The spike in Spain’s inflation and its impact

The upward trend in Spanish inflation has been driven by rising input costs, the abrupt nature of the global recovery and nascent structural transformations accelerated by the pandemic. While the immediate effect is a slowdown in the pace of recovery, further ahead, if global inflation becomes sustained, the perception of central bank independence will be key.

Abstract: Annual inflation has been on an upward trajectory since the beginning of the year, with Spanish CPI increasing from negative readings in February to 3.3% in August. Rising input costs and the abrupt nature of the global recovery are primarily responsible for this trend. However, the pandemic has also accelerated nascent structural transformations, such as digitalisation and the green energy transition, entailing significant relative price changes. While energy costs have sharply risen, core inflation has remained more subdued, suggesting price growth is so far limited to imported goods, with many analysts viewing the rise in inflation as largely temporary. However, this outlook is based on three considerations relating to, first, the duration of supply chain bottlenecks and of the external cost shock, second, the possibility of second-round effects, and third, the evolution of inflation expectations. More broadly, rising inflation poses challenges for central banks. Although they are maintaining their positions, there is growing pressure for the main central banks to initiate tapering and a normalization of interest rates due to the increase in inflation. Moreover, while their use of unconventional monetary policies helped reduce the impact of the crisis, it may have also constrained their ability to respond to a sustained period of inflation. Importantly, if markets perceive any weakening of central bank independence from governments’ fiscal policies, this could undermine the credibility of central banks and make it more difficult to maintain the low interest rate environment.

Introduction

Since early this year, prices have been rising sharply in Spain as in most advanced economies. The consumer price index has gone from registering negative rates throughout the pandemic to surpassing the targets set by central banks. Moreover, there has been a shift in expectations driven by the acceleration in electricity prices and the worsening of supply chain bottlenecks. As a result, some prominent forecasters are even talking about the return of inflation as a major economic policy challenge and a threat to the period of moderation observed so far this century.

The purpose of this paper is, following a brief overview of the factors behind the run-up in prices so far, to examine the macroeconomic impact and the implications for economic policy, with a specific focus on Spain.

The prevailing inflation spike

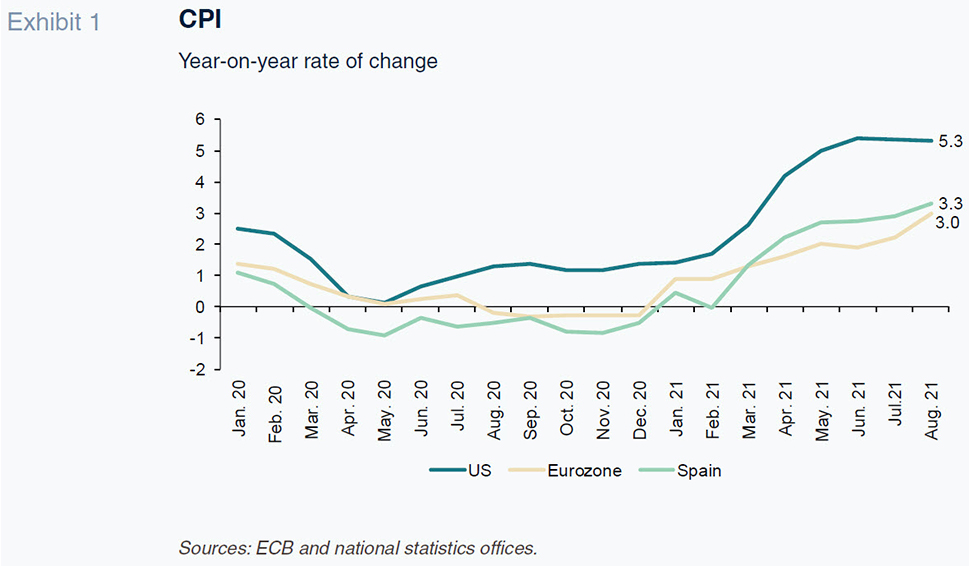

The year-on-year rate of change in the consumer price index (CPI) has been on an upward trajectory since the beginning of this year. In Spain, CPI has gone from negative readings in February to 3.3% in August (Exhibit 1). The trend in the rest of the eurozone has been broadly similar. In Germany, for example, year-on-year CPI is running at close to 4% according to the latest available data. And in the US, headline inflation is above 5%.

