Italy and possible implications for eurozone stability

After Italy’s unsuccessful push for reform at the EU Summit last month, many of its European partners may be tempted to write-off the country’s concerns. However, this somewhat complacent stance may be dangerous in that it underestimates the recent shift in Italian political dynamics that culminated in the formation of an unexpected coalition government and the extent to which this may impact financial markets and potentially EU stability.

Abstract: Italy’s recent election surprised many observers who expected a hung parliament and who were subsequently caught off guard by the success of the right-wing Lega and the populist Five Star Movement (M5S). This outcome can be attributed to an increasingly volatile Italian electorate and a shift in political dynamics brought about by the economic and financial crisis. As the protracted coalition negotiations demonstrated, the Lega and M5S are not natural political allies. While there are areas of policy overlap, the diverse nature of the M5S’s political movement, its relatively more expensive policy agenda, and Lega’s growing strength all suggest maintaining a united front may prove difficult. Nevertheless, this unexpected political partnership ought not to be written-off by European partners. Finding ways to interact with Italy’s new government poses a considerable challenge to EU leaders and, subsequently, the outlook for EU macroeconomic governance reforms and financial markets’ stability. However, such efforts will be necessary to stabilize the eurozone and contain anti-EU sentiment.

Introduction

When Italian Prime Minister Giuseppe Conte headed to Brussels for his first European Council summit in June 2018, he had a complicated negotiating agenda. Conte’s top priority was to win a commitment from his European partners that migrants who land in Italy from across the Mediterranean are not strictly an Italian responsibility.

Alongside the migration issue, Conte had to push his own country’s vision for reforming macroeconomic governance arrangements at the European level (Jones, 2018a)

[1]. He had to call for more attention to be given to the completion of the European Banking Union and specifically the elaboration of a European Deposit Insurance Scheme. He also had to make the case for greater European unity in responding to protectionism coming from across the Atlantic and for greater flexibility in Europe’s relationship with Russia, specifically in terms of relaxing sanctions imposed after Russia’s invasion of Crimea.

Finally, Conte needed to prove his personal mettle as Prime Minister to European counterparts who may be under the impression that the real power in the Italian government is shared unevenly by the Lega leader and Minister of the Interior, Matteo Salvini, and the Five Star Movement (M5S) leader and Minister of Labor, Luigi Di Maio. Doing so meant not only putting a strong face forward at the European level, but also bringing home a list of accomplishments that would not generate excessive public criticism from within his own government.

Conte’s success with this complex agenda was not obvious. Moreover, there is nothing surprising in this lack of accomplishment. Few heads of state or government achieve all their goals at the European level, particularly during their first major summit. That said, Conte’s approach was unconventional. He started the meeting by threatening to veto any decision unless and until the migration issue was addressed (Ciriaco and d’Argenio, 2018). This strategy cost him significant credibility and he progressively found himself isolated in the conversation. He succeeded in pushing Italy’s views on some of the more prominent issues and yet he did not bring home a major negotiating achievement.

The temptation for Italy’s European partners will be to discount the new government in light of this performance. If they do, they risk underestimating just how much Italy has changed since the onset of the economic and financial crisis in the country in 2011 (Jones, 2012). They also risk misinterpreting the new Italy’s relationship with financial markets and its importance for the stability of the euro area. This new Italy is only just learning to express itself politically and it has large ambitions in terms of economic performance and government finances. Moreover, the whole of Europe has an interest in helping this new Italy find some measure of success. This is not a political argument; many outside observers will want to take a normative position on the varieties of populism currently on display in the Italian Republic

[2]. Such normative judgments are not the issue. What matters is the fact that Italy is too big to fail.

An unexpected electoral outcome has resulted in a strange coalitionOn March 4

th, 2018, the Italian electorate delivered a parliamentary majority to the Five Star Movement (M5S) and the Lega. The polling data prior to the elections did not predict this outcome. On the contrary, a long run of polling data suggested that the M5S would get fewer than 30 percent of the votes and that the Lega would come in behind the center-right party headed by former Prime Minister Silvio Berlusconi.

[3] Reflecting on this data, most observers anticipated a hung parliament; those few brave enough to pick a clear outcome argued that the majority of the seats in both the Chamber of Deputies and the Senate would go to the center-right (see, for example, Rivara, 2018).

