CoCos (AT1) versus capital (CET1) at Spanish and European banks

CoCos have proven to be popular instruments among banks to raise tier 1 capital and for investors in search of yields. However, the dichotomous structure of CoCos leaves investors exposed to either reap considerable benefits or potentially suffer significant losses, with coupon values highly dependent on the issuer’s financial health.

Abstract: Contingent convertible bonds (CoCos) have emerged as one of the most popular instruments for recapitalisation in the European banking sector. In Spain alone, the 22 billion euros of CoCos issued over the last five years account for around 60% of Spanish banks’ capital-raising efforts. From the banks’ perspective, CoCos are an attractive funding instrument given their tier 1 status. For investors, these bonds’ appeal is undoubtedly driven by the fact that they have substantially outperformed issuers’ ordinary shares. That said, CoCos stand out for their dichotomous nature, underpinned by the two financial options they provide for issuers -prepayment and conversion. These options offer a distinctly asymmetric performance for investors depending on the issuer’s financial health. Under normal conditions, the bonds generate attractive returns for investors; however, in the event of recapitalisation, CoCo buyers stand to lose their entire investment. In analysing the main factors behind a CoCo’s coupon value, it was determined that this value is correlated to measures of financial health, such as Tier 1 capital adequacy (CET1), risk profiles (RWA/TA) and banks’ price-to-book values (PBV), with the combination of the latter two variables increasing in statistical significance.

The role of CoCos in European and Spanish bank recapitalisation

In the wake of the financial crisis, European banks have felt the pressure to shore up capital. It is in this context that contingent convertible bonds (popularly known as CoCos) have emerged as a core bank recapitalisation instrument at both the European level and in Spain, where banks are among the most active issuers of this class of security.

The main reason is that CoCos qualify as one of the highest calibres of capital -Additional Tier 1 or AT1- for regulatory purposes, due to their status as perpetual instruments. Furthermore, CoCos can be converted into shares if the level of top tier capital -Common Equity Tier 1 or CET1- falls below a pre-defined threshold. This gives CoCos full loss-absorbing capacity, the requirement for qualifying as tier 1 capital.

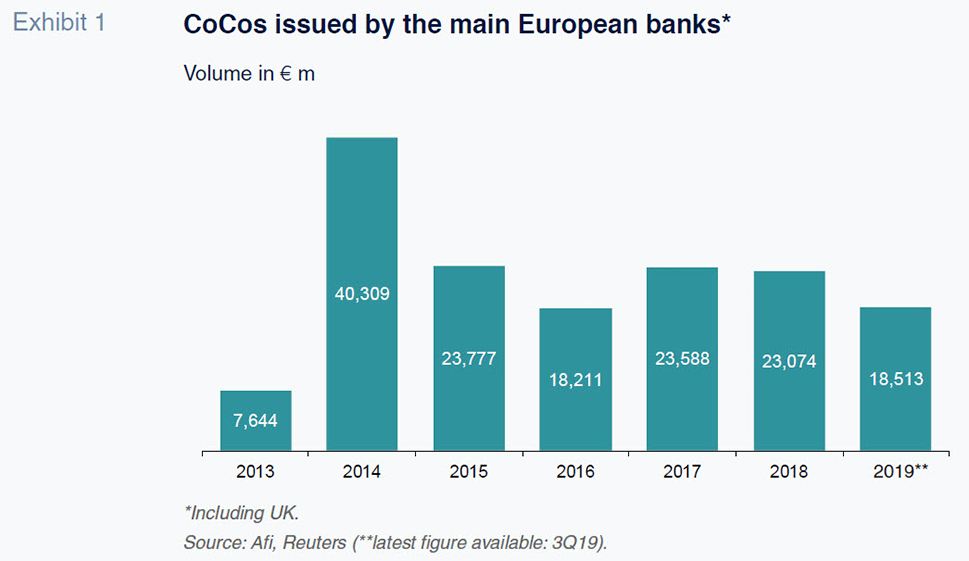

European banks began issuing CoCos in 2013, following publication of Regulation EU 575/2013 (the CRR) and the Bank Recovery and Resolution Directive (BRRD), with the aim of reinforcing their capital ratios.

