The Fed’s new monetary policy strategy: Could added flexibility impair financial stability?

The new monetary policy strategy adopted by the Federal Reserve last year has impacted both inflation expectations and the risk premia. However, analysis suggests it is unlikely to push yields high enough to threaten financial stability.

Abstract: Last year, the Federal Reserve amended its monetary policy to provide it with greater flexibility in accommodating its dual mandate of price and financial stability, while also increasing symmetry around the inflation target. In analysing the possible effects of the change in the Federal Reserve’s strategy, the trend in sovereign bonds is key. Since the Federal Reserve announced the change in its strategy in August 2020, the yield on 10-year Treasuries has increased by a little over 50 basis points, with medium-term bond yields widening by a little less. Analysis shows that nearly 83% of the movement in the bond yield until May is attributed to the shift in inflation expectations. In addition, the term premium and real rate of interest have also exerted a structural upward impact on yields. Since the new strategy was announced, the US inflation figures have come in higher than expected while other factors (expansionary fiscal plans, vaccine announcements, etc.) make it hard to isolate the effect of the strategy shift on inflation expectations. Looking forward, it is likely that the new monetary policy environment will result in the 10-year US Treasury rising to a moderately high range of 2.25%-2.60%, which is unlikely to undermine financial stability.

Introduction

In the last year, the Federal Reserve (Fed) and the European Central Bank (ECB) have revised their monetary policy strategies to tailor their objectives and toolkits to the structural changes that have emerged in the past two decades. That metamorphosis has translated into greater flexibility in terms of accommodating the dual mandate of price and financial stability and increasing symmetry around the inflation target. The idea is to signal to financial markets that the authorities will tolerate deviations around that target in either direction and boost central banks’ room for manoeuvre in handling the complex process of monetary policy normalisation. However, monetary policy flexibility nearly always ends up being reflected in the premia investors demand to protect themselves against unexpected increases in inflation, such as those observed on both sides of the Atlantic in recent months. Against that backdrop, it is worth considering how American financial markets reacted to the strategy changes announced by the Fed last year and whether there are signs of any risks to financial stability.

Trend in the debt markets since August 2020

In analysing the possible effects of the change in the Federal Reserve’s strategy, the trend in sovereign bonds is key. Sovereign debt is the asset most sensitive to monetary policy. The sovereign bond market is also one of the most liquid and efficient at pricing in changes to economic prospects. Additionally, sovereign bond prices act as a benchmark for price formation for other financial assets (e.g., corporate bonds, equities, etc.) and are therefore an important element in ensuring financial market stability.

It is thus necessary to analyse the channels through which this change in monetary strategy could affect the sovereign bond market and the broader financial market. This paper will examine how the public debt market has responded a year after the policy change and its influence on financial markets.

