Spanish manufacturing in the wake of COVID-19

Along with causing a contraction in output, COVID-19 has highlighted some of the vulnerabilities in Spain’s industrial sector including its reliance on foreign demand and low productivity. These challenges could be addressed, in part, through a robust industrial policy by the Spanish government with a particular focus on emerging technology and cooperation between the public and private sectors.

Abstract: COVID-19 unleashed a massive shock on Spain’s industrial sector before it had achieved the production levels of 2008, prior to the Great Recession. The impact of the pandemic on the manufacturing sector is the result of a dual supply and demand shock. The direct contraction in the manufacturing industry’s GVA is estimated at 11.1%, solely due to transport and electrical equipment. This figure rises to 24.2% when the knock-on effect on the rest of the economy’s sectors is considered. Spanish manufacturers are particularly sensitive to foreign demand considering that 40% of their output is exported, which means the anticipated drop in world exports could have a major impact on industry. While data show that the competitiveness of the Spanish manufacturing industry is relatively strong, productivity is lower than that of Germany, Italy and France. This underperformance is attributable to human and technological capital, two factors which Spanish companies include on their balance sheets under intangible assets. These challenges could be more surmountable through the adoption of more robust technology and industrial policy coordinated by the Spanish government in concert with private industry.

Introduction

The Spanish economy had barely recovered from the effects of the Great Recession when the COVID-19 induced recession emerged. Numerous forecasters put the year-on-year contraction in Spanish GDP at over 10% in 2020 and agree that it is unlikely GDP will recover to 2019 levels before the last quarter of 2022. That would put average annual GDP growth between 2008 and 2022 at just 0.4%.

The industrial sector is expected to be less affected than parts of the services sector. Nevertheless, it is now facing a massive shock before it had achieved the production levels of 2008, prior to the Great Recession.

The recovery from the pandemic, which is likely to start in the third quarter of this year and gradually gain pace if there are no major new outbreaks of COVID-19, will mark the start of a new era. This period will not be limited to recovering from both the temporary and permanent damage caused by the pandemic. It will also entail accelerated industrial restructuring at the European level in an attempt to turn the unanticipated recession into an opportunity for forcefully addressing two key challenges: digitalisation, with a focus on the development of artificial intelligence and the data economy; and, the energy transition.

Compared with the main EU economies, Spain will be more affected by the pandemic. Unfortunately, it has less fiscal room to combat it, and will rely on the support it may receive from the EU in the form of both flexibility on fiscal consolidation and aid disbursed from the recently presented recovery plan, Next Generation EU. Importantly, the government needs to build a broad consensus among both economic and political agents and identify targeted initiatives carefully.

To help formulate these objectives, this article analyses the effects of the pandemic on the Spanish manufacturing industry and the latter’s competitive positioning in the European context. Lastly, it defines the industrial policy objectives and tools needed in today’s climate.

The impact of the pandemic on manufacturing output

The impact of the pandemic on the manufacturing sector is the result of a dual supply and demand shock. The former relates to: a) the restrictions on the supply of inputs sourced from other countries as a result of impediments to cross-border transportation; b) the closure of non-essential commercial activities as a result of the state of emergency in force between March 14th and June 21st; and, c) the stoppage of all non-essential activities –not just commercial– between March 30th and April 9th. The demand shock is the result of a contraction in end demand in the home market and exports as a result of the lockdown in Spain and abroad. Additionally, the demand shock has been shaped by the loss of household income and uncertainty regarding the economic outlook, crucial to gross fixed capital formation (GFCF).

In its estimates of the effects of the pandemic on the Spanish economy, the Bank of Spain assumes that the restrictions on supply will have virtually shut down the manufacturing of automobiles. This shutdown affected the rest of the manufacturing sector only indirectly, except for the two-week suspension of all non-essential activities, during which the Bank of Spain estimates that around 50% of all manufacturing activity will have been affected. As a result, the manufacturing industry, excluding the automotive segment, is not believed to have been directly affected by the events. However, there will have been an important indirect effect on the remaining productive activities, particularly those most directly affected by the pandemic: hospitality, leisure and eateries, as well as transport, trade and construction.