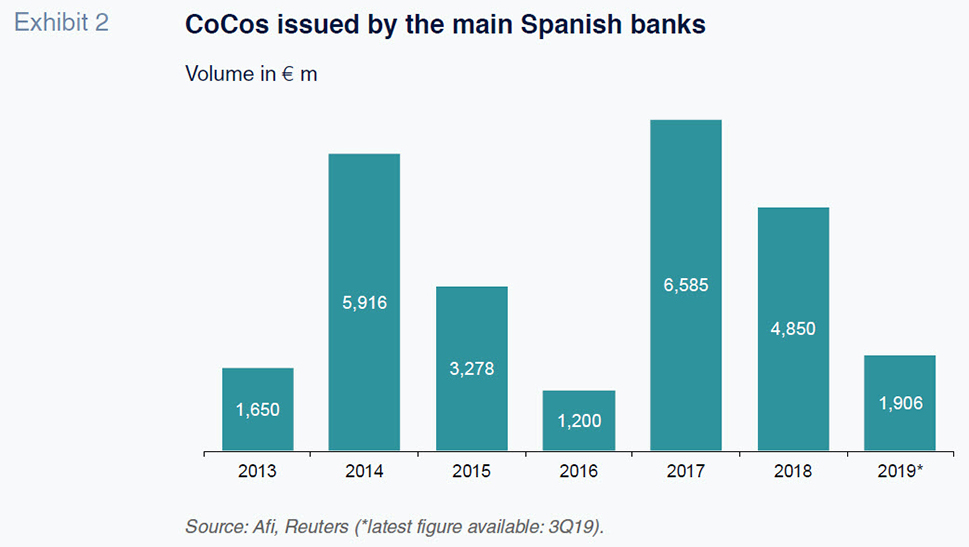

Since then, CoCos have emerged as one of the instruments most widely used by banks for recapitalisation purposes. By the first quarter of 2019, Euro Area CoCo issuance totalled 104 billion euros, nearly a third of total owned funds. This share rises to above 50% if other subordinate instruments (Tier 2) are considered. Notably, the 22 billion euros of CoCos issued in Spain over the last five years, from 2014 to 2018, account for around 60% of Spanish banks’ capital-raising effort.

It is noteworthy, however, that CoCos have lost some significance as a percentage of total issuance compared to earlier years, as many of the Spanish banks have already issued large volumes of these types of securities to meet regulatory demands early on. Nevertheless, given the significance of CoCos for capital-raising efforts by Spanish and European banks, as well as their role as a new, complementary asset class for investors, we have analysed the main characteristics of these instruments as distinct from shares and their relative performance from the investor standpoint.

Financial nature of CoCos: The epitome of asymmetry

In explaining the financial nature of a contingent convertible bonds as distinct from an ordinary share, it is important to note that from the investor perspective, this class of security is equivalent to a perpetual bond that pays a very high coupon. In exchange, the investor grants the issuer two starkly different options.

The first option is a prepayment option (call option), usually at par, during any of the annual windows the bank has from year five after the bonds are issued. The issuer exercises that call option depending on market conditions. Banks typically only prepay the bonds if they are able to place a new issue on the market for better terms than were secured when issuing the original CoCos. That option implies a market risk for the investor which includes generic factors (interest rates, market sentiment, etc.) as well as other considerations specific to the issuer (risk premiums).

The second option is converting the bond into shares in the event that its tier 1 capital (CET1) falls below a certain threshold or ‘trigger’ that could put the entity on a path towards resolution. That second option (a put option bought by the issuer) implies an unambiguous ‘tail risk’ for the investor with a low probability of materialisation but highly adverse implications. In such an event, the CoCo holder would probably lose his entire investment.

