Spanish corporates: Foreign exchange risk management in the face of increased complexity

Growing internationalisation and geographic diversification of Spanish corporates has increased their exposure to exchange rate, or FX, risk. Firms will need to adopt more refined hedging strategies to manage the impact of potential FX volatility on their financial statements.

Abstract: Spanish companies have significantly increased their presence in international markets in recent years, not only through export activity but also through foreign investment in other economies. This international expansion has simultaneously been accompanied by greater geographical diversification into non-traditional markets. The result has been a growing complexity in the management of various types of exchange rate risks, such as: translation or conversion risk, transaction risk; and economic risk - all of which could potentially impact the company’s financial statements through different channels. Effective exchange rate hedging strategies requires a company-by-company, dynamic assessment to ensure instruments are well suited to the underlying risks.

Increased corporate internationalisation and presence

in non-traditional markets

Spanish multinationals are managing risks against a backdrop which has changed dramatically over recent years. Exposure to these risks, specifically exchange rate risk, has been strongly influenced by very vigorous international expansion. This is clear when considering some of the main characteristics of the internationalisation process which Spanish companies have undergone in recent times.

This internationalisation process, which traditionally focused on export activity, has been reinforced with an increase in greenfield investment in other economies and has been characterised by a significant increase in geographical and currency diversification relative to the main trends seen a decade ago.

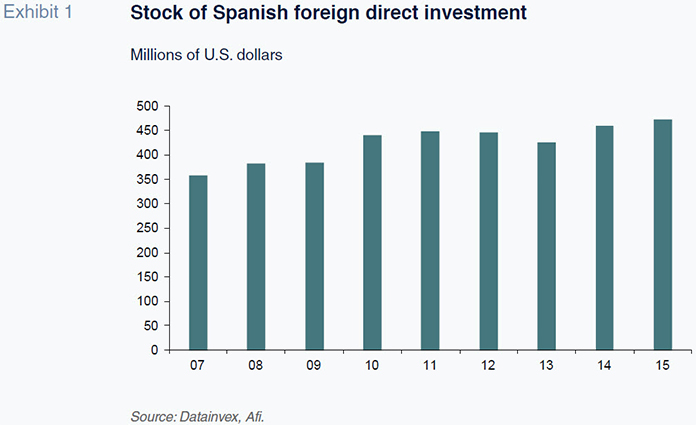

The latter is illustrated by a very notable increase in the stock of foreign direct investment, which surpassed 450 billion euros in 2015 according to the latest available data from Datainvex, some 30% above the end of 2007.

