Zombie firms: An analysis of business sector vulnerability post-COVID-19

Many companies that were not viable before the pandemic have survived thanks to financing and policy measures aimed at keeping money and credit flowing during the crisis. As support measures come to an end, these “zombie firms”, now exposed to increased borrowing costs on the back of upcoming rate hikes, may pose a risk to the global economy and financial sector.

Abstract: The COVID-19 pandemic is wreaking financial and economic havoc on many sectors. The businesses operating in the sectors squeezed most by the crisis, such as those related to the provision of services, particularly tourism, hospitality, leisure, retail, passenger transportation and professional services, have been hit particularly hard. The measures rolled out to mitigate the adverse effects of the pandemic have helped keep money flowing to the real economy, mainly in the form of credit, containing unemployment and staving off the demise of a significant number of businesses. That aid brings its own risks, however. Namely, that a considerable number of companies that were in precarious positions before COVID-19 may have used the pandemic support measures to survive, and lax financing conditions may be masking business models that are, in reality, not viable from an economic perspective. The survival or failure of such companies, known as “zombie firms”, has implications for the outlook of the global economy and the financial sector. In the case of Spain, such firms currently account for around 2.0% of the total. In line with the estimated European average, this share is high enough to raise the risk of loan non-performance in the Spanish banking sector. As well, over 62% of Spain’s zombie firms are small or microenterprises, which are more vulnerable to today’s economic and financial frictions. Thus, risks could increase should a new variant trigger fresh lockdowns and business restrictions necessary to contain transmission.

Introduction

2020 was marked by the pandemic induced by the SARS-CoV-2 virus, which triggered the so-called COVID-19 crisis. As has often been noted, the impact of that crisis, sparked mainly by the lockdowns and mobility restrictions introduced in an attempt to stem faster transmission of the virus, has been felt in multiple sectors and areas of the economy, most keenly in those related to retail and services, especially tourism-related services.

The economic disruption to the world’s main economies has no precedent in peacetime and has hit countries most reliant on tourism, including Spain, Portugal and Italy, particularly hard. Although the economic recovery is proving vigorous, thanks in part to the progress made in vaccinating the population, vulnerabilities linger as a result of new variants (which have prompted new restrictions in some countries), as well as the fallout from the ensuing global supply chain friction, materials scarcity and a spike in energy product prices, which are pushing inflation to levels not seen for decades and fuelling intense debate about central bank strategy.

However, beyond the risks that could still jeopardise the recovery and, ultimately, challenging outlook for growth, such as the aforementioned spike in inflation, possible monetary policy tightening and financial asset price correction (Bank of Spain, 2021), in this article we analyse another consequence: burgeoning corporate zombification. The amount of zombie firms has been rising since the onset of the crisis as a result of the partial discontinuation of the aid initially provided in the form of monetary and fiscal measures, which, while welcome and necessary for countering the effects of the crisis (in their absence, the picture would be much worse), have fostered or could foster growth in their numbers.

Zombie firms are not a new phenomenon. The topic has been addressed by various analysts since the Great Financial Crisis of 2008 when unconventional monetary policy measures were put in place by the main central banks around the world. The papers published by the OECD in 2017 (Andrews, McGowan

and Millot, 2017; McGowan, Andrews and Millot, 2017a, 2017b) stand out. Those articles analyse the trend in the percentage of zombie firms in Europe, the driving forces and the consequences for an economy’s productivity. Elsewhere, the body of papers on the subject emphasises the relationship between zombie firms and the financial sector, signalling that the former are more likely to fund themselves with loans from banks that present certain weaknesses in terms of solvency and profitability (Andrews and Petroulakis, 2019).

The number of papers addressing the topic has increased since the beginning of the ongoing crisis, and look primarily at the measures designed to keep credit flowing to enterprises, particularly smaller ones. Those measures have covered the companies’ short-term liquidity requirements, enabling many of them to survive the current climate. However, some, regardless of the pandemic, operate under business models that are not sustainable in ordinary conditions.