It is therefore clear that CoCos are an extraordinarily asymmetric security in terms of their investor return scenarios. Under normal circumstances, they will generate a very high return (6% or 7%), albeit for a period of time that is uncertain due to the potential call. This gives the issuer the option of prepaying it, and the possible triggering of the limit on coupon payments (the so-called maximum distribution amount or MDA).

Above all, CoCos entail a marginal risk whereby virtually the entire investment is lost in the event that the resolution-related conversion is triggered. That residual risk is entity-specific, related to the issuer’s proximity to the event that triggers conversion.

This stark asymmetry (high coupon under normal circumstances vs. loss of nearly all capital under more adverse circumstances), coupled with the complexity implicit in the security’s accompanying options, is the reason why CoCos are considered a sophisticated product and not appropriate for retail investors.

Past performance: CoCos versus ordinary shares

CoCos have played a significant role in the recapitalisation of Spanish banks during the last five years. As a result, they have become an attractive alternative to ordinary shares for both issuing banks and the institutional investor community, the only investors qualified to invest in CoCos. It is this expanding role that has prompted analysis of the relative performance of CoCos and other equity instruments in different markets.

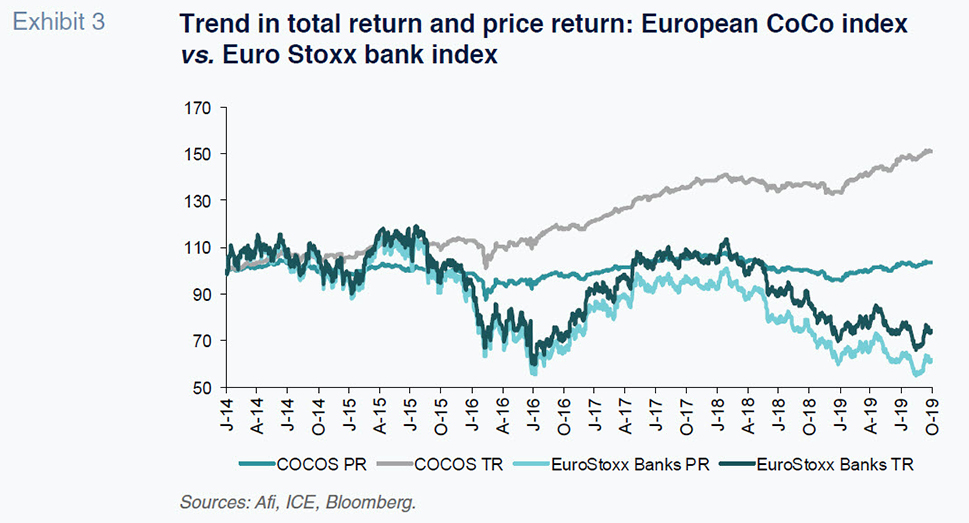

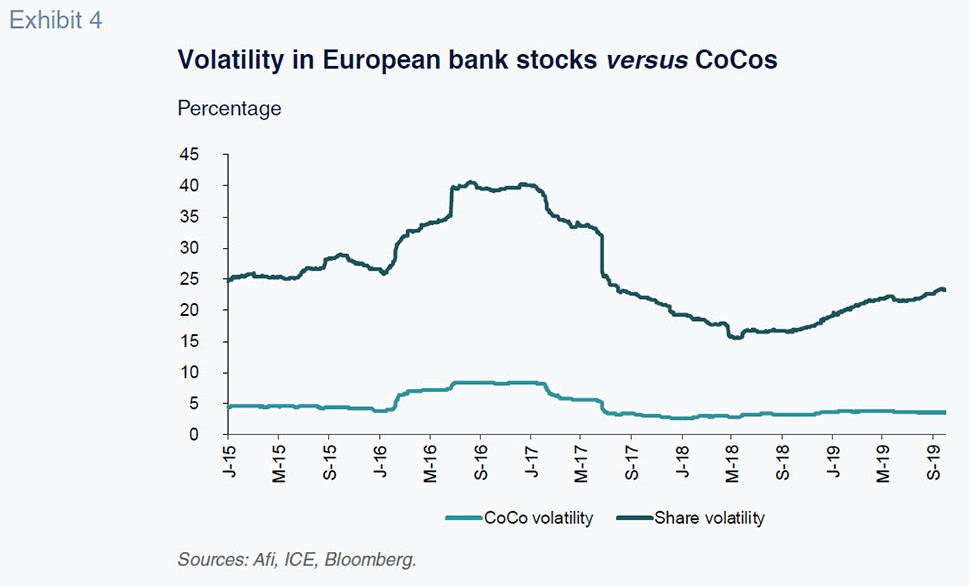

Exhibit 3 illustrates these securities’ performance since the start of 2014 (which is when CoCo issuance began on a widespread basis), analysing the CoCos’ price and coupon and ordinary shares’ dividends separately. Exhibit 4 complements that analysis by depicting the trend in the price volatility of the two instruments over the same time horizon.