According to estimates compiled by Prades and Tello (2020), each week of partial closure during the state of emergency

[1] will have driven a contraction in the Spanish economy’s overall gross value added (GVA) of 17% directly and of 28% indirectly, adding in the knock-on effects on other activities. The direct contraction in the manufacturing industry’s GVA is estimated at 11.1%, solely due to transport and electrical equipment. This figure rises to 24.2% when the knock-on effect on the rest of the economy’s sectors is considered. Applying that estimate to just 16 days in March yields a reduction in manufacturing GVA in the first quarter of 2020 close to that registered in Spain’s quarterly accounts in a preliminary estimate of 2.77%, far from the higher figure published on June 30

th of 7.2, which could be explain by the extraordinary impact on exports and gross investment in machinery and equipment, as explained in the following text.

The above approaches attempt to measure the effect of the supply shock, which largely overlaps with the harder to estimate demand shock. However, the latter may affect some productive activities more than others, making it a crucial input for analysing the impact on manufacturing. The manufacturers are particularly sensitive to foreign demand, considering that 40% of their output is exported, and to demand for capital goods, which is met exclusively by industry. The drastic drop anticipated in world exports, which the WTO is estimating within a very wide range of between 13% and 32%, could therefore have had a major impact on industrial activity. The Bank of Spain estimates that in the least severe scenario, exports will contract by 16.7% in 2020 in comparison with 2019 (Bank of Spain, 2020).

[2] Moreover, the contraction in gross fixed capital formation (not just capital but also construction goods), estimated at 20.6% by the central bank in the best-case scenario, will also have hit manufacturers hard. The scale of those contractions is very similar to those observed in 2009, during the first three quarters of the year in respect of exports and all four quarters in respect of GFCF. However, demand for capital goods fell by considerably more during that crisis. Manufacturing GVA contracted by 11.4% in 2009 as a whole, falling by a little more than that during the first quarter. Fortunately, the outlook for 2020 is much brighter for the second half of the year.

The most recent data available appear to confirm the above estimates, albeit pointing to a possibly higher impact via the adverse trends in exports and demand for capital goods. Indeed, in March alone, affected by the partial closure of factories for a little over a fortnight, exports of goods contracted by 16.6% year-on-year, and in April by 39.3%. The sectors hit the hardest were the automotive, capital goods, energy products and consumer products sectors. The hardest-hit destinations were France, Germany, Italy, Portugal and the UK.