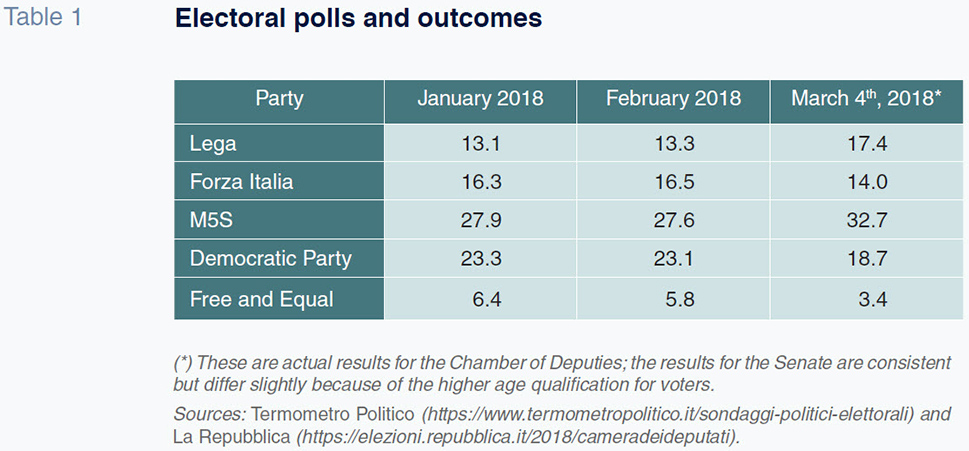

What the polling data failed to anticipate was the volatility of the Italian electorate. Although the polling data was consistent over a long period, the voters were not. To see the variation, it is enough to focus on five political parties: two on the center-right, Berlusconi’s Forza Italia and the Lega; two on the center-left, the Democratic Party and a splinter group called ‘Free and Equal’; and the Five Star Movement (Table 1). The data is the monthly average across multiple polls for January and February 2018 and the actual results for the Chamber of Deputies in the March 4

th elections. What is striking in the data is not just the gains made by the M5S or the redistribution of votes across the center-right, but also the collapse of the center-left. The two parties of the center-left only got 22.1 percent of the votes for the Chamber of Deputies on polling day (and 22.4 percent in the Senate – not reported in the table).

This volatility in the electorate fundamentally changed how the coalition negotiations took place after the votes were translated into seats. There were only two options. Either the Lega and the M5S could find a way to work together or the President of the Republic, Sergio Mattarella, could appoint a technical government with the broad support of parliament. Neither of those options were very attractive to either Salvini on the center-right or Di Maio in the M5S. Having spent weeks going in circles Salvini and Di Maio finally decided to work together.

The M5S and the Lega are not obvious coalition partners. Although international observers were quick to lump the two movements together as ‘populist’, they are in fact very different organizations, with different demographic constituencies and different geographic orientations.

The Lega has its roots in an older style of Italian politics. The movement has a strong local presence; it campaigns through public stands and gazebos; and it places great emphasis on its ‘retail’ presence. If the Lega is ‘populist’, that name fits because of the movement’s long tradition of campaigning against Italy’s ruling elites and what it describes as the corruption of the Italian political process (Gilbert, 1995, ch. 4). And while Salvini has tried to make inroads for the Lega in the middle and south of the country, including by dropping the word ‘Nord’ (or North) from the movement’s official name, the preponderance of support comes from areas north of Lazio and Abruzzo (IPSOS, 2018).

What the M5S shares with the Lega is a strong dislike of Italy’s ruling class. This was clearly on display in the aftermath of the 2013 elections, when the M5S took every opportunity to confound and embarrass party leaders who sought to try and bring it into a coalition government. This experience explains much of the antipathy that Renzi holds for the M5S. Within the movement, however, that willingness to expose contradiction and speak truth to power is characteristic, particularly when it upsets convention.

The M5S is a different political entity (Corbetta and Gualmini, 2013). In many ways, it is the opposite of the Lega. It is rooted in the use of technology to foster wide-ranging conversations, to organize flash demonstrations, to survey supporters, and to recruit candidates for election. The average M5S voter is younger, better educated, and more urban than the average for the Italian electorate (IPSOS, 2018). M5S voters are more often at the lower end of the income scale, they have not yet accumulated assets or savings, and they are often in precarious employment. The M5S also draws support from unemployed workers. More recently, the M5S has come to dominate electorally in the South of Italy where economic conditions are harsher and where social mobility is more restricted. This support is recent and may also prove ephemeral. The M5S will have to work hard to earn the loyalty of its new voters, who could become disillusioned with M5S as easily as they were disillusioned by the other parties beforehand. The challenge will be to find the resources to meet the many demands that M5S supporters give priority.