What is a zombie firm?

Before getting into the analysis, it is necessary to put the notion of zombie firms into context. There are two main definitions:

- The European Central Bank’s Financial Stability Review of May 2021 (ECB, 2021) devoted a section to analysing past and current trends in zombie firms. That document defines a zombie firm as one that is not viable in ordinary business conditions and survives thanks to highly accommodative financial conditions. More specifically, it defines zombie firms as those that meet all the following three criteria over at least two consecutive years.

- Negative returns on assets (identifying unprofitable firms);

- EBITDA over financial debt of below 5% (capturing indebted firms); and,

- Negative net investment (to avoid capturing young firms).

- The above-mentioned OECD-backed studies define a zombie firm as one that has been operating for at least 10 years without covering its interest payments from earnings for more than three years in a row.

Although the ECB definition might appear more sophisticated, they both underscore the same idea – a company is a zombie firm if it has been around for some time, does not make money and is highly leveraged. In this paper we use both definitions: (i) firstly, to analyse the trend in zombie firms in Europe to provide context; and, (ii) to run simulations for the Spanish economy.

Trends in zombie firms in Europe

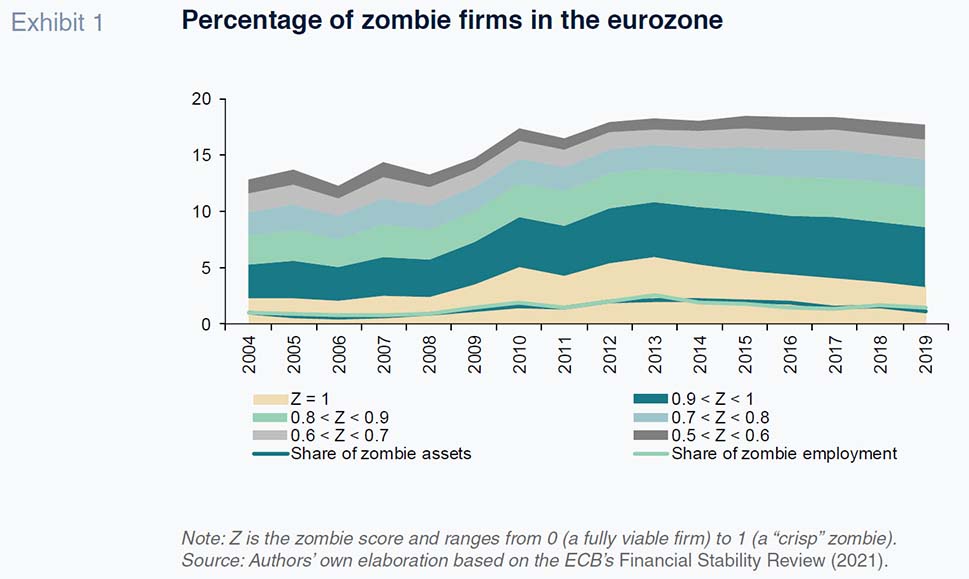

Based on the first definition, the ECB has estimated the trend in zombie firms between 2004 and 2019 in terms of assets and jobs, as illustrated in Exhibit 1. The peak, before the prevailing crisis, was reached in 2013, when zombie firms accounted for more than 2% of all assets and employees, although there are studies, such as by Acharya et al. (2020) which find that in 12 European countries, zombie firms had increased to nearly 7% by 2016. That percentage is likely to have dropped a little in recent years, but is probably close to the eurozone aggregate of 2%.