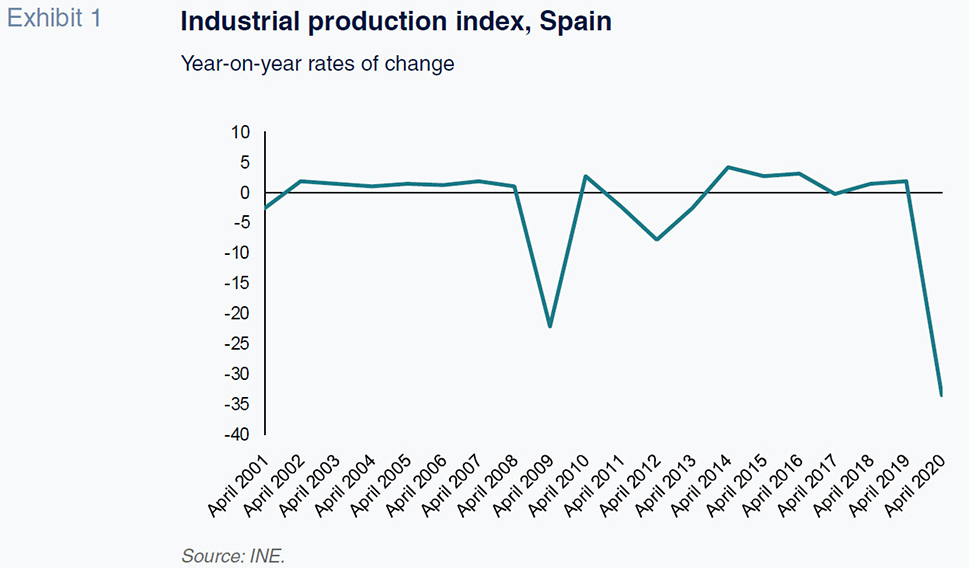

The industrial production numbers are also pointing in this direction (Exhibit 1), revealing a sizeable drop in production in March and a record collapse in April (-33.6%) and May (-24.5%), explained by the extraordinary measures taken to curb the pandemic. Spain, together with Italy, is the EU country in which demand for electricity has registered the most pronounced year-on-year decline (Costa and Batalla, 2020).

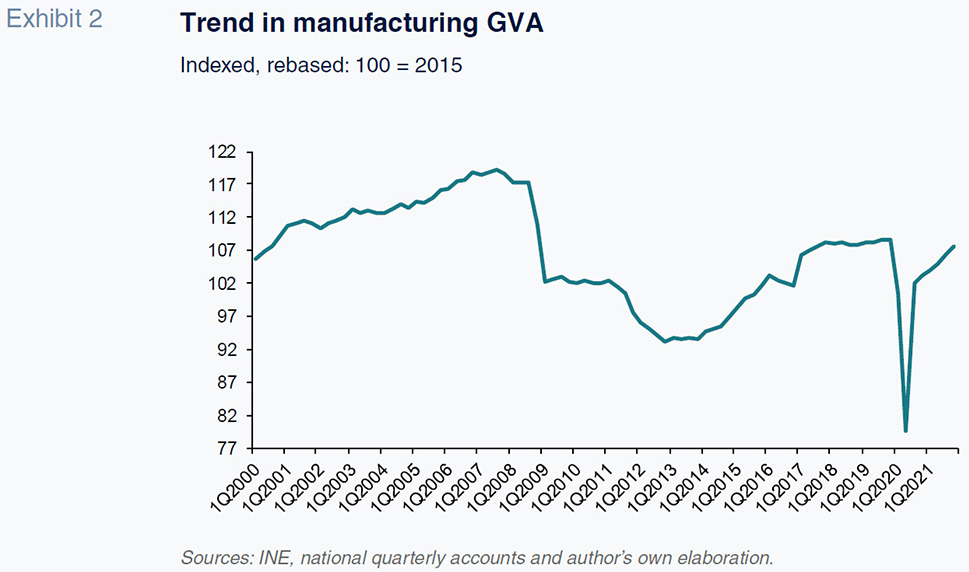

Based on these data, manufacturing GVA is forecast to decline by around 11% in 2020, compared to 2019. Exhibit 2 outlines these forecasts based on the highly optimistic assumption that manufacturing activity will reach 94% of third-quarter 2019 levels in the third quarter of this year and 95% by the fourth quarter. In this best-case scenario, manufacturing GVA would recover to 2016 levels in 2021 and 2019 levels in 2022, still below the level recorded prior to the Great Recession.

The pandemic means that the competitiveness challenge which the Spanish manufacturing industry must embrace is even more pressing now. Not only does the sector need to make up for the ground lost during these two recessions, it must do so in an environment of ecological and digital transformation accelerated by COVID-19. Moreover, there is the EU context to consider, whereby the institutions, supported by Germany and France, are strongly advocating for reindustrialisation, greater technological and productive autonomy vis-à-vis the US and China, as well as the provision of significant funds for industry and advanced services.

This strategic focus represents an opportunity for Spain, which also stands to benefit from the recovery instrument recently presented by the European Commission, the so-called Next Generation EU. However, this requires greater integration in the regional European value chain. Additionally, Spain needs to help its more symbolic companies exit from the crisis in the best possible conditions, using all of the available tools, even that of a temporary provision of equity funds by the State, a possibility recently open by the European Commission, after relaxing the rules for subsidizing companies.