The contrast in style and support for the Lega and M5S make them an unlikely pairing. The traditional structure of the Lega gives it a strong programmatic coherence; the more flexible structure of M5S makes it more unpredictable and even whimsical because the movement responds to the changing ambitions of its supporters (and leaders). The Lega has its origins in a Northern tax revolt focused on the alleged waste and abuse of their individual achievement by politicians in the South; the M5S draws support from younger generations who are more focused on equal opportunity and distributive justice. The combination of ‘hard work’ and ‘entitlement’ is also difficult. The two groups share an interest in overthrowing the traditional elites and replacing them with a new ruling class, but that agreement does not extend naturally to what comes after the revolution.

This contrast explains why the Lega and M5S needed time to accept the need to negotiate a coalition agreement. No matter what the underlying political calculus, the two groups are very different. They would have to learn not only to work together, but also to understand the wants and aspirations of each other’s supporters.

An ambitious and disruptive policy agendaWhen Salvini and Di Maio finally agreed to form a coalition, representatives from the Lega and M5S set out a ‘contract’ of policies measures to be pursued by the new government. That term also reflected the unusual nature of their partnership given the differences between the two movements. Although both Salvini and Di Maio were careful to underscore the closeness of their working relationship, trust was not something either could take for granted. The first page of the final draft even includes a formal space for signatures and identification details of Di Maio and Salvini as contracting parties.

[4]

The contract has four principal components: one focusing on migration and law-and-order issues close to the Lega; a second focusing on public service provision and labor market policies important to the M5S; a third related to economic policies; and a fourth related to Europe. The contract also touched on a range of other policy measures, but these four clusters are arguably the most consequential both for Italy’s economic performance and for its relationship with Europe.

The migration and law-and-order components reflect the history of the Lega as a right-wing political movement. They also reflect Salvini’s ambitions as Minister of the Interior, which is the position he claimed once both he and Di Maio agreed to renounce any ambition to serve as Prime Minister. The contract promises to take a tougher line on new arrivals to Italy from across the Central Mediterranean. In addition, the contract stresses the importance of expanding the prison service, investing in the police and tackling both crime and other forms of anti-social behavior.

From a public policy perspective, the commitments to improve public service provision have a very different texture. The passages on health care are a good illustration. What the contract promises is a more accessible, responsive and caring management of individual and public health – relying more on general tax revenues and less on individual participation. The formula for achieving this goal is to tackle waste and abuse. That is the same formula that the contract applies to higher education and research. The chapter on ‘schools’ has even greater emphasis on active state involvement. And the chapter on labor markets introduces commitments to provide a minimum wage for those sectors of precarious work that are not covered by collective action and to put an end to unpaid internships in the liberal professions. These are all areas where the imprint of M5S is strongest.

The economic components show a mix of both groups. There are some areas of overlap. Reversing the pension reforms introduced when Mario Monti was Prime Minister of the crisis government in 2012 is at the top of the list. This is an area where the two parties are in strong agreement. In other areas, they are more divided. The Lega is eager to introduce a flat tax regime for households, the self-employed, and corporations. The goal is simplification of tax compliance, to be accompanied by a much stricter regime for tax enforcement. In the long run, the Lega argues that this policy will recoup much of the revenue lost from lower tax rates and an initial tax amnesty through higher rates of growth and more consistently high rates of tax compliance. For its part, the M5S is eager to introduce a basic minimum income (reddito di citadinanza) alongside a minimum state pension. This policy would build on the infrastructure created by previous governments in the form of a solidarity income (reddito di inclusione) for the poor and a reactivation income (reddito di reinserimento) for the unemployed, but it would involve more active public-sector engagement and it would be more generous in financial terms. Taken together, the pension reform, the flat tax and the basic minimum income suggest a significant increase in current expenditures. Estimates range from 70 billion euros to well over 100 billion euros (see, for example, Carli 2018). Nevertheless, the contract insists that the government will continue to balance its finances even as it negotiates a more flexible regime for macroeconomic policy coordination with the rest of the European Union.