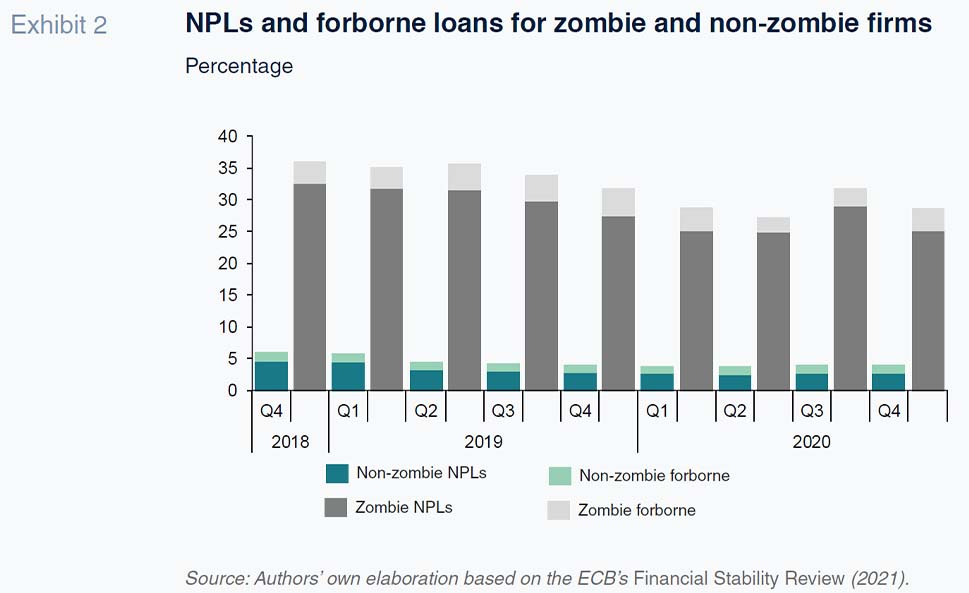

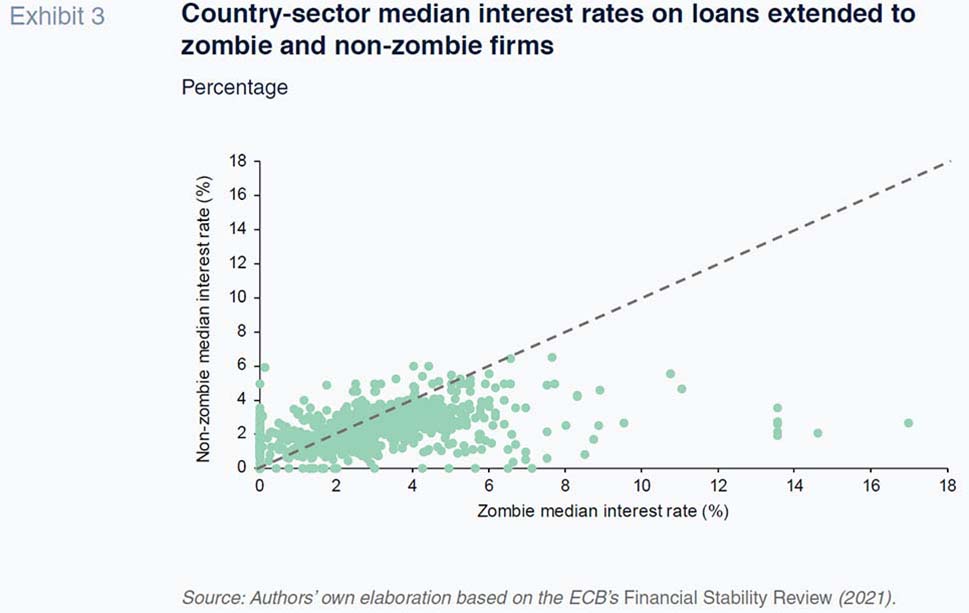

In addition, the ECB’s empirical study concludes, as expected, that zombie firms are less productive, started out as smaller firms and are more leveraged. In turn, as shown in Exhibit 2, those same characteristics make zombie firms more likely to default on their debt and/or embark on debt restructuring or refinancing processes. Moreover, the higher credit risk associated with zombie firms translates into higher rates on the loans they receive, as illustrated in Exhibit 3.