Spanish industry in the European context

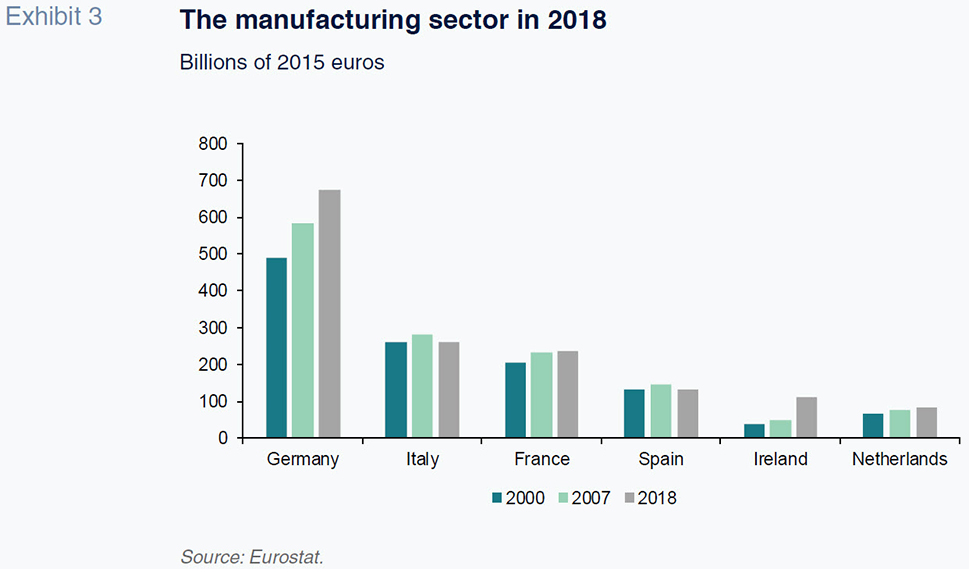

Measured on the basis of real gross value-added, the Spanish manufacturing sector is the fourth biggest in the EU. Its output is one-fifth of Germany’s and half that of Italy, and only slightly above that of Ireland.

Notably, Spanish industry has become more global since Spain joined the EU in 1986. As a result, its share of international trade in goods has increased to above Spain’s share of global GDP

[3]. The Great Recession accelerated the international expansion process, which helped Spain’s companies partially mitigate the adverse effects of the collapse in internal demand (Almunia

et al., 2018). As a result, the importance of Spanish industry within the overall economy, measured by its share of total value added –12.4%– has not fallen significantly and remains on a par with the shares commanded in other countries, such as France (11.35%), though lower than Germany (23.2%) and Italy (16.8%).