Relations with the EU are the fourth cluster and they constitute another area of overlap between the Lega and the M5S. This overlap was starkest in the first draft of the document, where the coalition partners appeared to be questioning Italy’s continued participation in the euro. Even in the later drafts, however, the change in the approach to Europe remains clear. The Lega and M5S recognize the need to coordinate closely across the government to present a united face to European partners. However, they question current practices of macroeconomic policy coordination and particularly the emphasis on balanced budgets. They are also willing to look for financing instruments that might strain European commitments to avoid monetary financing – and specifically the use of small denomination government debt obligations that could be traded in secondary markets and used by holders to offset tax payments. Finally, they raise questions about the usefulness of European sanctions on Russia, and they even question the effectiveness of Europe in negotiating commercial ties with third parties. This willingness to question Italy’s relationship with Europe is not new to the M5S-Lega coalition contract, but the agreement does challenge past practice more than previous governments (Jones, 2017).

Political tensions and financial markets turbulence

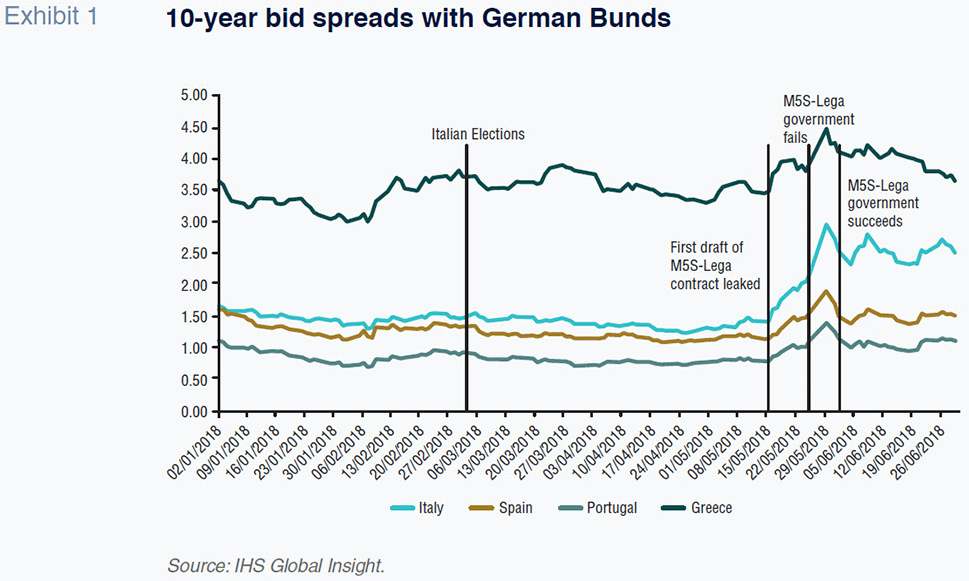

That willingness to challenge Europe almost brought an end to the relationship between the Lega and M5S during tense deliberations between the President of the Republic, Sergio Mattarella, and the coalition over key appointments, such as Prime Minister and Economy and Finance Minister. It also resulted in significant financial market volatility over this period. The volatility started when the two parties leaked the first draft of their contract, which included stark passages suggesting the new government may prepare to exit the euro, and it intensified with President Mattarella rejected the Lega’s preferred candidate for the Ministry of Economics and Finance and made moves to install a technical government instead.

Although market participants worried about what might be the policies of a government headed by the Lega and M5S, the prospect of a prolonged period of political uncertainty followed by fresh elections was harder to digest. More important, Italy was not alone in being affected. Bond prices moved in countries like Spain, Portugal and Greece as well. This correlation in peripheral bond movements in response to political turmoil in Italy raised concerns across Europe that a new crisis might emerge in the euro area which neither the EU’s bailout facilities nor the European Central Bank (ECB) could address. Whether such concerns were plausible was less important than the fact that they existed. Mattarella reconsidered his decision in light of this turbulence and encouraged the Lega and M5S to make one more effort at coming to an agreement, with Conte as putative Prime Minister. Conte proposed a new name for the Minister of Economics and Finance (instead of the more controversial initial choice Paolo Savona), the economist Giovanni Tria, and shifted Savona to the department for European affairs.