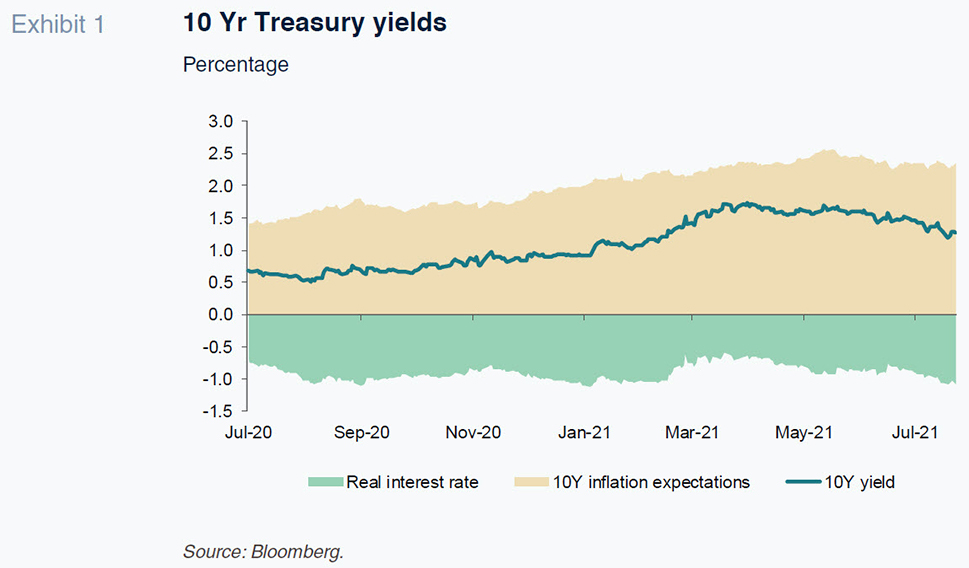

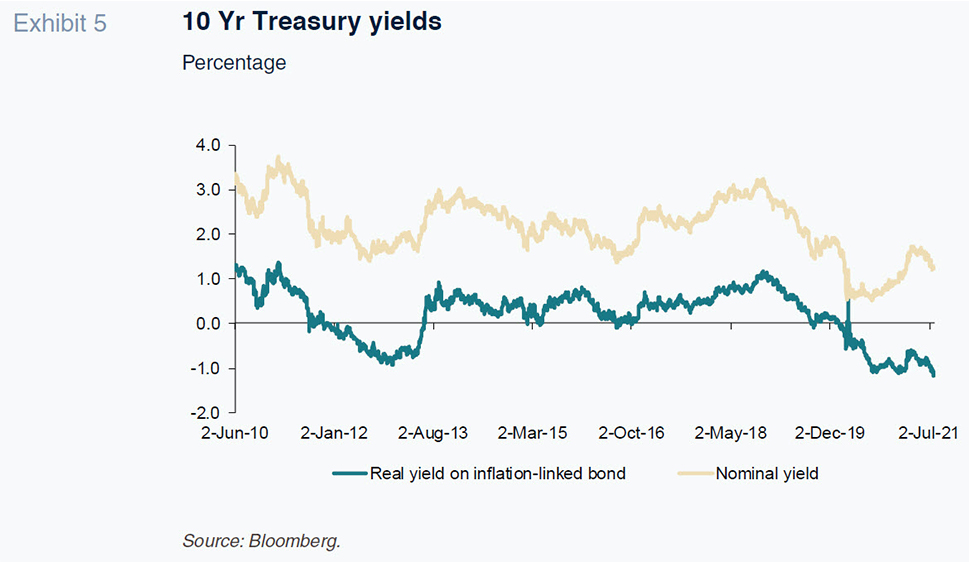

Since the Federal Reserve announced the change in its strategy in August 2020, the yield on 10-year Treasuries has increased by a little over 50 basis points, with medium-term bond yields widening by a little less (the 5-year Treasury yield has widened by 40 basis points). The widening on Treasury yields peaked in May at around one percentage point. The uptick in yields was primarily driven by higher inflation expectations, as evidenced by the fact that the inflation rate priced in by the 10-year bond peaked at 2.57%, up from 1.75% previously. The bond yield, in real terms, also widened during the period analysed, albeit by considerably less (from -1.0% to -0.83%). In short, nearly 83% of the movement in the bond yield until May is attributed to the shift in inflation expectations. If we extend the horizon to September, virtually all of the increase in yields is explained by inflation expectations as the real rate of interest narrowed by around 10 basis points between August 2020 and September 2021, using the price of inflation-linked bonds as a proxy for the real yield.

How has the change in monetary strategy affected the increase in yields?

Within the yield increase observed in the past year, it is harder to determine which part of the shift in outlook for inflation is due to the change in monetary policy strategy. Multiple factors are likely to have shaped inflation expectations in recent months, from surprises in the inflation figures to the fiscal plans announced with potentially expansionary effects on aggregate demand.

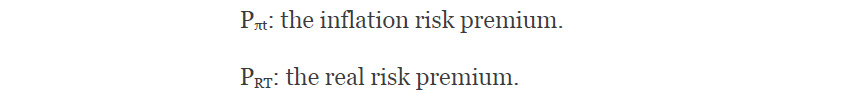

In order to tackle this challenge, it is necessary to first break down the components that comprise the nominal Treasury rate. There are two main components:

Where:

However, the inflation rate priced in by the market and real interest rates do not simply reflect prevailing expectations for inflation or growth and market liquidity conditions. These variables also discount a premium by way of compensation for the risks associated with the future trends in those variables (one might say a premium for forecasting errors). The above equation could therefore be reformulated as follows:

Where:

The sum of the premia for these two components of the nominal interest rate is what is known as the term premium. The above equation can be rewritten as follows:

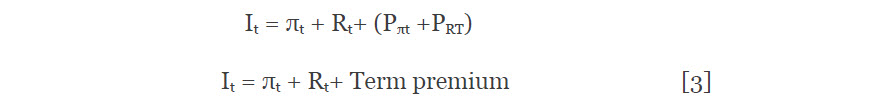

Regarding the first component (the inflation breakeven rate), it would be logical to expect that the change in the Federal Reserve’s strategy would have a clearly upward structural impact on the nominal bond yield, underpinned by the authority’s tolerance for inflation above the target of 2%. However, since the new strategy was announced, US inflation figures have taken the market by surprise, coming in higher than expected (particularly during the second quarter of 2021), although other factors (expansionary fiscal plans, vaccine announcements,

etc.) make it hard to isolate the effect of the strategy shift on inflation expectations. The period of lowest volatility since the Fed announced its change of strategy occurred between August and November 2020. Focusing on that time interval, and using a long-term measure such as the rate of inflation expected by the market in nine years’ time, we see an initial sharp reaction in expected inflation to levels more aligned with those observed between 2015 and the end of 2017 (Exhibit 2). Based on this evidence, the Fed is reversing the downward trend in the outlook for long-term inflation.

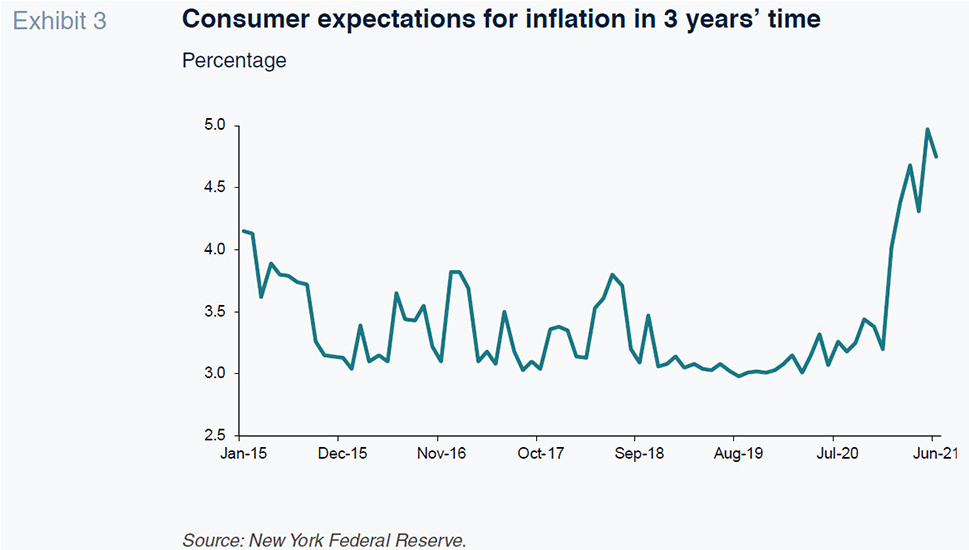

Other factors also suggest the change of strategy may already have had an impact on consumer, business and investor expectations. The various economic agent surveys carried out by the Federal Reserve point to an outlook for higher inflation in the medium- term. This is due to the unexpected acceleration of price growth in recent months, which has pushed inflation to over 5%.