Those numbers reflect the fact that small– and medium-sized enterprises (SMEs) are more exposed to imbalances, but also that they have received more aid to prop them up. It is worth highlighting, based on the 2018 figures, that SMEs account for 99.8% of total European Union firms by number (99.9% in Spain’s case), contributing 57% of value added and representing over 66% of employment (62.2% and 72.4% in Spain, respectively) (Analistas Financieros Internacionales, 2019).

The ECB states that although the numerous measures taken, particularly on the credit front in the form of guaranteed loan and moratorium schemes, have helped reduce the mortality of the firms eligible to receive such aid and artificially sustained certain companies whose economic viability was already in jeopardy prior to the pandemic (European Central Bank, 2021). In our view, this was coupled with lax monetary policy that has only gotten laxer since the onset of the pandemic.

That phenomenon, which will fuel growth in the number of zombie firms in the years to come, is primarily attributable, in the words of the ECB itself, to lax eligibility criteria that potentially failed to prevent zombie firms from becoming eligible for public support.

Framed by that approach, it is necessary to drill down further into the numbers to identify the percentage of firms that can be categorised as zombie firms that could drive up banks’ credit risks and, ultimately, non-performing loans.

Spain: Scenario analysis ahead of a potential shift in monetary policy

Having analysed zombie firm vulnerabilities and contributing factors, along with the main insights gleaned from recent academic literature on the subject, we next perform a scenario analysis to simulate, for a sample of Spanish zombie firms, what would happen to an average profit and loss statement (P&L) in the Spanish business sector.

Note that the global economy is currently at an extremely complex juncture and shrouded by uncertainty. First, the COVID-19 pandemic continues to rage on and new variants are threatening to interrupt the economic recovery. Second, the supply shocks reverberating across the global economy are driving prices higher, pushing inflation to levels not seen in decades and shaping the expectation that the central banks will start to gradually roll back their unconventional measures, sparking a debate about rate hikes.

Therefore, businesses are currently in an extremely difficult predicament, facing rising input prices, which, coupled with global supply chain friction and business restrictions designed to thwart virus transmission, are tantamount to an earnings stress test. The expectation that rates may be hiked, with the attendant implications for firms’ debt servicing, could nudge vulnerable firms towards business failure from which there is no going back.

The Spanish economy is by no means immune to this situation. In fact, some of the sectors most vulnerable to the measures rolled out to mitigate the pandemic are very prevalent in the country’s business landscape.

The Bank of Spain’s most recent Financial Stability Report (Bank of Spain, 2021) pinpoints the risks and vulnerabilities facing the Spanish economy and its financial system. Among those vulnerabilities, the monetary authority highlights what it terms “the weak financial position of certain segments of households and firms” (Bank of Spain, 2021). Specifically, it points out the fact that “the recovery remains incomplete in the hardest-hit sectors (e.g., hospitality, transport and car manufacturing), which have recorded the largest increases in bank debt, and also non-performing loans” (Bank of Spain, 2021). Moreover, those same sectors account for the highest percentage of “latent” or unrealised bank loan impairment whose probability of materialisation is nevertheless high.

To categorise zombie firms in Spain, we rely on the OECD definition (Andrews, McGowan and Millot, 2017); McGowan, Andrews and Millot, 2017a, 2017b): firms aged ≥10 years and with an interest coverage ratio of <1 over three consecutive years. Although we are dealing with a highly complex concept for which there is no set definition in the prevailing body of literature, we rely on that definition because it is one of the most widely used (refer to the works of Osório, Bento and Xarepe (2017); Hallak, Harasztosi and Schich (2018); Banerjee and Hofmann (2018); Andrews and Petroulakis (2019); Grieder and Ortega (2020); El Ghoula, Fu and Guedhami (2020); Cella (2020); Banerjee and Hofmann (2020); and Carreira, Teixeira and Nieto-Carrillo (2021), among others). Note, importantly, that by establishing a 10-year threshold, the analysis distinguishes between zombie firms and more recently created companies, while the three-consecutive-year coverage ratio hurdle avoids bias caused by cyclical swings.