From the outset, Tria made it clear that Italy would continue to live up to its European commitments to control government expenditures and to reduce public debt. He pushed a modified economic and finance document through parliament that showed little or no change in aggregate terms from the policies of the previous government. Moreover, he has offered constant reassurance that Italy’s participation in the euro is not in question. In that line, Paolo Savona has played a supporting role. Despite his involvement in academic work related to Italy’s exit from the euro, Savona as minister has insisted that such an action is not a policy goal of the current government (Savona, 2018). This concession has not stopped Tria (or Savona) from pushing for greater flexibility at the European level and for arguing for a reform in the pattern of European macroeconomic governance. It has also not prevented Tria from placing policy emphasis on the importance of stimulating growth (Tria, 2018). The point is simply that these are themes that would have been expected from the previous government as well.

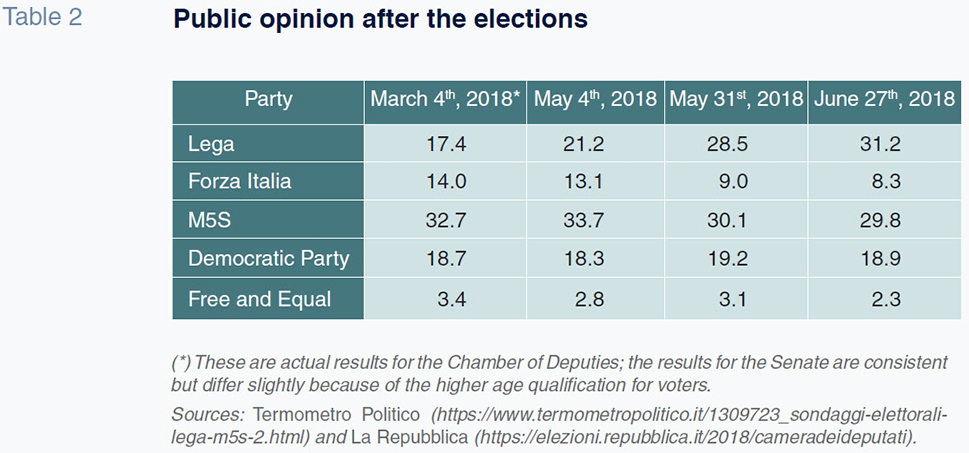

The initial days of the new government centered on migration rather than economic or social policy. That is a central theme that has won considerable support for Salvini and the Lega. Indeed, the Lega has almost doubled its support within the Italian electorate (see Table 2). More troubling for the stability of the coalition, the Lega now has more support than Di Maio’s Five Star Movement.

Nevertheless, the real challenge for the coalition will come only at the end of the summer as the parliamentary agenda narrows to focus on the legislative budget for the coming year. That budget debate will be complicated not only by Di Maio’s aspirations and Tria’s constraints, but also by Salvini’s desire to bring forward his tax reforms and associated amnesty provisions. This will open up a three-way conflict that could tear apart the governing coalition.

The early signs of conflict are already apparent, and they fall on what look like more traditional left-right political lines. Di Maio announced a decree to promote the ‘dignity’ of the workforce that would bolster the support provided to firms that take on new workers while at the same time restricting the use of temporary contracts. Di Maio’s goal is to strengthen incentives for firms to move workers into full-time, open-ended employment. This is a positive move for the M5S supporters among the young and underemployed in northern cities and among the unemployed in the South. Nevertheless, it is a negative move for employers, particularly in small firms, who worry about anything that restricts the flexibility of employment. Predictably, Salvini has started to push back, arguing in favor of enhanced support for firms who take on new workers but against any restrictions on temporary contracts.

Italy’s position on EU macroeconomic governance reform

These divisions emerging within the Italian coalition should not obscure the clear position that Italy has on the reform of European macroeconomic governance (Jones, 2018a). That position is worth underscoring because Italy’s participation in any future European arrangement will prove critical to the success of the single currency. Moreover, the clear lesson from the Renzi government is that any efforts of Italy’s European partners to take advantage of Italy’s weakness in European negotiations will only come back to haunt the governance of the euro area at some point in the future. Italy’s failure to negotiate a more favorable treatment of outstanding public debt in the fiscal compact negotiations is one illustration; its failure to negotiate a longer transition period for the changeover in banking resolution regimes is another. Renzi made it clear that both agreements were creating obstacles to domestic political stability and hence also meaningful reform efforts; hence, Renzi argued, Europe was not so much part of the solution as part of the problem (Jones, 2017).

