Cryptoassets: The good, the bad and the advent of CBDCs

The emergence of cryptoassets provides both risks and opportunities for investors, banks and central banks alike. However, determining the ideal design and regulation of these assets, as well as anticipating any potential risks, will be key to minimizing financial system disruption and maximizing the associated benefits.

Abstract: Cryptoassets draw admirers and detractors in equal amounts. They are, nevertheless, here to stay and are destined to play a prominent role in the global financial system over the coming decades, as renowned institutional investors and central banks are already acknowledging. However, it is not yet clear which type of asset will prove most dominant. Moreover, there are questions regarding the intrinsic value of a broad number of these assets, with potential risks for their holders and for the stability of the financial system. Here, banks could play an important role. These institutions have a comparative advantage given their experience with financial regulation and would benefit as they transition towards digital service platforms. Central banks are also increasingly considering how they could influence the development of cryptoassets. For example, the ECB is examining a number of options including a system of citizen retail accounts. However, this would have consequences, such as banks’ increased reliance on wholesale versus retail funding, with potentially adverse implications for their margins.

Introduction

The gradual digital transformation of payments, investments and savings has been reckoned with for decades. However, computing and cryptography have enabled the development of assets that are often hard to categorise and present unusual advances in aspects, such as transaction and settlement speed, data privacy and security. There are a wide range of assets with different configuration and usage, encryption, transparency and acceptance protocols. Cryptocurrencies are the most well-known and controversial of these assets on account of their economic and social ramifications.

It is an undeniable reality that this asset will affect much of the financial system in the coming decades. What shape the landscape will ultimately take and which assets will prove sufficiently deep and accepted remains unknown. In this paper, we analyse the attributes of some of these digital assets and how they are affecting essential financial system functions, such as bank intermediation, monetary policy and financial stability. At the centre of the prevailing debate are the so-called central bank digital currencies (CBDCs), which, coupled with incipient regulation of digital platforms and digital financial assets, are defining a new paradigm for a sector that has been, thus far, as confusing as it has been exciting.

The performance and acceptance of cryptoassets, or, more generically, digital financial assets, has varied considerably. In September, for example, El Salvador agreed to accept Bitcoin –the leading digital currency in the market– as legal tender. It was the first country in the world to do so. The decision was somewhat controversial. There is a degree of consensus in the analyst community that Bitcoin has failed to become a payment instrument with the exchange stability, divisibility and ease of settlement properties a fiat currency has. In October, the US Securities and Exchange Commission (SEC) approved an exchange traded fund (ETF) that tracks Bitcoin for NYSE listing, a move that has been followed by other cryptocurrency ETFs. That development, coupled with growing positioning in and openness to trading in cryptoassets by banks and investment companies, has fuelled these assets’ so-called “institutionalisation”. However, the very fact that these ETFs have listed on the market highlights the controversial reality facing those positions as, what initially translated into a boost for currencies, such as Bitcoin, in a few short days materialised in major losses for ETF investors and the digital currency itself. Speculation and questions about their underlying value linger.

The sharp movements in the value of cryptocurrencies and in the assets and funds securitised and marketed around them has ensured a lively debate. It is hard to deny the growing importance of cryptography, distributed ledger systems and the digitalisation of money (beyond its functions as a method of payment), which increasingly act as core aspects of the financial system. Against that backdrop, two developments could pave the way for a degree of organisation and restructuring in the crypto field: (i) increasing regulation of digital platforms and assets; and, (ii) central bank digital currencies (CBDCs).

