The reform of the Spanish cajas: From savings banks to banks and foundations

The crisis hit Spain’s cajas (savings banks) particularly hard and, in part, led to the introduction of regulation that significantly reformed the savings banks segment. As a result, this segment has become more concentrated and undergone a legal transformation from savings banks to banks and foundations, with significant implications for these entities’ ownership and corporate governance structure.

Abstract: Coupled with an extraordinary contraction in the number of entities, the most profound change in the Spanish financial system during the last decade has taken place in the savings banks segment. This segment was characterised by a large number of entities, had no shareholders, entrenched local roots, a commitment to giving back to society and represented half of the Spanish banking system prior to the crisis. However, the financial crisis hit the savings banks particularly hard, thereby resulting in the adoption of a series of new regulations that led to the sector’s reorganisation and reform. Specifically, this involved a contraction in the absolute number of entities and a change in their legal form −from savings banks or cajas to banks and foundations− with clear implications for their ownership and management structures (corporate governance).

The savings banks during the pre-crisis growth years

It is impossible to understand the transformation of the savings banks as a result of the crisis without a brief look back at their performance during the boom years in Spain, the decade before the crisis.

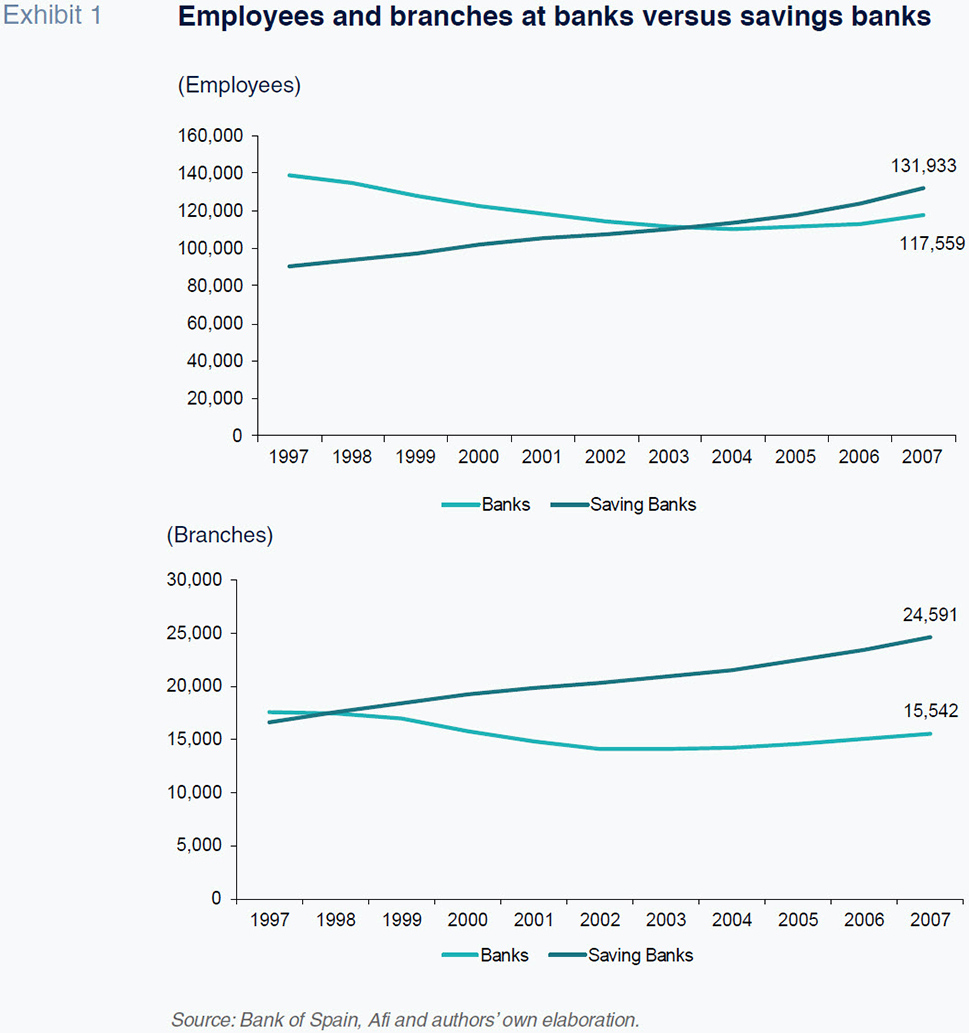

During that period, the banks and

cajas took divergent paths with the former closing branches and reducing headcount for much of the decade as their savings bank counterparts embarked on a significant expansion (Exhibit 1).

