Spanish economic forecasts panel: November 2019*

Funcas Economic Trends and Statistics Department

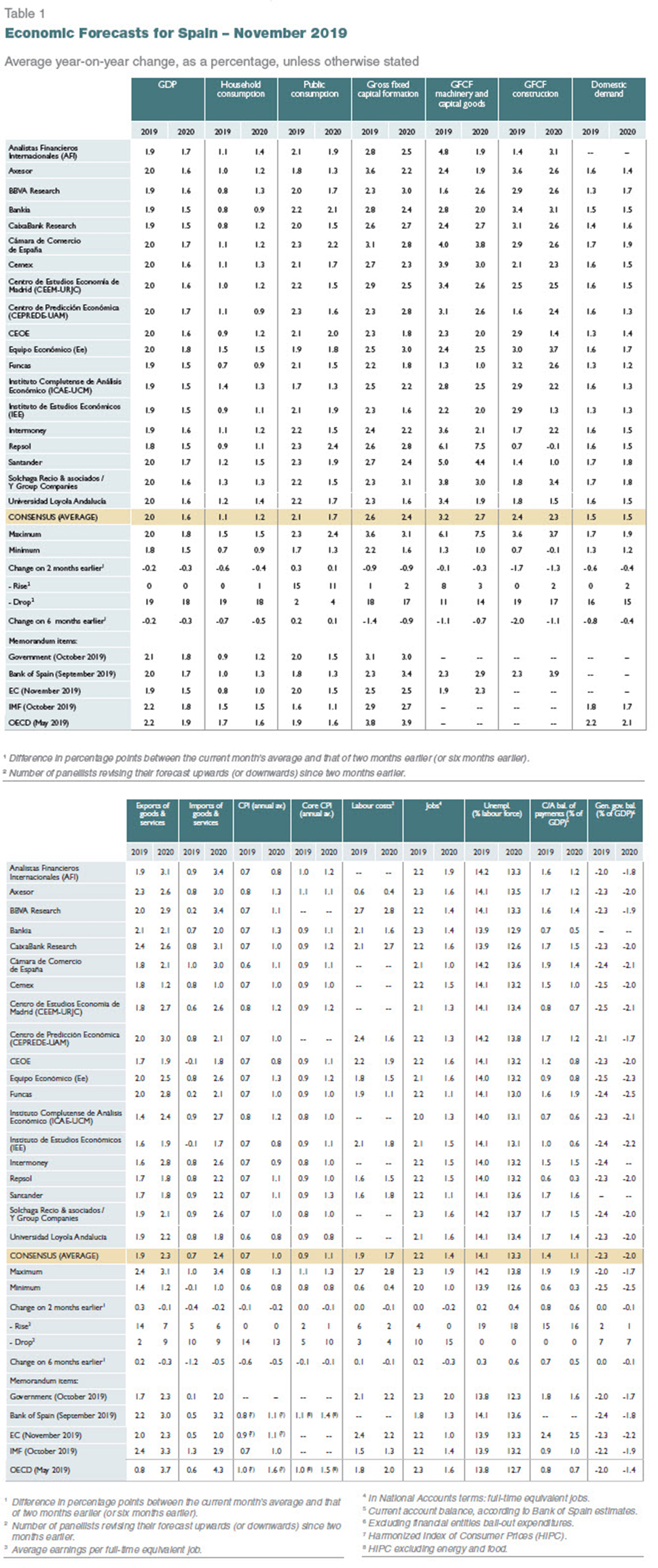

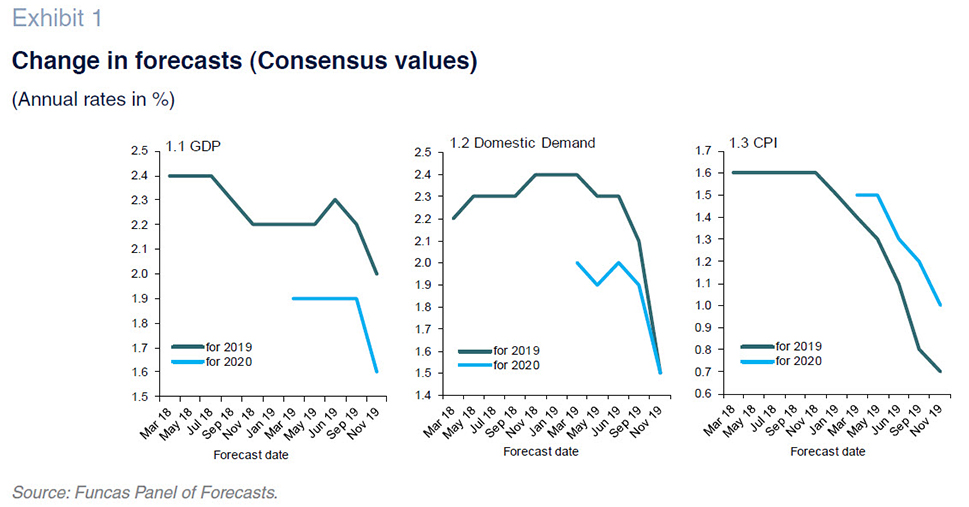

GDP growth forecast at 2% in 2019, down 0.2pp from the last survey

According to Spain’s national statistics office, GDP expanded an estimated 0.4% in the third quarter, in line with the previous quarter. The industrial sector staged a recovery from the non-existent or even negative growth of previous quarters, despite the slowdown foreshadowed by most indicators.

The consensus forecast is for growth of 2% in 2019, down 0.2pp from the last survey, which did not yet reflect the downward revision of the national accounting figures. All of the analysts surveyed have lowered their estimates since September.

The expected composition of estimated 2019 growth has also shifted: net exports are now expected to contribute 0.5pp (compared to a 0.1pp contribution in the last survey), while domestic demand is