Financial digitalisation in Spain in the wake of the pandemic: Assessing the impact

The pandemic has accelerated the push towards digitalisation in Spain on multiple fronts. This trend has been particularly significant within the financial arena, with Spaniards increasing reliance on online banking and payments methods, as well as their interest in crypto-assets, while at the same time taking into account the growing importance of related security measures.

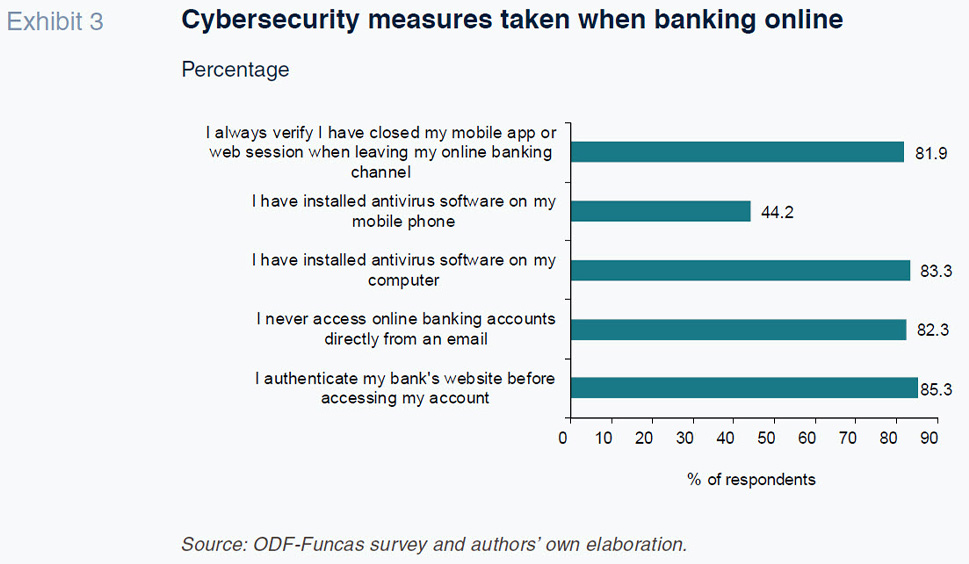

Abstract: In the wake of the pandemic, we are seeing considerable changes in how Spaniards are using banking services. The pandemic has given significant impetus to the process of financial digitalisation. According to the Observatory of Financial Digitalisation (ODF in its Spanish acronym)-Funcas online survey from December 2021, 36.4% of banking service users are currently using their online banking applications daily or almost daily, compared to 17.3% before the pandemic. That said, although the digital divide in online banking has narrowed, physical branches, despite being used less, continue to play an important role for some segments of the population. Another significant change relates to Spaniards´ methods of payment. Digital payments, especially from mobile phones, have displaced cash as the main payment method. Indeed, 69.1% of purchases are being settled using non-cash instruments and just 18% of those surveyed said they continued to use cash as their main payment method. There is also growing interest in crypto-assets, although so far their usage is concentrated within the younger population. According to survey results, the typical crypto-asset investor is young (and male), studies or works, generates a high monthly income and lives in a big city. Finally, in light of the cyber-risks ushered in by online banking, Spaniards stand out for their use of basic security measures in accessing those services. Over 80% of the population follows their banks’ security recommendations when banking online, with the sole exception of installing antivirus software on their mobile phones, where the percentage is a much lower 44.2%.

The pandemic: Catalyst for digitalisation

The impact of the pandemic has been felt on multiple fronts –personal, social and professional– and on all these fronts the result has been the acceleration of digitalisation. The imposition of social distancing rules and mobility restrictions forced consumers, businesses and public authorities to accelerate that digital leap.