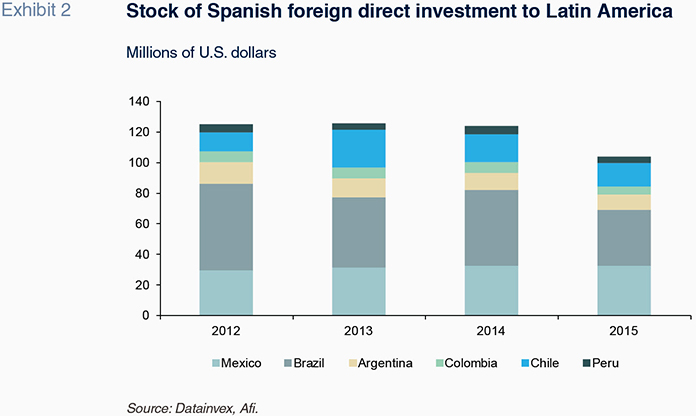

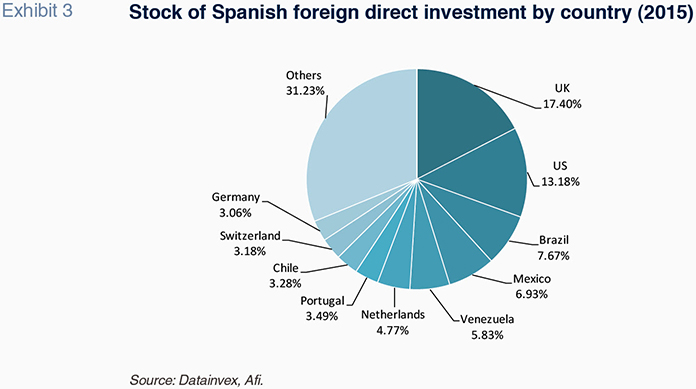

Investment has traditionally focused on Latin America, which currently represents 25% of total investment. Meanwhile, the United States and United Kingdom account for over 30% of the total, with both economies gaining importance.

In terms of the geographical composition of Spanish exports, Asian countries are increasing their weight at the expense of traditional partners (European Union). By the end of 2016, Asia accounted for 10% of total Spanish exports, with a further 7% going to Africa and 6% to Latin America.

The distribution to countries shows that both Brazil and Mexico account for over 45% of exports to LatAm, while China, Japan and South Korea represent over 35% of Spanish exports to Asia.

Classification of exchange rate risk in a multinational company

Before discussing the impact of internationalisation on companies’ exposure to these risks, it is worth briefly considering the main characteristics of an exchange rate risk map.

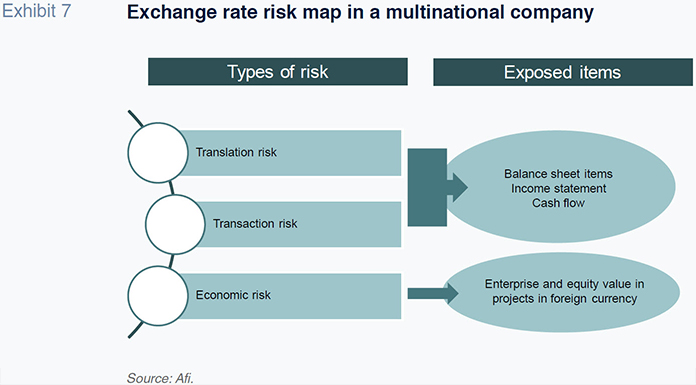

The exchange rate risk map for a non-financial corporation with foreign exposure is made up of three main components:

- Translation or conversion risk, which arises when consolidating subsidiaries’ financial statements for accounting purposes.

- Transaction risk, linked to their commercial activity in foreign currency, with an impact on the company’s cash flow.

- Economic risk, linked to the effect of the exchange rate on the value of investment projects in foreign currency.

The evolution of Spanish companies’ internationalisation has introduced new elements to the risk map, creating increased volatility with impacts across the board, ranging from transaction risk (linked to exporting and importing) to economic risk, and consequently to translation risk which is closely associated with the establishment of subsidiaries in non-EMU countries.

The next section of this articles looks at companies’ exposure to these different aspects of exchange rate risk in their financial statements, as well as how they have organised their risk management function and the main hedging strategies that are being employed.

The exchange rate risk map of Spanish multinational companies

This article draws on publicly audited information for the 2016 financial year to analyse the exchange rate risk map for a Spanish multinational. Using the data published by companies, we have put together an overview of the risks they are facing, including: how they are organising their risk function, the impact on financial statements; and, their main hedging strategies (the types of instruments being used).

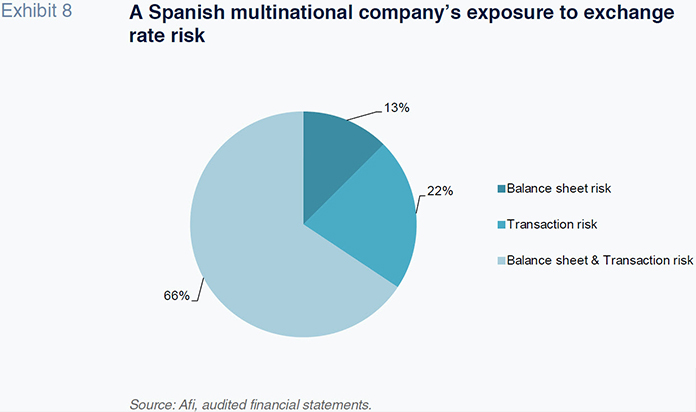

Classification of risks and organisation of risk management functionMost companies are exposed to a combination of both balance sheet as well as transaction risk (66%) with a smaller proportion exposed to only one of the two.