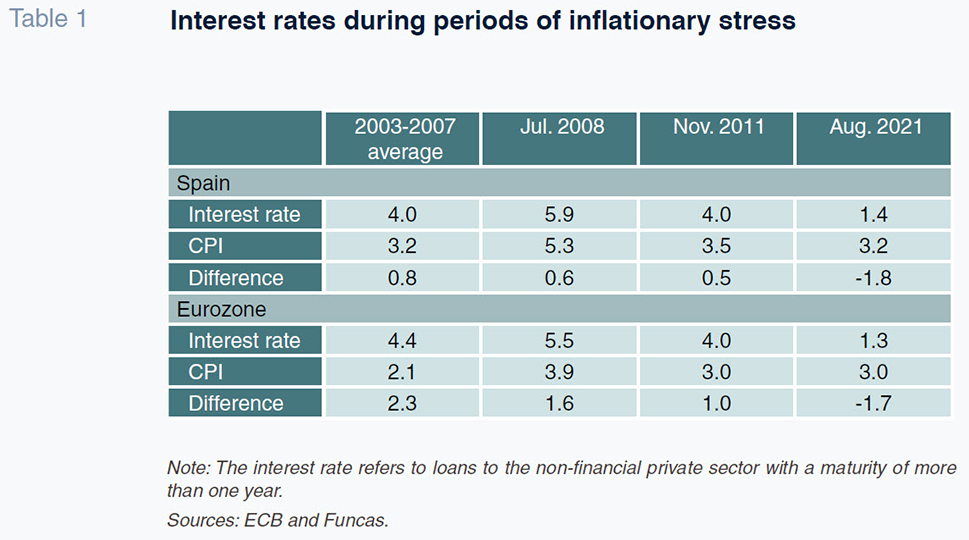

The current readings are still moderate with respect to the heady inflation of the 1970s (in Spain, CPI peaked at 28.4% in August 1977). They are also slightly below the inflation rates observed during the period of growth that culminated in the financial crisis. However, what is exceptional about this situation is the combination of growing price pressure with ongoing short-term rates at close to zero or even in negative territory (Table 1).

[1]

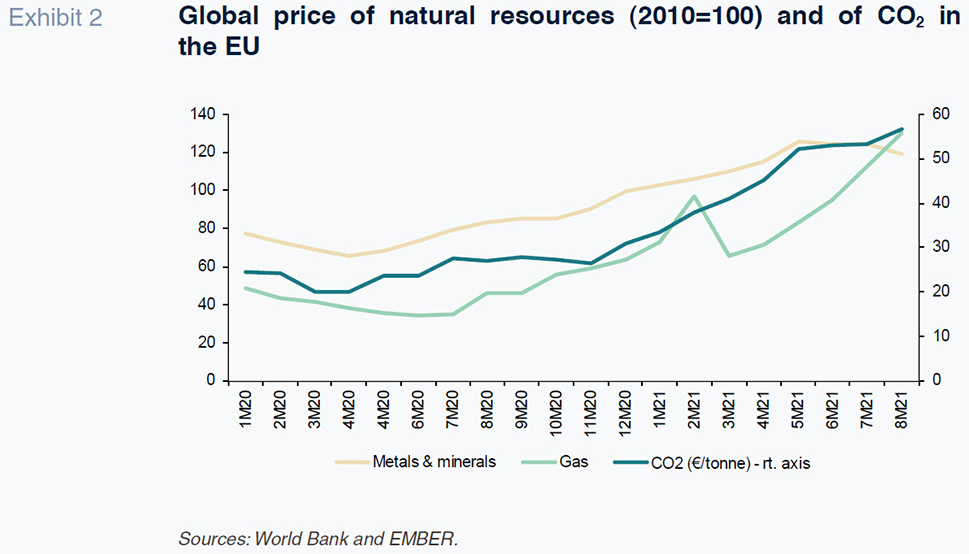

Supply-side factors are behind this trend, specifically the rising costs for all manner of natural resources and supplies because of the pandemic. The international metals index has increased by 26% year-to-date, while the food price index is up 14.4%. Energy prices have also shot up by 35%, with gas prices having doubled (Exhibit 2).

The driving force of these price jumps is the abrupt nature of the global recovery. During the “hard” lockdown, supply contracted in key sectors such as technology parts. In the case of natural resources, the downward trend in productive capacity due to underinvestment was exacerbated by the pandemic. In such a context of limited supply, the sudden rebound in global demand for goods from the first quarter of 2020, spearheaded initially by China and followed later by the US, has generated supply frictions and delays in international shipping. All of which has made the price of imported supplies more expensive.