It is important to note that the development of these new kinds of digital money is taking place during a protracted period of ultra-low or negative interest rates. That has created a niche for investment alternatives with wider risk-return trade-offs or the ability to unlock efficiency gains at some point along the financial instrument value chain. The institutionalisation and regulation of these assets and the rollout of CBDCs could give them a more official profile. Indeed, a large part of the criticism and concerns expressed by numerous economists, regulators and supervisors around cryptocurrencies focuses on the difficulty in determining an underlying value for many of them. However, in a significant number of cases it has been possible to ascribe considerable value to the technology embedded in them or to somewhat more transparent or financially endorsed versions thereof. It is conceivable that this gradual formalisation will give relative importance to public versus private digital currency initiatives. Many central banks have been warning of the negative consequences that a rapidly-spreading and uncontrolled digital currency could have for financial stability. For example, China’s ban on trading in cryptocurrencies came at the same time as the country launched a beta version of the official digital Yuan.

In the next section, we present an academic perspective on digital financial assets. We then focus on CBDCs as the likely dominant digital asset. Finally, the paper ends with a few brief conclusions.

Digital financial assets: An economic analysis

The popularity of cryptocurrencies and other digital assets has created a sort of intellectual gap in what could be very broadly termed the “future of money”. Cryptoassets are particularly popular among the younger generation. Their vision contrasts with the grimmer interpretation made by the economic establishment, which sees a lot more value in the underlying technology embedded in cryptoassets (such as blockchain or, more generically, distributed ledger technology) than the financial assets themselves.

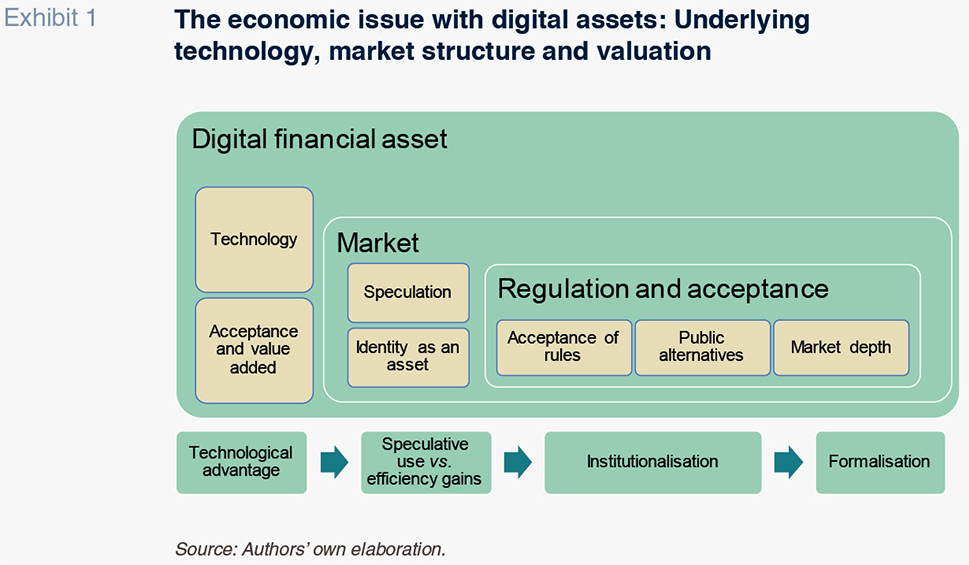

Exhibit 1 sums up the economic valuation problem. The market has accepted the digital financial asset concept and the value added by the embedded technology, Nevertheless, the market continues to make a distinction between those assets it considers fundamentally speculative and extremely volatile and others that are more credible (as payment instrument, store of value, traded asset or securitisation, clearance or settlement technology, among others). Lastly, regulations and the introduction of market rules are emerging as a force for sector organisation. In the post-financial crisis world, it is not a good idea to have an abundance of assets whose values swing sharply and are traded in the shadow market. However, the emergence of publicly backed alternatives and transparency requirements are introducing competition and rules that are gradually determining the depth of the market for each cryptoasset.