Management of risks is centralised. In other words, it is generally undertaken at the company’s headquarters, limiting subsidiaries’ discretion to take hedging decisions.

Impact on financial statements

Uncertainty regarding the strength of the economic recovery in recent years – both in developed and emerging economies – concerns about the capacity of developed country central banks to manage the unwinding of expansive monetary policy, and the recent increase in geopolitical tensions have generated significant volatility in financial markets. Currency markets have not been immune to these developments and indeed are frequently among the most volatile.

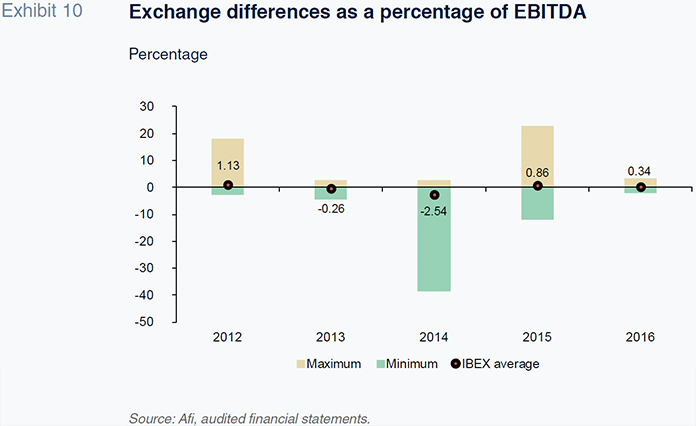

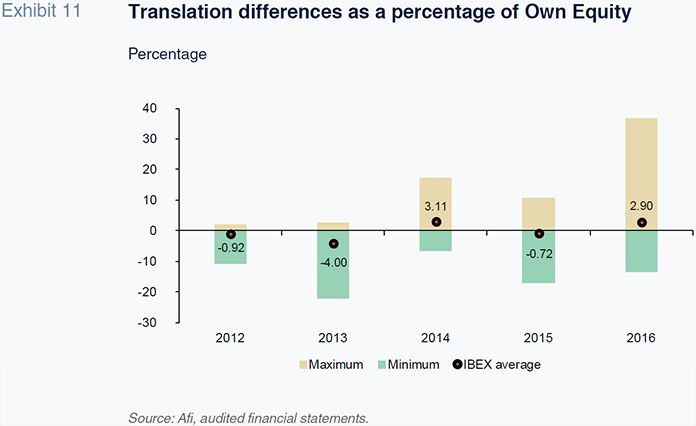

It is therefore hardly surprising that these fluctuations continue to have a very significant impact on multinational corporations’ financial statements, in some cases having a larger impact than seen on average over the last five years. Accordingly, other the last few years, we see that:

- Exchange rate differences in transactions have resulted in average impacts of around -0.5%, although with some very significant fluctuations among some of the listed IBEX 35 companies (negative impacts at the company level which in some years have had a one-off impact of 40% of reported EBITDA).

- Meanwhile, translation differences have had an average impact of around 0.37% on consolidated equity. Once again, this average figure masks significant variability with some company’s facing impacts of up to 20% of their net book value.

Greater international exposure has therefore generated significant impacts on financial statements. This is perhaps less obvious at an aggregate IBEX 35 level, but is undoubtedly the case when considering some of the individual impacts.