Framed by that definition, we drew from a sample of 17,979 legally incorporated Spanish firms taken from the SABI database, out of a total of around 975,000 (i.e., around 2.0% of the total, in line with the ECB’s estimate for Europe). This database compiles financial information pertaining to the enterprises that file their annual financial statements with Spain’s Companies Register. We then cleaned up the sample distribution to remove outliers by filtering out the 5% of companies with the highest and lowest average borrowing costs.

Table 1 provides the initial sample gleaned from the SABI database, the cohort obtained using the zombie firm definition applied and the final sample after outliers were filtered out.

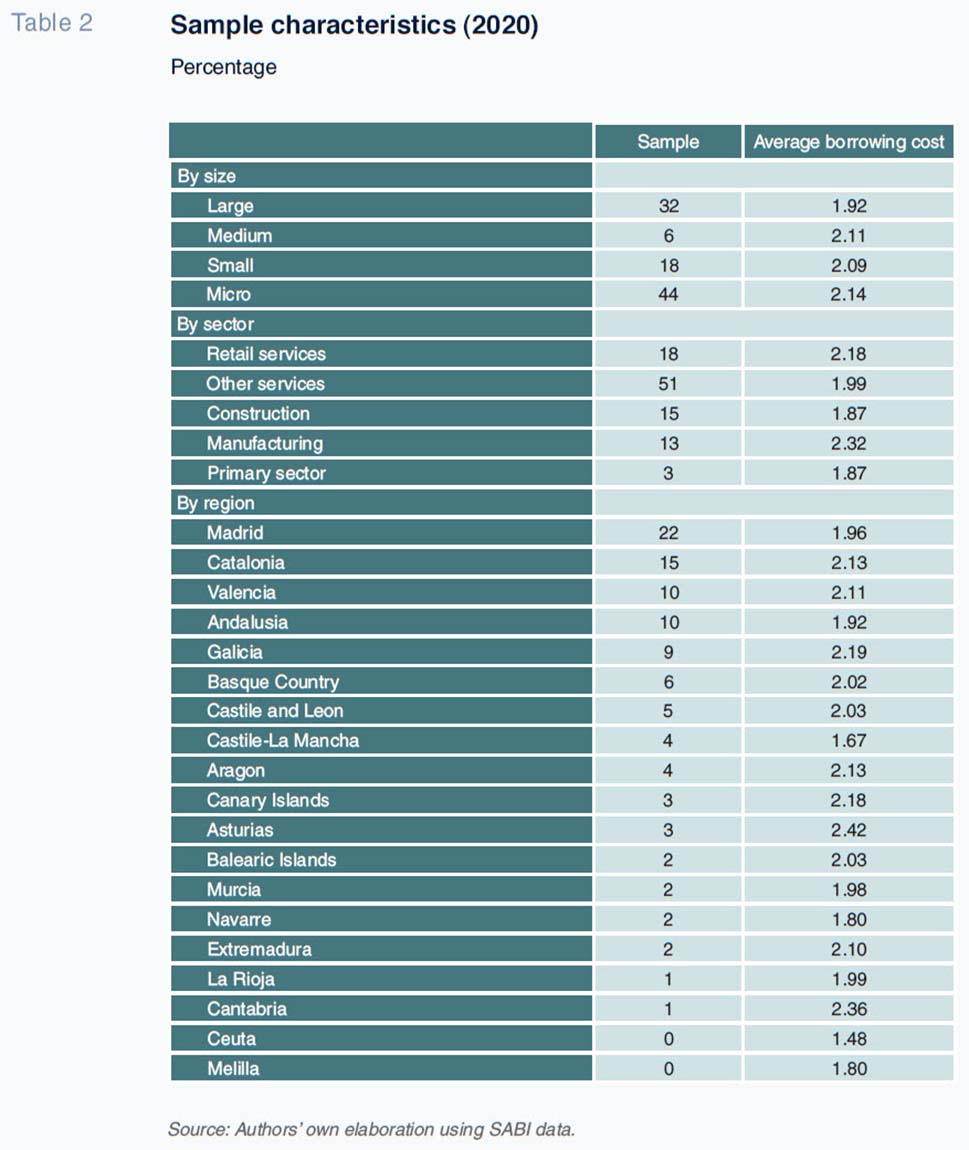

Meanwhile, Table 2 provides the sample breakdown by company size, business sector and region, and their average borrowing costs.

Table 2 yields very interesting conclusions about the zombie firm paradigm in Spain. First, 62% of the zombie firms are small or microenterprises, indicating the significant vulnerability of companies that normally encounter greater difficulties in accessing financing (Maudos, 2014). This is also evident in their average borrowing costs.

Nevertheless, it is worth noting that the percentage of large enterprises in that same situation is by no means insignificant, accounting for a third of the sample, which is evidence of the impact of the pandemic crisis on certain sectors. Unless they redefine their general and financial strategies, those companies could pose a problem in employment terms.