The debate centres around the flagship currency: Bitcoin. As explained by Conesa (2019), Bitcoin was not designed as an alternative to conventional payment systems but rather as a central authority for approving or rejecting transactions. What Bitcoin offered in 2008 was a powerful mechanism for facilitating anonymous transactions at a reduced cost, in a safe and speedy manner, eliminating the need for intermediaries. Its distributed ledger systems have been used in many ways. Although blockchain was initially presented as a near-ubiquitous solution it has enabled extraordinarily important developments, such as smart contracts and a significant improvement in international credit and commercial transfers and systems (e.g., the platforms created by banks for global trade credit).

Why have digital assets become more widely used and accepted? Blockchain and its value as a technology are largely responsible. But blockchain is not the whole story. Many economists believe that in the transition from cash to electronic payment methods, encryption and the development of new asset categories are the next evolutionary steps. They draw on historical analogies to remind us that the controversy and valuation problems around past innovations have frequently caused debate and even crises, only to give way to these new elements of the financial system. That narrative claims that cryptoassets are currently identifying weaknesses or gaps in the current system and proposing solutions, albeit in some instances this activity is incomplete. [1]

One of the problematic facets of cryptoassets lies with their volatility and implicit risk. As noted by Böhme et al. (2015), the original algorithm rules for mining Bitcoin were seen as an opportunity to solve a large number of problems with economic transactions and information flows. Instead of storing transactions on a single server or group of services, they are distributed to a network of participants, enabling verifiable participation and preventing concentrations of power (Böhme et al., 2015). Over time, some of those characteristics have remained valid and useful and been applied in other sectors (e.g., DLT), whereas other have failed. Bitcoin mining, for example, has relied on computing capacity and the assumption of energy costs, which has favoured the accumulation of power. Moreover, the restricted number of Bitcoins that can be created, their volatility and the opaque manner in which they are often used means that the cryptocurrency is not useful and cannot be considered a payment instrument.

To circumvent some of the issues posed by Bitcoin, other currencies have been developed that address these limitations. For example, stablecoins’ value is anchored or benchmarked against fiat currencies, such as the dollar. Cryptoassets, whose main purpose is to offer a less energy intensive mining protocol, are also under development.

Although some of these projects proved popular early on, their market depth remains very limited. In the stablecoin arena, the project that has sparked the most controversy is Facebook’s Libra, with initial doubts centred on asset definition and security problems. Many supervisors noted that the scale the currency could attain may pose an issue for financial stability, requiring a gamut of regulations ranging from equity market investment requirements to solvency demands. In terms of security, many regulators dwelt on the fact that a company that has experienced data privacy problems might not be the best destination for a global payment system. More recently, some economists have pointed out that these proposals do not offer any improvements in two key areas in which the fiat currencies and banking sector are working well: exchange rate stability and security in handling customers’ financial data (Stiglitz, 2019). However, other economists have suggested that the recent developments of greater interest in cryptography, data protection and transaction efficiency are happening in certain private cryptocurrencies and that the latter are destined to prevail even in the event of stringent regulation and the emergence of central bank digital currencies (Amstrong, 2020). The political economy currents behind those criticisms are additionally shaped by the central banks’ reluctance to make room for private initiatives that act as alternative monetary systems beyond their control. This concern is the driving force behind the development of many national CBDCs.

Fraud scandals have also undermined the value proposition of cryptocurrencies and other digital assets. Such scandals extend beyond security hacks or data theft to global pyramid schemes in cryptoassets. Consequently, the US is contemplating a series of accounting and transparency measures for control purposes. Additionally, the Bank of England may approve capital requirements for banks that trade in or hold such instruments on their balance sheets. The Chinese government has gone the furthest by banning all transactions in private digital currencies last September.

On February 9th, 2021, the Spanish securities market regulator and the Bank of Spain issued a memorandum on the risks of investing in cryptocurrencies. Both institutions had already warned in 2018 of the significant risks associated with these investments due to their extreme volatility, complexity and lack of transparency. In their memorandum, they acknowledge the positive aspects of cryptocurrencies but cautioned that:

- There is still no European Union framework regulating cryptoassets that provides guarantees and protection equivalent to those applicable to conventional financial assets.