Instruments employed to manage risks

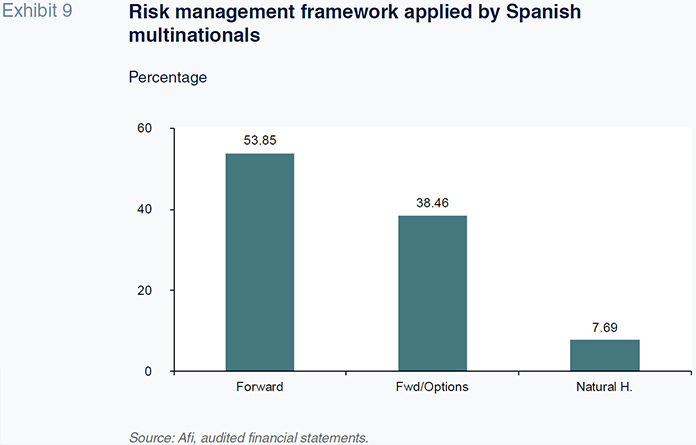

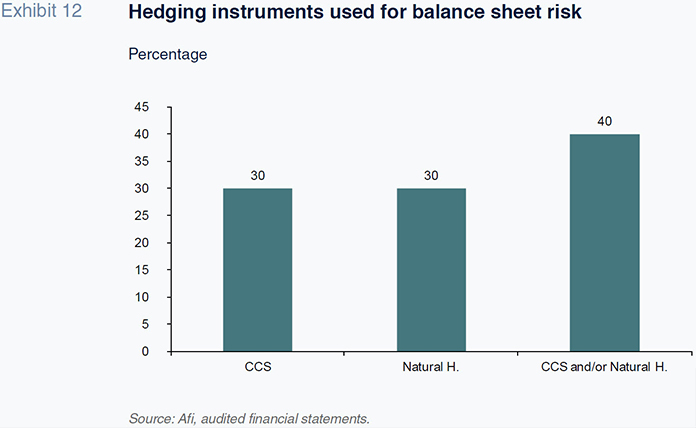

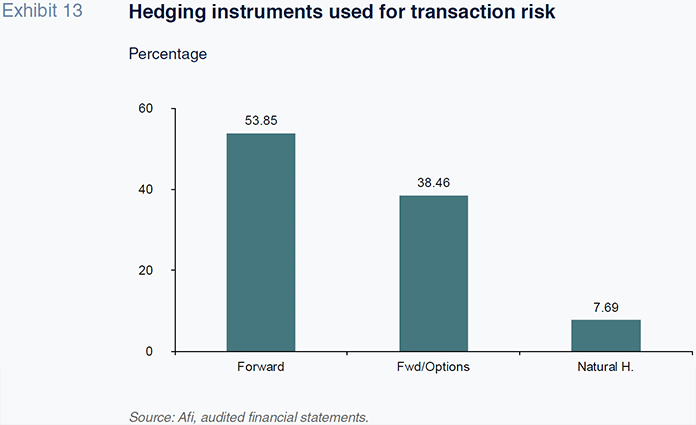

In terms of the main derivatives strategies adopted by companies to hedge against exchange rate risk:

- The most common strategy for hedging against transaction risk is the use of forex insurance or forwards.

- In order to hedge balance sheet risks, nearly all companies resort to Cross Currency Swaps (CCS) and natural hedging by borrowing in the same currency as their assets are denominated.

It is worth highlighting that accounting standards have become increasingly focused on promoting greater simplicity in the use of instruments to hedge risks. Upcoming changes to financial reporting standards (IFRS 9) repeatedly emphasise the need for contracted instruments to substantially replicate the risks they cover in order to ensure that they are not treated in the same way as speculative financial assets from an accounting perspective.

Recommendations regarding an appropriate management strategy

This final section summarises some generic, structural recommendations for companies with international exposure looking to hedge exchange rate risk. Implementation will require an analysis of each company’s individual situation to ensure hedges are perfectly suited to the underlying risks.

