Impact of the TLTRO and negative rates on banking margins

Spanish and European banks’ net interest margins (NIM) are proving highly volatile due to the “volume effect” on credit, as well as the difficulties in layering a negative rates component into funding costs. Going forward, the considerable sensitivity of banks’ NIM could increase in 2022, depending on the level of compliance with TLTRO eligibility benchmarks.

Abstract: The trend in the Spanish and European banks’ net interest margin (NIM) is proving highly volatile in year-on-year and earnings contribution terms. One reason for this volatility is the “volume effect” associated with the trend in the outstanding balance of credit. That balance sustained sharp growth in 2020 (breaking a decade-long downtrend) thanks to the state guarantees rolled out to mitigate the economic ramifications of the COVID-19 pandemic before losing steam at the start of 2021. In this context of stagnant (or contracting) credit, the trend in the margin is highly sensitive to the ability to increasingly layer a negative component into funding costs. One such source is the widespread application of negative rates to a growing proportion of deposits, particularly those held by businesses and high net worth individuals. However, the banks’ net interest margin is most sensitive to the use of the ECB’s liquidity facilities in the form of targeted longer-term refinancing operations (TLTROs) and compliance with the related eligibility benchmarks which determine whether the (negative) rate applicable by the ECB is -1% or -0.5%. This will be especially important in the case of Spanish banks, which have used the facility heavily, and where NIM is particularly sensitive to benchmark compliance.

Earnings growth via impairment losses and non-recurring gains

On the whole, the Spanish banking sector’s earnings in 2021 (with three sets of quarterly results already published) show clear improvement from 2020. This momentum is due not so much to a recovery in margins, which have been volatile and mainly trending negatively, but rather the positive effects of a smaller provisioning effort and the impact of sizeable one-off gains.

With respect to asset impairment charges, the extraordinary effort made by the banks to frontload their loan-loss provisions in 2020, triggering losses, on aggregate, across the Spanish banking system, has paved the way for a substantially lower provisioning effort in 2021 (around 50% of 2020 levels), albeit still nearly twice pre-pandemic levels.

On top of the impact of the lower volume of provisions, it is worth highlighting the high level of non-recurring gains unlocked by M&A activity concluded in 2021, with a significant impact on earnings at the aggregate level.

The offset of the positive effects of the restatement of the acquirees’ net assets to fair value is the recognition by the acquirors of sizeable non-recurring charges related to the restructuring plans associated with the mergers.

Both the “step-down” effect on provisions and the consequences of the various mergers on earnings are one-offs and largely responsible for the significant increase in returns being reported by the Spanish banks at above pre-pandemic levels in terms of return on equity.

Margins under pressure from interest income

The positive impact of the above one-offs should not distract us from the main recurring component of the banks’ income statements, their net interest margin (NIM). The trend presents high volatility, having sustained year-on-year growth of 1.5% in the first half, which had moved to a contraction of 1.6% by the end of the third quarter (with a strong likelihood that the negative trend will last until the end of the year).