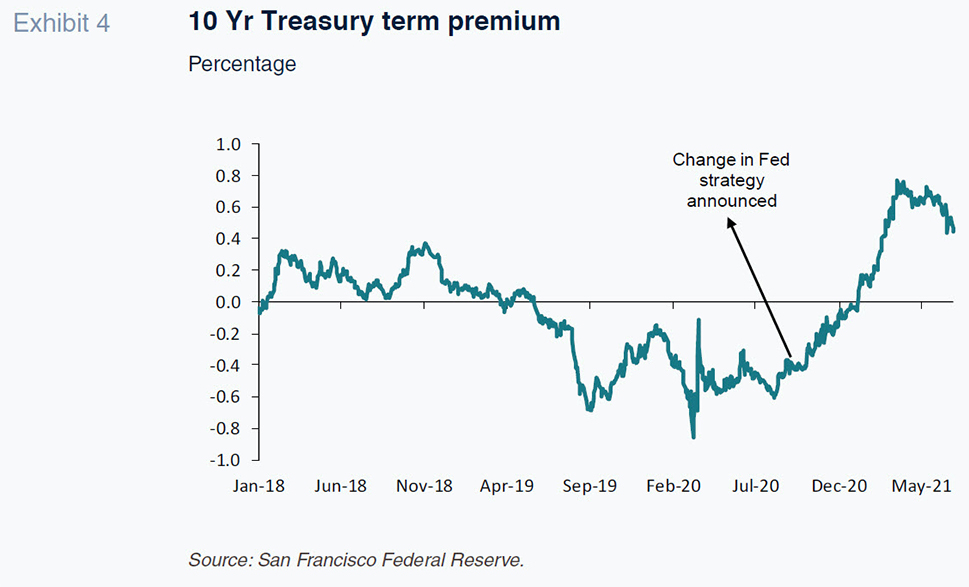

The second component with an upward impact on the bond yield is the term premium. It is conceivable that the price paid by the central bank in exchange for a more flexible monetary policy strategy will be an increase in perceived uncertainty.

The inflation target in the Fed’s new policy framework is based on an analysis of the rates actually reported (data dependent), rather than a more preventative track articulated around forecasts. This, in addition to a lack of specifics about the benchmark period used to calculate average inflation and verify compliance with the new target, could increase uncertainty about the future shape of monetary policy. Thus, by achieving greater flexibility, the Fed has raised the market’s perception of risk, which should imply an increase in the term premium required to hold bonds.

Since the Federal Reserve approved its new strategy, the term premium [1] on the 10-year Treasury bond has widened, from -0.45 percentage points to over 0.7 percentage points at one point during the second quarter (around 0.35 percentage points as of mid -September).

In April, the IMF (Adrian et al., 2021) published an article analysing the reason for the increase in the nominal yield on Treasury bonds through March in which it found that the increase in implied inflation in 5 years’ time reflected increases, of nearly equal magnitude, in both expected inflation and the inflation risk premia. In other words, the increase in the term premium has had a lot to do with the increase in yields observed in the first few months of this year. Clearly, that may be attributable to the complex and volatile economic situation but also has to do with the heightened uncertainty that always comes with a move towards a more flexible monetary policy strategy, at least for as long as the markets are digesting those changes.

The third component is the real interest rate. Here it is less clear what impact the new strategy will ultimately have on bond prices. On the one hand, it should translate into higher expected economic growth, which would push the real rate of interest higher. However, numerous factors have exerted clear downward pressure on equilibrium interest rates in recent years, including population ageing, higher overall savings and scant public and private investment levels.

The last time real interest rates were close to or within negative territory was at the end of 2012. This was upended by the market’s so-called ‘taper tantrum’, triggered by remarks by then Fed Chairman Ben Bernanke, regarding the ‘tapering’ of the Fed’s asset repurchase programme in the near future and the prospect of rate tightening. The upshot was that both nominal and real long-term rates widened significantly in 2013 (Exhibit 5). Specifically, real yields climbed back above 0% and, more importantly, stayed in positive territory (averaging 0.5%) almost continuously for the next six years.

Today’s situation is somewhat different. At the Jackson Hole meeting in August, Fed Chairman Jerome Powell suggested the Fed would begin to taper its asset purchase program at the end of this year or early next year but said that he did not perceive the need for short-term rate hikes until the job market had fully recovered. Nevertheless, the 2012 episode shows that when the economy is moving toward positive rates of growth and inflation and the central back rolls back its stimulus measures, real interest rates should move into positive territory. A return to average levels of 0.5%-0.6%, as seen in the wake of the financial crisis, would be reasonable. However, the trend in recent months, coupled with the fact that monetary policy will likely remain markedly accommodative, makes it probable that any upward pressure on real rates will not be as pronounced as in the past. It is therefore likely that real rates will rise in the coming months, driven by the economic recovery and anticipated normalisation of monetary policy rather than the Fed’s new policy direction.