expected to contribute 1.5pp, down 0.6pp from the September consensus estimate. The forecast for private consumption has been cut by 0.6pp since the last report (with all analysts lowering their estimates), while the forecast for public consumption has been revised upwards by 0.3pp. It is worth highlighting the 0.9pp reduction in estimated investment in capital goods, particularly construction, where the forecast has been reduced by 1.7pp to 2.4%. As for foreign trade, the forecast for import growth has been lowered by 0.4pp to 0.7%, whereas the forecast for export growth has been raised by 0.3pp to 1.9%.

The forecast for 2020 has been cut to 1.6%

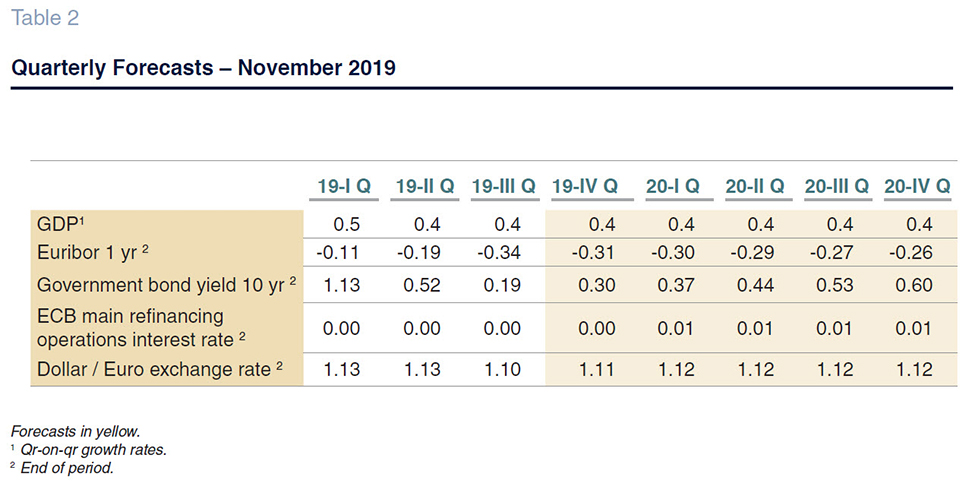

For 2020, 18 out of the 19 analysts have trimmed their growth forecasts, leaving the consensus at 1.6%, down 0.3pp from September. The quarterly pattern is expected to be flat, at around 0.4% (Table 2), down 0.1pp from the last survey. The slowdown is mainly attributed to lower export growth.