Consequently, Spanish society has made considerable progress on its digitalisation. According to the most recent data published by Spain’s National Statistics Office, the INE (INE, 2021), 95.9% of Spanish households currently have internet access, which is 4.5 percentage points higher than before the pandemic. As for usage, 85.8% of Spaniards go online daily, up 10.6pp from pre-pandemic levels. The range of activities carried out online has also broadened significantly. The most frequent uses are: social interaction (use of social media or sending messages to family and friends); information searches (reading the news or looking up information about leisure activities), learning (completing courses online); and job searches. For the first time since the INE has been tracking this information, more than half of the population (55.2%) is shopping online regularly. And those purchases are no longer limited to digital products and subscriptions like music, films, ebooks: 54.1% of the adult population is now shopping online for products that entail physical delivery. Digitalisation is also impacting how we interact with the public authorities. In 2021, 68.7% of all adults had some form of online contact or interaction with the public authorities or services.

This transition coincides with growth in Spaniards’ digital skills. The most recent European Commission data (2021) evidence the progress in digital capabilities. 64.2% of Spanish citizens now possess basic digital skills, up 7 percentage points from before the pandemic. That is the biggest increase on record.

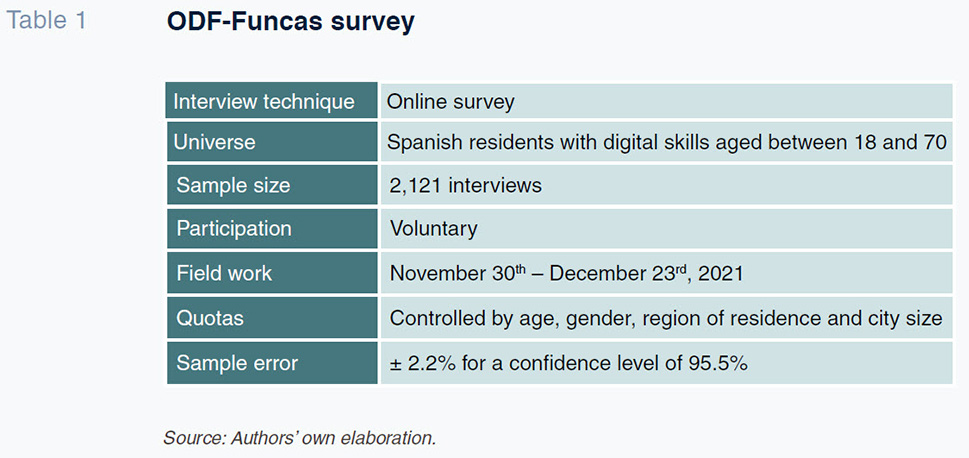

A very significant part of the acceleration observed in the push towards digitalisation in Spain has taken place in the financial arena. Increasingly, Spaniards are contacting their banks, paying for and purchasing products using online banking channels. Moreover, the pandemic has given fresh impetus to the use of new digital assets connected with the world of finance –crypto-assets– which has also implied a major change in many Spaniards’ investment patterns. To analyse the changes in banking service access and the degree of adoption of crypto-currencies, ODF-Funcas conducted a survey looking at the use of online banking services, digital payment methods and crypto-assets. It was sent to a representative sample of digitally-savy consumers resident in Spain, aged between 18 and 70, in December 2021.