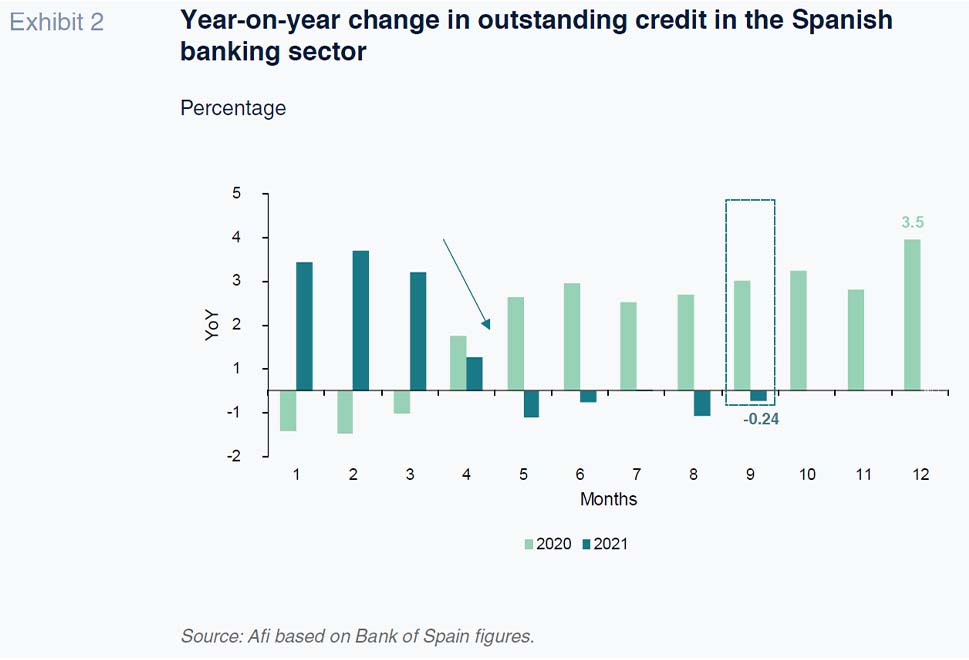

The adverse margin trend is being shaped primarily by the drop in interest income as a result of the so-called volume effect, which in turn is driven by the pattern in outstanding credit over the course of 2021.

As shown in Exhibit 2, compared to the significant growth sustained in outstanding credit in 2020, tied mainly to the state guarantee scheme for pandemic relief, credit has been stagnating since early 2021, even registering small declines from April onward.

On top of the volume effect, the reconfiguration of the loan portfolio in 2020 is also having an impact on interest income: the weight of secured credit and mortgages, where new lending activity has registered growth of 40%, has increased relative to more profitable segments, driving the return on the banks’ loan books lower.

A final element exerting downward pressure on finance income is the lower contribution by the fixed-income portfolio in the form of coupons due to the high volume of assets sold by the entities last year to offset, at least partially, the adverse impact in 2021 of the banks’ strategic decision to frontload their loan-loss provisions.

Pass-through of negative rates to depositors

Faced with such sharp downward pressure on their interest income, the banks are being forced to eke out further savings in funding costs by venturing to apply negative rates on a growing percentage of deposits. That need is all the more imperative in light of the high growth in household bank deposits, which is being fuelled by the sharp increase in the savings rate. Customer deposits soared by over 100 billion euros in the wake of the pandemic, providing the banking system’s liquidity with a significant boost. That trend can also be observed in most European countries, where banking systems have begun to cross the “red line” of applying negative rates to a significant chunk of customer deposits.