- Cryptoassets are not considered payment methods, they are not backed by a central bank or other public authority and they are not covered by customer protection mechanisms, such as the deposit or investment guarantee schemes.

- The estimated number of cryptocurrencies on the market with similar characteristics to Bitcoin stands at over 7,000. They are complex investment instruments that may not be suitable for small savers and their prices are driven significantly by speculation, exposing investors to potentially large losses.

- There are leveraged derivative products written over cryptocurrencies that enable indirect investments, further increasing their complexity.

- Digital currency price formation takes place in the absence of effective mechanisms for preventing price manipulation.

- Many of these cryptoassets may lack the liquidity needed to unwind a position without incurring significant losses.

- The distributed ledger technology used to issue digital coins entails specific risks. Their custody is neither regulated nor supervised.

Other cryptoasset spinoffs have garnered a lot of attention in recent years. The most important are the initial coin offerings (ICOs) in which a wide variety of assets, from interests in start-ups to video games or image rights, are securitised by means of virtual units of value, or tokens. While the financial and investment institutions see extensive technological and financing possibilities in these instruments, it is estimated that 80% of ICOs have lacked intrinsic value, generating losses for their holders, or have directly constituted fraud (Roubini, 2018). The development of ICOs without legal guarantees creates a misguided incentive system in terms of banking/investment network security and money laundering.

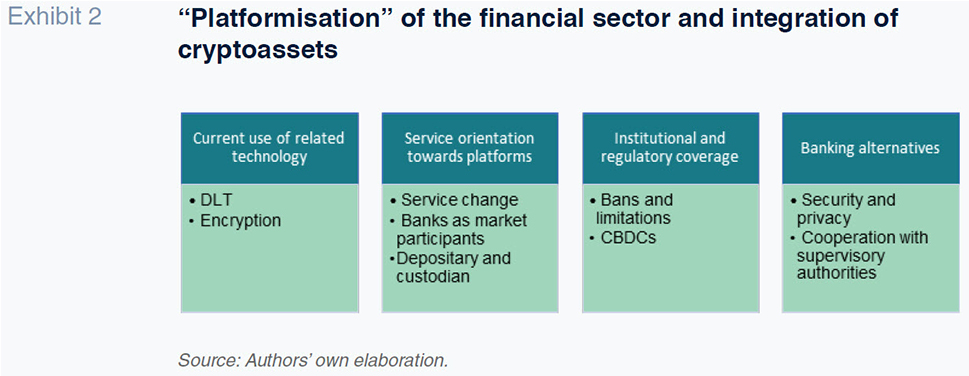

In this uncertain environment, the banking sector could play a key role. Financial institutions view cryptoassets as too big an investment opportunity to ignore. Banks, acting as intermediaries, could provide those security elements that are lacking in areas, such as accounting reporting and transparency, defence against money laundering and even the ability to act as security depositary and custodian. Banks could also use these services as part of their value propositions in a digital platform model that is likely to dominate across the sector (Exhibit 2). In addition, any type of CBDC that uses the banks as intermediary could also lend institutional coverage to these developments.

The Bank of Spain has developed a register for firms trading with cryptocurrencies, marking a first and important step towards greater transparency. This register includes a list of providers of virtual money for fiat currency exchange and electronic wallet custody services. As such, it catches the full spectrum of participants in virtual currency trading, from purchase to custody and storage. In tandem, the European authorities are developing a set of regulations governing cryptoassets and the platforms they are traded on known as MICA (Markets in Cryptoassets), which could launch in 2022.

These initiatives, which could be coined the “re-intermediation” of digital asset trading, contrast with less orderly formalisation initiatives, such as El Salvador’s decision to approve the use of Bitcoin as legal tender last September. As noted by Gorjón (2021) “the project faces numerous practical uncertainties that raise doubts over the initiative’s medium-term future. For instance, it is difficult to judge who really bears the foreign exchange risk stemming from Bitcoin’s market fluctuations. It is unclear whether the fund, with the amounts allocated to it, will be able to absorb such fluctuations, nor the outcome once the fund is depleted. Ultimately, any future losses may have to be borne by taxpayers” (Gorjón, 2021).