One reason for this disparate performance relates to the strategies adopted by the large banks in the second half of the 1990s. Immersed in their respective mergers, they prioritised their international expansion strategies. At the same time, based on their belief that the banking market in Spain was saturated, they deployed ‘retreat’ tactics in their home market, closing branches in areas where there was geographic overlap between the merged banks.

The gaps left by those branch closures were rapidly filled by the savings banks which, in contrast to the banks, presented two unique traits: (i) their smaller size prevented them from pursuing aggressive international expansion strategies; and, (ii) their strategic commitment to the Spanish market, particularly the businesses related to the real estate and mortgage markets, was far more resolute than that of the banks.

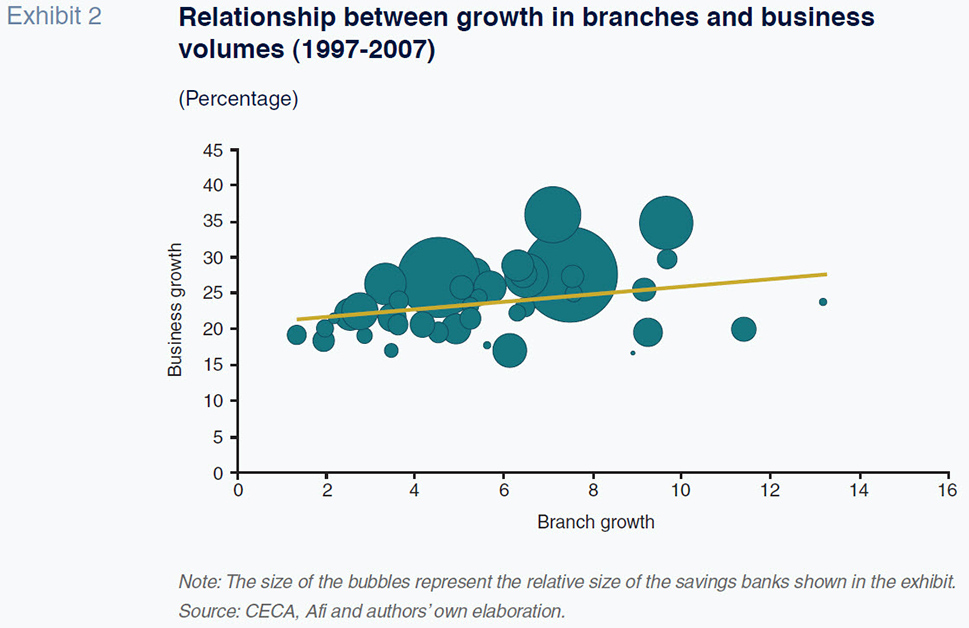

As a result, they focused their growth strategies around targeting new urban settlements, with new branch openings as their main strategic weapon. Judging by Exhibit 2, which correlates branch openings with business growth, it can be said that the opening of new branches held the key to gaining market share in a country whose retail banking business sustained one of the highest rates of growth in the world between 1997 and 2007.

However, the most noteworthy aspect of this period of intense branch openings by the savings banks was unquestionably the fact that it primarily took place outside of the savings banks’ traditional areas of influence. Of the 5,000 branches which the savings banks added to their networks from the mid-90s on −whether new branches or branches acquired from banks− 75% were located outside the region of origin of the respective savings banks.

In addition to the perception of bank saturation in Spain, it is worth highlighting the fact that the Spanish economy entered the financial crisis in a highly vulnerable position on account of its overexposure to the real estate sector and its high dependence on external borrowings. These two factors were closely related insofar as a growth model based on the construction sector consumed large sums of credit, leading to borrowing rates above internal savings capacity.