Inflation forecasts continue to be trimmed

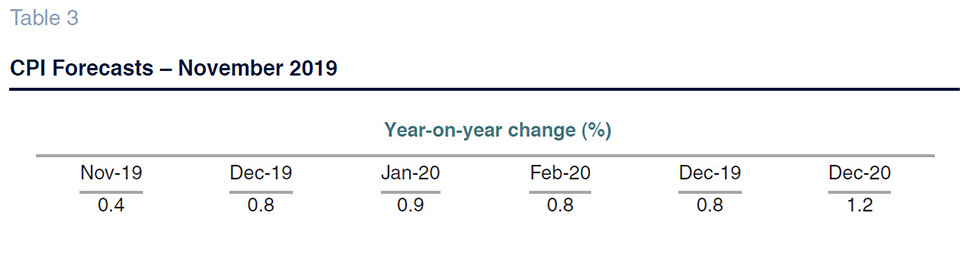

Inflation has been coming down throughout the year, levelling off at 0.1% in September and October, mainly due to the drop in energy prices. For 2019, analysts are currently forecasting average inflation (CPI) of 0.7%, down 0.1pp from September. In 2020, they are looking for a slight uptick, to 1%. As

for core inflation, the consensus forecast is for 0.9% in 2019 and 1.1% in 2020, down 0.1pp from the last set of forecasts. The year-on-year rates of change in December of this year and next are currently forecast at 0.8% and 1.2%, respectively (Table 3).

Slowing job creation

According to the economically-active survey (EPA), job creation was very modest in the third quarter. Nevertheless, unemployment fell to 13.9%, which is down 0.7pp year-on-year. Although growth in social security contributor numbers remained weak to September, the October figure took the market by surprise, fuelled mainly by the services sector and notably within the latter, the public sector. The trend in unemployment (in terms of both the EPA and official unemployment numbers) is less favourable than that in employment, due to growth in the active population.

The consensus forecasts for growth in employment are for 2.2% in 2019 and 1.4% in 2020 (down 0.2pp from September). The forecasts for growth in GDP, job creation and wage compensation yield implied forecasts for growth in productivity and unit labour costs (ULC). Productivity is expected to drop by 0.2pp this year (last forecast: 0%), going on to rise 0.2pp in 2020. ULCs, meanwhile, are expected to increase by 2.1% in 2019 (down 0.2pp from the September report) and 1.5% in 2020.

The average annual unemployment rate is expected to continue to decline to 14.1% in 2019 and 13.3% in 2020 (down 0.2pp and 0.4pp from the last survey, respectively).

Stronger external surplus

The Bank of Spain has recently revised its historical balance of payments series substantively. As a result, the current account surplus in 2018 was revised upwards from 0.9% of GDP to 1.9%.

To August, Spain presented a surplus of 15.13 billion euros, compared to 16.53 billion euros in the first eight months of 2018, shaped by erosion of the trade surplus and an increase in the income deficit.

Following the Bank of Spain’s revision, the analyst community has revised their estimates upwards. As a result, they are currently forecasting a current account surplus of 1.4% of GDP this year and of 1.1% in 2020, up 0.8pp and 0.6pp from the September consensus forecasts, respectively.