Aspects to consider in hedging decisions

- Management of exchange rate risk can be static or dynamic. However, empirical evidence shows firms should start out by defining a time horizon to be managed, as well as establishing some tracking milestones which help with fine-tuning the decisions that have been taken.

- Effective management should take account of which risks needed to be covered and their order of priority. In this regard:

- There are some financial risks which have accounting impacts and are immediately reflected in the company’s cash flow. These risks must be given absolute priority from the outset in hedging decisions.

- Some financial risks have accounting impacts but do not immediately affect the company’s cash position. These risks should be given secondary priority.

- Finally, some financial risks do not generate accounting impacts and therefore do not have a direct impact on the company’s cash flow. These are essentially economic risks which do not explicitly appear in the financial statement although they can be indirectly reflected. The approach to managing these risks is outside the scope of this article.

- Effective management should consider the impact on the company’s cash position to avoid the risk of a breakdown in cash flow following the settlement of derivatives where the company has obtained a loss.

- It should also consider the accounting implications of hedging in terms of the recognition of contracted hedging instruments.

Summary of transaction risk measures (cash flow hedges)

- It is worth considering a hedging policy that runs across various periods.

- The time frame for hedging should not be restricted to financial years but instead be viewed as a moving window – for example, on an ongoing 12-month basis – with dynamic adjustment of the percentage hedge depending on: (i) the realization of receipts and payments; and, (ii) the state of play in currency markets.

- An example of a layered approach would be hedging 80% of the expected cash flow for the first quarter, 60% for the second quarter, 40% for the third quarter and 20% for the fourth quarter over the twelve-month period.

- This time frame must consider the cost of protection: the longer the horizon, the greater the (implicit or explicit) cost of the contracted hedging instruments.

- Firms should cover a high proportion of cash flows (around 80%) as soon as the company is certain of the timing and amount of a receipt (or payment).

- This approach has the virtue of addressing a certain cash flow which is known to take place at a specific time and whose volatility would otherwise imply an unnecessary risk to the income statement and treasury.

Summary of balance sheet risk measures (equity hedge)

- The difference between assets and liabilities in a currency creates a balance sheet item (equity) which is exposed to exchange rate risk. In general terms, natural hedging is the preferred approach. This exposure tends not to be covered by contracting derivative instruments.

- Although financial literature does accept that derivative hedging may be appropriate at specific points in time and when dealing with currencies which are expected to depreciate over the long-term due to structural factors.

- The aversion to the use of derivative hedging for balance sheet items arises because it can generate risks due to the potential for impact on the company’s liquidity. This is because all hedging using derivatives can have an impact on cash flow (derivative settlement), while the exchange rate risk on balance sheet items does not itself affect cash.

- An alternative approach to covering balance sheet exposure is to convert part of the corporate debt into the same currency as

the assets which it has been used to buy. This approach respects the principle of natural hedging with debt being denominated in the same currency as the asset, which reduces the difference between assets and liabilities denominated in foreign currency, thereby reducing the value of own equity exposed to exchange rate risk.

Conclusions

The significant expansion in Spanish companies’ international activity, both in terms of exports and foreign direct investment in other economies, has increased the need for more refined management of exchange rate risk.

Managing such risks is undoubtedly complex within the context of a non-financial corporation, given that these risks can take different forms and have a range of impacts on the balance sheet, income statement and company cash flow.

The complexity of managing exchange rate risk increases further still:

- Against a backdrop of growing geographical diversification of Spanish companies around the world, which has led to companies transacting and managing weak and often extremely volatile currencies.

- Depending on the phase of the company’s internationalisation, which can multiply the potential coexistence of different risks at the same time, meaning that the above guidelines cannot be considered as one-size fits-all given the different impacts that can be generated.

Therefore, it is important to conclude by reiterating that despite the recommendations set out in this article, it is vital to approach the management of exchange rate risk on a company-by-company basis as part of what should be considered a dynamic process.

Pablo Guijarro and Isabel Gaya. A.F.I. - Analistas Financieros Internacionales, S.A.