The Spanish economy’s dependence on the construction industry was even more obvious in the Spanish banking sector and, specifically, in the retail banking segment. By the end of 2009, total exposure to the construction and real estate sector for the banking sector as a whole accounted for 19% of overall outstanding credit, 15% on average in the case of the banks versus 23% in the case of the savings banks. However, there were major differences entity-wise in each segment, such that the savings banks could not be solely blamed for that overexposure, as was later highlighted by the resolution of Banco Popular, whose relative exposure at the time was similar to that of the most exposed cajas.

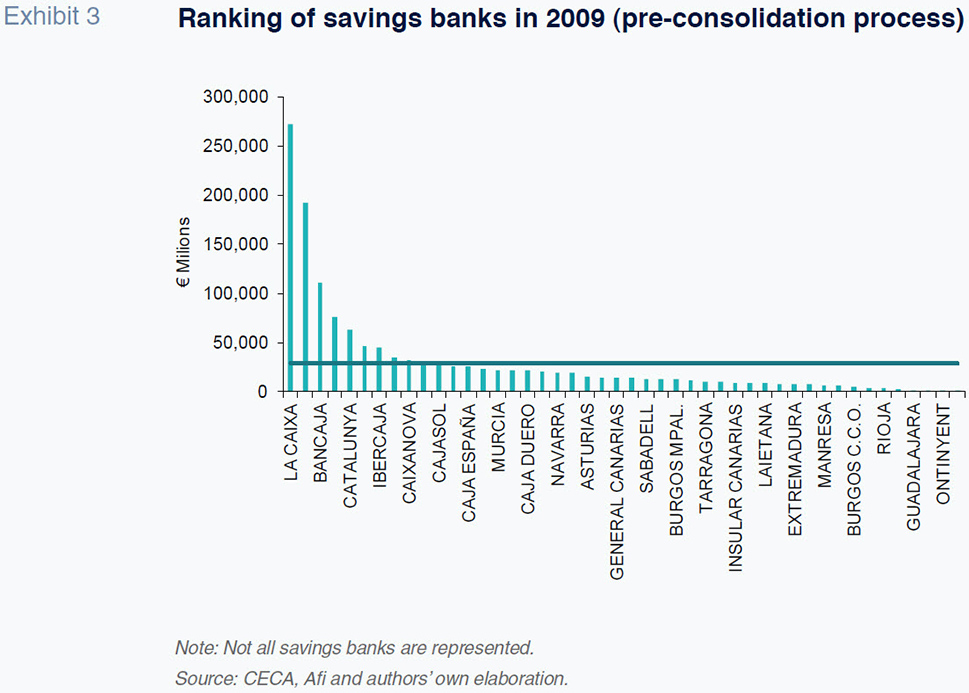

Regardless, over two years after the start of the international financial crisis, the map of entities in the savings banks segment remained intact at 45, a number which had hardly moved in nearly a decade. The business environment during that decade was marked by sharp growth in business volumes, which presumably permitted them to run their businesses free from the consolidation pressures the crisis would later bring on. That entity map (Exhibit 3) was marked by significant fragmentation: just three savings banks had assets in excess of 100 billion euros, whereas 36 had less than 35 billion euros.

This map would be turned upside down in mid-2010, when the capitalisation of the Fund for Orderly Bank Restructuring (FROB in its Spanish acronym), whose bailout funding required consolidation in order to reduce capacity, triggered an unprecedented wave of mergers. Specifically, the framework sparked a total of 12 consolidation processes through conventional mergers, the creation of institutional protection schemes (IPSs) or the acquisition of previously intervened entities, which involved the vast majority of savings banks. Of those 12 processes, nine took the form of applications for funding from the FROB (the other three were undertaken without applying for public funds). In the processes that resorted to public funding, the incremental cost of the funds received (very high and escalating coupons) was supposed to act as an incentive to produce synergies and reduce capacity and costs.

However, the economy deteriorated far more than was anticipated, undercutting the scenarios contemplated in the merger plans and reducing the value of the banking sector’s assets.

That downturn would be amplified by the vicious circle of the deterioration of bank asset quality and macroeconomic conditions, which in turn put growing pressure on vulnerable public finances, sparking doubts over the sustainability of Spain’s sovereign debt. These doubts were particularly intense throughout 2011, when the spread between the sovereign bonds of the so-called peripheral issuers, including Spain, and those of the core issuers, widened significantly and the primary markets all but shut down, making it difficult for the Treasuries to issue the bonds they needed. Another contagion effect was the higher cost of sovereign funding, which exerted additional pressure on the banks’ cost of funding, further undermining their earnings performance.