The exhibit show a correlation (0.5) between the CoCo and share price index, albeit with far lower volatility (around one-quarter) in the case of the CoCos. This means that during market rallies, the banks’ shares outperform their CoCos, but during corrections, CoCo prices fall by far less than the corresponding share prices. Overall, for the period analysed, which has been dominated by bear markets, the share price index has corrected by 40%, while the CoCo price index has gained 3.5%.

However, the main performance differential in favour of the CoCos becomes apparent when we layer in the coupon/dividend feature, as shown on the total return exhibit. In the case of the shares, the dividend component contributed a return of just 10 percentage points to the accumulated return during the five-year period analysed. Conversely, CoCos’ coupons contributed nearly 50 percentage points. In terms of total return, the European banks’ CoCo index has significantly outperformed the corresponding stock index (+50% vs. -25%) during the five-year period. This is because under adverse trading conditions, they endured much smaller price losses while continuing to accrue a high coupon.

Given the importance of CoCos’ coupons from an investor standpoint, we conducted an across-the-board analysis for a broad sample of European banks (including Spanish institutions), in an attempt to pinpoint which factors determine the different coupons the market demands from one issuer to the next. As we noted in the previous section, the CoCo accrues a high coupon in exchange for the risk assumed by the investor in giving the issuer the two options: the prepayment call and conversion into shares in the event of resolution. Thus, the coupon payable by the various issuers should bear a relationship with the relative ‘distance to resolution’.

As this ‘distance to resolution’ concept is not directly observable, we have used three proxy indicators we believe could indicate the distance from such an event and therefore explain the different coupons carried by the CoCos issued to date by European banks.