Additionally, the pandemic has accelerated pre-crisis structural transformations, such as digitalisation and the green energy transition. The alteration of consumption patterns and working arrangements (surge in online commerce, teleworking, etc.) spurred sharp growth in demand for digital products. By the same token, the stimulus measures, in tandem with growing awareness of the consequences of climate change, have shone the spotlight on renewable energies and the need to decarbonise. The price of CO2 has doubled so far this year (Exhibit 2). The green transition is also responsible for the increased demand for metals such as copper, cobalt, magnesium and lithium.

Stress in the markets for natural resources, energy products and technological parts has spilt over to production costs (Exhibit 2). According to the purchasing managers survey for Spain, the industrial production cost indicator, which was in negative territory at the end of 2020, is under increasing pressure (the industrial purchase price PMI reached 80 in May, close to the series’ high). In the case of services, purchaser prices are also heading north, albeit with somewhat of a lag compared to industrial prices (PMI of 61). Industrial prices, meanwhile, continue to climb higher. In August, energy prices registered year-on-year growth of 41.6%, while non-energy industrial prices rose by 8.4% -the fastest pace since 1985.

The impact on core inflation and the economic recovery

The upward trend in production costs is spilling over to the CPI, but only partially, for now. The energy component of the CPI index is registering sharper growth. Stripping out the step effect, shaped by the anomalous price depression that characterised the lockdown, the trend remains ascendant. Since January, the energy CPI has been rising at an average monthly rate of close to 1%.

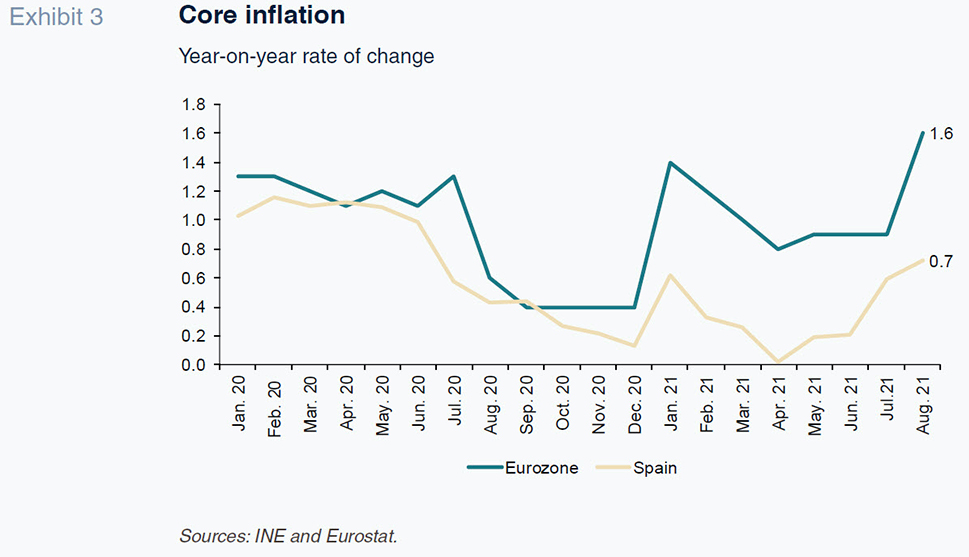

The other components of the index, however, have barely moved (Exhibit 3). Excluding energy products, CPI is still at under 1% per annum, just 0.2 percentage points above the year-end 2020 level. The goods CPI is at even lower levels, suggesting that producers are not passing along the increase in costs to their customers, assuming margin compression instead. Nor are services showing any clear signs of inflation.

Other indicators also point to limited passing on of the rise in external costs to internal prices. For example, the GDP deflator extended its path of muted growth of around 1% per annum (with data until the second quarter).

Wage growth is similarly moderate. The wage cost index and the collective bargaining agreements negotiated since the start of the year reveal slower growth than observed during the period of zero inflation. The result is a loss of purchasing power, especially for less affluent households, where the incidence of energy and food spending is higher.