Financial digitalisation: From branch to online banking

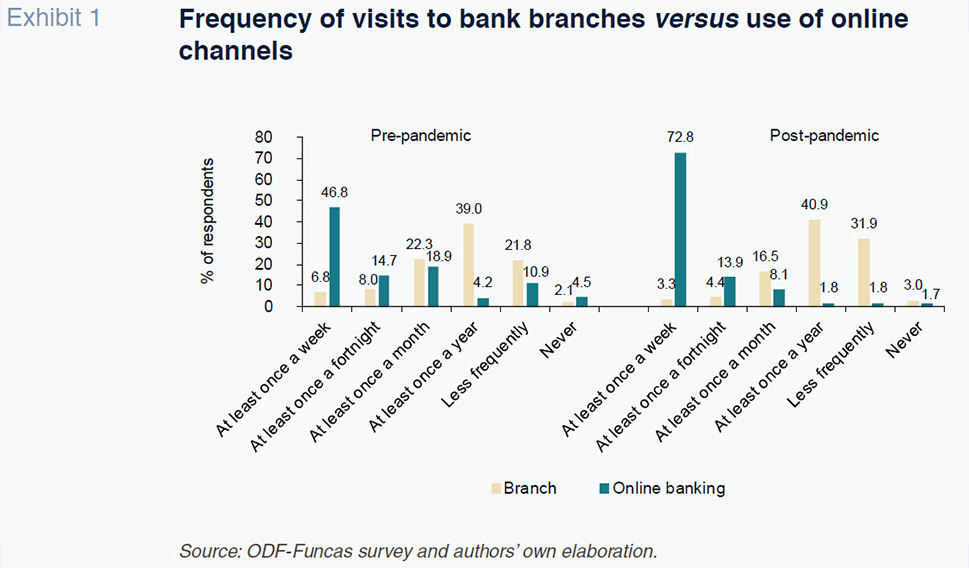

The results of the survey reveal a clear shift in how people are banking. In general terms, the pandemic has accelerated the use of online banking at the expense of branch banking (Exhibit 1). Currently, 36.4% of bank customers access their online banking apps daily or almost daily. Before the pandemic, just 17.3% of respondents said they used their online apps daily. Moreover, 72.8% report using online banking services weekly.

The number of customers who have never banked online has decreased. Before the pandemic, 4.5% of respondents said they had never used the online channel. In the wake of the pandemic, that percentage has fallen to 1.7%. In general, those figures suggest that both usage of and access to online banking have increased. Many customers who before the health crisis had never asked their banks for online access codes did so during or after the pandemic.

Digitalisation is also evident in growth in the number of purely online bank users. 46.1% of respondents reported having at least one account at a purely online bank. That percentage is higher among younger people. Over half of respondents under the age of 40 has an account with an online-only bank, specifically 52.6% of those aged between 30 and 39.

The growth in the use of online banking has decreased reliance on branches. The custom of going physically to the bank to perform certain banking transactions has decreased in the wake of the pandemic. 31.9% of banking users polled said they go to the bank less frequently than before the pandemic. In fact, just 3.3% of those surveyed go to the bank weekly. Indeed, nearly four out of ten adults claim not to go to the bank even once a year. Considering the fact that, according to the World Bank, 94% of the Spanish population over the age of 15 has a bank account, it can be inferred that nearly 14.9 million Spaniards never visit their banks over the course of the year.

The ODF-Funcas survey indicates a reduction in branch usage across all age and income brackets. However, there are still differences in digitalisation rates. Despite the fact that the biggest percentage increases in the use of online banking are observed in the groups of the population that were less digitalised before the pandemic, (Carbó-Valverde, Cuadros-Solas and Rodríguez-Fernández, 2021) there are still gaps by socioeconomic status. 37.4% of adults aged between 60 and 70 visit their bank branches at least once a month. Branch usage is also higher among the less educated. 35.1% of respondents without higher level studies or with basic studies visit their branches every month.