CBDCs: The elephant in the room or a balancing mechanism?

Theoretical underpinnings and implementation challenges

As the various governments and monetary authorities study the launch of official digital currencies, we are seeing a plethora of hypotheses about what impact they could have on global financial geopolitics, central bank policy, the private banking business and the reconfiguration of the digital asset market.

Many monetary authorities have internalized the relevance acquired by cryptoassets in many markets, particularly the significance assumed by cryptocurrencies. They have realised that at some point it might be necessary to jump on stage and play a leading role. Fundamentally, it is supposed to be the central banks that monitor and take decisions with respect to the money supply. By the same token, governments are aware that the significant penetration of a fiat currency in digital form could impact the exchange markets and monetary control on an international scale. It could therefore become necessary to regulate cross-border acceptance of central bank digital currencies (CBDCs).

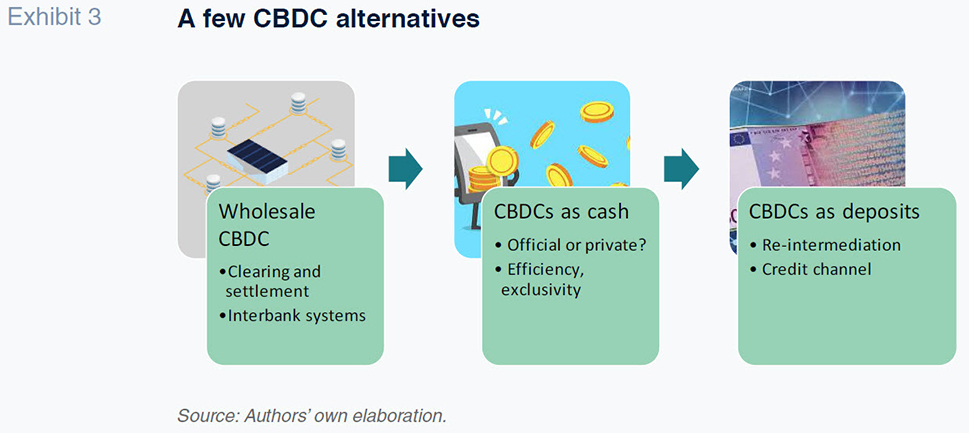

The design of potential CBDCs could have structural consequences for payment methods, bank intermediation, savings and credit channels. As shown in Exhibit 3, there are three main ways of developing a CBDC. The first is to create a digital wholesale system to improve clearing and settlement systems and foster faster, more secure, and more efficient interbank transfers. It is worth noting that there are already wholesale payment mechanisms in the main monetary areas that are working well. It is important to consider to what extent this wholesale use of CBDCs could bring fresh benefits.

A second route is to create a CBDC that works as “digital cash”. The idea is that in the current low-rate environment, monetary policy may have reached its lower bound and no longer be effective. Against that backdrop, it might be useful to have a CBDC that consists of digital cash (of a limited amount) which could be associated with an interest rate. Notes and coins are affected by inflation as they do not generate a return; but a monetary ledger of digital cash could offer an associated return, even if only a small one. This option would give central banks broader control over cash movements. There are already a few private wallets that are linked, primarily to bank accounts, albeit used merely as a payment method, without offering any remuneration. It is worth assessing to what extent it would make sense to substitute the private systems for public alternatives, with a focus on the degree of anonymity provided by such initiatives and whether to layer in remuneration on the digital cash.

A third option is to foster the development of CBDCs as central bank deposits that are more permanent in nature and offer higher remuneration than holding digital cash. That would constitute a wholly disruptive scenario. While such a development would be more efficient and offer greater monetary control and security benefits, it would also constitute a transformation cost for the bank intermediation system and monetary policy transmission channel currently in place. It would also have a negative impact on bank deposits, which are an essential input for the banking business.