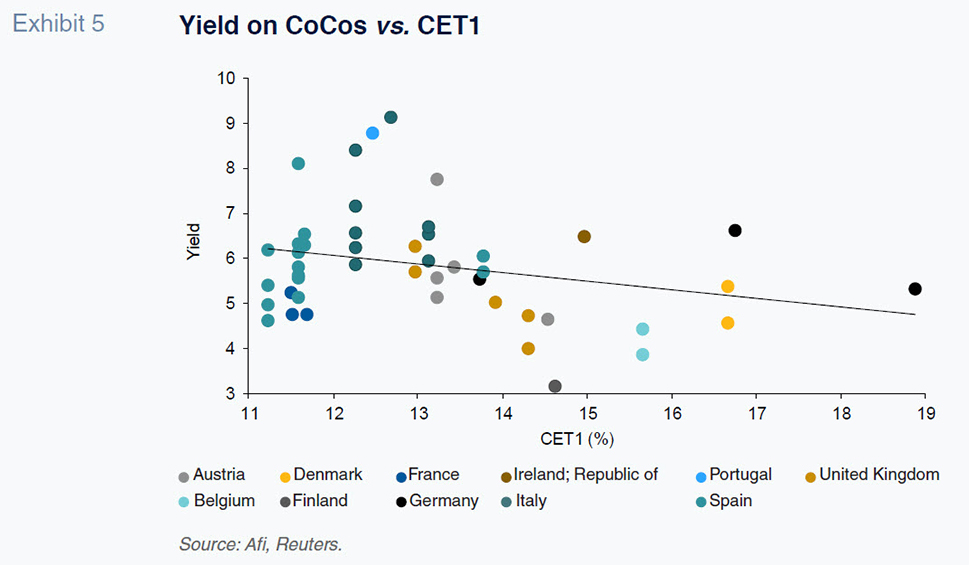

The first and most obvious proxy is Tier 1 capital adequacy (CET1), as it is a shortfall or dip below a certain minimum threshold of CET1 that triggers conversion and potentially leads to resolution. Exhibit 5 illustrates how the effective yield (nominal coupon, adjusted for the market price) on the various CoCos issued is inversely correlated to the issuing banks’ CET1 ratios. This means banks with less of a CET1 buffer are obliged to pay a higher coupon for their CoCos. However, the correlation holds little explanatory power, prompting us to look at other variables.

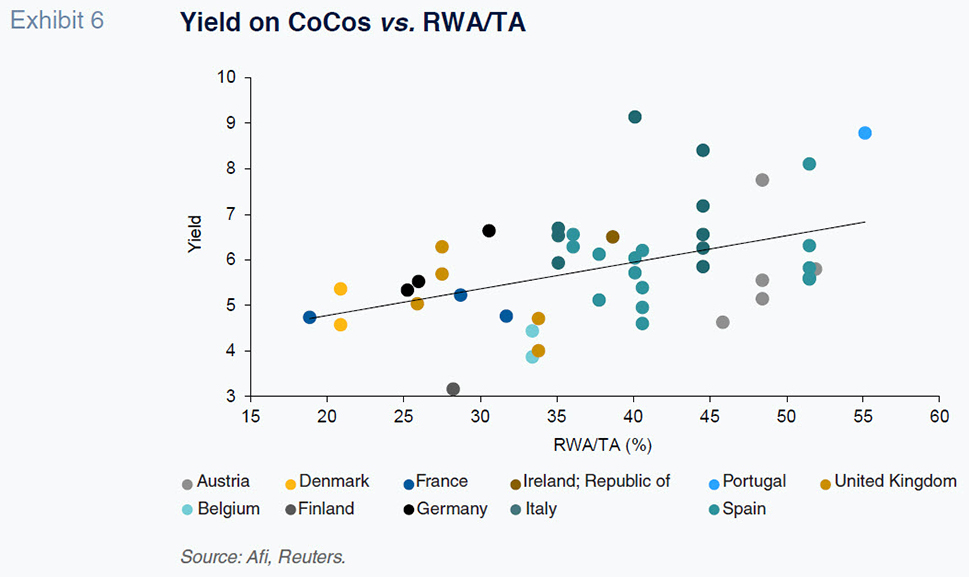

The second proxy relates to the extent of the issuing bank’s risks, understood as the ratio of risk-weighted assets over total assets (RWA/TA). As shown in Exhibit 6 for the sample of European banks analysed, the effective yield demanded by investors on CoCos is positively and significantly correlated with RWA.