Payments preferences in Spain in the wake of the pandemic

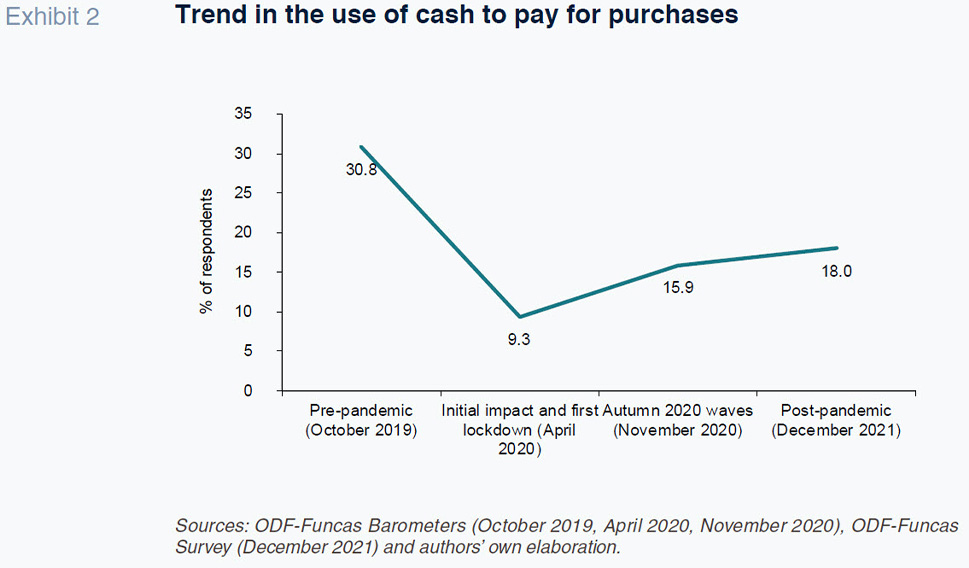

One of the most noteworthy changes observed since the pandemic is the shift in how Spaniards are paying for their purchases. Cash, whose usage was already on the decline before the onset of the health crisis, is no longer the most popular payment method. As shown in Exhibit 2, the drastic drop in the use of cash observed during the first lockdown subsequently reversed only to a small degree. Cash usage remains very low compared to pre-pandemic levels. Use of the new digital payment methods –payment cards, mobile/wearable payments and payments using QR codes– is rising across all segments of the Spanish population.

According to the results of the ODF-Funcas survey, 69.1% of purchases made by our respondents are paid for using methods other than cash. Indeed, just 18% of those surveyed said they continued to use cash as their main payment method. The use of cash is even declining among the older segments of the population. The use of cash to pay for purchases stands at 34.9% among those aged between 60 and 70.

Elsewhere, if we focus on digital transactions, especially those paid for using mobile handsets or other devices, we are seeing significant changes in the use of payment applications. 67.9% of respondents reported that they had used a payment app in the past year. Among the payment apps used, it is worth highlighting the surge in person-to-person (P2P) payments, particularly Bizum, whose usage has jumped from 55.66% before the pandemic to 75.4% today. It is estimated that close to 30.5 million Spaniards are using Bizum to send money to other people or pay for online purchases. Other applications provided by tech firms such as PayPal, Google Pay, Apple Pay and Amazon Pay are also gaining ground in the wake of the pandemic.

Digital assets: The use of crypto-assets

The digital revolution accelerated by the pandemic has also sparked growing interest in crypto-assets. The proliferation of a broad range of different crypto-assets –with close to 17,000 in existence, between cryptocurrencies, stablecoins, NFTs and/or tokens– and increasing media coverage have driven this greater degree of consumer interest.

According to the survey, 5% of respondents have crypto-currencies in their digital wallets. That figure contrasts with other estimates, such as the crypto-currency exchange, Finder (2021), which estimates penetration in Spain at 12%, as indicated by the Bank of Spain in its Financial Stability Report (Bank of Spain, 2022). The gap between the two figures may be attributable to differences in the number of users that have opened an account in any of the main cryptocurrencies in a digital wallet and the number of people who are actually actively trading in those virtual assets.