Crisis, bailout and transformation of the cajas

The widespread deterioration of the Spanish economy generated increasing doubts about the quality of its banking assets, particularly those related with the real estate sector. All this occurred against the backdrop of an international regulatory environment (Basel III) which called for higher capital requirements, albeit over a sufficiently staggered timeframe so as not to jeopardise the economic recovery. Indeed, the new core capital requirements were set to virtually double between then and 2019.

Faced with this staggered requirement, Spain went ahead and implemented a new capital requirements framework for its financial institutions that was far more demanding than the international standards introduced under Basel III. It included a higher capital requirement (8%) and an extraordinarily tight timeframe (six months) for full compliance.

In addition to the stringent new capital requirements introduced in Spain and of the associated implementation timeline, it is worth noting the discrimination implied by the establishment of an even higher requirement for entities not traded on the stock exchange, without significant shareholders and reliant –to a significant degree (over 20%)– on the wholesale funding markets. For those entities, essentially the savings banks, the core capital requirement was set at 10%, i.e., 2 percentage points higher than for the listed banks. This discriminatory and aggressive (timewise) capital requirement may have prompted some of the entities created as a result of the merger of savings banks (Bankia or Banca Cívica) to rush their IPO plans as the only means for availing themselves of a capital requirement of 8%, compared to the penalising 10% applicable to unlisted entities.

The adverse economic context in which those capital requirements were introduced took an irreversible turn for the worse when contagion and fear spread to the retail deposit segment. The divergence between countries (core versus periphery) marked a clearcut fracture in the eurozone’s financial integration and interfered with the ECB’s monetary transmission mechanism.

The asymmetric trend in bank deposit withdrawals between the two blocks of eurozone countries depicted a significantly fragmented banking system, posing risks for financial stability in the monetary area, which in Spain reached its zenith in the spring of 2012, with the eruption of problems in Bankia. The fact that Bankia was the result of the merger of seven savings banks (five of which were small and the number two and three cajas by assets) cast serious doubts over the logic behind the consolidation process which had taken place in Spain during the two previous years.

The loss of confidence in the Spanish banking system occurred at a time when the banks had emerged as the main −indeed nearly the only− buyers of Spanish sovereign bonds. The result was extraordinarily negative for how the market perceived the two risks and for the ability of the Treasury and financial institutions to tap those markets for refinancing purposes.