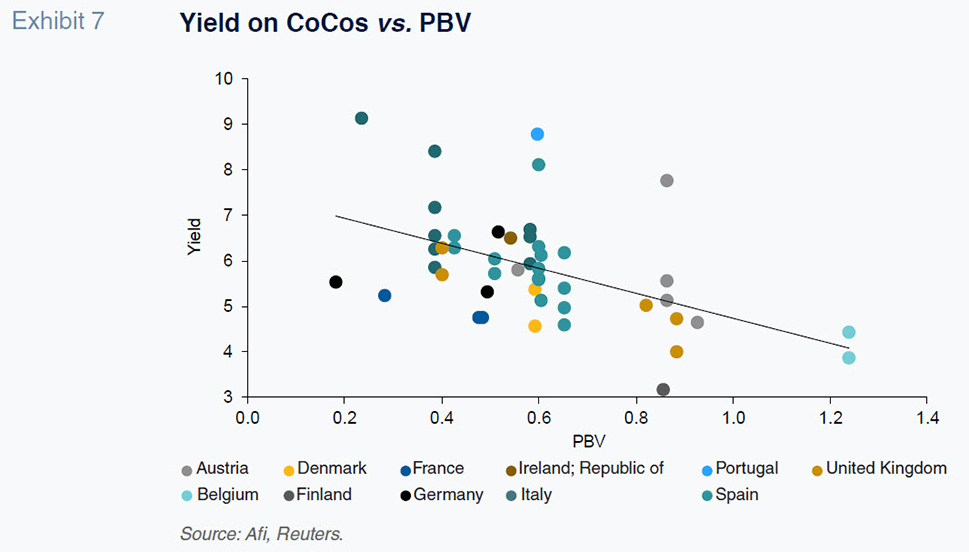

The last proxy for the distance to resolution is a market variable -the ratio of market to book value (PBV)- for each of the banks analysed. The rationale for using that proxy is as follows: when valuing the banks’ assets in relation to their book value, the market may be sending a ‘signal’ regarding those assets’ intrinsic value and a possible shortfall of own funds in accounting terms. Exhibit 7 illustrates the clear and significant inverse correlation between the effective yield on CoCos and their PBV ratios.

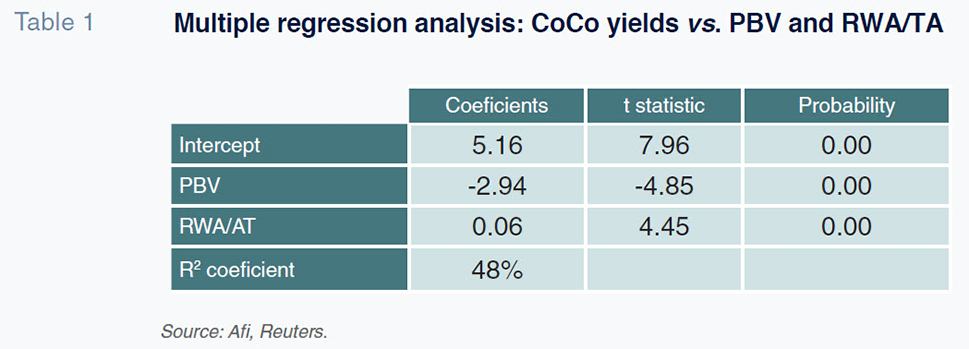

Lastly, to take an umbrella approach to explaining the difference in yields on the various CoCos issued, we conducted a multiple regression analysis with the three variables used as proxies for distance to resolution. In that analysis, the CET1 proxy ceases to be statistically significant, while the statistical significance of the other two proxies considered together increases. We excluded CET1 from the analysis, which yielded an explanatory power of 48% for the variation in yields among the issuers.

Conclusion

The analysis performed highlights the significance of CoCos for both issuer banks and institutional investors, the only investors qualified to buy these complex securities.

For European banks, and especially Spanish banks, CoCos have emerged as the prime instrument for reinforcing their capital since CoCos were awarded AT1 status.

From the investor standpoint, CoCos have clearly outperformed banks’ stocks. They present markedly lower volatility (less than one quarter), so that their price performance is much smoother during periods of stock market volatility. Additionally, the high coupon they accrue on a recurring basis gives investors’ a ‘buffer’ (self-insurance) vis à vis the extreme scenario (resolution) in which they could stand to see their entire investment wiped out.

It is precisely that ‘tail risk’ that makes it advisable to channel investment in CoCos through vehicles (funds) whose investments are broadly diversified across a large number of issuers.

That being said, and framed by that diversification disclaimer, analysis shows that for a broad sample of European banks which have issued CoCos, the yield paid by each is correlated with different measures of their ‘financial health’, including their Tier 1 capital adequacy (CET1), risk profiles (RWA/TA) and their price-to-book values (PBV).

Ángel Berges, Alfonso Pelayo and Javier Pino. A.F.I. - Analistas Financieros Internacionales S.A.