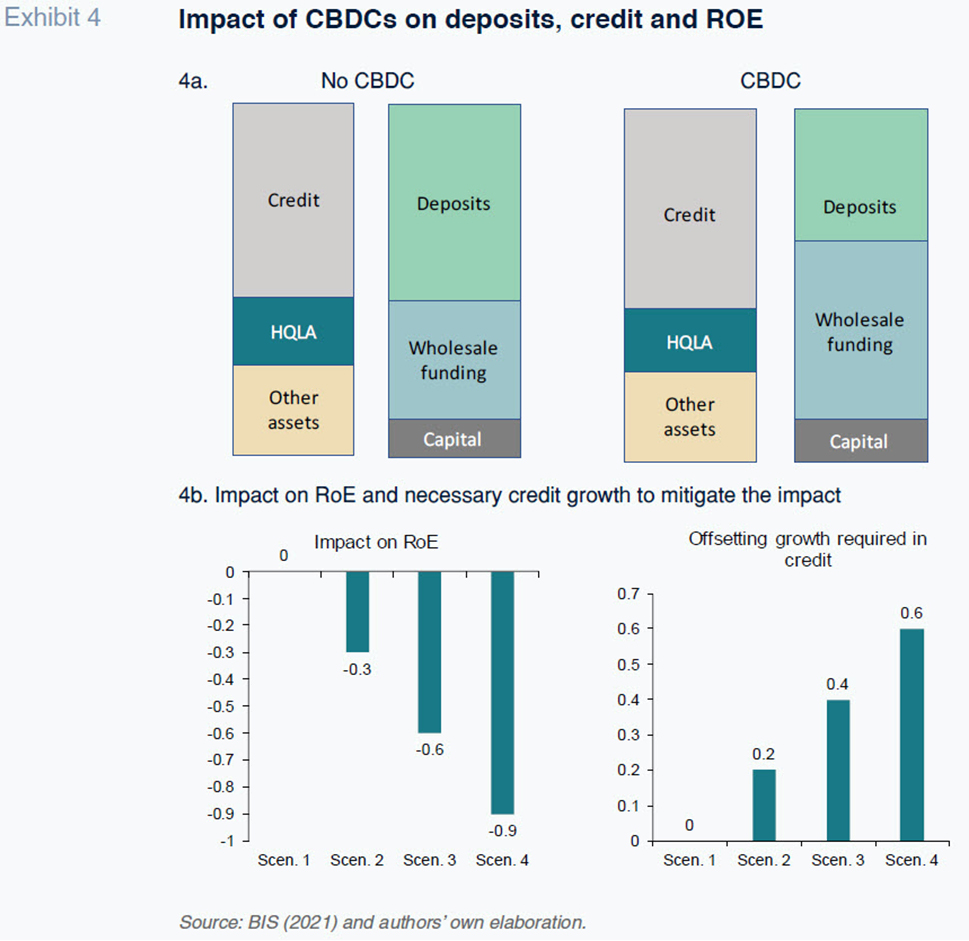

The monetary authorities are aware of the possible disruptive impact of CBDCs. Several of the world’s highest-profile central banks have conducted a study together with the Bank for International Settlements (BIS, 2021) in order to calibrate the impact of a CBDC that allows citizens to hold deposits at a central bank. The main estimates are summed up in Exhibit 4. The upper section of the exhibit shows the basic bank balance sheet structure with and without CBDCs. On the investment side, we show credit, high-quality liquid assets (HQLA), such as public debt, and other assets. On the liability side, there are deposits, wholesale funding and own funds.

The launch of this form of CBDC would entail the switch of a good chunk of banks’ retail funding (deposits) to wholesale funding, as a majority of bank accounts would move to the central bank digital currency, with significant consequences. Firstly, it would alter the structure of liability remuneration and could push up the cost of funding and erode the banks’ margins. Secondly, it would change customer relations and the manner in which deposits have traditionally been channelled into credit.