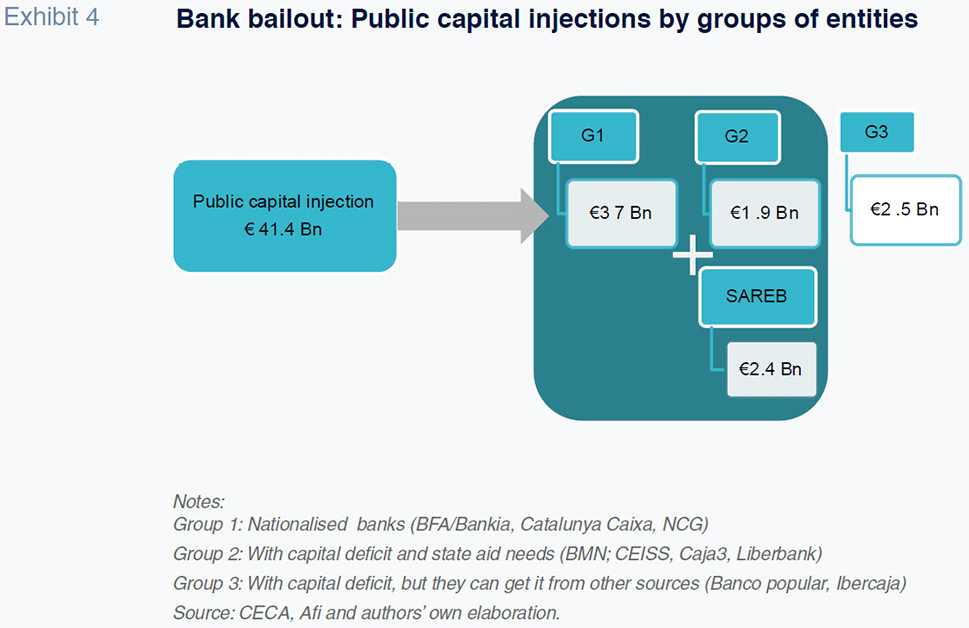

It was that perception of extreme risk that drove Spain to request a bailout for its banking system, which was approved by the eurozone’s finance ministers at the end of June 2012. It consisted of a maximum bailout of 100 billion euros of which, following the pertinent stress tests, 41.4 billion euros would ultimately be used: 2.4 billion euros to capitalise the SAREB, Spain’s so-called bad bank, and around 39 billion euros to shore up the capital of the entities that came up short in the stress tests and were not able to raise capital by alternative means (Exhibit 4).

The fact that all of the entities that received public funding (a total of seven) were entities resulting from savings bank mergers supported the perception that the banking crisis in Spain was a problem that was exclusive to and widespread within the savings bank segment. This idea is misguided for two reasons. First, the difficulties and ultimate resolution of Banco Popular has demonstrated that the institution already presented symptoms equivalent to those of the neediest savings banks back in 2012 and was only able to sidestep public intervention by means of a rights issue that substantially diluted its shareholders’ stake in the firm.

Second, as early as the stress tests in 2012, but also in the tests later performed by the European Banking Authority, several of the entities created from mergers between savings banks have systematically rated as the best positioned and the most resilient in the scenarios tested, demonstrating that not all the savings banks were in bad shape by virtue of being cajas, just as not all the banks were in good shape by virtue of being banks.

Nevertheless, the initial perception that the problem was limited to the savings banks and some of their legal idiosyncrasies −the lack of shareholders and market discipline to exact correct corporate governance− became entrenched and contributed to one of the conditions imposed as part of the bank bailout: a legislative change to eliminate the cajas as a separate legal form of incorporation.

In particular, Law 26/2013, of December 27th, 2013, on Savings Banks and Bank Foundations (hereinafter, the Act), imposed as a condition as part of the Memorandum of Understanding (MoU) with the EU associated with the bank bailout, forced the cajas to convert to banks, unless they were very small in size and/or had narrower geographic spheres of influence, specifically those that met the following requirements:

- Assets of less than 10 billion euros;

- A market share in terms of deposits in their geographic spheres of influence of ≤ 35% of the total;

- A geographic sphere of influence no bigger than an autonomous region, unless such outside business is performed in a maximum of 10 conjoined provinces.

In addition, the new legislation also regulated the banking foundations derived from the former savings banks. This was a legislative amendment of great impact for the entities resulting from the integration of savings banks. Specifically, the legislation defined a Banking Foundation as an entity that “holds an interest in a credit institution, whether directly or indirectly, equivalent to at least 10% of the entity’s capital or voting rights or an interest that permits it to appoint or remove a member of its governing body. Its corporate purpose shall be welfare-oriented and its core business focused on the development of community work and the adequate management of its ownership interest in a credit institution.” These foundations are governed by the contents of the Act, regional regulations, their own bylaws and, on a supplementary basis, the provisions of Law 50/2002, of December 26th, 2002, on Foundations.

Alternatively, an Ordinary Foundation does not consist of the direct or indirect ownership interest of 10% of a credit institution’s capital or voting rights nor does it have the power to appoint or remove any of the members of the investee credit institution’s governing body. Ordinary Foundations are governed exclusively by Law 50/2002, Article 2, which defines them as “non-profit organisations which, at the behest of their creators, earmark their capital on an ongoing basis to matters of general interest. They shall be governed by the wishes of their founders, their bylaws and, in any case, the law.”

Each of the foundations had to choose between Banking and Ordinary Foundations depending on the fulfilment of the above criteria. However, there was a certain amount of ambiguity, particularly as regards the ability to appoint directors. In several instances involving entities that initially formed part of an IPS, which was later integrated into a larger-scale entity, the right to appoint a board member in that larger-scale entity may be rotated among the various original foundations. In these cases, it is unclear whether each foundation has the right to name a director and therefore must necessarily take the form of a Banking Foundation or whether this right is shared, exonerating them from that obligation. This is the reason for the coexistence of Banking and Ordinary Foundations, with similar shareholdings −in all cases less than 10%− in a given financial institution.