Sector-wise, 51% of the zombie firms are involved in service sectors not related to retail, clearly reflecting the impact of the COVID-19 crisis and the mitigating measures rolled out in 2020.

Lastly, from a regional perspective, Madrid and Catalonia account for the highest shares of zombie firms, followed by Valencia, Andalusia and Galicia.

It is also worth highlighting that 29% of the companies in the sample display negative equity and, very significantly, 90% are loss-making at the EBIT level, clearly illustrating the extreme vulnerability of these companies from a strategic perspective, regardless of their financial structures.

Having analysed the overall zombie company paradigm in Spain, we decided to perform a sensitivity analysis. We simulated an increase in average borrowing costs, in line with the rate hikes being discounted by the market, of 50, 75 and 100 basis points, to analyse the impact on Spanish zombie firms’ P&Ls. Finally, we simulated an average P&L statement for our cohort of firms.

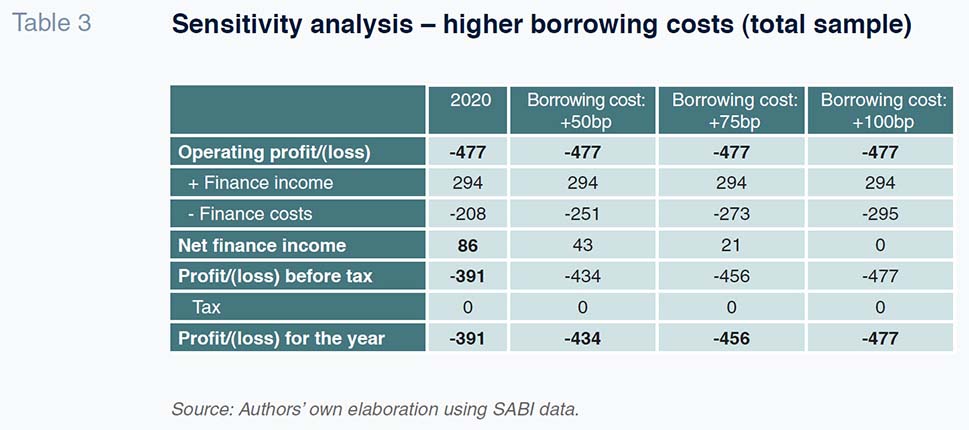

Table 3, which synthesises the simulations, yields certain compelling conclusions. First, the firms in the sample present negative EBIT on average, which means they cannot even cover their current borrowing costs, despite having sizeable volumes of finance income shaped by the need to generate a financial return in a zero-rate environment.