It is therefore too soon to talk about an inflationary process in Spain or the rest of the eurozone; rather we are seeing growth in the prices of essentially commodities and imported goods. This is akin to an external shock, which erodes the real income of enterprises, by squeezing their margins, and of households, by eating into their purchasing power. That is why most analysts are predicting that the inflation shock will prove transient. The situation is different on the other side of the Atlantic, where there are more tangible signs of core inflationary dynamics. In some segments of the US labour market there are concerning shortages as well as an uptick in labour costs that depict a risk of a more protracted bout in inflation than in Europe.

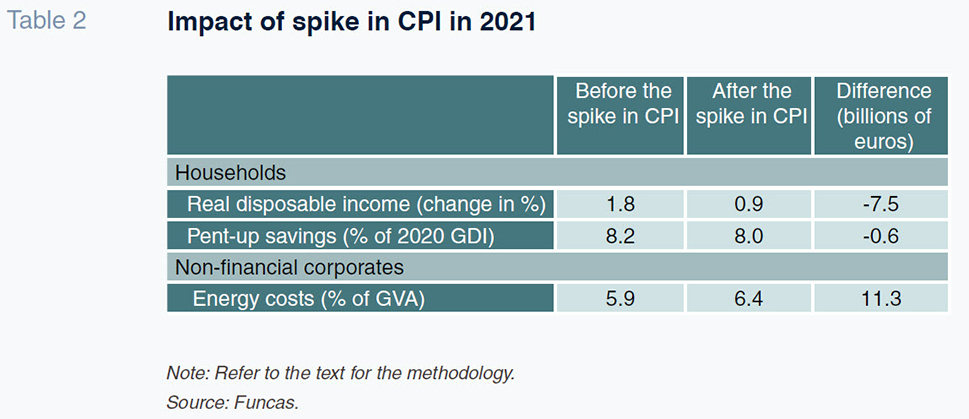

Either way, the inflationary pressures are having an adverse impact on the recovery. The energy price shock is undermining households’ purchasing power while eroding the real value of the surplus savings built up during the pandemic. In Spain, the loss of household purchasing power is estimated at close to 7.5 billion euros (Table 2). [2] On the corporate side, the effect is bigger, due to the significant impact of rising input costs on margins. The non-financial corporations are expected to forego at least 11.3 billion euros of profits as a result of the price shock. Naturally, companies can increase their sales prices to offset the margin contraction. However, that would only exacerbate the loss of purchasing power in the household segment.