Beyond the definitions of these two classes of foundations, the most important feature of the Act is the shareholder limit imposed on the Banking Foundation into which the savings banks have transformed. Specifically, the Act stipulates that Banking Foundations with an ownership interest of 50% or more in a credit institution draw up a divestment plan in order to reduce that stake to below 50% or, if they opt to retain a higher interest, requires them set up a reserve fund to cover possible capital requirements.

This requirement left the Banking Foundations with ownership interests of 50% or higher with two choices: (i) a divestment plan which would in all likelihood entail an IPO roadmap or dilution if the entity was already listed; or, (ii) endowment of the above-mentioned reserve fund, eroding the resources available for the performance of community work.

The old cajas in today’s financial system

If the initial and successive waves of savings bank mergers had irreversibly altered the caja landscape, the above Act would provide the definitive push for the transformation of the resulting entities, not only in terms of their legal form (conversion into banks) but also in terms of the adaptation of their ownership structures (opening up of the shareholder ranks), with the attendant ramifications on the corporate governance front. The final outcome is a landscape of entities that is very different to that observed before the crisis.

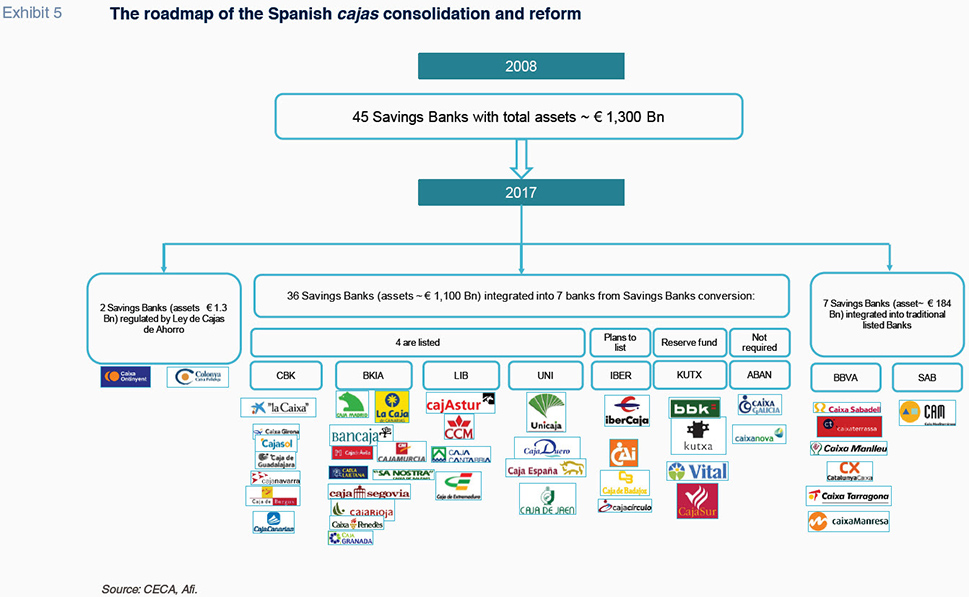

Specifically, just two of the 45 savings banks in existence in 2008 have been able to maintain their legal status: Caixa Ontinyent and Caixa Pollença. Both entities passed the restrictive conditions imposed by the Act as they were small in size (1.3 billion euros of assets between the two) and highly concentrated in their regions of origin.

Except for those two small entities, all the other cajas in existence before the crisis have completed their transformation into banks, either via: (i) absorption by previously-existing banks; or, (ii) conversion into banks of the indirect vehicles (IPSs) used in the initial integration processes to facilitate the desired concentration. The distinction between the origin of today’s caja-derived banks (cajas integrated into existing banks versus banks newly created as a result of conversion) has no relevance from a legal perspective as they are both equivalent to banks for all intents and purposes. However, we believe the route taken is of interest to the extent that those deriving from conversion may still be closer to the savings banks’ traditional spirit in terms of local roots, customer orientation and giving back to society.