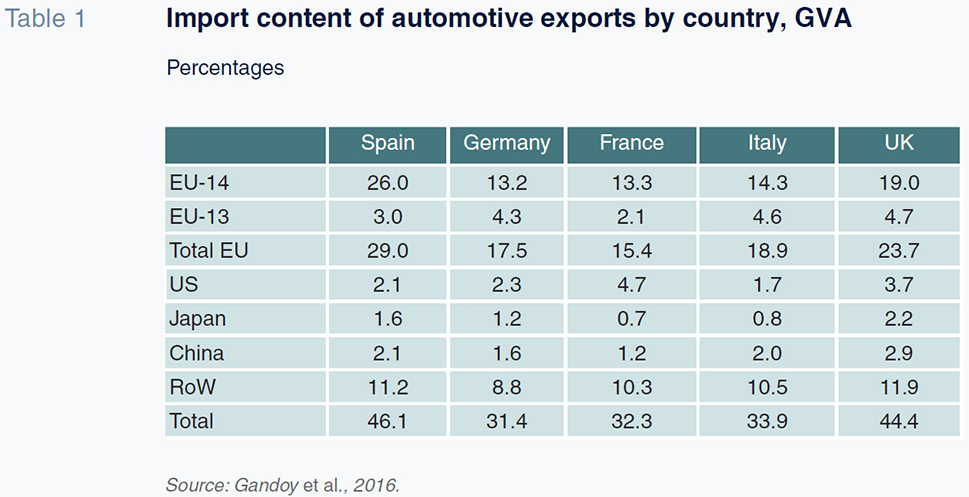

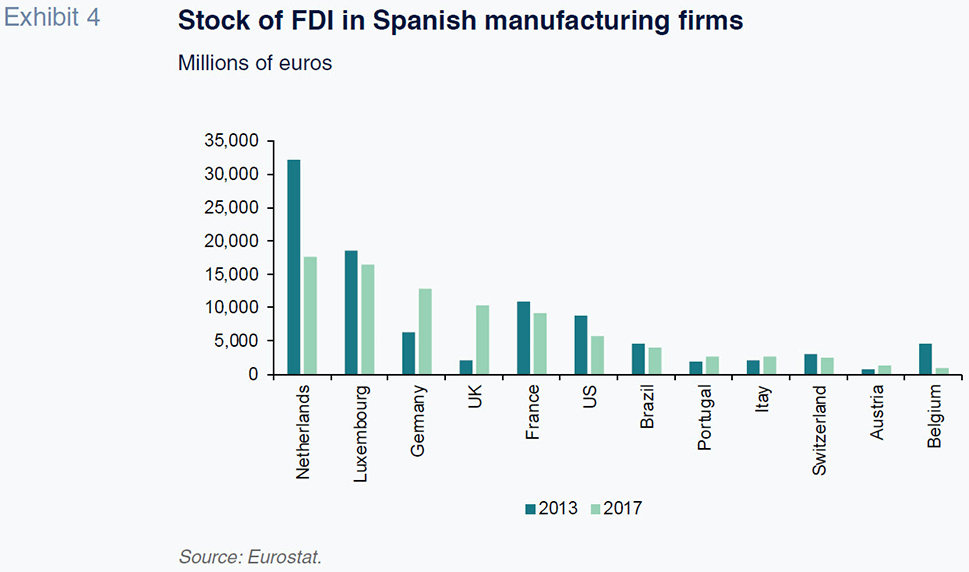

With their expansion into foreign markets, Spanish companies have increasingly inserted themselves into global value chains, particularly European ones. A good example is the automotive industry, a key export sector for Spain that ranks second in Europe after Germany. The sector’s reach now extends to Morocco, such that Spanish automobile manufacturer SEAT has gone from importing inputs for the manufacture of end products in Spain to exporting inputs for assembly in Morocco (Moreno and Fernandez, 2019). Trade in intermediate goods with Germany, France the UK and Italy, in particular, is very intense (Table 1).

Although the numbers show that the automotive industry continues to grow, it faces radical change as a result of the shift towards electric vehicles and new forms of urban mobility. If Spain is to defend its current position, it will have to commit seriously to emerging technologies, while designing transitional measures to support the production of less environmentally harmful diesel cars.

The growing inroads made by Spanish goods in international markets have been accompanied by growth in the export of intermediate services, most importantly the so-called

advanced services, specifically business-to-business, telecommunication and IT services. In fact, Spain ranks eleventh among global suppliers. These services are significantly entrenched in manufacturing production and are very important to unlocking productivity gains in the industry (Blázquez, Díaz Mora and González, 2019)

[4].

Data show that the competitiveness of the Spanish manufacturing industry and the Spanish economy as a whole is relatively strong. Together with Germany, the sector has proven remarkably resistant to the onslaught of Chinese trade following the Asian giant’s entry into the WTO.

Additionally, if we analyse the scope for diversification of the Spanish manufacturing industry, we can identify many opportunities for growth in the chemicals, mechanical machinery, scientific and optical instruments and food industries, alongside new developments such as artificial intelligence, electric vehicles, renewable energies, biochemistry, healthcare and security (Álvarez and Vega, 2016).