The lines that any Italian government should be expected to push at the European level are for greater mutualization of risk, longer transitions in risk reduction efforts and a more evidence-based approach to understanding how domestic public debt markets should be managed. The mutualization of risk centers on resolution financing, including liquidity provision for banks undergoing restructuring, and the harmonization and integration of European deposit insurance protection. These are both issues that remain on the European agenda for the December European Council summit. At the same time, the Italian government will try to explain to the European Central Bank why efforts to introduce aggressive provisioning against new credit at risk and to promote accelerated disposal of existing non-performing assets are likely to work at cross-purposes, particularly when these are accompanied by changes in the accounting rules related to what constitutes a viable bank asset. This argument is not about the need for harmonized accounting rules or about leveling the playing field for the regulatory treatment of European banks, it is about the speed with which this new regime is being introduced at a time when Italy is still wrestling with the legacies of the recent crisis.

The management of Italian sovereign debt markets is more complicated. Neither the Bank of Italy nor prominent members of the ECB secretariat are convinced that high levels of domestic bank exposure to domestic sovereign debt constitute prima facie evidence either of risk to the profitability of the banking system or of a sinister symbiosis between banks and sovereigns. On the contrary, they regard the high exposure of Italian banks to Italian sovereign debt as a legacy of the successful incentives created for the Italian banking system to act as buyer of last resort to stabilize Italian sovereign debt markets in late 2011 and early 2012. Even if they accept, therefore, that bank treasurers may decide to rebalance their asset portfolios away from Italian sovereign debt instruments, they will resist the imposition of any a priori limits on how much Italian sovereign debt Italian banks are allowed to hold.

Beyond these elements, there are positions that the current government is likely to push strongly but that any Italian government would pursue in some form. These positions are related to the interpretation of European fiscal rules, the pattern for banking resolution, and the prospect of enhanced European conditionality in exchange for European support. This government needs greater flexibility in the interpretation of European fiscal rules if it is to meet the wide array of spending commitments that the Lega and M5S made to their supporters during the electoral campaign. As conflict between the coalition partners intensifies, much of the friction is likely to be reflected against the rest of Europe. This is true particularly where matters relate to the compensation of small investors who lost money during the recent resolution of Italian banks both in the Veneto region in Northern Italy, and in the central regions of Tuscany and Le Marche. Neither the M5S or the Lega supports bank bail-ins in principle and their contract argues that even small equity holders should be compensated in the event of banking resolution.

Of the three elements, the prospect of enhanced conditionality is the most controversial. This is true both in terms of crisis-prevention and in terms of crisis-management. Since these aspects are tied to the proposed evolution of the European Stability Mechanism, it is worth following the Italian position closely. The current government’s resistance to any form of European conditionality is also relevant to the actions of the European Central Bank. As the recent experience of Greece and Cyprus reveals, the ECB is reluctant to maintain wavers on the credit ratings requirements for sovereign debt instruments used as collateral when the government in question is not in a program; the ECB’s Governing Council is also reluctant to extend emergency liquidity assistance for banks that lack high quality collateralizable assets; and the ECB cannot engage in outright monetary transactions to stabilize sovereign debt markets for governments that refuse to enter into some kind of European program. So long as these positions remain consistent on both sides of the argument, the potential for this government to create uncertainty in the markets is significant. The market reaction to political uncertainty in Italy should be seen in that context.

An uncertain future for the coalition and a delicate balance with the EU

The uncertainty about the future of the governing coalition cannot be resolved analytically. Only time will tell. Nevertheless, two factors are relatively easy to discern in light of the present. The first is that the Italian electorate is more volatile now than it has been since the collapse of the First Republic. The fact that the Lega can almost double its support in a matter of months is unprecedented. The fact that this support is extending rapidly down into the south of Italy is worth noting as well. The Lega is likely to emerge as a national center-right political movement with few necessary ties to other forces, including Berlusconi’s Forza Italia. This new strength and freedom for maneuver is likely to galvanize the Lega as a permanent and essential force in Italian politics. In other words, other European countries will have to learn how to work with Salvini even if the current government were to fail.

A second factor that seems apparent is the general confusion on the center-left of the Italian political spectrum. The open question is whether the M5S will find some way to move closer to the Democratic Party. What is unsure is whether the M5S is willing to embrace a center-left ideological position. Having thrown his lot in with Salvini, Di Maio lacks the credibility to lead a center-left political movement. So long as the center-left remains confused, the terrain is open for Salvini to drive the political conversation. Thus far, the Lega appears to be moving from strength-to-strength. How long that run of success can last is difficult to gauge.

