service users’ interests would appear to shift in time. The motivation for using these services in the first place is primarily to check account balances, a phenomenon that fits with the surveys Funcas has been conducting regarding how Spaniards pay for their goods and services which indicate that control over spending (i.e., balance tracking) is paramount. The leap takes place when they switch from merely obtaining information or consulting balances to more transactional uses such as online payments or transfers. We are talking about the initiation of another 10% of the population in these uses over four years. The other implication of these estimates is the fact that the transformation of the supply side – which is becoming increasingly digital and characterised by fewer branches – makes some sense in response to the shifts in demand. However, this conclusion should be qualified to the extent that our survey does not capture how digitalisation is affecting more relationship-based and complex transactions (with more notable human interventions and involving greater negotiation) such as loans.

Secondly, the estimates suggest that mobile devices will surpass computers for the purpose of balance checking and getting other banking information. Once again, this shift suggests that the banks are orienting a large part of their offering towards apps for smartphones, this being the main channel now used by much of the population to communicate and get information. However, it would appear that the computer continues to be seen as a more secure device relative to mobile handsets (additionally benefitting from the opportunity to peruse more thoroughly) for operations that entail more than just information and involve some form of financial transaction. Specifically, although the use of mobiles to make transfers or pay bills is expected to increase (to 39.7% and 29.6%, respectively), their use will remain reduced relative to computers.

Thirdly, the advent of non-bank players in the retail payment field is making its presence felt. According to our estimates, 53.2% of the population is expected to use non-banking payment services (Paypal, Amazon et al.) by 2020. This implies a competitive challenge for the banks, albeit also posing, to an extent, a shared opportunity by driving transaction volumes on both the banking and non-banking sides of the equation, irrespective of who channels them. Development of the second Payment Services Directive (PSD2) will unquestionably provide an avenue for the proliferation of the use of bank accounts by third parties.

Lastly, in terms of usage intensity, the percentage of Spaniards expected to check their balances or transfer money online at least once a week is expected to reach 59% by 2020, again according to our estimates. This indicator would appear to suggest that Spain will continue to trail the European average in terms of online banking penetration according to Europe’s so-called digital agenda indicators. However, these European indicators refer to usage irrespective of frequency whereas the indicator projected by the Observatory of Financial Digitalisation refers to frequent users who check their balances or transact online at least once a week.

Conclusions and implications

This paper analyses the highlights of the progress being made on the digital agenda, particularly its financial component, in Spain in the European context. It also provides projections regarding the outlook for several financial digitalisation indicators in Spain.

Spain ranks as a “medium performer” in the European context in terms of its performance on the so-called digital agenda (overall and not exclusively financial digitalisation), according to the most recent assessment by the European Commission. However, the European indicators reveal considerable progress in the last three years which is necessarily shaping the increasingly financial dimension of the digitalisation process. Specifically, Europe’s Digital Economy and Society Index (DESI) suggests that the penetration of online banking stood at 53.6% in Spain in 2016.

The Observatory of Financial Digitalisation’s projections provided in this paper suggest that Spain will continue to make progress on the financial digitalisation front in the years to come and, as has been the case at other times in the past, the change will be driven not only by the logical transformation in demand imposed by society and an increasingly digital work place but also an effort on the supply side to tailor products and services to these needs.

The projections would appear to suggest, at least tentatively, that one of the ways in which users first approach online financial services is to look for information and/or make enquiries. More specifically, to control their spending and check transactions and balances. This change is accompanied, not all of the time but increasingly so, by more transactional online activity such as invoice settlement or money transfers. By way of illustration, according to the Observatory estimates, 79.4% of Spaniards are expected use their computers to make enquiries online by 2020, while 54% will be settling invoices online and 64.8% will be using their online accounts to transfer money. This apparent jump from using online accounts to make enquiries to executing transactions is of sufficient magnitude for the banks to seek to further stimulate the shift. The supply side shift not only relates to branch network downsizing but also the increasingly prominent role being played by smartphones as devices apt for financial uses.

The estimates appear to indicate that there is a certain perception that computers are more secure than mobiles for transacting, while smartphones are set to gradually replace computers as the main means for obtaining financial information. The Funcas Observatory of Financial Digitalisation’s projections suggest that the incidence of online transfers and invoice settlement from mobile devices will rise to 39.7% and 29.6%, respectively, in 2020. Although the estimated progress is considerable (around 10 percentage points in four years), Spain will continue to present significant upside in terms of penetration of mobile-based financial services over the longer term horizon.

It is also worth highlighting that the penetration of non-bank players’ services is projected to reach a noteworthy 53.2% in 2020. Note that these services are mainly limited to the payment arena. There is substantial scope for the financial institutions to offer a suite of financial services that goes beyond payments (the latter nevertheless being very important). It is estimated that the percentage of Spaniards expected to check their balances or transfer money online at least once a week will reach 59% in 2020. The analysis summarised in this paper appears to suggest that there is room for accelerating adoption of online banking services, and online financial activity in general, to the extent that it is possible to combat the perception that online practices are riskier than the traditional forms of interaction (mainly at bank branches) in the retail financial services arena.

Santiago Carbó Valverde. Bangor Business School, and the Funcas Observatory of Financial Digitalisation

Francisco Rodríguez Fernández. Granada University and the Funcas Observatory of Financial Digitalisation