Spanish economic forecasts panel: January 2022*

Funcas Economic Trends and Statistics Department

2021 GDP growth estimated at 4.9%

The analysts’ consensus GDP forecast for 2021 is 4.9%, up 0.1pp from the last survey, shaped by the upward revision to the official third-quarter growth figure, from 2% to 2.6%, more than offsetting the cut to their fourth-quarter estimates, from 2.1% to 1.9% (Table 2), as a result of the surge in inflation and the emergence of the Omicron variant. Note, however, that leading indicators point to a sharp rebound in the fourth quarter.

National demand is expected to contribute 4.7 percentage points to the forecast GDP growth, unchanged from the last set of forecasts. The expected 0.2pp contribution by external demand, meanwhile, is up 0.1pp from the November survey.

The growth forecast for 2022 stands at 5.6%, down 0.1pp from the last report

The consensus forecast for GDP in 2022 is for growth of 5.6%, down 0.1pp since the last survey. As for the quarterly trend, the analysts are forecasting growth of around 1% every quarter, except for the third quarter, when growth is expected to be higher (Table 2).

In drawing up their forecasts, most of the analysts assumed that energy and commodity prices will remain at current levels until the spring, and then start to trend lower. Elsewhere, the assumption made by most of the analysts is that Spain will execute around 25 billion euros of the NGEU funds in 2022.

Growth in 2022 is expected to be driven by domestic demand, with a forecast contribution of 4.9 percentage points, down 0.2pp from November. Growth in investment is expected to pick up, driven by investment in construction, which should more than offset the anticipated slowdown in investment in machinery and capital goods. As for consumption, public spending is expected to slow, whereas household spending should keep pace. Foreign trade is expected to contribute 0.7 percentage points to growth, up 0.1pp from the last set of forecasts.

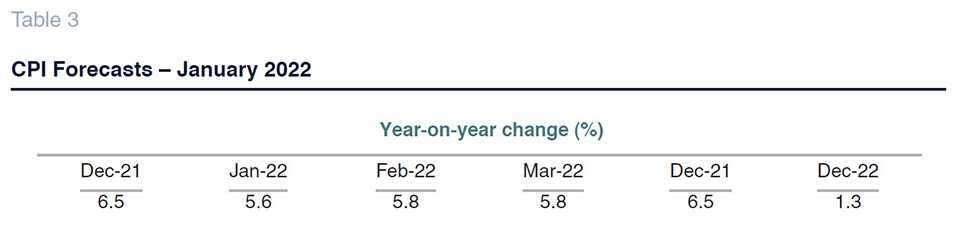

Significant upward revision to CPI forecasts

After headline inflation reached 5.4% in October, fuelled by the price of energy products and price recovery in certain services to pre-pandemic levels, inflation has only continued to rise, reaching 6.5% year-on-year in December. Such high rates suggest that the increase in production costs is getting passed on to end consumer prices.

The consensus forecast for average inflation in 2022 has increased by 1.1 points since the last report, to 3.5%, with the year-on-year rate trending lower to 1.3% by December (Table 3). The consensus forecast for core inflation, meanwhile, has been raised by 0.6pp from November to an average rate of 2%, which would be 1.2 points above the 2021 average.

The unemployment rate should continue to trend lower

According to the Social Security contributor numbers, although job creation slowed in the fourth quarter by comparison with the third, it remained dynamic. In 2021, average contributors increased by 476,000, or 2.5%. The number of people on furlough and self-employed professionals on benefit support continued to trend lower, ending the year at around 250,000.

The forecasts for growth in GDP, job creation and wage compensation yield implied forecasts for growth in productivity and unit labour costs (ULC). Productivity is thought to have decreased by 1.3% in 2021 (0.8pp more than was expected in November) and is expected to increase by 1.6% in 2022. Expectations are that ULCs increased by 1% in 2021 and will increase by 0.1% in 2022, having risen sharply in 2020. In the prevailing circumstances, however, these variables should be read with caution.

The average annual unemployment rate is estimated at 15.1% for 2021, falling to 14.2% in 2022, down 0.1 and 0.2 percentage points, respectively, from November estimates.

The trade surplus continues to widen

The current account surplus stood at 8.72 billion euros to October, compared to 5.32 billion euros in the same period of 2020. That improvement is attributable to a 33% increase in the trade surplus, more than offsetting the downturn in the investment income deficit.

The consensus forecast is for a surplus equivalent to 1% of GDP in 2021 (unchanged) and of 1.3% in 2022, up 0.1pp from November.

The 2021 public deficit is expected to come in below the government’s forecast

The fiscal deficit, excluding local authorities, amounted to 47.54 billion euros in the first 10 months of 2021, compared to 81.16 billion euros in the same period of 2020. That improvement has been shaped significantly by the extraordinarily positive trend in tax revenue, which is running almost 30 billion euros higher than in the same period of 2020 and some 10.5 billion euros higher than even the 2019 figure. By the same token, social security contributions are up 5.7 billion euros year-on-year and are tracking 6.8 billion euros above 2019 levels.