Outlook for inflation and economic policy challenges

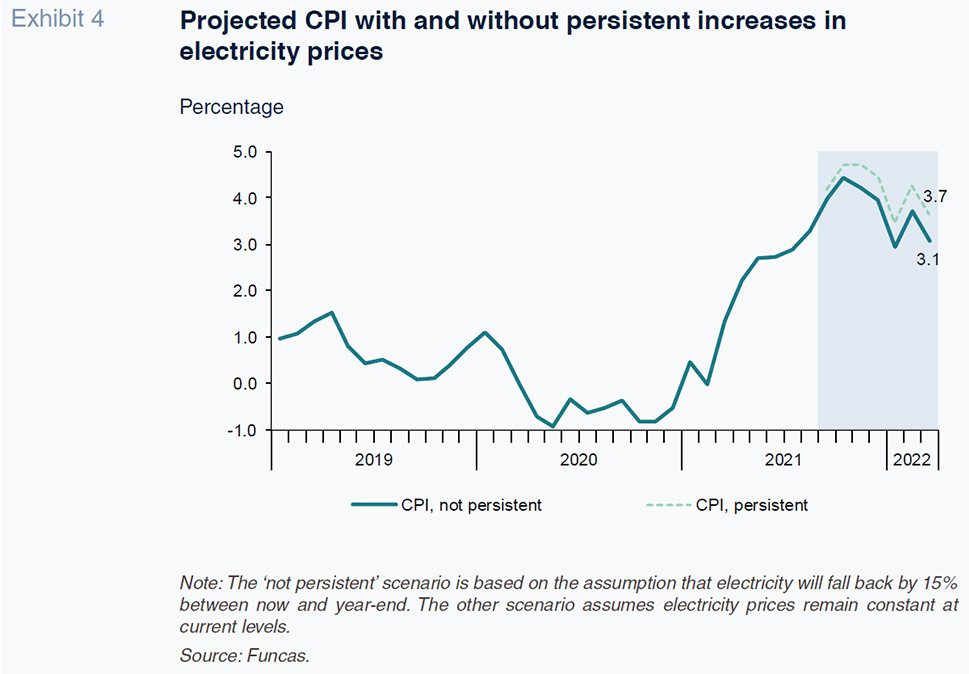

Although core inflation remains relatively low for now, the outlook hinges on three considerations. Firstly, the external cost shock could last for longer than currently anticipated. The green energy transition requires adjustments that will take time, intensifying the scarcity of certain inputs and putting upward pressure on energy prices. Funcas estimates that Spanish CPI will continue to climb higher, reaching 4% this autumn, before starting to trend lower as prices soften. However, if the energy markets are less benevolent, the impact would be significantly higher (Exhibit 4). ECB projections for the eurozone also assume the inflationary impact will be transient. The consensus forecast, too, is that inflation will fall below the ECB’s target in 2022. However, those forecasts are predicated on the belief that the pressure on production costs will ease.

Elsewhere, the bottlenecks in the semi-conductor sector could linger, at least until the recent incentives to support capacity growth take effect. These incentives include the US sector recovery plan estimated at $30 billion, plans to set up a manufacturing facility in Germany, and new investments in existing factories in Asia.

Secondly, much depends on second-round effects. So far, although businesses could also offset the increase in their costs by hiking their sales prices, the current competitive environment is keeping a lid on things. However, if competing firms were to simultaneously raise prices, this could unleash a spiral of price hikes.

Similarly, wage-earners could demand compensation for the loss of purchasing power. A lot depends on their bargaining power vis-à-vis the companies. In Spain, where unemployment is still above 16%, the prospect of greater wage pressure is improbable for the labour market as a whole. However, the situation is different in other countries within the eurozone. In Germany and France, for example, some hospitality firms are finding it hard to hire skilled labour, while in construction, one of the sectors benefitting the most from the recovery, there is a chronic shortage of tradespersons. These pressures could spill over to the entire eurozone. Likewise, in the US, such demands could prevail in the high-tech and services sectors where labour is scarce. For now, unemployment and/or inactivity are still above pre-pandemic levels, evidencing considerable slack productive capacity. But hysteresis effects and rapid changes in the demand for certain skills could change the picture in low-unemployment economies.

Thirdly, expectations play a vital role and are as important, if not more so, than supply supply-side factors. According to the Bank of International Settlements (BIS), agents take their price and salary decisions based on the expectation that inflation will be low. [3] Those expectations are the result of monetary policy credibility, earned during the 1980s battle against the high inflation ‘regime’. However, if expectations were to become unanchored, inflation could come out of its long hibernation and get stuck around levels that are far higher than those observed in recent decades.

In this regard, it is important to remember that a key facet of advanced economies’ deflationary policies during the 1980s was the decoupling of monetary policy from fiscal policy. Previously, it had been fairly common for governments to raise financing directly by means of cash advances and other liquidity injections from the central banks. However, in the 1980s, central banks switched their focus to their financial stability mission, leaving governments to finance themselves via the financial markets, mainly by issuing public debt securities. Thanks to the strict separation of monetary policy from fiscal policy, the central banks gained credibility, facilitating the unwinding of inflation expectations. The flip side of the coin was the abrupt increase in interest rates during the years of transition towards low inflation, weighing on output and employment.