The productivity challenge

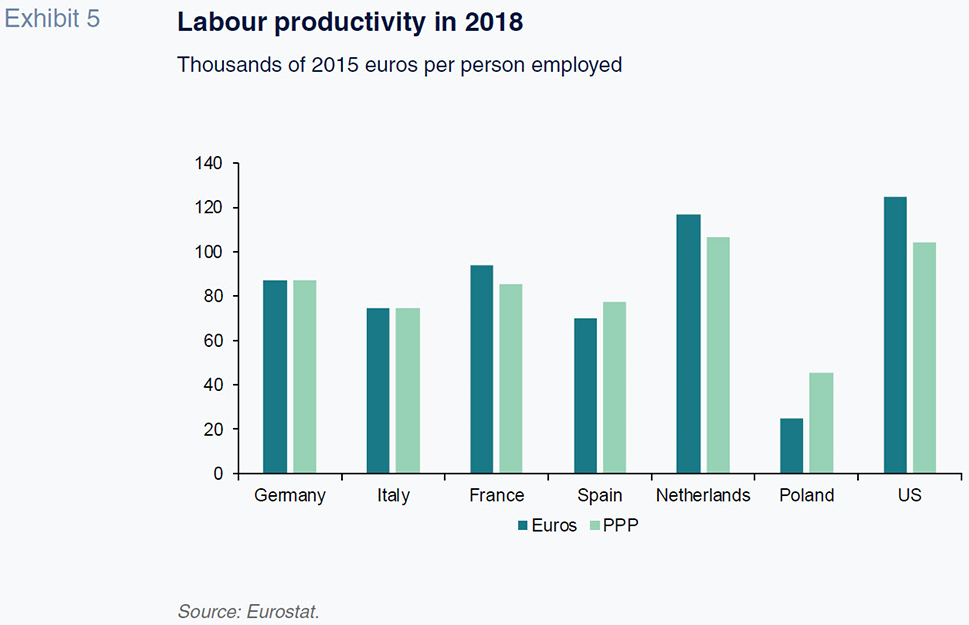

In order to remain competitive, it is essential that the Spanish manufacturing industry tackles its formidable productivity challenge. In 2018, Spanish labour productivity was lower than in Germany, Italy and France (Exhibit 5). Moreover, unlike other countries which saw an improvement in labour productivity during the economic recovery, Spain’s indicator was actually lower in 2018 than in 2015.