On average, the earnings for the firms analysed would be undermined by monetary policy moves to increase interest rates. Specifically, all other things being equal, a 50 basis point increase in interest rates would drive 11% growth in losses for the year, a rate that would rise to 17% and 22% in the case of 75 and 100 basis point increases, respectively.

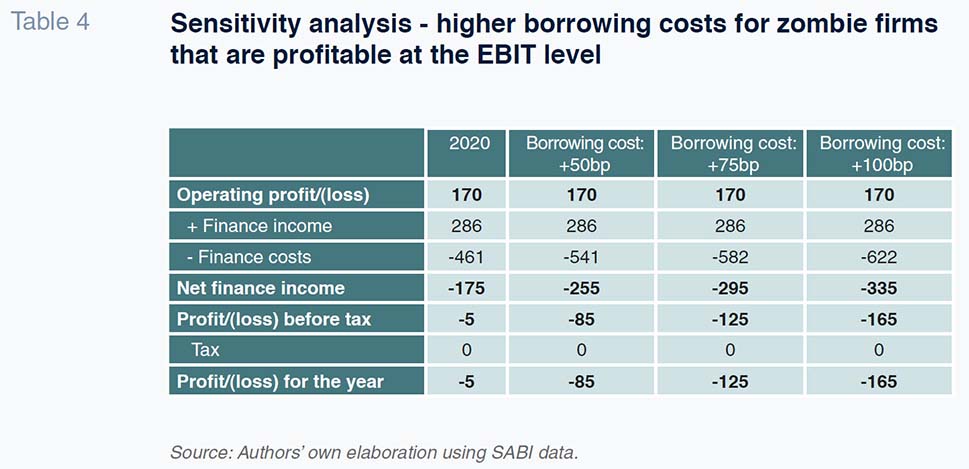

Given the gravity of the situation for 90% of the cohort analysed,

i.e. firms that are loss-making, we then removed those firms and ran the simulation again for the cohort of firms that reported a profit in 2020. The results of that exercise, provided in Table 4, are similarly interesting. The first thing to note is that, despite being profitable, these firms’ borrowing costs are higher than for the Spanish zombie firms, on average. That means that despite being profitable at the EBIT level, they are ultimately loss-making in terms of their bottom lines. Those losses would increase sharply in the event of an increase in borrowing costs as a result of a shift in monetary policy. All other things being equal, a 50 basis point increase in interest rates would increase losses for the year by 80 million euros, a figure that would rise to 120 and 160 million euros in the case of 75 and 100 basis point increases, respectively.

These findings have implications not only for the companies themselves, but also for the banks that finance their business activities. A worsening of this cohort’s plight would probably increase the banks’ non-performance, as these zombie firms would not only be unable to service their interest, they would probably be unable to make their principal payments. A simulation that looks only at the firms profitable at the EBIT level, and therefore in theory less likely to default, assuming an average debt repayment time frame of five years, suggests that their interest and principal coverage ratio would fall from 4.65% to 4.55% in the event of a 50 basis point increase in their borrowing costs. If their borrowing costs were to increase by 75 or 100 basis points, that coverage ratio would decline to 4.50% and 4.45%, respectively, highlighting the credit risk to which the banks are exposed.

Conclusions

The current business climate is highly uncertain. The measures taken by the various institutions to counter the adverse effects of the lockdowns and business restrictions are nearing an end. Meanwhile, supply chain bottlenecks are undermining global trade and fuelling inflation. Inflation, originating mainly in rising energy prices and the inability to cater to burgeoning post-pandemic demand as savings get released, has put a shift in the expectations for prevailing ultra-lax monetary policy on the horizon. The market is currently discounting a rate hike as soon as 2022.