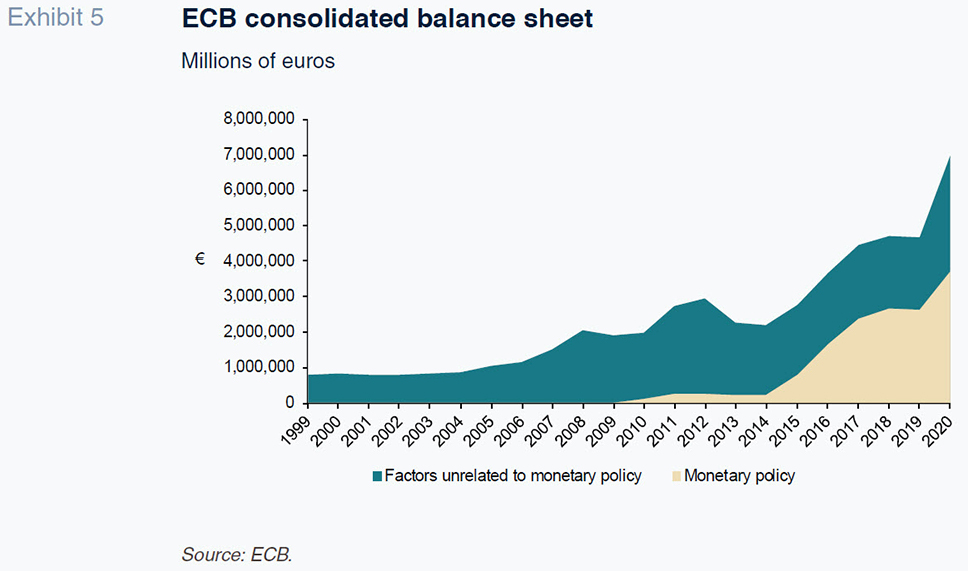

Nowadays, legal requirements protect central banks’ autonomy. For example, the treaty establishing the ECB limits the scope for monetising the public deficit. In practice, however, the policy mix has changed following the use of unconventional monetary measures (such as the buyback of public bonds in the secondary markets and keeping rates at negative levels) during the financial crisis. While those instruments are compatible with the legal framework that safeguards the ECB’s autonomy, their use for such a protracted period of time may have had unintended effects that curtail the effectiveness of monetary policy. These include the emergence of zombie firms kept alive by ultra-low rates, and weaker incentives for balanced budgets. It has also interfered with the interest rate structure, making it hard to allocate funds to the more productive sectors. The pandemic crisis has forced the authorities to intensify their use of quantitative easing to support governments’ financing of business support measures.

Greater coordination between monetary and fiscal policies has been the right decision given the severity of the crisis. However, it has reduced the margin for monetary policy manoeuvre in the hypothetical event of an inflationary episode (Exhibit 5). In the eurozone, for example, tighter monetary conditions would increase the cost of public debt and force governments, particularly the more indebted ones, to make significant fiscal adjustments that would certainly end up hurting the recovery. Zombie firms, on the other hand, would disappear in relatively short order, hurting the banks’ asset quality. Lastly, the rolling back of the debt purchase programme and other quantitative easing measures would bring the monetary union’s shortcomings to light. That union remains incomplete, despite long-promised reforms such as the European deposit insurance scheme. The Next Generation EU plan, focused on transforming the European economy, will not be able to replace a more accommodative monetary policy or play a sufficiently stabilising role. The risk of financial fragmentation, therefore, would increase and, with it, the risk premiums weighing on the more indebted economies, such as Spain.

Central banks would therefore be in a bit of a bind if inflation proved long-lasting. They would undoubtedly react with moderation, as much of the economy depends on rates remaining low. However, central banks also have to stick to their monetary stability commitments, which include independence with respect to fiscal policy, so as to not unanchor expectations.

There are few signs that markets have priced in the risk of fiscal dominance. Yields on public debt have increased, as have the inflation expectations implicit in swap rates, but the adjustment looks small, no doubt thanks to the credibility of central banks built up over the years.

In short, the developed world’s main central banks believe the current bout of inflation will prove transient and will not require a shift in their current monetary policy direction. [4] It is true that the rise in the CPI in recent months essentially reflects the higher cost of natural resources, energy products and technological supplies as a result of the sudden and simultaneous global recovery. For now, therefore, the rise in those production costs is not generating an inflationary cycle in internal prices and wages in Spain or in the rest of the eurozone. Looking forward, however, the unanchoring of inflation expectations cannot be ruled out: it all depends on how long the current episode of higher costs last and, above all, on the markets’ perception of the central banks’ level of dependence with respect to the various states’ fiscal policies. Perceived excessive fiscal dominance would undermine the credibility of the financial stability target and make it hard to control inflation in the face of external cost shocks, such as those currently playing out. All of which highlights the need for the central banks to build buffers and embark on a gradual reversal of their crisis-related monetary measures as the recovery gains traction.

Conclusion

The spike in prices is attributable to external factors that have not yet unleashed an inflationary process, neither in Europe nor in Spain, where high unemployment and idle capacity are acting as countervailing forces. A slowdown in the recovery pace, however, seems unavoidable. Looking forward, the duration of the prevailing episode of higher costs and the credibility of central banks’ independence will be key to preventing the unanchoring of inflation expectations.

Notes

Refer to Borio, C. (2021).

This estimate is derived from the difference in CPI between the start of the year and September, applied to disposable household income (flow effect) and the savings built up during the crisis (shock effect).

References

Raymond Torres. Economic Perspectives and International Economy Division, Funcas