Although it is a distant possibility in the opinion of most central banks, there are four possible scenarios (refer to the bottom section of Exhibit 4) depending on the percentage of deposits that end up being replaced by wholesale funding. In scenario 1 the movement is estimated at between 0% and 5%, while in scenario 2 it would range from 5% - 10%. In scenario 3, the movement would increase to between 10% and 20%, and in scenario 4, it would exceed 20%. The negative impact on the banks’ return on capital (ROE) could reach 0.9%. In addition, the banks would have to increase their loan books to offset the impact on their margins. The necessary increase in the rate of growth in lending activity is estimated at between 0.2% and 0.6%.

The digital euro

The ECB is keenly aware of the potential importance of CBDCs and is looking at a range of models. It has set up a specific section on its web portal to explain its progress and the experimental studies underway. In the ECB’s opinion, “The digital euro would still be a euro: like banknotes but digital. It would be an electronic form of money issued by the Eurosystem (the ECB and national central banks) and accessible to all citizens and firms.” It is important to note that according to the ECB, a digital euro would not replace cash, but rather complement it.

As for the reasons given for adopting a digital euro as a retail payment instrument, the ECB argues it would be a fast, easy and secure instrument for daily payments, support the digitalisation of the European economy and actively encourage innovation in retail payments.

The ECB acknowledges that part of its interest in developing a digital euro is to tackle the growth in digital payment systems issued and controlled from outside the eurozone, potentially jeopardising financial stability and monetary sovereignty. It prioritises protection of privacy. The central bank decided to launch a study into a digital euro in July 2021. The current investigation phase will last until at least 2023.

As well, in July 2021, the ECB published the results of certain technical experiments researching the practical possibilities of implementing a digital euro. [2] It concluded that “no major technical obstacles were identified to any of the assessed design options”. It does, nevertheless, acknowledge that the implications go far beyond the technical feasibility of implementation, signalling that the “findings will need to be weighed up by a number of related areas, ranging from policy to legal. For some solutions, confirmation of whether or not they could be implemented in a way that is suitable for a retail digital euro aimed at the general public would be necessary, taking into account issues such as safety, reliability, speed, convenience and cost efficiency.”

Conclusions

In this paper, we analyse the ongoing debate surrounding cryptoassets, focusing in particular on digital coins and the potentially disruptive role of central bank digital currencies (CBDCs). We draw three main conclusions:

- Neither investment service firms nor central banks can afford to ignore the inroads made by cryptoassets. However, there are still a number of questions about the intrinsic value of a broad number of these assets, implying risks for their holders and for overall financial stability. Part of the problem lies with the lack of official or practical identification of some of these digital products within a specific financial asset category (e.g., as a payment instrument, investment or store of value).

- The financial institutions could play a balancing role in the adoption of purely digital cryptography, currencies and transaction systems using distributed ledger technology. There is a degree of agreement that the regulation of cryptoassets will accelerate in the coming years, with banks having a comparative advantage in terms of experience with regulatory compliance, reputation and privacy control. In the transition towards digital service platforms, encrypted assets and channels will be essential elements.

- Central bank digital currencies (CBDCs) will be rolled out gradually across the various jurisdictions. In the eurozone, this will not occur before 2023. The ECB is considering a number of options and a system of citizen retail accounts (including deposits) at the central bank is the most feasible option. That class of CBDC would require the banks to rely more heavily on wholesale funding, which would have adverse implications for their margins. The impact should, however, be limited (up to 0.9% of ROE according to recent estimates) and implementation is unlikely to happen soon.

Notes

For a synopsis of papers about this “evolutionary” theory of cryptoassets, refer to Bartolucci et al. (2018).

Santiago Carbó Valverde and Francisco Rodríguez Fernández. University of Granada and Funcas