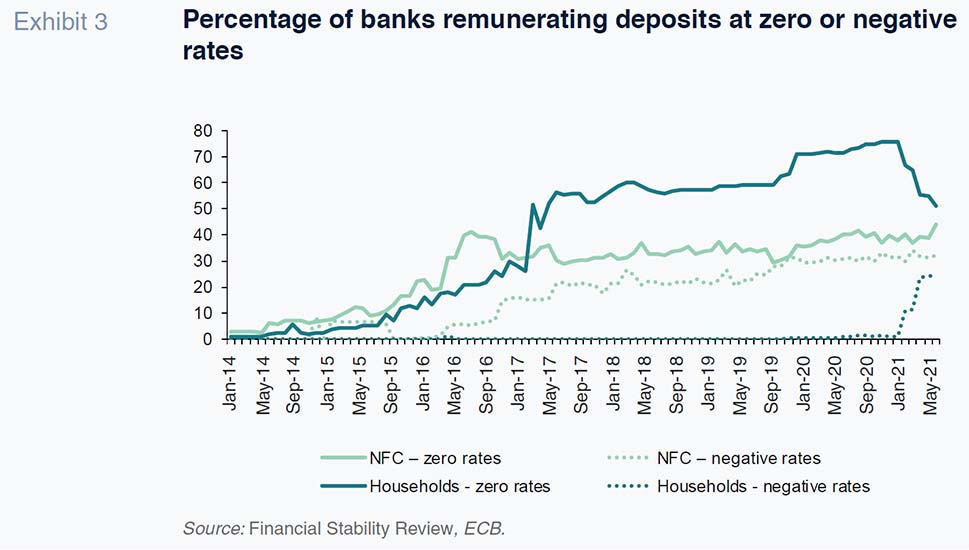

The ECB flagged that trend in its recent Financial Stability Review, which is illustrated in Exhibit 3. It clearly shows the change of attitude in 2021 in terms of applying negative rates to deposits. The exhibit depicts the percentage of European banks applying zero or negative rates to the deposits taken in from businesses and households. In the business segment, the percentage of banks applying negative rates has been increasing systematically over the last five years, reaching 30% by mid-2021 (40% applying zero rates).

In terms of the household segment, while the application of zero rates has become more widespread over the last five years, resistance to “crossing the red line” to negative rates has been higher. However, a significant shift took place in mid-2021, with nearly 25% of banks that had been applying rates of zero shifting to application of negative rates.

Here, it is worth noting that the practice of charging for household deposits is not commonplace among the Spanish banks, which are providing low, but above zero, remuneration of about 0.05% on average, according to the most recent data published. The alternative to negative rates, which have the danger of putting off retail banking customers, has been to focus on charging fees for services related with collections and payments, such as a current account maintenance fee and credit card fees, particularly for less “bundled” customers with weaker ties to the entity in question.

In addition to those efforts to pass negative rates through to depositors, the Spanish and European banking systems have significant volumes of funds currently making a positive contribution to their earnings, i.e., funding at negative rates, such as that obtained via the new and improved TLTRO III.

Recall that among the measures rolled out to counteract the impact of the pandemic and ensure credit continued to flow to the real economy, in June 2020, the ECB launched a new round of financing under the umbrella of TLTRO III with particularly advantageous terms and conditions for the banks using the facility. Specifically, those liquidity auctions were designed to enable the banks to earn remuneration on the funds drawn of 0.5% (i.e., a borrowing cost of -0.5%), which could increase to 1% if the trend in the reference loan portfolio meets the associated benchmarks.

Such favourable financing terms have prompted European banks to rely heavily on the new TLTRO III facility, which has translated into a liquidity injection of around 2.1 trillion euros in Europe since June 2020, generating significant savings for the banks in terms of borrowing costs.

The Spanish banks have used the facility heavily, drawing down close to 300 billion euros, which has had a positive impact on their margins in the first quarters of the year when the banks reported year-on-year growth in NIM (see Exhibit 1). However, that positive effect was diluted in the third quarter when the year-on-year change in NIM moved into negative territory. That may have had to do with a TLTRO III base effect, as the facility was introduced in June 2020, such that it was already responsible for a reduction in funding costs and a change in trend in the Spanish banks’ NIM in the third quarter of that year.