Against that backdrop, many zombie firms, most of which stem from the previous financial crisis and have received support that is now about to end, are exposed to an increase in borrowing costs on the back of a rate hike, and, by extension, deeper losses. In Spain, such firms currently account for around 2.0% of the total, in line with the estimated European average, a share sufficient to pose a higher risk of loan non-performance in the Spanish banking sector, the key source of financing for these vulnerable firms.

Over 62% of Spain’s zombie firms are small or microenterprises, which are more vulnerable to the economic and financial friction we are experiencing. Thus, risks could increase in the event of new virus variants that trigger fresh lockdowns and business restrictions to contain transmission.

References

ACHARYA, V. V., CROSIGNANI, M., EISERT, T. and EUFINGER, C. (2020). Zombie credit and (dis)inflation: evidence from Europe. National Bureau of Economic Resarch Working Paper, 27158.

ANALISTAS FINANCIEROS INTERNACIONALES (2019). La Banca y las pymes, December. https://www.afi-research.es/InfoR/descargas/1924537/1832181/

La-banca-y-las-pymes.pdf

ANDREWS, D., MCGOWAN, M. A. and MILLOT, V. (2017). Confronting the zombies: policies for productivity revival. OECD Economic Policy Papers, 21, December.

ANDREWS, D. and PETROULAKIS, F. (2017). Breaking the shackles: zombie firms, weak banks and depressed restructuring in Europe. European Central Bank Working Paper Series, 2240, February.

BANERJEE, R. and HOFMANN, B. (2020). Corporate zombies: Anatomy and life cycle. BIS Working Papers, 88, September.

BANK OF SPAIN (2021). Financial Stability Report: Autumn 2021, November.

CARREIRA, C., TEIXEIRA, P. and NIETO-CARRILLO, E. (2021). Recovery and exit of zombie firms in Portugal. Small Business Economics. https://doi.org/10.1007/s11187-021-00483-8

CELLA, C. (2020). Zombie firms in Sweden: implications for the real economy and financial stability. Sveriges Riksbank, Staff Memo, September.

EL GHOULA, S., FU, Z. and GUEDHAMI, O. (2020). Zombie firms: prevalence, determinants, and corporate policies. https://ssrn.com/abstract=3740950 or http://dx.doi.org/10.2139/ssrn.3740950

EUROPEAN CENTRAL BANK (2021). Corporate zombification: post-pandemic risks in the euro area. Financial Stability Review, May.

GRIEDER, T. and ORTEGA, J. (2020). A financial stability analysis of zombie firms in Canada, Financial Stability Department Bank of Canada.

Staff Analytical Notes, 2020–3, February.

HALLAK, I., HARASZTOSI, P. and SCHICH, S. (2018). Fear the walking dead? Incidence and effects of zombie firms in Europe. Joint Research Centre Technical Report. https://publications.jrc.eceuropa.eu/

repository/handle/JRC111915

MAUDOS, J. (2014). The relevance of company size in accessing bank finance: A determining factor for Spain’s SMEs. Spanish Economic and Financial Outlook, 3(3), May.

MCGOWAN, M. A., ANDREWS, D. and MILLOT, V. (2017a). The walking dead? Zombie firms and productivity performance in OECD countries. OECD Economics Department Working Papers, 1372.

MCGOWAN, M. A., ANDREWS, D. and MILLOT, V. (2017b). Insolvency regimes, zombie firms and capital reallocation. OECD Economics Department Working Papers, 1399, June.

OSÓRI, G., BENTO, F. and XAREPE, D. (2017). Zombie companies in Portugal: the non-tradable sectors of construction and services. GEE Papers, 88, December.

Fernando Rojas. PhD candidate from the Autonomous University of Madrid in Economics and Business, Masters of Banking and Finance from Afi

Francisco del Olmo. PhD in Economics and Business Management and Associate Professor of Applied Economics at the University of Alcalá and Researcher at the University Institute of Economic and Social Analysis (IAES)

Diego Aires. Masters in Finance from Afi and Masters in Economics from Universidad Carlos III