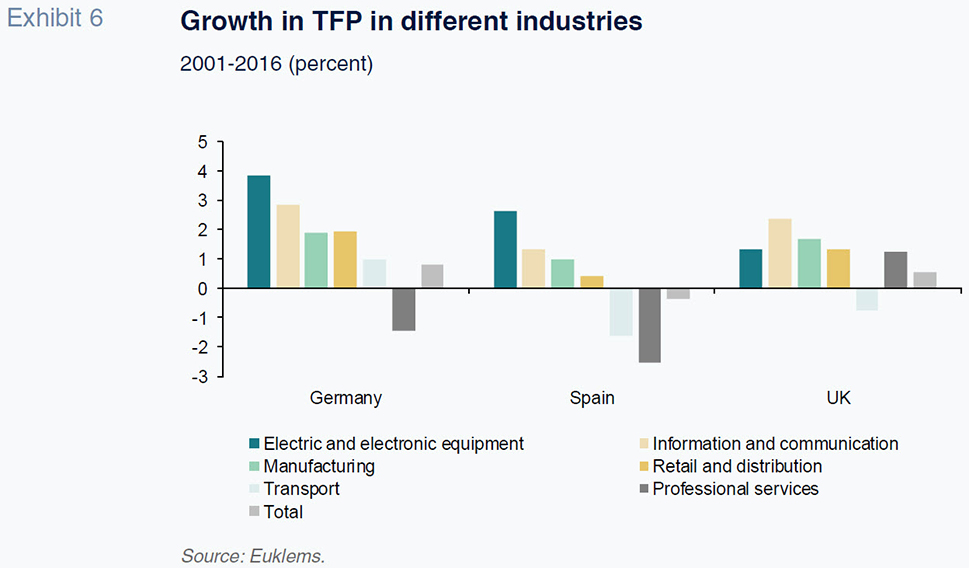

The productivity problem extends beyond the manufacturing sector to include the services sector, too. Exhibit 6 compares productivity levels for manufacturing and several services in Spain with those of Germany (more specialized in manufacturing) and the UK (specialized in services). In fact, the trend in Spanish manufacturing companies’ efficiency levels (measured using total factor productivity or TFP) is stronger compared with the trend in the services sector (excluding IT and communication).

This underperformance is attributable to human and technological capital, two factors which Spanish companies include on their balances sheets under intangible assets. According to Corrado, Lasinio and Iommi (2016) intangible assets can be divided into three categories: software and databases (computerised information); technology (innovative property); and, economic competencies, which include employee training, marketing, branding and business management assets (management quality). In comparison with other economies, Spain stands out for the low weight of these intangible assets as a percentage of its GDP, particularly those related with innovation and economic competencies.

Industrial policy objectives

Industrial policy should stimulate the development of the intangible assets that are key to corporate competitiveness. Importantly, the production of many intangible assets is subject to several kinds of externalities that disincentivize production in the absence of public support, making a case for government intervention. For the technology research and innovation arenas, addressing these externalities is especially important given the ongoing digital transformation and environmental sustainability concerns.

There is scope for the Spanish government to play an increased role in supporting technological developments and innovation. Technology policy is the fundamental industrial policy for an advanced economy like Spain. In close cooperation with the private sector, government actions could facilitate areas of innovation that have high risks or externalities linked to the R&D process. As technology advances, these areas of innovation will increase both in number and importance, especially given today’s work in advanced data analytics and AI.

Medium-sized enterprises should be at the core of any government support for private sector innovation. In Spain, these firms should be defined as employing between 150 and 1,000 people and are key to maintaining the country’s competitiveness. Whereas technology diffusion means small-sized enterprises end up benefitting from new technologies with relative ease, medium-sized enterprises have to make a bigger technological effort to grow.

In addition to stimulating the development of intangible assets, industrial policy faces the enormous challenge of restructuring sectors with significant economies of scale that are being highly affected by prevailing energy transition targets, particularly the automotive sector and transportation in general. For this reason, Spain could benefit from increased involvement with Germany, France and Italy in the search for car battery factories and in the development of AI.

Conclusion

Today’s technological and environmental challenges warrant a new industrial policy. At the same time, the Spanish manufacturing industry needs to consolidate its position as a core part of the European industrial landscape. This can be achieved through active government intervention and greater cooperation between the public and private sectors alongside collaboration between academic institutions and companies. Specifically, the public sector should encourage greater cohesion among private firms and encourage them to formulate medium- and long-term action plans.

Such a policy should be based on: i) a central administration and regional administrations with larger budgets and better technically-trained staff; and, ii) expanded specialized cooperation between public-private bodies based on international best practices. In close proximity to companies, such agencies could help define the future prospects and strategic options available for each manufacturing activity, as well as contribute to the implementation of the different policies, specializing horizontally and in some cases in specific sectors (automobile, aeronautics, for example).

This approach to policymaking could benefit from support and guidance via the industrial restructuring unfolding in Europe. Initiated by multiple stakeholders, including the European Round Table of Industrialists (ERT), and sketched out by the French and German governments, this European reindustrialisation momentum has received a strong boost from the pandemic, which has heightened the risk of business destruction. The European Commission has thrown its weight behind the reindustrialisation initiative, endorsing the application of large-scale programmes designed to prop up corporate income, easing business aid rules and even opening the door to temporary state intervention of flagship companies.