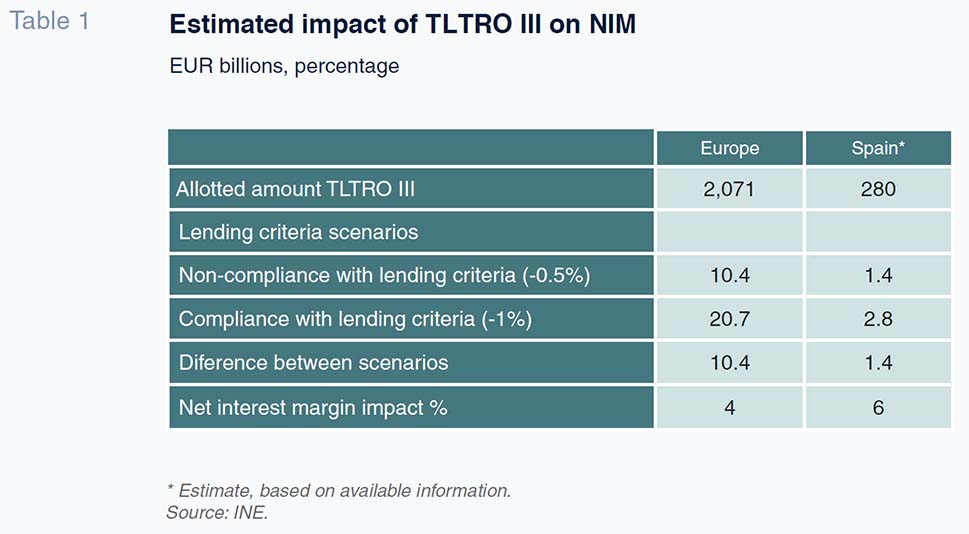

The considerable earnings volatility introduced by the TLTRO III could intensify in 2022 depending on compliance with the benchmarks that would allow the banks to accrue a rate of -1% of the volume of financing drawn down, whereas non-compliance would cap the negative rate at -0.5%.

Our analysis of the key figures available suggests that the banks’ net interest margin is highly sensitive to the benchmark compliance issue, which could translate into greater earnings volatility than that already observed in 2021.

Table 1 shows the “step” effect on the European and Spanish systems’ NIM of compliance versus non-compliance with the benchmark set for eligibility for funding at -1% compared to -0.5%. Specifically, the European system has drawn down 2.1 trillion euros in total under the facility and sensitivity to non-compliance with the TLTRO III conditions stands at around 4% of NIM, with the Spanish sector relatively more exposed: by our estimates, that percentage impact on NIM increases to 6%, [1] expressed as the difference in NIM between compliance and non-compliance with the stipulated benchmark.

To that end, it is worth analysing the current level of compliance with the eligibility benchmarks across the various European banking sectors, focusing particularly on the Spanish system, whose NIM is particularly sensitive to compliance.

Before getting into the analysis, recall that the compliance scenario requires that the banks’ eligible credit portfolios, comprised mainly of business and consumer loans, register growth between October 2020 and December 2021.

Framed by that requirement, based on the quarterly information available until the date shown in Exhibit 4, compliance was uneven across the main European banking sectors over the first half of 2021. Whereas in countries such as Germany and France the trend in the credit portfolio appeared clearly dynamic towards the end of 2021, which would put those systems in compliance with the ECB’s financing benchmarks, the pattern does not look as favourable for the Italian or Spanish banks.

In the case of the Spanish banking sector, the overall balance of outstanding credit has been markedly stable throughout the year; however, as shown in Exhibit 4, in the business loan segment, which is particularly important for benchmarking purposes, the outstanding balance is clearly lower than it was at the end of the third quarter of 2020, taken as a proxy for the October 2020 balance, which marks the start of the period for measuring benchmark compliance. Although we do not yet have data for the second half of 2021, which will ultimately determine compliance with the benchmark, the trend observed in the first six months of the year calls into question whether the sector, on aggregate, will comply on the basis of the adverse trend in loans to SMEs and large enterprises and in the consumer loan segment, which also forms part of the benchmark portfolio.

As a result of the foregoing, the pronounced volatility in the Spanish banks’ net interest margin in 2021 may well intensify in 2022 to the extent that the entities are not able to meet the terms stipulated under the framework of the TLTRO III facility to be entitled to accrue a cost of -1% on the total amount drawn. All this takes place in a market environment in which the net interest margin remains under pressure due to high volumes of household and corporate deposits and the attendant drag in funding costs, while any recovery in interest income depends largely on a rate hike scenario not anticipated in the near-term. On the other hand, lending activity looks set to pick up pace in 2022, fuelled by the expected economic recovery and the multiplier effect of execution of the NGEU funds.

Note

Approximation of the impact for an average sector player. It should be noted that analysis of compliance with the benchmark will occur at the entity level and not at the aggregate sector level.

References

BANK OF SPAIN (2021). Financial Stability Report, October.

ECB (2021). Financial Stability Review, November.

Marta Alberni, Ángel Berges and María Rodríguez. A.F.I. – Analistas Financieros Internacionales, S.A.