In sum, the three factors outlined – inflation expectations, the term premium and the real rate of interest – will have a structural upward impact on yields, particularly at the longer tenors. Although it is too soon to anticipate what portion of the anticipated rise in the Treasury yields will be attributable to the shift in monetary policy, data for the last 12 months already point to an upward impact in the term premium and in expected long-term inflation.

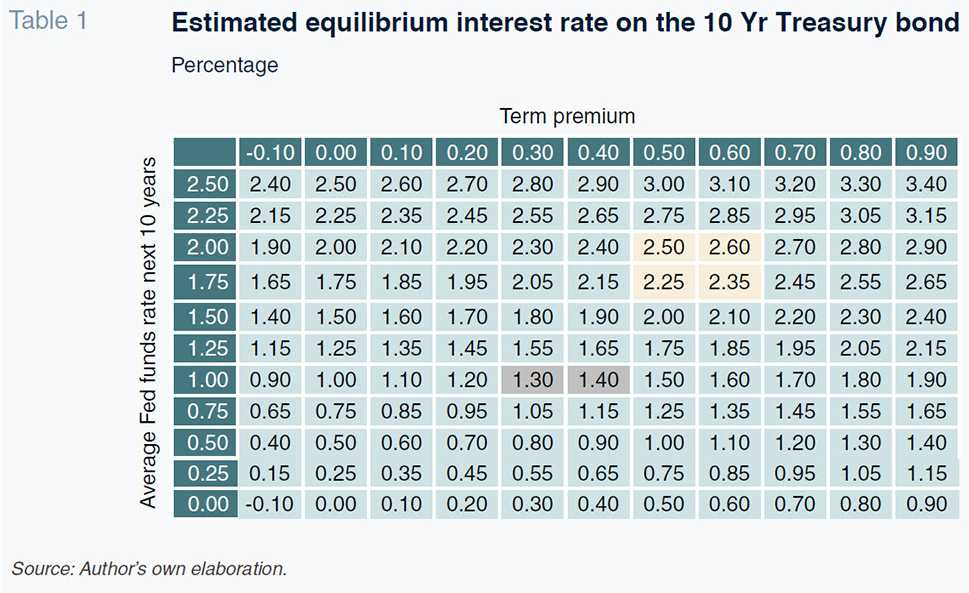

In this emerging environment, characterised by a new framework for intervention by the Fed that should have upward ramifications for Treasury yields, it is worth considering where they might settle by calculating the rate at which the 10-year US Treasury reaches fair value or its point of equilibrium. This is one way of checking whether financial stability could be at risk.

To do that, we use a traditional model, based on the capitalisation of expectations for short-term rates for the next 10 years plus an estimated term premium. The rates implied by the call money swap curve currently discount an average Fed rate for the next 10 years by 1%. Logic holds that once nerves settle, that rate will move towards 2% (a conservative estimate considering that the Fed estimates a long-run Fed funds rate of 2.5%). As for the term premium, it is also reasonable to assume an increase to at least 0.6%, for those same reasons. Based on these assumptions, as shown in Table 1, the fair value of the 10-year yield would fall within a range of 2.25%-2.60%, well above current levels, but not by any means a level that could significantly undermine financial stability.

Conclusions

Our analysis of the trend in the US bond market since the summer of 2020 indicates that the change in US monetary policy is beginning to have an impact on inflation expectations and the term premium. That, coupled with the rise in real interest rates, explains the upward shift in nominal yields on US public debt in recent months. That movement is happening in an orderly fashion and, therefore, suggests that the added flexibility in monetary policy, if combined with clear messaging, can facilitate delivery of the inflation target and help escape the liquidity trap without having to pay too high a price in terms of financial stability.

Notes

The Jens H. E. Christensen and Glenn D. Rudebusch (CR) model used to calculate the term premium in Treasury bond yields deconstructs the nominal yield curve into three components: future short-term interest rate expectations; a term premium that measures bond investor aversion to the risk of holding longer-maturity bonds; and, a model residual.

References

ADRIAN, T., GOEL, R., MALIK, S. and NATALUCCI, F. (2021). IMF Blog, Understanding the Rise in Long-Term Rates. April.

José Ramón Díez Guijarro. Caixabank Research and CUNEF