The analysts are forecasting a deficit of 7.4% of GDP in 2021, down 0.5pp from the last set of forecasts. That is lower than the official government forecast, of 8.4%. In 2022, the consensus forecast is for a deficit of 5.4% of GDP, in this instance higher than the official forecast (5%).

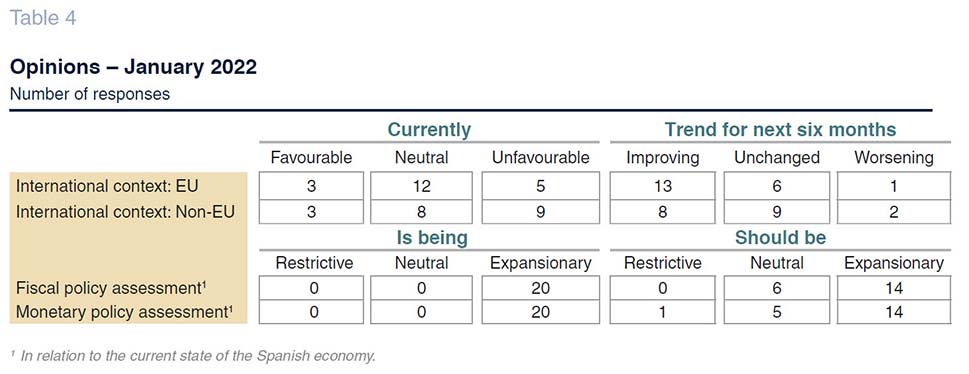

The international environment is perceived to be deteriorating, especially outside the EU

The global economy continues to reel from the supply chain disruptions prevailing since the start of the recovery. Although certain bottlenecks have eased thanks to higher supply (e.g., shipping and metals), the difficulties persist in other products (e.g., technology parts and oil and gas extraction). Moreover, a number of countries tightened their restrictions in an attempt to curb the spread of Omicron, generating fresh supply delays. All of the above, coupled with labour shortages in some countries, especially Anglo-Saxon economies, is sending production costs, particularly energy costs, into an upward spiral.

The main activity indicators have worsened since the last survey. In the US, the PMI reading fell back sharply in January to just 50.7 points. The eurozone reading also declined, but to a lesser extent, and, at 52.4, it is still relatively high. The Chinese economy would also appear to be slowing.

In its winter outlook, the IMF has cut its global growth forecast for 2022 to 4.4% (0.5pp less than in the autumn forecasts). In the case of the eurozone, growth was cut by 0.4pp to 3.9%. As for inflation, the Washington experts have revised their projections sharply higher, to 3.9% across the universe of advanced economies (up 1.6 points from the forecasts available at the time of the last survey) and to 5.9% in the rest of the world (up 1 point).

Reflecting these trends, analysts that view the international context as unfavourable now clearly outnumber those that believe the opposite. Indeed, pessimistic assessments outweigh the optimists by six in the non-EU context and two in the EU. Nevertheless, the outlook for the coming months is relatively optimistic. Thirteen analysts think the context in the EU will improve (compared to 10 in November) and eight think the same will happen outside the EU (down one from November). Only one analyst thinks things will get worse in the EU and two think that will happen outside the EU.

Central bank decoupling amidst rising inflation

The return of inflation, coupled with the recovery of pre-pandemic output levels in many countries, has shifted the context for monetary policy. Central banks now are faced with the dilemma of curbing inflationary pressures without harming the recovery or triggering financial stress. Since November, that dilemma has triggered a reduction in the bond repurchase programmes rolled out at the onset of the pandemic, preparing the way for future rate hikes. The Fed is expected to tighten rapidly, while the ECB is taking a more gradual approach, reflecting the differences in economic momentum and inflation between the two regions.

Meanwhile, markets have begun to price in the shift in monetary policy. The yield on 10-year Spanish government bonds has widened to 0.65%, from 0.5% in November (the spread over German bonds is largely unchanged). 12-month EURIBOR has barely budged, however, reflecting how gradually the ECB is expected to move on rates, with the deposit facility rate expected to remain anchored at -0.5% for the near future.

Against that backdrop, the analysts believe that market rates will continue to climb higher throughout the projection period. The yield on 10Y public bonds is expected to increase to 0.83% by year-end 2022 (up from a forecast 0.79% as per the November survey).

Euro depreciation

In light of the shift in direction of US monetary policy and the prospect of sharper and sooner rate hikes than in the eurozone, the dollar has tended to appreciate against the euro since the last survey. Most analysts believe that the current rate of exchange -€/$1.13- will hold relatively steady throughout the projection period (Table 2).

*

The Spanish Economic Forecasts Panel is a survey run by Funcas which consults the 20 research departments listed in Table 1. The survey, which dates back to 1999, is published bi-monthly in the months of January, March, May, July, September and November. The responses to the survey are used to produce a “consensus” forecast, which is calculated as the arithmetic mean of the 20 individual contributions. The forecasts of the Spanish Government, the Bank of Spain, and the main international organisations are also included for comparison, but do not form part of the consensus forecast.