To start with, the first group (savings banks merged into previously-existing banks) consists of the former cajas (seven with total assets of around 180 billion euros) which, following their intervention and/or nationalisation as a result of significant injections of public funds, were later auctioned off to the banks. The first of these was Banco CAM (created from Caja de Ahorros del Mediterráneo), which was acquired by Banco Sabadell; the second consisted of the sale to BBVA, in two separate auctions, of two entities arising from the integration of the Catalan cajas: Unim (Caixa Sabadell, Caixa Terrassa and Caixa Manlleu) and Catalunya Banc (Caixa Catalunya, Caixa Manrresa and Caixa Tarragona).

The vast majority (36, with total assets of 1.1 trillion euros) have morphed into banks by means of the conversion of former cajas or groups of cajas. As alluded to earlier, we believe that this route should imply a more pronounced maintenance of local ties and a more prominent role for the Banking Foundations with shares in the banks created upon conversion.

Indeed, it is the presence of these foundations in the shareholder ranks and the restrictions on their presence imposed under the Act that has shaped and continues to shape the existence of different shareholder models and/or market listings for the new banks arising from the transformation of the old cajas. The key lies with the above-mentioned requirement under the Act whereby foundations with shares in a bank of over 50% draw up a divestment plan or set up a reserve fund to cover the investee bank’s potential capital requirements.

Four of the above caja-derived banks have listed on the stock exchange, thereby achieving the goal of diluting the foundations’ ownership interests. The first, the ‘caja-bank’ which has been listed the longest, is CaixaBank. That bank, building on the foundations of the former Caixa de Pensiones (La Caixa), has gone on to absorb one caja (Caixa Girona), one ‘caja-bank’ (Banca Cívica, created by the integration of the former Caja Navarra, Cajasol, Caja General de Canarias and Caja Burgos) and several Spanish and international banks. The second to emerge is Bankia, this time created from the initial integration of seven cajas into BFA, the subsequent IPO of 2011 and the subsequent recapitalisation by the FROB, with the total loss of capital for the original foundations and, lastly, in early 2018, the addition to its scope of consolidation of BMN, also the result of the merger of four cajas (Murcia, Granada, Penedés and Sa Nostra). This group of ‘caja-banks’ is rounded out by the stock-market listed Liberbank (made up of the cajas of Asturias, Extremadura, Cantabria and CCM) and Unicaja Banco (the former cajas Unicaja, Jaen, España and Duero).

Among those entities not yet listed, there are three other caja-derived banks. Firstly, Ibercaja Banco (which, on the basis of Ibercaja, absorbed CajaTres: Caja Inmaculada, Badajoz and Círculo Católico), an entity with IPO plans but whose comfortable capital position (it has already repaid all of the funds injected into CajaTres by the FROB) gives it sufficient margin to optimise the timing of its IPO. Secondly, Kutxabank, the bank which encompasses the former Basque cajas (BBK, Kutxa and Vital), as well as Cajasur, acquired by BBK. In the wake of the Act, Kutxabank opted to create the required reserve fund, thereby avoiding a reduction in the foundations’ shares and, thus, having to publicly list in order to dilute the value of their holdings.

Thirdly, Abanca, which originated from NovaGalicia Banco, was created from the merger of the former Galician cajas (CaixaNova and Caixa Galicia) and was sold in auction to the Venezuelan bank Banesco. Given that Abanca’s shareholder ranks do not include any foundations, it is not obliged to dilute their holdings under the Act or, by extension, to list its shares publicly, a decision that is solely within the purview of its shareholder, Banesco.

Exhibit 5 graphically sums up the routes taken by the former

cajas in their evolution into banks (separately showing the two small surviving

cajas referred to earlier). For a more detailed snapshot of the transition from

caja to bank, the Appendix itemises the initiatives taken by the 45

cajas in existence in 2009 en route to forming part of one of the entities in existence today.

Lastly, it is worth underscoring the fact that all of the banks into which the former cajas have morphed constitute significant entities from the standpoint of the European supervisor (SSM), such that irrespective of whether they are publicly listed or not, they are all subject to the same oversight and corporate governance requirements as traditional banks.

Ángel Berges and Fernando Rojas. A.F.I. - Analistas Financieros Internacionales, S.A.