The role of Europe is the missing piece in this analysis. That role has two components as well. The first of these is mechanical. The correlation in bond yields across the euro area does signal the need to complete Europe’s Banking Union and related institutional arrangements. The recent summit did not go far in that direction. The December 2018 European Council summit will be decisive. This is where the second, more political component becomes important. If the European Union evolves in a way that lowers the tension in Italy, it will at the same time deprive the current government of a long-standing grievance that both the Lega and M5S have used for political mobilization. If Italy’s European partners choose to ignore Italian concerns instead, they will add fuel to anti-EU sentiment in Italy and strengthen the government’s critique of European institutions. Finding a way to engage constructively with this government is going to be challenging and yet the alternative of ignoring the new Italy is likely to be worse (Jones, 2018b).

Notes

For an extended analysis of Italy’s position in the macroeconomic governance debate, see Jones (2018a).

For an overview and comparison between Italy and France, see Diamanti and Lazar (2018).

For historical polling data, see Termometro Politico – https://www.termometropolitico.it/sondaggi-politici-elettorali

The final version of the government contract can be found here: http://download.repubblica.it/pdf/2018/politica/contratto_governo.pdf

References

CARLI, A. (2018), "Cottarelli: per realizzare contratto M5S-Lega mancano coperture fino a 125 miliardi,"

Il Sole 24 Ore (May 18),

http://www.ilsole24ore.com/art/notizie/2018-05-18/per-realizzare-misure-contratto-m5s-lega-mancano-1087-1257-miliardi-102636.shtml?uuid=AEYPZcqE&refresh_ce=1

CIRIACO, T., and A. D’ARGENIO (2018), "Ue, Conte frena sul vertice: “Veto senza intesa su migrantì,"

La Repubblica (June 28),

http://www.repubblica.it/politica/2018/06/28/news/vertice_ue_conte_minaccia_senza_disponibilita_altri_paese_

veto_italiano_-200287854/?refresh_ceCORBETTA, P., and E. GUALMINI, eds. (2013),

Il partito di Grillo, Bologna: Il Mulino.

DIAMANTI, I., and M. LAZAR (2018),

Popolocrazia: La metamorfosi delle nostre democrazie, Roma: Editori Laterza.

GILBERT, M. (1995),

The Italian Revolution. London: Taylor and Francis.

IPSOS (2018),

Elezioni Politiche 2018: L’Analisi del Voto, Milan.

JONES, E. (2012), "Italy’s Sovereign Debt Crisis,"

Survival 54(1) (February/March): 83-110.

— (2017), "Relations with Europe: Beyond the Vincolo Esterno," in A. CHIARAMONTE and A. WILSON (eds),

Italian Politics: The Great Reform that Never Was, New York: Berghahn Books: 51-69.

— (2018a), "Italy and the Completion of the Euro Area," in J. ERIKSSON (ed.),

The Future of the Economic and Monetary Union: Reform Perspectives in France, Germany, Italy and the Netherlands, Stockholm: SIEPS: 26-38.

— (2018b), "Italy, Its Populists and the EU,"

Survival 60:4 (August/September) forthcoming.

RIVARA, L. (2018), "Sprint del centrodestra, al Senato è già maggioranza,"’

La Repubblica (February 17),

http://www.repubblica.it/politica/2018/02/17/news/camera_senato_centrodestra_centrosinistra_m5s_vassallo_stime_collegi_sicuri-189040767/

SAVONA, P. (2018), "Intervento del Ministro Savona alla Camera dei Deputati," Office of the Department for European Affairs (June 27),

http://www.politicheeuropee.gov.it/it/ministro/dichiarazioni/intervento-ministro-savona-camera-dei-deputati-27-giugno-2018/TERMOMETRO POLITICO (2018), "Sondaggi elettorali Ipsos: Lega oltre il 31%, M5S accusa il colpo,"

Termometro Politico (June 30),

https://www.termometropolitico.it/1309723_sondaggi-elettorali-lega-m5s-2.htmlTRIA, G. (2018), "Discussione del Documento di economia e finanza 2018 - Intervento del Ministro dell’Economia e delle finanze Giovanni Tria alla Camera dei deputati," Office of the Minister for Finance and Economics (June 19), http://www.mef.gov.it/ufficio-stampa/articoli/article.html?v=/ufficio-stampa/articoli/2018_2023-Giovanni_Tria/article_0002.html

Erik Jones. Director of European and Eurasian Studies and Professor of European Studies and International Political Economy at the Paul H. Nitze School of Advanced International Studies