Spanish economic forecasts panel: July 2018*

Funcas Economic Trends and Statistics Department

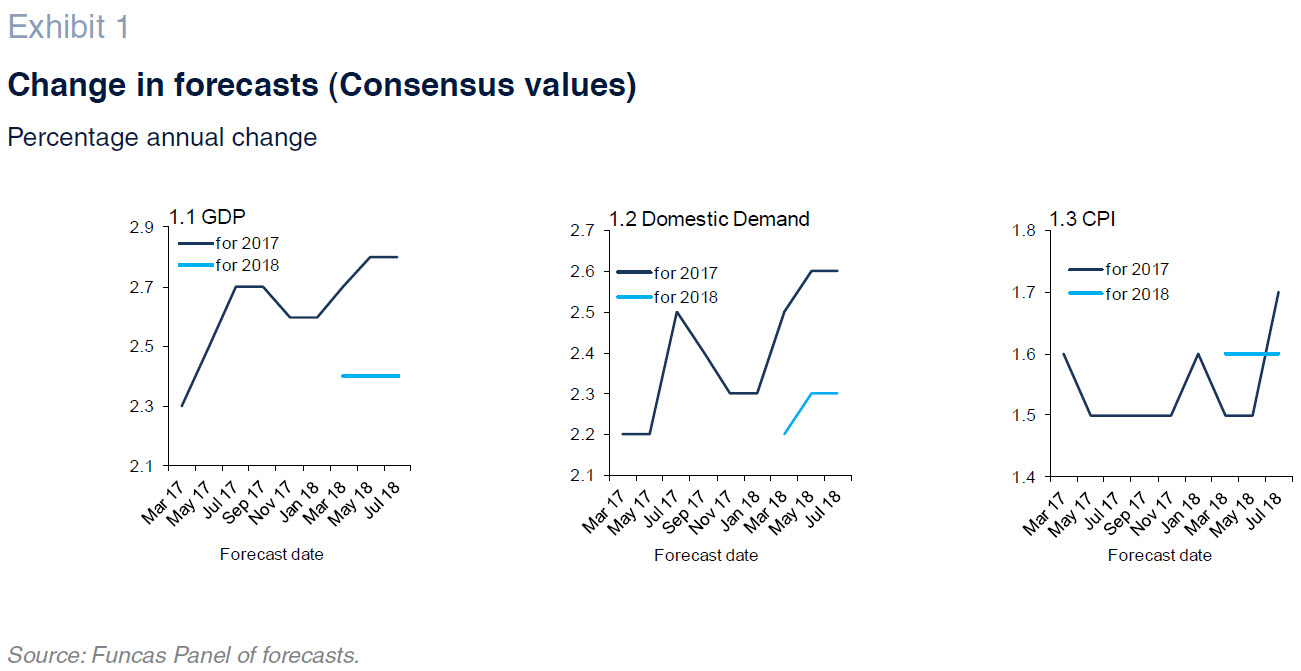

No change in GDP forecasts for 2018

The consensus forecast for second-quarter GDP growth is 0.7%, the rate actually observed during the last three quarters. The indicators point to a slowdown in consumption, shaped by the uptick in inflation, and a recovery in investment.

The consensus forecast for GDP growth in 2018 is unchanged from the last survey at 2.8%. Growth during each of the last two quarters of the year is estimated at 0.6%. There have been some changes in the expected composition of that growth: the analysts have raised their forecasts for private and public consumption and for investment in construction, while cutting their forecasts for investment in capital goods substantially. They have also lowered their forecasts for growth in exports and imports. Domestic demand is currently expected to contribute 2.5 percentage points to growth, with foreign demand contributing to the outstanding balance: 0.3 percentage points.

The GDP forecast for 2019: Unchanged at 2.4%

The consensus forecast for GDP growth in 2019 is unchanged at 2.4% The slowdown is expected to be driven primarily by weaker private consumption. The analysts expect foreign demand to continue to make a positive contribution to GDP growth.

Inflation on the rise in 2018

The inflation rate increased to 2.3% in June, from levels of around 1% in the first three months of the year, as a result mainly of energy product inflation.

The consensus forecast for average inflation in 2018 has risen by 0.2 percentage points to 1.7%; the forecast for core inflation is unchanged at 1.2%. The headline inflation rate is expected to decline in 2019, with core inflation increasing. The estimates for the year-on-year rates for December of this year and next are 1.8% and 1.5%, respectively.

The unemployment rate continues to trend lower

According to the Social Security registration numbers, the pace of job creation gathered force in May and June, having slowed in March and April, so that growth in employment in the second quarter ended up the same as in the first quarter. Recall, however, that for some time now the trend in employment revealed by the Labour Force Survey is less dynamic than that gleaned from the Social Security numbers.