The time is ripe for committing strategically to the manufacturing industry and advanced services sectors. It is an effort that will require thoughtful and sustained work for many years. What is needed is an apparatus designed for orderly interaction with industrial companies that does not currently exist.

Notes

As opposed to the severe shut-down, which refers to the period from March 30th to April 9th when all non-essential businesses were forced to close.

The contraction in exports is expected to affect tourism and non-tourism services the most but also lead to a decline in industrial production of 5%, affecting GVA by an amount that is hard to calculate.

Spain’s share of goods exports is currently 1.3 times its share of global GDP, a ratio that is higher than that of France but below that of Italy and Germany.

The export of these services has transformed Spain’s balance of payments. Today’s surplus accounts for 2% of GDP, compared to a slight deficit at the end of the 1990s.

ALMUNIA, M., ANTRÁS, P., LÓPEZ-RODRÍGUEZ, D. and MORALES, E. (2018). Venting Out: Exports during a Domestic Slump. Working Paper, 1844. Bank of Spain.

ÁLVAREZ-LÓPEZ, M.ª E. and VEGA CRESPO, J. (2016). La promoción exterior [Trade promotion]. In R. MYRO (Dir.), Una nueva política industrial para España [A new industrial policy for Spain], pp. 153-173. Madrid: Consejo Económico y Social.

ÁLVAREZ, E., MYRO, R. and SERRANO, J. (2020). Complejidad económica de las exportaciones Españolas [Economic complexity of Spanish exports]. ICE: Revista de Economía, No. 913, pp. 125-139.

BANK OF SPAIN. (2020). Macroeconomic projections for the Spanish economy (2018-2020): The Banco de España’s contribution to the Eurosystem’s June 2020 joint forecasting exercise.

BATALLA, J. and COSTA, M. T. (2020). Impacto de la COVID-19 en la demanda de productos energéticos [Impact of Covid-19 on demand for energy products]. InfoIEB, No. 37. Institut d´Economia de Barcelona. May 20th.

BLÁZQUEZ, L., DÍAZ MORA, C. and GONZÁLEZ, B. (2019). La servitización de las cadenas globales de valor: una aproximación a partir del análisis de redes sociales [The servitization of the global supply chains: takeaways from analysis of the social media]. Cuadernos Económicos de ICE, No. 50, pp. 87-114.

CHANG, H. J., ANDREONI, A. and KUAN, M. M. (2013). International Industrial Policy experiences and the lessons for the UK. Working Paper, No. 450. Centre for Business Research.

CORRADO CAROL, J. H., JONA-LASINIO, C. and IOMMI, M. (2016). Intangible investment in the EU and US before and since the Great Recession and its contribution to productivity growth. EIB Working Papers 2016/08. European Investment Bank (EIB).

MARIN, D. (2019). The Case for Intelligent Industrial Policy. Opinion Piece. Bruegel. October 7th.

MORENO GARCÍA-CANO, L. O. and FERNÁNDEZ DE BOBADILLA, A. (2019). El futuro de la relación España-Marruecos: hacia una cadena de valor euromediterránea. Boletín Económico de ICE, Nº 3115.

MYRO, R. (2018). La apuesta por la industria y la política industrial [A commitment to industry and industrial policy]. In E. HUERTA and M. J. MORAL (Edits.) Innovación y competitividad: desafíos para la industria española [Innovation and competitiveness: challenges for Spanish industry]. Funcas.

PRADES, E. and TELLO, P. (2020). Heterogeneidad en el impacto económico del COVID-19 entre regiones y países del área euro [Covid-19: uneven impact across the various eurozone countries and regions]. Economic Bulletin, 2. Bank of Spain.

TORRES, R. and FERNÁNDEZ, M. J. (2020). The Great Lockdown of the Spanish economy. SEFO, Vol. 9, No. 3, May 2020. Funcas.

Rafael Myro. Universidad Complutense, Madrid