Slight improvement in 2020 public deficit forecast

The public deficit to August (at all levels of government except for the local authorities) was 2.09 billion euros higher year-on-year. The deterioration is attributable to growth in the social security deficit and a fresh deficit at the regional government level, compared to a surplus in 8M18, more than offsetting the consolidation observed at the state level.

Analysts continue to forecast a deficit of 2.3% of GDP this year, while they are expecting a deficit of 2% in 2020. Those numbers would imply missing the government’s targets by 0.3pp in both years.

External environment remains adverse

The main indicators are pointing to a sharp economic slowdown, globally and in the European Union, in line with the trend anticipated in the September assessment. Although manufacturing remains the sector suffering the most, services are also losing steam.

As a result, the main international organisations have cut their forecasts in recent weeks. In its October World Economic Outlook (WEO), the IMF is forecasting global growth of 3% in 2019, the lowest level since the Great Recession and down 0.3pp from its April WEO. It believes growth could recover in 2020, to 3.4%, down 0.2pp from its last forecast. The improvement is expected to be driven by a recovery in emerging markets, while advanced economies are expected to remain weak. The IMF has warned that the US and Chinese economies could slow by more than expected, particularly if prevailing trade tensions prove protracted.

Likewise, in its Autumn forecasts, the European Commission cut its forecast for eurozone growth to 1.1% in 2019 (down 0.1pp from its last forecast and nearly half of the level it was projecting one year ago) and 1.2% in 2020 (down 0.2pp). The European economy, highly dependent on exports, is one of the most exposed to the stagnation in international trade.

Nearly all the analysts see the external environment as unfavourable. There have been no major changes on that front since the last survey. However, they have become slightly less pessimistic about the outlook for the months to come, perhaps on account of a potential truce in the trade war between the US and China. A few analysts are anticipating an improvement in the external environment, compared to none in September, whereas only three are expecting additional deterioration, down from eight in September.

Monetary policy set to remain expansionary with rates staying at reduced levels

Markets have priced in the major monetary policy decisions taken by the ECB in September in an attempt to tackle the economic slowdown and inflationary weakness: resumption of the asset purchase programme (APP); deposit rate cut; introduction of a tiered scheme for surplus bank reserves; and, a new round of long-term refinancing operations (TLTRO–III).

The 12-month EURIBOR remains in negative territory, largely unchanged from September, while the yield on 10-year Spanish bonds remains low, despite having moved slightly higher in recent weeks.

The analysts’ assessment of the monetary situation is largely unchanged, with all of the opinion that monetary policy is expansionary. They also agree that these conditions will persist throughout the coming months. The yield on the 10-year bond is barely expected to move in the near term and is forecast at 0.60% at the end of 2020, down from the last forecast of 0.65%. The 12-month EURIBOR is expected to remain in negative territory for all of the forecast horizon, at similar levels to those forecast in September. Lastly, the majority of analysts continue to believe that the prevailing accommodative monetary policy is what the Spanish economy needs right now.

Euro largely stable against the dollar

Since September, the euro has been trading sideways against the dollar, oscillating at around 1.11. Analysts believe that monetary policy easing in the US, potentially more pronounced than in Europe, could lead to a slight appreciation of the euro against the dollar in the quarters to come. They are forecasting an exchange rate of EUR/USD1.12 at the end of the projection period, down USD0.02 from the last survey.

Most analysts view fiscal policy as expansionary

Most analysts continue to view fiscal policy as expansionary, as they did in September. Nor has their opinion changed with respect to what stance fiscal policy should take, with most believing it should be neutral.

The Spanish Economic Forecasts Panel is a survey run by Funcas which consults the 19 research departments listed in Table 1. The survey, which dates back to 1999, is published bi-monthly in the months of January, March, May, July, September and November. The responses to the survey are used to produce a “consensus” forecast, which is calculated as the arithmetic mean of the 19 individual contributions. The forecasts of the Spanish Government, the Bank of Spain, and the main international organisations are also included for comparison, but do not form part of the consensus forecast.