According to the consensus forecasts, employment is set to increase by 2.4% in 2018 and 2% in 2019. Using the forecasts for growth in GDP, job creation and wage remuneration we can obtain implied forecasts for growth in labour productivity and unit labour costs: the former is expected to register growth of 0.4% in both 2018 and 2019, while ULCs are expected to increase by 0.7% in 2018 and by 1.1% in 2019. The average annual unemployment rate is expected to continue to decline to 15.3% in 2018 and 13.6% in 2019. None of these estimates has changed since the last edition of the Panel.

Spain set to continue to report a current account surplus

To April, Spain presented a current account deficit of 2.8 billion euros, compared to a slight surplus in the same period of 2017, as a result of a narrower trade surplus and a wider income deficit.

The deficit presented during the first few months of the year is highly seasonal, however, and Spain is expected to report an overall surplus equivalent to 1.5% of GDP in 2018, just 0.1 percentage points below the 2017 surplus. In 2019, the surplus is expected to decline by an additional 0.1 percentage points.

Spain expected to miss its public deficit targets

The fiscal deficit amounted to 3.98 billion euros in the first quarter of 2018, down from 5.38 billion euros in the first quarter of 2017. Tax revenue increased by 6.8% during the quarter while on the expenditure side, the recovery in investment, particularly at the state government level, stands out.

All of the Panel members bar one believe that Spain will miss its public deficit targets this year and next. They are forecasting a deficit of 2.5% of GDP in 2018 (unchanged from the last Panel forecasts) and of 2% in 2019, up 0.1 percentage points from the last survey.

Less benign external environment

The external environment remains favourable, as evidenced by the global economic forecasts of the main international organisations. However, the perception has deteriorated somewhat since the last Panel survey. The signs of a slowdown in the European economy foreshadowed in previous surveys have materialised. The German economy, at close to full employment, may be encountering difficulties in continuing to fuel strong growth. In addition, political uncertainty and the state of the financial sector have clouded the outlook for the Italian economy. Elsewhere, Brexit negotiations do not appear to be headed in the right direction. Meanwhile, the British economy is posting sluggish growth.

However, the main external risk factor lies with the intensification of trade tensions in the wake of the import duties introduced by the US administration. These tensions have played a part in weakening growth in the Chinese economy, which was already tackling private sector deleveraging issues. If the US government were to introduce new duties on imported cars, this could have a material impact on the sector and ramifications for the European economy in general and the Spanish economy in particular. Lastly, oil prices remain high, approaching $80 a barrel during some trading sessions.

As a result, the members of the Panel are less optimistic about the external environment than previously. The majority continue to view the context as favourable. However, several analysts believe that the current environment is neutral and, specifically in relation to the environment outside of the European Union, two view it as negative. And although the majority of analysts think that the environment will remain favourable, the number cautioning about a deterioration in the international context in the coming months has increased.

Interest rates due to move higher

The ECB, despite the expectation that core inflation will increase slightly, would not appear to be considering a significant change in its plans for monetary policy normalisation. This means that the spread between rates in Europe and the US, where normalisation is further along, will continue to exist throughout the horizon of the forecasts.

The Panel members are not anticipating any change in the timing of benchmark rate increases compared to the last set of forecasts. They are virtually all expecting the rate hikes to begin in 2019 with most expecting this to happen in the second half of that year. Just two analysts think that the rate hikes will come sooner, namely in the second quarter (with none forecasting any earlier moves).

The expected increase in benchmark rates will have an impact on market rates. The Panel analysts believe that 12-month Euribor will start to move higher in the second half of this year and enter positive territory by the second quarter of 2019 (no change with respect to the last set of forecasts). The yield on Spain’s 10-year Treasury bonds is expected to etch out a similar pattern, increasing to 2% by year-end 2019. That would still be a relatively low rate of interest, in line with what the economy demands.

Euro depreciation against the dollar may continue until 2019

The gap between European and US interest rates has impacted the capital markets and continues to exert pressure on the exchange rate. The euro is trading at around 1.16 dollars, which is lower than at the time of our last publication. This means that the euro has depreciated by 7% from its annual high. The majority of analysts believe that the rates observed during the early part of this year will not be revisited until the end of 2019.

Shift in assessment of fiscal policy

The analysts’ assessment of monetary policy has not changed. All of the Panel members view it as expansionary and the majority think it will remain so during the months to come (no change from the last survey).

In contrast, there is an apparent lack of consensus regarding fiscal policy. The analysts are split as to whether fiscal policy is expansionary or neutral. And whereas the majority are calling for a neutral fiscal policy, five analysts believe it should be contractionary.

The Spanish economic forecasts panel is a survey run by Funcas which consults the 18 research departments listed in Table 1. The survey, which dates back to 1999, is published bi-monthly in the first fortnights of January, March, May, July, September and November. The responses to the survey are used to produce a “consensus” forecast, which is calculated as the arithmetic mean of the 18 individual contributions. The forecasts of the Spanish Government, the Bank of Spain, and the main international organisations are also included for comparison, but do not form part of the consensus forecast.