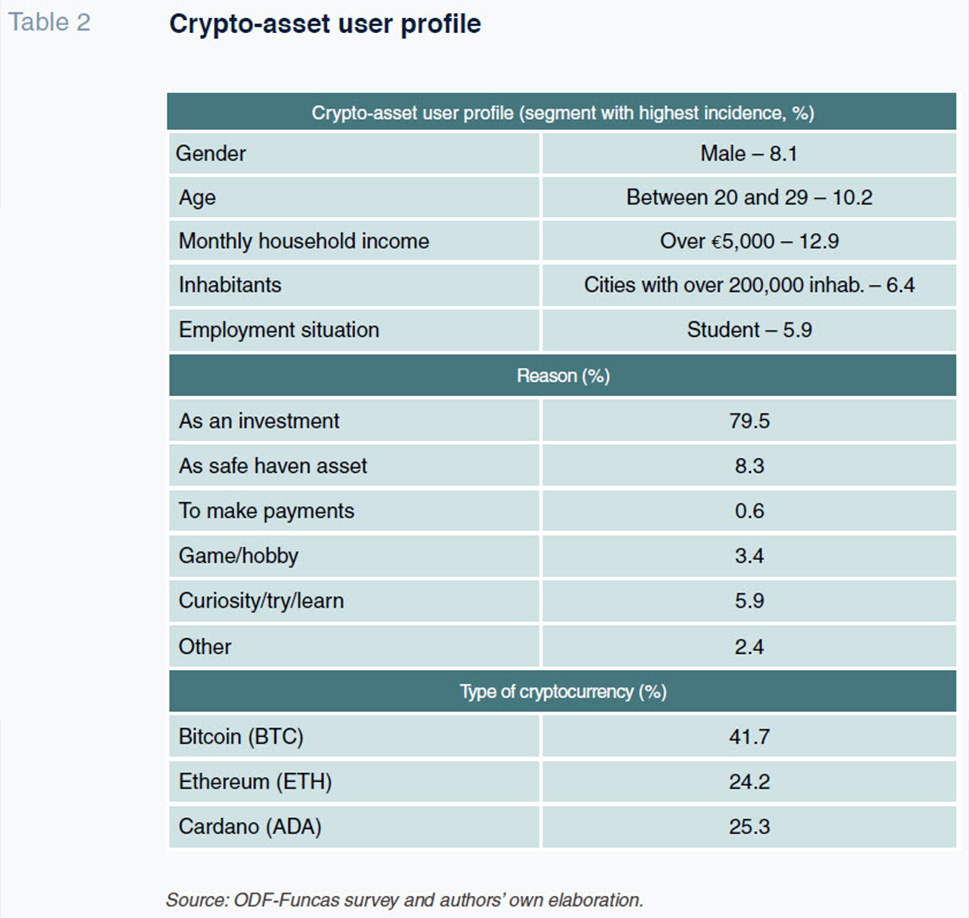

The survey suggests that age, occupancy and income levels are indicators of the propensity to use crypto-assets. According to the poll, the typical virtual currency investor is young (and male), studies or works, generates a high monthly income and lives in a big city (Table 2).

The survey also highlights Bitcoin’s dominance over the other cryptocurrencies. Four out of every ten cryptocurrency investors have Bitcoins in their digital wallets. It is the most popular asset in every age bracket. Bitcoin is followed in popularity by Ethereum (24%) and Cardano (25%). Other currencies such as Solana, Polkadot and Dogecoin account for less than 10% of the polled crypto users’ holdings.

Irrespective of which cryptocurrencies are purchased, they are mainly acquired for investment purposes (79.5%). The potential returns, in exchange for assuming higher risk, have enticed many consumers to invest some of their savings in those assets, particularly with interest rates at or below zero. As central banks begin to raise interest rates, appetite for investing in such a high-risk asset class could wane. What does seem clear is the fact that at present their use as a payment method is scant. Just 0.6% of those surveyed said they had purchased cryptocurrencies for online payment purposes.

Cybersecurity and online banking

The switch from physical to online banking ushers in the risk of cyber-crime. In addition to the cybersecurity measures taken by the financial institutions, the use of online banking channels requires consumers to take a series of measures to reduce the likelihood of falling victim to a financial cyber scam.

As shown in Exhibit 3, a significant percentage of banking customers follow the security measures recommended by their banks when banking online. 85.3% of respondents verify the authenticity of their bank´s website before accessing their online accounts. They also take that precaution when they end their online banking sessions (81.9%). Given that a significant proportion of fraud attempts start with a fake email which purports to supplant the various financial institutions’ identities (phishing), it is vital that users follow a series of additional precautionary steps when accessing their online accounts. 82.3% of respondents said they never access their online accounts from an email, even if that email has apparently been sent by their bank.

The only major security gap relates to the installation of antivirus software on mobile phones. Less than half of those surveyed (44.2%) has installed antivirus software on their smartphones. That contrasts with computer security, where 83.3% of users have active antivirus software. That shortfall of mobile device security is significant considering the fact that the use of social media and messaging apps facilitates the spread of computer viruses that can end up gaining fraudulent access to user banking data.

References

Santiago Carbó Valverde. University of Granada and Funcas

Pedro Cuadros Solas. CUNEF University and Funcas

Francisco Rodríguez Fernández. University of Granada and Funcas